Date Issued – 9th June 2025

Preview

This week, global markets processed signals of both relief and renewed pressure across key sectors. China extended a rare olive branch to Western automakers by easing rare earth export controls, offering temporary relief to strained supply chains. Meanwhile, Chinese exports to the U.S. fell over 34% – the steepest decline in five years – underscoring ongoing trade fragility despite a recent tariff truce. Tesla continued its downward spiral after Elon Musk’s public feud with President Trump triggered a record $152 billion market cap loss. In Europe, UBS may face up to $26 billion in new capital requirements under Swiss regulatory reform plans.

China Offers Rare Earth Reprieve to Auto Giants

China has moved to ease pressure on Western automakers by proposing a “green channel” to expedite rare earth export licenses for EU firms and granting licenses to suppliers of major U.S. players like GM, Ford, and Stellantis. The shift follows rising tensions from Beijing’s April export curbs – initially imposed in response to U.S. tariffs – that had threatened production across Europe’s automotive sector. While welcomed as a positive signal, industry leaders remain cautious, citing low global inventories and bureaucratic delays as ongoing risks amid China’s dominance over 60% of global rare earth supply.

Investment Insight:

This policy shift signals potential short-term relief for automakers, but long-term risk remains. Investors should continue to monitor trade negotiations and supply chain diversification strategies, as China’s grip on critical minerals presents structural vulnerabilities – especially for electric vehicle and clean tech players.

China’s Exports to U.S. Plunge 34% in May

China’s exports to the U.S. dropped 34.5% year-over-year in May – the sharpest decline in over five years – highlighting the lingering effects of high tariffs and trade friction. Imports from the U.S. also fell 18%, while overall Chinese exports grew just 4.8%, missing expectations. The drag from U.S. trade was partially offset by gains in shipments to ASEAN, the EU, and Africa. Though a late-May tariff ceasefire offers hope for June data, analysts caution that high residual duties and diplomatic friction could continue to weigh on bilateral trade momentum.

Investment Insight:

The steep decline in the U.S.-bound Chinese exports underscores the fragility of the trade truce. While a short-term recovery may materialize in June, structural headwinds remain. Investors should track sector-specific rebounds – particularly in electric machinery and critical minerals – while pricing in volatility tied to ongoing negotiations and policy shifts.

Tesla Faces Deepening Crisis as Musk Feud Escalates

Tesla’s mounting business troubles worsened after CEO Elon Musk’s public fallout with President Trump, wiping $152 billion off its market value in a single day. The dispute – sparked by Musk’s attacks on Trump’s budget bill – jeopardizes Tesla’s access to government contracts, EV subsidies, and tariff exemptions. Meanwhile, the company is struggling with sliding sales, product recalls, and global backlash tied to Musk’s political behavior. Analysts have slashed forecasts, and institutional investors are urging Tesla’s board to step up governance as Musk shifts focus to robotaxis and AI amid deteriorating fundamentals.

Investment Insight:

Tesla’s brand and valuation premium are under pressure from both operational setbacks and reputational risk. As political exposure deepens and execution falters, investors may need to recalibrate expectations – especially if the board fails to reassert leadership discipline or if Tesla loses its regulatory advantages in the U.S. and abroad.

UBS May Face $26B Capital Hike Under Swiss Reforms

UBS could be required to raise up to $26 billion in additional capital over the next decade under proposed banking reforms by the Swiss government, according to Bloomberg. The most significant change would mandate the bank to hold 100% capital coverage for foreign subsidiaries – up from the current 60% – forcing UBS to shift as much as $23 billion into its Swiss-based entity. These measures aim to reinforce financial stability following UBS’s post-Credit Suisse dominance, but could pressure the bank’s balance sheet and strategic flexibility moving forward.

Investment Insight:

Capital reforms could tighten UBS’s financial latitude, particularly in expanding or restructuring foreign operations. Investors should watch for regulatory clarity and any capital management guidance from the bank. While phased over time, the proposed requirements may influence dividend policy, M&A plans, or balance sheet optimization strategies.

Conclusion

From geopolitics to corporate accountability, this week revealed how deeply policy and leadership decisions can impact investor confidence. While China’s rare earth easing and trade recalibrations offer tactical breathing room, Tesla and UBS highlight growing investor sensitivity to governance and regulation.

As volatility resurfaces in both equity and currency markets, staying focused on fundamentals and central bank positioning will be key.

Upcoming Dates to Watch

- June 11th: U.S. Crude Oil Inventories

- June 12th: U.S. CPI, ECB Interest Rate Decision & Press Conference

- June 13th: Eurozone Industrial Production

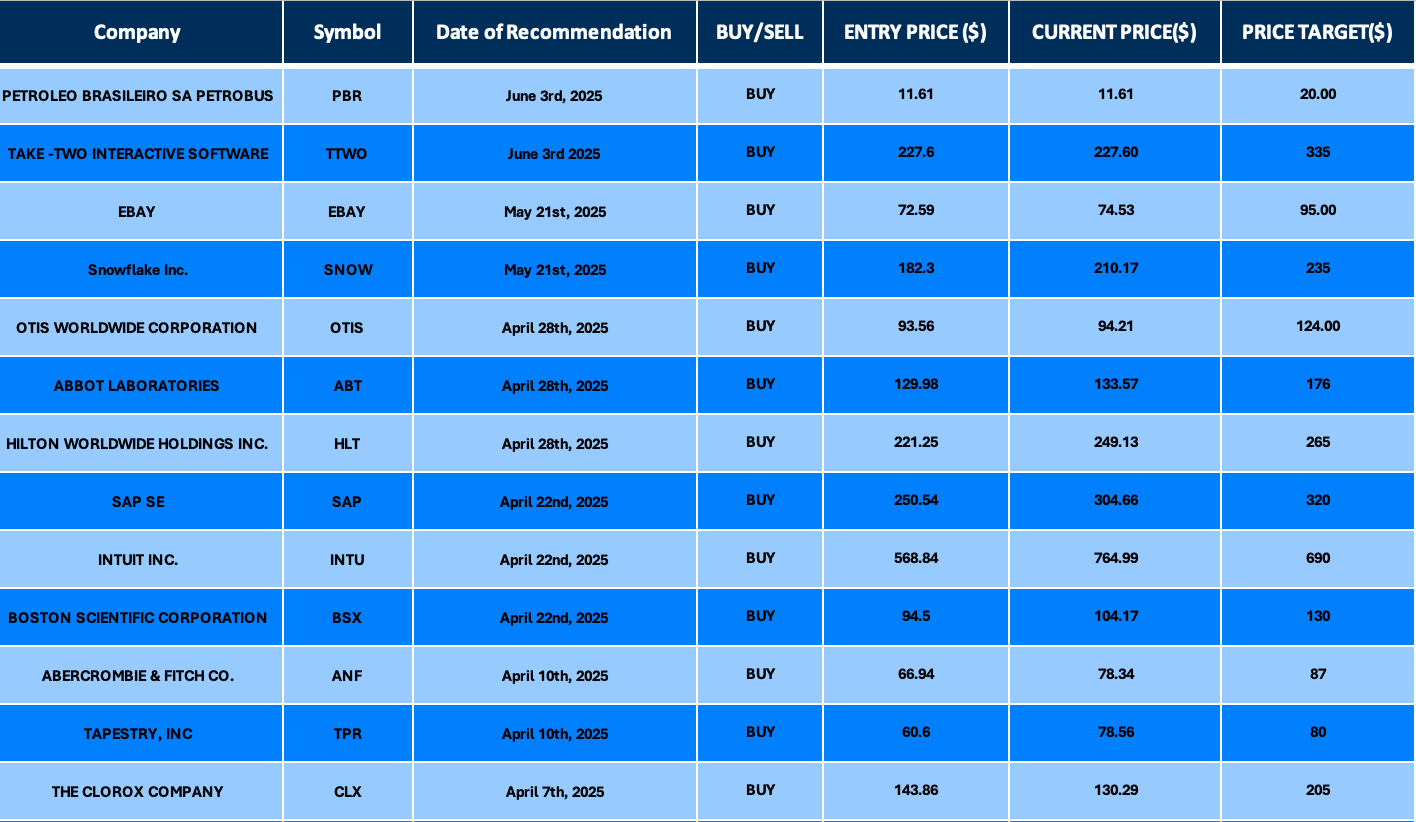

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.