Date Issued – 30th January 2025

Tesla Earnings: Spotlight on Self-Driving and Robotaxi Updates

Tesla is set to release Q4 earnings today, with investors closely watching for updates on self-driving initiatives, robotaxis, and affordable EV models. Analysts expect adjusted EPS of $0.75 and revenue of $27.21 billion. While Tesla’s stock is down 1.4% year-to-date, some analysts remain bullish, citing potential growth in AI and autonomous driving. Wedbush Securities predicts Tesla could reach a $2 trillion market cap by 2025, while Morningstar warns of delays in robotaxi rollouts and labels the stock overvalued. Morgan Stanley sees Tesla as an “embodied AI ETF,” benefiting from favorable U.S. policies, with RBC anticipating margin growth from wider FSD adoption.

Investment Insight:

Tesla’s long-term growth hinges on its AI-driven autonomy and affordability strategy. Short-term risks include overvaluation and potential production delays, but favorable policies and AI advancements could drive significant upside.

Market Price: Tesla Inc (TSLA): USD 389.10

Roche Beats 2024 Estimates, Expects Growth in 2025

Swiss pharma giant Roche exceeded 2024 expectations, reporting 7% sales growth at constant currencies, driven by its pharmaceuticals and diagnostics divisions. Core earnings per share rose to 18.80 Swiss francs, above analyst expectations of 18.59 francs. However, net profit fell to 9.19 billion francs from 12.36 billion. For 2025, Roche forecasts mid-single-digit sales growth and high-single-digit EPS growth, with plans to increase its dividend from 9.70 francs per share. The company remains optimistic about steady growth in the year ahead.

Investment Insight:

Roche’s strong core earnings and dividend growth signal resilience, but declining net profit warrants caution. Investors should focus on its performance in high-margin divisions and how currency fluctuations may impact future results.

Market Price: Roche Holding AG Genussscheine (ROG): CHF 280.80

Conclusion

Markets remain focused on central bank actions, with the BOJ and BoE setting the tone for currency and equity movements. Corporate updates highlight confidence, as Sanofi’s buyback and Roche’s steady growth outlook signal resilience in healthcare, while Tesla’s earnings could reveal key advancements in AI and autonomy. Investors should stay alert to policy shifts, fiscal pressures, and evolving sector dynamics. With mixed signals across regions and industries, near-term caution is warranted, but opportunities in innovation-driven sectors like AI and pharma remain compelling for long-term growth. Keep an eye on company strategies and macroeconomic developments shaping the investment landscape.

Upcoming Dates to Watch

- January 30, 2025: US GDP, Jobless claims; Apple, Deutsche Bank, Shell earnings

- January 31, 2025: Tokyo CPI, Japan jobless claims, US PCE inflation

ASML Shares Soar on Strong Q4 Bookings

ASML shares jumped 8.7% in Frankfurt trading Wednesday after reporting better-than-expected Q4 bookings of €7.08 billion, driven by strong demand for its advanced chip-making tools. The results helped ease investor concerns following recent losses tied to the DeepSeek AI model’s market impact. Analysts at Jefferies noted the robust backlog alleviates 2025 growth worries, though uncertainties around 2026 remain.

Investment Insight:

ASML’s strong bookings highlight enduring demand for advanced semiconductor equipment. However, investors should remain cautious about long-term growth projections amid broader industry uncertainties.

Volkswagen Weighs US Production for Audi, Porsche Amid Tariff Threats

Volkswagen is exploring US production sites for its Audi and Porsche brands to mitigate potential tariffs threatened by President Donald Trump, according to Handelsblatt. Unlike VW’s core brand, Audi and Porsche currently lack US-based production, leaving them vulnerable to trade barriers. The move could safeguard the luxury brands from heightened costs and maintain their competitiveness in the US market. Volkswagen has not commented on the report.

Investment Insight:

Tariff threats underscore the importance of localized production for global automakers. Investors should monitor VW’s expansion plans, which could reduce trade risks and strengthen its foothold in the US premium car market.

Conclusion

Markets remain in flux as investors balance optimism in tech and energy sectors with looming uncertainties. Strong Q4 results from ASML and Nvidia’s rebound highlight resilience in semiconductor and AI-driven industries, while bitcoin’s rise reflects growing institutional interest. The Federal Reserve’s upcoming decision adds another layer of anticipation, with potential signals on future rate cuts. Meanwhile, Volkswagen’s US production plans underscore the importance of mitigating geopolitical risks. As volatility persists, investors should focus on sectors demonstrating both adaptability and long-term growth potential while staying alert to shifting macroeconomic and regulatory dynamics.

Upcoming Dates to Watch

- January 30, 2025: US GDP, Jobless claims; Apple, Deutsche Bank, Shell earnings

- January 31, 2025: Tokyo CPI, Japan jobless claims, US PCE inflation

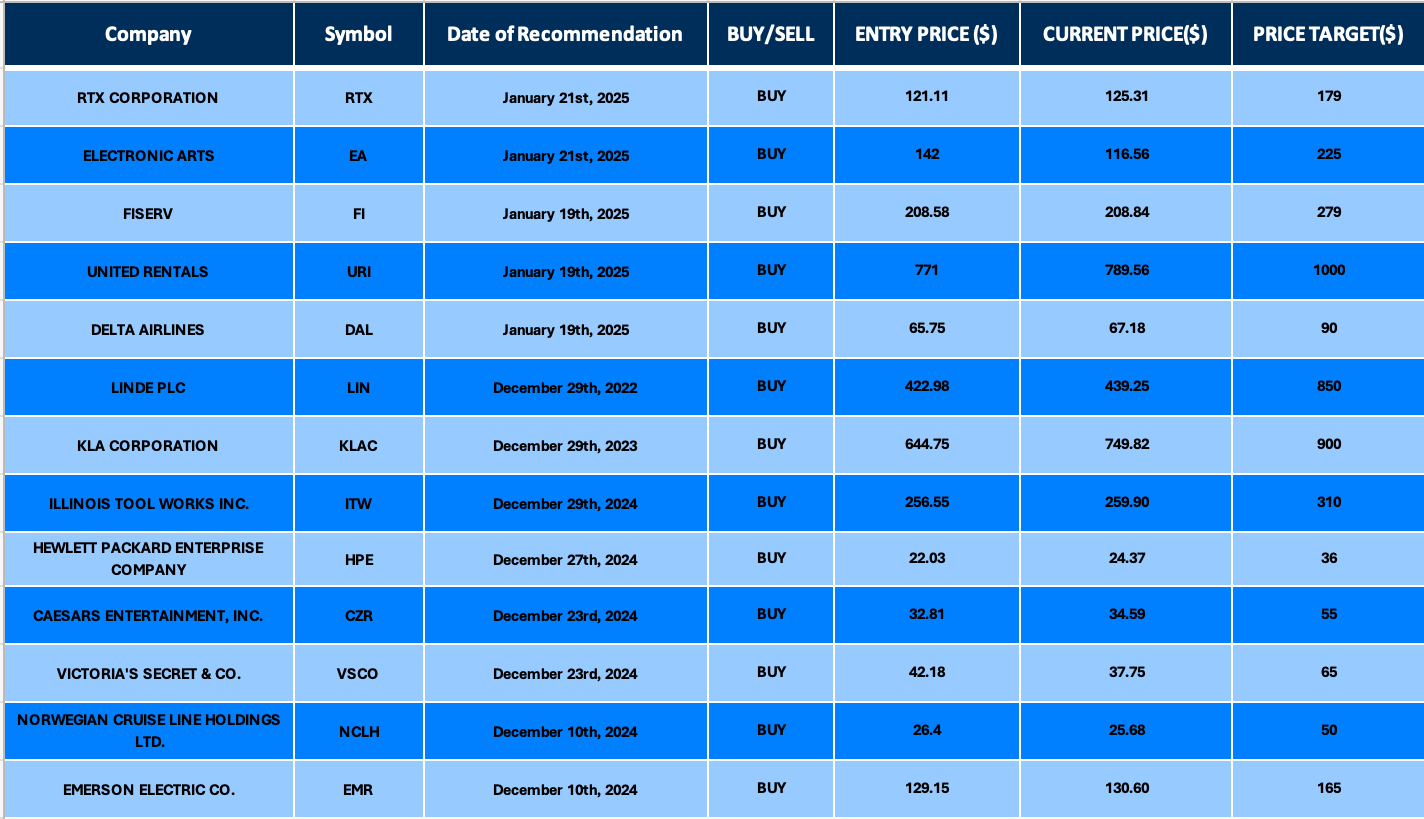

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.