Date Issued – 16th January 2025

Asian stocks rose on US inflation cooling, boosting hopes for Fed rate cuts, while speculation of a Bank of Japan hike lifted the yen.

TSMC beat forecasts with strong AI-driven demand but faces US-China tensions. Oil prices surged, driven by US sanctions on Russia and falling inventories, while China ramped up grid spending to support its renewable energy boom, fueling demand for metals like copper. Rio Tinto reported weaker iron ore exports but saw gains in copper and lithium production, reflecting its shift toward energy transition metals. Investors should remain cautious as geopolitical and market risks persist.

Asian Stocks Rise on Easing US Core Inflation and BOJ Rate Speculation

Asian equities climbed on Thursday, following Wall Street’s rally after US core inflation cooled, fueling hopes for Federal Reserve rate cuts later this year. Indices in Hong Kong, China, and Australia gained, marking the third straight day of Asian stock increases. The yen surged amid speculation of a possible Bank of Japan rate hike next week, while the South Korean won strengthened after an unexpected policy hold by its central bank.

US swap traders are now fully pricing in a rate cut by July, reversing earlier skepticism. However, market optimism faces upcoming tests, including Fed and BOJ policy announcements and the inauguration of US President-elect Donald Trump. Oil prices extended gains amid supply concerns, while gold and the Canadian dollar remained steady.

Investment Insight

Cooling US inflation supports the narrative of potential Fed rate cuts, boosting risk-on sentiment in equities. However, investors should remain cautious as upcoming central bank decisions and geopolitical events could trigger volatility. Diversification remains key amidst shifting global monetary policies.

TSMC Beats Outlook, Signals Resilient AI Spending

Taiwan Semiconductor Manufacturing Co. (TSMC) delivered a strong quarterly outlook, projecting $25–$25.8 billion in revenue for Q1, beating analysts’ $24.4 billion estimate. It also exceeded capital expenditure forecasts, expecting $38–$42 billion in 2025 investments, driven by sustained demand for AI hardware. TSMC’s net income surged 57%, reflecting robust growth fueled by ongoing AI chip demand, new smartphone chips, and potential outsourcing from Intel.

Despite optimism, TSMC faces challenges from US-China tech tensions, including new export controls on AI chips. The chipmaker is expanding globally, with factories in Arizona, Japan, and planned facilities in Europe to diversify operations.

Investment Insight

TSMC’s strong guidance underscores the resilience of AI-driven demand, but geopolitical risks and muted smartphone sales remain headwinds. Investors should monitor global expansion efforts and shifts in AI spending cycles as key factors for future growth.

Market price: TSMC Semiconductor Manufacturing Co Ltd. (TPE: 2330): TWD 1,105.00

BOJ Signals Possible Rate Hike Decision Next Week

Bank of Japan Governor Kazuo Ueda hinted at the possibility of a rate hike during the January 23-24 policy meeting, citing spring wage negotiations and economic momentum as key factors. The yen strengthened 0.2% to 157.67 against the dollar following his comments. Markets are pricing in a 68% chance of a hike this month, rising to 86% by March. The BOJ is also expected to release an updated economic outlook, potentially raising its inflation projections due to higher rice costs and a weaker yen.

Investment Insight:

A BOJ rate hike could strengthen the yen and pressure Japanese equities, particularly exporters. Investors should monitor inflation revisions and wage growth signals for further policy direction.

Markets Hold Steady Ahead of US Inflation Data

Asian equities traded cautiously Wednesday, with the MSCI Asia Pacific Index trimming early gains and US equity futures remaining flat, as investors awaited US inflation data for signals on Federal Reserve policy. The dollar steadied after a prior drop, while 10-year Treasury yields dipped slightly. A higher-than-expected CPI reading could tighten financial conditions globally, impacting Asian markets. Meanwhile, China’s central bank injected significant liquidity to address pre-Lunar New Year cash demand, and European and US bank earnings loom on the horizon.

Investment Insight:

With markets in a holding pattern, today’s US CPI report could influence the Fed’s rate trajectory and global liquidity conditions. Investors should monitor inflation closely, as a hotter-than-expected print may pressure equities and strengthen the dollar.

Conclusion

From geopolitical negotiations to shifting global markets, this week highlights the intricate balance between policy, innovation, and investment. China’s potential enlistment of Elon Musk in the TikTok dispute underscores his growing influence, while its credit market rebound signals cautious optimism amid economic fragility. Quantum computing’s resurgence reflects the sector’s long-term promise despite volatility. As markets await US inflation data and the BOJ’s potential rate hike, investors should stay alert to policy shifts shaping global liquidity and currency trends. With key developments unfolding across sectors, opportunities and risks continue to evolve in today’s dynamic economic landscape.

Upcoming Dates to Watch

- January 15, 2025: US, France, and UK CPI; Eurozone industrial production

- January 16, 2025: Australia unemployment, Germany CPI

- January 17, 2025: Eurozone CPI, US industrial Production

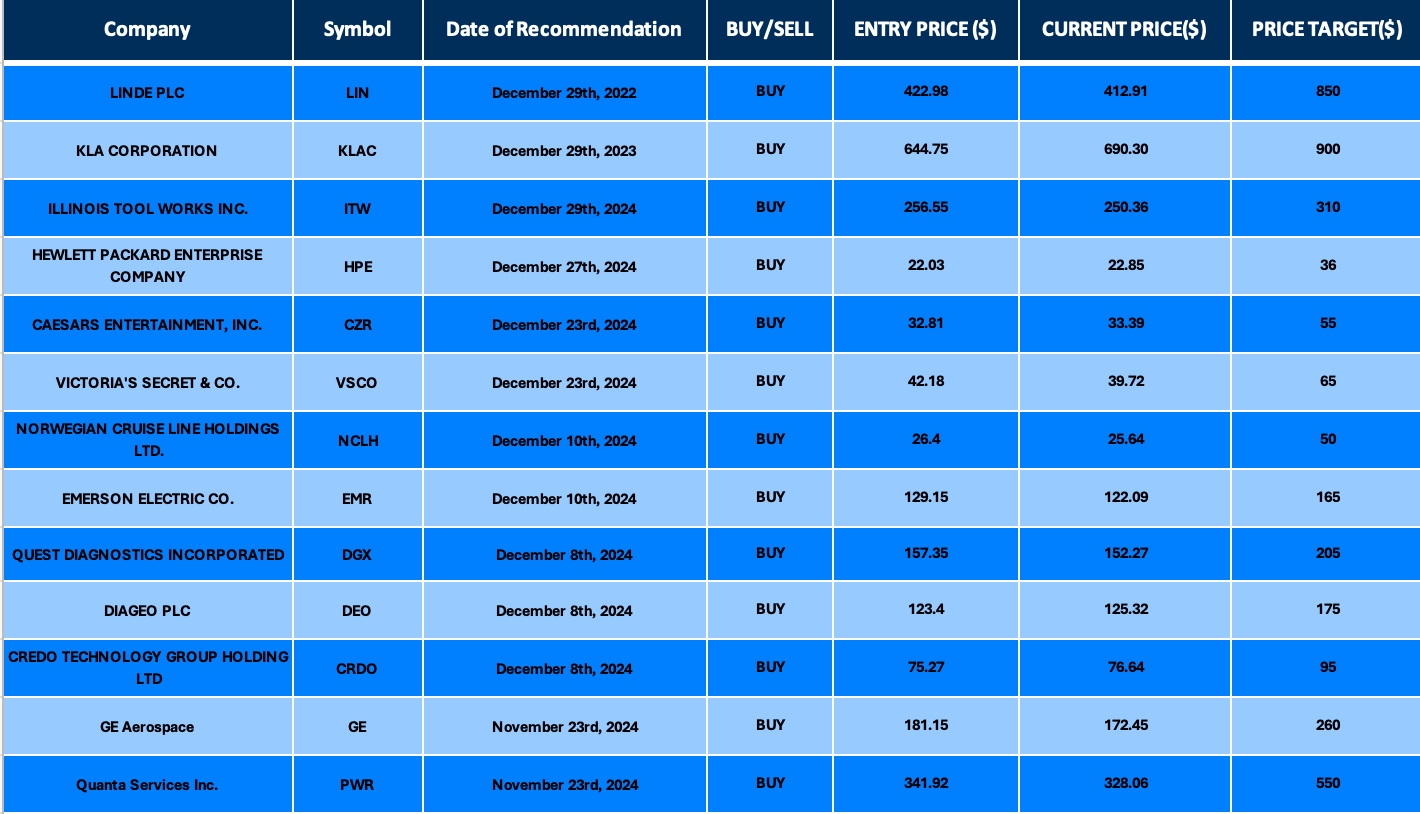

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.