Date Issued – 10th March 2025

Preview

Asian markets brace for a weak open amid global economic uncertainty, with US equities and Treasury yields under pressure as the Fed may cut rates by May. Foxconn unveiled “FoxBrain,” its first large language model, aiming to enhance manufacturing with AI while boosting Nvidia’s GPU demand. Japan’s 10-year bond yield hit a 15-year high on BOJ rate hike expectations, signaling tighter monetary policy. Meanwhile, China launched a $138 billion high-tech fund to drive AI and emerging industries, alongside measures to boost domestic consumption. Trade tensions escalated as China imposed tariffs on US farm goods, further straining relations with the US.

Asian Equities Poised for Weak Open Amid Economic Concerns

Asian markets are set for a subdued start as risk sentiment faltered globally. S&P 500 and Nasdaq 100 futures dropped 0.5%, while Treasury yields declined as investors sought safer assets. The US economy faces growing uncertainty, with tariffs, rising unemployment, and weak Chinese economic data contributing to a cautious outlook. Short-dated Treasuries rallied on expectations the Fed might cut rates by May to counter economic headwinds. Meanwhile, European futures pointed to gains, supported by fiscal policy shifts in Germany.

Investment Insight: Global markets are grappling with heightened uncertainty, favoring defensive assets like short-term Treasuries. Investors may consider diversifying portfolios with safe-haven assets and maintaining a cautious stance on riskier equities.

Foxconn Unveils First Large Language Model, “FoxBrain”

Foxconn has launched its first large language model, “FoxBrain,” which aims to enhance manufacturing and supply chain management. Built using Meta’s Llama 3.1 architecture and trained on 120 Nvidia H100 GPUs in just four weeks, the model is optimized for traditional Chinese and Taiwanese language styles. While slightly behind China’s DeepSeek distillation model, FoxBrain achieves near-world-class performance. Initially designed for internal use, its capabilities include data analysis, decision-making, and code generation. Foxconn plans to collaborate with partners, expand applications, and promote AI across industries. Further details will be revealed at Nvidia’s GTC conference.

Investment Insight: Foxconn’s venture into AI-powered manufacturing could streamline operations and bolster its competitive edge. Nvidia’s integral role in training FoxBrain also highlights the growing demand for high-performance GPUs, reinforcing its position in the AI hardware market.

Japan 10-Year Yield Hits 2008 High Amid BOJ Rate Hike Expectations

Japan’s 10-year government bond yield surged to 1.575%, its highest level since 2008, fueled by the fastest base pay gains in over three decades and expectations of further Bank of Japan (BOJ) rate hikes. While the BOJ is likely to hold rates steady at its May meeting, market pricing suggests an 85% chance of a hike by July and certainty by September. Sluggish demand at a recent five-year debt auction reflects growing sentiment that yields will continue climbing. JPMorgan raised its year-end forecast for Japan’s 10-year yield to 1.7%, with some predicting it could reach 2%.

Investment Insight: Rising Japanese yields signal tightening monetary policy, providing opportunities in JGBs but potentially pressuring equity markets. Investors should monitor BOJ decisions closely, as further hikes could reshape the global fixed-income landscape.

China Launches $138 Billion High-Tech Fund to Drive AI and Emerging Industries

China announced a state-backed “venture capital guidance fund” to boost innovation in AI, quantum technology, and hydrogen energy storage. The fund, expected to attract nearly 1 trillion yuan ($138 billion) over 20 years, aims to bolster economic growth and counteract US tech restrictions. DeepSeek’s recent AI breakthrough, achieving cutting-edge performance on less powerful chips, highlights China’s rapid progress despite challenges. Premier Li Qiang also outlined plans to foster emerging industries like 6G and bio-manufacturing while ramping up domestic consumption through infrastructure investment and consumer subsidies.

Investment Insight: China’s heightened focus on tech innovation and domestic consumption signals growth potential in AI, quantum computing, and infrastructure sectors. Investors should watch for opportunities in these industries as China navigates external pressures and regulatory easing for private enterprises.

China’s Retaliatory Tariffs on US Farm Goods Take Effect Amid Trade Tensions

China imposed tariffs of up to 15% on US agricultural goods, including beef, poultry, and grains, while suspending soybean imports from three US entities and halting log purchases. This response follows the Trump administration’s decision to double tariffs on Chinese exports. Beijing’s calibrated measures allow room for negotiations but aim to mitigate domestic impact by sourcing goods elsewhere. These developments come as China targets 5% economic growth despite trade uncertainties, a property crisis, and deflation pressures. Premier Li Qiang has pledged fiscal expansion to counter the challenges.

Investment Insight: Agricultural markets face volatility as China shifts sourcing away from the US. Investors should monitor alternative suppliers, such as Brazil, where agricultural exports may see increased demand.

Conclusion

Global markets are navigating heightened uncertainty, from economic pressures in the US and Japan to escalating trade tensions between China and the US. Foxconn’s AI advancements and China’s ambitious high-tech fund highlight the growing focus on innovation to drive economic growth. Meanwhile, Japan’s rising bond yields and China’s fiscal expansion underline the shifting monetary and trade policies shaping the global landscape. As risks mount, investors may find opportunities in defensive assets, emerging technologies, and alternative markets like Brazil’s agriculture sector. Staying attuned to policy shifts and geopolitical developments will be key to navigating the evolving investment climate.

Upcoming Dates to Watch

March 10th, 2025: Germany industrial production

March 11th, 2025: Japan GDP, household spending; US job openings

March 12th, 2025: US CPI, Japan PPI

March 13th, 2025: US PPI, initial jobless claims; Eurozone industrial production

March 14th, 2025: France CPI, Germany CPI, UK industrial production

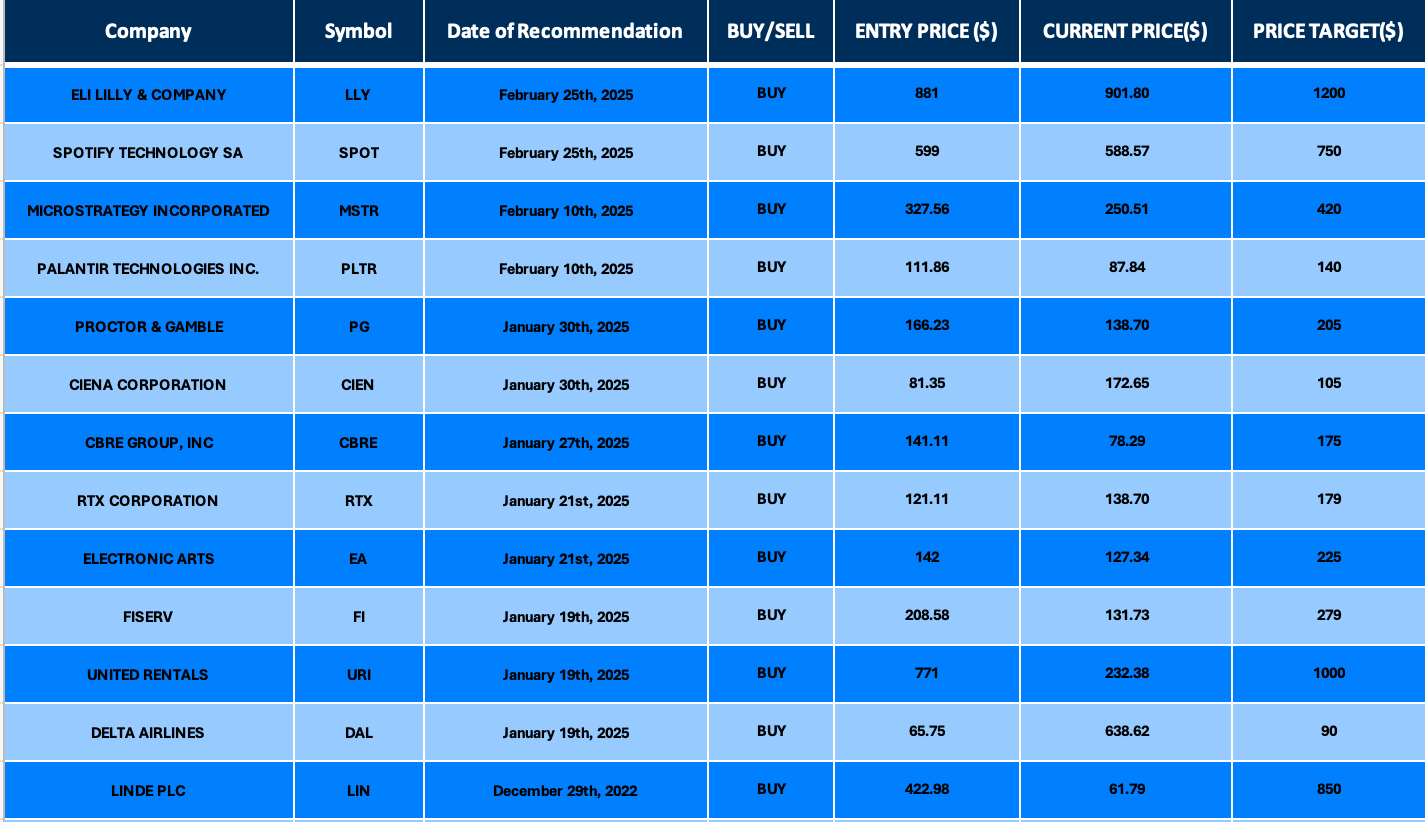

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.