Date Issued – 17th June 2025

Preview

Gold Outshines Treasurys, Yen and Swiss Franc

Gold continues to outperform traditional safe havens in 2025, with prices surging 30% year-to-date, outpacing the yen, Swiss franc and U.S. Treasurys. Currently trading around $3,403 per ounce after peaking above $3,500 in April, gold’s rise is fueled by growing global uncertainty, fiscal concerns and diminished confidence in sovereign debt markets. Recent U.S. policy volatility, including Trump’s tariffs and a Moody’s downgrade, has pressured Treasurys, while Japan’s structural weaknesses and Switzerland’s near-zero rates reduce their currencies’ appeal. Experts emphasize that gold’s independence from government liabilities, intrinsic value and absence of counterparty risk strengthen its role as the ultimate safe haven. Central banks remain strong buyers, with 2024 marking a third consecutive year of net purchases above 1,000 tons and the ECB recently reported gold has overtaken the euro as the world’s second-largest reserve asset.

Investment Insight:

Gold’s decisive outperformance highlights a strategic global shift toward non-sovereign stores of value amid persistent geopolitical instability and mounting sovereign debt pressures. The growing central bank accumulation signals a structural rebalancing of reserves away from fiat currencies. Investors should closely monitor continued policy uncertainty in the U.S. and Asia, as further erosion of sovereign credit confidence could extend gold’s secular bull run. Elevated institutional demand, combined with limited supply growth, offers strong technical and fundamental tailwinds for long-term gold positioning.

Bank of Japan Slows Bond Purchase Cuts

The Bank of Japan (BOJ) held its benchmark rate steady at 0.5% while announcing a more gradual reduction in Japanese government bond (JGB) purchases amid rising growth risks. Until March 2026, monthly JGB purchases will be reduced by ¥400 billion ($2.76 billion) per quarter, reaching ¥3 trillion. From April 2026 to March 2027, cuts will slow to ¥200 billion per quarter, targeting ¥2 trillion monthly purchases – roughly the level prior to BOJ’s ultra-loose monetary policy started in 2013. The decision aims to stabilize JGB markets following recent long-end yield spikes, with 30-year yields reaching multi-decade highs near 3.2% in May before easing to 2.93%. Japan faces mounting headwinds as Q1 GDP contracted 0.2% and headline inflation hit 3.6% in April, marking over three years above the BOJ’s 2% target. Governor Ueda reaffirmed that rate hikes will proceed cautiously, contingent on sustained inflation progress.

Investment Insight:

The BOJ’s cautious approach underscores the delicate balance between inflation control and growth stability in Japan’s post-ultra-loose era. While gradual JGB tapering signals confidence in market resilience, persistent inflation and contracting growth may complicate normalization efforts. The yen remains sensitive to global rate differentials and any further delay in BOJ tightening could sustain currency weakness. For fixed income investors, Japan’s evolving yield curve offers selective opportunities, while equities may face increased volatility as policy uncertainty collides with fragile domestic demand.

U.S. Steel & Nippon Steel Merger Approved

U.S. Steel shares rose 5% after President Trump approved its acquisition by Japan’s Nippon Steel through an executive order. The approval was contingent on the signing of a national security agreement granting the U.S. government a “golden share” – a mechanism that gives the president significant oversight authority. Commerce Secretary Howard Lutnick detailed that the golden share grants veto power over key decisions such as headquarters relocation, offshoring production or jobs, plant closures and renaming the company. The deal, structured as U.S. Steel becoming a wholly owned subsidiary of Nippon Steel North America, has cleared all regulatory approvals and is expected to close shortly. Trump emphasized the transaction as a “partnership” rather than a foreign takeover, reflecting political sensitivities surrounding domestic manufacturing and national security.

Investment Insight:

The unique golden share arrangement sets a precedent for foreign acquisitions of U.S. strategic assets under heightened national security scrutiny. While the deal secures capital infusion and operational scale for U.S. Steel, the embedded government oversight limits full foreign control, signaling a more protectionist framework for future cross-border M&A in critical sectors. Investors should monitor how similar structures may impact valuations and deal premiums in sectors like defense, infrastructure and energy. Near term, U.S. Steel gains from operational certainty and political resolution, but longer term, government intervention could influence strategic flexibility and capital allocation.

Meta Launches Ads on WhatsApp

After over a decade since its $19 billion acquisition, Meta is officially introducing ads to WhatsApp, marking a pivotal monetization shift for the previously ad-free messaging platform. The new status ads will appear in the app’s Updates tab, alongside WhatsApp’s Status and Channels features, keeping personal conversations untouched. In addition to ads, Meta will monetize Channels through search ads and future subscription fees. Channel admins can boost visibility and eventually charge monthly subscriptions, with Meta taking a 10% cut. WhatsApp currently boasts over 3 billion monthly users globally, including more than 100 million users in the U.S. – positioning the platform as a major pillar in CEO Mark Zuckerberg’s long-term growth strategy. Meta emphasized that ad targeting will rely on basic user data like location, language and interaction patterns, avoiding intrusive personal data collection.

Investment Insight:

Meta’s move to monetize WhatsApp directly taps into its largest untapped user base and diversifies revenue beyond its core ad platforms. The introduction of native ads, search monetization and subscription models aligns with industry-wide shifts toward messaging-based commerce. While the cautious rollout seeks to minimize user disruption, scaling monetization on WhatsApp could drive meaningful revenue acceleration over time, especially in emerging markets where the app dominates daily communication. However, regulatory scrutiny – particularly as Meta faces ongoing antitrust litigation – remains a structural risk. Investors should monitor adoption metrics, subscription uptake and user engagement as early signals of monetization success.

Oil Jumps After Trump Calls for Tehran Evacuation

Oil prices initially surged after U.S. President Donald Trump publicly called for the evacuation of Tehran amid rising Middle East tensions. The sharp reaction reflects mounting fears that the conflict between Israel and Iran could escalate further and impact global oil supply. While prices later pared some of their gains, the market remains highly sensitive to geopolitical developments in the region. Investors are closely watching for any disruptions that could affect critical energy infrastructure or shipping routes such as the Strait of Hormuz, through which roughly 20% of the world’s oil flows.

Investment Insight:

The oil market’s reaction underscores the fragile balance between geopolitical risks and supply stability. Any direct conflict escalation between Israel and Iran would elevate the probability of significant supply disruptions, potentially pushing crude prices sharply higher. While short-term price spikes remain driven by headlines, sustained price elevation would depend on the extent of physical supply impact. Investors should maintain heightened sensitivity to political developments, potential sanctions, retaliatory actions and logistical threats to global crude flows. Volatility premiums may stay elevated in oil markets as long as the risk of regional escalation persists.

Conclusion:

This week’s developments reflect the underlying shifts in market psychology: safety flows increasingly favor physical assets like gold over sovereign paper, while central banks continue managing fragile growth trajectories. U.S. policy moves show a tightening grip on foreign investments in strategic sectors, while Meta’s WhatsApp ad rollout signals the relentless drive for new monetization vectors. Simultaneously, the Middle East remains the core wildcard for commodity and energy markets, with each escalation carrying amplified systemic risks for oil supply stability. Expect volatility to remain elevated as investors recalibrate exposures across risk and safety assets.

Upcoming Dates to Watch:

- June 18th: U.K. CPI, Eurozone CPI

- June 19th: BoE Interest Rate Decision

- June 21st: Flash PMIs (US, EU, UK, Japan)

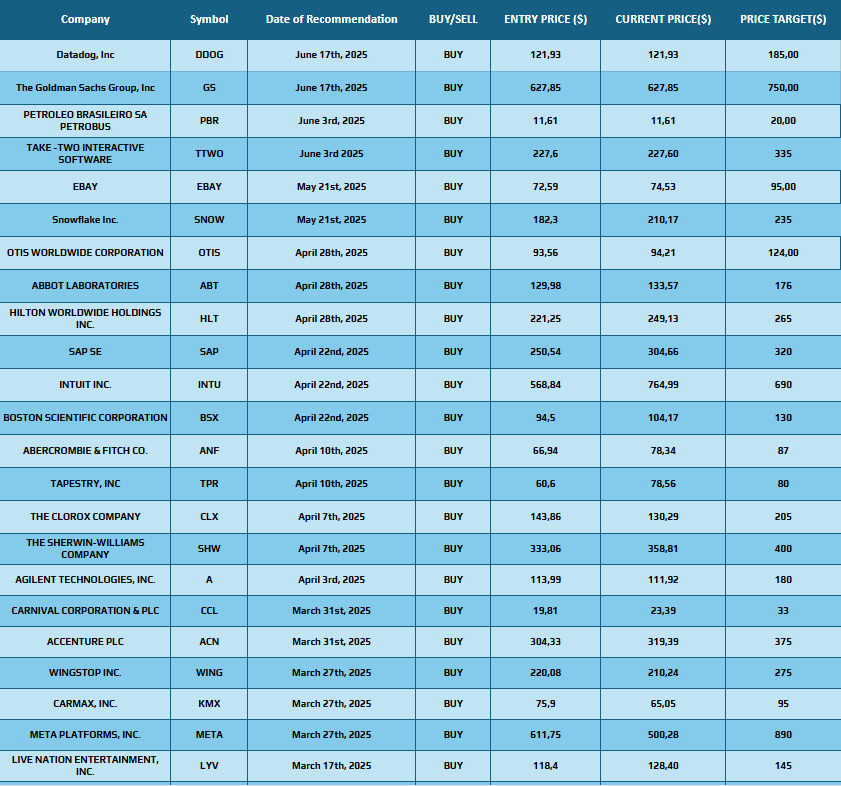

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.