Date Issued – 6th January 2025

Preview

Industrial metals declined as China’s efforts to support the yuan failed to offset weak demand, with aluminum and iron ore hitting recent lows. Samsung unveiled AI-powered upgrades for its premium TVs at CES, aiming to strengthen its market dominance through partnerships with Microsoft and Google. Goldman Sachs delayed its $3,000 gold forecast to mid-2026, citing fewer expected US rate cuts and weaker speculative demand. In Canada, Prime Minister Justin Trudeau is reportedly set to resign amid mounting political pressure, triggering a leadership race. Meanwhile, shares of Asian alcohol producers slid after the US Surgeon General linked alcohol consumption to cancer risks, sparking fears of tougher regulations.

Metals Slide Despite China’s Yuan Support Measures

Aluminum hovered near a three-month low, and iron ore futures continued their decline, as China set a stronger yuan reference rate to counter the US dollar’s rally. The yuan, which recently breached the 7.3-per-dollar mark, was set stronger than 7.2, but its weakness has made industrial metals pricier for Chinese buyers, dampening demand. Metals markets remain under pressure, with Donald Trump’s US presidential win boosting the dollar and uncertainty persisting over China’s growth recovery. Aluminum fell 0.2% to $2,488 a ton, while iron ore dropped 1.2% to $97.05 a ton, its lowest since November.

Investment Insight

A strong dollar and weak Chinese demand signal further downside risk for industrial metals. Investors should monitor currency trends and trade policy developments closely.

Samsung Brings Generative AI to Top-Selling TVs

Samsung Electronics is integrating generative AI into its premium TV lineup with its new Vision AI suite, unveiled at CES 2025. The AI-powered TVs can identify on-screen actors or products, translate content in real time, and generate personalized backgrounds. High-end models feature an AI processor to enhance visuals and audio. Samsung, the world’s leading TV seller for nearly 20 years, is also partnering with Microsoft and Google to expand Vision AI’s capabilities, signaling its shift toward making TVs more interactive and adaptive.

Investment Insight

Samsung’s AI-driven innovation reinforces its market leadership while leveraging partnerships with tech giants. This move could drive premium sales and strengthen its position in the home entertainment market.

Market price: Samsung Electronics Co Ltd. (KRX: 005930): KRW 56,000

Goldman Delays $3,000 Gold Forecast Amid Fewer Rate Cuts

Goldman Sachs has postponed its $3,000 gold price forecast to mid-2026, citing expectations of fewer Federal Reserve rate cuts in 2025. Analysts now project gold will reach $2,910 per ounce by year-end, as slower monetary easing and weaker ETF flows weigh on demand. While central bank purchases remain a strong driver, speculative demand has softened, keeping gold prices range-bound. Goldman expects 75 basis points of rate cuts this year, down from a prior forecast of 100.

Investment Insight

Slower rate cuts and reduced speculative demand may limit gold’s upside in the near term. However, sustained central bank buying offers long-term support, making gold a defensive asset for cautious investors.

Canada’s Trudeau Expected to Resign Amid Party Pressure

Canadian Prime Minister Justin Trudeau is likely to resign as leader of the Liberal Party this week, according to The Globe and Mail. Trudeau has faced mounting calls from Liberal lawmakers to step down, intensifying after Finance Minister Chrystia Freeland resigned in December over policy disagreements. If confirmed, his departure would trigger a leadership race at a critical time, with opposition parties poised to force a confidence vote by March and Conservatives holding a commanding lead in polls. Potential leadership contenders include Freeland, Mark Carney, and other senior cabinet members.

Investment Insight

Political uncertainty in Canada could weigh on markets, but Trudeau’s exit may bring clarity to fiscal and trade policies. Watch the Canadian dollar and sectors sensitive to US-Canada trade relations for volatility.

Asian Alcohol Stocks Drop After US Cancer Warning

Shares of major Asian liquor and beer makers fell sharply after the US Surgeon General linked alcohol consumption to increased cancer risk and suggested warning labels. Japan’s Sapporo Holdings dropped 5.1%, China’s Wuliangye Yibin fell 3.7%, Budweiser Brewing APAC slid 2.6%, and Australia’s Treasury Wine Estates dipped 2.7%. Analysts warn the sector could face long-term pressure if stricter regulations on alcohol labeling follow, though any changes are likely years away.

Investment Insight

Heightened regulatory risk could weigh on the alcohol sector, particularly for companies heavily reliant on US sales. Investors should monitor developments in labeling and marketing rules, as well as broader consumer sentiment shifts.

Conclusion

This week’s headlines highlight shifts across markets and industries. Weak Chinese demand and a strong US dollar continue to pressure industrial metals, while Samsung’s AI-powered TVs signal innovation in consumer tech. Gold faces a tempered outlook as rate cut expectations ease, and Canada braces for political uncertainty with Trudeau’s likely resignation. Meanwhile, Asian alcohol stocks tumble on regulatory fears after a US cancer warning. Investors should remain vigilant, monitoring currency trends, policy developments, and sector-specific risks to navigate the evolving landscape. Stay informed as these stories unfold and shape the year ahead.

Upcoming Dates to Watch

- January 7, 2025: Eurozone CPI, Unemployment

- January 8, 2025: Eurozone PPI, Consumer confidence

- January 9, 2025: China CPI, PPI

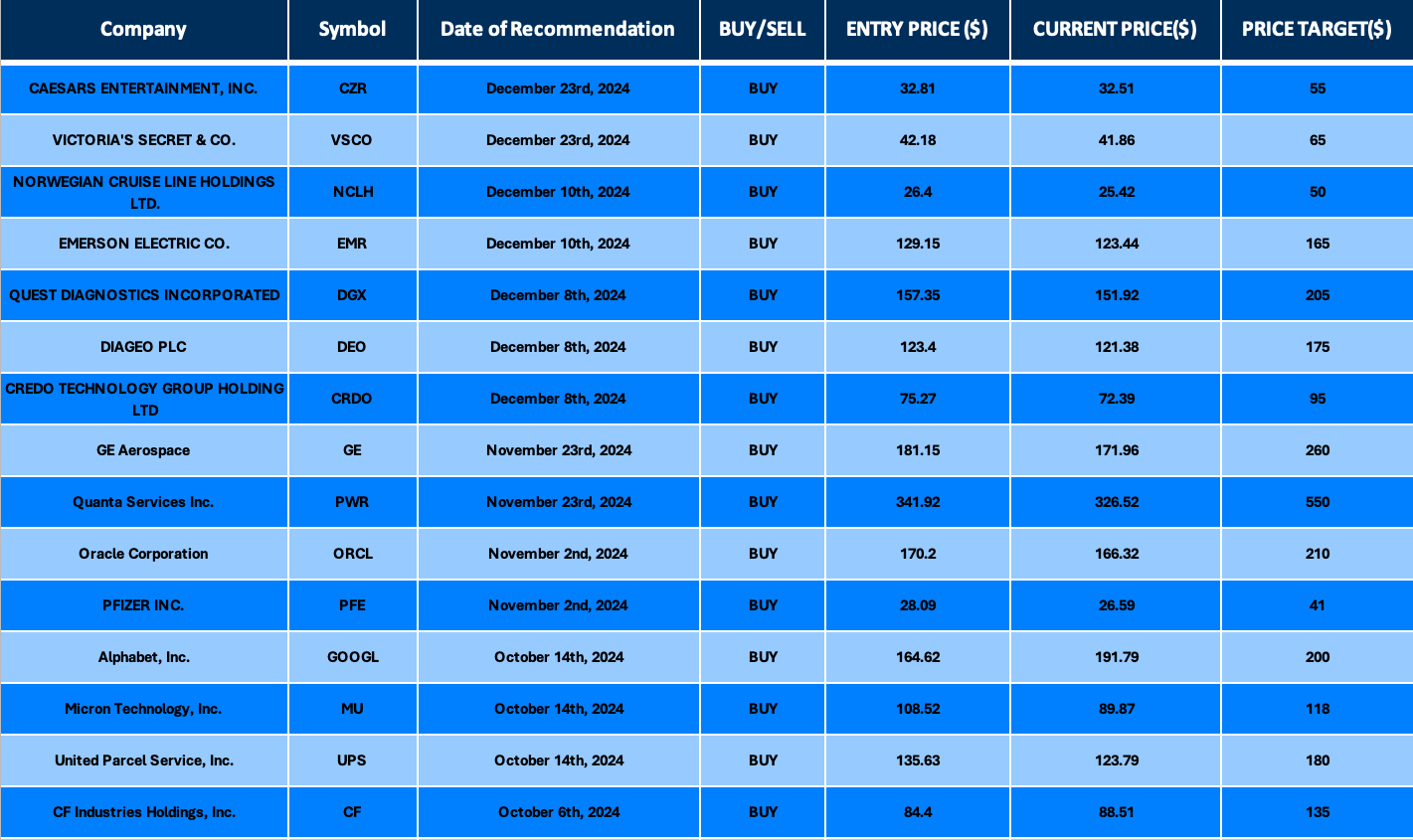

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.