Date Issued – 15th April 2025

Preview

Global markets rallied as President Trump eased tariff tensions, lifting equities in Europe and Asia, though luxury giant LVMH plunged 7.9% on weak Q1 sales. Palantir shares rose 4.6% after a NATO deal boosted sentiment, while US Treasury yields dropped to 4.35%, offering relief after last week’s historic selloff. In the UK, job vacancies hit pre-Covid lows, with hiring dampened by higher taxes and wages. Amid ongoing volatility, investors are eyeing opportunities in cyclical sectors like autos, defensive assets such as Treasuries and gold, and potential rate cuts from central banks to counter growing economic risks.

Tariff Reprieve Lifts Global Markets

Global stocks rallied as US President Trump hinted at a pause in auto tariffs, easing market fears after earlier trade tensions erased $10 trillion from global equities. Europe’s Stoxx 600 gained 0.6%, led by automakers such as Stellantis, while Japan’s Nikkei surged on strength in Toyota and Honda. Luxury giant LVMH dropped over 7% in Paris following underwhelming sales, dragging down other high-end retailers. US equity futures edged higher, while 10-year Treasury yields stabilized after last week’s record 50-basis-point jump. Oil and gold both climbed, reflecting cautious optimism in markets amid ongoing trade uncertainties.

Investment Insight: The market’s positive reaction to potential tariff relief underscores the importance of policy clarity in a volatile environment. Investors should remain cautious, as shifting US trade stances and slowing global growth continue to pose risks. Opportunities may emerge in cyclical sectors like autos, while defensive assets such as gold and Treasuries remain critical hedges. As volatility persists, disciplined asset allocation will be key.

LVMH Shares Plunge as Q1 Sales Disappoint

LVMH shares tumbled 7.9% after first-quarter revenue fell 3%, missing analysts’ forecasts of 2% growth. Weak U.S. demand for beauty products and cognac, paired with sluggish Chinese sales, signaled deeper troubles for the luxury sector. The disappointing results dragged down shares of peers Kering and Hermès, with analysts warning of a challenging year ahead. RBC cut its forecast for LVMH’s 2025 sales to flat, citing a weaker macroeconomic backdrop and ongoing trade concerns.

Investment Insight: LVMH’s miss reflects mounting headwinds for the luxury sector, including softer consumer spending and geopolitical uncertainties. Investors should monitor demand trends in key markets like the U.S. and China, as well as the impact of trade policies. While luxury stocks may face near-term volatility, long-term opportunities could arise if valuations adjust to reflect slower growth expectations. Diversification across sectors remains prudent amidst heightened macro risks.

Market price: LVMH Moet Hennesy Louis Vuitton SE (MC): EUR 497.3

Palantir Extends Gains on NATO Deal

Palantir Technologies shares climbed 4.6% Monday, continuing a recovery fueled by NATO’s acquisition of the company’s AI-enabled military system. The deal alleviated fears of reduced European reliance on U.S. defense contractors amid trade uncertainty. Palantir is up 22% year-to-date, despite losing nearly 25% of its value since February’s record high. A bullish engulfing pattern on the weekly chart, coupled with a rally in the relative strength index, signals improving investor sentiment. Key resistance levels lie at $121 and $300, while critical support areas to monitor are $66 and $45.

Investment Insight: Palantir’s NATO deal reinforces its strategic importance in the defense sector, but volatility remains amid geopolitical and fiscal uncertainties. The bullish technical signals suggest potential for further upside, yet investors should remain cautious at key resistance levels, particularly near $121. Long-term growth prospects in AI-driven defense solutions remain promising, but maintaining a disciplined approach to entry and exit points around technical levels is crucial.

Market price: Palantir Technologies Inc. (PLTR): USD 92.62

Bond Market Rebound Eases Trade-Induced Turmoil

US Treasury yields retreated Monday, with 10-year yields falling 12 basis points to 4.35%, offering relief after last week’s historic selloff triggered by escalating trade tensions. Wall Street also saw modest gains as President Trump extended tariff exemptions on electronics and refrained from further trade escalations. The S&P 500 rose 0.8%, while volatility gauges like the VIX remained elevated, underscoring lingering market unease. Fixed-income leaders, including JPMorgan and Barclays, signaled that current yield levels may offer buying opportunities as recession risks loom, but uncertainty around trade and economic growth persists.

Investment Insight: The bond market’s rebound highlights its enduring appeal as a defensive asset amid trade-induced volatility and slowing growth concerns. While yields may stabilize in the near term, investors should consider diversifying into high-quality fixed-income assets to manage risk. Equity markets may remain choppy, with trade policy uncertainty likely to spur further volatility—positioning for resilience through balanced portfolios will be critical as the macroeconomic landscape evolves.

UK Job Vacancies Fall to Pre-Covid Levels Amid Tax and Wage Pressures

Job vacancies in the UK have dropped to 781,000, their lowest level since the pandemic, as businesses respond to Chancellor Rachel Reeves’ £25bn National Insurance hike and a 6.7% minimum wage increase. The Office for National Statistics (ONS) also reported a decline in payrolled employees by 78,000 in March, reflecting mounting caution among employers. Economists warn that Donald Trump’s trade war and rising costs could further dampen hiring, with unemployment expected to rise to 4.6% this year. Meanwhile, rapid wage growth of 5.9% is complicating the Bank of England’s decision on whether to prioritize inflation control or support a weakening labor market.

Investment Insight: The UK labor market’s slowdown underscores broader economic risks from rising costs and geopolitical uncertainty. Investors should anticipate potential downward revisions to growth forecasts and maintain caution toward consumer-facing sectors reliant on discretionary spending. Fixed-income instruments may gain appeal if the Bank of England cuts interest rates to support growth, while defensive stocks with steady cash flows could offer resilience in a softening economic environment.

Conclusion

Markets are showing tentative signs of stabilization, but volatility remains a key theme as trade tensions, economic uncertainty, and corporate challenges weigh on sentiment. While tariff relief has provided some optimism, weak data from the UK labor market and disappointing earnings from LVMH highlight broader risks to global growth. Investors are balancing caution with opportunity, focusing on defensive assets like gold and Treasuries, while selectively eyeing growth areas such as AI-driven technologies and cyclical sectors. As central banks weigh rate decisions, the path ahead will require disciplined portfolio management and a focus on resilience in an uncertain economic environment.

Upcoming Dates to Watch

April 16th, 2025: Industrial Production

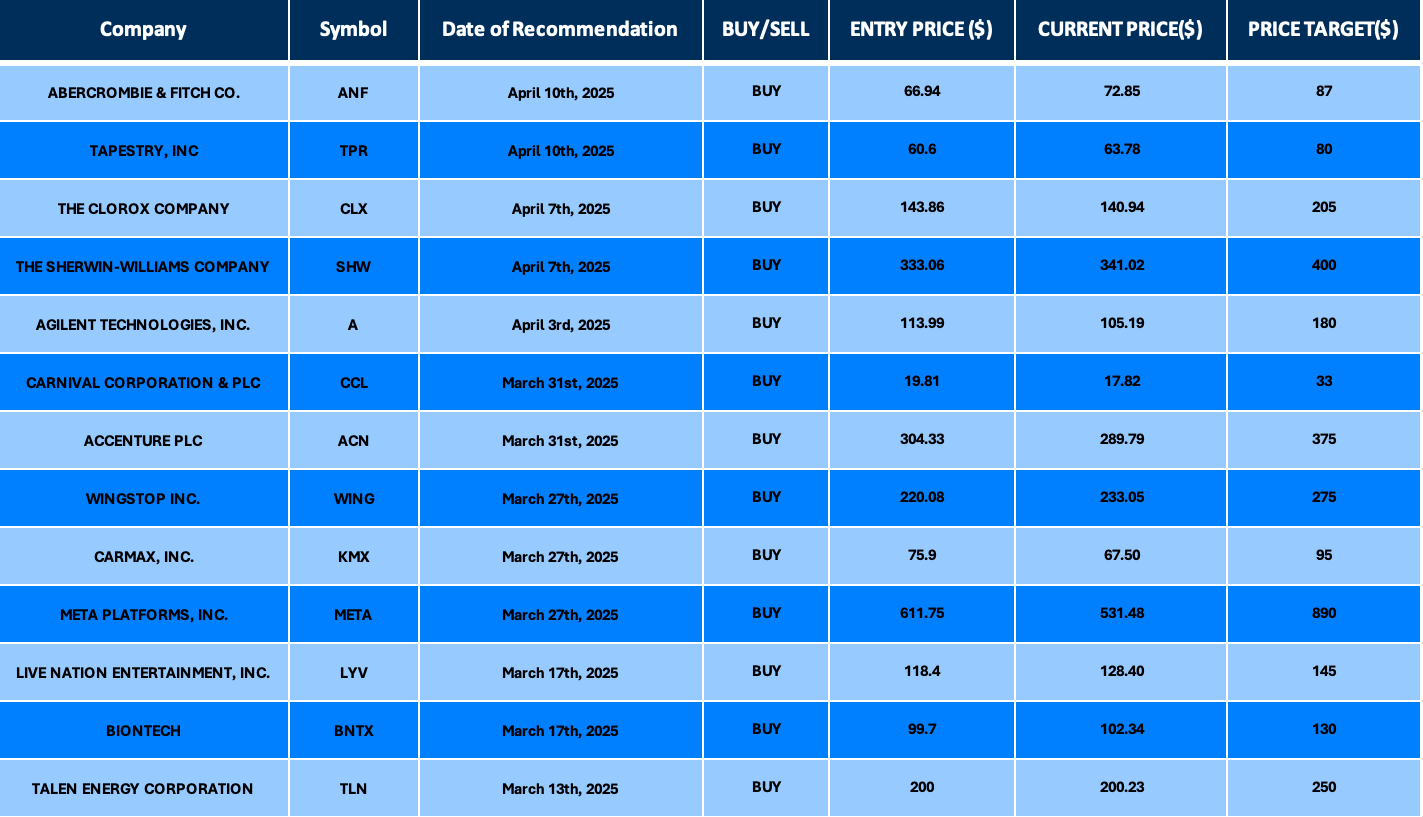

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.