Date Issued – 23rd June 2025

Preview

Global markets remain surprisingly calm despite escalating geopolitical tensions in the Middle East. Following U.S. strikes on Iranian nuclear sites, oil prices surged over 2%, raising fears of supply disruption through the Strait of Hormuz. Shipping threats are rising, with new warnings of potential attacks on commercial vessels and sharp increases in freight rates. Airlines are canceling flights and rerouting around Iran, Israel and neighboring airspaces. Despite the volatility, markets appear to view the crisis as contained – for now. Analysts caution that future developments, particularly Iran’s response, could change the outlook quickly.

Markets Stay Calm as U.S. Strikes Iran’s Nuclear Sites; Focus Shifts to Retaliation Risk

Global markets remained largely unmoved after the U.S. launched strikes on Iranian nuclear sites, with the MSCI World Index dipping just 0.12% and safe haven assets trading mixed. Analysts suggest the strikes are being viewed as a containment move that neutralizes nuclear threats rather than sparking broader conflict. The dollar strengthened while gold and the yen weakened slightly. Markets remain alert to Iran’s response, particularly the threat of closing the Strait of Hormuz. However, experts view this as unlikely, citing Tehran’s limited retaliatory options and fear of U.S. escalation.

Investment Insight:

The muted market reaction signals investor confidence that escalation risk is contained. However, energy markets remain vulnerable to supply disruption scenarios. Traders should monitor Iran’s stance on Hormuz and oil price volatility. A sudden closure could trigger a risk-off shift, but for now, equity and FX markets appear to be pricing in strategic restraint and geopolitical deterrence.

Oil Prices Spike as U.S. Strikes Iran, Raising Fears of Strait of Hormuz Disruption

Oil futures jumped over 2% after the U.S. launched strikes on Iranian nuclear sites, intensifying fears of supply disruption in the Middle East. Brent briefly breached $81 before settling at $78.81 per barrel. The escalation revived concerns over the strategic Strait of Hormuz, through which 20% of global oil supply transits. Iran’s parliament signaled support for a closure, but final approval rests with the national security council. The U.S. warned such action would prompt a severe response. Markets are also monitoring Iran’s allies in Iraq and regional responses from Saudi Arabia and China.

Investment Insight:

Crude markets are pricing in geopolitical risk premiums amid elevated tensions. While a full closure of the Strait remains unlikely, any perceived increase in Iranian retaliation could trigger a sharp oil rally. Energy investors should brace for volatility and monitor military developments, while broader market participants assess the inflationary implications of higher oil prices on central bank policy trajectories.

Shipping Risks Surge in Strait of Hormuz and Red Sea Amid Escalation

Global maritime group Bimco warns of rising threats to commercial shipping around the Arabian Peninsula following U.S. strikes on Iranian nuclear sites. Iran may retaliate with anti-ship missiles, drones or even sea mines, potentially disrupting the critical Strait of Hormuz, which handles 20% of global oil flows. Freight rates have already surged – spot rates from Shanghai to Jebel Ali are up 55% month-over-month, while crude and gas tanker rates have soared over 100%. U.S. or Israel-affiliated vessels are primary targets, though broader disruptions remain possible as tensions escalate.

Investment Insight:

Logistics disruptions in one of the world’s key energy corridors add upward pressure on oil prices and inflation expectations. Investors in energy, shipping and insurance sectors should monitor risk premiums and consider geopolitical hedges. Supply chain-sensitive industries face renewed vulnerability amid volatile freight costs and route uncertainties.

Airlines Divert Routes and Cancel Flights Amid Middle East Tensions

Following U.S. airstrikes on Iranian nuclear sites, global airlines are rerouting flights around the Middle East due to increased geopolitical risk. Carriers like Singapore Airlines and British Airways canceled flights to Dubai and Doha, while U.S. operators suspended service to Qatar and the UAE. Flight paths now avoid Iranian, Iraqi, Syrian and Israeli airspace, adding fuel and labor costs. Risk monitoring group Safe Airspace warns U.S. carriers could face heightened danger amid escalating regional threats, with ripple effects on global air traffic and aviation fuel costs due to rising oil prices.

Investment Insight:

Airline stocks may face near-term pressure due to higher operational costs, regional instability and potential jet fuel price hikes. Watch travel demand, insurance risk premiums and oil market volatility. Investors with exposure to airlines, logistics, or travel ETFs should monitor route disruptions and policy updates from aviation regulators.

Conclusion

While the U.S. strikes on Iran have intensified tensions across the Middle East, financial markets are currently pricing in a limited and contained conflict. Risk assets have remained resilient, supported by the perception that a broader escalation is unlikely and that global oil supply remains intact – at least for now. However, with shipping threats, rerouted airlines and diplomatic uncertainty rising, the situation remains highly fluid. Investors should remain vigilant, particularly as any disruption to the Strait of Hormuz or retaliatory strikes could significantly alter market dynamics and commodity flows in the weeks ahead.

Upcoming Dates to Watch

- June 24th: U.S. Consumer Confidence Index

- June 27th: U.S. Core PCE Price Index

- July 4th: Senate vote on Republican + debt ceiling bill

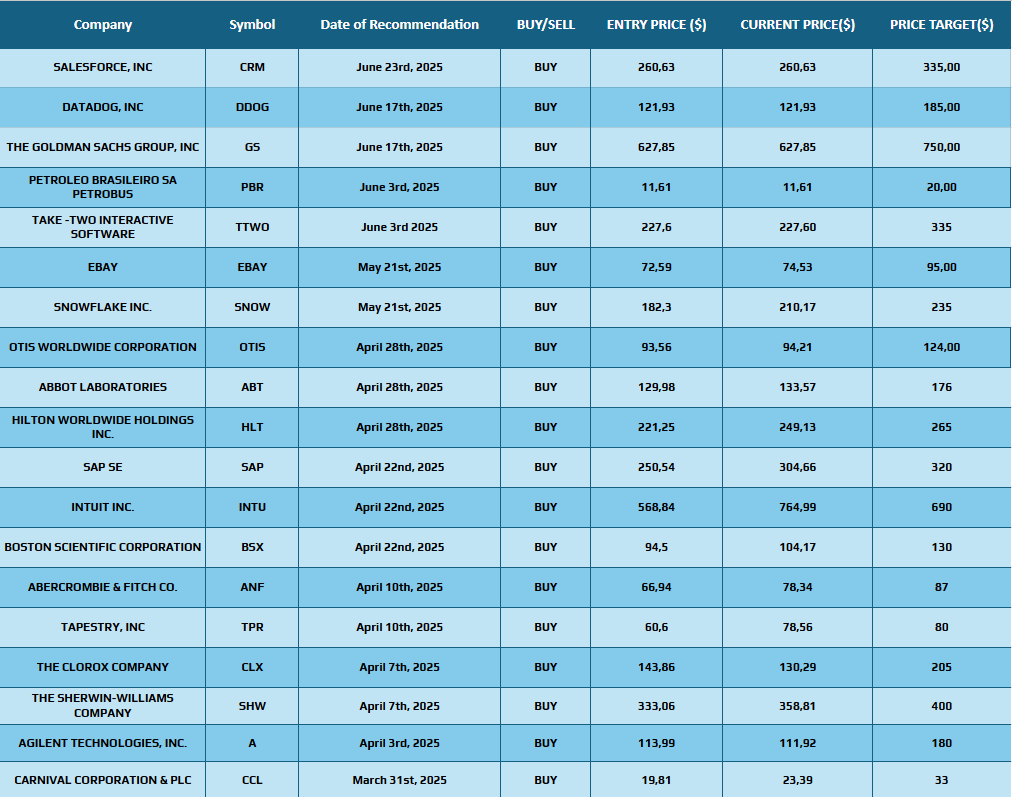

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.