Date Issued – 6th February 2025

Preview

Mitsubishi UFJ Financial Group (MUFG) is set to achieve record profits of ¥1.75 trillion ($11 billion) this fiscal year, driven by rising domestic rates, strong markets, and a weak yen. Despite a 39% surge in shares, CFO Jun Togawa stresses sustainable growth through fee revenue, fintech in Asia, and cost control, aiming for a higher price-to-book ratio and global competitiveness.

Meanwhile, Alphabet’s $75 billion AI-driven capex plan for 2025 has fueled a semiconductor rally, benefitting Nvidia, Broadcom, and others. Amazon’s earnings on Thursday will offer clues on retail trends amid strong consumer spending but lingering risks like tariffs. China’s tungsten export controls are stoking supply fears, with Almonty Industries seeing surging demand as it expands outside China. Lastly, the Bank of England is expected to cut rates to 4.50% amid economic stagnation, signaling concerns but offering relief to rate-sensitive sectors. Across industries, opportunities coexist with geopolitical, economic, and market risks, demanding careful investor navigation.

MUFG Eyes Sustainable Growth Beyond Record Profits

Mitsubishi UFJ Financial Group (MUFG) is on track to achieve a record ¥1.75 trillion ($11 billion) in net income for the year ending March, bolstered by rising domestic interest rates, a buoyant stock market, and a weak yen. Shares have surged 39% over the past year, making MUFG Japan’s second most valuable company by market cap after Toyota.

However, CFO Jun Togawa emphasizes the need for sustainable growth through fee revenue expansion, fintech investments in Asia, and improved cost control. MUFG is also targeting a higher price-to-book ratio to compete globally and attract international investors, supported by ongoing share buyback programs.

Investment Insight

MUFG’s focus on fee-based revenue and fintech investments signals long-term growth potential. Its undervalued shares and shareholder-friendly buybacks may appeal to investors seeking exposure to Japan’s financial sector recovery.

Market price: MUFG Financial Group Inc (TYO: 8306): JPY 1,952

Google’s AI Spending Spurs Chip Stock Surge

Alphabet’s announcement of a $75 billion capital expenditure plan for 2025—up sharply from $52 billion last year—has sparked optimism across the chip sector. Nvidia, Broadcom, and other semiconductor stocks rallied on Wednesday, buoyed by expectations that Google’s AI ambitions will drive robust demand for cutting-edge chips.

Alphabet’s spending plans come amid a broader wave of AI investment, with Meta, Microsoft, and Tesla also committing to increased capex for AI development. Despite a 7% drop in Alphabet’s stock, Nvidia climbed nearly 5%, Broadcom surged 6%, and other chipmakers, including TSMC and Micron, saw gains.

Investment Insight

The AI arms race among tech giants promises sustained demand for advanced semiconductors. Investors should monitor chipmakers with strong ties to AI-focused firms, as this trend could fuel long-term growth opportunities.

Amazon Earnings Could Set Tone for Retailers in 2025

Amazon will kick off major retailers’ earnings season on Thursday, offering insights into consumer spending after a record-breaking holiday season. Analysts predict strong sales growth for Amazon, Walmart, Costco, and Target this year, driven by rising consumer spending, moderated inflation, and stable job markets. Amazon is expected to report a 10% year-over-year increase in goods sold, while Walmart and Costco benefit from value-focused shoppers.

However, risks such as tariffs and a potential stock market correction could dampen momentum, with analysts warning these factors may halve consumer spending growth in 2025.

Investment Insight

Retailers with strong e-commerce platforms and value-driven strategies—like Amazon and Costco—are well-positioned for growth. However, investors should remain cautious of macroeconomic risks like tariffs and market volatility that could impact consumer spending trends.

China’s Tungsten Export Controls Spark Supply Fears

China’s recent export controls on tungsten, a critical metal for defense and high-tech industries, have sent shockwaves through global markets. Almonty Industries, a major North American tungsten miner, reports surging inquiries as customers grapple with potential supply shortages. China produces 80% of the world’s tungsten, and additional restrictions could further tighten availability.

Almonty’s stock has surged 41% in two days, reflecting investor concerns over the scarcity of the material, used in munitions, engine parts, and semiconductors. Almonty is expanding operations in South Korea to reduce reliance on Chinese output, with a new mine set to open in two months.

Investment Insight

China’s dominance in tungsten supply underscores geopolitical risks in critical minerals. Investors may consider companies like Almonty, which are diversifying production outside of China, as strategic plays in an increasingly constrained market.

Bank of England Poised for Third Rate Cut

The Bank of England is expected to cut its key interest rate to 4.50% on Thursday, marking its third reduction in six months. While inflation remains slightly above the 2% target at 2.5%, a stagnating economy and declining employment are pushing policymakers toward more urgent action.

The move comes as inflationary pressures ease, particularly in the services sector, despite looming business tax hikes from the Labour government. Markets will closely watch Governor Andrew Bailey’s tone and the bank’s updated economic forecasts for clues on future monetary policy.

Investment Insight

Lower rates could ease borrowing costs but signal deeper concerns about the U.K.’s economic outlook. Investors should assess potential headwinds for banks and opportunities in rate-sensitive sectors like housing and consumer goods.

Conclusion

In a rapidly shifting global landscape, opportunities and risks are emerging across industries. MUFG’s push for sustainable growth highlights the evolving dynamics of Japan’s financial sector, while Alphabet’s AI investments signal long-term demand for advanced semiconductors. Retail giants like Amazon are poised for solid performance, though macroeconomic risks cast a shadow over consumer spending. China’s tungsten export controls underscore the fragility of critical supply chains, pushing diversification efforts. Meanwhile, the Bank of England’s expected rate cut reflects mounting economic pressures.

For investors, strategic positioning in growth sectors and vigilance toward geopolitical and economic headwinds will be key to navigating 2025.

Upcoming Dates to Watch

- February 6th, 2025: UK rate decision, Amazon earnings

- February 7th, 2025: US nonfarm payrolls, unemployment; Canada unemployment

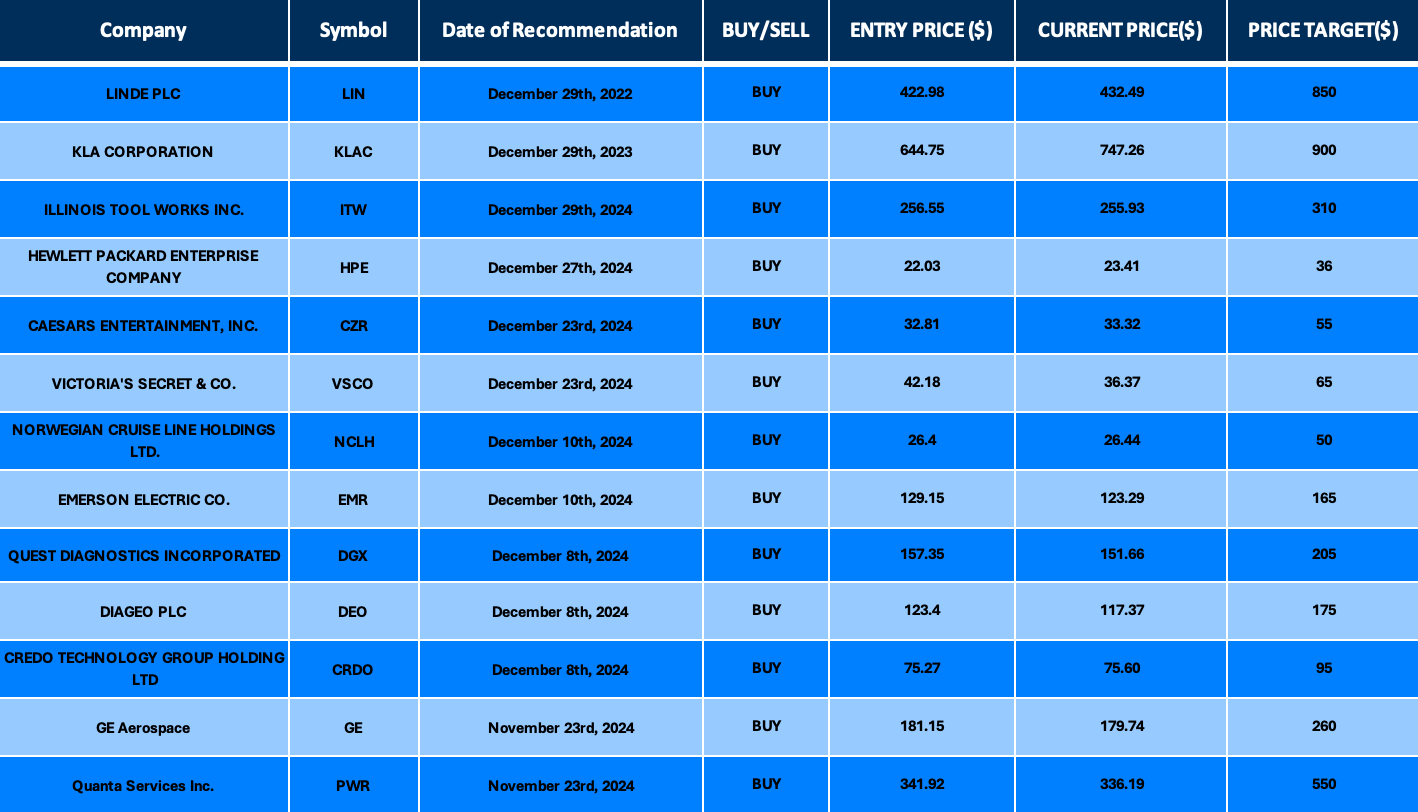

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.