Date Issued – 23rd May 2025

Preview

Markets entered Friday with a cautious tone as U.S. equity futures dipped on concerns over President Trump’s fiscal agenda and a Moody’s credit downgrade, while rising Treasury yields signaled growing debt anxiety. Despite this, mega-cap tech stocks have staged a powerful rebound, inflicting $257 billion in losses on short sellers since April, driven by outsized gains in Tesla, Nvidia, and Microsoft. In Europe, Germany’s economy surprised with 0.4% Q1 growth on pre-tariff export strength, though economists warn the momentum may not last. Meanwhile, BYD overtook Tesla in European EV sales for the first time, sending its shares to record highs despite EU tariffs. On the digital front, major U.S. banks are exploring a joint stablecoin initiative to counter crypto disruption, pending regulatory clarity from the GENIUS Act. Investors are balancing optimism in tech and industrial resilience with persistent macro risks and policy uncertainty.

Wall Street Slips as Trade Policy, Debt Concerns Pressure Sentiment

U.S. equity futures edged lower Friday as markets digested renewed concerns over economic stability tied to President Trump’s evolving trade and tax proposals. Dow futures slipped 0.1%, S&P 500 futures lost 0.2%, and Nasdaq 100 contracts dropped 0.3% as Wall Street looked to close a volatile week. Early optimism following U.S.-China trade truce talks faded midweek after Moody’s downgraded the U.S. credit rating, citing fiscal risks from Trump’s proposed tax legislation. The bond market reacted sharply, with 30-year Treasury yields surging past 5%, signaling growing investor unease over long-term debt sustainability. Asian markets, by contrast, posted modest gains, reflecting regional hopes for sustained trade stability.

Investment Insight: The market’s cautious tone reflects a shift in investor focus from geopolitical relief to fiscal reality. Elevated Treasury yields underscore rising skepticism over the macroeconomic impact of deficit-funded tax cuts. In this environment, investors should prioritize balance sheet strength and cash flow resilience, particularly ahead of Nvidia’s earnings, which may test sentiment in tech amid policy headwinds and AI spending scrutiny.

Short Sellers Crushed by Tech Surge as Tariff Relief Fuels Rally

A powerful rebound in U.S. equities has left short sellers deep in the red, with losses totaling $257 billion from April 8 to May 20, according to S3 Partners. The brunt of the damage came from the “Magnificent Seven” tech stocks, which accounted for $35.8 billion in mark-to-market losses. Tesla led the rout for bears, soaring 54% and inflicting $9.7 billion in losses on shorts. Nvidia and Microsoft followed closely, with respective rallies of 38% and 29%. The surge followed a steep sell-off triggered by President Trump’s tariff announcements, but markets have since rallied sharply, with the S&P 500 up 17% and the Roundhill Magnificent Seven ETF gaining 28% since early April.

Investment Insight: The sharp rebound in mega-cap tech underscores the risk of concentrated short positioning in highly liquid, sentiment-driven names. With volatility tied to trade policy still in play, investors should be cautious about timing contrarian bets. Instead, consider focusing on long exposure to secular growth leaders with pricing power and strong earnings momentum—particularly in AI and cloud computing—where fundamental support meets favorable market dynamics.

German Economy Surprises With Stronger Q1 Growth on Export Surge

Germany’s economy expanded 0.4% in the first quarter of 2025, twice the initial estimate, driven by a late-quarter surge in exports and industrial activity, according to revised data from the Federal Statistical Office. The rebound marks the strongest quarterly growth since Q3 2022 and offers a rare bright spot for Europe’s largest economy, which has grappled with back-to-back annual contractions. Analysts attribute the uptick to firms accelerating shipments ahead of anticipated U.S. trade barriers tied to President Trump’s tariff agenda. However, economists warn the strength may prove temporary, with the government’s advisory panel forecasting flat growth for 2025 and just 1% expansion in 2026.

Investment Insight: Germany’s better-than-expected Q1 growth reflects front-loaded industrial activity amid trade uncertainty rather than a structural turnaround. Investors should remain cautious on eurozone cyclicals and export-heavy sectors, particularly as geopolitical trade risks persist. Focus may shift to infrastructure-linked opportunities tied to Chancellor Merz’s investment push, which could support select German industrials and construction plays over the medium term.

BYD Surges to Record High After Overtaking Tesla in European EV Sales

Shares of BYD hit an all-time high in Hong Kong trading Friday after data showed the Chinese automaker outsold Tesla in Europe for the first time. According to JATO Dynamics, BYD registered 7,231 battery-electric vehicles in April, narrowly surpassing Tesla’s 7,165 units—a symbolic milestone in the increasingly competitive EV space. BYD’s rally was fueled further by a bullish outlook from Citi, which cited strong export momentum despite EU tariffs. The company’s stock rose as much as 1.97% before paring gains slightly, helping lift the Hang Seng index by 0.6%. Tesla, meanwhile, continues to navigate a global sales slowdown amid delayed model refreshes and reputational headwinds linked to CEO Elon Musk.

Investment Insight: BYD’s breakthrough in Europe signals its growing global clout and resilience amid trade barriers, reinforcing its position as a formidable rival to Tesla. Investors may consider increasing exposure to Chinese EV exporters with diversified powertrain portfolios and expanding international footprints. However, continued geopolitical friction and regulatory scrutiny in Western markets warrant a selective, risk-aware approach within the sector.

Market price: BYD Ord Shares H (HKG: 1211) HKD 465.20

Wall Street Banks Explore Joint Stablecoin to Fend Off Crypto Disruption

America’s largest banks are in early-stage discussions to create a joint stablecoin, aiming to safeguard their dominance in payments amid mounting pressure from crypto and big tech, The Wall Street Journal reported. JPMorgan, Bank of America, Citigroup, and Wells Fargo are among the institutions involved, alongside payment infrastructure players like Zelle operator Early Warning Services and the Clearing House. The initiative remains conceptual and hinges on progress of the GENIUS Act, which would establish a regulatory framework for stablecoins. If enacted, the move could enable banks to offer faster, cheaper cross-border payments while defending against disintermediation from decentralized finance and nonbank issuers.

Investment Insight: A banking-backed stablecoin could mark a pivotal shift in the digital payments landscape, signaling traditional finance’s bid to reclaim ground from crypto-native platforms. Investors should monitor regulatory developments around the GENIUS Act, which may unlock new fintech-bank collaborations. Long-term, incumbents with robust digital infrastructure and strategic partnerships stand to benefit from integrating blockchain-based settlement layers into their core operations.

Conclusion

As markets navigate a landscape shaped by policy shocks, fiscal strain, and evolving global competition, investor attention is shifting from short-term rallies to structural positioning. The rebound in tech and industrial resilience reflects selective optimism, but elevated bond yields, regulatory overhangs, and geopolitical risks remain key hurdles. From Germany’s export-driven surprise to Wall Street’s stablecoin ambitions, the week underscores a broader recalibration underway across sectors and asset classes. With Nvidia earnings ahead and legislation like the GENIUS Act poised to reshape digital finance, staying agile and focused on fundamentals will be critical in the weeks to come.

Upcoming Dates to Watch:

May 23rd, 2025: Singapore CPI

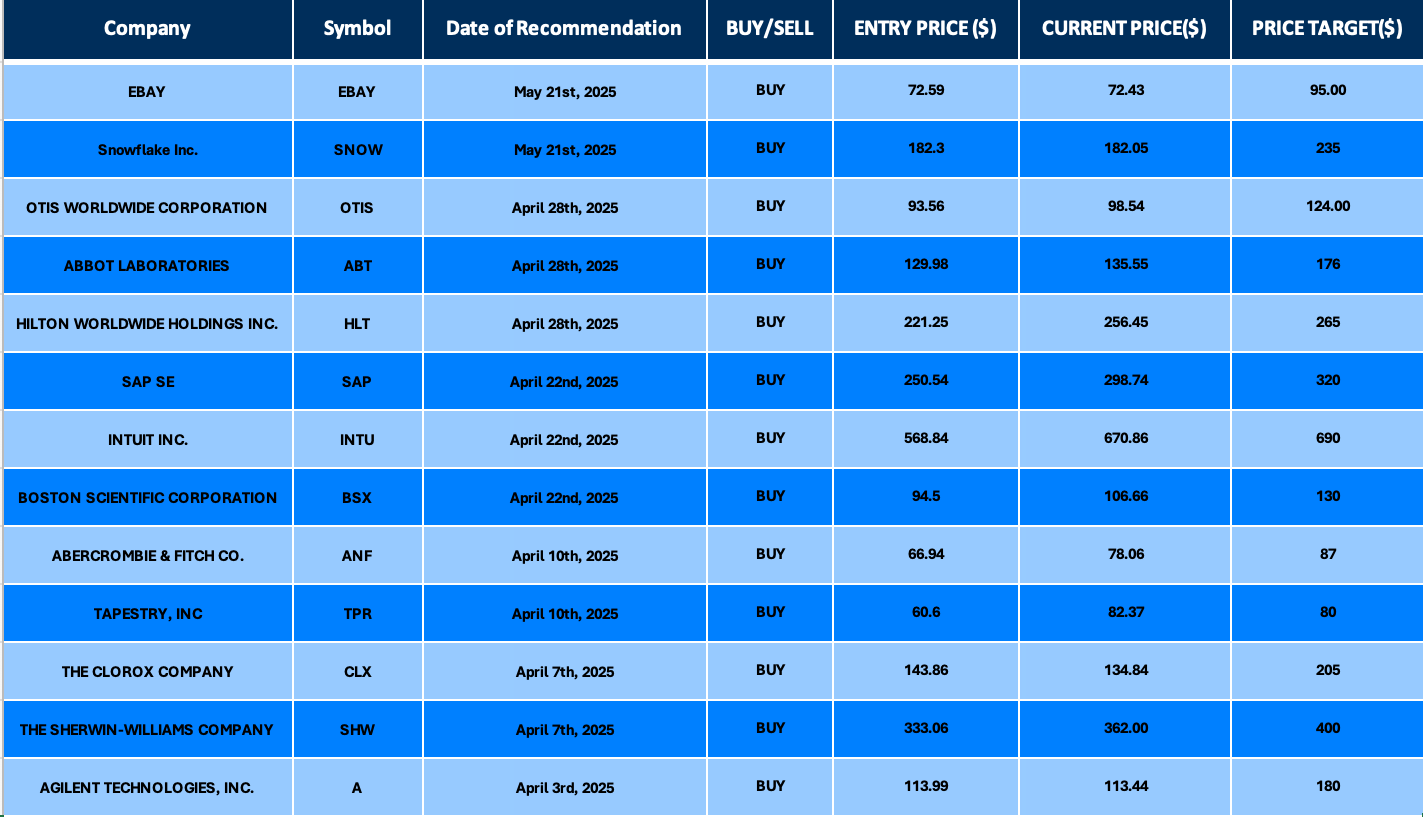

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.