Date Issued – 12th June 2025

Preview

Markets are navigating a complex web of geopolitical, corporate, and fiscal developments. ADNOC is eyeing strategic BP assets as oil majors recalibrate; Chinese firms like Insta360 push into U.S. markets despite trade tensions; oil prices spike on escalating U.S./Iran tensions. Meanwhile, Chime’s $11.6B IPO signals revived fintech appetite, U.S./China tariff talks stabilize without new breakthroughs, and the U.S. budget deficit widens 14% year-over-year, underscoring persistent fiscal headwinds. Each storyline is reshaping investor sentiment across sectors, from energy and tech to fiscal policy and global trade.

ADNOC Eyes BP Assets Amid Growing Takeover Speculation

Takeover rumors surrounding BP are intensifying as UAE’s ADNOC explores acquiring portions of the British energy giant’s portfolio, with particular focus on its LNG assets. While a full takeover appears unlikely, ADNOC’s international arm, XRG, is reportedly evaluating selective asset acquisitions as BP undergoes a strategic reset. BP is simultaneously pursuing $20 billion in divestments while boosting oil and gas investments to $10 billion annually through 2027, reversing earlier green energy commitments. Other global players including Shell, ExxonMobil, Chevron, Aramco and private equity firms are also rumored to be monitoring BP’s asset sales as the firm works to stabilize after a year of underperformance.

Investment Insight:

BP’s restructuring opens the door for targeted acquisitions as activist pressure for capital discipline collides with divestment plans. ADNOC’s selective interest highlights the ongoing consolidation trend in global energy as national oil companies and majors reposition for scale in LNG and hydrocarbons. Investors should track asset sale valuations and strategic shifts in BP’s portfolio composition.

Chinese Firms Accelerate U.S. Expansion Despite Trade Tensions

Chinese companies continue aggressively expanding into U.S. markets despite ongoing geopolitical and trade headwinds. Insta360, which just completed the STAR board’s largest IPO to date, sees the U.S. already accounting for over 23% of its revenue, matching both China and Europe. Other firms like Roborock, Hisense, Bc Babycare, and toy giant Pop Mart are also rapidly growing their U.S. presence, diversifying global operations amid slowing domestic demand. Chinese companies are entering a third phase of globalization: building independent international brands, opening local offices and hiring regional teams to support direct market penetration, particularly in consumer electronics, appliances and toys.

Investment Insight:

This new wave of direct global expansion by Chinese companies reflects both structural domestic growth limits and rising confidence in their international competitiveness. While trade tensions remain unresolved, investors should monitor these firms’ ability to establish resilient revenue streams outside China – especially in U.S. consumer markets – as a key long-term driver of valuations and capital allocation.

Oil Surges Over 4% Amid Escalating U.S.-Iran Tensions

Oil prices jumped more than 4% on Wednesday as geopolitical tensions flared between the U.S. and Iran. The sharp rally follows rising concerns over potential supply disruptions in the Middle East after multiple confrontations and renewed rhetoric out of Washington and Tehran. Brent crude futures climbed above $86 per barrel, while WTI rose past $82. The spike comes amid an already tight oil market as OPEC+ continues to restrict output, while U.S. stockpiles showed unexpected draws this week, further amplifying supply-side pressures.

Investment Insight:

The Middle East remains a major swing factor for oil markets. Any sustained escalation could trigger a risk premium across global energy markets, supporting elevated crude prices in the short term. Investors should closely watch diplomatic developments, shipping security and any retaliatory actions that could tighten supply or disrupt transport routes through critical chokepoints such as the Strait of Hormuz.

U.S.-China Tariff Levels to Hold Steady

Following recent trade negotiations, Cantor Fitzgerald CEO Howard Lutnick indicated Wednesday that U.S. tariffs on Chinese goods are unlikely to change in the near term. The statement comes after Treasury Secretary Scott Bessent led a second round of discussions with Chinese Vice Premier He Lifeng in London. While both sides cited modest progress, Lutnick emphasized that the current tariff structure – averaging 51.1% on Chinese imports – is expected to remain stable, providing U.S. companies with much-needed predictability after years of fluctuating trade policy.

Investment Insight:

A stable tariff environment may help ease supply chain planning for multinationals operating across U.S./China corridors, even as geopolitical tensions persist. However, elevated duties continue to weigh on cost structures, particularly in sectors like semiconductors, EVs and consumer electronics. Investors should watch for any downstream margin compression or shifts in sourcing strategies as companies adjust to this new steady-state trade regime.

Chime IPO Values Fintech Firm at $11.6 Billion

Chime, one of the leading U.S. digital banking platforms, priced its IPO at $27 per share on Wednesday, giving the fintech company a valuation of $11.6 billion. The listing marks one of the largest fintech IPOs in recent quarters and signals renewed investor appetite for consumer financial technology names. Chime’s no-fee banking services and debit-focused model have attracted millions of customers, particularly among younger and lower-income demographics, fueling steady revenue growth even as the broader fintech sector faced regulatory and profitability pressures in recent years.

Investment Insight:

Chime’s successful IPO underscores growing confidence in fintech platforms that blend customer acquisition scale with disciplined lending exposure. While competition remains fierce in the digital banking space, Chime’s focus on fee-free services, customer retention and strong unit economics may offer resilience in a higher-rate, credit-sensitive environment. Investors should monitor its path toward sustainable profitability and product expansion post-IPO.

U.S. Budget Deficit Widens 14% Year-Over-Year to $316 Billion in May

The U.S. federal budget deficit totaled $316 billion in May, bringing the fiscal year’s cumulative shortfall to nearly $1.2 trillion – a 14% increase compared to the same period last year. Treasury data released Wednesday shows spending outpaced revenue growth, driven by higher interest payments on federal debt and continued mandatory outlays. Total government receipts reached $3.28 trillion year-to-date, while outlays swelled to $4.45 trillion. The rising deficit highlights the growing fiscal strain from both elevated borrowing costs and entitlement spending, reigniting debates over long-term debt sustainability.

Investment Insight:

Rising deficits continue to fuel upward pressure on Treasury supply and long-term yields, potentially complicating monetary policy calibration. Investors should monitor how sustained fiscal imbalances may affect credit markets, dollar strength, and inflation expectations – particularly as political discourse around fiscal discipline intensifies ahead of the 2026 elections.

Conclusion

Geopolitical maneuvering, corporate repositioning, and fiscal imbalances continue to drive cross-market volatility. As strategic energy deals, trade recalibrations and fintech capital raises play out alongside surging deficits and unresolved geopolitical risks, investors are forced to remain hyper-attentive to both macro and sector-specific catalysts. Expect heightened positioning around upcoming inflation prints, Fed commentary, and further corporate restructuring headlines.

Upcoming Dates to Watch

- June 13th: Eurozone Industrial Production

- June 17th: U.S. Retail Sales

- June 18th: U.K. CPI, Eurozone CPI

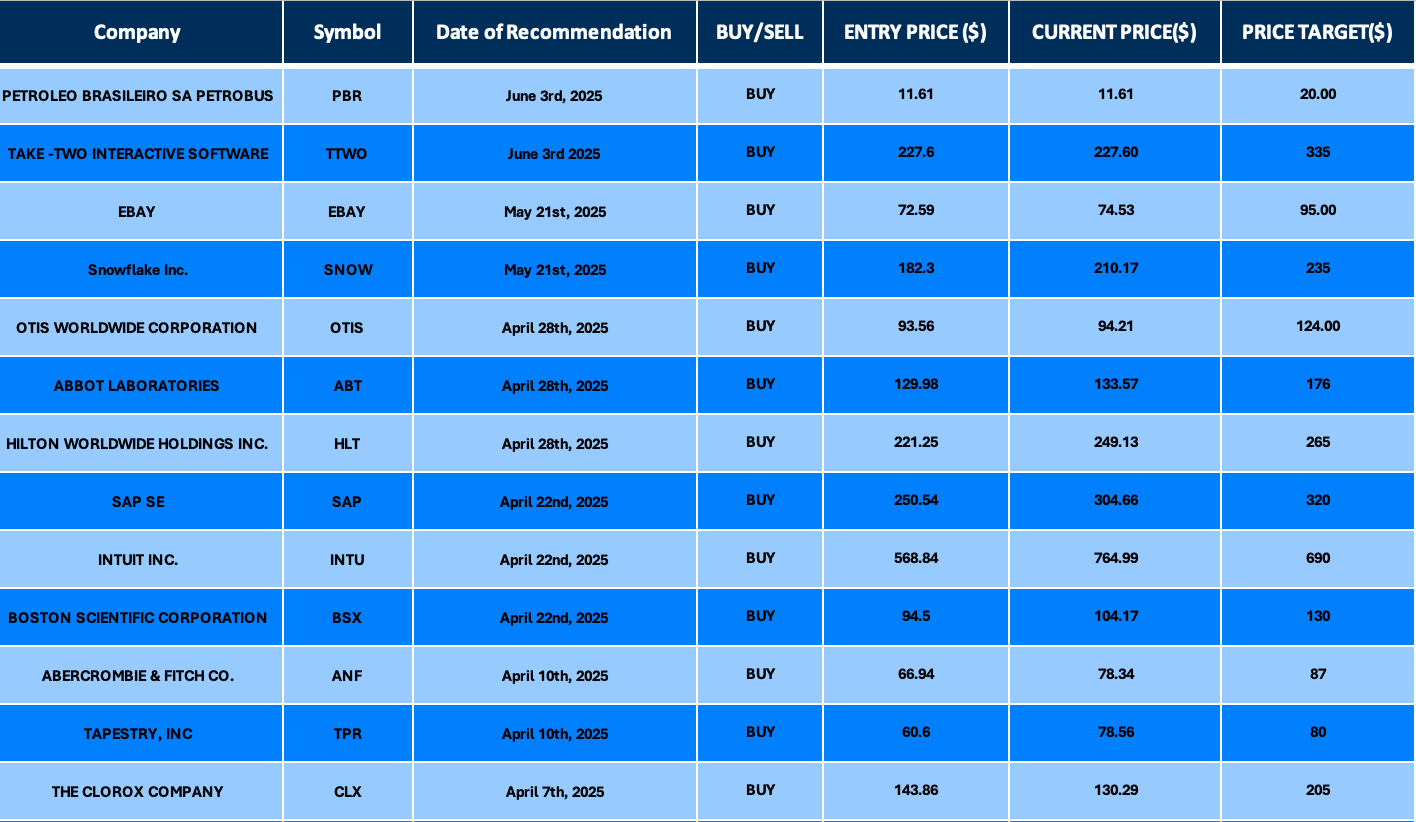

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.