Date Issued – 6th March 2025

Preview

Global markets are on edge as bond yields surge, with Japan’s 10-year yields reaching 1.5%, the highest since 2009, and German bunds seeing their steepest rise since 1990. Meanwhile, Asian equities gained, driven by optimism over Chinese economic support and delayed US auto tariffs, with Hong Kong’s Hang Seng China Enterprises Index jumping 3.3%. In corporate news, Rio Tinto announced a $1.8 billion Pilbara iron ore expansion, Eutelsat shares soared over 500% amid Starlink concerns in Ukraine, and Alibaba’s stock surged 7.6% after unveiling a cutting-edge AI model. US tech stocks struggled, while oil rebounded and gold held steady near record highs. Markets remain highly sensitive to inflation, fiscal spending, and geopolitical developments.

Global Bond Selloff and Asian Market Gains

A global bond selloff intensified Thursday, with Japanese 10-year yields reaching 1.5%, their highest since 2009, as inflation pressures and borrowing costs rise. German bunds saw their sharpest yield surge since 1990, driven by concerns over expanded government spending. The euro rallied ahead of the ECB’s policy meeting, where a rate cut is widely expected. Meanwhile, Asian equities climbed, spurred by optimism over potential Chinese economic support and a delay in US auto tariffs on Mexico and Canada. Japan, South Korea, and Hong Kong indexes posted gains, with the Hang Seng China Enterprises Index jumping 3.3%.

US tech stocks struggled, with Marvell Technology and Broadcom slipping on AI-related revenue concerns. Oil ticked up from six-month lows, and gold held steady near record highs. Markets remain sensitive to geopolitical developments, growth forecasts, and inflationary pressures.

Investment Insight:

The bond selloff signals rising risks in fixed-income markets, with yields drawing upward pressure from inflation and fiscal spending. Investors may consider diversifying into equities or commodities, particularly in regions like Asia where growth momentum appears stronger.

America’s Shift from Europe Sparks Economic Opportunities

With the US distancing itself from Europe militarily and economically, the EU faces urgent pressure to bolster its defense capabilities independently. This shift, coupled with rising military spending, could fuel economic growth if Europe prioritizes domestic innovation and production of advanced military technologies. Increased spending on locally made armaments could boost GDP, create jobs, and generate technological spillovers, much like past defense-driven innovations such as GPS and the internet. However, Europe’s fragmented defense industry and reliance on imports remain hurdles, with experts estimating it could take a decade to achieve self-sufficiency.

Investment Insight:

Rising defense budgets in Europe may unlock opportunities in local defense and dual-use tech sectors. Investors could benefit by focusing on companies poised to lead innovation or consolidate fragmented industries to capitalize on this structural shift.

Rio Tinto Commits $1.8 Billion to Pilbara Iron Ore Expansion

Rio Tinto announced a $1.8 billion investment to develop the Brockman Syncline 1 iron ore project in Western Australia’s Pilbara region. With approvals secured, the project is set to begin production by 2027, a year ahead of schedule. The expansion extends the life of the Brockman hub, which produced 43 million tons of iron ore in 2024, and reinforces Rio Tinto’s focus on Pilbara’s profitability amid its broader shift toward copper for renewable energy needs.

Investment Insight:

Rio Tinto’s Pilbara investment highlights the enduring value of iron ore in its portfolio. Investors should watch for opportunities in companies tied to long-term iron ore demand, while monitoring Rio Tinto’s pivot to copper to capitalize on the green energy transition.

Market price: Rio Tinto Ltd (ASX: RIO): AUD 114.92

Eutelsat Stock Soars Amid Starlink Concerns in Ukraine

French satellite firm Eutelsat’s shares surged over 500% this week, fueled by fears that Ukraine’s access to Starlink, critical for military communications, could be disrupted as US aid to Kyiv falters. Eutelsat, which merged with Starlink competitor OneWeb in 2023, now offers low-Earth orbit satellite services and is in talks with the EU to address Ukraine’s internet needs. Despite its rapid stock gains, Eutelsat’s satellite capacity remains a fraction of Starlink’s. Meanwhile, Europe is ramping up defense spending, with leaders proposing an $840 billion collective budget.

Investment Insight:

Eutelsat’s stock boost highlights investor optimism around European alternatives to US technology. Watch for opportunities in European defense and satellite firms as the region seeks greater autonomy in critical infrastructure.

Market price: Eutelsat Group (ETL.PA): EUR 7.84

Alibaba Shares Soar 7% on New AI Model Launch

Alibaba’s stock surged 7.6% after introducing its QwQ-32B AI model, which rivals DeepSeek’s performance while requiring just 5% of the data. This open-source breakthrough reinforced confidence in the tech giant, contributing to a 5% rally in Chinese tech stocks. Alibaba’s AI advancements align with Beijing’s push for tech innovation, further buoyed by its $52 billion investment in AI infrastructure over the next three years. The company’s growing AI expertise and stabilizing business after regulatory challenges signal a strong comeback in 2025.

Investment Insight:

Alibaba’s AI innovation and government support position it as a key player in China’s tech resurgence. Investors may consider opportunities in Chinese AI-related stocks as the sector gains momentum.

Market price: Alibaba Group Holding Ltd. (HKG: 9988): HKD 139.70

Conclusion

Markets are navigating a mix of rising bond yields, geopolitical uncertainty, and rapid innovation. While fixed-income markets face pressure from inflation and fiscal spending, opportunities are emerging in equities, particularly in Asia, where growth momentum is stronger. Defense spending in Europe, Alibaba’s AI breakthroughs, and Rio Tinto’s investments highlight strategic shifts across industries. Meanwhile, Eutelsat’s surge underscores investor appetite for alternatives in critical infrastructure. As markets remain sensitive to inflation, growth forecasts, and geopolitical risks, diversification into equities, AI, and commodities may offer resilience in an increasingly dynamic global landscape.

Upcoming Dates to Watch

March 7th, 2025: Eurozone GDP; US nonfarm payrolls, consumer credit

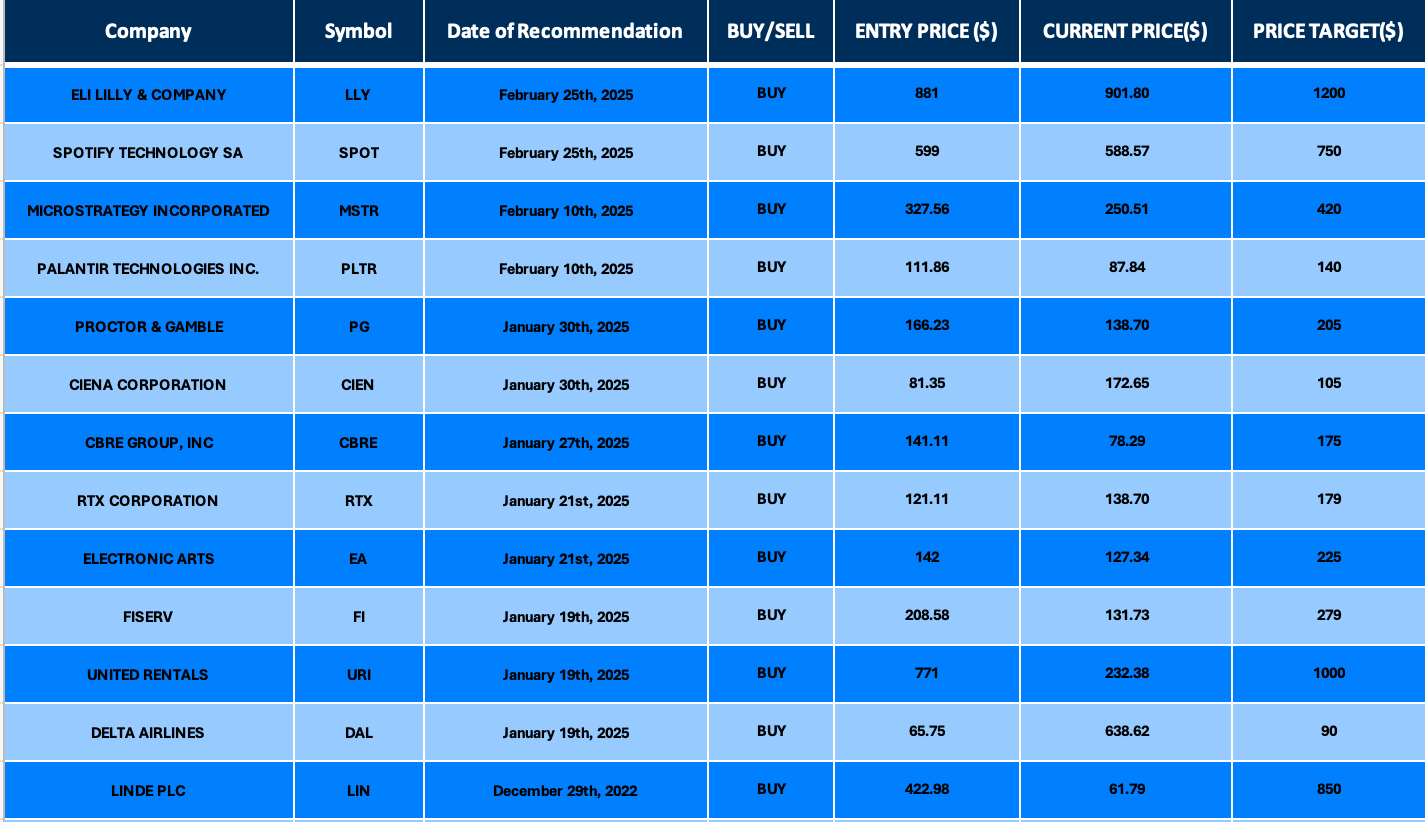

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.