Date Issued – 14th July 2025

Key Points

- European equities fall after Trump announces 30% tariffs on EU goods, with Germany’s DAX leading losses and autos hit hardest.

- China’s exports beat expectations in June, with rare earth shipments surging 60% and trade surplus widening despite a continued drop in U.S.-bound exports.

- Bitcoin tops $122,600 amid record ETF inflows and anticipation of pro-crypto legislation in Congress during ‘Crypto Week’.

- Wall Street braces for earnings season as S&P 500 profit growth slows and the G20 kicks off in South Africa without U.S. Treasury Secretary Bessent.

- Australia strengthens trade ties with China amid lingering security tensions, as PM Albanese meets Xi following a full reset of key commodity flows.

Preview

Markets opened the week under pressure from renewed trade tensions as Trump’s EU tariff move rattled Europe. China’s export resilience and Bitcoin’s surge past $120K offered contrasting optimism. Investors now look to earnings season for clarity on U.S. corporate margins, while geopolitical dynamics—from the G20 to Australia-China relations—remain fluid.

European Markets Slide as Trump Imposes 30% Tariff on EU Imports

European equities fell sharply Monday after President Trump announced a 30% tariff on EU goods, effective August 1. The Stoxx 600 dropped 0.5%, led by a 1% decline in the autos sector. Germany’s DAX shed 0.8%, while the FTSE 100 held slightly higher. EU Trade Commissioner Maros Sefcovic said a deal with the U.S. is still “very close,” though the threat casts a shadow over €1.7 trillion in transatlantic trade.

Earnings expectations for European firms have already reversed course, with Q2 EPS now forecast to fall 0.2% year-on-year, down from a 7.2% gain projected in April. Meanwhile, the Bank of England hinted at a potential rate cut as labor market softness builds, with markets pricing a 25bps reduction in August.

Investment Insight:

The tariff escalation adds fresh pressure to Europe’s export-heavy sectors, particularly autos and pharma, and compounds existing earnings headwinds. Investors should watch German and Irish equities for outsized impact. With the BoE signaling policy easing, GBP assets may see volatility while eurozone earnings revisions could intensify into Q3. Defensive positioning and selective U.S.-exposed European plays may offer relative insulation.

China’s Exports Beat Expectations as Rare Earth Shipments Hit Record High

China’s exports surged 5.8% year-on-year in June, surpassing forecasts and underscoring resilience in the face of U.S. tariffs. Rare earth exports soared 60.3% to an all-time high, with global buyers stockpiling ahead of the Aug. 12 deadline. Exports to the U.S. continued to slide, down 16.1%, despite a temporary truce, while shipments to Southeast Asia and the EU rose 16.8% and 7.6%, respectively. Imports posted their first gain this year, up 1.1%.

Steel, autos, and integrated circuit exports also jumped, reflecting robust industrial activity. Still, economists warn the momentum may fade in H2, with trade tensions and weak domestic demand clouding the outlook.

Investment Insight:

China’s better-than-expected export performance masks structural risks, as frontloaded shipments and geopolitical flashpoints threaten sustainability. The rare earth surge signals urgency among buyers to hedge supply chain exposure. Investors should monitor commodity plays linked to Chinese export dynamics and brace for potential volatility tied to second-half policy shifts or a breakdown in U.S.-China trade diplomacy.

Bitcoin Hits All-Time High Above $120,000 Ahead of U.S. ‘Crypto Week’

Bitcoin surged past $122,600 on Monday, setting a new record amid robust institutional inflows into Bitcoin ETFs and anticipation over major U.S. crypto legislation. ETF inflows reached $1.18 billion last Thursday — the strongest single-day showing in 2025. The rally precedes ‘Crypto Week’ in Congress, where lawmakers will debate bills including the Genius Act, aimed at regulating stablecoins and paving the way for private digital dollar issuance.

Market confidence has been further boosted by pro-crypto rhetoric from President Trump and growing expectations that regulatory clarity will unlock broader capital participation.

Investment Insight:

Bitcoin’s breakout underscores the strategic reallocation underway among institutions betting on digital assets as inflation hedges and geopolitical safe havens. While macro risks — including Fed policy and tariff-driven volatility — remain, regulatory progress could unlock the next leg of capital rotation into crypto. Investors should monitor legislative outcomes this week, as passage of key bills may catalyze new inflows and sustain momentum toward year-end targets of $140K–$160K.

G20 Diplomacy Frays as Earnings Season Kicks Off Under Trade Cloud

The week ahead marks the start of Q2 earnings season, with U.S. banking giants JPMorgan, Citi, Goldman Sachs, Morgan Stanley, and Bank of America reporting within days. Analysts expect S&P 500 earnings-per-share growth to decelerate to 4% from 12% in Q1, pressured by rising input costs and modest pricing power amid Trump’s widening tariff campaign.

Meanwhile, tensions simmer ahead of the G20 finance ministers’ meeting in Durban, South Africa, as U.S. Treasury Secretary Scott Bessent skips the summit following a diplomatic rift between President Trump and President Ramaphosa. South Africa now faces a 30% U.S. tariff, further straining ties ahead of the G20 Leaders summit in November.

Investment Insight:

Markets will closely watch U.S. bank results for signs of tariff-driven margin compression, particularly in trading and lending income. European financials, buoyed by a strong first half, may offer relative upside in Q3. On the geopolitical front, rising G20 friction and America’s selective tariff policy could accelerate the fragmentation of global trade alignments — an environment that may benefit firms with diversified regional exposure and low U.S.-EU reliance.

Australia Balances Trade Gains with Security Strains in China Reset

Australian Prime Minister Anthony Albanese arrived in Shanghai on a six-day visit aimed at deepening economic ties while managing simmering security tensions with Beijing. The trip marks his second since taking office and follows a series of trade normalizations — including the removal of tariffs on barley, wine, beef, and lobster — that have largely restored pre-2020 export flows.

However, security concerns persist, with recent flashpoints including naval incidents, espionage trials, and Australia’s Pacific defense posturing. Albanese is set to meet President Xi Jinping amid a broader regional recalibration driven by Trump-era tariffs and the emerging BRICS bloc.

Investment Insight:

Australia’s commodity sectors — particularly wine, beef, and minerals — stand to benefit from the continued thaw in trade relations with China. Yet investors should monitor defense-linked tensions that could reignite frictions and reintroduce volatility to bilateral trade. Companies with diversified export destinations and low strategic resource dependencies are better positioned as Canberra walks the tightrope between economic integration and national security.

Conclusion

Today’s newsletter reflects a broad theme of geopolitical risk intersecting with global economic and corporate dynamics. European markets are reacting to U.S. trade policy, China’s strong trade data underscores resilience despite weaker ties with the U.S., and Bitcoin’s surge highlights growing institutional interest ahead of regulatory clarity.

Earnings season begins under the shadow of trade pressures and G20 tensions, while Australia‑China relations remind us of the fragile balancing act between security and commerce. Investors should prepare for macro volatility as tariffs, central bank policy, and geopolitical headwinds could test both risk assets and safe havens.

Upcoming Key Dates to Watch

| Date | Event | Why It Matters |

|---|---|---|

| July 15, 2025 | U.S. CPI Report | Key inflation gauge that may shift Federal Reserve rate outlook. |

| July 15, 2025 | China Q2 GDP & Retail Sales | Tests China’s economic resilience amid trade uncertainty. |

| July 20, 2025 | Japan Upper House Election | Outcome may influence fiscal policy and yen volatility. |

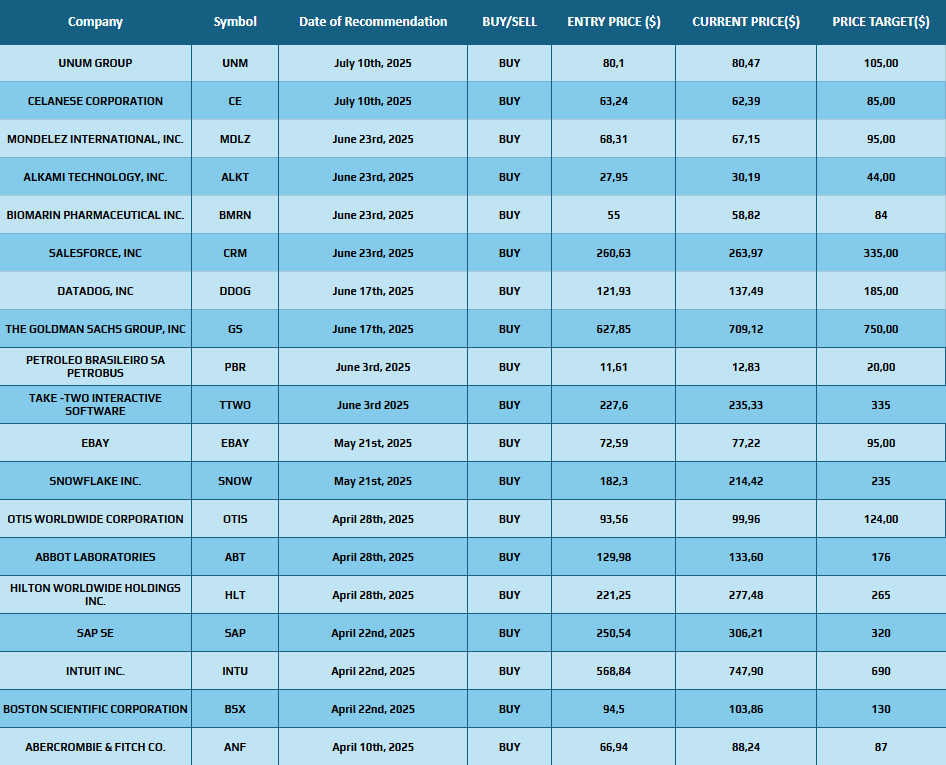

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.