Date Issued – 15th July 2025

Key Points

- Nvidia to Resume China AI Chip Sales – Nvidia secured U.S. approval to restart H20 GPU shipments to China.

- China Q2 GDP Beats Forecasts at 5.2% – Strong industrial output offset weak retail sales, but deflationary pressures and soft real estate investment fuel calls for fresh fiscal stimulus.

- Port of Los Angeles Hits Record Traffic – Container volumes surged 8% in June as importers raced to beat Trump’s August 12 tariff deadline on Chinese goods.

- Trump Threatens 100% Secondary Tariffs – The U.S. president set a 50-day deadline for Russia to reach a Ukraine peace deal.

- U.S. Housing Market Cools Further – Nearly one-third of major housing markets report annual price declines.

Preview

Global markets brace for renewed trade and policy shocks as Nvidia’s U.S.-approved China chip sales lift tech sentiment, while China’s 5.2% GDP growth underscores lingering domestic headwinds. Shipping demand surged ahead of looming U.S. tariffs, and Trump’s threat of 100% secondary tariffs heightens geopolitical risk. Meanwhile, U.S. housing markets cool further, signaling potential regional investment opportunities.Nvidia Cleared to Resume H20 AI Chip Sales to China

Nvidia announced it expects to restart H20 GPU shipments to China after receiving assurances from the U.S. government that export licenses will be approved. Sales were halted in April due to tightened U.S. export controls, which had cut Nvidia’s China market share nearly in half. The decision follows a meeting between CEO Jensen Huang and President Trump, coinciding with a preliminary U.S.-China trade framework easing tech export restrictions. Nvidia shares rose 4.5% in early trading, signaling investor optimism over regained Chinese market access.Investment Insight

The resumption of H20 GPU shipments could provide a meaningful revenue boost for Nvidia, reinforcing its competitive edge in China against domestic rivals like Huawei. Investors may view this as a short-term catalyst for earnings, but ongoing U.S.-China tech tensions and future regulatory shifts remain key risks.China’s Q2 Growth Beats Estimates but Deflation Fears Linger

China’s GDP expanded 5.2% in Q2, slightly above forecasts but slower than Q1’s 5.4%, keeping Beijing on track to hit its 5% annual target. Industrial output rose 6.8%, while retail sales slowed sharply to 4.8%, reflecting weak consumer demand. Fixed asset investment grew just 2.8% as real estate investment contracted 11.2%. Economists warn that price discounting is eroding trade gains, with the GDP deflator down 1.2% year-on-year — the steepest drop since the global financial crisis. Calls for deeper fiscal stimulus and structural reforms are mounting, even as policymakers weigh delaying large-scale measures.Investment Insight

While above-target growth reduces immediate pressure for aggressive stimulus, deflationary risks and weak domestic consumption threaten China’s economic momentum in H2. Investors should monitor upcoming Politburo signals and potential fiscal measures; infrastructure and consumer-focused sectors could benefit if Beijing moves ahead with targeted support. However, lingering tariff uncertainty and structural headwinds may cap upside for Chinese equities.Port of Los Angeles Hits Record Container Volume Amid Tariff Rush

The Port of Los Angeles logged its busiest June ever, processing 892,340 TEUs — an 8% year-on-year rise — as importers accelerated shipments ahead of President Trump’s August 12 tariff deadline, which could raise levies on Chinese goods to 145%. The rush followed a temporary tariff pause that lowered rates to 45%, boosting U.S. manufacturing orders from China and fueling its $114.7 billion trade surplus last month. Port officials expect cargo volumes to ease after August as new tariffs take hold, with the National Retail Federation forecasting a double-digit decline in shipments through year-end.Investment Insight

The record traffic underscores the “tariff whipsaw effect,” where shifting trade deadlines disrupt supply chains and frontload orders. Logistics providers and select shipping companies may see short-term gains, but rising freight costs and softening retail demand point to volume contraction later this year. Investors should remain cautious on transport and retail-exposed equities as the tariff uncertainty pressures margins and dampens holiday-season demand.Trump Sets September Deadline, Threatens 100% Secondary Tariffs on Russian Export Buyers

President Donald Trump warned he will impose “secondary tariffs” of around 100% on nations buying Russian exports if Moscow fails to reach a peace deal on Ukraine within 50 days. Speaking at the White House alongside NATO Secretary General Mark Rutte, Trump expressed frustration with President Vladimir Putin, saying he expected a deal months ago. The proposed levies could heavily impact major Russian energy buyers such as China, India, Brazil, and Turkiye. Trump also announced additional U.S. military equipment purchases funded by European allies to bolster Ukraine via NATO supply chains.Investment Insight

The tariff threat raises geopolitical and market risks, particularly for energy-importing nations reliant on Russian oil and gas. Secondary sanctions could tighten global energy supplies, driving volatility in oil prices and pressuring emerging-market currencies tied to Russian trade. Energy and defense sectors may benefit in the short term, but global trade disruption risks heighten uncertainty for broader markets, especially in Europe and Asia.Nearly One-Third of Major U.S. Housing Markets Now Facing Price Declines

The U.S. housing market continues to cool as high mortgage rates, rising supply, and slowing demand weigh on prices. Annual home price growth slowed to 1.3% in June, the weakest pace in two years, according to ICE. Nearly one-third of the largest 100 housing markets now report annual price declines of at least 1%. Inventory jumped 29% year-over-year, though gains have slowed in recent months. Price weakness is concentrated in the South and West, with steep drops in Cape Coral, Austin, and Tampa, while the Northeast and Midwest still show solid price growth.Investment Insight

Cooling prices and rising inventories signal a shift toward a more balanced housing market, potentially easing affordability pressures for buyers. However, continued regional disparities and persistent high mortgage rates suggest selective opportunities for real estate investors. Markets in the Northeast and Midwest may remain resilient, while overvalued markets in the South and West could face further price corrections, creating entry points for long-term investors.Conclusion

Today’s developments underscore the interconnected pressures shaping markets—from the resurgence in global AI chip sales to trade-driven shipping spikes and the threat of sweeping tariffs. China’s outperformance masks underlying softness in consumption and real estate, suggesting policymakers may need to act. In the U.S., cooling housing data echoes a broader economic recalibration, while geopolitical tensions—marked by looming secondary sanctions—add uncertainty. Investors should watch China’s upcoming fiscal response, Nvidia’s execution in China, and U.S. consumer resilience as interest rates remain elevated. Strategic positioning across tech, regional real estate, and trade-exposed assets will be essential amid evolving risk dynamics.Upcoming Key Dates to Watch

| Date | Event | Forecast |

|---|---|---|

| Tue, Jul 15 | China CPI & PPI (Jun) | Monitor deflation risks |

| Thu, Jul 17 | U.S. Retail Sales & Industrial Production (Jun) | Key to consumer-led growth |

| Fri, Jul 18 | BoJ & BoE Monetary Policy Minutes | Insights on global rate outlooks |

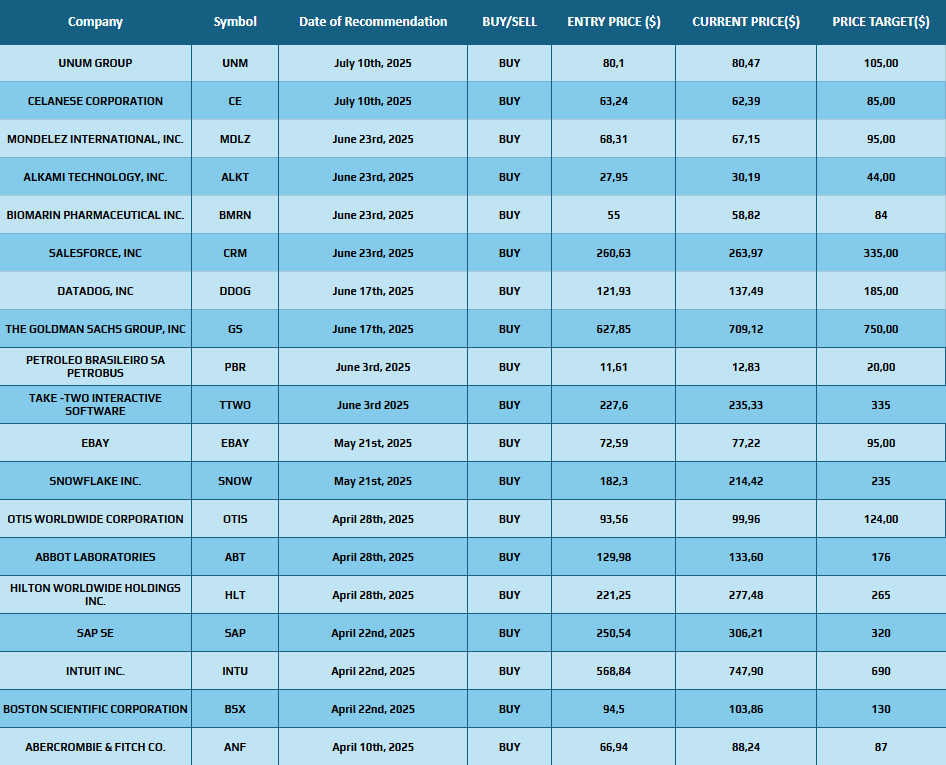

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.