Date Issued – 30th December 2024

Preview

Asian stocks retreated as US equities declined

With year-end caution and thin trading volumes weighing on markets, Asian stocks pulled back. Oil prices held steady but face risks in 2025 from oversupply and geopolitical uncertainty, while gold surged 27% this year, supported by monetary easing and safe-haven demand. Japan’s factory activity contracted at a slower pace in December, hinting at stabilization despite weak orders and rising input costs. Meanwhile, Ibiden, a key Nvidia supplier, plans to accelerate capacity expansion amid surging AI chip demand, signaling continued growth in the semiconductor sector. Investors should remain cautious in volatile markets, focus on diversification, and monitor policy shifts and demand trends heading into 2025.

Asian Stocks Drop Amid US Losses and Year-End Caution

Asian stocks slipped as US equities declined on Friday, and investors trimmed positions ahead of year-end. The MSCI Asia Pacific Index fell after a five-day rally, with shares in Japan and Australia dropping amid thin trading volumes. Treasury yields hovered near multi-month highs, adding pressure to equities, while the Australian dollar strengthened on higher iron ore prices. Despite Monday’s dip, Asian markets are set to close 2024 with a 7.5% gain, buoyed by easing monetary policies and AI-driven tech rallies.

Investment Insight

Year-end caution and thin trading volumes amplify stock market volatility. Investors should remain cautious with major decisions during this period, particularly in overvalued sectors like tech.

Oil Holds Steady as Traders Eye 2025 Risks

Oil prices remained stable in thin year-end trading, with West Texas Intermediate hovering near $71 a barrel and Brent above $74. Despite a 1.6% gain last week, crude is set to end 2024 with annual losses, constrained by ample supply and demand uncertainties. Key risks for 2025 include oversupply, OPEC+ production challenges, and policy shifts under President-elect Donald Trump, who has hinted at tariffs on major oil producers and plans to intensify pressure on Iran. Concerns over Chinese demand and ongoing Middle East tensions also weigh on the market.

Investment Insight

Oversupply and geopolitical uncertainty may cap oil price growth in 2025. Investors should monitor policy shifts and demand signals closely before making energy sector bets. Volatility could provide opportunities for short-term trading, but long-term positions may carry elevated risk. Diversifying exposure within the energy sector, including renewable energy plays, could balance potential downside.

Gold Shines with 27% Gain in a Mixed Year for Metals

Gold is set for a standout 27% annual gain in 2024, driven by US monetary easing, geopolitical risks, and record central bank purchases. This surge defied traditional headwinds like a stronger US dollar and rising real Treasury yields, signaling a potential shift in market dynamics. Meanwhile, base metals had a mixed year, with the LMEX Index posting modest gains, while iron ore dropped 28% amid China’s construction slowdown. Lithium extended its slump due to a global supply glut and challenges in the EV sector.

Investment Insight

Gold’s resilience in 2024 highlights its appeal as a safe-haven asset amid economic and geopolitical uncertainties. Investors should consider gold as a hedge going into 2025, particularly if US monetary policy remains uncertain. Base metals may face continued pressure from weak Chinese demand, while oversupply in lithium could persist, challenging bullish positions.

Ibiden Plans Faster Expansion to Meet Soaring AI Chip Demand

Ibiden Co., a key supplier of advanced chip substrates for Nvidia’s AI semiconductors, is considering accelerating production capacity expansion to meet surging demand. The Japanese company’s new factory in Gifu, Japan, is set to reach partial production in late 2025, but clients, including Nvidia, Intel, and AMD, are already urging further investments. AI substrates now account for over 15% of Ibiden’s revenue, a figure expected to grow as Nvidia scales production of its next-generation Blackwell chips. Despite competition from Taiwanese rivals, analysts believe Ibiden’s dominance in high-quality substrate manufacturing is secure.

Investment Insight

The AI boom is driving strong demand for semiconductor components, positioning suppliers like Ibiden as key beneficiaries. Investors should watch for capacity expansion updates, as delays could hinder growth. Diversification beyond Intel and leveraging AI trends could strengthen Ibiden’s long-term outlook.

Market price: Ibiden Co Ltd. (TYO: 4062): USD JPY 4,766

Japan’s Factory Activity Shrinks at Slower Pace in December

Japan’s factory activity contracted for the sixth consecutive month in December, but the pace of decline slowed, with the manufacturing PMI rising to 49.6 from November’s 49.0. Softer reductions in production and new orders drove the improvement, though new orders continued their 19-month contraction due to weak domestic and overseas demand, particularly in the semiconductor market. Employment rebounded to its highest level since April, while input costs surged on higher raw material prices, labour costs, and a weak yen. Despite challenges, manufacturers remained optimistic, citing new product launches and future demand growth.

Investment Insight

Japan’s manufacturing sector shows signs of stabilization, but weak demand and rising costs remain headwinds. Investors should monitor PMI trends and input price pressures, as sustained recovery depends on global demand revival and cost management. Export-driven sectors may face prolonged challenges tied to semiconductor weakness.

Conclusion

As 2024 wraps up, markets remain shaped by year-end caution, geopolitical uncertainties, and sector-specific challenges. Gold’s standout performance underscores its resilience as a safe-haven asset, while oil and base metals face pressure from oversupply and weak demand. The AI boom continues to drive growth opportunities for key suppliers like Ibiden, while Japan’s manufacturing sector shows tentative signs of stabilization. Looking ahead to 2025, investors should prepare for volatility, closely watch policy changes, and focus on diversified strategies to navigate risks and opportunities across sectors. Patience and careful positioning will be key in the evolving global market landscape.

Upcoming Dates to Watch

- December 31, 2024: China manufacturing PMI, non-manufacturing PMI

- January 1, 2025: US manufacturing PMI, Jobless claims

- January 2, 2025: US ISM manufacturing

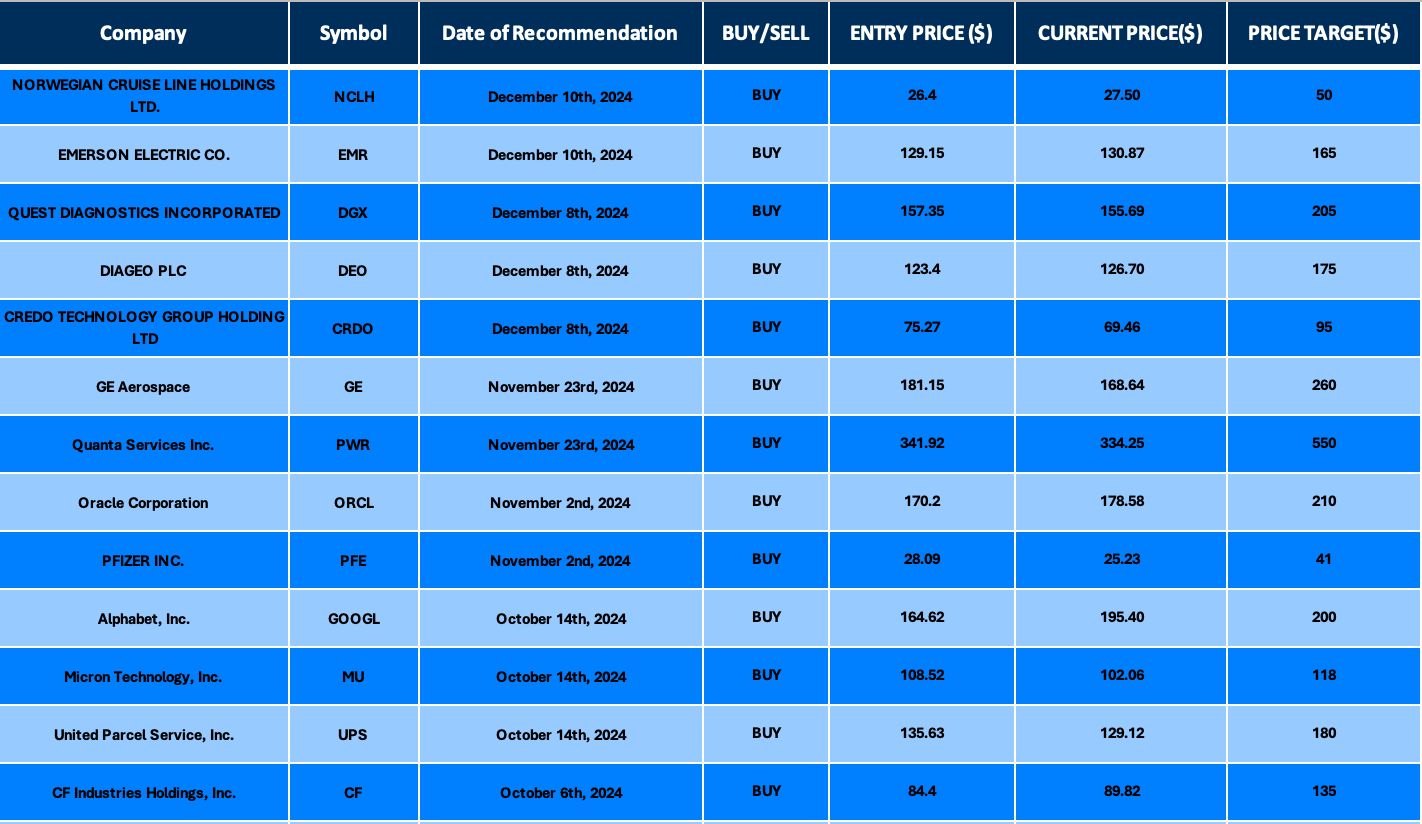

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.