Date Issued – 20th January 2025

Preview

Asian stocks rose on optimism from a Trump-Xi call, boosting Chinese equities as markets await Trump’s policy agenda, including potential tariffs and reforms. Oil steadied near $81 as traders braced for Trump’s domestic energy push and sanctions, with global crude flows remaining volatile. Instagram and X unveiled new video tools, vying for TikTok’s user base amid its uncertain US future following a federal ban. South Korea announced record export financing to counter Trump’s trade policies, focusing on shielding vulnerable sectors like semiconductors while exploring opportunities in defense and shipbuilding. Meanwhile, the Bank of Japan is expected to raise rates to 0.5%, the highest in 17 years, signaling confidence in Japan’s recovery despite risks from Trump’s policies. Investors should monitor geopolitical developments, energy markets, and shifts in video platforms, while noting opportunities in export-reliant sectors, financials, and energy producers.

Asian Stocks Rise on Trump-Xi Call, Optimism Grows

Asian markets climbed after Donald Trump and Xi Jinping’s pre-inauguration call raised hopes for easing US-China tensions. Key Chinese stocks in Hong Kong surged up to 2.5%, while Wall Street futures dipped slightly with US markets closed for a holiday. The discussion, which touched on trade, TikTok, and fentanyl, signaled potential improvements in bilateral relations, boosting risk sentiment. Meanwhile, the dollar continued to slide, and Chinese banks held their loan prime rates steady.

Attention now shifts to Trump’s sweeping policy agenda post-inauguration, including expected executive orders on energy, immigration, and regulatory reform, alongside a potential inflationary impact from his protectionist stance. Analysts predict higher Treasury yields, with some forecasting rates to climb to 6% this year. In Japan, all eyes are on the Bank of Japan’s rate decision, with speculation around a possible hike.

Investment Insight

Improved US-China relations may buoy Asian equities in the short term, but Trump’s pro-growth, protectionist policies could stoke inflation, strengthening the dollar and pressuring bonds. Investors should monitor sectors like tech, energy, and EVs, which are directly influenced by geopolitical shifts.

Oil Steadies Near $81 as Markets Eye Trump’s Energy Plans

Oil prices held steady with Brent trading below $81 and WTI near $78 as markets brace for uncertainty tied to Donald Trump’s second term. The president-elect is expected to invoke emergency powers to boost domestic energy production and impose hefty tariffs on key trade partners, alongside potential sanctions on Iran.

Crude markets remain volatile, with US sanctions on Russia driving Asian buyers to seek alternative supplies, Middle Eastern crude prices surging, and Brent’s backwardation widening. Speculators have ramped up long positions on Brent, while further sanctions targeting Russia’s oil industry could deepen market disruptions. Lower trading volumes are anticipated due to a US federal holiday.

Investment Insight

Energy markets face heightened volatility as Trump’s policies could disrupt global oil flows and bolster US energy exports. Investors should monitor geopolitical risks, particularly around Russia and Iran, while considering exposure to US energy producers poised to benefit from domestic production boosts.

Instagram and X Launch Video Tools Amid TikTok Ban Turmoil

Instagram unveiled “Edits,” a video editing app debuting in February, offering advanced creative tools like green screens and transitions. The announcement coincided with TikTok briefly going dark in the US due to a federal ban stemming from national security concerns. TikTok resumed service after President-elect Donald Trump paused enforcement, but its future hinges on a mandated sale of its US operations.

Meanwhile, Elon Musk’s X (formerly Twitter) rolled out a dedicated video tab to expand its presence in online content, including live streaming and longform videos. Instagram, already a key competitor with its Reels feature, took advantage of TikTok’s absence, running ads in Apple’s App Store targeting users searching for TikTok.

Investment Insight

The shifting video landscape presents opportunities for platforms like Instagram and X to capture disaffected TikTok creators and audiences. Investors should keep an eye on Meta and X’s video strategies, which could drive user engagement and advertising revenue growth.

South Korea Boosts Export Support Ahead of Trump’s Trade Policies

South Korea announced a record 360 trillion won ($247.74 billion) in export financing to shield its economy from potential fallout as Donald Trump begins his second term. Concerns over heightened trade uncertainty prompted the government to expand insurance against foreign exchange volatility and increase spending on trade initiatives.

Key sectors like semiconductors and rechargeable batteries face risks from Trump’s protectionist stance, while defense, nuclear energy, and shipbuilding are seen as areas for potential collaboration. Trump’s pledge to impose stiff tariffs on major trading partners is expected to impact South Korean companies, especially those with factories in Mexico, Canada, and China. Export growth is projected to slow to 1.8% in 2025, down from 8.1% last year.

Investment Insight

South Korea’s proactive support for exporters highlights the vulnerability of global trade to US protectionism. Investors should watch for shifts in export-dependent sectors like semiconductors and batteries, while opportunities may arise in defense and shipbuilding. Diversification within South Korean equities is key.

Bank of Japan Set to Raise Rates to 17-Year High

The Bank of Japan (BOJ) is expected to raise its short-term policy rate to 0.5% this Friday, marking the highest level since 2008. The move signals the central bank’s confidence in Japan’s economic recovery and its commitment to achieving its 2% inflation target. Markets have already priced in an 80% chance of a hike, following signals from BOJ Governor Kazuo Ueda.

The rate increase comes as inflation has exceeded the BOJ’s target for nearly three years, supported by wage growth and elevated import costs due to a weaker yen. However, uncertainties remain around U.S. President-elect Donald Trump’s policies, which could disrupt global markets. The BOJ’s policy trajectory will be closely watched during Ueda’s post-meeting briefing.

Investment Insight

A BOJ rate hike could strengthen the yen and pressure Japan’s exporters, while signaling a shift away from ultra-loose monetary policy. Investors should monitor Japanese equities, particularly export-reliant sectors, and consider opportunities in financials, which may benefit from rising rates.

Conclusion

Global markets are bracing for significant shifts as Donald Trump’s policies take center stage. Optimism over US-China relations lifted Asian equities, but trade tensions and protectionist measures could create headwinds for export-heavy economies like South Korea. Oil markets remain volatile amid Trump’s energy agenda, while Japan’s anticipated rate hike signals a turning point in its monetary policy. In the tech space, Instagram and X are seizing opportunities as TikTok faces regulatory uncertainty. Investors should stay vigilant, focusing on sectors tied to energy, trade, and tech, while navigating the broader geopolitical and economic developments shaping 2025.

Upcoming Dates to Watch

- January 20, 2025: Donald Trump Inauguration, World Economic Forum in Davos begins

- January 21, 2025: Canada CPI, UK Jobless Claims

- January 23, 2025: South Korea GDP, Eurozone Consumer Confidence

- January 24, 2025: Japan CPI, rate decision

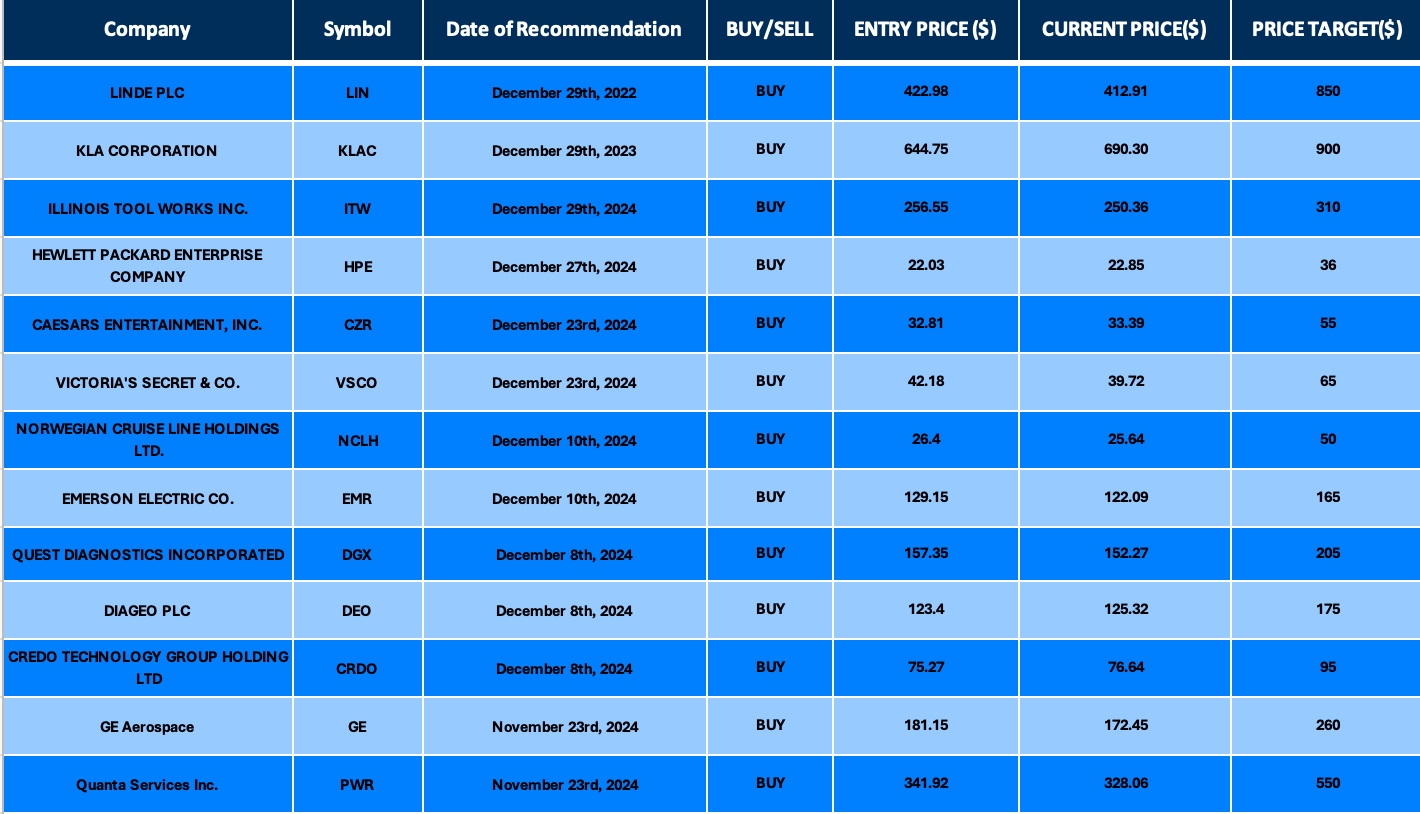

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.