Date Issued – 13th March 2025

Preview

Asian equities extended losses as US growth concerns and trade tensions weighed on sentiment, with Wall Street strategists trimming forecasts. Intel shares surged over 11% after naming semiconductor veteran Lip-Bu Tan as CEO, amid speculation of a potential manufacturing business sale. Taiwan’s central bank warned of currency risks following record stock outflows, as TSMC shares dropped over 9% this year. Meanwhile, JPMorgan signaled the worst of the US equity correction may be over, citing resilient credit markets and sustained ETF inflows. Oil prices slipped despite strong demand forecasts, as rising OPEC+ production and renewed tariff threats from President Trump clouded the outlook.

Market Jitters Deepen Amid Growth Concerns

Asian equities extended their losing streak, with a regional index falling 0.4% as investors grappled with mounting concerns over US economic growth and geopolitical uncertainty. Futures on the Nasdaq 100 and S&P 500 dropped 0.8% and 0.6%, respectively, reversing gains seen after softer-than-expected US inflation data. Treasury yields edged lower, and the dollar remained stable. Wall Street strategists, including those at Goldman Sachs and Citigroup, have revised down their US equity outlooks, with Citi shifting its stance to neutral while upgrading China. Meanwhile, trade tensions escalated as President Trump signaled retaliation against EU and Canadian tariffs, adding to market unease.

Investment Insight: The market’s volatility reflects deepening investor anxiety over slowing US growth and trade policy risks. While a softer inflation reading initially buoyed equities, concerns over employment data and geopolitical tensions have kept risk appetite in check. With capital increasingly flowing into Asian markets and some strategists suggesting a bottom for US stocks, investors should adopt a selective approach—focusing on regions and sectors poised to benefit from shifting global capital flows while remaining cautious on US equities until macroeconomic clarity improves.

Intel Soars as Lip-Bu Tan Takes Helm

Intel (INTC) shares surged over 11% in after-hours trading following the announcement of Lip-Bu Tan as the company’s new CEO. Tan, a semiconductor veteran and former Cadence Design Systems chief, steps in amid Intel’s steep decline in market position and revenue. His appointment comes as Intel faces intensifying competition from TSMC, Nvidia, AMD, and Qualcomm, while also navigating delays in its US manufacturing expansion under the CHIPS Act. Meanwhile, reports indicate a consortium led by TSMC is in talks to acquire Intel’s manufacturing business, signaling potential structural shifts in the industry.

Investment Insight: Tan’s leadership marks a critical inflection point for Intel as it seeks to reclaim competitiveness in chip manufacturing and AI. While the stock’s rally reflects investor optimism, execution risks remain high. Intel’s turnaround hinges on strategic clarity—whether it doubles down on its foundry business or pivots toward a leaner, design-focused model. Investors should watch for Tan’s early moves, particularly regarding Intel’s manufacturing division and AI strategy, as key indicators of long-term viability.

Market price: Intel Corp (INTC): USD 20.68

Taiwan Faces Currency Pressures Amid Stock Outflows, Trade Risks

Taiwan’s central bank is bracing for further currency interventions as foreign investors continue to pull capital from its stock market, exacerbating downward pressure on the Taiwan dollar. The bank sold a record $16.4 billion in 2024 to stabilize the currency, which fell more than 6% against the US dollar last year and remains under strain. Trade uncertainties linked to Trump’s policies and a cooling AI-driven rally in Taiwan Semiconductor Manufacturing Co. (TSMC) have contributed to the worst foreign investor selloff on record. TSMC shares, which dominate Taiwan’s benchmark index, have dropped over 9% this year, amplifying concerns over capital flight.

Investment Insight: Taiwan’s growing reliance on foreign capital makes its markets particularly vulnerable to global risk sentiment. With TSMC’s dominance in AI-related investments, its stock performance directly influences Taiwan’s currency stability. Investors should monitor central bank interventions and policy shifts, particularly if inflation pressures force rate adjustments. While Taiwan remains a key player in global semiconductors, capital outflows suggest near-term volatility, making a selective approach to Taiwanese equities prudent.

JPMorgan Signals End of US Equity Correction

JPMorgan strategists suggest the worst of the US equity correction may be over, citing credit markets that imply a lower risk of recession than equities or rate markets. While small caps are pricing in a 50% chance of a downturn, credit markets suggest only a 9% to 12% probability. The S&P 500 has dropped nearly 9% from its February peak, driven by quant fund adjustments rather than fundamental economic weakness. Despite recent equity downgrades from Goldman Sachs and Citigroup, JPMorgan sees potential support from ETF inflows and institutional rebalancing, which could inject up to $135 billion into markets.

Investment Insight: JPMorgan’s analysis highlights a disconnect between equity market fears and credit market signals, suggesting that recession risks may be overstated. With ETF inflows holding steady and institutional rebalancing on the horizon, near-term volatility could present buying opportunities. Investors should watch for stabilization in small caps and tech stocks as potential indicators of a broader market recovery.

Oil Slips as Trade Risks Offset Demand Strength

Oil prices edged lower Thursday, retracing gains from a 2% rally in the prior session driven by a sharp drop in U.S. gasoline inventories. Brent crude dipped to $70.90 per barrel, while WTI fell to $67.58. Despite firm demand expectations—global oil consumption is running ahead of forecasts at 102.2 million barrels per day—macroeconomic concerns weighed on sentiment. Traders remain wary of escalating trade tensions after President Trump threatened new tariffs on EU goods, stoking fears of a global slowdown. Meanwhile, rising OPEC+ production, led by Kazakhstan, further complicates market dynamics.

Investment Insight: Oil markets remain caught between supportive demand fundamentals and broader economic uncertainty. While tightening U.S. fuel inventories and geopolitical disruptions lend price support, trade tensions and oversupply risks from OPEC+ could cap gains. Investors should watch for shifts in global trade policy and OPEC+ compliance as key drivers of oil price direction in the coming weeks.

Conclusion

Markets remain on edge as investors weigh economic uncertainty, trade risks, and shifting capital flows. While Intel’s leadership change and JPMorgan’s optimism on US equities offer bright spots, Taiwan’s currency pressures and ongoing stock outflows highlight broader volatility. Oil markets reflect this mixed sentiment, with strong demand offset by geopolitical and supply concerns. As macroeconomic signals diverge, investors should stay tactical—monitoring policy developments, corporate strategy shifts, and fund flows for direction. With volatility likely to persist, a selective, data-driven approach remains key to navigating the evolving market landscape.

Upcoming Dates to Watch

- March 13th, 2025: US PPI, initial jobless claims; Eurozone industrial production

- March 14th, 2025: France CPI, Germany CPI, UK industrial production

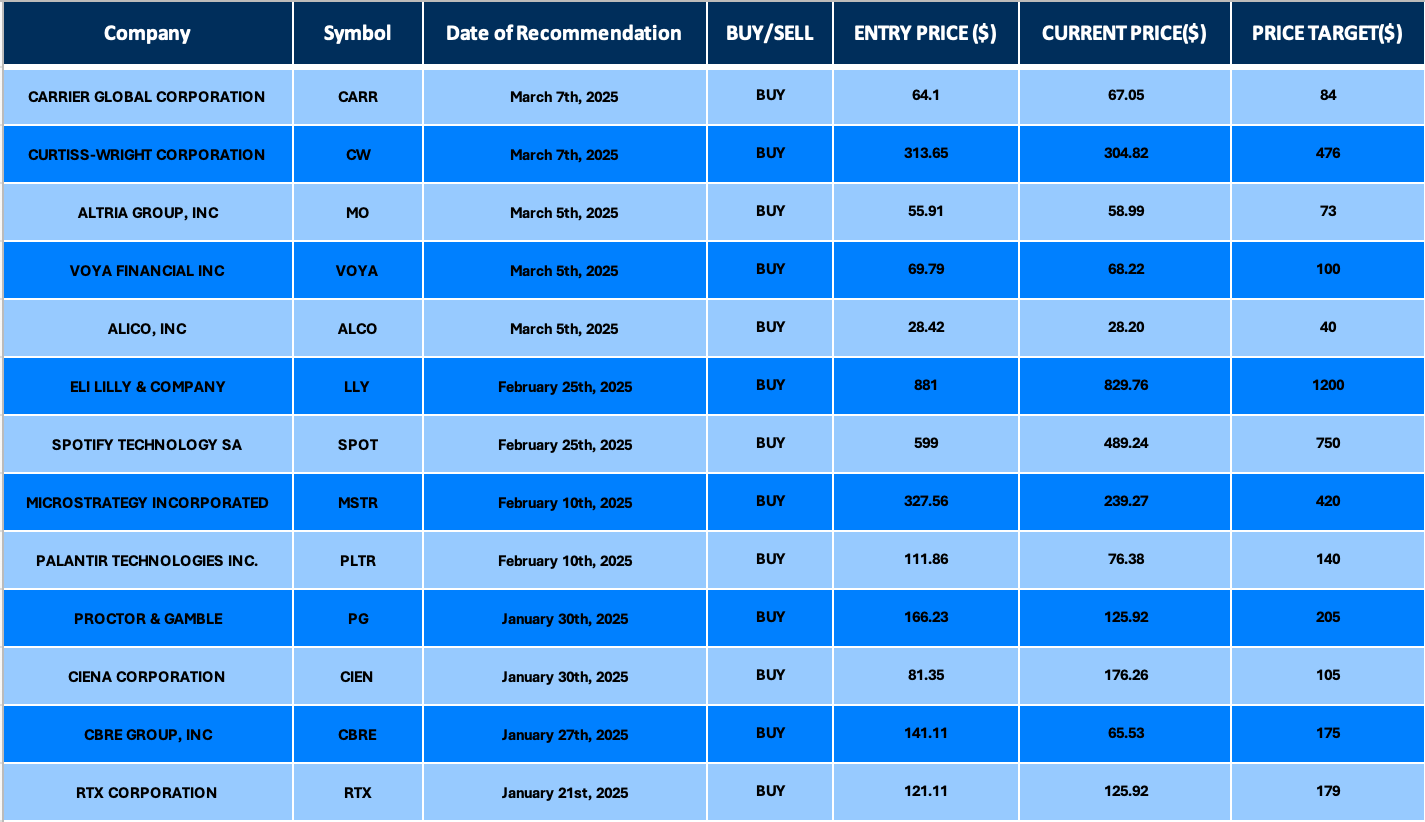

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.