Date Issued – 3rd June 2025

Preview

US stock futures fell as renewed US-China-EU trade tensions and looming labor data fueled caution, while Airbus faced scrutiny over a 4% May delivery decline tied to supply chain woes. In China, car dealers urged automakers to halt inventory dumping amid price wars, which have shuttered dealerships. Deutsche Bank raised its S&P 500 target to 6,550 on tariff optimism and a resilient economy, though it warned of volatility. Meanwhile, Japanese equity funds recorded $7.49 billion in outflows—the largest since 2007—amid profit-taking, yen strength, and cautious earnings outlooks. Investors are urged to brace for volatility while seeking opportunities in defensive plays and long-term structural trends.

Futures Slide Amid Renewed Trade Tensions

US stock futures edged lower on Tuesday as trade tensions reignited between the US, China, and the EU. Futures tied to the Dow Jones Industrial Average, S&P 500, and Nasdaq 100 declined around 0.4%, reflecting investor caution. China pushed back on accusations of trade agreement violations, while the EU countered President Trump’s tariff increases on steel and aluminum imports. Markets have endured volatility since the administration’s tariff policies began in April, with looming court decisions adding further uncertainty. Meanwhile, Wall Street anticipates key labor market data this week, including the JOLTS report, ADP employment figures, and May’s non-farm payrolls, which could shed light on the broader economic impact of trade disputes.

Investment Insight: Trade uncertainty underscores the importance of diversification in portfolios to mitigate geopolitical risks. Investors should monitor upcoming labor data for signals on economic resilience, as strong employment figures may temper volatility. Defensive sectors like utilities and consumer staples could provide stability in this unsettled environment.

Airbus Deliveries Decline Amid Supply Chain Strain

Airbus delivered approximately 51 aircraft in May, marking a 4% year-over-year decline, according to industry sources. Year-to-date deliveries stand at 243 planes, down 5% from the same period in 2024. The world’s largest aircraft manufacturer is under mounting pressure to meet its full-year target of 820 deliveries, a 7% increase, as airlines voice frustration over persistent supply chain disruptions. Delays, partly driven by engine shortages, have drawn sharp criticism from carriers like Saudi Arabia’s flyadeal, which labeled the setbacks “inexcusable.” Airbus anticipates stabilization of supply issues by summer, but tensions remain high as the company prepares to release its official May performance report on June 5.

Investment Insight: Supply chain bottlenecks highlight ongoing challenges for the aerospace sector, with potential ripple effects on airline growth plans. Investors should monitor Airbus’s progress toward delivery targets, as any further slowdowns could weigh on its valuation. Long-term demand for air travel remains robust, but near-term disruptions suggest opportunities may lie in suppliers poised to benefit from easing constraints.

Market price: Airbus SE (AIR): EUR 162.86

China’s Auto Dealers Push Back Against Inventory Dumping

Chinese car dealers are urging automakers to curb excessive inventory transfers, citing severe cash flow constraints and profit pressures amid intensifying price wars. The China Auto Dealers Chamber of Commerce highlighted worsening conditions as aggressive discounting in the second quarter forces some dealerships to shut down. The chamber proposed more reasonable production and sales targets, shorter payment cycles, and an end to coercive dealer closures disguised as network optimization. The ongoing price war, which prompted a government appeal for restraint, has already claimed casualties, including a major BYD dealer in Shandong province, where at least 20 stores were shuttered.

Investment Insight: The escalating tensions in China’s auto sector underscore risks to both automakers and their supply chains during prolonged price wars. Investors should exercise caution with companies exposed to the Chinese market, particularly in traditional and electric vehicle segments. As the industry faces pressure to adopt sustainable sales practices, long-term opportunities may emerge in firms focused on operational efficiency and dealer support.

Deutsche Bank Raises S&P 500 Target Amid Optimism on Earnings and Tariffs

Deutsche Bank has lifted its year-end S&P 500 target to 6,550, up from 6,150, citing reduced tariff-related earnings drag and a resilient US economy. The revised projection suggests a 10.35% upside from the index’s last close of 5,935.94. This upgrade aligns with a broader trend among Wall Street firms, including Goldman Sachs, UBS, and RBC, which have also raised their targets in recent weeks. The S&P 500 rallied in May, posting its strongest monthly gain since late 2023, driven by easing tariff concerns, robust corporate earnings, and subdued inflation. However, Deutsche Bank cautioned that the rally could face volatility due to trade policy uncertainties.

Investment Insight: The wave of upward revisions reflects growing confidence in the US equity market’s resilience, but investors should remain vigilant. While reduced tariff impacts and strong earnings provide bullish tailwinds, the potential for sharp pullbacks tied to trade tensions warrants a balanced approach. Consider maintaining exposure to growth sectors while hedging against volatility with defensive plays or diversified strategies.

Japanese Equity Funds See Largest Weekly Outflows Since 2007

Japanese equity funds witnessed $7.49 billion in net outflows in the week ending May 28, marking the sharpest withdrawal since July 2007. Investors capitalized on May’s rally, driven by earlier US-China trade optimism, while others grew wary of weakening earnings potential. Domestic institutions, including life insurers and pension funds, led the withdrawals, rebalancing portfolios toward bonds. A 10% yen appreciation against the US dollar this year has pressured export profitability, with analysts trimming forward 12-month earnings estimates for Japanese firms by 1.8% in the past month. Despite ongoing corporate governance reforms, improvements in profitability remain slow, with Japan’s return on equity still lagging global peers.

Investment Insight: The sharp outflows reflect short-term profit-taking and cautious sentiment amid yen strength and softer earnings prospects. While long-term investors may find opportunities in Japan’s governance reforms and undervalued equities, near-term headwinds suggest focusing on defensive sectors or exporters less reliant on currency stability.

Conclusion

Markets remain defined by a mix of optimism and caution as investors navigate trade uncertainties, supply chain disruptions, and shifting economic data. Upward revisions to the S&P 500 reflect confidence in US resilience, but volatility persists amid geopolitical risks. In Asia, Japan faces profit-taking pressures and currency challenges, while China’s auto sector grapples with price wars and dealer unrest. Airbus’s delivery struggles further highlight global supply chain fragility. As the week unfolds, key labor data and corporate developments will shape sentiment. Investors should stay nimble, balancing exposure to growth opportunities with defensive strategies to weather near-term market fluctuations.

Upcoming Dates to Watch

- June 3rd, 2025: Swiss CPI, South Korea GDP, Australia GDP

- June 5th, 2025: Europe PPI, US Jobless claims

- June 6th, 2025: Europe GDP

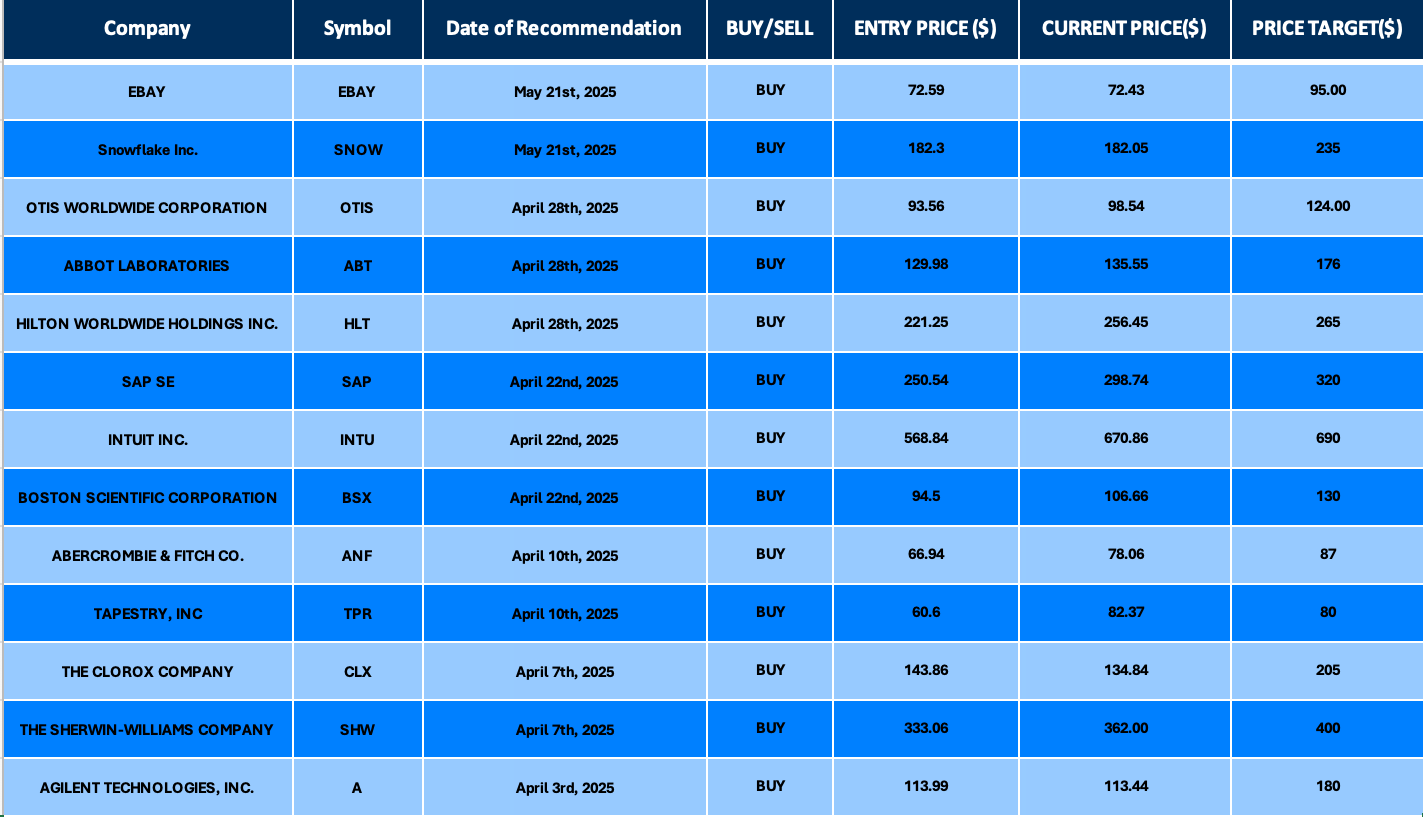

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.