Date Issued – 13th June 2025

Preview

Markets remain on edge as geopolitical tensions and sector-specific shocks drive sharp moves across multiple industries

Oil prices surged over 13% at one point after Israel launched airstrikes against Iran’s nuclear facilities, raising fresh concerns over global energy supply chains. Meanwhile, tragedy struck in India as a Boeing Dreamliner suffered its first-ever fatal crash, further complicating Boeing’s ongoing safety and reputational challenges. In the tech sector, Meta finalized its $14.3B deal to acquire Scale AI talent and leadership as it races to catch OpenAI in the generative AI race, while AMD unveiled its latest MI400 AI chips in partnership with OpenAI’s Sam Altman. Finally, Oracle delivered strong cloud-driven earnings, sending shares to new all-time highs and signaling continued momentum in enterprise AI infrastructure.

Oil prices surge on heels of Israeli strikes, set for largest single-day gains in about five years

Oil prices spiked as much as 13% after Israel launched airstrikes against Iran’s nuclear and ballistic missile sites without U.S. backing. Brent rose 6.3% to $73.73 per barrel, while WTI climbed 6.5% to $72.48. The attack heightened fears of broader Middle East instability potentially impacting global oil supplies, particularly if Iran retaliates or attempts to disrupt shipments through the Strait of Hormuz, which handles about 20% of global oil flow. While Iran’s oil production sites were not directly targeted, markets remain wary of escalation. The U.S. emphasized non-involvement, while Israel declared the operation would continue as necessary. Analysts stress that any further retaliation or military miscalculation could rapidly spiral into significant supply disruptions, though for now, physical oil flows remain unaffected.

Investment Insight:

This conflict-driven oil spike underscores how geopolitical shocks can override otherwise muted energy markets. While Iran’s production remains intact for now, any escalation involving key shipping lanes or broader regional players could reprice oil risk premiums sharply higher. Near-term, energy traders should closely monitor Iran’s response and shipping security. For investors, exposure to oil majors, energy ETFs and tanker companies may provide asymmetric upside if tensions escalate further. However, watch for sharp reversals if diplomatic pressure – particularly from China and major buyers – reins in the conflict.

Air India crash: What to know about the first fatal Boeing Dreamliner tragedy

An Air India Boeing 787-8 Dreamliner crashed seconds after takeoff from Ahmedabad, India, killing 241 out of 242 people onboard. This marks the first fatal crash involving a Dreamliner, raising fresh concerns for Boeing, already under scrutiny for previous safety issues with its 737 Max and 787 programs. Preliminary data shows the aircraft lost altitude rapidly, crashing into a residential area. Investigators are now focused on retrieving the black boxes to analyze possible causes, which could range from mechanical failure to pilot error or environmental factors. While some experts suggest manufacturing flaws are unlikely given the aircraft’s decade-long service, Boeing’s past quality control issues remain under global observation.

Investment Insight:

While tragic, this incident may have limited financial impact on Boeing in the near term unless systemic design flaws emerge. Dreamliner orders remain strong with 900 units still in backlog and airlines often maintain orders despite isolated crashes. However, further revelations of production or safety oversight failures could severely damage Boeing’s already fragile regulatory standing, particularly as certification of the 777X approaches. Investors should monitor the investigation closely as early conclusions could influence both public perception and regulatory tightening – both critical for Boeing’s long-term reputation and growth trajectory.

Scale AI’s Alexandr Wang confirms his exit for Meta as part of $14.3 billion deal

Scale AI founder Alexandr Wang officially announced his exit to join Meta as part of a $14.3 billion strategic partnership. Meta acquires a 49% non-voting stake in Scale AI, solidifying its aggressive push into artificial intelligence while avoiding regulatory risks tied to full acquisitions. Jason Droege, Scale’s chief strategy officer, has been named CEO. A small group of Scale employees will also transition to Meta, where Wang will focus on “superintelligence” efforts. Scale AI will continue to serve its broad client base, which includes Meta’s key AI competitors such as Google, Microsoft and OpenAI, with the company emphasizing that client confidentiality remains intact.

Investment Insight:

This move underscores Meta’s urgent bid to close the AI gap with leading rivals by securing both elite leadership and advanced data capabilities without triggering antitrust scrutiny. Wang’s technical expertise – and Scale AI’s vast experience in data labeling – position Meta to strengthen its next-generation AI training infrastructure. For investors, this aggressive $14.3 billion deployment reflects Meta’s full commitment to AI leadership but also raises execution risk as the company enters a more complex competitive and regulatory environment. If successful, this partnership could be a cornerstone for Meta’s long-term AI monetization and enterprise solutions strategy.

AMD reveals next-generation AI chips with OpenAI CEO Sam Altman

AMD unveiled its next-generation MI400 series AI accelerators at its Computex keynote, sharing the stage with OpenAI CEO Sam Altman – a rare joint appearance signaling deepening ties between semiconductor firms and AI leaders. The MI400, expected to debut in 2026, aims to compete directly with Nvidia’s dominant H100 and H200 chips in the rapidly growing AI infrastructure market. AMD’s CEO Lisa Su emphasized the company’s commitment to scaling up its AI chip capabilities while addressing rising demand for alternative suppliers amid Nvidia’s supply constraints. Altman praised AMD’s innovation, highlighting the broader ecosystem benefits of increased competition in AI hardware.

Investment Insight:

AMD’s strategic positioning as Nvidia’s most credible challenger in AI accelerators gains new momentum with the MI400 launch and public backing from OpenAI’s CEO. While Nvidia remains dominant, hyperscaler demand for diversified supply chains creates a multi-billion-dollar growth opportunity for AMD. Investors should watch closely for early adoption signals, large-scale orders and performance benchmarks as MI400 samples become available. AMD’s long-term upside hinges on its ability to secure significant market share in both training and inference workloads as global AI buildout accelerates.

Oracle shares pop 13% to record high on earnings beat, cloud optimism

Oracle shares surged 13% to a record high after the company delivered stronger-than-expected fiscal Q4 results and raised long-term guidance, driven by accelerating cloud adoption. Quarterly revenue rose 11% YoY to $15.9 billion, beating consensus, while adjusted EPS reached $1.70, above estimates. Oracle’s cloud revenue hit $3 billion for the quarter, still trailing hyperscalers like Amazon, Microsoft and Google, but growing at a faster pace. Chairman Larry Ellison highlighted strong multicloud adoption, AI-driven database demand and significant upside tied to projects like OpenAI’s Stargate data center initiative. Oracle now expects FY2026 revenue above $67 billion and FY2029 revenue to surpass its prior $104 billion target.

Investment Insight:

Oracle’s cloud momentum and AI-enhanced database solutions are fueling a sharp re-rating as investors bet on its positioning within the multicloud and enterprise AI landscape. Though capacity constraints remain a headwind, robust RPO growth (+41% YoY) signals strong forward demand. With multiyear revenue targets rising, Oracle’s transformation story is gaining credibility. Investors should monitor hyperscaler partnerships, AI workload penetration and infrastructure buildouts as key drivers of sustained upside in the stock.

Conclusion:

The current environment reflects a fragile balance between escalating geopolitical risks, intensifying AI competition and ongoing corporate transformation across key sectors. The oil market is once again reacting to Middle East conflict scenarios, while AI continues to attract massive capital deployments – both from incumbents like Meta and chipmakers like AMD. Boeing faces yet another credibility test, while Oracle’s cloud growth provides a glimpse into where long-term enterprise spending is headed. With multiple macro catalysts ahead – including central bank decisions, inflation prints and potential geopolitical spillovers – investors should remain highly tactical while closely tracking both sector rotation and cross-asset volatility signals.

Upcoming Dates to Watch:

- June 17th: U.S. Retail Sales

- June 18th: U.K. CPI, Eurozone CPI

- June 19th: BoE Interest Rate Decision

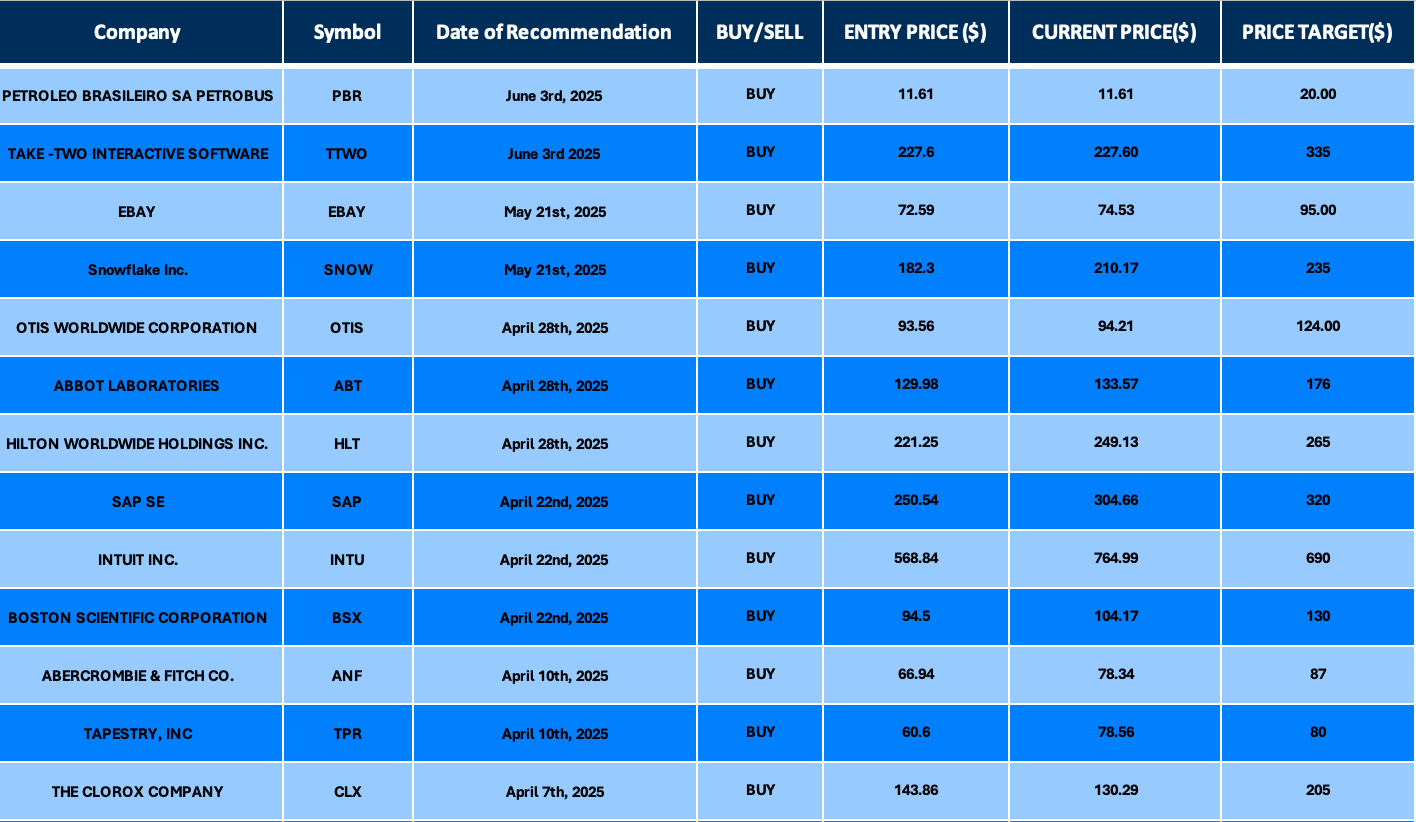

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.