Date Issued – 4th June 2025

Preview

Investors brushed aside fresh tariff concerns as equity futures held steady, buoyed by strong labor data and Nvidia’s surge past Microsoft to become the world’s most valuable company with a $3.45 trillion market cap. The chipmaker’s stellar earnings and AI dominance fueled broader gains in semiconductors, despite export headwinds. Meanwhile, Alphabet faces a potential 25% downside in a tail-risk scenario flagged by Barclays, which warned a forced Chrome divestiture could sharply erode earnings power. Elsewhere, Barclays lifted its S&P 500 year-end target to 6,050, citing easing trade tensions and improving earnings visibility into 2026. In aviation, Chinese carriers are reportedly eyeing a major Airbus order, signaling a rebound in travel demand and strengthening trade ties with Europe.

Tariff Tensions Fail to Deter Wall Street Optimism

US equity futures traded largely flat Wednesday as investors looked past President Trump’s surprise move to double tariffs on steel and aluminum imports—excluding the UK—amid rising trade tensions with China and the EU. Futures tied to the Dow Jones, S&P 500, and Nasdaq 100 hovered near unchanged, following Tuesday’s gains fueled by an upbeat April JOLTS report and a rally in Nvidia shares. While the tariff hike introduces fresh geopolitical uncertainty, investor sentiment remained resilient ahead of key labor market data, including Wednesday’s ADP report and Friday’s pivotal May jobs number.

Investment Insight

Markets appear to be discounting near-term tariff risks in favor of strong labor data and tech sector momentum. Investors should watch for signs of wage pressure or labor market cooling in Friday’s jobs report, which could recalibrate expectations around Fed rate policy and test the current risk-on posture.

Nvidia Surpasses Microsoft as Market Cap King at $3.45 Trillion

Nvidia surged past Microsoft to become the world’s most valuable publicly traded company, closing Tuesday at a record $141.40 per share and lifting its market capitalization to $3.444 trillion. The stock rallied 3% on the day, extending a powerful month-long run driven by blowout Q1 earnings and sustained investor confidence in the AI chipmaker’s dominance, despite geopolitical headwinds. Nvidia’s revenue soared 69% year-over-year to $44.06 billion, underscoring robust demand for its AI hardware. Broader chip stocks also rallied, with the VanEck Semiconductor ETF up 2% and Micron gaining 4%, reflecting bullish sentiment across the sector even as new US chip export controls cloud the outlook for sales in China.

Investment Insight

Nvidia’s ascent signals continued investor conviction in the AI hardware cycle, with market leadership shifting decisively to firms positioned at the core of AI infrastructure. Despite export restrictions, the market is pricing in Nvidia’s ability to outgrow regulatory setbacks through product leadership and global demand. Investors should monitor the sector for potential policy-driven volatility but remain focused on structural AI tailwinds powering long-term semiconductor growth.

Market price: NVIDIA Corp (NVDA): USD 141.22

Alphabet Faces Legal Tail Risk as Barclays Flags Potential 25% Stock Slide

Alphabet could see its stock fall by as much as 25% in a worst-case legal scenario, according to Barclays, which warned that a forced divestiture of Google Chrome would significantly impair the tech giant’s earnings power. While considered a low-probability event, a federal remedy in the ongoing antitrust trial could mandate the sale of Chrome—responsible for 35% of Google’s search revenue and accessed by roughly 4 billion users. Barclays estimates such a divestiture could reduce earnings per share by over 30%, with no current investor pricing in the risk. Alternative remedies, like opening Google’s index to competitors or unwinding traffic acquisition deals, could also dent EPS by up to 20%, though with less severe equity downside.

Investment Insight

Alphabet’s antitrust overhang introduces a material tail risk that could reshape its search dominance. While a Chrome divestiture remains unlikely, the increasing legal scrutiny justifies a risk premium. Investors may consider de-risking exposure or hedging positions ahead of the court’s remedy decision, as potential structural changes to Alphabet’s business model could weigh on long-term valuation multiples.

Market price: Alphabet Inc Class C (GOOG): USD 167.71

Barclays Lifts S&P 500 Target to 6,050 on Easing Trade Risks, Earnings Optimism

Barclays raised its year-end target for the S&P 500 to 6,050 from 5,900, citing reduced trade uncertainty and expectations for normalized earnings growth in 2026. The revised forecast implies a modest 1.3% upside from Tuesday’s close of 5,970.37. The upgrade aligns with recent target hikes from Goldman Sachs, UBS, RBC, and Deutsche Bank, following a strong May rally that saw the index gain 6.2%—its best monthly performance since November 2023. Barclays maintained its 2025 EPS forecast at $262 and introduced a 2026 target of 6,700, supported by a projected $285 EPS, anticipating that tariff-related headwinds will taper off by next year.

Investment Insight

The upward revision signals growing institutional confidence in the resilience of U.S. equities, even as trade and policy risks persist. With inflation moderating and earnings stabilizing, the S&P 500 appears on a path toward steady multiple expansion. Investors may consider leaning into cyclical and growth sectors that stand to benefit from a normalized earnings environment in 2026, while remaining selective amid modest near-term upside.

Chinese Carriers Weigh Major Airbus Order Amid Aviation Rebound

Chinese airlines are reportedly evaluating a large-scale purchase of Airbus SE aircraft, potentially amounting to hundreds of jets, according to Bloomberg News. The deal, which could be announced as early as next month, would mark a significant boost for Airbus as demand for air travel in Asia continues to rebound. While the report remains unconfirmed, shares of Airbus (EADSY) rose 1.6% on the news. A major order from China would signal improving trade dynamics with Europe and deepen Airbus’s foothold in one of the world’s most critical aviation markets.

Investment Insight

A multibillion-dollar order from Chinese carriers would reinforce Airbus’s market leadership in Asia and inject further momentum into the aerospace sector. Investors should monitor confirmation of the deal and any geopolitical ramifications, particularly in the context of EU-China trade relations. Increased visibility into long-haul aircraft demand could also lift sentiment across the broader aviation supply chain.

Market price: Airbus SE (AIR): EUR 170.72

Conclusion

Markets remain resilient in the face of policy uncertainty, with investor sentiment buoyed by strong corporate earnings, cooling inflation, and renewed confidence in tech leadership. Nvidia’s ascent underscores the market’s conviction in AI-driven growth, while Alphabet’s legal overhang highlights the risks of regulatory disruption. Upward revisions to S&P 500 targets reflect growing optimism for 2026, even as near-term risks persist. Meanwhile, potential Airbus orders from China suggest a rebound in global demand and shifting trade dynamics. As key economic data looms, investors are positioning with cautious optimism, balancing structural growth narratives against evolving macro and geopolitical pressures.

Upcoming Dates to Watch

- June 5th, 2025: Europe PPI, US Jobless claims

- June 6th, 2025: Europe GDP

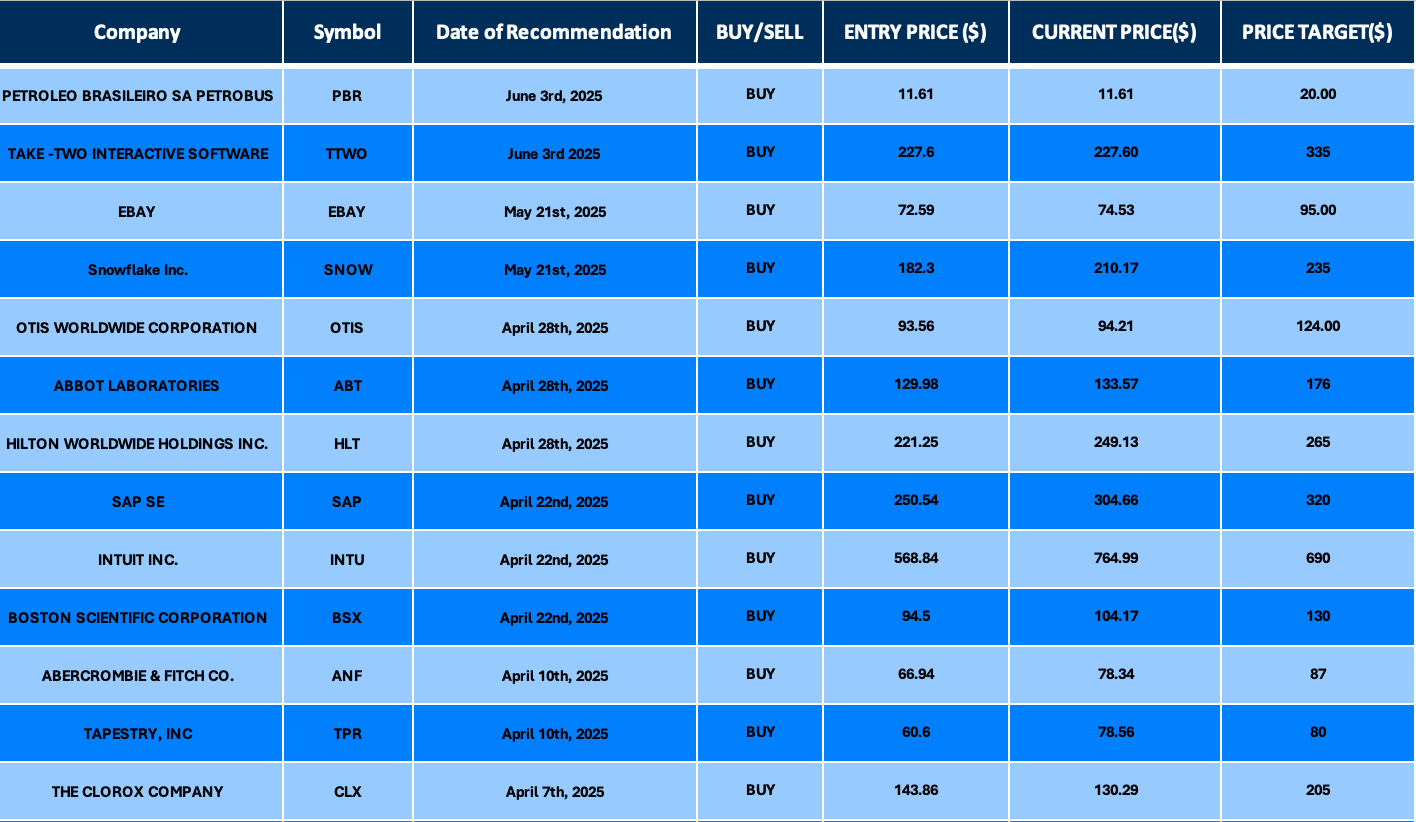

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.