Date Issued – 11th June 2025

Preview

Strategic repositioning is front and center this week across technology, manufacturing, media, and AI. Meta moves aggressively to narrow the competitive gap in artificial intelligence with a $14 billion stake in Scale AI, aiming to sharpen both leadership and capabilities. General Motors reallocates $4 billion into U.S. production as auto tariffs reshape North American manufacturing economics. IBM intensifies the quantum computing race with its ambitious Starling supercomputer roadmap. Paramount Global executes another round of workforce reductions as it braces for a complex merger and streaming market recalibration. Each headline reflects a distinct recalibration of capital allocation in response to both regulatory shifts and evolving market leadership.

Meta to Take $14B Stake in Scale AI to Revamp Its AI Strategy

Mark Zuckerberg is preparing Meta’s biggest AI move yet, finalizing a $14 billion investment for a 49% stake in Scale AI. The deal would bring in Scale AI’s founder, Alexandr Wang, to help lead Meta’s AI research lab as the company seeks to close the competitive gap with OpenAI and Google. Scale AI, already a major Meta vendor, specializes in data annotation and model training, with deep ties to both tech and U.S. defense sectors. The move reflects Zuckerberg’s dissatisfaction with Meta’s recent Llama 4 performance and underscores the growing urgency to strengthen Meta’s AI position.

Investment Insight:

Meta’s decision signals a strategic pivot toward leadership-by-acquisition rather than internal development. Securing Wang’s operational and technical expertise may accelerate Meta’s AI competitiveness, but the company remains under pressure to convert these moves into consumer-facing breakthroughs amid intensifying global competition.

GM to Shift $4B Investment to U.S. Plants Amid Auto Tariffs

General Motors will invest $4 billion to expand U.S. production, reallocating assembly of its Chevrolet Blazer and Equinox models – previously built in Mexico – to American plants. The move follows recent 25% tariffs imposed by the Trump administration on imported vehicles and parts. GM’s Fairfax (Kansas) and Spring Hill (Tennessee) plants will handle the production shifts starting in 2027. While the Blazer will fully relocate, Equinox production will remain partially in Mexico for non-U.S. markets. The strategy allows GM to scale U.S. output beyond 2 million vehicles annually while navigating shifting trade dynamics.

Investment Insight:

GM’s repositioning reflects both policy adaptation and production recalibration. The ability to mitigate tariff pressures while maintaining capital flexibility underscores management’s operational discipline. Investors will closely watch GM’s North American footprint evolution as EV spending slows and regulatory risks drive manufacturing realignment.

IBM Unveils Roadmap for Quantum Starling Supercomputer by 2029

IBM has announced its most ambitious quantum computing roadmap yet, unveiling plans to build the Quantum Starling — a fault-tolerant quantum supercomputer capable of running massive, error-corrected computations. Key milestones include the rollout of IBM’s new Quantum Nighthawk processor later this year, followed by a sequence of processors and adapters (Loon, Kookaburra, Cockatoo) through 2028. The Nighthawk chip is expected to scale from 5,000 to 15,000 operational gates within three years. The Starling system will be developed at IBM’s Poughkeepsie Lab in New York. The race in quantum hardware is intensifying as IBM moves to counter recent advances by Google, Microsoft, and Amazon.

Investment Insight:

IBM’s roadmap reflects both technological ambition and long-term capital commitment. While commercial quantum utility remains years away, IBM’s aggressive sequencing and first-mover positioning could secure future leadership in sectors ranging from defense to cryptography. Investors will monitor execution risk, competitive breakthroughs, and enterprise demand as quantum shifts from research to application.

Paramount to Cut 3.5% of U.S. Workforce Amid Restructuring

Paramount Global will reduce its U.S. workforce by 3.5%, impacting several hundred employees as the company continues streamlining ahead of its proposed merger with Skydance Media. The layoffs, announced Tuesday, follow last year’s 15% workforce reduction and reflect mounting pressure from cord-cutting and ongoing legal battles, including regulatory delays tied to a CBS interview with former VP Kamala Harris. Further international job reductions may follow. Paramount joins peers like Disney and Warner Bros. Discovery in deeper cost-cutting as traditional media confronts accelerating structural challenges.

Investment Insight:

Paramount’s continued workforce reductions underscore the broader industry recalibration as legacy media shifts toward streaming-first models under increasing profitability pressure. The pending Skydance merger and regulatory headwinds add complexity, with execution and margin stabilization becoming key metrics for investor confidence.

Conclusion:

The signals remain clear: capital is being aggressively redeployed to fortify competitive positioning. Whether it’s Meta securing talent, GM managing policy exposure, IBM investing into long-cycle innovation, or Paramount restructuring for survival — leaders are actively redefining their cost bases and technology stacks. For investors, focus remains on execution, balance sheet discipline, and timing as these transformations accelerate across sectors.

Upcoming Dates to Watch:

- June 12th: U.S. CPI, ECB Interest Rate Decision & Press Conference

- June 13th: Eurozone Industrial Production

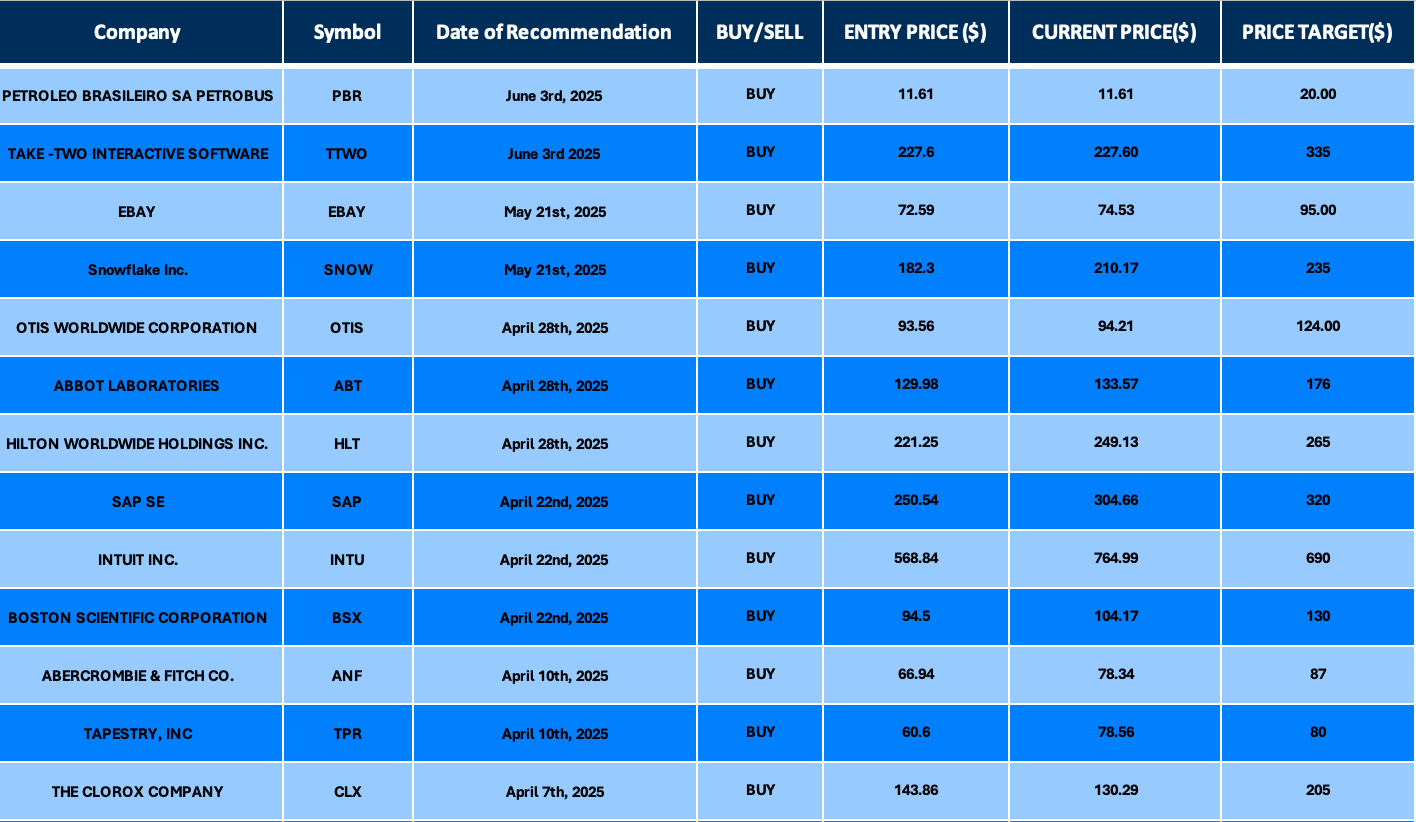

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.