Date Issued – 24th January 2025

Preview

Global markets rallied for a ninth straight day as President Trump signaled flexibility on China tariffs, boosting emerging-market currencies and equities. Meanwhile, Trump’s executive order banning central bank digital currencies and establishing crypto regulations was welcomed by industry leaders, though near-term volatility is expected. Boeing warned of a $3.5 billion Q4 cash flow loss due to labor strikes and layoffs, further pressuring its financials. Oil prices are poised for their first weekly drop of 2025 as Trump urged OPEC to lower prices, adding volatility to energy markets. In Japan, the BOJ raised rates to 0.5%, its highest in 17 years, strengthening the yen and signaling confidence in sustained inflation growth. Markets remain cautious as geopolitical uncertainties and policy shifts continue to unfold.

Global Stocks Surge as Trump Signals Tariff Flexibility

Global markets rallied for a ninth consecutive day, with the MSCI All-Country Index approaching a record high. US President Donald Trump hinted at a softer stance on China tariffs during a Fox News interview, fueling gains in Chinese equities and emerging-market currencies. The Australian dollar climbed 0.7%, while the yen strengthened after the Bank of Japan raised rates for the first time since July. Despite optimism, analysts remain cautious, citing Trump’s unpredictable nature and ongoing trade challenges. Meanwhile, US futures held steady, and Europe’s markets advanced.

Investment Insight: Markets are buoyed by optimism over US-China trade, but volatility remains likely as negotiations unfold. Investors should tread carefully, balancing short-term gains against uncertainty in policy shifts and geopolitical risks.

Trump Signs Executive Order Supporting Crypto Industry

President Donald Trump signed an executive order fulfilling two campaign promises to the cryptocurrency world: banning central bank digital currencies (CBDCs) and creating a presidential working group to establish clear regulations for digital assets. While the order stops short of creating a “strategic national bitcoin stockpile,” it instructs the group to evaluate the feasibility of a broader national crypto reserve, potentially including assets seized by law enforcement. Trump also revoked a 2022 Biden-era directive that sought to reduce risks from digital assets. Bitcoin briefly rose on the news before stabilizing, with industry leaders lauding the president’s pro-crypto stance as a pivotal step for regulatory clarity.

Investment Insight: Trump’s crypto-friendly policies signal long-term opportunities for the industry, but near-term volatility remains as markets digest regulatory developments. Investors should monitor the working group’s outcomes and shifts in federal crypto oversight.

Boeing Warns of $3.5 Billion Cash Flow Loss Amid Labor Strikes and Layoffs

Boeing (BA) expects a $3.5 billion operating cash flow loss in Q4 due to an eight-week IAM labor strike, layoffs, and challenges in its defense business. Preliminary results project $15.2 billion in revenue, falling short of $16.76 billion consensus estimates, with a GAAP loss per share of $5.46 versus a projected $1.32 loss. Pre-tax charges of $1.7 billion in the defense and space segment and higher labor costs from a new four-year IAM contract are adding to financial pressures. Boeing delivered 348 commercial jets in 2024, a third fewer than the prior year, but executives remain focused on stabilizing operations and rebuilding production.

Investment Insight: Boeing faces near-term headwinds from labor disruptions and cost overruns, pressuring profitability. Long-term investors should assess recovery potential as production normalizes and cash reserves improve through capital raises.

Market price: Boeing Co (NYSE: BA): USD 178.50

Oil on Track for First Weekly Drop in 2025 as Trump Pressures Prices

Oil prices are set for their first weekly decline this year, with Brent near $78 per barrel and WTI below $75, down around 3%. Market unease follows President Donald Trump’s calls for Saudi Arabia and OPEC to lower oil prices and his tariff threats on Canada, Mexico, and China. While a weaker dollar pared some crude losses, futures are still headed for their largest weekly drop since November. US crude stockpiles fell for a ninth consecutive week, but lower inventories and strong sanctions on Russian oil continue to disrupt global flows and pressure prices.

Investment Insight: Trump’s push to lower oil prices may heighten volatility in energy markets. Investors should monitor OPEC’s response and global supply dynamics as sanctions and production adjustments create opportunities and risks.

Bank of Japan Raises Rates, Signals End to Ultra-Low Borrowing Costs

The Bank of Japan (BOJ) raised its key policy rate by 0.25 percentage points to 0.5%, the highest level in 17 years, signaling confidence in inflation surpassing its 2% target. This marks the BOJ’s third hike under Governor Kazuo Ueda. The yen strengthened 0.7% against the dollar, while 10-year Japanese bond yields rose to 1.23%. Analysts expect gradual rate hikes every six months, with inflation momentum and wage growth closely monitored. The hike aligns Japan’s rates closer to global levels and offers flexibility for future economic shifts.

Investment Insight: The BOJ’s hawkish stance supports the yen but could pressure Japanese equities. Investors should watch for inflation trends and currency impacts as Japan pivots away from ultra-loose monetary policy.

Conclusion

Markets are navigating a mix of optimism and caution as geopolitical shifts and policy changes take center stage. Trump’s softer tone on China tariffs and crypto-friendly moves have spurred market momentum, while his push on oil prices adds volatility to energy markets. Boeing faces significant near-term challenges with labor disruptions weighing on its financials. Meanwhile, Japan’s rate hike signals a turning point in its monetary policy, supporting the yen but pressuring equities. As global markets rally, investors should remain vigilant, balancing short-term opportunities with the risks posed by unpredictable policies, trade uncertainties, and evolving economic conditions worldwide.

Upcoming Dates to Watch

- January 24, 2025: Japan CPI, rate decision

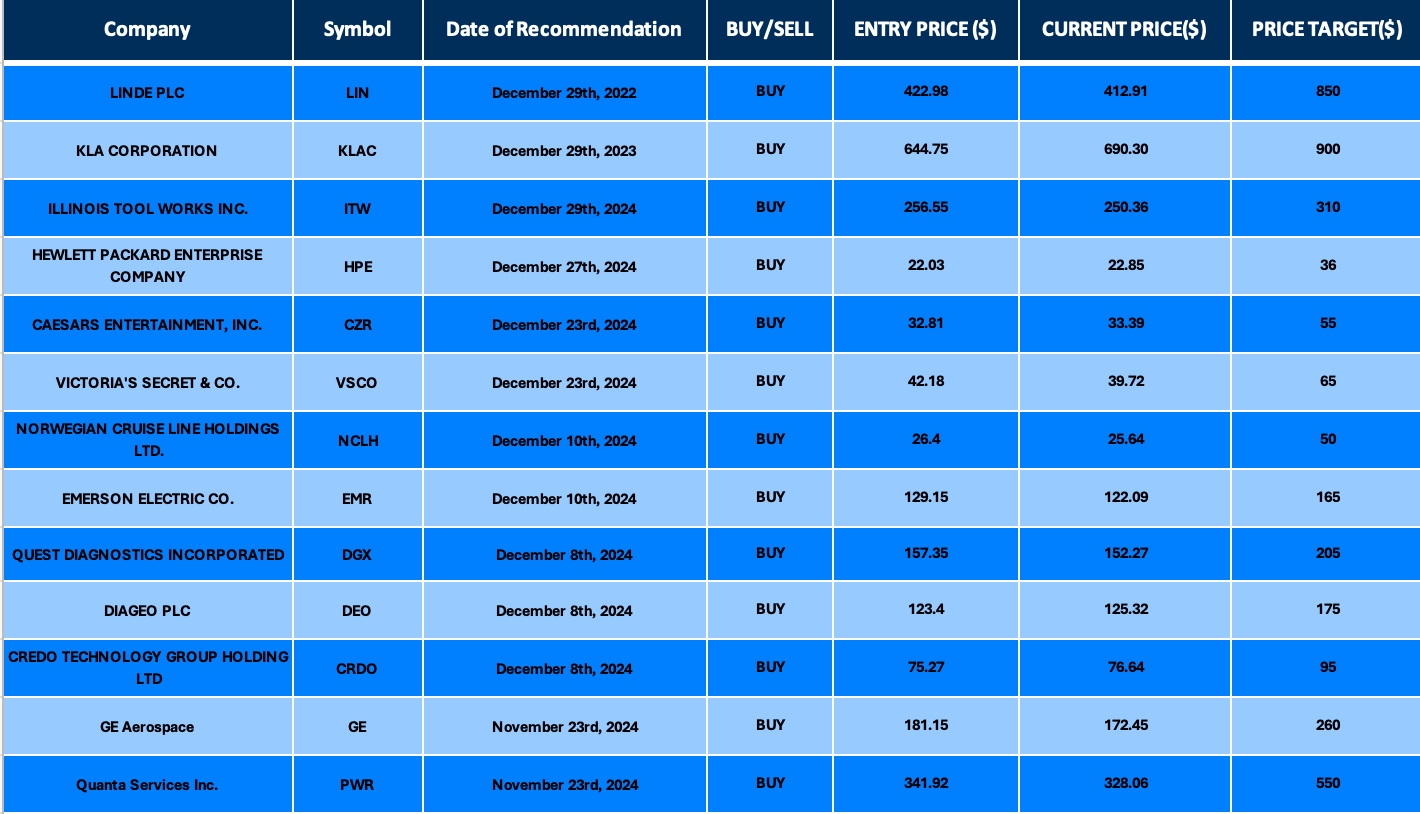

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.