Date Issued – 4th March 2025

Preview

Global markets face turbulence as U.S. tariffs on Canada, Mexico, and China trigger volatility in equities, oil, and currencies, with China retaliating on U.S. agricultural imports. Oil prices fell further as OPEC+ plans to boost output, while TSMC announced a $100 billion investment in U.S. chipmaking, enhancing its AI supply chain. In the UK, shop prices rose at their fastest pace in a year, driven by food inflation and rising retailer costs, prompting warnings of further price hikes. Meanwhile, Seven & i shares dropped 7.8% amid speculation it may reject a $47 billion buyout offer from Couche-Tard, highlighting Japan’s shifting stance on foreign capital.

Global Markets Stagger as Tariffs and Trade Uncertainty Take Center Stage

Global markets reeled as U.S. tariffs on Canada, Mexico, and China took effect, triggering significant volatility across equities, commodities, and currencies. The S&P 500 fell 1.8%, while oil slumped to a three-month low amid signs of slowing U.S. growth. China retaliated with tariffs of up to 15% on U.S. agricultural imports like soy, pork, and beef, while its equities showed resilience, signaling room for negotiation. Emerging-market currencies and the Canadian and Mexican pesos slipped as geopolitical tensions escalated. Meanwhile, Beijing’s upcoming National People’s Congress is expected to unveil economic stimulus measures to combat deflation and bolster growth. Cryptocurrencies remained under pressure, with Bitcoin extending losses, and OPEC+ stuck to plans to revive oil production despite price declines.

Investment Insight

Heightened global trade tensions and slowing U.S. growth signal caution for equities in the short term. Look to defensive assets like gold or explore opportunities in resilient Asian markets such as China and Japan, which may benefit from forthcoming stimulus measures.

Oil Slumps as Tariffs Bite and OPEC+ Eyes Output Hike

Oil prices continued their slide, with Brent nearing $71 a barrel and WTI hovering around $68, as the Trump administration’s tariffs on Canada, Mexico, and China took effect. Beijing retaliated with levies on U.S. agricultural products, intensifying trade war fears. Meanwhile, OPEC+ announced plans to increase oil production in April after months of delays, adding to concerns of a supply surplus. Analysts warn that the combination of trade tensions and higher output could further weaken global demand for crude.

Investment Insight

Investors should brace for continued oil price volatility as trade tensions and oversupply fears weigh on the market. Consider energy sector exposure selectively, focusing on companies with strong balance sheets and resilience in low-price environments.

TSMC Commits $100 Billion to US Chipmaking in Boost for Trump’s Domestic Manufacturing Push

Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s leading AI chip producer, announced an additional $100 billion investment in U.S. plants, further expanding its domestic presence to support President Donald Trump’s goal of bolstering American manufacturing. The new spending, which builds on $65 billion in prior commitments, will establish multiple advanced chip facilities, creating thousands of high-tech jobs. The announcement comes as TSMC aims to anchor a resilient AI supply chain in the U.S., with key partners like Nvidia and Apple relying on its output. While critics question the scale of the investment, analysts suggest political pressure, rather than tariffs, drove TSMC’s decision.

Investment Insight

TSMC’s U.S. expansion underscores the strategic importance of semiconductors and AI technology. Investors may focus on companies benefiting from a strengthened U.S. chip supply chain, including Nvidia and AMD, while monitoring broader geopolitical implications for the sector.

Market price: Taiwan Semiconductor Manufacturing Co Ltd (TPE:2330): TWD 1,000.00

Shop Prices Surge as Food Costs and Retailer Pressures Mount

Shop prices in the UK rose 0.4% between January and February, the sharpest monthly increase in a year, driven by price hikes for staples like butter, cheese, eggs, and bread. Food prices climbed 2.1% year-on-year, and the British Retail Consortium (BRC) warns they could hit 4% later this year. Rising global coffee costs, a £7 billion hike in retailer costs from the autumn Budget, and a new packaging levy are expected to fuel further inflation. Major retailers like Tesco and M&S cautioned that these pressures may lead to store closures and job cuts, while economists question whether the government can mitigate the impact amidst limited fiscal flexibility.

Investment Insight

Higher food inflation and rising retailer costs could squeeze margins for UK supermarkets and high-street chains. Investors might consider defensive consumer staples or discount retailers better positioned to weather inflationary pressures.

Seven & i Shares Drop Amid Buyout Rejection Speculation

Shares of Seven & i Holdings, operator of 7-Eleven, fell as much as 12% after reports suggested the company might reject a $47 billion takeover bid from Canada’s Alimentation Couche-Tard. While Seven & i denied the report, stating discussions are ongoing, the stock ended the day down 7.8%. The rejection is rumored to stem from antitrust concerns in the U.S., adding to investor unease after a failed buyout attempt by the founding Ito family last week. The saga highlights Japan’s evolving openness to foreign capital amid governance reforms and shareholder pressure for greater value creation.

Investment Insight

The uncertainty surrounding Seven & i’s strategic direction could weigh on its stock in the near term. Investors may want to monitor developments in governance reforms and shareholder decisions, as these may unlock potential long-term value.

Conclusion

Global markets are grappling with heightened uncertainty as trade tensions, inflationary pressures, and shifting corporate strategies dominate the headlines. From U.S. tariffs impacting equities and oil prices to TSMC’s massive investment in American manufacturing, the interplay between geopolitics and economic priorities is reshaping industries. Rising UK shop prices signal persistent inflation risks, while Seven & i’s buyout saga underscores the challenges of balancing shareholder value with governance reforms. As markets remain volatile, investors should stay alert to opportunities in sectors showing resilience, such as semiconductors, defensive stocks, and energy, while keeping an eye on evolving global trade dynamics.

Upcoming Dates to Watch

- March 5th, 2025: Australia GDP, China’s National People’s Congress; Eurozone HCOB services PMI, PPI

- March 7th, 2025: Eurozone GDP; US nonfarm payrolls, consumer credit

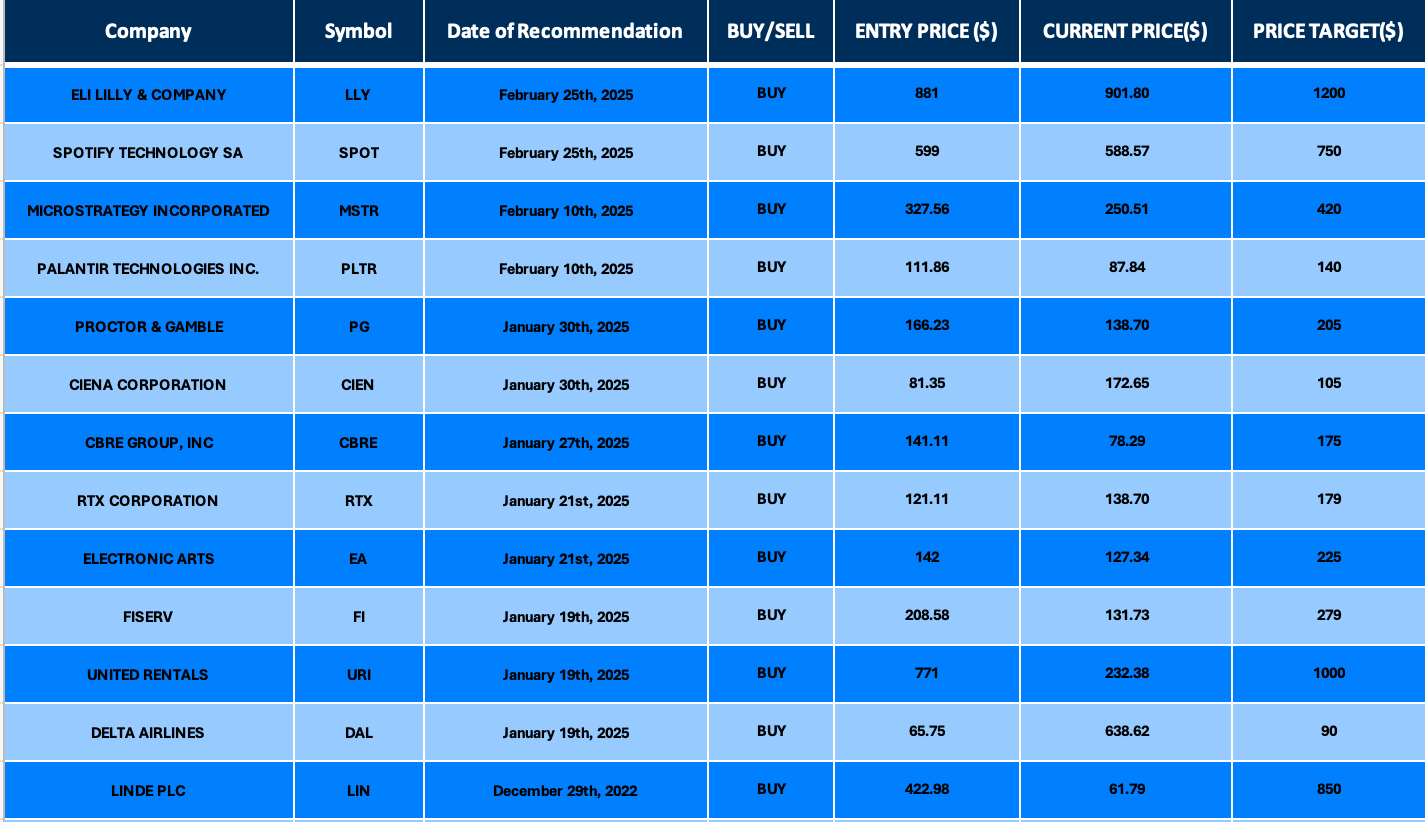

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.