Date Issued – 19th June 2025

Preview

Markets digest a cautious Fed stance as interest rates remain unchanged, with two cuts still projected for 2025 despite persistent inflation and slowing growth. Nippon Steel finalizes its $11B acquisition of U.S. Steel, ending its NYSE listing under strict U.S. oversight. Gilead secures FDA approval for Yeztugo, a twice-yearly HIV prevention injection, though federal funding threats loom. A politically charged cyberattack wipes out $90M from Iran’s Nobitex exchange, signaling new geopolitical risks in crypto. Together, these developments highlight rising policy uncertainty, strategic sector shifts and the growing intersection of digital infrastructure and international conflict.

Fed Holds Rates Steady, Signals Two Cuts for 2025 Despite Stagflation Concerns

The Federal Reserve left its benchmark rate unchanged at 4.25% – 4.5% but maintained projections for two rate cuts in 2025, according to its latest dot plot. The updated economic outlook points to slower GDP growth at 1.4%, core inflation rising to 3.1% and unemployment edging to 4.5%. While uncertainty is said to be easing, Chair Powell emphasized the Fed will “wait to learn more” before adjusting policy. Rising inflationary risks from tariffs and geopolitical instability remain key considerations, as the Fed balances political pressure from the White House with signs of softening consumer demand and labor market fragility.

Investment Insight:

The Fed’s neutral hold, paired with a modestly dovish dot plot, suggests a policy pivot remains on the table – but not imminent. Investors should watch for incoming inflation data and labor market trends to confirm timing on the anticipated rate cuts. Short-duration Treasuries and rate-sensitive equities may benefit from increased clarity, while volatility could resurface if inflation accelerates or geopolitical shocks persist.

Nippon Steel Finalizes $11B U.S. Steel Takeover; Trading Ceases on NYSE

U.S. Steel shares ceased trading Wednesday as Nippon Steel completed its acquisition, making the American icon a wholly owned subsidiary of Nippon Steel North America. Despite earlier opposition, President Trump approved the deal, securing a “golden share” that grants veto power over key governance and strategic decisions, including jobs, production and relocation. U.S. Steel will retain its name, Pittsburgh HQ and U.S. incorporation, while Nippon has committed to a $11 billion investment through 2028. The NYSE delisting takes effect June 30.

Investment Insight:

The takeover underscores a broader shift in industrial consolidation with geopolitical strings attached. While U.S. Steel will technically remain domestically governed, the structure highlights growing political oversight in foreign ownership of strategic assets. Investors in the industrial sector should expect further scrutiny on cross-border deals and align exposure with firms backed by stable policy frameworks and long-term capital commitments.

FDA Approves Gilead’s HIV Prevention Injection Amid Policy Uncertainty

The FDA has approved Gilead’s twice-yearly HIV prevention injection, Yeztugo (lenacapavir), a milestone in combating the global epidemic. Clinical trials showed near-total efficacy, with one study recording 100% prevention among cisgender women. Yeztugo offers a major advantage in convenience over daily pills and bi-monthly shots, especially in underserved communities. However, proposed cuts to Medicaid and CDC prevention programs under the Trump administration threaten access for vulnerable populations. Gilead has pledged to support uninsured patients and expand global access, but broad insurance adoption remains critical to impact.

Investment Insight:

Gilead’s Yeztugo positions the company at the forefront of next-gen HIV prevention, with potential peak global sales estimated at $4 billion. Yet, policy headwinds and reimbursement risks could temper early adoption in the U.S. Market watchers should evaluate the regulatory and political landscape closely. Long-term upside depends on global licensing strategy and successful penetration into populations not currently reached by existing PrEP solutions.

$90M Crypto Hack on Iran’s Nobitex Marks New Geopolitical Flashpoint in Cyber Warfare

Pro-Israel hacker group “Predatory Sparrow” claimed responsibility for a politically motivated cyberattack on Iran’s largest crypto exchange, Nobitex, draining over $90 million across multiple cryptocurrencies. The funds were funneled into inaccessible “burner wallets,” suggesting symbolic destruction over financial theft. The attack coincided with escalating hostilities between Israel and Iran and follows a similar breach of Bank Sepah earlier in the week. Blockchain firms linked Nobitex to IRGC-associated wallets, Hamas and other sanctioned entities, highlighting the growing weaponization of crypto platforms in geopolitical conflict.

Investment Insight:

The Nobitex breach underlines the rising cybersecurity risks tied to crypto infrastructure, especially in geopolitically sensitive regions. For institutional investors and compliance teams, the incident reinforces the importance of blockchain analytics and real-time risk monitoring tools. As crypto becomes a theater for political retaliation, expect regulatory scrutiny on digital asset exchanges with ties to sanctioned actors to intensify globally.

Conclusion

This week’s developments underscore a complex macro environment shaped by cautious central bank policy, geopolitical risk and sectoral transformation. The Fed’s decision to hold rates steady while projecting limited easing reflects persistent inflationary pressures and softening growth. Meanwhile, cross-border corporate activity – exemplified by Nippon’s U.S. Steel acquisition – continues under heightened regulatory scrutiny. In healthcare, Gilead’s breakthrough HIV prevention therapy offers medical progress, though access risks remain amid proposed funding cuts. Finally, the Nobitex hack marks a new era of politically motivated attacks on digital assets, reinforcing the strategic importance of cyber and crypto infrastructure in modern conflict. Strategic positioning remains key.

Upcoming Dates to Watch

- June 20th: Philly Fed Manufacturing Index, Canadian Retail Sales

- June 21st: Flash PMIs (US, EU, UK, Japan)

- June 23rd: Earnings from FactSet and Naspers ADR

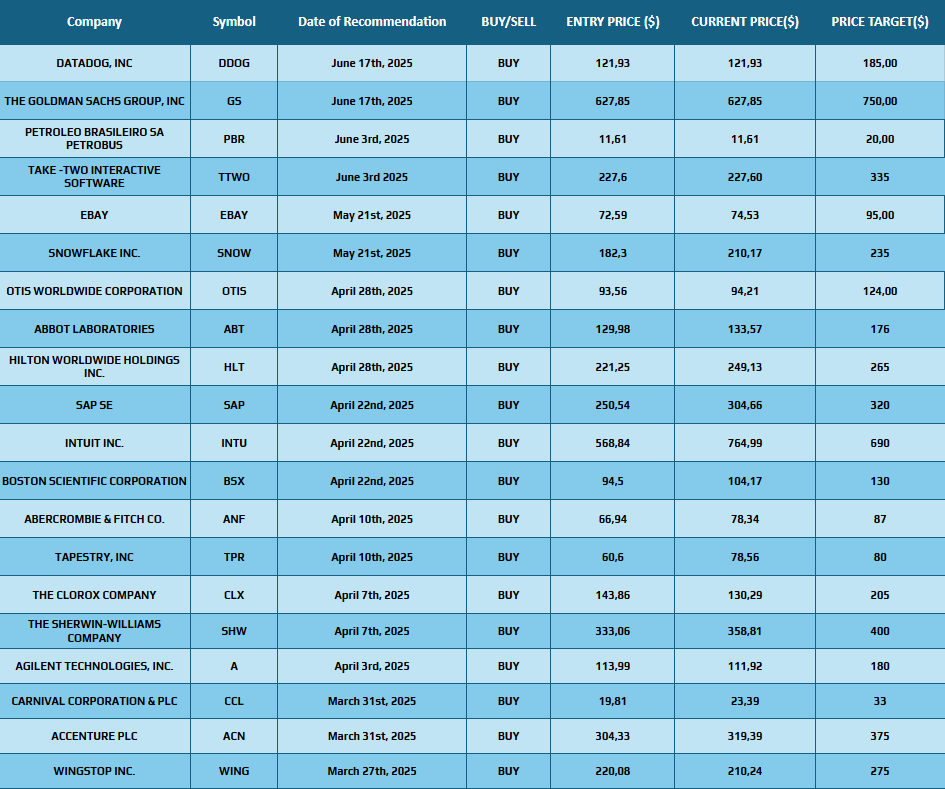

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.