Date Issued – 20th June 2025

Preview

Global markets remain on edge as inflation, geopolitical tensions and industrial disruptions shape investor sentiment. Japan’s core inflation hit a 17-month high, driven by a historic surge in rice prices, while the Bank of England held rates steady but signaled a possible August cut. Oil climbed 3% as Israel vowed deeper strikes on Iran, raising fears of supply shocks. Meanwhile, Airbus dominated the Paris Air Show amid Boeing’s muted presence and another SpaceX Starship explosion raised fresh doubts about launch reliability. Together, these developments signal an environment of elevated risk and selective sector resilience.

Japan Inflation Surges on Soaring Rice Prices, Pressuring BOJ Policy Outlook

Japan’s core inflation surged to 3.7% in May – its highest level since January 2023 – driven by a historic 101.7% year-over-year spike in rice prices. The core-core rate, which excludes food and energy, also climbed to 3.3%, signaling persistent pricing pressure. Despite this, the Bank of Japan held its policy rate at 0.5%, citing expected inflation moderation ahead. With inflation running above the 2% target for 38 consecutive months and economic growth contracting by 0.2% in Q1, policymakers face a balancing act between supporting the economy and addressing rising costs.

Investment Insight:

Food-driven inflation, particularly rice prices, is now a central variable in Japan’s monetary outlook. While the BOJ remains cautious, investors should anticipate greater hawkish signaling if core-core inflation remains elevated. Bond markets may see upward pressure on yields, while equity sectors sensitive to consumer spending and input costs could experience volatility. Defensive positioning and attention to BOJ language shifts are warranted.

Oil Prices Climb 3% as Israel Escalates Strikes on Iran, Raising Global Supply Fears

Crude prices surged Thursday, with Brent settling at $78.85 (+2.8%) and U.S. crude topping $77.50 (+3.2%), as Israel vowed to intensify military strikes on Iranian strategic and government targets. The escalation follows reports of an Iranian missile hitting a hospital in Beersheba. Israeli officials openly threatened Iran’s leadership, while President Trump weighs a potential U.S. strike on Iran’s nuclear facilities. JPMorgan warned that any regime change in Iran – an OPEC heavyweight – could trigger prolonged supply disruptions and sustained oil price spikes.

Investment Insight:

Heightened geopolitical tensions in the Middle East are reintroducing risk premia into oil markets. Investors should prepare for potential volatility in energy prices and monitor diplomatic developments closely. Exposure to oil and gas equities may benefit in the short term, while transportation and industrial sectors could face margin pressure. Hedging strategies may be prudent as uncertainty around U.S. involvement intensifies.

Airbus Dominates Paris Air Show as Boeing Retreats Amid Ongoing Crisis

Airbus led the Paris Air Show with over $21 billion in orders, including major deals with VietJet, EgyptAir and LOT, while Boeing maintained a subdued presence amid fallout from the Air India Dreamliner crash. Airbus showcased growing demand for its A321XLR and widebody A350s, reflecting airlines’ push for fuel efficiency and longer range. Boeing’s quieter stance follows years of reputational setbacks and delivery delays, despite still-strong global demand. Defense contracts also featured prominently amid heightened geopolitical tensions, with orders rising as governments boost military spending ahead of the upcoming NATO summit.

Investment Insight:

Airbus’ strong order pipeline reaffirms investor confidence in commercial aviation’s long-term recovery, particularly in fuel-efficient and long-range segments. Boeing’s strategic silence highlights reputational risk and regulatory exposure, though its fundamentals remain supported by robust backlog and state-backed deals. Defense exposure appears increasingly valuable in this climate, positioning diversified aerospace suppliers and contractors for continued momentum.

SpaceX Starship Explodes During Routine Test, Raising Concerns Over Lunar and Mars Timelines

SpaceX’s Starship rocket suffered a catastrophic explosion during a routine test at its Texas Starbase facility, marking the fourth such failure this year. No injuries were reported and an investigation is underway. Starship is critical to NASA’s Artemis III and IV missions as well as Elon Musk’s long-term plans for Mars colonization. The rocket’s sheer scale and complex systems continue to raise technical hurdles, with reliability concerns mounting ahead of key launch milestones, including the deployment of private space stations and future manned missions.

Investment Insight:

While SpaceX remains a privately held leader in aerospace innovation, recurring Starship failures may delay critical NASA and commercial contracts, impacting timelines for broader space infrastructure initiatives. Investors in aerospace and defense should monitor implications for suppliers and partners involved in deep space systems and orbital platforms. Long-term bets on space commercialization remain intact but carry increased execution risk in the near term.

Bank of England Holds at 4.25%, Signals August Rate Cut Possible Amid Global Uncertainty

The Bank of England held interest rates steady at 4.25% in June, with six of nine MPC members voting to maintain the current level. A more dovish tone emerged, however, as three members pushed for a 25 bps cut, citing soft domestic growth and easing wage pressures. Inflation remains elevated at 3.4%, with geopolitical tensions and rising oil prices threatening to reignite upward pressure. Policymakers emphasized they are “not on a pre-set path,” signaling flexibility ahead of a potential cut in August, depending on energy markets, trade policy and macroeconomic data.

Investment Insight:

With disinflation underway but geopolitical risks clouding the horizon, the BOE’s cautious tone suggests investors should expect rate adjustments only with clear justification. A summer rate cut remains likely, favoring gilts and rate-sensitive equities. Yet, any spike in oil or tariff fallout could reverse easing expectations. Stay alert to global developments and UK labor and CPI trends to refine positioning.

Conclusion:

This week underscores a market caught between persistent inflationary pressures and rising geopolitical instability. Central banks are exercising caution, balancing the need for policy flexibility with the reality of slowing growth and energy-driven inflation risks. Meanwhile, the aerospace and energy sectors reflect divergent fortunes: Airbus surges on robust demand, while SpaceX grapples with recurring technical setbacks. Escalating conflict in the Middle East adds to volatility, with oil markets and global risk sentiment at stake. For investors, active risk management and sector-specific positioning remain essential as monetary, geopolitical and technological variables converge in unpredictable ways.

Upcoming Dates to Watch:

- June 21st: Flash PMIs (US, EU, UK, Japan)

- June 23rd: Earnings from FactSet and Naspers ADR

- June 24th: U.S. Consumer Confidence Index

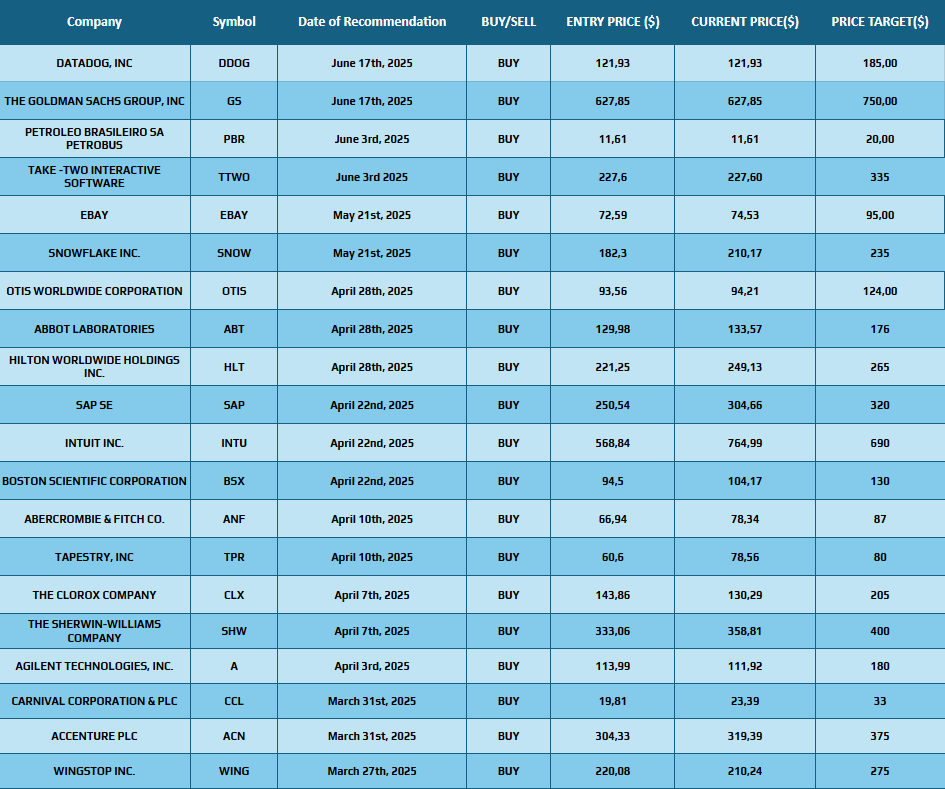

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.