Date Issued – 21th February 2025

Preview

Global markets are navigating a mix of opportunities and uncertainties. Taiwan’s potential ETF rule changes and surging Chinese tech stocks highlight regional growth prospects, while gold’s rally underscores investor caution amid geopolitical tensions. Nissan’s challenges, from Moody’s downgrade to Tesla partnership talks, reflect broader struggles in the auto sector, while Trump’s push for U.S. LNG exports signals a strategic shift in Asia’s energy landscape. As economic and geopolitical dynamics evolve, investors should remain vigilant and assess opportunities in technology, energy, and safe-haven assets while balancing risks tied to restructuring and global trade uncertainties.

Taiwan Considers Lifting ETF Weighting Cap as TSMC’s Influence Grows

Taiwan’s Financial Supervisory Commission is weighing a proposal to lift the 30% cap on single-stock weightings in local ETFs that track indexes. The move comes as Taiwan Semiconductor Manufacturing Co. (TSMC) now represents 37% of the Taiex benchmark, driven by its 140% stock surge since late 2022 amid the AI investment boom. Current rules complicate adjustments for ETFs tracking such benchmarks. A decision could come in the first half of 2025. This follows similar regulatory changes in South Korea, where ETF caps were eased in 2020 due to Samsung’s growing dominance.

Investment Insight: TSMC’s swelling market share underscores the risks of concentration in passive ETF strategies. Investors should monitor potential rule changes to assess the diversification benefits of Taiwan-based ETFs.

Market price: Taiwan Semiconductor Manufacturing Company Ltd. (TPPE:2330): TWD 1,095.00

Gold Extends Rally as ETF Inflows Surge Amid Geopolitical Uncertainty

Gold is on track for an eighth consecutive weekly gain—its longest streak since 2020—driven by heightened haven demand amid geopolitical tensions and trade concerns. Though bullion dipped below $2,928 an ounce on Friday, it remains over 1% higher this week. Global ETF holdings in gold surged by 16 tons, marking the largest weekly inflow since 2023. Contributing factors include fears over U.S. diplomacy with Russia on Ukraine, a weakening dollar, and central-bank buying. Goldman Sachs raised its year-end target for gold to $3,100 an ounce, citing sustained demand.

Investment Insight: Gold’s prolonged rally reflects its role as a hedge against geopolitical and currency risks. Investors should weigh exposure to bullion-backed ETFs as central-bank buying and dollar weakness persist.

Nissan Faces Uncertainty Amid Tesla Partnership Hopes and Moody’s Downgrade

A Japanese group, including former Prime Minister Yoshihide Suga, is courting Tesla to invest in Nissan following the collapse of its $60 billion merger talks with Honda. The group hopes Tesla will become a strategic partner, potentially acquiring Nissan’s U.S. plants. Elon Musk’s recent comments about Tesla’s steering-wheel-free “Cybercab” highlight the automaker’s ambitions to transform the EV industry. Nissan shares jumped 9.6% after the report.

At the same time, Moody’s downgraded Nissan’s credit rating to junk status (Ba1), citing challenges with its restructuring plan, aging product lineup, and global trade risks, including potential U.S. tariffs. While Nissan’s turnaround includes workforce cuts and capacity reductions, free cash flow remains negative, raising concerns about its financial health despite adequate short-term liquidity.

Investment Insight: Tesla’s potential partnership with Nissan could provide a competitive edge in scaling EV production, but Moody’s downgrade underscores significant risks for Nissan. Investors should remain cautious, particularly with automakers facing restructuring and trade uncertainties.

Trump Pushes U.S. LNG to Reshape Asia’s Energy Landscape

President Donald Trump is advancing a plan to expand U.S. LNG exports to Asia, spotlighting the $44 billion Alaska LNG project in talks with Japanese Prime Minister Shigeru Ishiba. Trump pitched the initiative as a way for Japan to reduce reliance on Middle Eastern and Russian energy while addressing trade imbalances with the U.S. Though Japan expressed tentative support, logistical and cost hurdles remain for the Alaska pipeline. The broader strategy seeks to bind Asian allies like Japan, South Korea, and Taiwan to U.S. energy supplies, enhancing their energy security and reducing China’s and Russia’s influence in the region.

Investment Insight: The push for U.S. LNG in Asia highlights opportunities in energy infrastructure and export terminals. Investors should watch for developments in Alaskan LNG projects and partnerships with Asian allies, which could drive demand for U.S. natural gas.

Chinese Tech Stocks Surge on Strong Earnings and Renewed Optimism

The Hang Seng Tech Index jumped over 5% on Friday, reaching its highest level since early 2022, as upbeat earnings from top Chinese tech firms fueled investor sentiment. Alibaba surged nearly 14% after reporting stronger-than-expected sales, while Bilibili and Lenovo also rallied on positive results. Investor enthusiasm has been bolstered by breakthroughs from AI startup DeepSeek and President Xi Jinping’s recent conciliatory meeting with tech executives, signaling potential government support for the sector. The broader Hang Seng China Enterprises Index rose over 3%.

Investment Insight: Chinese tech stocks are regaining momentum, supported by strong earnings and improved regulatory sentiment. Investors may find opportunities in leading firms like Alibaba, especially as foreign funds reconsider exposure to Chinese equities.

Conclusion

Global markets are navigating a mix of opportunities and uncertainties. Taiwan’s potential ETF rule changes and surging Chinese tech stocks highlight regional growth prospects, while gold’s rally underscores investor caution amid geopolitical tensions. Nissan’s challenges, from Moody’s downgrade to Tesla partnership talks, reflect broader struggles in the auto sector, while Trump’s push for U.S. LNG exports signals a strategic shift in Asia’s energy landscape. As economic and geopolitical dynamics evolve, investors should remain vigilant and assess opportunities in technology, energy, and safe-haven assets while balancing risks tied to restructuring and global trade uncertainties.

Upcoming Dates to Watch

February 21st, 2025: Eurozone HCOB manufacturing & services PMI, US S&P Global manufacturing & services PMI

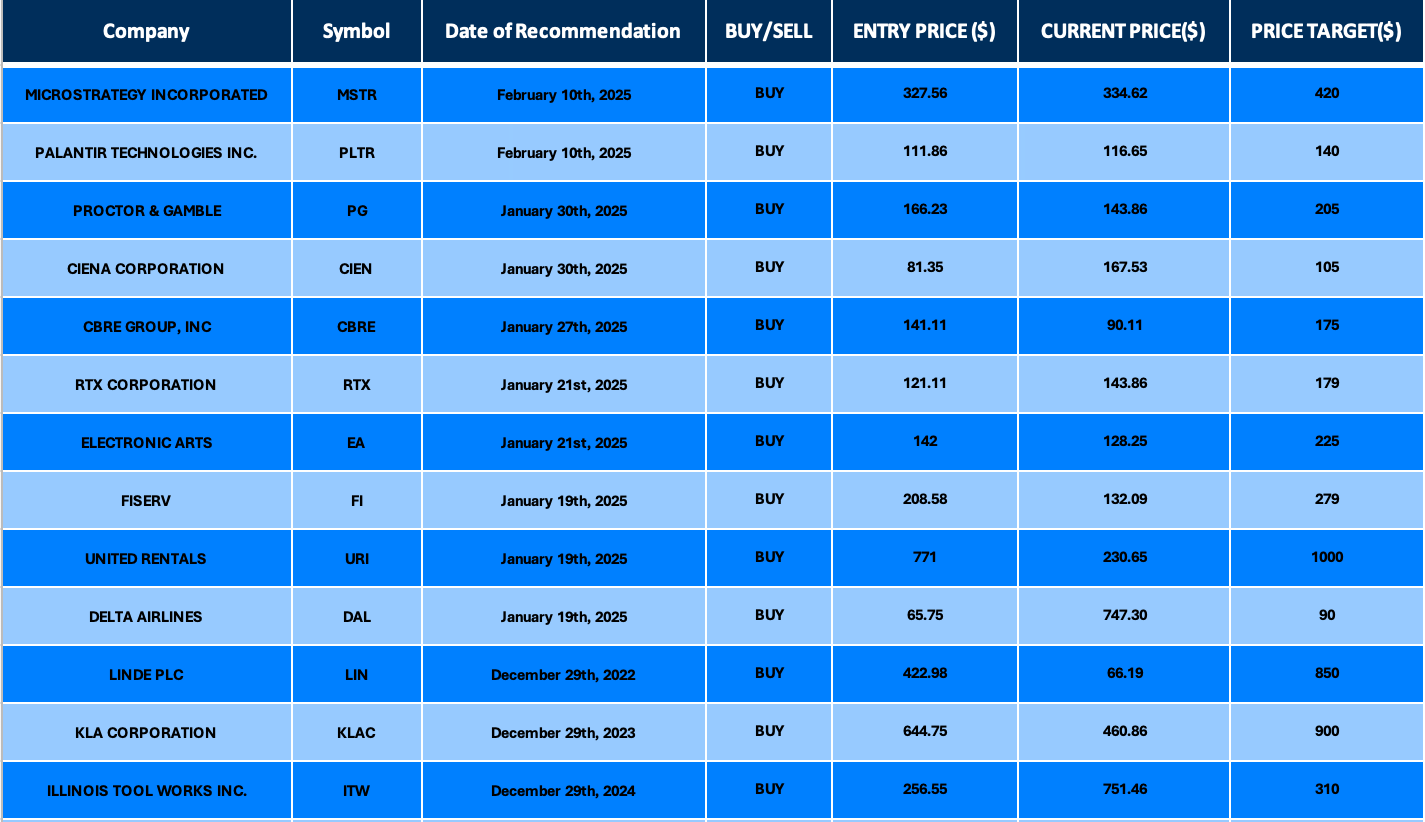

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.