Date Issued – 13th January 2025

Asian Stocks Slide and Oil Surges Amid Key Economic Events

Asian stocks slid as strong US jobs data dampened hopes for Federal Reserve rate cuts, while Brent crude surged past $81 on new Russian oil sanctions, raising inflation risks. The pound faces potential declines amid UK fiscal concerns, with sterling hitting a 14-month low. The dollar strengthened to its highest since 2022 on US economic resilience, pressuring other currencies. China’s central bank pledged to boost consumption but faces structural challenges. EV battery giant CATL plans a $5 billion Hong Kong listing, while TSMC anticipates a 58% profit surge on AI chip demand despite geopolitical risks. Lithium prices are set to stabilize in 2025 as the EV market grows, easing oversupply concerns. Investors should brace for volatility, monitor energy markets, currency shifts, and geopolitical developments, and assess opportunities in AI, EVs, and consumer sectors.

Asian Stocks Drop, Oil Surges Amid Russia Sanctions

Asian markets fell alongside bonds after stronger-than-expected US jobs data dampened hopes for Federal Reserve rate cuts. The MSCI Asia Pacific Index dropped 1.1%, with Hong Kong, Taiwan, and South Korea leading losses. Chinese stocks extended declines despite record export figures, as investors await pro-consumption policies. Brent crude surged past $81 a barrel, hitting a four-month high after the US unveiled sweeping sanctions on Russia’s oil sector, adding inflationary pressure. Meanwhile, the dollar strengthened, and China stepped up efforts to stabilize the yuan, which neared record lows in offshore trading.

Investment Insight:

Surging oil prices and reduced Fed rate-cut expectations suggest heightened inflation risks ahead. Investors should monitor energy markets and central bank policy shifts closely for portfolio adjustments.

Pound Faces Potential 8% Drop Amid Fiscal Concerns

Pound traders are bracing for a potential 8% drop as fiscal challenges weigh on the UK currency. Options data shows strong demand for contracts betting on sterling falling below $1.20, with some targeting $1.12 — levels not seen in over two years. Last week, UK assets tumbled amid sticky inflation, fiscal concerns, and high borrowing costs, prompting comparisons to the 2022 mini-budget crisis. While UK officials emphasized market stability, sentiment remains bearish, with hedge funds increasing bets against the pound. Sterling slid further Monday, hitting $1.2145, its lowest since November 2023.

Investment Insight:

Ongoing fiscal uncertainty and global rate dynamics suggest further downside risk for the pound. Investors should assess exposure to UK assets and consider hedging strategies to manage volatility.

Dollar Surges as U.S. Jobs Data Highlights Economic Strength

The dollar rallied to its highest level since November 2022, driven by robust U.S. jobs data that underscored the economy’s resilience. The euro fell to $1.0216, its weakest in over two years, while sterling hit a 14-month low of $1.2138 amid domestic fiscal concerns. The Chinese yuan saw modest gains after Beijing relaxed borrowing rules to stabilize the currency, though it remains near a 16-month low. Meanwhile, the Australian and New Zealand dollars traded near multi-year lows, reflecting weak sentiment. Markets are now pricing in fewer Federal Reserve rate cuts for 2025, with inflation risks heightened by President-elect Trump’s incoming policies.

Investment Insight:

The dollar’s strength signals a shift in global capital flows, favoring U.S. assets. Investors should consider exposure to dollar-denominated investments while monitoring inflation data and Fed policy for further cues.

TSMC Q4 Profit Expected to Surge 58% on AI Chip Demand

Taiwan Semiconductor Manufacturing Co. (TSMC) is projected to report a 58% jump in fourth-quarter profit to T$377.95 billion ($11.41 billion) on Thursday, fueled by surging demand for AI chips from clients like Apple and Nvidia. The company’s revenue already exceeded expectations, driven by the global AI megatrend. However, TSMC faces challenges, including U.S. technology restrictions on China and potential tariffs under President-elect Trump. TSMC continues heavy investments in overseas fabs, including a $65 billion project in Arizona, with progress on production yields closely watched. TSMC’s stock soared 81% last year, outpacing broader market gains.

Investment Insight:

TSMC’s AI-driven growth highlights its critical role in advanced chipmaking. Yet, geopolitical risks and rising capital expenditures may pressure margins. Investors should weigh long-term growth potential against near-term uncertainties.

Market Price: Taiwan Semiconductor Manufacturing Co. (TSMC) – TWD 1,075.00

China to Prioritize Consumption Over Investment, Says PBOC

China’s central bank governor, Pan Gongsheng, announced a policy shift toward boosting consumption alongside investment to drive economic growth. Speaking at the Asian Financial Forum, Pan emphasized raising incomes, increasing subsidies, and improving social security to stimulate domestic demand. The move comes as China faces sluggish consumer confidence, persistent deflation, and the threat of higher U.S. tariffs under President-elect Trump. While incremental measures, such as trade-in programs for appliances and cars, have been introduced, the policy mix still leans heavily on investment. Pan also reassured markets about the yuan’s stability and signs of improvement in the property market.

Investment Insight:

China’s pivot to consumption-led growth signals potential opportunities in consumer-focused sectors. However, structural challenges and policy uncertainty warrant a cautious approach to Chinese equities.

CATL Plans $5 Billion Hong Kong Listing

Contemporary Amperex Technology Co. Ltd. (CATL), the world’s largest EV battery maker and a key Tesla supplier, is set to hire Bank of America, CICC, CSC Financial, and JPMorgan as lead arrangers for a $5 billion Hong Kong listing, potentially one of the city’s largest offerings in recent years. CATL’s board approved the secondary listing in December, with the final size and timeline still under consideration. The move reflects a broader trend of China-listed firms pursuing second listings in Hong Kong amid increased deal activity. CATL’s shares, listed in Shenzhen, have fallen 7.2% this year, giving it a $150 billion market value.

Investment Insight:

CATL’s secondary listing could enhance liquidity and valuation opportunities. Investors should watch for regulatory developments and market reactions, especially amid geopolitical concerns surrounding Chinese firms.

Lithium Prices Set to Stabilize in 2025 Amid Reduced Glut

Lithium prices are expected to stabilize in 2025 after plummeting nearly 86% over two years, as mine closures and robust EV sales in China ease oversupply. Analysts project the global lithium surplus to shrink to 80,000 tons of lithium carbonate equivalent (LCE), down from 150,000 tons in 2024. China’s doubled EV subsidies drove a late-2024 demand boost, with lithium prices forecast to average $11,092 per metric ton this year. However, analysts caution that mine reopenings and potential U.S. policy changes under President-elect Trump could cap price gains.

Investment Insight:

Stabilizing lithium prices signal recovery potential for EV battery supply chains. Investors should monitor Chinese policy support and U.S. trade risks while assessing opportunities in lithium producers and EV-related sectors.

Conclusion

In a volatile global landscape, markets are grappling with surging oil prices, strong U.S. economic data, and shifting central bank policies. Currency pressures persist, with the dollar strengthening while the pound and yuan face headwinds. China’s pivot to consumption-driven growth and CATL’s Hong Kong listing highlight opportunities in Asia, though geopolitical risks loom. TSMC’s AI-fueled growth underscores innovation’s role in driving profits, while stabilizing lithium prices signal recovery in EV supply chains. Investors should remain vigilant, balancing near-term uncertainties with long-term opportunities across energy, technology, and consumer sectors, while closely monitoring inflation, fiscal policies, and geopolitical developments.

Upcoming Dates to Watch

- January 13, 2025: India CPI

- January 14, 2025: US PPI

- January 15, 2025: US, France, and UK CPI; Eurozone industrial production

- January 16, 2025: Australia unemployment, Germany CPI

- January 17, 2025: Eurozone CPI, US industrial production

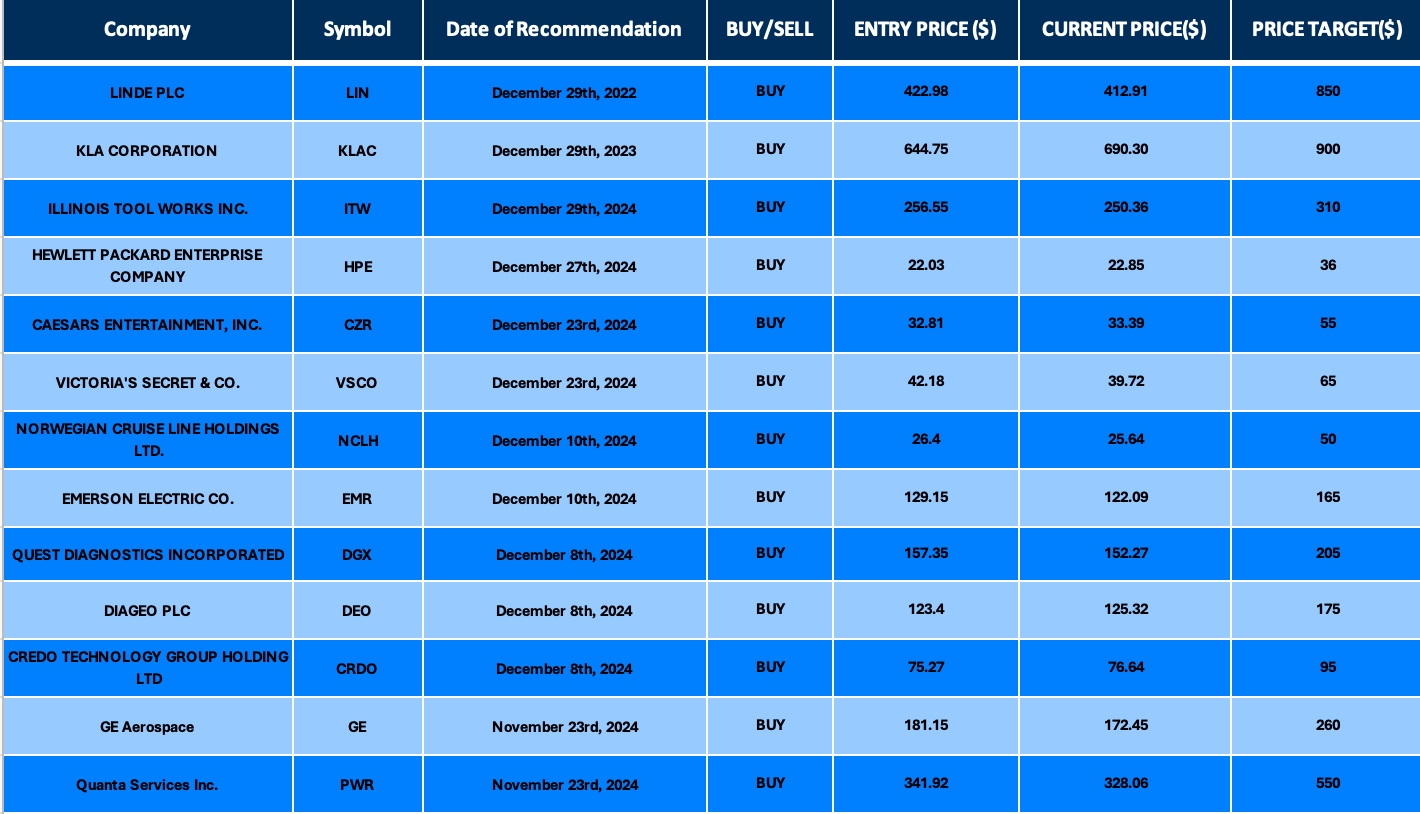

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.