Date Issued – 3rd January 2025

Preview

Tesla shares slide over 6% after a Q4 delivery miss and first annual sales decline

Tesla (TSLA) shares fell over 6% after reporting Q4 2024 deliveries of 495,930 vehicles, missing analysts’ estimates of 510,400. For the year, Tesla delivered 1.78 million vehicles, slightly below 2023’s 1.8 million — the automaker’s first-ever year-over-year sales decline. Analysts attribute the miss to increasing competition, global economic pressures, and Tesla’s focus on new model preparations. Meanwhile, Chinese rival BYD reported 4.3 million global deliveries, with 1.76 million pure EVs, closing in on Tesla.

Wedbush analyst Dan Ives remains optimistic, projecting 20%-30% delivery growth in 2025, fueled by Tesla’s anticipated lower-cost EV, FSD software uptake, and robotaxi innovations.

Investment Insight

Tesla’s delivery miss signals short-term challenges, but long-term growth potential remains. Investors may view current dips as opportunities, banking on new product launches and accelerated delivery targets in 2025.

Market price: Tesla Inc (TSLA): USD 379.28

Yuan’s Rally Risks Undermining China’s Exporters

China’s efforts to stabilize the yuan at 7.3 per dollar have strengthened its exchange rate against key trading partners, including the euro and South Korea’s won, reaching its highest level since October 2022. While this bolsters market stability and regional currencies, it risks weakening Chinese exporters’ competitiveness and undermining recovery efforts amid global economic uncertainty and tariff threats from U.S. President-elect Donald Trump. Analysts warn that China’s strict currency defense could reduce the effectiveness of monetary easing and lead to future volatility.

Investment Insight

China’s rigid currency strategy may create short-term stability but risks long-term economic drag. Investors should monitor trade policy developments and volatility spikes as potential inflection points for Chinese assets.

South Korea, Hong Kong Lead Asian Stocks Higher Amid Global Weakness

Asian equities rallied on Friday, with South Korea’s benchmark up 2.3% and Hong Kong and Australia also posting gains, bucking the global downtrend that saw U.S. stocks fall for a fifth straight session. Chinese stocks remained subdued after their worst yearly start since 2016, while China’s 10-year bond yield dropped below 1.6% for the first time amid economic concerns. U.S. equity futures rose, signaling a potential rebound, as investors reassess strategies after a volatile end to 2024.

Investment Insight

Asia’s divergence from U.S. market weakness highlights regional opportunities, particularly in South Korea and Hong Kong. Investors should monitor interest rate trends and China’s bond market for broader economic signals.

China Plans Export Curbs on Lithium Tech to Protect Supply Chain Dominance

China is proposing stricter export controls on advanced technologies used in lithium refining and battery material production, aiming to safeguard its dominance in the global battery supply chain amid escalating U.S.-China trade tensions. The curbs target emerging processes like direct lithium extraction and specific compounds crucial for high-performance batteries. While existing projects may remain unaffected, future investments and joint ventures could face tighter scrutiny. This move follows China’s broader strategy of restricting exports of key minerals and technologies tied to high-tech and military applications.

Investment Insight

China’s tightening grip on lithium technology could disrupt global battery supply chains, heightening risks for non-Chinese EV and battery manufacturers. Investors should watch for potential supply bottlenecks and increased costs in the EV market.

Biden Blocks Nippon Steel’s Bid for U.S. Steel

President Joe Biden has decided to block Nippon Steel’s proposed acquisition of U.S. Steel, according to the Washington Post. The decision, attributed to concerns over national interests, underscores the administration’s focus on safeguarding critical industries. The $14.1 billion deal faced months of scrutiny and opposition, raising questions about the future of U.S. Steel and its role in the domestic industrial sector.

Investment Insight

The blocked deal highlights rising protectionism in critical industries. Investors should consider potential volatility in U.S. Steel’s stock (X) and broader implications for foreign investments in U.S. strategic sectors.

Conclusion

This week highlighted intensifying global competition across industries. Tesla’s delivery miss signals rising pressure in the EV market, while China’s proposed lithium export curbs underscore its supply chain dominance amid trade tensions. Asian equities offered a bright spot, led by South Korea and Hong Kong, as global markets grapple with inflation and tight monetary policy. Meanwhile, Biden’s block on Nippon Steel’s U.S. Steel bid reveals growing protectionism in critical sectors. As 2025 unfolds, investors should stay attuned to geopolitical shifts, trade policies, and sector-specific developments shaping opportunities and risks in an evolving global economy.

Upcoming Dates to Watch

- January 3, 2025: US ISM manufacturing

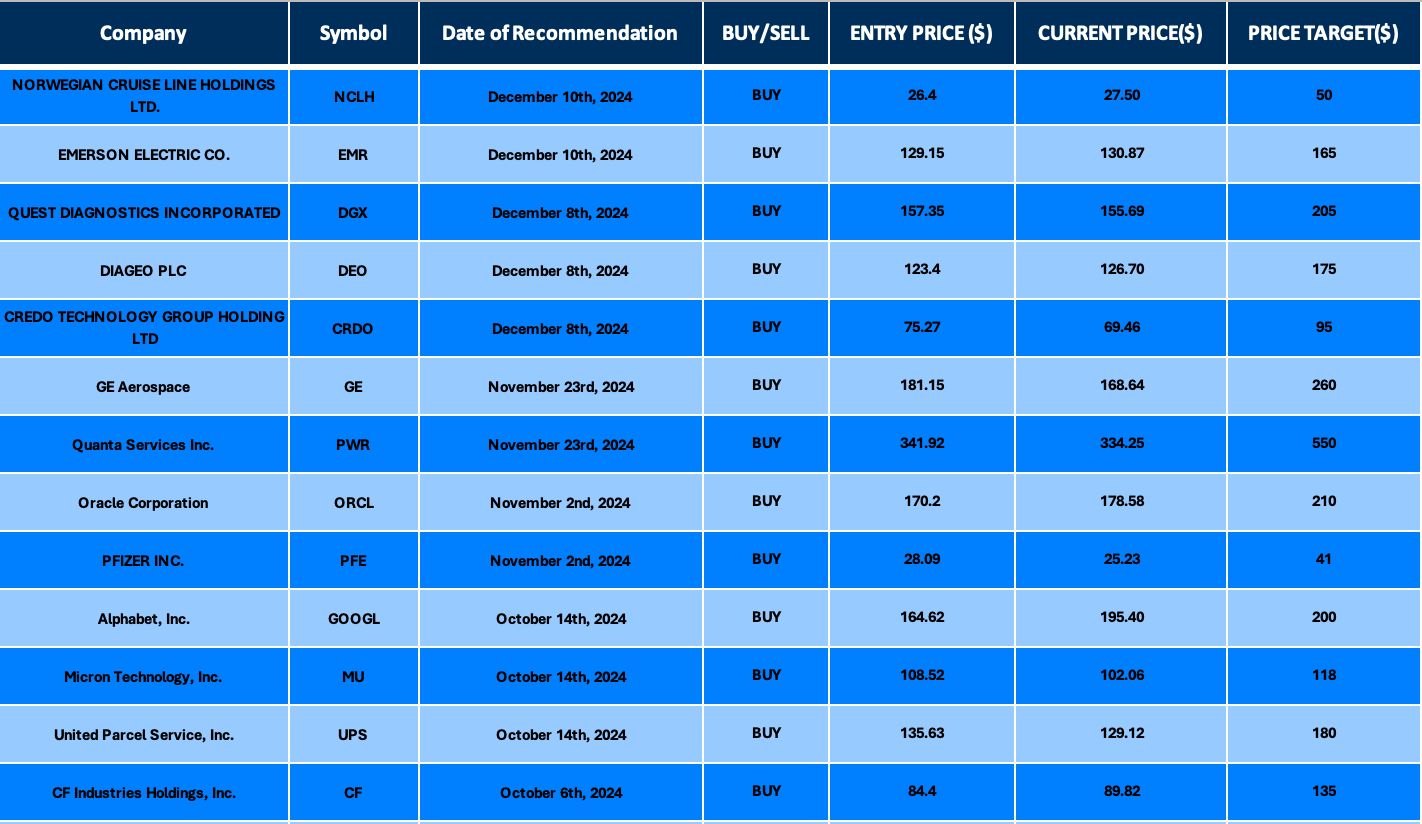

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.