Date Issued – 17th April 2025

Preview

Asian Stocks Rise Amid Trade Optimism; Yen Weakens

Asian stocks rose on optimism around US-Japan trade talks, while the yen weakened as currency issues were left off the table. Gold hit a record $3,357.78 per ounce, fueled by safe-haven demand amid Federal Reserve Chair Powell’s cautious comments and ongoing trade tensions. TSMC reported a 60% profit surge on strong AI chip demand, though shares fell 3.6% on profit-taking. Nvidia, grappling with a $5.5 billion charge from US export curbs on AI chips to China, dropped 6.9%, with investors eyeing key technical levels. Meanwhile, OpenAI’s $500 billion Stargate project is weighing UK investment as global competition for AI infrastructure heats up.

Asian Stocks Rise Amid Trade Optimism; Yen Weakens

Asian equities advanced on optimism surrounding US-Japan trade negotiations, with Japanese shares gaining after President Trump cited “big progress” in talks aimed at averting higher tariffs. The yen weakened as Japan’s negotiator confirmed that currency issues were not discussed, easing investor concerns. Gold hit a record high on safe-haven demand, while US Treasury yields climbed, reflecting a cautious risk-off sentiment. US equity futures edged higher, while European contracts declined, as global markets assess the broader implications of ongoing trade tensions, particularly with China. Meanwhile, the Bank of Korea held rates steady, emphasizing stability amidst monetary policy uncertainty in the region.

Investment Insight: The preliminary progress in US-Japan trade talks offers a modest tailwind for Japanese equities and signals a potential roadmap for US trade negotiations with other allies. Investors should monitor developments in US-China discussions, as any further escalation could drive shifts into safe-haven assets like gold and Treasuries. A balanced portfolio strategy, incorporating defensive assets alongside equity exposure, may help navigate the unpredictability of trade policy outcomes.

TSMC Q1 Profit Jumps 60% on AI Chip Demand

Taiwan Semiconductor Manufacturing Co. (TSMC) reported a 60% surge in Q1 net profit to T$361.6 billion ($11.12 billion), surpassing market expectations of T$354.6 billion. The world’s largest contract chipmaker benefited from robust demand for semiconductors powering artificial intelligence applications, with key customers such as Apple and Nvidia driving growth. Despite the strong results, TSMC shares fell 3.6%, reflecting broader market concerns and potential profit-taking following recent gains.

Investment Insight: TSMC’s results highlight the accelerating adoption of AI technologies and the critical role semiconductor manufacturers play in this ecosystem. While the stock’s pullback may signal near-term caution, long-term investors should consider TSMC’s strong market position and its exposure to high-growth industries like AI and advanced computing. Allocating to semiconductor leaders could provide a strategic edge in portfolios seeking growth from technological innovation.

Market price: Taiwan Semiconductor Manufacturing Co Ltd (TPE: 2330) TWD: 847.00

OpenAI’s $500 Billion Stargate Eyes UK Expansion

Stargate, a $500 billion AI infrastructure project funded by SoftBank, OpenAI, and Oracle, is considering the UK as a potential site for future investment, according to the Financial Times. The project aims to expand overseas as it builds critical data-center infrastructure to support AI development. British Prime Minister Keir Starmer’s pro-innovation regulatory stance and promises to improve access to electricity for data centers have bolstered the UK’s appeal, alongside Germany and France. Stargate previously committed to investing up to $500 billion in US AI infrastructure over four years, with discussions of a European expansion also gaining momentum.

Investment Insight: The Stargate project underscores the escalating global competition in AI infrastructure. The UK’s regulatory push to become an AI hub may attract significant capital inflows, providing opportunities for investors in tech infrastructure, utilities, and AI-related sectors. As AI adoption accelerates, companies involved in data-center development, energy provisioning, and advanced computing technologies are poised to benefit from this transformative trend.

Nvidia Falls on Chip Export Curbs; Key Levels in Focus

Nvidia shares dropped 6.9% Wednesday to $104.49 after announcing a $5.5 billion charge tied to new U.S. export restrictions on its H20 AI chips to China. The curbs, aimed at limiting Beijing’s access to advanced computing technologies, caught investors off guard, adding to broader concerns over U.S.-China trade tensions. Nvidia has lost about 20% of its value year-to-date as regulatory uncertainty and constrained AI-related spending weigh on sentiment. While the stock formed a doji candlestick pattern—a signal of market indecision—investors are closely watching key technical levels for potential moves.

Investment Insight: Nvidia’s near-term outlook hinges on its ability to navigate export restrictions and maintain its AI leadership. Key support levels at $96 and $76 may offer potential entry points for long-term bulls, while resistance at $130 and $150 could signal profit-taking opportunities for traders. With geopolitical risks weighing on semiconductor stocks, disciplined portfolio management is critical. Investors should balance exposure to the sector while monitoring regulatory developments and AI adoption trends globally.

Market price: NVIDIA Corp (NVDA): USD 104.49

Gold Breaks Record High Amid Trade Tensions and Fed Uncertainty

Gold hit a historic $3,357.78 per ounce on Thursday, rising nearly 28% year-to-date as trade war concerns and Federal Reserve Chair Jerome Powell’s cautious remarks on intervention drove safe-haven demand. The dollar dropped to a six-month low, further supporting bullion, while Wall Street saw sharp declines amid tariff-driven volatility. Powell emphasized the Fed’s reluctance to act preemptively, adding to market unease. Limited progress in US-Japan trade talks and ongoing tensions with China heightened fears of a global economic slowdown, reinforcing gold’s appeal.

Investment Insight: Gold’s sustained rally highlights its value as a hedge against economic and geopolitical risks. With uncertainty surrounding US trade policy and central bank action, gold could remain a strong performer in the near term. Investors may consider increasing allocations to gold to mitigate portfolio risk during volatile periods. However, a rebound in the dollar or improved trade dynamics could cap gains, requiring vigilance in managing exposure to the precious metal.

Conclusion

Markets remain driven by a mix of geopolitical tensions, regulatory developments, and evolving investor sentiment. The rally in gold underscores heightened demand for safe-haven assets amid trade uncertainty and cautious central bank policies. Meanwhile, TSMC’s strong earnings and Nvidia’s challenges highlight the shifting dynamics in the semiconductor space, tied closely to AI adoption and trade restrictions. OpenAI’s potential UK expansion reflects the competitive push for AI infrastructure dominance. As volatility persists, investors should focus on diversification, balancing defensive assets like gold with exposure to growth areas such as AI and advanced technologies to navigate current market complexities effectively.

Upcoming Dates to Watch

- April 17th, 2025: ECB rate decision, Japan CPI, US jobless claims

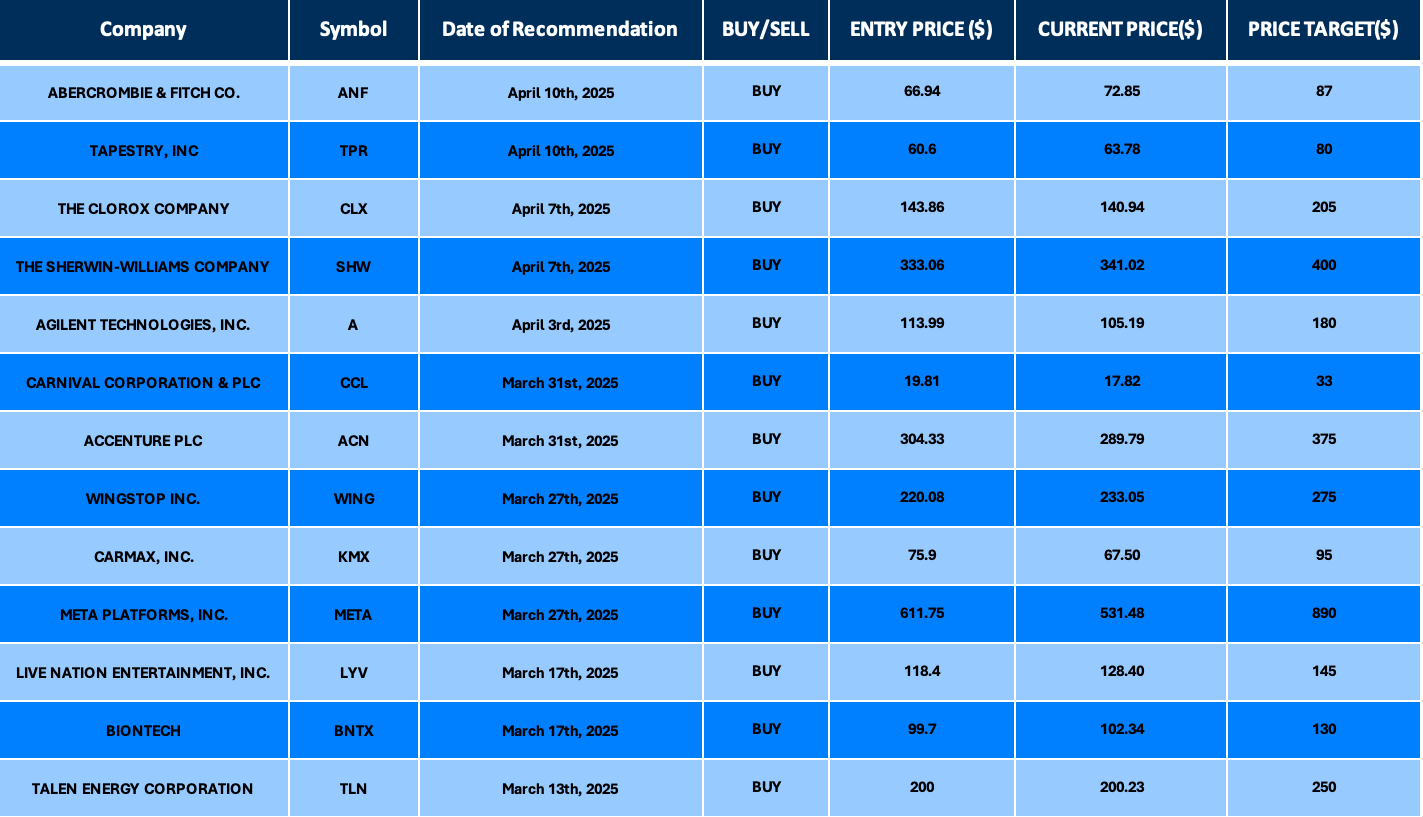

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.