Date Issued – 18th June 2025

Preview

This week brings a delicate market equilibrium. The Fed is expected to hold rates steady, but revised projections and the dot plot could shift sentiment quickly. Markets still price in a September cut, though the Fed’s cautious tone suggests a slower path. Meanwhile, oil spiked after Trump called for a Tehran evacuation, highlighting renewed geopolitical risk. Japan’s exports saw their sharpest drop in 8 months, driven by falling U.S. auto shipments and rising trade tensions. JPMorgan made headlines by launching JPMD, a blockchain-based deposit token for institutional use – another sign that traditional finance is adapting. JetBlue, under pressure from weak domestic demand, announced more cost cuts and flight reductions, pointing to continued softness in consumer spending.

UK Inflation Holds at 3.4% – Rate Cut Postponed

In May, the U.K.’s annual inflation held steady at 3.4%, matching expectations and casting doubts over any imminent rate cuts by the Bank of England. Although core inflation eased slightly to 3.5% from 3.8%, services inflation remains elevated at 4.7% – keeping pressure on the central bank. The BoE is expected to hold rates at 4.25% in its upcoming meeting, with the next move likely coming in August. Analysts also warn of potential upside risks if the conflict in the Middle East sustains high oil prices.

Investment Insight:

Sticky inflation and rising geopolitical tensions (including a 4% surge in crude oil prices) are keeping central banks cautious. For investors, this reinforces the case for energy sector exposure and a hedge against UK Gilts volatility. Also, watch for renewed strength in the British Pound (GBP) if rates remain elevated longer than expected. A higher-for-longer stance by the BoE may keep UK equities under pressure in the short term – particularly rate-sensitive sectors like housing and retail.

Fed in Focus: No Rate Change, But Dot Plot Could Shake Markets

The Federal Reserve is widely expected to hold interest rates steady at its June meeting, but markets will be watching closely for updated forecasts and forward guidance. Key attention will be on the revised “dot plot” – the Fed’s internal projections for rate cuts this year. In March, the median forecast pointed to two cuts in 2025, but even minor shifts in voting members’ expectations could bring that down to one. While inflation remains relatively tame and labor market data shows signs of softening, geopolitical risks, including Middle East tensions and Trump’s proposed tariffs, complicate the outlook.

Investment Insight:

Markets are currently pricing in a potential first rate cut in September, but recent Fed commentary suggests a more cautious, “wait-and-see” approach. In this context, investors should closely monitor rate-sensitive assets. Treasury yields may remain stable or even rise if the updated dot plot signals a shift toward a single rate cut this year. Equities, particularly in the tech and growth segments, could face short-term volatility. Meanwhile, commodities – especially oil and energy-related stocks – remain highly responsive to geopolitical tensions and could outperform if high rates persist. With the Fed expected to revise its GDP and inflation projections, market attention will likely intensify around macroeconomic indicators throughout the summer. In such an environment, strategic positioning in value stocks, short-duration bonds and inflation-hedged commodities may offer greater resilience.

Japan’s Export Slump Deepens Amid Trade Pressure and Tariff Risk

Japan’s exports fell by 1.7% in May year over year, marking the sharpest decline since September 2024. The drop, though less severe than the 3.8% forecast by economists, reverses the 2% gain recorded in April. Exports to the U.S. were down 11.1%, with automobile shipments plunging 24.7%. Japan’s car industry, which represented over 28% of all exports to the U.S. in 2024, faces rising pressure ahead of a new 24% reciprocal tariff scheduled to take effect on July 9. Exports to China also declined by 8.8%. Meanwhile, imports fell by 7.7%, contributing to a smaller-than-expected trade deficit of 637.6 billion yen. The Bank of Japan noted in its latest statement that growth is likely to moderate due to trade-related uncertainties, while Moody’s Analytics emphasized that tariffs remain the main threat to Japan’s economic outlook.

Investment Insight:

The data confirms a deteriorating trade environment for Japan, particularly in key sectors such as automobiles and industrial exports. Ongoing trade disputes with the United States, combined with weak demand from China, are undermining Japan’s ability to drive growth through external demand. With export momentum weakening and domestic demand also cooling, Japan may face increasing pressure to revise monetary policy in the coming months. Investors should monitor developments in the Japan/U.S. trade talks, as well as the yen’s trajectory, which could further impact export competitiveness. Near-term volatility in Japanese equities remains likely, especially for companies heavily exposed to the U.S. market.

JPMorgan Launches JPMD: A Permissioned Stablecoin Alternative

JPMorgan is stepping deeper into crypto by introducing JPMD, a digital deposit token designed to offer a stablecoin-like experience with the reliability of traditional banking infrastructure. Built on Coinbase’s Base blockchain, JPMD allows 24/7 settlement, interest accrual and seamless B2B transactions – but only for institutional clients.

Unlike public stablecoins such as USDT and USDC, JPMD is a “permissioned” token, meaning it cannot be freely traded on public markets. Instead, it mirrors commercial bank deposits and offers tighter integration with the existing financial system. This structure aligns with upcoming regulatory frameworks, especially as the U.S. Senate prepares to vote on the GENIUS Act, aimed at regulating stablecoins.

Investment Insight:

JPMorgan’s move marks a pivotal step toward on-chain institutional finance. By offering an interest-bearing digital token backed by a major bank, JPM is blurring the lines between traditional banking and decentralized infrastructure – without compromising regulatory alignment. The use of Base (Coinbase’s Layer 2 network) signals a clear intention to build trust and scalability within crypto-native rails. Expect rising demand for regulated digital cash equivalents, particularly among large institutions seeking speed, transparency and interoperability. This development could place pressure on existing stablecoin players – and further validate blockchain infrastructure providers like Coinbase, Ethereum Layer 2s and regulated DeFi custodians.

JetBlue Slashes Costs as Break-Even in 2025 Becomes ‘Unlikely’

JetBlue Airways is enacting deeper cost-cutting measures amid soft travel demand and declining airfares, with CEO Joanna Geraghty warning staff that break-even operating margins in 2025 are now improbable. The airline will reduce off-peak flights, pause retrofits of some older aircraft and evaluate leadership structure and hiring plans. While financial forecasts have been withdrawn, key initiatives remain active, including new aircraft deliveries and its partnership with United Airlines, aimed at driving long-term growth.

Investment Insight:

JetBlue’s post-merger strategy reset underlines the pressures mid-tier airlines face in an uncertain travel market. With domestic airfare down 7.3% YoY and a cloudy economic outlook, cost control has become critical. However, strategic partnerships (like the one with United) and continued investment in premium offerings show a dual focus on survival and selective growth. Investors should view JetBlue’s moves as a defensive posture, but not a retreat – signaling a transition phase that may favor leaner, more connected carriers in the medium term.

Conclusion:

In a week shaped by geopolitical risks, uncertain rate forecasts and corporate realignment, investors are navigating markets defined by caution and recalibration. The Fed’s upcoming dot plot will likely dictate summer positioning. September remains the base case for a potential rate cut – but any signal of reduced cuts could drive yield spikes and short-term equity pullbacks, particularly in tech. Value stocks and inflation-hedged commodities may offer near-term resilience. Meanwhile, oil prices remain reactive to Middle East tension and defense of domestic industry is becoming a theme – from Trump’s “golden share” over U.S. Steel to Japan’s trade vulnerability and JetBlue’s retreat from growth. JPMorgan’s launch of JPMD signals traditional finance leaning deeper into blockchain – but in a tightly controlled, institutional-only format. Overall, capital remains cautious but opportunistic.

Upcoming Dates to Watch:

- June 19th: BoE Interest Rate Decision

- June 20th: Philly Fed Manufacturing Index, Canadian Retail Sales

- June 21st: Flash PMIs (US, EU, UK, Japan)

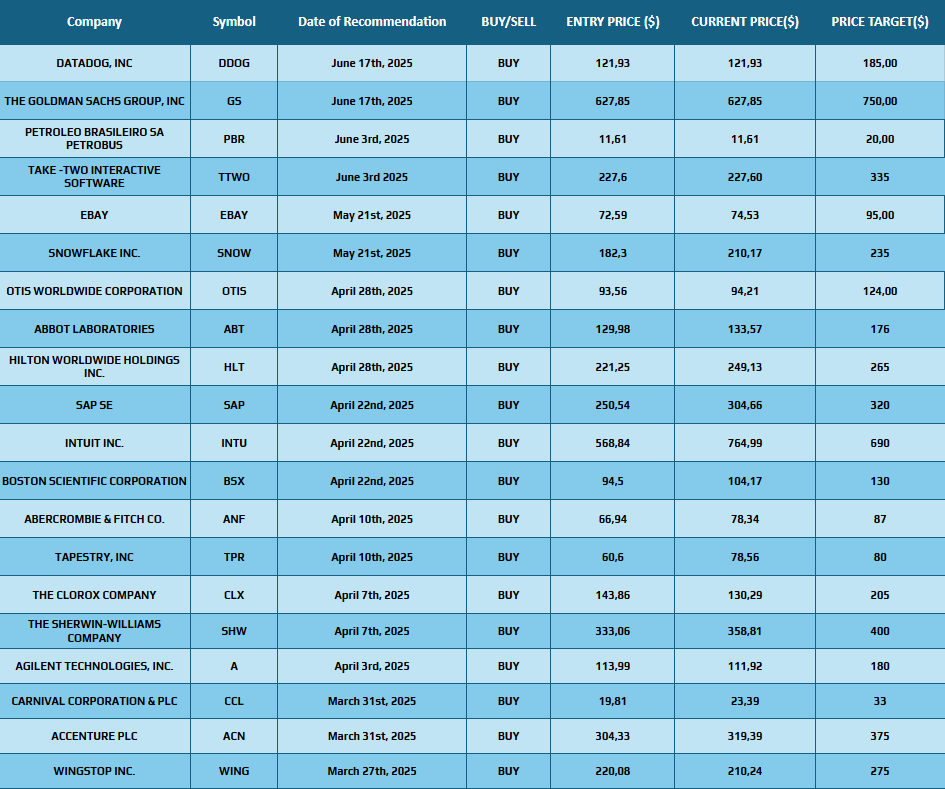

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.