Date Issued – 17th February 2025

Preview

Tencent surged to its highest since 2021 after integrating DeepSeek’s AI into WeChat, while Baidu slid nearly 9% on profit-taking. Asian central banks ramped up dollar forward contracts to defend currencies, raising concerns over deferred risks. Australian insurers, including Suncorp and IAG, plunged after opposition leader Peter Dutton threatened to break them up over premium hikes. Broadcom and TSMC are reportedly eyeing separate deals for struggling Intel, potentially splitting the chipmaker amid U.S. government scrutiny. In Japan, Q4 GDP beat forecasts with 2.8% growth, bolstering the BOJ’s rate hike trajectory despite slowing consumption and global trade uncertainties.

Tencent Shares Surge, Baidu Slides After DeepSeek’s WeChat Debut

Tencent’s stock climbed to its highest level since 2021 after integrating DeepSeek’s AI model into WeChat search, signaling strong AI adoption across Chinese tech. The Shenzhen-based giant has seen shares rise over 70% in the past year, bolstered by its gaming successes and investor optimism surrounding AI capabilities. Meanwhile, Baidu shares fell nearly 9% on profit-taking ahead of its earnings report, despite also integrating DeepSeek. Chinese equities are gaining momentum, fueled by AI advancements and renewed government support for private enterprises.

Investment Insight: Tencent’s strategic AI integration positions it as a leader in China’s tech resurgence. However, investors should monitor broader macroeconomic challenges and policy shifts to assess sustainability in the sector’s rally.

Market price: Tencent Holdings Ltd. (HKG: 0700): HKD 493.60

Rise of Dollar Forwards Builds Risk for Asian Central Banks

Asian central banks, including those in India and Indonesia, are increasingly relying on dollar forward contracts to defend their currencies against a strong dollar without depleting reserves. India’s forward position hit a record $68 billion, while Indonesia’s reached $19.6 billion, raising concerns about deferred selling pressures. While forwards offer cost advantages and avoid draining reserves, critics warn this strategy risks masking underlying vulnerabilities. Meanwhile, the Indian rupee and Indonesian rupiah remain among Asia’s weakest currencies over the past year.

Investment Insight: The growing use of forwards reflects central banks’ efforts to maintain currency stability amid dollar strength. However, investors should be cautious of hidden risks, as deferred depreciation could amplify future volatility.

Australian Insurance Stocks Slide After Opposition Leader’s Breakup Threat

Shares in Australian insurers tumbled Monday after opposition leader Peter Dutton vowed to scrutinize the sector and break up companies accused of exploiting customers if elected. Suncorp fell 21.3%, its steepest drop since 2020, while IAG and QBE also declined. Dutton’s remarks come amid mounting voter dissatisfaction with rising insurance premiums, which surged 16.4% last year, the highest in three decades. The pledge adds pressure on an industry already facing weak earnings and heightened scrutiny ahead of federal elections due by May.

Investment Insight: Political risks are rising for Australian insurers, with potential regulatory intervention looming. Investors should brace for volatility as election-driven uncertainty weighs on the sector.

Broadcom, TSMC Weigh Separate Deals for Struggling Intel

Broadcom and TSMC are exploring separate bids for Intel, potentially splitting the legacy chipmaker, according to the Wall Street Journal. TSMC is eyeing Intel’s chip plants, while Broadcom is interested in its chip-design and marketing business but may require a partner for Intel’s manufacturing arm. Talks remain in early stages, with no formal approach to Intel yet. The move comes as Intel grapples with financial losses in its foundry business and struggles to compete with rivals like Nvidia, AMD, and Qualcomm. U.S. government involvement, tied to Intel’s CHIPS Act funding, may complicate any foreign acquisition of its factories.

Investment Insight: Intel’s potential breakup signals opportunities for competitors but raises risks tied to political intervention. Investors should watch for developments in AI-driven chip demand and the fate of Intel’s leadership transition.

Japan’s Economy Outperforms Forecasts, Keeping BOJ on Track

Japan’s economy grew at an annualized 2.8% in Q4, beating the 1.1% consensus estimate and marking a third consecutive quarter of growth. Business investment and net trade drove the expansion, despite slowing private consumption and weaker imports. The data bolsters expectations that the Bank of Japan will continue gradual rate hikes, with the yen strengthening slightly after the release. Nominal GDP surpassed ¥600 trillion for the first time, though the annual growth pace for 2024 was the weakest since the pandemic.

Investment Insight: Japan’s stronger-than-expected growth supports the BOJ’s policy normalization, but slowing consumption and global trade uncertainties warrant caution. Investors should monitor the yen’s fluctuations and inflation’s impact on real wages.

Conclusion

Markets are navigating a mix of opportunities and risks, from Tencent’s AI-driven surge to Intel’s potential breakup and Japan’s robust economic growth. However, challenges persist, with political scrutiny weighing on Australian insurers, deferred risks in Asian currency interventions, and global trade uncertainties impacting Japan’s outlook. As AI advancements and macroeconomic developments shape industries, investors must remain vigilant, particularly with rising geopolitical and regulatory risks. The week ahead will likely bring further clarity on central bank policies, corporate earnings, and strategic shifts across sectors, keeping market participants poised for potential volatility and emerging opportunities.

Upcoming Dates to Watch:

- February 18th, 2025: Australia rate decision, Canada CPI

- February 19th, 2025: UK CPI

- February 21st, 2025: Japan CPI

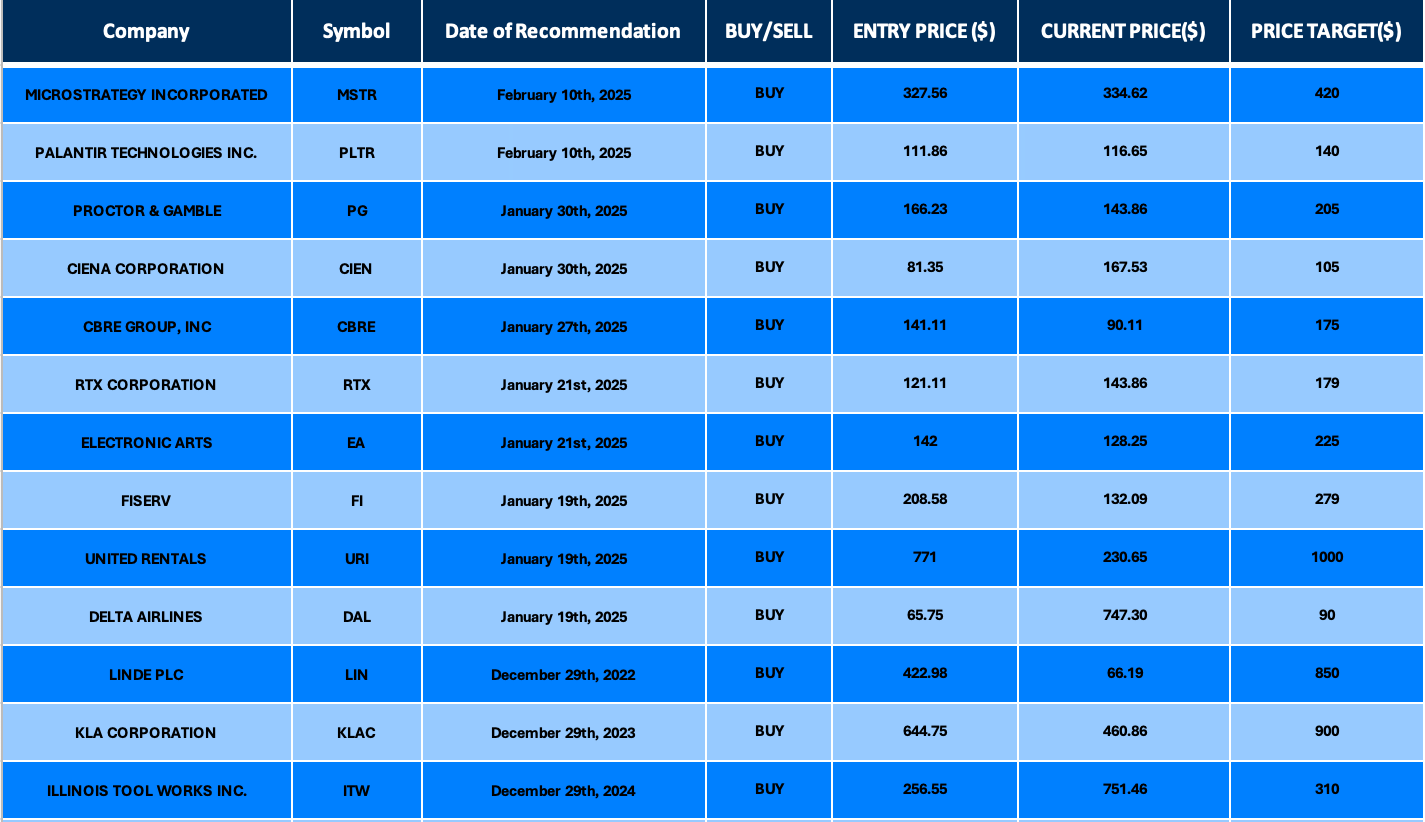

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.