Date Issued – 19th February 2025

Preview

Oil prices held steady as OPEC+ considers delaying April supply increases, while geopolitical tensions and tighter Russian oil price caps cloud the outlook. President Trump’s proposed 25% tariffs on autos, semiconductors, and pharmaceuticals could disrupt global supply chains, hitting Asian nations and European automakers hardest. Intel surged 16% on reports of a potential breakup, driving a 38.5% weekly gain, though regulatory hurdles loom. Super Micro Computer, up 83% YTD, leads the S&P 500 amid AI-driven optimism tied to Nvidia’s next-gen GPUs, despite accounting challenges last year. Meanwhile, Mitsui is investing $5.3 billion in a Rio Tinto-led Australian iron ore project, aiming to meet demand for greener steelmaking materials.

Oil Steadies Amid OPEC+ Supply Talks and Russian Uncertainty

Oil prices remained steady after recent gains, with Brent crude hovering near $76 a barrel and WTI around $72. OPEC+ is reportedly considering postponing planned supply increases set for April, marking the fourth potential delay. Meanwhile, geopolitical tensions persist: G7 nations are weighing tighter oil price caps on Russian exports, and repairs on a key Russian pumping station could cut Kazakh oil flows to the Black Sea by 30%. Talks in Riyadh between US and Russian officials on Ukraine excluded President Zelenskiy, raising European concerns. Analysts suggest non-OPEC production and OPEC+ pressure will shape the market’s trajectory.

Investment Insight: Oil prices are stabilizing, but supply-side uncertainties from OPEC+ and geopolitical risks underscore the importance of diversified energy investments. Watch for policy shifts and production changes impacting long-term crude trends.

Trump Eyes 25% Tariffs on Autos, Semiconductors, and Drugs

President Donald Trump announced plans to impose 25% tariffs on automobile, semiconductor, and pharmaceutical imports, potentially starting April 2. This move significantly broadens his trade war strategy beyond China, targeting industries critical to global supply chains. The auto sector faces sweeping impacts, with imported vehicles comprising nearly half of US sales. Asian nations, including South Korea, Japan, and Malaysia, as well as European automakers, could be hit hardest. The tariffs are expected to reshape trade flows, increase consumer prices, and spark retaliatory measures from affected nations. Markets remain cautious amid the uncertainty.

Investment Insight: Heightened trade tensions could disrupt global supply chains, particularly in autos and semiconductors. Investors should monitor tariff negotiations and consider diversifying exposure to industries vulnerable to US trade policy shifts.

Intel Soars on Breakup Speculation Amid Acquisition Rumors

Intel (INTC) stock surged 16% Tuesday, its largest single-day gain since 2020, following reports of potential takeover interest from Broadcom (AVGO) and TSMC (TSM). Broadcom is reportedly eyeing Intel’s product business, while TSMC may acquire stakes in its manufacturing division. These developments come as analysts increasingly advocate for Intel to split its foundry and product units to unlock value. Intel shares have climbed 38.5% in the past five days, marking the biggest weekly gain in its history. However, regulatory challenges and constraints tied to US CHIPS Act funding could complicate any deal.

Investment Insight: Intel’s potential breakup could unlock shareholder value, but regulatory and operational hurdles remain significant. Investors should monitor developments while assessing exposure to the semiconductor sector amid consolidation trends.

Super Micro Computer Leads S&P 500 With 83% YTD Gain Amid AI Optimism

Super Micro Computer surged 16% on Tuesday, extending its one-week gain to 45% and its YTD climb to 83%, making it the top-performing S&P 500 stock in 2025. The rally follows a bullish fiscal 2026 outlook despite missed earnings estimates. Investor enthusiasm centers on Nvidia’s upcoming Blackwell GPUs, a key revenue driver for Super Micro’s AI-focused server racks. The stock is rebounding from an 80% drop last year after resolving accounting issues, with analysts split on whether its optimistic guidance will materialize.

Investment Insight: AI-driven demand is fueling Super Micro’s resurgence, but its lofty projections may face supply chain and market risks. Investors should review AI-related exposure and remain cautious of speculative growth expectations.

Mitsui Joins Rio Tinto in $5.3 Billion Australian Iron Ore Project

Mitsui & Co. will invest $5.3 billion for a 40% stake in the Rhodes Ridge iron ore project in Western Australia, with Rio Tinto retaining 50%. Production is slated to start in 2030, with an initial output of 40 million tons annually, potentially scaling to 100 million tons. The project aims to supply high-grade iron ore for greener steelmaking, addressing global decarbonization goals. This is Mitsui’s largest investment to date and reinforces its decades-long partnership with Rio Tinto in Australia’s Pilbara region. Iron ore prices remain subdued at around $100 a ton, reflecting slower Chinese growth.

Investment Insight: The deal underscores long-term demand for high-grade iron ore despite near-term market softness. Investors should monitor decarbonization trends in steelmaking and Rio Tinto’s ability to sustain output from its premium-grade assets.

Conclusion

This week highlights the delicate balance between opportunity and risk across markets. From steady oil prices amid OPEC+ deliberations to Trump’s tariff threats disrupting global trade, uncertainty continues to shape the economic landscape. Intel and Super Micro’s surging stocks reflect optimism in tech, but regulatory hurdles and speculative projections add caution. Mitsui’s $5.3 billion iron ore bet signals long-term confidence in greener steelmaking, even as near-term commodity prices soften. Investors should remain vigilant, balancing exposure to growth sectors like AI and semiconductors while navigating geopolitical and policy-driven headwinds. Stay informed, and position for both resilience and opportunity.

Upcoming Dates to Watch

- February 19th, 2025: UK CPI

- February 21st, 2025: Japan CPI

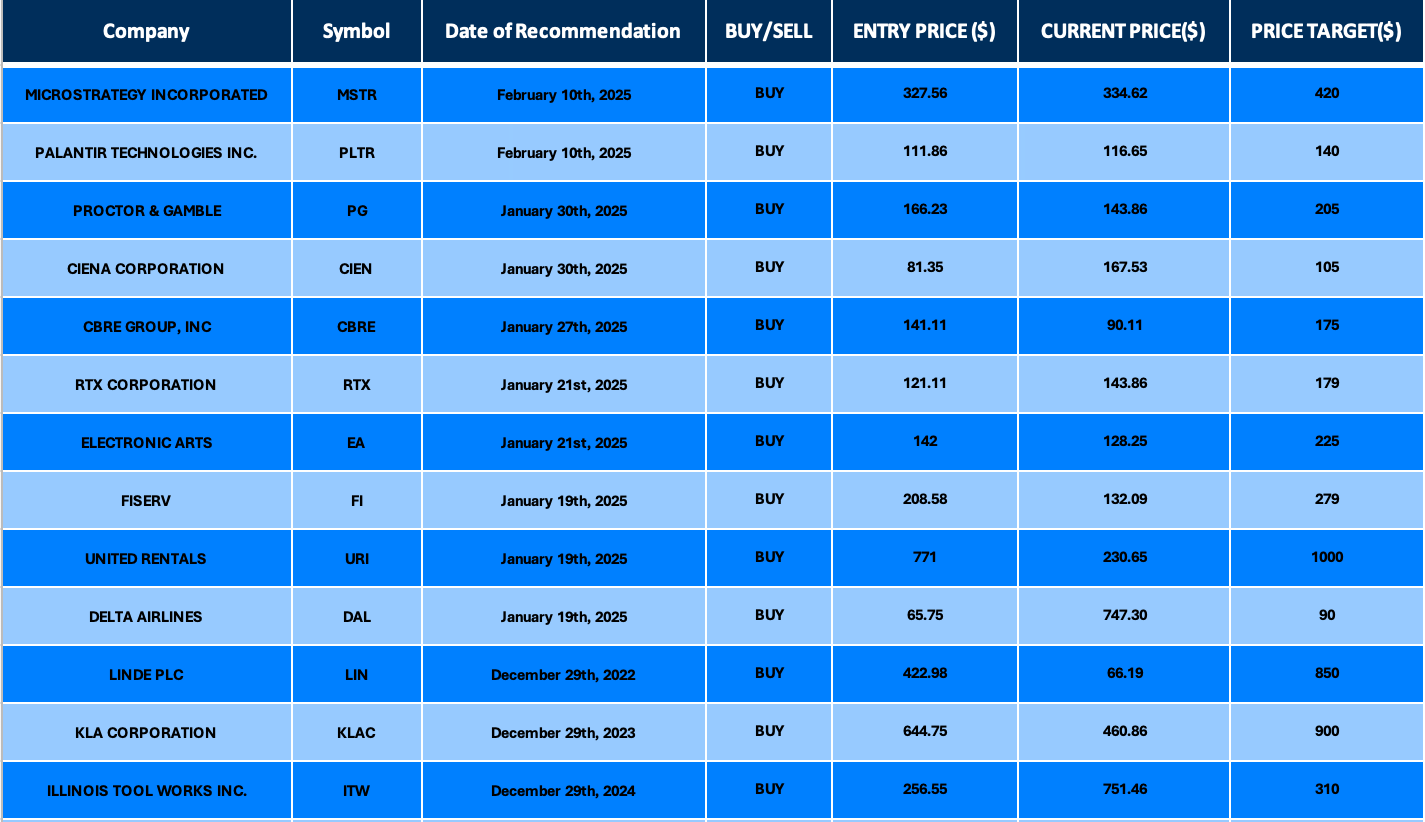

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.