Date Issued – 10th June 2025

Preview

This week’s market shifts reveal a common thread: recalibration. Apple delivered its boldest visual overhaul in over a decade but left AI investors wanting. OpenAI, on the other hand, blew past $10 billion in ARR, cementing its grip on the enterprise AI stack. Meanwhile, Merck entered a high-stakes battle in pediatric RSV care, Walmart cut financial ties to build its own, and Warner Bros. Discovery began dismantling its empire to survive the streaming wars. Behind each move: a clear message to investors: adapt, or fall behind.

Apple Unveils Major Software Redesign, Underwhelms on AI

Apple’s WWDC event introduced its most significant software redesign in over a decade, but underdelivered on artificial intelligence – a disappointment that sent shares down 1.2%. The company revealed a new system-wide design language called “Liquid Glass,” featuring curved elements and translucent animations across iOS, macOS, and VisionOS. While Apple expanded integration with OpenAI’s ChatGPT and introduced translation features, analysts described the AI updates as incremental. The company also announced a shift in naming convention: starting this year, iOS and related operating systems will be labeled by calendar year – beginning with iOS 26 this fall.

Investment Insight:

Apple’s emphasis on aesthetic over breakthrough AI left investors cautious, especially as competitors advance on generative intelligence. While the redesign may enhance UX and brand appeal, AI leadership remains key to long-term growth. Watch for fall product launches to reassess AI integration and hardware-software synergy.

OpenAI Reaches $10B in ARR as ChatGPT Adoption Soars

OpenAI has surpassed $10 billion in annual recurring revenue, doubling its ARR from last year and marking one of the fastest revenue growth trajectories in tech history. The figure, driven by ChatGPT’s consumer subscriptions, enterprise offerings, and API usage, excludes Microsoft licensing and one-time deals. The company now boasts 500 million weekly users and 3 million paying business clients. Despite a $5 billion loss in 2024, OpenAI recently closed a $40 billion funding round and is targeting $125 billion in revenue by 2029 – underscoring investor confidence in its scale and monetization potential.

Investment Insight:

OpenAI’s rapid monetization, rising enterprise adoption, and strong capital backing position it as a dominant force in the AI economy. While valuation remains aggressive, growth momentum and product stickiness justify bullish long-term expectations in enterprise AI infrastructure and generative platforms.

FDA Approves Merck’s RSV Shot for Infants, Challenging Sanofi-AstraZeneca

The FDA has approved Merck’s Enflonsia, a preventative monoclonal antibody designed to protect infants from respiratory syncytial virus (RSV) during their first season. The approval allows Merck to begin distribution before the fall-winter RSV season, positioning the drug as a direct competitor to Sanofi and AstraZeneca’s blockbuster Beyfortus. Unlike Beyfortus, which is weight-based, Enflonsia offers a simplified dosing regimen. In trials, the shot reduced RSV-related hospitalizations by over 84% and respiratory infections requiring medical attention by more than 60%.

Investment Insight:

Merck’s entry into the infant RSV market expands its footprint in pediatric immunization and pressures Sanofi-AstraZeneca’s share of a high-demand segment. With supply-chain execution and CDC guidance pending later this month, investor focus should stay on adoption rates, pricing strategies, and seasonal logistics.

Walmart Ditches Capital One, Launches Credit Cards via OnePay and Synchrony

Walmart’s fintech arm, OnePay, announced a new credit card program in partnership with Synchrony, marking a major shift after ending its relationship with Capital One. Starting this fall, Synchrony will issue and underwrite the new cards, while OnePay will manage the customer experience via its app. The rollout includes two products: a general-purpose Mastercard and a store-only card. Customers with weaker credit will be offered the latter.

Investment Insight:

The move underscores Walmart’s fintech ambitions as it expands OnePay’s ecosystem, which now includes savings, debit, and peer-to-peer payments. This partnership-centric model enables rapid scaling while targeting financially underserved customers – an area ripe for disruption and long-term growth.

Warner Bros. Discovery Will Split Into Two Companies by 2026

WBD will break into two public entities: one for streaming and studios (HBO Max, Warner Bros. films) and one for global networks (CNN, TNT Sports, Discovery). CEO David Zaslav will lead the streaming unit, while CFO Gunnar Wiedenfels will head the networks company.

The split mirrors Comcast’s strategy and aims to give each division more strategic focus. Though traditional TV still brings in strong cash flow, it’s losing long-term value – prompting a $9.1B write-down last year. The networks unit will carry most of the company’s debt, while both entities are expected to have strong liquidity.

Investment Insight:

This is a major play in a rapidly evolving media landscape. The split may unlock hidden value in both divisions – especially if streaming is able to reach profitability independently while the networks segment continues funding debt reduction. It also signals increasing openness to media M&A activity post-breakup.

Conclusion:

Every headline this week reflects companies redrawing their lines of control. Some are building new moats (OpenAI, Walmart), others are repositioning for speed and clarity (WBD, Merck), while giants like Apple are grappling with the cost of moving slower on frontier tech. For investors, the signals are strong: capital is flowing toward focus, infrastructure, and monetization-ready innovation. The names may be familiar – but their trajectories are evolving fast.

Upcoming Dates to Watch:

- June 11th: U.S. Crude Oil Inventories

- June 12th: U.S. CPI, ECB Interest Rate Decision & Press Conference

- June 13th: Eurozone Industrial Production

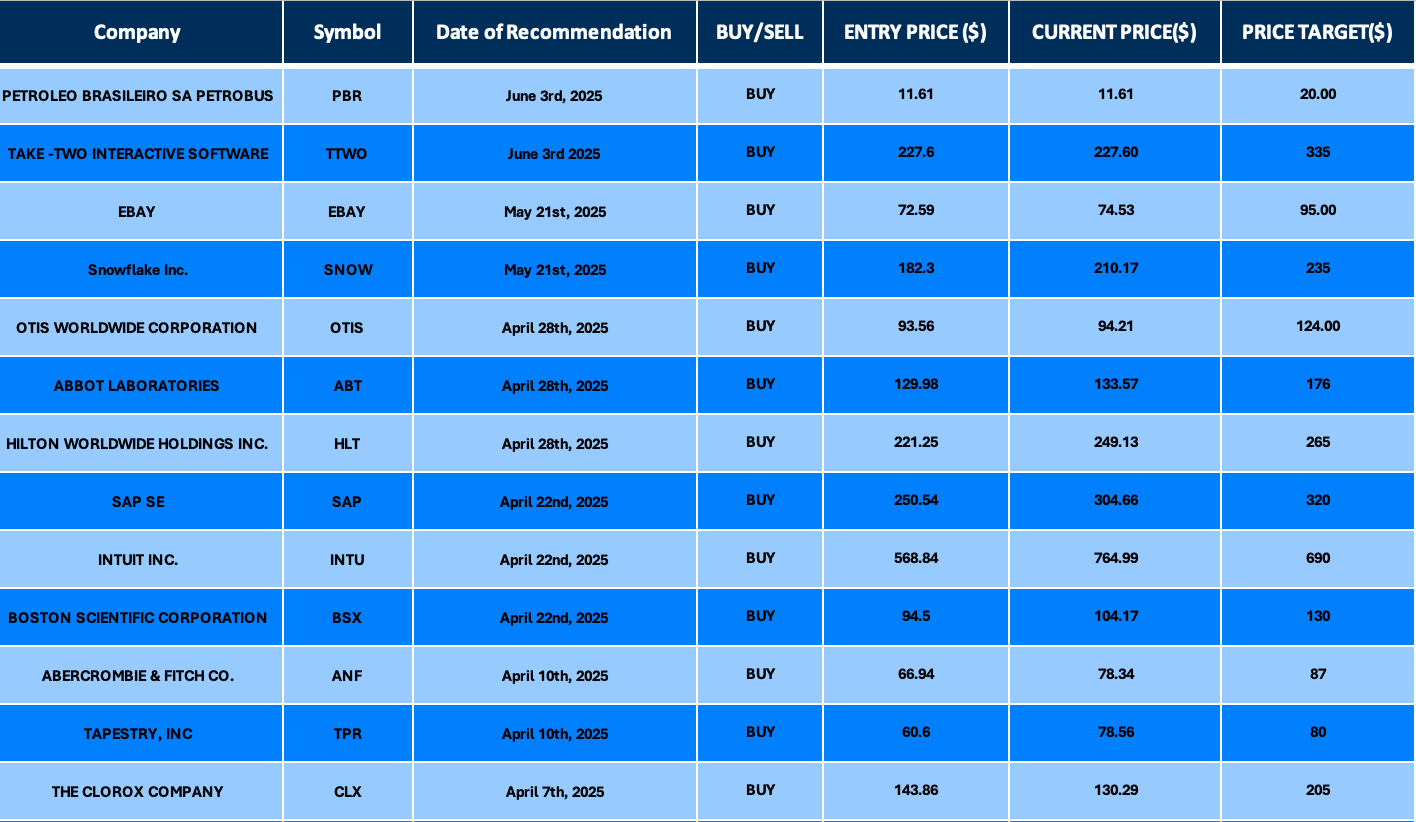

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.