Date Issued – 7th January 2025

Preview

Nvidia unveiled its GB10 superchip and AI platforms at CES 2025, showcasing innovations in robotics and self-driving tech as it expands beyond its core data center business. Meanwhile, Tencent shares dropped 7% after being blacklisted by the US for alleged military ties, escalating US-China tensions. Bitcoin surged past $102,000 on a weaker dollar and strong ETF inflows but remains sensitive to macroeconomic shifts. In currency markets, China’s record yield gap with the US intensified pressure on the yuan as the PBOC struggles to stabilize it amid capital outflows. Finally, Asian shares rose on hopes for softer Trump tariffs, though uncertainty around trade policy persists, with key US economic data due this week.

Nvidia Unveils GB10 Superchip and AI Systems at CES 2025

Nvidia (NVDA) showcased its latest AI advancements at CES 2025, including the GB10 superchip, AI tools for robotics, and self-driving technologies. The GB10, a compact version of Nvidia’s powerful Blackwell-based GB200, integrates a Grace CPU with a Blackwell GPU, offering researchers a desktop AI supercomputer called Project DIGITS starting at $3,000. Nvidia also launched Cosmos, a platform for developing AI-powered humanoid robots and self-driving cars using virtual simulations, alongside Isaac GROOT Blueprint, which simplifies robot training using motion synthesis. On the automotive front, Toyota and other partners will leverage Nvidia’s DRIVE hardware and software for autonomous vehicles. Nvidia’s smaller AI segments, including Robotics and Automotive, are growing rapidly, with a 72% year-over-year revenue increase despite still trailing its dominant Data Center business.

Investment Insight

Nvidia’s diversified AI portfolio positions it as a leader in emerging markets like robotics and autonomous vehicles. While these segments contribute modestly to its revenue today, their growth potential underscores the company’s long-term strategy beyond its core data center dominance.

Market price: Nvidia Corp (NVDA): USD 149.43

Tencent Shares Drop After US Adds Firm to Military Blacklist

Tencent and battery giant CATL were blacklisted by the US Defense Department for alleged ties to the Chinese military, sparking a 7% drop in Tencent’s shares and a 5% decline for CATL in Hong Kong. The move, weeks before Donald Trump’s inauguration, adds to escalating US-China tensions and could disrupt CATL’s supply chain to major automakers, including Tesla and Ford. Tencent denied any military affiliations, calling the decision a “mistake,” while analysts suggest the blacklist may not impact operations directly. Other firms, including SenseTime and Cnooc, were also added to the list, though some Chinese companies have successfully contested such designations in the past.

Investment Insight

The blacklisting underscores geopolitical risks for Chinese tech and industrial giants like Tencent and CATL. Investors should monitor regulatory developments closely, as sustained tensions could weigh on global supply chains and investor sentiment in Chinese equities.

Market price: Tencent Holdings Ltd (HKG: 0700): HKD 381.60

Bitcoin Surges Past $102,000 Amid Dollar Weakness on Tariff News

Bitcoin broke above $102,000 on Monday, buoyed by a weakening dollar after reports suggested Trump’s tariffs might be less extensive than feared. Although the report was later refuted, Bitcoin held steady above $100,000, supported by strong ETF inflows, with $500 million pouring into Bitcoin ETFs in just three days, according to CoinShares. MicroStrategy also continued its buying spree, adding $100 million in Bitcoin to its holdings, now worth nearly $45 billion. The dollar’s movements, coupled with expectations for changing monetary policy in 2025, remain key factors driving Bitcoin’s momentum.

Investment Insight

Bitcoin’s rally underscores its increasing correlation with macroeconomic trends, particularly the dollar’s performance. Investors should watch for further institutional demand via ETFs and corporate buying, as these factors solidify Bitcoin’s role as a hedge in volatile markets.

China’s Record Yield Gap with US Puts Yuan Under Pressure

China’s yield discount to US Treasuries hit a record 300 basis points, intensifying downward pressure on the yuan as capital outflows mount. The gap, driven by falling Chinese bond yields amid deflationary pressures and weak credit growth, contrasts with relatively firm US economic activity keeping Treasury yields elevated. The yuan has slid toward record lows in offshore trading, despite the People’s Bank of China (PBOC) intervening to stabilize the currency. With a fragile economy, prolonged property downturn, and tariff threats from President-elect Trump, policymakers face a tough choice between further yuan depreciation and economic support measures.

Investment Insight

The widening yield gap highlights China’s economic vulnerabilities and the yuan’s sensitivity to capital flows. Investors should brace for continued yuan weakness and monitor PBOC interventions, as policy decisions may signal broader economic priorities amid global uncertainties.

Asia Shares Rise on Hopes of Softer Trump Tariffs

Asian markets gained on Tuesday, mirroring Wall Street’s optimism after reports suggested President-elect Donald Trump might adopt a selective tariff approach targeting specific sectors rather than broad measures. Japan’s Nikkei surged 2%, while China’s CSI300 edged up 0.12%. However, Trump later denied the report, tempering the dollar’s decline. Investors remain cautious as Trump’s trade policy stance evolves. Meanwhile, U.S. economic data releases, including December’s nonfarm payrolls and Fed minutes, are expected to shape global markets this week. Oil prices dipped slightly, while gold edged higher to $2,640.49 an ounce.

Investment Insight

Market optimism over potential trade policy shifts highlights the region’s sensitivity to U.S.-China relations. Investors should monitor tariff developments and upcoming U.S. economic data, as these factors will influence both currency and equity market trajectories in the near term.

Conclusion

The week’s developments highlight the interplay of innovation, geopolitics, and macroeconomic forces shaping global markets. Nvidia’s AI advancements signal growth opportunities in emerging sectors, while Tencent’s blacklisting underscores rising US-China tensions and regulatory risks. Bitcoin’s rally above $102,000 reflects growing institutional interest, but its sensitivity to monetary policy remains high. Meanwhile, China’s widening yield gap with the US pressures the yuan, exposing vulnerabilities in its economy. Optimism in Asian markets over potential tariff shifts is tempered by uncertainty around Trump’s trade policies. Investors should stay vigilant as global economic data and policy decisions continue to drive market sentiment.

Upcoming Dates to Watch

- January 7, 2025: Eurozone CPI, Unemployment

- January 8, 2025: Eurozone PPI, Consumer confidence

- January 9, 2025: China CPI, PPI

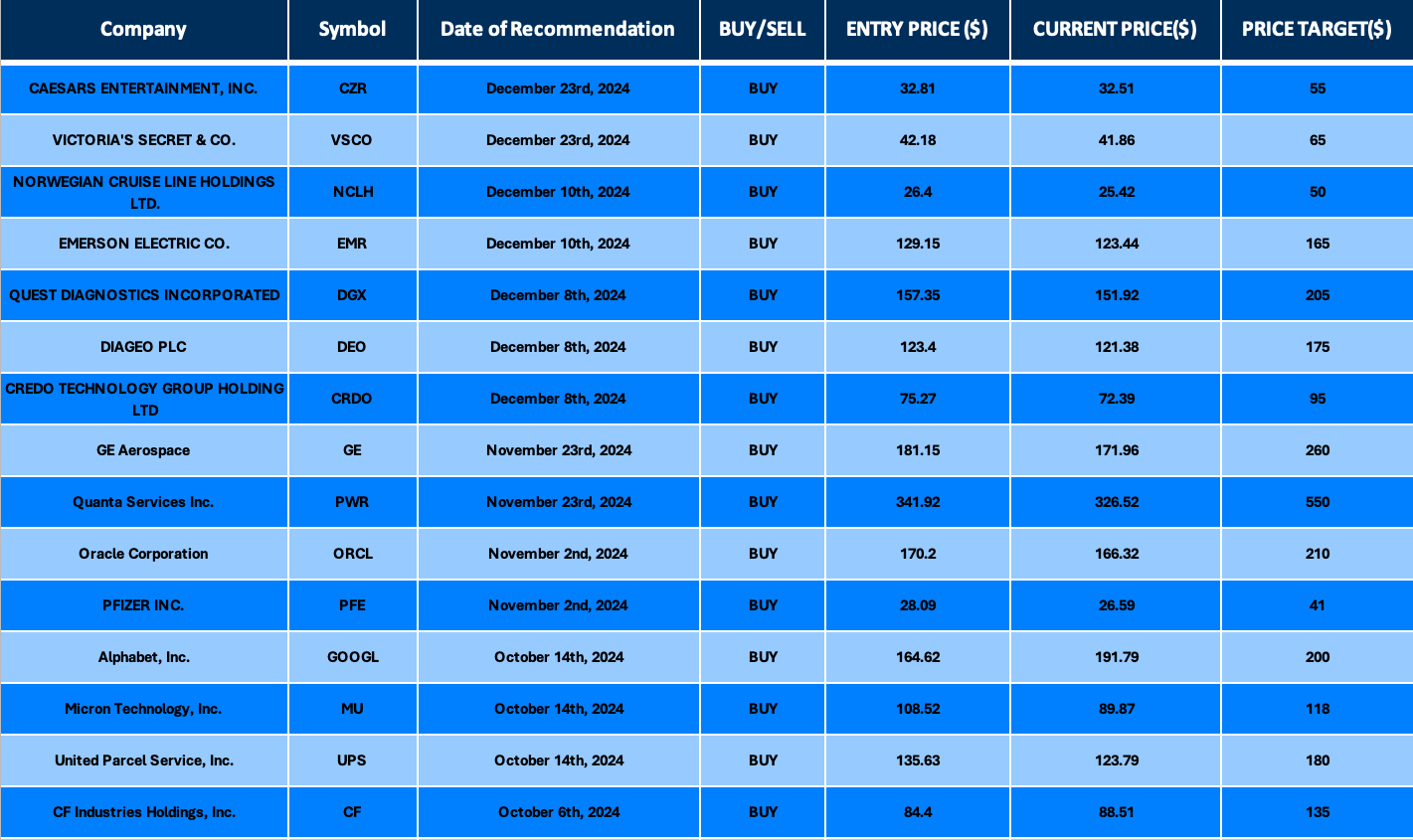

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.