Date Issued – 11th March 2025

Preview

Global markets showed signs of stabilization as US equity futures rebounded after Monday’s selloff, with Asian equities trimming losses and optimism around Chinese AI growth boosting Hong Kong stocks. China’s record two-year bond sale this week will test market sentiment amid rising yields and tight liquidity. In South Korea, new FX rules aim to attract foreign inflows, though analysts say structural reforms are needed for long-term stability. Meanwhile, Japan’s slower Q4 growth complicates BOJ rate decisions, while the Panama Canal explores an LPG pipeline to meet rising Asian energy demand. Investors should stay cautious, diversify, and watch for selective opportunities.

Asia Stock Selloff Eases, Futures Recover

A global stock selloff moderated during Asian trading hours, with US equity futures, Treasury yields, and cryptocurrencies rebounding from earlier declines. The S&P 500 index futures rose 0.3% after steep losses, while Nasdaq 100 and European futures also advanced. Asian equities fell to a five-week low, but Hong Kong and Chinese stocks trimmed losses amid hopes for government stimulus. Mainland Chinese investors continued buying Hong Kong stocks, buoyed by optimism around AI-driven growth. Meanwhile, US markets suffered sharp losses Monday, with the S&P 500 down 2.7% and megacaps like Tesla plunging 15%. Investors remain cautious, citing geopolitical tensions, economic uncertainty, and hawkish central bank policies.

Investment Insight: The selloff signals a shift to risk-averse sentiment, but opportunities may exist in oversold Asian markets like Hong Kong and China. Diversification and selective entry into resilient sectors are key as global uncertainty persists.

China Plans Record Two-Year Bond Sale Amid Market Turmoil

China’s debt market faces mounting pressure as the government prepares to auction a record 167 billion yuan ($23 billion) in two-year bonds this Friday. The move comes during a worsening bond selloff, driven by the People’s Bank of China’s (PBOC) reluctance to ease monetary policy, tight liquidity, and optimism in Chinese equities. Yields on two-year bonds have surged 50 basis points this year, hitting their highest since October, raising concerns about weak demand and further losses. The auction will serve as a key market sentiment indicator, as China’s annual new government bond issuance climbs to a record 11.86 trillion yuan amid rising fiscal deficits.

Investment Insight: Rising yields signal heightened risk in China’s fixed-income market. Investors should monitor auction results closely as a barometer of sentiment, while remaining cautious of further bond market volatility. Diversification across asset classes may help mitigate risk.

South Korea’s New FX Rules Highlight Need for Structural Reform

South Korea has introduced measures to boost foreign currency inflows, including raising FX derivatives’ hedging limits, easing “Kimchi” bond regulations, and streamlining tax paperwork for foreign investors. While these changes may provide short-term market stability, analysts warn they won’t address deeper imbalances in Korea’s financial system. The won was Asia’s worst-performing currency in 2024, falling over 12% against the dollar, with foreign investors cutting their stock holdings as the Kospi dropped 9.6%. Experts argue that structural reforms, including stronger industrial and corporate policies, are critical for attracting sustainable foreign investment.

Investment Insight: The new measures offer limited relief for Korea’s markets. Investors should remain cautious about the won and consider broader macroeconomic trends before increasing exposure to Korean assets. Long-term opportunities may depend on meaningful structural reforms.

Japan’s Economy Shows Slower Growth Amid Consumer Weakness

Japan’s economy expanded at a revised 2.2% annualized rate in Q4 2024, down from an earlier estimate of 2.8%, as consumer spending and private demand underperformed. Real GDP rose 0.6% quarter-on-quarter, slightly lower than initial figures, while exports grew 1.0%. The country continues its moderate recovery despite lingering deflation risks, which have been tempered by recent wage increases. Policymakers face challenges as the slower-than-expected growth complicates the Bank of Japan’s potential interest rate hikes. Trade uncertainties, including U.S. tariffs under President Donald Trump, remain a concern for export-reliant Japanese industries, prompting high-level diplomatic talks in Washington.

Investment Insight: Japan’s slower growth, coupled with the BOJ’s cautious stance on rate hikes, signals potential opportunities in government bonds as yields rise. However, export-reliant sectors may face headwinds due to trade tensions. Investors should keep an eye on wage trends and inflation data, which are key to Japan’s policy direction.

Panama Canal Explores LPG Pipeline to Meet Asian Demand

The Panama Canal is considering building a pipeline to transport liquefied petroleum gas (LPG) across its trade passage, with Japan identified as a key market for U.S.-sourced gas. Canal administrator Ricaurte Vasquez revealed plans for infrastructure capable of moving up to one million barrels per day, aiming to diversify operations after droughts disrupted shipping traffic. This development comes amid geopolitical tensions between the U.S. and Panama, further complicated by a U.S.-led acquisition of nearby port assets. A decision on the pipeline is expected within 12 months, as the canal allocates $8 billion to infrastructure projects over the next decade.

Investment Insight: The Panama Canal’s potential pipeline underscores growing energy demand in Asia. Investors should monitor developments for opportunities in infrastructure and energy sectors tied to U.S. exports and Asian markets.

Conclusion

Markets are navigating a challenging global landscape, with cautious optimism emerging after recent selloffs. Key developments, such as China’s record bond sale, South Korea’s FX reforms, and Japan’s slower growth, highlight the need for careful monitoring of policy shifts and economic trends. The Panama Canal’s potential pipeline underscores the growing demand for infrastructure investments tied to energy and trade. As uncertainties persist, investors should focus on diversification, resilient sectors like AI and infrastructure, and opportunities in oversold markets. Staying attuned to geopolitical and macroeconomic changes will be crucial in identifying areas of growth and managing risk effectively.

Upcoming Dates to Watch

- March 11th, 2025: Japan GDP, household spending; US job openings

- March 12th, 2025: US CPI, Japan PPI

- March 13th, 2025: US PPI, initial jobless claims; Eurozone industrial production

- March 14th, 2025: France CPI, Germany CPI, UK industrial production

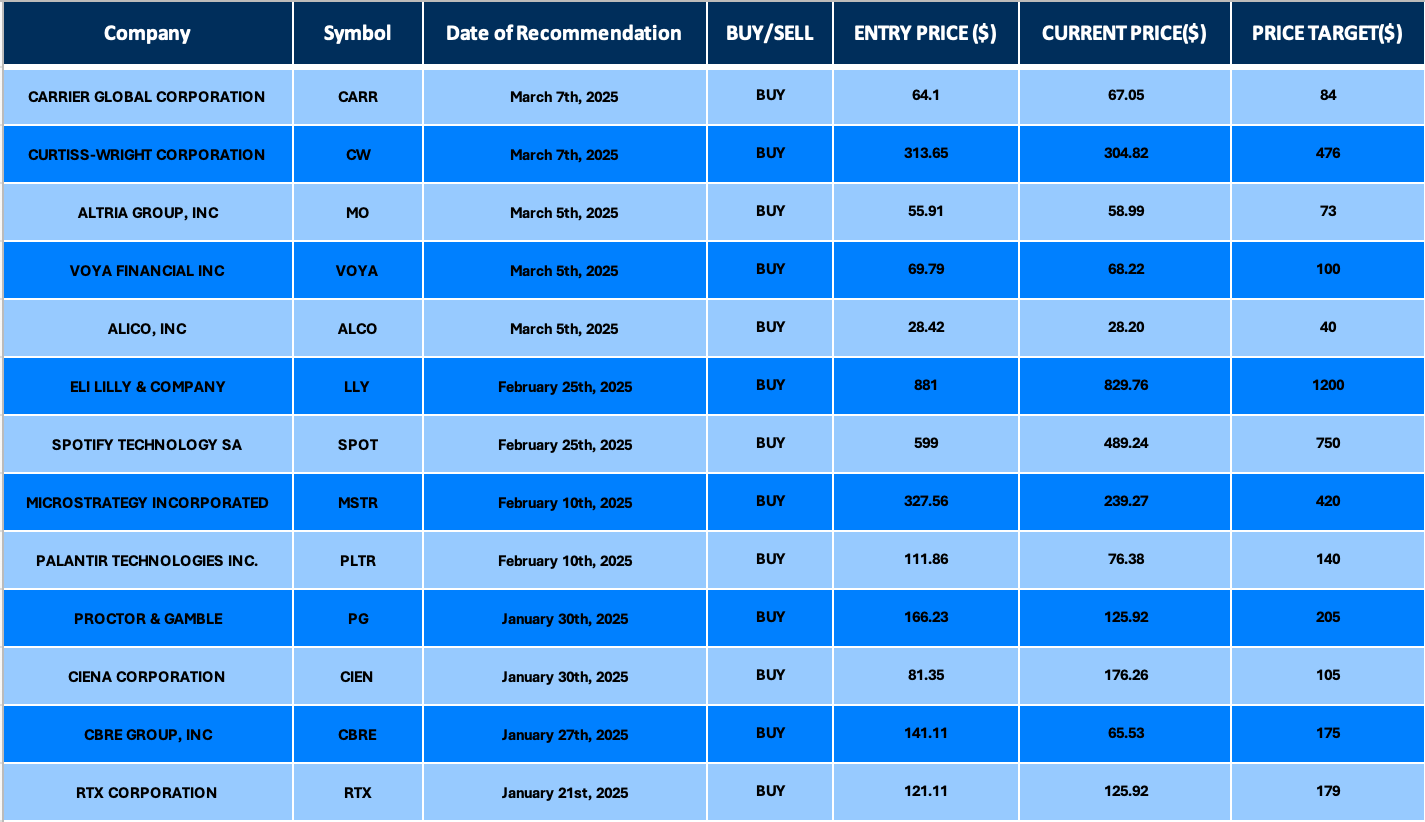

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.