Date Issued – 7th March 2025

Preview

Global markets are on edge as geopolitical and policy uncertainties weigh heavily. Asian and European stocks mirrored US declines, while Bitcoin slid 5.7% following details of a new US Strategic Bitcoin Reserve ahead of the White House crypto summit. China’s energy imports fell amid oversupply and slowing demand, and its metals imports also weakened, reflecting lower industrial activity. Oil is set for its steepest weekly drop since October due to tariff uncertainty and rising OPEC+ output. Meanwhile, antimony prices surged nearly 300% as defense demand soars, exposing a critical supply gap. Investors face heightened volatility across sectors and should adopt a cautious, diversified approach while monitoring regulatory developments and macroeconomic signals.

Asian and European Stocks Follow US Declines

Asian stocks dropped sharply, mirroring declines in US markets, as geopolitical uncertainty and shifting US tariff policies under President Trump roiled investor confidence. Japan’s Nikkei-225 fell over 2%, while European futures retreated and the S&P 500 struggled to stabilize. The dollar index extended its losing streak to a fifth session, and Bitcoin dropped 5.7% after underwhelming details of a US strategic reserve plan. Despite Trump delaying tariffs on Mexican and Canadian goods under NAFTA, markets remained jittery amid unclear policy directions.

In the US, nonfarm payroll data and comments from Fed Chair Jerome Powell are awaited for clues on the economy’s trajectory. Meanwhile, Treasury yields edged higher, and oil is set for its steepest weekly decline since October, while gold rose as a safe haven.

Investment Insight: Heightened volatility driven by geopolitical and policy uncertainties suggests a cautious approach. Diversify into defensive sectors like utilities or gold while monitoring labor market data and central bank signals for interest rate expectations.

China’s Energy Imports Decline Amid Supply Glut and Weak Demand

China’s energy imports fell sharply in early 2025, with crude oil imports dropping 5% year-over-year and natural gas imports down 7.7%. The decline follows last year’s record shipments of coal and gas, which left an oversupply in the market. A mild winter, faltering industrial demand, and a slowing economy further dampened energy consumption. Liquefied natural gas (LNG) imports hit a five-year low, as traders redirected cargoes to higher-priced European markets. Meanwhile, coal imports rose modestly by 2.1% but remain below peak levels due to oversupply.

Metals imports also weakened, with copper falling 7.2% and iron ore down 8.4%, reflecting lower industrial demand and disruptions in Australian supply. Elevated port inventories and China’s plans to cut steel output are expected to further suppress import levels.

Investment Insight: China’s slowing energy and metals demand signals potential headwinds for commodity markets. Investors should monitor China’s industrial activity closely and consider exposure to markets benefiting from higher European LNG prices or alternative energy sources.

Antimony Shortage Deepens as Defense Demand Soars

A global shortage of antimony, a key metal in munitions, threatens to escalate as the US and Europe replenish depleted stockpiles used in Ukraine. Prices have surged nearly 300% in the past year, driven by China’s export restrictions and heightened demand from defense industries. Antimony, essential for bullet cores, explosives, and flame retardants, faces a production gap of about 40,000 tons annually.

China and Russia dominate 87% of global supply, but new Western sources are emerging. Australia’s Larvotto Resources plans to open a major antimony mine next year, potentially supplying 7% of global demand. Meanwhile, the US Defense Department has backed a domestic mine project in Idaho to reduce reliance on foreign sources.

Investment Insight: Rising antimony prices and geopolitical tensions present opportunities in defense-related supply chains and Western mining ventures. Investors should watch for projects aimed at reducing dependence on Chinese and Russian materials.

Trump Establishes Strategic Bitcoin Reserve Ahead of Crypto Summit

President Donald Trump signed an executive order to create a Strategic Bitcoin Reserve, making the US one of the first nations to stockpile Bitcoin as a strategic asset. The reserve will include Bitcoin confiscated through criminal and civil forfeiture, currently estimated at 200,000 BTC, worth roughly $17.5 billion. A new US Digital Asset Stockpile will also manage other cryptocurrencies, such as Ethereum, Solana, XRP, and Cardano.

The move comes ahead of the first-ever White House crypto summit, marking a stark departure from the Biden administration’s tougher stance on crypto regulation. Critics have raised concerns about the volatility of cryptocurrencies and the potential conflict of interest for policymakers, while supporters of the initiative argue it positions the US as a leader in digital asset innovation.

Investment Insight: Trump’s pro-crypto policies could signal long-term support for digital assets. Investors should monitor regulatory developments, especially regarding Bitcoin and Ethereum, while remaining cautious about market volatility tied to macroeconomic uncertainties and policy shifts.

Oil Prices Face Biggest Weekly Drop Since October Amid Tariff Uncertainty and Rising Supply

Oil prices are set for their steepest weekly decline since October, with Brent down 4.9% and WTI off 4.8%. Fluctuating US trade policies and economic uncertainty are dampening demand forecasts, while OPEC+ and non-OPEC producers add supply. Brent crude edged up 0.24% to $69.63 per barrel on Friday, while WTI rose 0.18% to $66.48, but both benchmarks remain near four-month lows.

US President Donald Trump’s suspension of tariffs on Canadian and Mexican goods until April 2, excluding steel and aluminum, has done little to ease market jitters. Analysts warn of further price drops amid oversupply risks, with OPEC+ adding 138,000 barrels per day in April. Meanwhile, US actions to curb Iranian oil exports could provide limited support to prices but may not offset broader headwinds.

Investment Insight: Oil markets face pressure from oversupply and geopolitical uncertainty. Investors should prepare for increased volatility and consider defensive energy stocks or explore opportunities in natural gas and renewable energy amid shifting market dynamics.

Conclusion

Markets are grappling with heightened uncertainty as geopolitical tensions, shifting US policies, and slowing global demand weigh on sentiment. From declining energy and metals imports in China to oil’s steep weekly drop and Bitcoin’s volatility following the creation of a US Strategic Bitcoin Reserve, investors face a complex landscape. With defense-driven shortages like antimony highlighting supply-chain vulnerabilities and the crypto summit signaling potential regulatory shifts, the focus remains on navigating risk. Diversification into defensive assets, close monitoring of policy decisions, and attention to macroeconomic data will be crucial as markets seek clarity and stability in the weeks ahead.

Upcoming Dates to Watch

March 7th, 2025: Eurozone GDP; US nonfarm payrolls, consumer credit

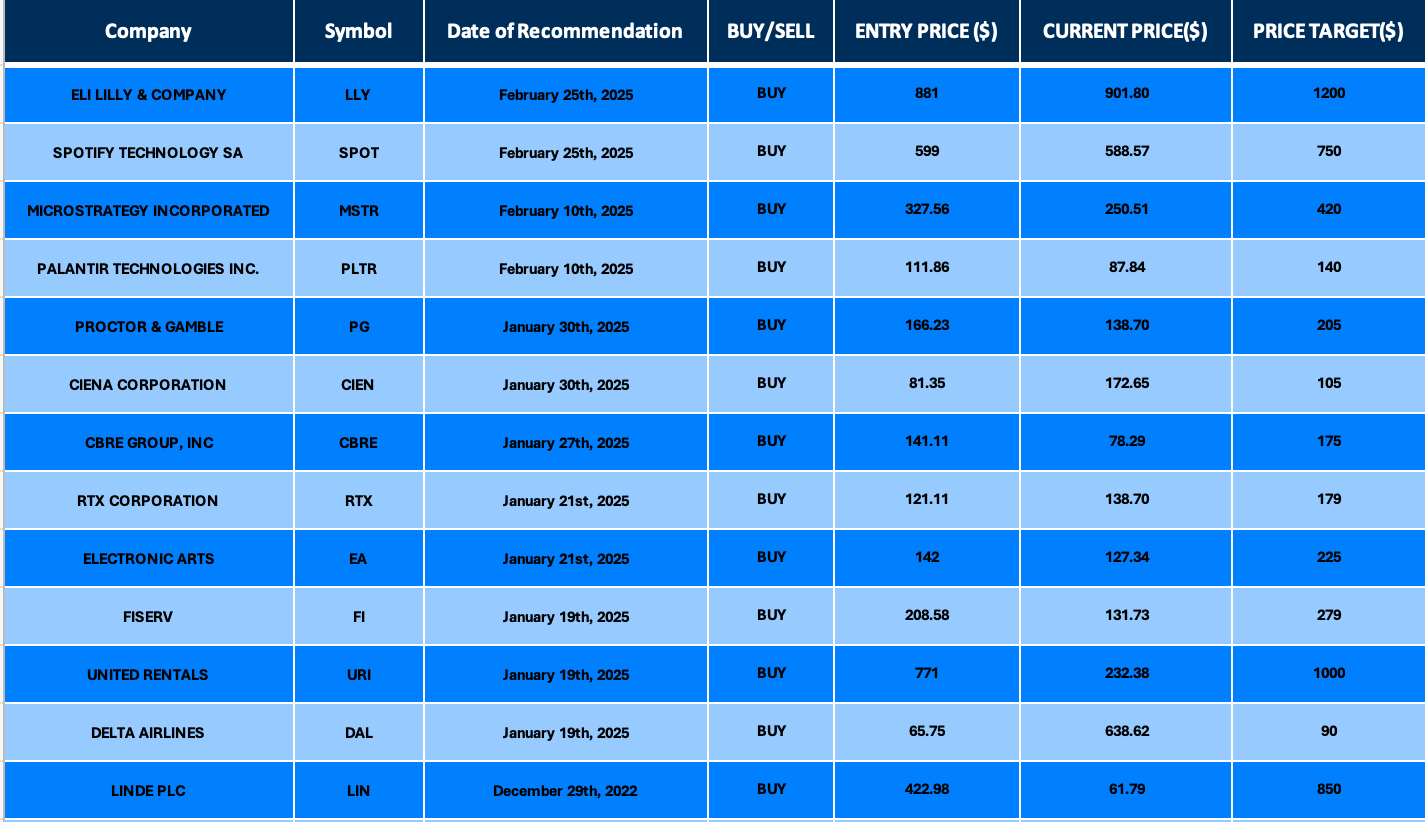

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.