Date Issued – 21th January 2025

Preview

Markets are bracing for volatility as President Trump’s tariff plans on Canada and Mexico rattle currencies and metals markets, while China remains a potential trade target. Apple’s iPhone sales in China plunged 18% last quarter, losing ground to Huawei’s locally-driven dominance. Trump’s repeal of Biden’s AI executive order may boost innovation but raises safety concerns. Meanwhile, an extreme winter storm is disrupting Texas energy production and pushing electricity demand to near-record highs, with prices surging. Investors should monitor trade developments, AI advancements, and energy market volatility as key drivers in the coming weeks.

Trump’s Trade Signals Jolt Markets, Stirring Volatility Concerns

Markets reacted unevenly to President Trump’s first day of his second term, with no immediate tariffs on China offering relief, while threats of 25% levies on Canadian and Mexican imports caused their currencies to tumble. The MSCI Asia Pacific Index edged up 0.2%, but US equity futures were flat as investors braced for continued trade uncertainty. The dollar rose 0.7%, while Treasury yields fell on easing inflation fears. Analysts warn of heightened volatility as Trump’s “America First” agenda unfolds, with China possibly next on the tariff radar.

Investment Insight

Prepare for market swings driven by tariff developments. Safe-haven assets like Treasuries may offer temporary refuge, but currency markets, particularly the yuan, remain vulnerable to trade policy shifts.

Apple’s iPhone Sales in China Plunge 18% in Holiday Quarter

Apple’s iPhone sales in China fell 18.2% during the December quarter, pushing the company to third place in the world’s largest smartphone market, according to Counterpoint Research. Huawei reclaimed the top spot, driven by strong sales of its Mate 70 and Nova 13 series, which feature HarmonyOS and Chinese-made chips. Apple’s decline in China contributed to a global 5% drop in iPhone sales during the key shopping season. While Apple’s new AI-powered features boosted early sales, limited access to these capabilities in China has dampened momentum. Talks with local tech giants like Baidu and Tencent to resolve this issue remain inconclusive.

Investment Insight

Apple’s struggles in China underscore growing competition from Huawei and the importance of local partnerships for AI advancements. Investors should monitor Apple’s ability to regain market share in China and capitalize on AI opportunities, while Huawei’s resurgence highlights potential growth in Chinese tech and semiconductors.

Market price: Apple Inc (APPL): USD 229.98

Metals Slide as Trump Targets Canada and Mexico with Tariff Threats

Base metals fell after President Trump announced plans for 25% tariffs on imports from Canada and Mexico starting February 1, boosting the dollar and making metals pricier for global buyers. Copper, already strained by weak Chinese demand, remains under pressure after an 11% drop last quarter. While Trump refrained from imposing new China tariffs, uncertainty over future actions continues to cloud market sentiment. Aluminum and lead declined on the London Metal Exchange, while iron ore bucked the trend, rising on stronger Chinese demand prospects.

Investment Insight

Trade tensions and a strong dollar will likely weigh on industrial metals, but iron ore could outperform due to China’s infrastructure-driven demand. Stay cautious around base metals tied to global trade sentiment.

Trump Repeals Biden’s AI Executive Order on Day One

President Donald Trump repealed a 2023 executive order by former President Joe Biden that aimed to mitigate AI risks to consumers, workers, and national security. Biden’s order had tasked NIST with creating guidance on addressing AI biases and required companies to share safety test results with the government before public release. Trump’s allies criticized the requirements as overly burdensome and harmful to innovation, while Trump pledged to promote AI policies focused on “free speech and human flourishing,” though specifics remain unclear.

Investment Insight

The repeal may accelerate AI development by reducing regulatory hurdles, favoring companies in the AI sector. However, the lack of safety oversight could heighten risks tied to biased or untested models.

Extreme Cold and Record Snowfall Threaten Texas Power Grid

An unprecedented winter storm is hitting the US South, with record-breaking snowfall expected in cities like Houston and New Orleans. Texas faces extreme cold warnings, with temperatures in West Texas dropping as low as 15°F. The freeze is disrupting oil and natural gas production while driving electricity demand to near-record highs. The Electric Reliability Council of Texas (ERCOT) forecasts peak demand to hit 77.5 gigawatts, with electricity prices in Dallas more than doubling. Travel has been severely impacted, with flight cancellations and highway closures across the region.

Investment Insight

Energy prices may rise as freezing temperatures strain production and demand spikes. Utility and energy stocks could see short-term volatility, while increased weather-related disruptions highlight infrastructure investment opportunities.

Conclusion

As markets adjust to President Trump’s policies, investors face a turbulent landscape shaped by trade tensions, disruptive weather, and shifting tech dynamics. Tariffs on Canada and Mexico weigh on metals, while China looms as the next trade battleground. Apple’s struggles in China highlight growing competition and the importance of localized innovation. Extreme weather in Texas underscores vulnerabilities in energy infrastructure, sparking price surges and production disruptions. With AI regulations loosened, opportunities for growth emerge alongside heightened risks. Staying agile and focused on evolving global trends will be key to navigating the uncertainty ahead.

Upcoming Dates to Watch

- January 21, 2025: Canada CPI, UK Jobless claims

- January 23, 2025: South Korea GDP, Eurozone Consumer Confidence

- January 24, 2025: Japan CPI, rate decision

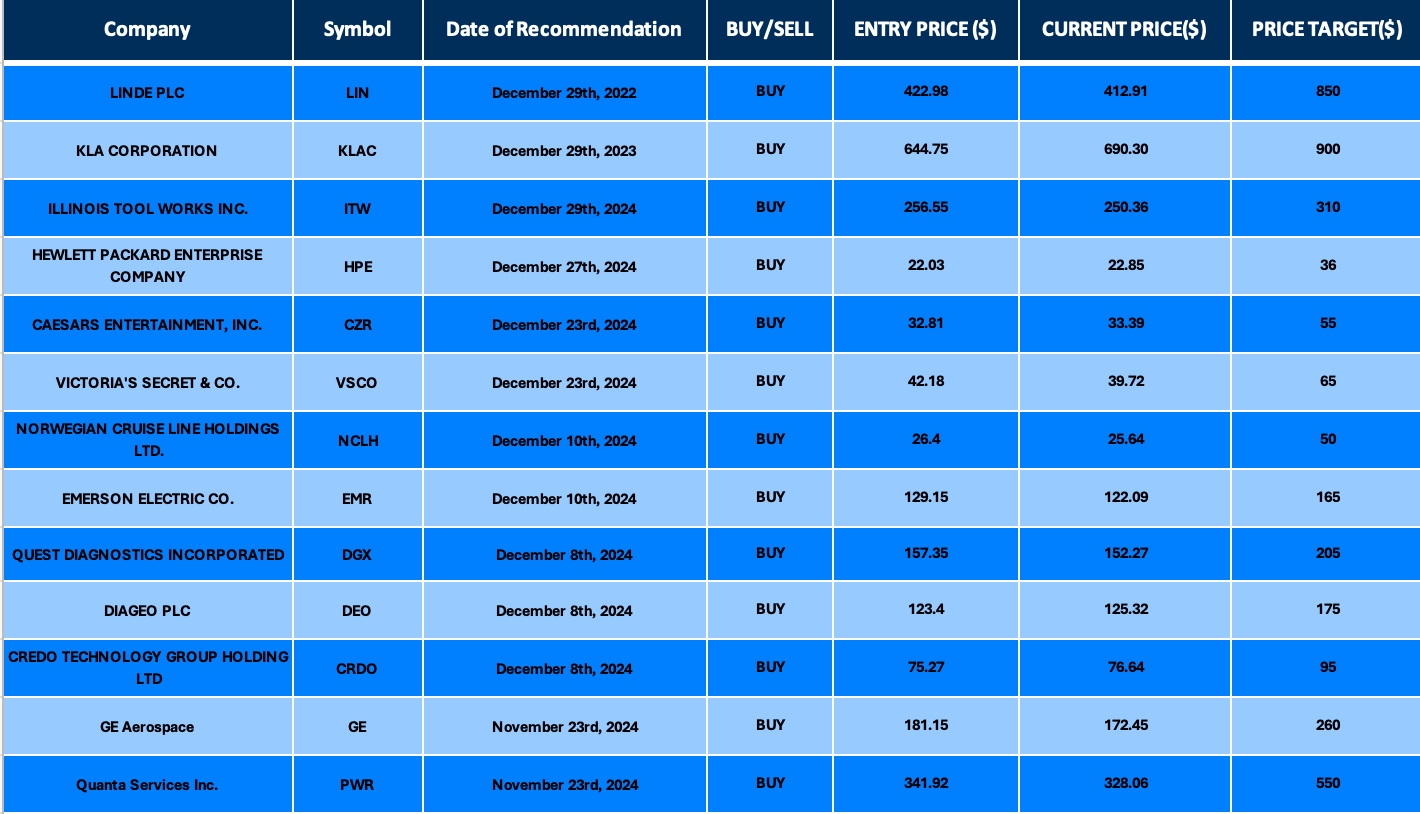

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.