Date Issued – 16th June 2025

Preview

This week’s headlines span across industries, but one common theme dominates: strategic repositioning in response to deep structural shifts. Kering’s surprise move to appoint auto-industry veteran Luca de Meo as CEO reflects the urgency to revitalize its flagship luxury brands. In Australia, Santos shares surge after a $18.7B takeover bid led by ADNOC signals growing Middle East appetite for LNG expansion. Meanwhile, Middle East tensions escalate as Israel strikes Iranian energy infrastructure, pushing oil markets higher once again. Starbucks intensifies its internal reset, focusing on employee engagement as part of its ambitious “Back to Starbucks” turnaround plan. And finally, the advertising world faces a disruptive AI revolution: industry leaders from WPP and Publicis explain how generative AI is rapidly reshaping creativity, personalization and agency economics.

Kering Surges on CEO Shift, Renault’s de Meo Poised to Lead Luxury Turnaround

Shares of Kering jumped over 10% after reports surfaced that Luca de Meo, Renault’s outgoing CEO, is set to take the helm at the luxury conglomerate. De Meo, a 30 year auto industry veteran with prior leadership at Toyota, Fiat and Volkswagen, is widely credited for orchestrating Renault’s significant turnaround, where shares climbed over 90% under his tenure. His entry marks a pivotal moment for Kering, which has struggled in recent years – particularly with Gucci’s sales slump and a 60% drop in share value over two years. Kering’s long-time CEO François-Henri Pinault is reportedly preparing to split the chairman and CEO roles, signaling a broader management restructuring. Despite the optimism, analysts caution that reviving Gucci and Saint Laurent will require substantial investment, patience, and deft brand repositioning in an increasingly crowded luxury market.

Investment Insight:

De Meo’s appointment injects fresh leadership and strategic credibility into Kering’s stalled turnaround narrative. His operational discipline and brand-building experience may reignite growth at Gucci and Saint Laurent – two core revenue drivers under pressure. While execution risks remain elevated due to the cost and complexity of repositioning luxury brands, today’s rally reflects investor enthusiasm for proactive succession planning and the possibility of significant multiple expansion if brand momentum is successfully restored.

Santos Shares Jump 15% on $18.7B Takeover Bid from ADNOC-Led Consortium

Santos shares surged over 15% after receiving an $18.7 billion non-binding takeover bid led by Abu Dhabi’s National Oil Company (ADNOC) investment arm XRG, alongside Abu Dhabi Development Holding Co and private equity giant Carlyle Group. The offer values Santos at AU$ 8.89 per share – a 27.7% premium to its previous close – marking its largest intraday rally since 2020. This is ADNOC’s latest move to secure global energy assets, following multiple prior unsuccessful takeover attempts by other suitors for Santos. If completed, the acquisition would give the consortium control over Santos’ extensive LNG operations in Australia and Papua New Guinea, strengthening its position in global gas markets amid rising demand for LNG and energy transition assets.

Investment Insight:

The ADNOC-led bid reflects continued Middle Eastern appetite for strategic LNG assets as part of their long-term diversification and energy transition strategies. Control of Santos’ LNG infrastructure provides immediate production scale, geographic diversification, and access to Asia-Pacific growth markets. The premium signals strong buyer conviction despite prior failed M&A attempts. Investors should monitor regulatory review, competing bids, and shareholder approval process. If successful, the deal may spark additional consolidation across the global LNG sector.

Oil Prices Surge on Israeli Strikes Against Iranian Energy Facilities

Oil markets remain volatile after Israel escalated its strikes on Iranian energy infrastructure, targeting the massive South Pars gas field and oil depots near Tehran over the weekend. While U.S. crude briefly touched $77.48 per barrel, both WTI and Brent eased slightly in early Monday trading, though prices still sit well above last week’s levels after a 13% weekly surge. The conflict enters its third day with no signs of de-escalation, raising fears of broader disruptions to Middle Eastern oil supplies. Iranian officials have floated the possibility of shutting down the Strait of Hormuz – a critical global oil chokepoint – though analysts question Iran’s ability to fully close the passage under the watch of the U.S. Fifth Fleet. Goldman Sachs warned that a full shutdown could push crude prices beyond $100 per barrel.

Investment Insight:

The escalating Israel-Iran conflict has reintroduced significant geopolitical risk premium into oil markets. While no major supply outages have yet materialized, sustained attacks on energy infrastructure raise the probability of production losses or regional retaliations that could tighten global supply. The Strait of Hormuz remains the key flashpoint. Energy investors should expect continued volatility, with upside risk for crude prices if military action spreads or strategic shipping routes are threatened. Defensive positioning in energy equities and oil-linked assets may offer short-term hedging benefits amid the conflict.

Starbucks Moves to the Next Phase in Its Turnaround: Winning Over Employees

Starbucks CEO Brian Niccol unveiled the next phase of the company’s turnaround plan during its Leadership Experience event in Las Vegas, focusing heavily on regaining employee trust and restoring Starbucks’ original culture. The strategy – branded as “back to Starbucks” – includes reintroducing more seating in cafes, adding fulltime assistant managers to most North American stores, and prioritizing internal promotions as the company expands. Roughly 14,000 store managers attended the event, where Niccol emphasized returning Starbucks to its identity as a “third place” while improving operational efficiency and customer experience. After years of labor cuts that fueled widespread unionization, Starbucks is now accelerating staffing improvements through its Green Apron labor model. The company’s shares have risen nearly 20% since April, supported by recent cost-cutting measures and stronger investor sentiment.

Investment Insight:

Starbucks is attempting to stabilize its long-term growth by addressing one of its most persistent operational risks: labor relations. Management’s shift toward employee-first policies may reduce union pressures and improve store-level performance, while simultaneously strengthening brand identity. If successful, these cultural and operational adjustments could drive higher customer retention and sales per location, particularly as Starbucks plans to add 10,000 new U.S. locations. However, execution risks remain, and investors will be watching labor costs, unionization outcomes, and same-store sales metrics closely through 2025.

AI Is Disrupting the Advertising Business in a Big Way – Industry Leaders Explain How

The global advertising industry is undergoing a massive transformation as artificial intelligence reshapes how creative content is produced, distributed, and optimized. WPP’s outgoing CEO Mark Read called the AI disruption “unnerving” for both investors and industry leaders, stating that AI will “totally revolutionize our business.” Tools like OpenAI’s DALL-E, Google’s Veo, and Midjourney allow agencies to generate high-quality images and videos rapidly, while AI-driven platforms automate campaign creation and personalization. WPP has already integrated AI across its workforce, with 50,000 employees using its proprietary WPP Open platform. Publicis Groupe CEO Maurice Levy echoed similar views, emphasizing AI’s ability to scale personalized messaging and accelerate content production. However, both executives acknowledged that while AI will displace some jobs, it will ultimately create new roles, transforming rather than eliminating much of the workforce.

Investment Insight:

AI is driving both opportunity and risk for the $600+ billion global ad industry. On one side, generative AI enables agencies to lower costs, increase personalization, and improve campaign efficiency—providing margin expansion potential. On the other, it intensifies industry consolidation as smaller agencies struggle to keep pace with AI integration and clients demand higher output for less spend. Publicis and WPP are emerging as early adopters with first-mover advantage, while platform providers like Google, Meta, and OpenAI increasingly control critical AI infrastructure. For investors, leading ad holding companies with deep AI integration may outperform, but client brands face long-term strategic shifts as creative differentiation becomes harder to sustain in a world of mass AI-generated content.

Conclusion:

The market narrative remains centered on leadership shifts, aggressive M&A, and AI-fueled transformation across sectors. Luxury retail, energy, and advertising are all recalibrating their business models to adapt to both cyclical pressures and long-term structural changes. As tensions rise geopolitically, investors are recalibrating risk premiums in energy markets while also betting on companies that successfully leverage technological disruption to secure competitive advantage. Strategic adaptability will remain a key driver of both short-term market moves and long-term equity re-ratings in the coming quarters.

Upcoming Dates to Watch:

- June 17th: U.S. Retail Sales

- June 18th: U.K. CPI, Eurozone CPI

- June 19th: BoE Interest Rate Decision

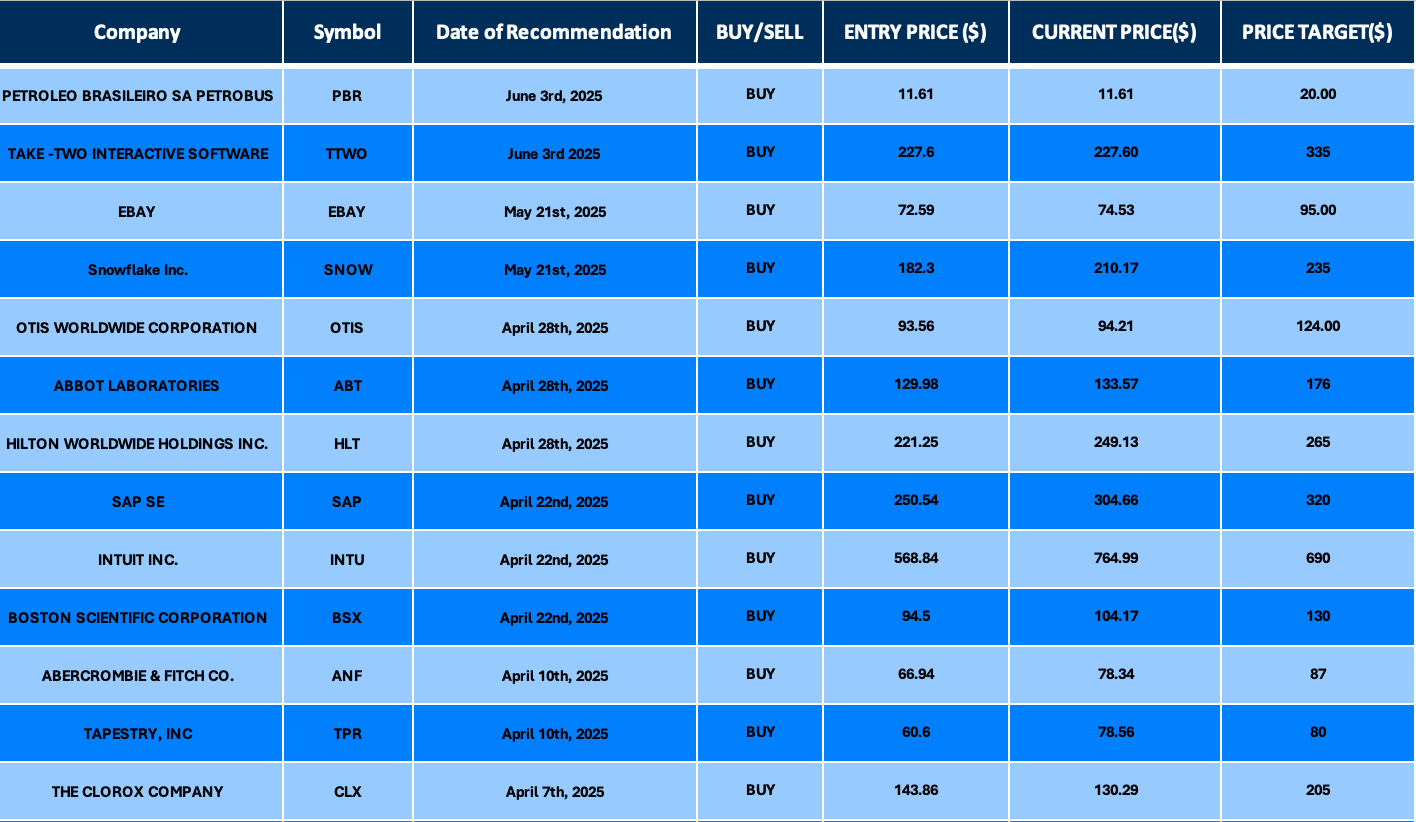

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.