Date Issued – 24th February 2025

Preview

European markets are poised for gains after Germany’s conservatives secured an election victory, boosting optimism for fiscal spending to address economic challenges. Alibaba announced a $53 billion investment in AI infrastructure, aiming to compete globally despite U.S. sanctions. Meanwhile, lithium and nickel miners face cost-cutting pressures as oversupply and price crashes continue, with potential for M&A activity in 2025. Microsoft is scaling back U.S. data center leases, raising questions about AI demand sustainability amid rising competition from cheaper models like China’s DeepSeek. In trade, President Trump escalated tensions with China through sweeping restrictions on investment and shipping, signaling further strain between the world’s largest economies.

European Shares Set to Gain Following German Election Result

European markets are set for a positive start as Germany’s conservatives, led by Friedrich Merz, secured a federal election victory. Futures for Germany’s DAX Index and the Euro STOXX 50 rallied, while the euro posted its largest monthly gain against the dollar, reflecting optimism over Merz’s promise to swiftly form a government. Investors expect increased fiscal spending from Germany to tackle economic challenges, including the impact of Russia’s war in Ukraine. Meanwhile, Asian markets saw a pause in Chinese tech rallies after President Trump restricted Chinese investment in key U.S. sectors.

Investment Insight: Germany’s election outcome signals a market-friendly environment, with potential for increased fiscal stimulus. Investors should monitor policy developments closely, as these will shape Europe’s near-term economic outlook.

Alibaba to Invest $53 Billion in AI Pivot

Alibaba Group announced plans to invest 380 billion yuan ($53 billion) in AI infrastructure, including data centers, over the next three years. This marks a dramatic pivot as the company doubles down on artificial intelligence, with a focus on developing Artificial General Intelligence (AGI) and expanding its cloud computing capabilities. The investment trails spending by U.S. peers like Microsoft and Meta but reflects Alibaba’s renewed determination to compete globally in AI after years of regulatory challenges. The move is part of a broader strategy to integrate AI into its core businesses and regain its market leadership in China.

Investment Insight: Alibaba’s bold AI investment underscores its commitment to long-term growth in a competitive sector. Investors should monitor its ability to execute in an AI landscape constrained by U.S. sanctions and rising competition from domestic and global peers.

Market price: Alibaba Group Holding Ltd (HKG: 9988): HKD 137.2

Battery Metal Price Crash Forces Miners to Cut Costs

Lithium and nickel miners are bracing for cost cuts and potential consolidation as the sector struggles with plummeting prices and weak earnings. Key Australian lithium producers, including PLS Ltd. and IGO Ltd., reported significant losses, while nickel miners like Nickel Industries Ltd. saw impairments due to multi-year low prices. Lithium prices have dropped over 80% since 2022, and nickel has halved since 2023, fueled by oversupply and softer EV demand. Analysts expect the oversupply to persist through the decade, prompting miners to curtail spending and pause expansions, while depressed valuations may drive M&A activity in 2025.

Investment Insight: The prolonged downturn in battery metals highlights risks for investors in the sector. However, low valuations may present strategic buying opportunities, especially for major players eyeing consolidation.

Microsoft Cancels AI Data Center Leases Amid Oversupply Concerns

Microsoft is canceling leases for significant data center capacity in the U.S., including agreements totaling hundreds of megawatts, according to TD Cowen. The move has raised questions about whether Microsoft is growing cautious about long-term AI demand despite maintaining its $80 billion fiscal year spending target for AI infrastructure. Analysts speculate this reflects potential oversupply, as rivals like Meta have similarly slowed capital outlays. Wall Street scrutiny of AI spending has increased following the emergence of lower-cost AI models, such as those from Chinese upstart DeepSeek, which challenge the economics of massive investments.

Investment Insight: Microsoft’s lease cancellations suggest a reevaluation of AI infrastructure growth. Investors should monitor how this impacts the broader AI race and whether spending adjustments signal a potential plateau in AI demand.

Market price: Microsoft Corp (MSFT): USD 408.21

Trump Escalates Trade Tensions With China in Sweeping New Moves

President Trump has taken his most aggressive steps yet against China, targeting investment, trade, and shipping industries. A new memorandum directs the Committee on Foreign Investment to restrict Chinese investments in U.S. strategic sectors, including tech, energy, and farmland. Additional measures include proposed fees on Chinese-built ships, scrutiny of a 1984 tax treaty, and curbs on U.S. pension fund investments in Chinese high-tech firms. These actions, paired with ongoing tariffs and security restrictions, signal a deepening rift between the two economic powers. Beijing has criticized the moves, warning they could erode investor confidence and further strain U.S.-China trade relations.

Investment Insight: Rising tensions between the U.S. and China may weigh on global trade and increase market volatility. Investors should assess exposure to affected sectors like shipping, AI, and tech supply chains, while watching for potential retaliatory actions from Beijing.

Conclusion

Markets are navigating a complex landscape shaped by geopolitical tensions, technological pivots, and shifting commodity dynamics. Germany’s election outcome brings hope for fiscal stimulus in Europe, while Alibaba’s bold AI investment underscores the intensifying competition in the tech sector. Battery metal miners face consolidation pressures as oversupply weighs on prices, and Microsoft’s reevaluation of AI infrastructure highlights growing scrutiny over long-term demand. Meanwhile, escalating U.S.-China trade tensions could disrupt global markets further. As investors seek clarity, monitoring policy shifts, corporate strategies, and economic indicators will be key to identifying opportunities in an increasingly uncertain environment.

Upcoming Dates to Watch

- February 24th, 2025: Eurozone CPI

- February 25th, 2025: US consumer confidence, South Korea rate decision

- February 26th, 2025: Nvidia Earnings

- February 28th, 2025: US PCE inflation, Germany CPI, Tokyo CPI

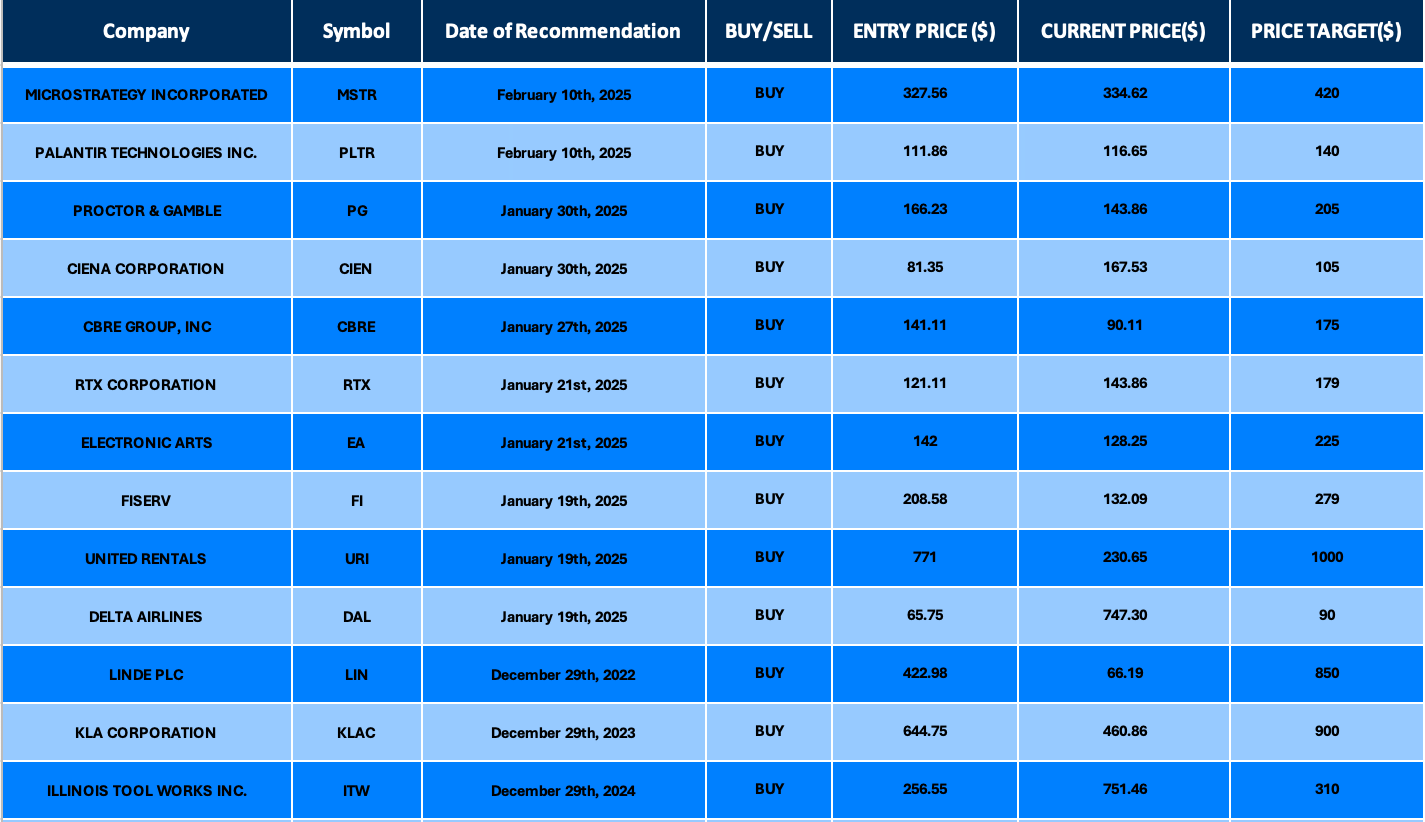

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.