Date Issued – 11th July 2025

Preview

Markets woke up to a whirlwind of economic signals and regulatory tensions. The U.K. economy contracted for a second month in a row, prompting speculation of an imminent rate cut. In the U.S., the pharmaceutical industry is bracing for impact as Trump floats a staggering 200% tariff that could reshape global drug manufacturing. Meanwhile, Tesla races to catch up in the autonomous vehicle space, eyeing Phoenix as its next Robotaxi battleground. Bitcoin is in full breakout mode – blasting through $113K as investors dive headfirst back into risk assets.

UK Economy Contracts Again in May, Raising Recession Fears

The U.K. economy unexpectedly contracted by 0.1% in May, following a 0.3% decline in April, missing expectations for a modest rebound. Weakness was concentrated in production (-0.9%) and construction (-0.6%). The slump comes despite the country securing a U.S. trade deal, with domestic headwinds – including rising labor costs, higher employer contributions and lingering business uncertainty – weighing on output. Analysts now expect Q2 GDP to underperform earlier forecasts, prompting speculation that the Bank of England could cut rates as early as August.

Investment Insight:

Markets are now pricing in an 80% chance of an August rate cut by the Bank of England, despite inflation sitting just above 3%. Investors should watch for further signals from BOE officials, especially Andrew Bailey, ahead of the August 14 GDP release. A dovish pivot could support U.K. equities and rate-sensitive sectors like real estate and small caps, while putting downward pressure on the pound. Fixed income investors may look to extend duration in anticipation of falling yields.

Trump’s 200% Tariff Threat Leaves Pharma Firms Scrambling

President Trump has reiterated plans to impose sweeping tariffs of up to 200% on pharmaceutical imports, giving companies 12-18 months to prepare. While no formal timeline has been set, the threat has sent shockwaves through the sector, with analysts warning of massive cost inflation, margin erosion and potential drug shortages. UBS noted the grace period is insufficient for supply chain reshoring, which typically takes 4-5 years. The industry is hoping for carve-outs in ongoing trade talks, but clarity remains elusive as the Section 232 investigation report is expected by month’s end.

Investment Insight:

Pharma stocks could face significant margin pressure if tariffs are enacted, particularly for firms reliant on non-U.S. manufacturing (e.g., Sanofi, Novartis, Roche). U.S.-centric firms with stronger domestic supply chains (e.g., Eli Lilly, Pfizer) may become relative outperformers. Investors should also watch for signs of reshoring trends benefiting U.S. contract manufacturers and life sciences REITs. Near-term volatility is likely until the Section 232 report is released – options markets may see increased activity around large-cap pharma. Stay alert for any movement in U.S. trade negotiations, particularly with the EU and Switzerland.

Tesla Targets Phoenix in Robotaxi Expansion Push

Tesla has applied to begin testing and operating its Robotaxi service in Phoenix, Arizona – a city where Alphabet-owned Waymo already has a mature presence. This follows Tesla’s June rollout of a supervised Robotaxi pilot in Austin, Texas. Unlike Waymo’s fully autonomous model, Tesla’s approach currently involves remote supervision and an in-vehicle human safety operator. The company is also eyeing an expansion into the San Francisco Bay Area, though it has yet to file required applications in California. Regulatory scrutiny persists after public incidents in Austin raised safety concerns.

Investment Insight:

Tesla’s Robotaxi ambitions are high-stakes, with massive upside if successful – but current execution lags Waymo and incidents are attracting regulatory heat. Short-term, this initiative may increase R&D spend and headline risk, especially if Austin pilot issues persist. However, investors bullish on Tesla’s full self-driving (FSD) thesis should monitor progress in Phoenix closely, especially Tesla’s approach to cost-effective autonomy using vision-only systems. Alphabet, via Waymo, may gain first-mover advantage and reputational benefits, reinforcing its leadership in AV tech. Look for any Robotaxi commentary in Tesla’s July 23 earnings call.

Bitcoin Breaks Above $113K as Risk Appetite Roars Back

Bitcoin surged to a new all-time high of $113,863 on Thursday, buoyed by renewed investor appetite for risk assets, a wave of short liquidations and bullish momentum in crypto markets. The flagship cryptocurrency has now remained above $100,000 for more than 60 days, supported by sustained inflows into Bitcoin ETFs and increasing purchases by public companies. The rally also lifted altcoins and crypto-related equities like Coinbase, Robinhood and Bitcoin miners Riot and Marathon. Positive sentiment was reinforced by broader risk-on market behavior and optimism over stablecoin legislation progress in Congress.

Investment Insight:

The momentum behind Bitcoin’s breakout appears structurally stronger than past rallies. ETF inflows and corporate treasury accumulation (outpacing ETF buys in Q2) signal growing institutional support. The liquidation of $318M in shorts adds technical fuel, but long-term drivers – such as regulatory clarity and macro tailwinds – are beginning to take center stage.

Conclusion:

Global markets are navigating a complex mix of policy shifts and economic uncertainty. The U.K.’s surprise economic contraction in May has increased pressure on the Bank of England to cut rates, while Trump’s 200% tariff threat has pharma firms bracing for major cost and supply disruptions. Tesla is pushing ahead with its Robotaxi expansion despite safety setbacks and regulatory hurdles. Meanwhile, Bitcoin continues to surge past new records, driven by institutional demand and optimism around crypto regulation.

Upcoming Dates to Watch:

- July 15th: US Retail Sales & Industrial Production

- July 16th: UK CPI & Unemployment Rate

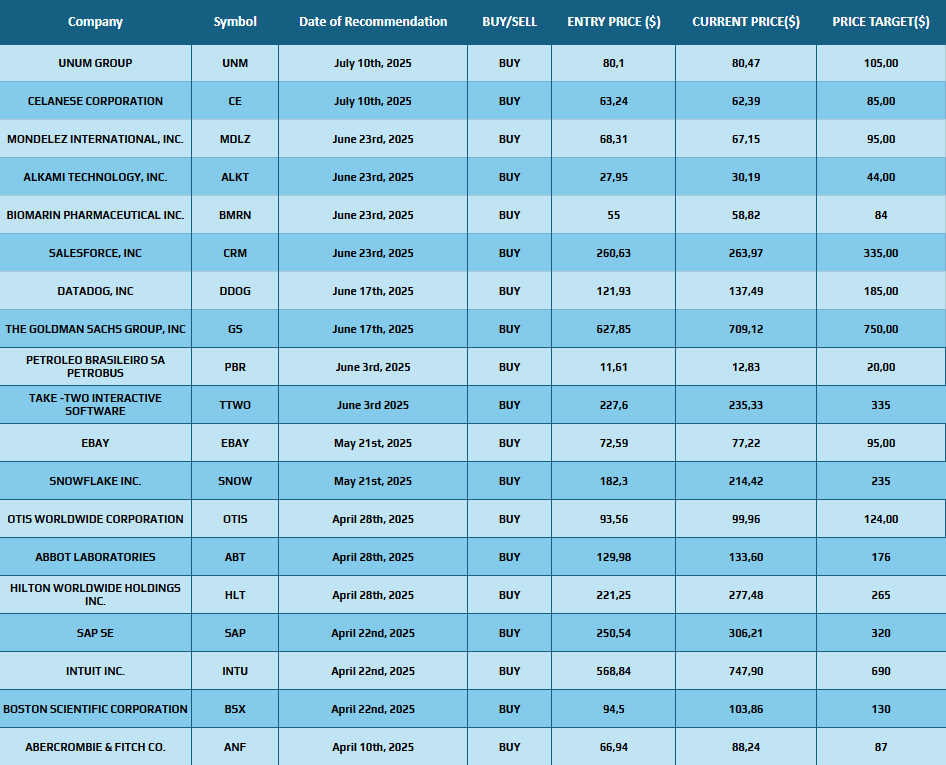

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.