Date Issued – 9th January 2025

Preview

Indonesia’s potential nickel quota cuts in 2025 could slash global supply by 35%, according to Macquarie, risking price surges due to tightened markets. Foreign investors are locking in gains from Japan’s strong 2024 equity performance, while China’s record offshore yuan bill issuance signals efforts to stabilize its currency amid economic challenges. Wildfires in Southern California are projected to cause up to $57 billion in damages, impacting utility stocks like Edison International and PG&E. Meanwhile, pound options trading surged as markets brace for volatility tied to UK fiscal concerns and global economic risks. Investors face a landscape of heightened uncertainty across commodities, currencies, and equities.

Indonesia’s Nickel Cuts Could Slash Global Supply by 35%

Indonesia may significantly lower its nickel mine quotas in 2025, potentially removing over a third of global supply, according to Macquarie Group. The government is considering reducing quotas from 272 million tons in 2024 to as low as 150 million tons this year—a drastic 40% below Macquarie’s base case. While the bank sees cuts of that scale as unlikely, any reduction in output from the world’s top producer of nickel could drive prices higher. Nickel prices have already faced pressure from oversupply and weakened demand but may be influenced by Chinese stimulus efforts and U.S. tariff policies in 2025.

Investment Insight

Nickel markets are volatile, with Indonesian production acting as a crucial supply lever. Potential quota cuts could tighten supply, presenting upside risks for prices. Investors should monitor Indonesian policy developments and Chinese economic recovery efforts closely.

Foreign Investors Sell Japanese Stocks to Lock in 2024 Gains

Foreign investors became net sellers of Japanese stocks in the week ending Jan. 4, offloading 74 billion yen ($468 million) after a strong 2024 that saw the Nikkei index rise 19.22%, its second-best performance in 11 years. Profit-taking followed heavy buying earlier in the year, with foreigners acquiring 1.23 trillion yen of Japanese equities in 2024 but selling 4.77 trillion yen in the latter half. Despite the equity sell-off, foreign investors purchased 227.5 billion yen of Japanese debt last week, reversing a three-week selling streak. Meanwhile, Japanese investors continued their trend of buying foreign equities but sold off foreign bonds for a third consecutive week.

Investment Insight

The shift to net selling reflects profit-taking and risk management as markets adjust to a strong 2024. Investors should track foreign fund flows and monitor Japanese debt as a potential safe haven amid global economic uncertainty.

China Boosts Yuan Support With Record Offshore Bill Issuance

China’s central bank will issue a record 60 billion yuan ($8.2 billion) of six-month bills in Hong Kong on Jan. 15 to tighten offshore liquidity and curb yuan depreciation. This marks the largest offshore bill issuance since 2018 and highlights Beijing’s efforts to stabilize the currency amid economic sluggishness and tariff uncertainties. The move is expected to make shorting the yuan more expensive and reflects the People’s Bank of China’s commitment to preventing excessive currency weakening. Analysts warn that tighter liquidity may persist, keeping offshore yuan funding constrained in the near term.

Investment Insight

The PBOC’s aggressive liquidity measures signal its determination to stabilize the yuan but could lead to further market tightness. Investors should brace for continued yuan volatility and monitor the impact of global interest rate differentials and trade policies on China’s currency.

Wildfires Ravage Southern California, Driving Massive Costs

Southern California wildfires are projected to cause $52-57 billion in damages, making them the most expensive U.S. wildfire in history. Blazes in affluent areas like Malibu, where median home values exceed $2 million, have led to 80,000 evacuations and the destruction of 1,000 structures. Hurricane-force winds continue to fuel the devastation, with smoke exposure and damage to tourism adding to long-term impacts. For comparison, California’s 2018 Camp Fire caused $30 billion in damages, while Hurricane Katrina remains the costliest U.S. disaster at $200 billion.

Edison International (EIX) shares fell 10.18% after its subsidiary, Southern California Edison, cut power to 70,000 customers to prevent fire risks. The Palisades Fire alone could result in $10 billion in insured losses. PG&E (PCG) shares declined 3.65%, as utilities face growing scrutiny over liabilities and service disruptions.

Investment Insight

The dual impact of surging wildfire costs and utility stock losses highlights the growing financial risks linked to climate change. Investors should monitor utility companies’ exposure to liabilities, rising insurance premiums, and regulatory pressures, while also evaluating the broader implications for real estate, infrastructure, and local economies in disaster-prone regions.

Market price: Edison International (EIX): USD 69.50

Pound Options Surge as Markets Fear ‘Truss Redux’ Scenario

Pound options trading hit its highest level since the 2022 mini-budget crisis under Liz Truss, with volumes surging to £13.7 billion ($16.9 billion) on Jan. 8, triple the previous day’s activity. Traders increasingly bet on a weaker pound, with some targeting a drop to $1.15, reflecting growing concerns over UK debt sustainability, inflation, and potential U.S. tariffs. Sterling fell over 1% on Wednesday to its lowest since April, while three-month implied volatility rose to its highest since 2023. Bearish put options on the pound have seen strong demand as traders brace for further volatility, particularly ahead of U.S. payroll data.

Investment Insight

The pound faces mounting pressure from economic uncertainty and global headwinds. Investors should monitor UK inflation, fiscal policies, and U.S. labor market data, as these factors could drive further currency and gilt market volatility.

Conclusion

Indonesia’s potential nickel supply cuts, China’s yuan stabilization efforts, and the fallout from Southern California’s record-breaking wildfires underscore the growing global economic and environmental challenges. Meanwhile, profit-taking in Japanese equities and heightened volatility in UK pound options reflect shifting investor sentiment amid uncertain fiscal policies and geopolitical pressures. From commodities to currencies and equities, markets are navigating a complex web of risks, driven by policy changes, climate impacts, and economic headwinds. As 2025 unfolds, investors must stay vigilant, tracking critical developments across global supply chains, fiscal strategies, and environmental risks to navigate this turbulent landscape effectively.

Upcoming Dates to Watch

- January 9, 2025: China CPI, PPI

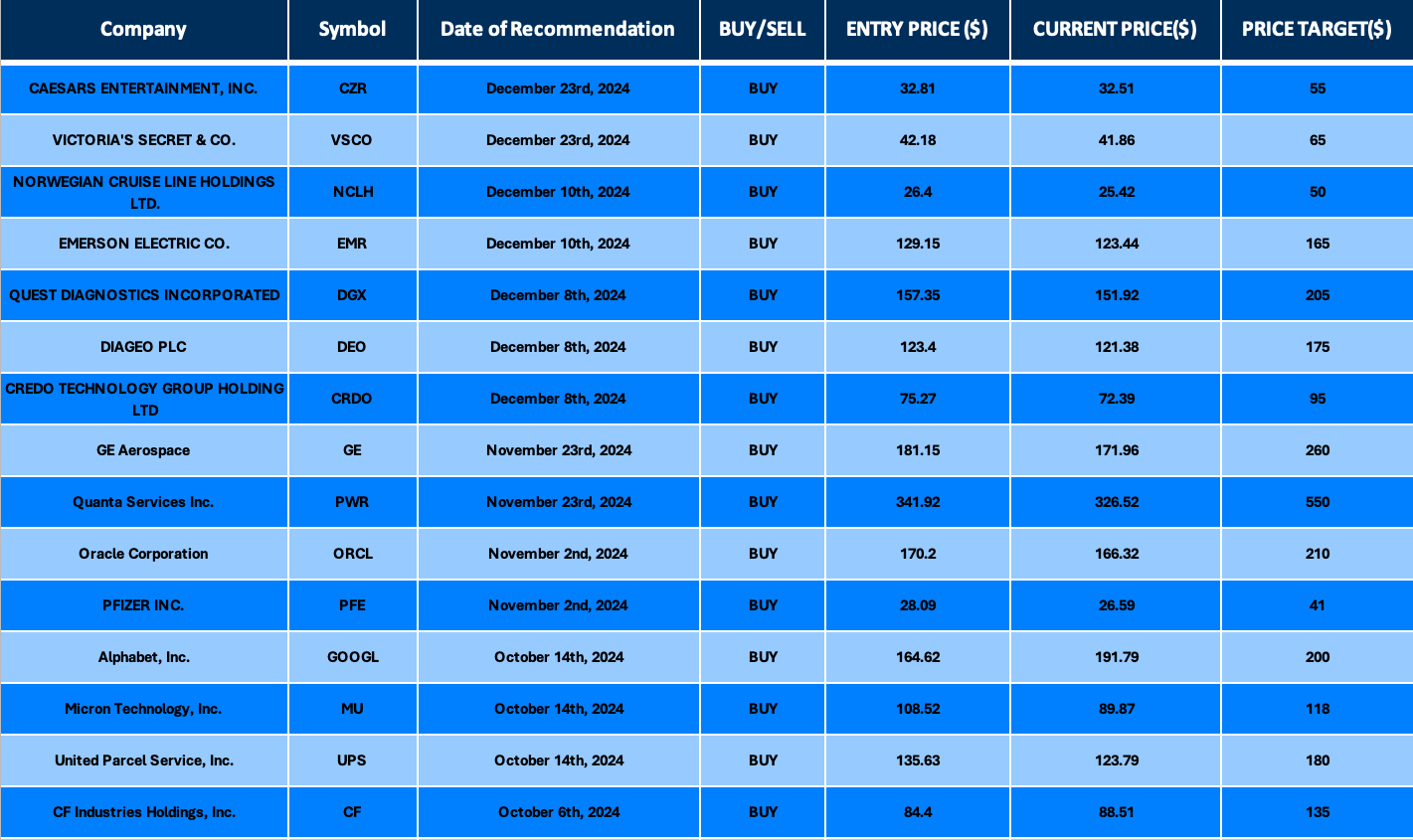

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.