Date Issued – 7th April 2025

Preview

Global markets face intensifying turmoil as U.S. tariffs and China’s retaliation disrupt equities, cryptocurrencies, and economic forecasts. The Federal Reserve remains cautious, citing uncertainty from trade tensions and inflation risks, while JPMorgan projects a 0.3% GDP contraction for 2025. Asian markets plunged, with Japan’s Nikkei dropping 8% and Taiwan’s Taiex falling 9.7%, as the impact of tariffs ripples across export-driven economies. Bitcoin slipped below $80,000, mirroring sharp selloffs in equities, as global market capitalization shed $8.2 trillion. Meanwhile, LG Energy Solution’s Q1 profit surged 138% on U.S. subsidies, though underlying losses reflect cooling EV demand. Investors are advised to brace for volatility, explore defensive sectors, and monitor opportunities in domestic-focused markets and alternative assets.

Fed Stays on Sidelines Amid Economic Uncertainty

Federal Reserve Chair Jerome Powell signaled a cautious approach to monetary policy, citing elevated uncertainty due to conflicting economic signals, including President Trump’s unexpected tariff hikes and their potential inflationary impact. Despite strong March job growth, Powell indicated the Fed is unlikely to cut interest rates soon, emphasizing the risks of premature action. Markets remain jittery as tariffs are expected to drive inflation higher while curbing growth; JPMorgan now forecasts a 0.3% GDP contraction for 2025. Powell underscored the Fed’s commitment to deliberate action, contrasting the current situation with past crises that demanded immediate responses.

Investment Insight

Investors should brace for heightened volatility as the Fed adopts a wait-and-see stance amid tariff-driven economic disruptions. With inflation risks rising and growth forecasts dimming, portfolio hedges against stagflation—such as commodities or inflation-protected securities—may offer strategic value. Avoid heavy bets on rate cuts in the near term, as the Fed appears focused on maintaining optionality.

China Rallies Domestic Resilience Amid Escalating Trade War

China responded to President Trump’s sweeping tariff hikes with a call for calm and a detailed plan to counter economic fallout. The Communist Party’s People’s Daily emphasized resilience, pledging domestic stimulus measures such as rate cuts, increased liquidity, and fiscal expansion to bolster growth. While the Hang Seng China Enterprises Index plunged 10.8% and the yuan weakened, Beijing signaled readiness for further retaliation if needed. Analysts warn of escalating risks to global growth, with China’s strategy shifting toward fostering domestic demand and diversifying trade partnerships. Negotiations remain possible, but the trade war continues to weigh heavily on markets.

Investment Insight

Investors should prepare for prolonged volatility as China prioritizes domestic stimulus over immediate trade resolutions. Consider exposure to sectors tied to Chinese domestic consumption, which Beijing aims to strengthen, while exercising caution around export-reliant industries vulnerable to US tariffs. The yuan’s potential devaluation and increased fiscal measures may also create opportunities in Chinese government bonds and consumer-driven equities.

LG Energy Solution Posts 138% Profit Surge Amid Industry Headwinds

LG Energy Solution (LGES) reported a 138% rise in Q1 operating profit to 374.7 billion won, surpassing expectations of 29 billion won. The surge was driven by tax credits from the U.S. Inflation Reduction Act (IRA). However, excluding these credits, the company faced an operating loss of 83 billion won ($56.52 million), reflecting the impact of declining EV demand. LGES, a key supplier to General Motors and Tesla, highlighted ongoing challenges in the electric vehicle market despite supportive policy tailwinds.

Investment Insight

The sharp contrast between LGES’s headline profit and its underlying loss underscores the market’s dependency on government incentives. Investors should monitor policy developments like the IRA for near-term support but remain cautious about the structural challenges posed by softening EV demand. Diversified exposure to battery materials or renewable energy infrastructure may provide more balanced opportunities in the sector.

Bitcoin Slips Below $80,000 Amid Market Turmoil

Bitcoin fell under $80,000 on Sunday, losing over 3% in two hours, as U.S. tariffs triggered widespread selloffs across global markets. Ethereum dropped nearly 8%, and the GMCI 30 Index of top cryptocurrencies declined over 6% in one day, extending its year-to-date losses to 32%. The crypto slump mirrored sharp pullbacks in equities, with the S&P 500 and Nasdaq shedding nearly 6% last week, as global market capitalization plunged by $8.2 trillion. Analysts warn of heightened volatility ahead, with Bitcoin potentially poised for a major move depending on broader market sentiment.

Investment Insight

Amid escalating market uncertainty, Bitcoin’s safe-haven narrative faces pressure as both crypto and equities decline. Investors should monitor Bitcoin’s price action alongside Wall Street’s volatility index (VIX), as compressed crypto volatility could signal an upcoming breakout. Diversifying into lesser-correlated assets or stablecoins may offer protection, while long-term holders could see buying opportunities if Bitcoin stabilizes near key technical levels.

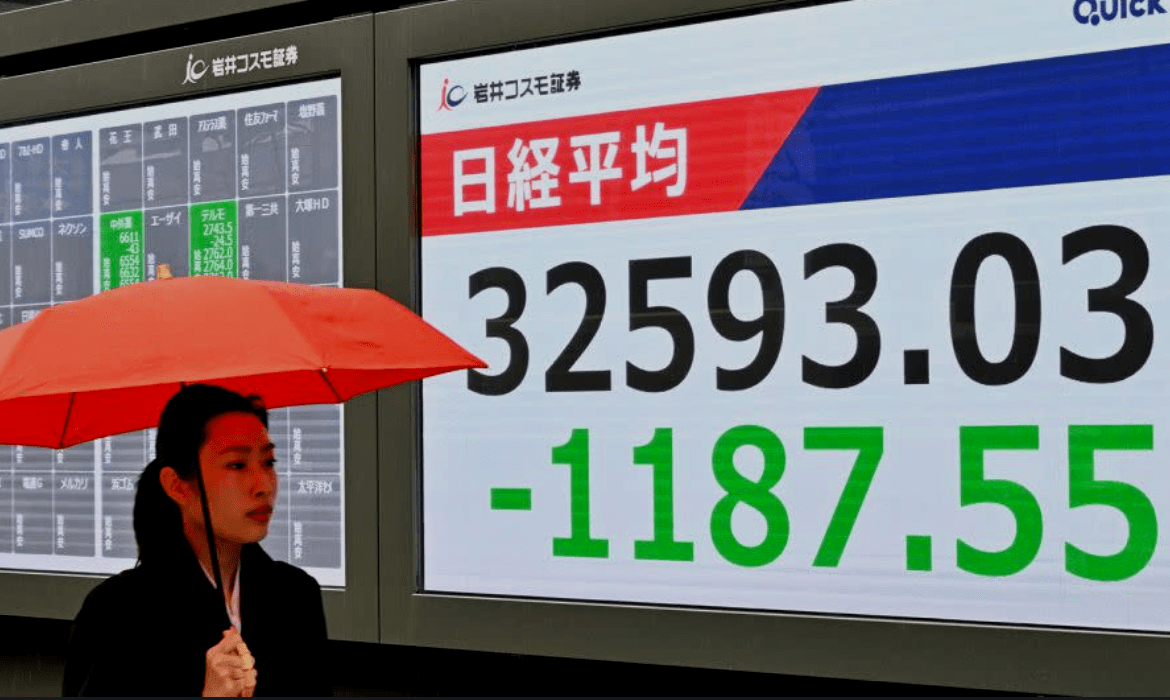

Asian Markets Plunge Amid Escalating Trade War

Asian markets tumbled Monday as President Trump’s sweeping tariffs and China’s forceful retaliation deepened global market turmoil. Japan’s Nikkei fell over 8% shortly after opening, while the Shanghai Composite and Hong Kong’s Hang Seng dropped 6.7% and 9%, respectively. Taiwan’s Taiex plummeted 9.7%, with major exporters like TSMC and Foxconn hitting circuit breakers. The sell-off follows a $5.4 trillion wipeout in global equities, with U.S. futures signaling further losses. Economists warn of worsening economic damage, as trade tensions between the U.S. and key Asian economies escalate, stoking fears of a global slowdown.

Investment Insight

With Asian markets under pressure, investors should focus on defensive sectors and consider reducing exposure to export-reliant stocks in regions heavily impacted by U.S. tariffs. Diversifying into non-correlated assets, such as gold or cash equivalents, may help navigate volatility. In the medium term, watch for potential buying opportunities in undervalued equities once the trade landscape stabilizes.

Conclusion

Markets remain fragile as escalating U.S.-China trade tensions, volatile crypto movements, and mixed corporate earnings weigh on investor sentiment. The Federal Reserve’s cautious stance highlights the uncertainty surrounding inflation and growth, while Asian markets and Bitcoin’s slump underscore the global ripple effects of tariffs. Despite LG Energy Solution’s profit surge, underlying challenges in the EV market reflect broader headwinds. Investors face a landscape marked by heightened volatility and shifting dynamics. Staying defensive, diversifying portfolios, and monitoring policy developments will be critical as markets navigate the fallout from trade disruptions and search for stability in the weeks ahead.

Upcoming Dates to Watch

- April 10th, 2025: US CPI

- April 11th, 2025: US PPI

- April 16th, 2025: Industrial Production

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.