Balfour Capital Group Partners with Fundstream to Launch Institutional-Grade Real Estate Credit Investment for High-Net-Worth Individuals

Date Issued – 10th April 2025

London, [Date] — Balfour Capital Group is pleased to announce the launch of a new institutional-grade investment product in partnership with Fundstream, a highly regarded Australian investment management firm specializing in secured real estate credit.

This exclusive offering provides high-net-worth individuals and institutional investors with access to consistent fixed returns of up to 8.1% p.a.* through a portfolio of first mortgage-secured loans on residential property. With zero exposure to construction lending, the strategy emphasizes capital preservation, monthly income generation, and low-risk diversification.

Fundstream has successfully managed over $720 million across more than 800 loans and is recognized for its disciplined credit philosophy and seasoned leadership. Their approach is rooted in conservative Loan-to-Value Ratios (LVRs) and rigorous credit assessment processes, ensuring a stable and secure investment experience. Learn more at www.fundstream.com.au.

“With this offering, Balfour Capital Group opens the door for high-net-worth individuals and institutions to access the same conservative lending strategies typically reserved for large financial institutions,” said Steve Alain Lawrence, Chief Investment Officer of Balfour Capital Group. “Working with true experts who know the risk model inside and out is paramount to us—and Fundstream exemplifies that.”

Fundstream combines deep credit expertise with proprietary technology through its SAIL™ Platform, a data-driven system designed to enhance decision-making across the lending lifecycle.

Developed in-house, the platform supports Fundstream’s credit team by evaluating security suitability, assessing borrower and guarantor creditworthiness, identifying fraud indicators, and automating key due diligence checks. This integration of technology and credit discipline enables faster, high-quality decisions while maintaining a strong risk management framework.

The credit team is led by experienced professionals with a proven track record in conservative lending and portfolio oversight.

The initiative will be led by Vikram A. Srivastava, Division Head of Asia (based in Hong Kong), and Johan Boos, Division Head of Europe. Their global leadership will ensure alignment with Balfour’s strategic investment objectives and a seamless integration into the firm’s broader advisory platform.

Balfour Capital Group Sydney Summit: Event Highlights

February 27, 2025 – Sydney, Australia

On February 27, 2025, Balfour Capital Group hosted its exclusive investor summit at the prestigious Four Seasons Hotel in Sydney, Australia. The invitation-only event brought together prominent investors, financial experts, and industry leaders to discuss crucial developments influencing global markets and economic strategies.

Overview of the Sydney Summit

The summit provided attendees an opportunity to connect directly with key figures in finance and investment, exploring recent shifts in the global economic landscape and emerging investment opportunities. The event emphasized the importance of shared knowledge and strategic collaboration.

Esteemed Speakers and Discussions

Key speakers included Steven Alain Lawrence, Chief Investment Officer at Balfour Capital Group, Hersh Oberoi, Division Head of Australia, and Vikram Aditya Srivastava, Head of Asia. Oberoi shared valuable insights from his extensive experience in financial market analysis, risk assessment, and portfolio management, highlighting the intricacies of Australia’s finances. Srivastava offered an expert perspective on investment management and innovation opportunities within Asia, reflecting on his extensive experience fostering startup investments and scaling enterprises.

Key Topics Explored

Participants actively discussed the implications of recent U.S. presidential policies, particularly under President Donald Trump, and their potential economic effects across Europe, Asia, and the Middle East. Panel discussions further explored geopolitical impacts, market strategies, and investment frameworks essential for navigating these evolving circumstances.

Networking and Strategic Engagement

The Sydney summit facilitated strategic networking among industry leaders and provided valuable platforms for direct interaction and exchange of investment strategies. Attendees capitalized on these networking sessions to form lasting professional relationships and exchange key insights.

Balfour Capital Group reaffirmed its commitment to delivering strategic financial guidance and fostering meaningful connections with its global clientele.

For more on this summit, please see The Event

BCG Monaco Finance Summit 2025

February 20, 2025 | Le Méridien Beach Plaza, Monaco

Balfour Capital Group successfully hosted its exclusive Investor Summit at the prestigious Le Méridien Beach Plaza in Monaco. This invitation-only event brought together top investors, financial experts, and advisors to discuss the latest global market developments and economic trends shaping 2025 and beyond.

Event Highlights

Expert Insights and Keynote Speakers

The summit featured a deep dive into the first 30 days of the new U.S. presidential administration under Donald Trump, examining new policies and their worldwide impact. Discussions provided attendees with strategic investment insights, focusing on economic shifts, geopolitical risks, and evolving financial markets across Europe, Asia, and the Middle East.

Industry leaders and keynote speakers, including Steven Alain Lawrence (Chief Investment Officer, Balfour Capital Group), Johan Boos (Division Head of Europe), and Matias Oscar Pejko (Division Head of Latin America and Spain), shared in-depth analyses on emerging financial landscapes.

Key Topics Addressed

Geopolitical Risks and Global Market Impacts

Attendees explored the implications of new U.S. policies on international trade, economic alliances, and market stability. Experts debated how shifting diplomacy and trade agreements could reshape global investment opportunities.

Interest Rate Trends and Financial Strategies

Rising interest rates continue to affect borrowing costs and investment returns. Analysts provided forecasts on central bank policies, inflation rates, and risk management strategies for long-term investors.

Energy Sector Developments

The financial landscape of the energy sector remains dynamic, with a strong focus on the transition to renewables and the evolving role of fossil fuels. The summit explored how U.S. energy policies influence global markets and investment trends.

AI and Fintech Disruption

The rise of artificial intelligence (AI) in finance was a major topic. Panelists discussed AI-driven quantitative analysis, automated trading, and the growing reliance on machine learning in investment decision-making.

Emerging Markets and Growth Opportunities

Experts identified key investment regions, highlighting high-growth Latin America, Asia, and Africa sectors. Discussions revolved around navigating risk in emerging economies and capitalizing on new opportunities.

Networking and Industry Collaboration

Beyond discussions and presentations, the summit provided unparalleled networking opportunities, allowing investors and financial professionals to build new partnerships and discuss investment strategies in a private, high-level setting.

Looking Ahead

Balfour Capital Group remains dedicated to guiding investors through an ever-changing financial landscape. The insights and strategies shared at this event will shape investment approaches for 2025 and beyond.

For additional insights and future event updates, visit our Event Calendar

Daily Synopsis of the New York market close – Dec 23, 2024

Date Issued – 19th December 2024

Preview

Asian stocks rebounded Monday, ending a six-day decline as softer US inflation data revived hopes for Federal Reserve rate cuts in 2025. The MSCI Asia Pacific Index rose, led by South Korea and Taiwan, while US equity futures gained and the dollar steadied after Friday’s slide. Semiconductor and computing stocks in China saw optimism despite broader concerns over global tariffs and sluggish recovery. Hedge funds trimmed nuclear tech exposure after a rally, shifting focus to uranium producers amid supply chain constraints. Oil prices climbed on policy optimism, though capped by concerns over China’s slowing consumption and global overcapacity. Japan’s bond market faces pressure with its largest supply in a decade as yields rise, fueling bearish sentiment. Bitcoin logged its first weekly drop since Trump’s victory, with a 7% decline amid hawkish Fed signals and ETF outflows, leaving its near-term outlook volatile. Investors are urged to diversify, monitor macroeconomic risks, and focus on undervalued opportunities across asset classes.

Markets Stabilize as Fed Rate Cut Bets Resurface

Asian stocks rebounded Monday, snapping a six-day losing streak, as softer-than-expected US inflation data revived hopes of Federal Reserve rate cuts in 2025. The MSCI Asia Pacific Index rose, with gains led by South Korea and Taiwan, while US equity futures climbed. Meanwhile, the dollar steadied after Friday’s 0.5% slide, and US Treasuries held firm in thin holiday trading.

Investor sentiment remains cautious, weighed by concerns over global tariffs under President-elect Trump and China’s sluggish recovery. In China, semiconductor and computing stocks saw gains, signaling optimism around innovation and policy support.

Investment Insight: Easing inflation could fuel Fed rate cut bets, offering short-term upside for equities. However, geopolitical risks, global tariffs, and economic uncertainty may constrain gains in 2024. Diversified strategies are key.

Investment Insight

The Fed’s cautious pivot suggests prolonged dollar strength and persistent pressure on global equities. Investors should brace for continued volatility in currency and bond markets while keeping an eye on inflation-linked assets.

Hedge Funds Scale Back Nuclear Tech Exposure After Rally

Hedge funds, including Tribeca Investment Partners and Segra Capital Management, are trimming their exposure to nuclear power stocks after a strong rally this year. Key players like Constellation Energy and NuScale Power saw massive gains, but stretched valuations and uranium supply-chain constraints have raised caution. While some funds are reducing nuclear tech holdings, others are pivoting to oversold uranium producers, betting on supply chain disruptions and potential Big Tech investments in nuclear energy.

Investment Insight: Nuclear stocks have seen explosive growth but now face valuation challenges. Investors may find better opportunities in uranium supply chain plays, which could benefit from rising demand and constrained supply in 2025.

Oil Prices Edge Higher on US Policy Optimism

Oil prices rose on Monday, with Brent crude at $73.20 per barrel and WTI at $69.77, buoyed by cooling US inflation data and expectations of policy easing that may support economic growth and energy demand. Risk assets, including equities, also gained after the US Senate passed legislation to avoid a government shutdown. However, lingering concerns over global growth, China’s projected peak oil consumption in 2027, and Fed caution limited optimism.

Investment Insight: Oil markets remain sensitive to macroeconomic signals. While easing inflation supports demand prospects, structural concerns like slowing Chinese consumption and global overcapacity may cap price rallies in 2024. Focus on diversified energy plays.

Japan’s Bond Market Braces for Largest Supply in a Decade

Japan is set to issue its largest supply of sovereign bonds in over ten years, as the Bank of Japan (BOJ) reduces its balance sheet and scales back purchases. A projected 64% increase in net bond supply for the next fiscal year, coupled with rising interest rates, adds pressure on investors navigating a bearish bond market. While some strategists believe short- and medium-term bonds can absorb the excess, others warn of worsening supply-demand imbalances and upward pressure on yields.

Investment Insight: Rising bond supply and higher yields signal challenges for Japanese government debt. Investors should monitor yield movements and consider opportunities in short- to intermediate-term bonds, which may offer better absorption capacity.

Bitcoin Logs First Weekly Decline Since Trump’s Victory

Bitcoin fell over 7% last week, marking its first weekly drop since Donald Trump’s election win. A hawkish Federal Reserve stance, signaling slower monetary easing, dampened market optimism despite Trump’s pro-crypto policies. Broader crypto markets, including Ether and Dogecoin, slid 10%. Bitcoin ended the week at $94,344, well below its $108,000 record high, as outflows from Bitcoin-focused ETFs and increased hedging in the options market weighed on sentiment. Analysts expect volatility ahead, especially with a record options expiry event on December 27.

Investment Insight: Bitcoin’s near-term outlook remains volatile amid low liquidity and macro headwinds. Long-term investors may find opportunities post-correction, but caution is warranted with key levels like $90,000 under pressure.

Conclusion

Markets are navigating a complex landscape of easing inflation, geopolitical risks, and shifting monetary policies. While hopes for Federal Reserve rate cuts in 2025 have lifted sentiment, concerns over China’s recovery, global tariffs, and stretched valuations in key sectors like nuclear tech and Bitcoin underline the need for caution. Rising oil prices and Japan’s bond market challenges further highlight the balancing act investors face. Diversification and a focus on undervalued opportunities, such as uranium supply chains or short-term bonds, may offer resilience. As volatility persists, staying attuned to macroeconomic signals and sector-specific shifts will be crucial heading into 2024.

Upcoming Dates to Watch

- December 23, 2024: Singapore CPI, UK GDP, Taiwan industrial production

- December 26, 2024: US initial jobless claims

- December 27, 2024: Japan Tokyo CPI, unemployment, retail sales

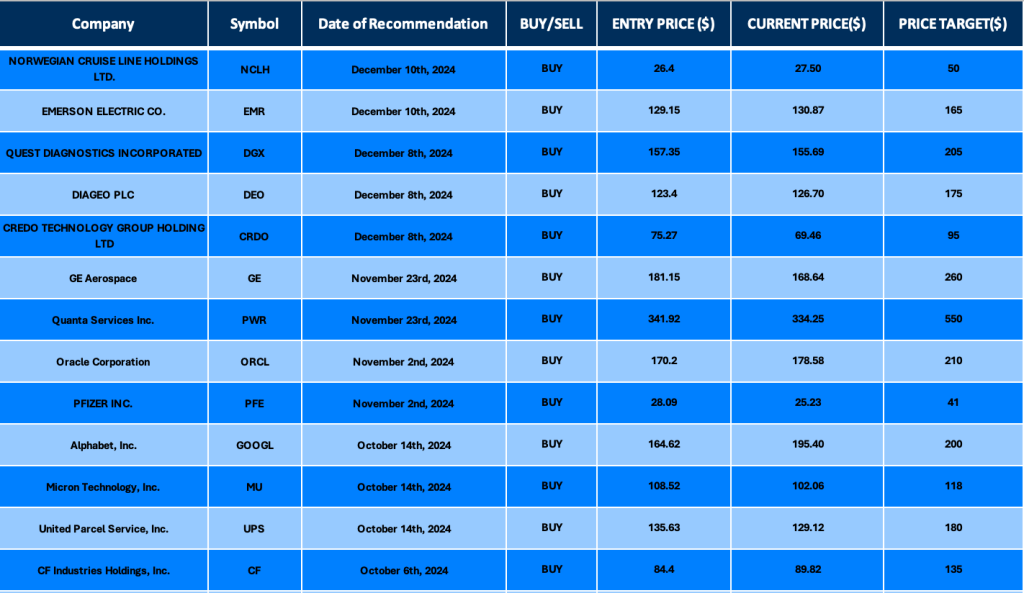

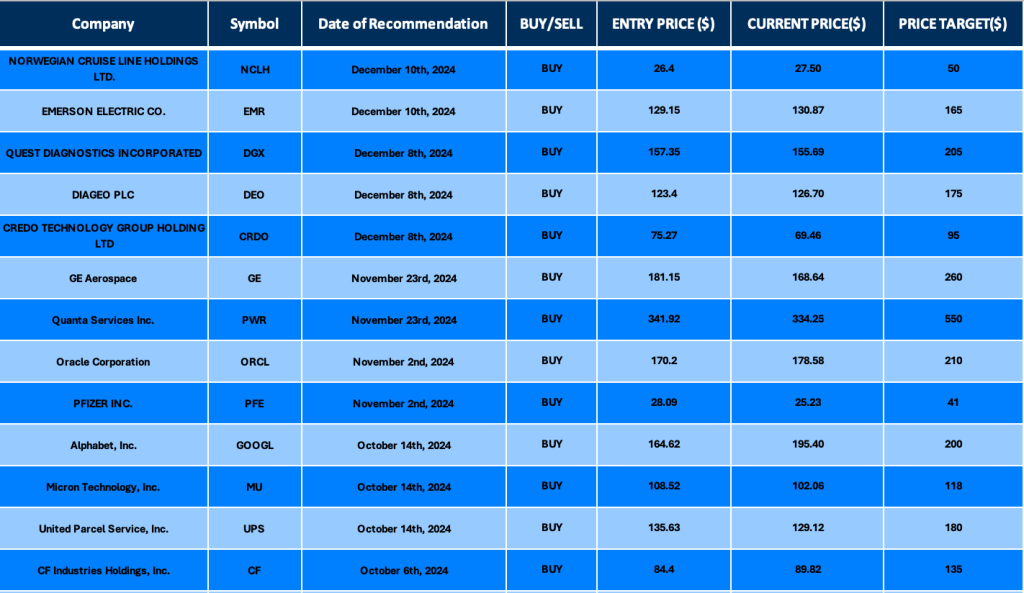

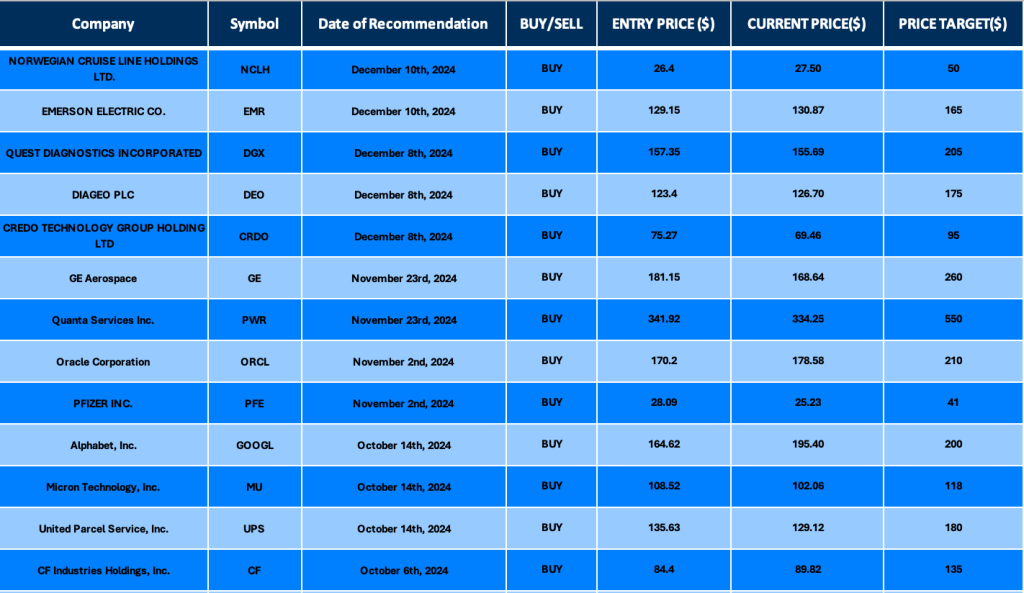

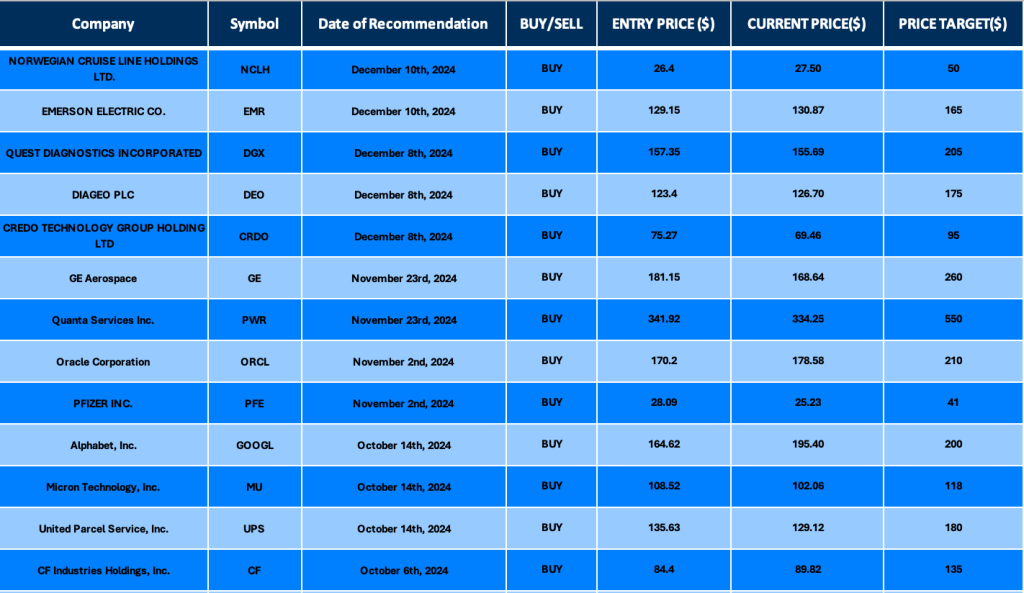

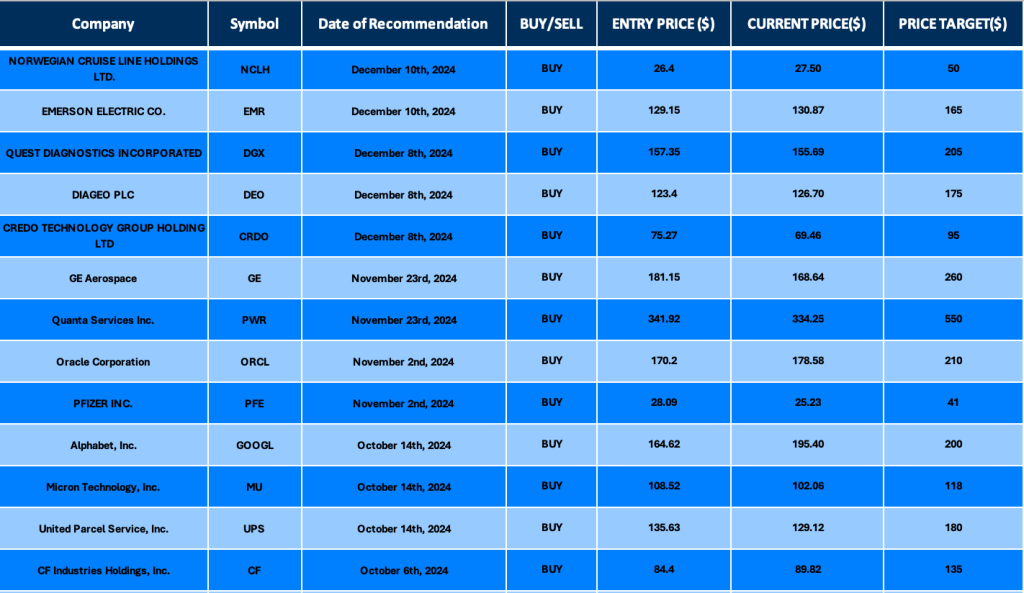

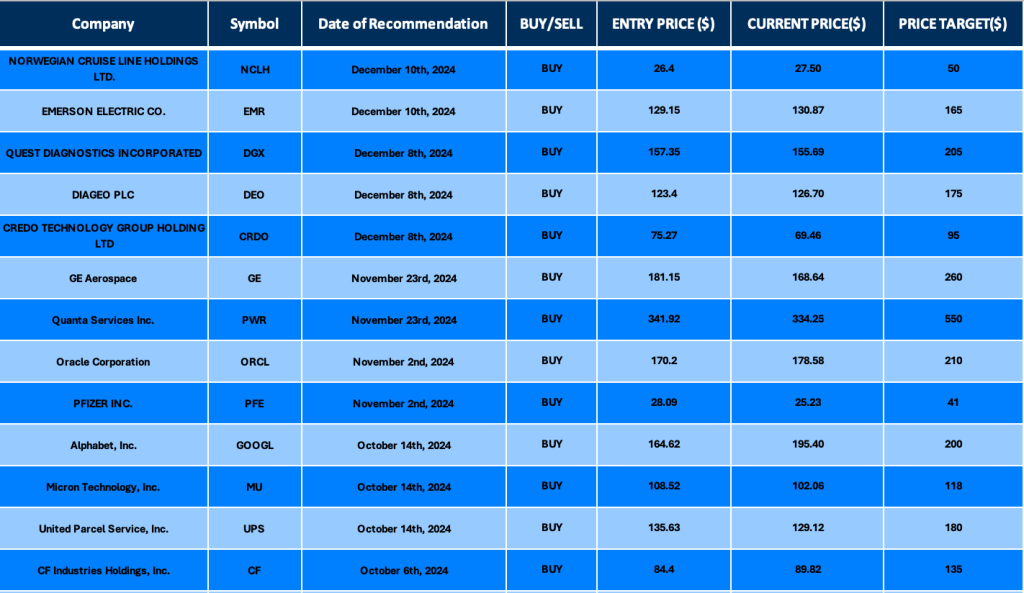

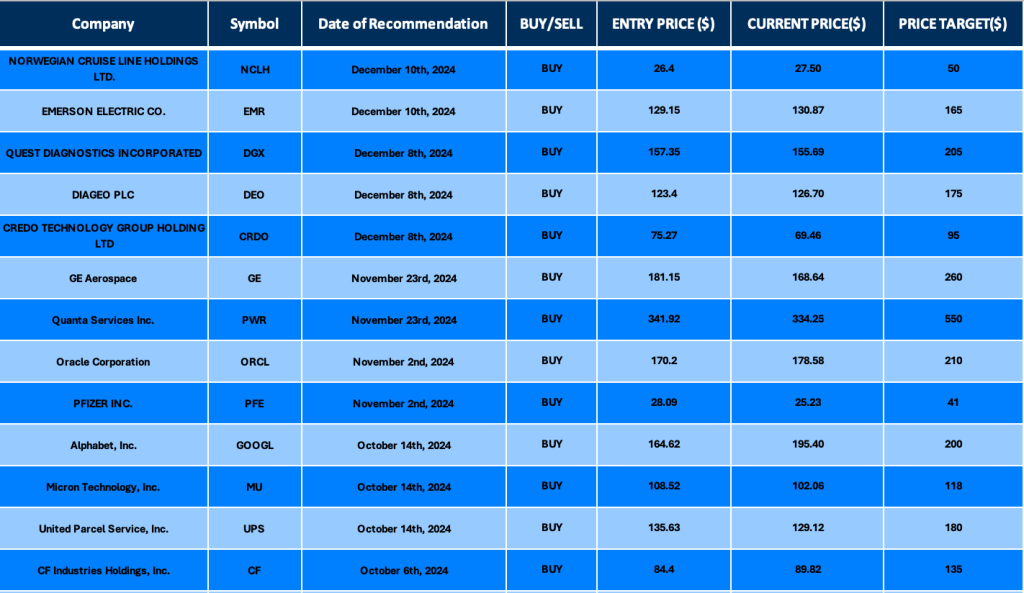

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – Dec 19, 2024

Date Issued – 19th December 2024

Preview

Asian stocks slipped Thursday after the Federal Reserve signaled slower rate cuts in 2025, while the Bank of Japan maintained its policy, weakening the yen. Wall Street mirrored global jitters, with the Dow plunging over 1,000 points as the Fed reinforced its “higher-for-longer” stance. Nvidia regained momentum after a December slump, with Chinese firms like ByteDance emerging as top AI chip buyers despite U.S. export controls. Battery giant CATL plans a $5 billion Hong Kong listing to fund global expansion, while Apple explores Chinese AI partnerships to counter Huawei’s competitive edge. Meanwhile, Foxconn eyes Nissan’s stake as Honda and Nissan discuss a potential merger to navigate EV and tech challenges. Investors face heightened volatility amid shifting market dynamics, geopolitical risks, and evolving corporate strategies.

Asian Stocks Slip as Fed Slows Rate-Cut Plans, BOJ Holds Steady

Asian equities dropped Thursday following the Federal Reserve’s signal of slower rate cuts in 2025, while the Bank of Japan held its policy steady, as expected. The Fed’s hawkish stance pushed the dollar to a two-year high, with the yen weakening to a one-month low of 155.43 per dollar. BOJ Governor Kazuo Ueda is set to address the decision and future rate hike plans amidst growing inflationary risks. Meanwhile, Wall Street losses mirrored global market jitters, with the Dow plunging over 1,000 points. The Fed now projects only two rate cuts by 2025, reinforcing the “higher-for-longer” narrative on interest rates.

Investment Insight

The Fed’s cautious pivot suggests prolonged dollar strength and persistent pressure on global equities. Investors should brace for continued volatility in currency and bond markets while keeping an eye on inflation-linked assets.

Nvidia’s AI Chip Orders Reveal Surprising Buyers Amid Market Shift

Nvidia (NVDA) is regaining ground after a December slump driven by concerns over slowing AI spending and rising competition. A recent Omdia report, based on supply chain analysis, highlights Nvidia’s top AI chip customers in 2024. Microsoft leads with 485,000 Hopper GPU orders, followed by ByteDance (230,000), Tencent, Meta Platforms, Tesla, Amazon, and Google. Notably, Chinese buyers ByteDance and Tencent rank high despite U.S. export controls limiting chip power. Meanwhile, Amazon and Google appear to be scaling back Nvidia reliance, favoring in-house chip development.

Investment Insight

As competition intensifies, Nvidia’s reliance on international markets, particularly China, heightens risk amid geopolitical uncertainties. Investors should monitor alternative AI chipmakers like Broadcom and shifts in U.S.-China trade policies.

Battery Giant CATL Eyes $5 Billion Hong Kong Listing

Contemporary Amperex Technology Co. Ltd. (CATL), the world’s largest EV battery maker, is considering a secondary listing in Hong Kong to raise at least $5 billion, potentially the city’s largest offering since 2021. The listing, expected as early as the first half of 2025, would support CATL’s overseas expansion efforts. CATL’s Shenzhen-listed shares have surged 65% this year, buoyed by government stimulus optimism, giving the company a market value of $164 billion. Analysts predict strong demand from international investors if the plan moves forward, pending regulatory approval.

Investment Insight

CATL’s Hong Kong listing could bolster its global growth ambitions while offering investors exposure to the EV supply chain. Keep an eye on Hong Kong market trends and CATL’s expansion strategy as key drivers of its valuation.

Apple Explores AI Partnerships in China Amid Market Challenges

Apple is in early talks with Tencent and ByteDance to integrate their AI models into iPhones sold in China, sources reveal. With ChatGPT unavailable in China due to regulatory restrictions, Apple is seeking local collaborators to deliver AI features like enhanced Siri capabilities. The move comes as Apple faces declining market share in China amid fierce competition from domestic brands like Huawei, whose AI-powered Mate 70 series is gaining traction. Discussions with Baidu over its Ernie AI model reportedly faced setbacks over data usage disputes.

Investment Insight

Apple’s push for local AI partnerships highlights its strategic pivot to retain relevance in China’s competitive smartphone market. Investors should monitor developments in AI integration and Apple’s ability to counter Huawei’s resurgence.

Market price: Apple Inc (APPL): USD 248.05

Foxconn Eyes Nissan Stake as Honda-Nissan Merger Talks Advance

Foxconn, the iPhone maker, is reportedly in talks with Renault, Nissan’s largest shareholder, about acquiring its 36% stake in the Japanese automaker, according to Taiwan’s Central News Agency. Nissan, struggling with slashed earnings forecasts and global job cuts, has yet to respond favorably to Foxconn’s direct approach. Meanwhile, Honda and Nissan are exploring a potential merger to counter competition from Toyota, Tesla, and Chinese automakers. Honda has threatened to withdraw its software partnership with Nissan if it aligns with Foxconn but may act as a “white knight” investor to block a hostile takeover. Official merger talks could begin as early as Dec. 23.

Investment Insight

The potential Honda-Nissan merger reflects the auto industry’s push for consolidation to tackle EV and tech challenges. Foxconn’s interest in Nissan signals its growing EV ambitions. Investors should track Renault’s stance and Honda’s strategic maneuvers.

Conclusion

Global markets are navigating a volatile landscape as central banks signal cautious policy shifts and geopolitical risks loom large. The Fed’s “higher-for-longer” stance pressures equities and currencies, while Nvidia, Apple, and CATL adapt to evolving market demands and international challenges. The potential Honda-Nissan merger and Foxconn’s growing EV ambitions reflect the auto sector’s push for consolidation. Investors must stay vigilant, balancing opportunities in AI, EVs, and inflation-linked assets against risks from U.S.-China tensions and tightening financial conditions. As uncertainties persist, strategic positioning in resilient sectors will be key to navigating 2024’s complex economic and market environment.

Upcoming Dates to Watch

- December 19, 2024: Japan rate decision

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close

Date Issued – 18th December 2024

Preview

Asian stocks edged higher Wednesday ahead of the Federal Reserve’s final rate decision for 2024, with Japan’s Nikkei down 0.2% but gains in Hong Kong, Shanghai, and South Korea. Nissan shares surged 22% on merger talks with Honda, while U.S. futures rose and Bitcoin retreated after hitting $108,000. The Fed is expected to cut rates, though robust U.S. retail data raises doubts about easing in 2025. In South Korea, the Bank of Korea maintained its 2% inflation target despite persistent price pressures. Meanwhile, Kioxia’s Tokyo IPO jumped 12% on optimism about data center demand, and SF Holding rose 3.5% in its Hong Kong debut despite concerns over China’s recovery. Nissan-Honda merger talks sparked record Nissan share gains, signaling potential industry consolidation. Investors remain cautious amid inflation risks, global market uncertainty, and lingering economic challenges. Focus shifts to the Fed’s decision, inflation trends, and recovery signals in tech, logistics, and auto sectors for future growth.

Asian Stocks Edge Higher Ahead of Fed Decision

Asian markets were broadly higher on Wednesday as investors awaited the Federal Reserve’s final interest rate decision for 2024. Japan’s Nikkei 225 dipped 0.2% amid mixed trade data, while Hong Kong’s Hang Seng and Shanghai’s Composite Index posted gains of 0.6% and 0.7%, respectively. South Korea’s Kospi rose 1%, buoyed by optimism. Meanwhile, Nissan Motor shares surged 22% following merger talks with Honda, though no agreement has been finalized.

U.S. futures also gained, while oil prices were mixed. The Fed is widely expected to cut rates for the third time this year, though strong U.S. retail data is raising questions about rate cuts in 2025. Bitcoin remains volatile after hitting a record $108,000 before retreating slightly.

Investment Insight: The Fed’s expected rate cut could provide short-term market lift, but persistent inflation and strong U.S. economic data may limit further easing in 2025. Stay cautious as global risk appetite may waver.

Bank of Korea Maintains 2% Inflation Target Amid Persistent Price Pressures

The Bank of Korea (BOK) announced it will keep its 2% inflation target, stating that a “low-inflation” era is unlikely in the next one to two years. Governor Rhee Chang-yong highlighted stable inflation expectations, though persistent price pressures from a strong dollar, climate change, and public utility costs remain. Despite weaker-than-expected consumer inflation at 1.5% last month, the BOK expects inflation to rise to the upper-1% range in early 2025 and stabilize near the target in the latter half of the year.

Investment Insight: Rising inflation pressures and a weakening currency suggest limited room for further rate cuts in South Korea. Investors should monitor inflation trends and currency movements closely, particularly for export-heavy sectors.

Kioxia Surges 12% in Tokyo IPO Debut Amid Investor Optimism

Memory-chip maker Kioxia Holdings Corp. jumped 12% in its Tokyo Stock Exchange debut, closing at ¥1,627—well above its IPO price of ¥1,455. The listing values the company at ¥877 billion ($5.7 billion), far below the $18 billion paid by Bain Capital and partners to acquire it in 2018. Despite a challenging backdrop of weak NAND memory prices, the IPO drew strong investor demand, helped by its relatively low valuation. Kioxia’s price-to-book ratio of 1.87 lags behind U.S. rival Micron’s 2.67, reflecting cautious optimism about a recovery in chip demand fueled by global data center investments.

Investment Insight: Kioxia’s debut highlights investor appetite for undervalued tech plays, but weak NAND pricing and global demand challenges could weigh on future growth. Investors should focus on broader tech recovery trends and Kioxia’s potential to capitalize on data-center expansion.

Nissan-Honda Merger Talks Spark Record Nissan Share Surge

Nissan Motor Co. and Honda Motor Co. are exploring a potential merger to create a formidable rival to Toyota and better compete globally. Nissan shares soared 24% on the news, marking their largest intraday gain ever, while Honda shares fell 3.4%. A merger would consolidate Japan’s auto industry into two key groups: Honda-Nissan-Mitsubishi and Toyota-led alliances. The talks, in early stages, could result in a new holding company. Both companies aim to strengthen their electric vehicle strategies and scale production to compete with Tesla and Chinese automakers. Analysts view the merger as a strategic move to address financial struggles and market challenges.

Investment Insight: If finalized, the merger could provide short-term relief for Nissan and long-term scale benefits for both automakers. However, overlapping operations and integration risks may pose challenges. Investors should watch for further announcements and implications for Japan’s auto sector dynamics.

Market price: Nissan Motor Co Ltd. (TYO: 7201): JPY 418.00

SF Holding Rises in Hong Kong Debut After $749 Million Listing

SF Holding Co., China’s largest express-delivery firm, saw a modest 3.5% rise in its Hong Kong trading debut following a $749 million IPO—the city’s second-largest listing this year. While its valuation offered a 25% discount to its mainland share price, investor enthusiasm was tempered by lingering concerns over China’s economic recovery and renewed trade tensions after Donald Trump’s U.S. election win. SF has grown rapidly, partnering with giants like Alibaba and JD.com, but its debut fell short of expectations, with analysts predicting stronger gains.

Investment Insight: SF’s discounted valuation appeals to long-term investors, but macroeconomic uncertainty and trade risks could weigh on performance. Watch for catalysts like China’s recovery momentum and global logistics demand to assess growth potential.

Market price: S.F. Holding Co Ltd. (HKG:6936): HKD 32.40

Conclusion

Markets are navigating a mix of optimism and caution as key economic decisions and corporate developments unfold. The Fed’s anticipated rate cut could provide short-term relief, but persistent inflation and strong U.S. data cloud the 2025 outlook. In Asia, the Bank of Korea’s inflation stance, Nissan-Honda merger talks, and Kioxia’s strong IPO debut highlight opportunities amid challenges. SF Holding’s modest Hong Kong debut reflects lingering concerns over China’s recovery. Investors should stay vigilant, focusing on inflation pressures, global demand trends, and industry-specific catalysts, as markets remain sensitive to economic shifts and evolving corporate strategies heading into 2024.

Upcoming Dates to Watch

- December 18, 2024: US Federal Reserve Economic Projections

- December 18, 2024: US interest rate decision

- December 18, 2024: UK/Eurozone CPI

- December 19, 2024: Japan rate decision

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close

Date Issued – 17th December 2024

Alibaba Plans to Sell Intime Department Stores for $1 Billion Amid Restructuring

Alibaba Group announced plans to sell its department store chain, Intime, to a consortium led by Youngor Fashion and Intime’s management for 7.4 billion yuan ($1.02 billion). The sale marks a strategic shift as Alibaba refocuses on its core e-commerce and cloud operations. The company, which acquired Intime in 2017 for $4 billion, will record a loss of 9.3 billion yuan on the transaction. The move comes as Intime struggles with waning consumer spending in China post-Covid. This divestment is part of broader restructuring efforts by Alibaba, which previously expanded aggressively into physical retail under former CEO Daniel Zhang.

Investment Insight:

Alibaba’s pivot away from brick-and-mortar reflects a sharper focus on high-margin tech sectors like cloud computing. The sale underscores challenges in China’s retail sector, signaling caution for investors exposed to consumer-driven stocks.

Cohere Partners with Palantir to Deploy AI Models for Enterprise Customers

Cohere, a prominent AI startup valued at $5.5 billion, is quietly collaborating with Palantir to deploy its language models to enterprise customers. Details shared at Palantir’s DevCon1 conference in November revealed that Cohere’s AI is already being accessed through Palantir’s Foundry platform, which serves commercial clients. While specific customers remain undisclosed, Cohere highlighted its ability to handle strict data constraints and perform inference in languages like Arabic, showcasing its technical versatility.

This partnership adds to Palantir’s growing AI ecosystem, which includes collaborations with startups like Anthropic, as it expands its footprint in both commercial and defense sectors. Cohere, known for its enterprise focus, has been less vocal about its defense-related engagements, declining to comment on potential military use cases.

Investment Insight:

Cohere’s collaboration with Palantir strengthens its position in the enterprise AI market, signaling opportunities for scalable growth. Investors should monitor how AI startups balance commercial ambitions with potential defense applications, which could impact public perception and regulatory scrutiny.

Walmart Partners with Meituan to Boost E-Commerce in China

Walmart China has announced a strategic partnership with Meituan, the country’s largest food delivery platform, to accelerate its e-commerce growth. The collaboration integrates Walmart stores into Meituan’s delivery ecosystem, capitalizing on the rapid growth of online shopping. Currently, nearly half of Walmart China’s sales come from e-commerce.

This follows Walmart’s decision to sell its $3.7 billion stake in JD.com earlier this year, signaling a shift toward building its own operations. Walmart has also expanded its Sam’s Club footprint in China, operating 50 stores to tap into the rising demand for membership-based retail.

Investment Insight:

Walmart’s partnership with Meituan leverages China’s robust delivery infrastructure, positioning it to better compete in a highly competitive market. For investors, the move signals Walmart’s commitment to localized strategies to drive growth in the Chinese retail sector.

China Targets Record Budget Deficit of 4% of GDP in 2025 Amid Growth Challenges

China plans to raise its budget deficit to a record 4% of GDP in 2025, up from this year’s 3% target, while maintaining an economic growth goal of around 5%, according to sources familiar with the discussions at recent high-level economic meetings. The increased deficit, amounting to 1.3 trillion yuan ($179.4 billion), is part of a “proactive” fiscal policy to counter a slowing economy, local government debt issues, and potential U.S. tariff hikes under President-elect Donald Trump.

China is also expected to issue more off-budget special bonds and adopt an “appropriately loose” monetary stance, signaling further rate cuts and liquidity injections. Meanwhile, pressure from weakened exports, a property crisis, and declining consumer demand continues to weigh on the world’s second-largest economy.

Investment Insight:

China’s record deficit signals a strong commitment to stimulus amid domestic and external pressures. Investors should watch for fiscal and monetary easing measures, but rising debt and trade risks could limit long-term growth prospects. Diversify exposure to mitigate volatility.

Australia Consumer Sentiment Falls as Economic Uncertainty Grows

Australian consumer confidence dropped 2% in December to 92.8 points, according to a Westpac survey, reflecting renewed concerns over inflation, high interest rates, and global instability. Despite improvement over the year, confidence remains below the 100-point threshold dividing optimism and pessimism. Economic growth stagnated in recent quarters, and homebuyer sentiment fell sharply, with the “time to buy a dwelling” index declining 6% to 81.6.

The biggest declines were in short- and long-term economic outlook sub-indexes, which fell 9.6% and 7.9%, respectively, erasing gains from prior months. However, sentiment toward purchasing major household items rose to a 2.5-year high, suggesting mixed consumer behavior as unemployment unexpectedly dipped to 3.9%.

Investment Insight:

The dip in sentiment underscores consumer caution, driven by inflation and interest rate pressures. Investors should monitor sectors tied to discretionary spending and housing, as uncertainty could weigh on recovery. Defensive stocks and essential goods may offer stability.

Conclusion:

Alibaba’s divestment of Intime signals a sharper focus on core operations amid China’s struggling retail sector, while Cohere’s partnership with Palantir underscores the growing enterprise AI market. Walmart’s collaboration with Meituan highlights the importance of localized strategies in a competitive Chinese e-commerce landscape. Meanwhile, China’s record budget deficit plan reflects intensified stimulus efforts to combat slowing growth and rising debt. In Australia, declining consumer sentiment points to lingering economic uncertainty despite pockets of optimism. Across these developments, shifting corporate strategies and fiscal policies emphasize the need for investors to balance opportunities in growth sectors with caution toward broader market risks.

Upcoming Dates to Watch:

- December 18, 2024: US Federal Reserve Economic Projections

- December 18, 2024: US interest rate decision

- December 18, 2024: UK/Eurozone CPI

- December 19, 2024: Japan rate decision

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close

Date Issued – 16th December 2024

Preview

This week, all eyes are on the Federal Reserve’s final meeting of 2024, where a 25-basis-point rate cut is anticipated. Fed Chair Jerome Powell’s comments on the 2025 outlook will be pivotal, especially as rate cuts may proceed more cautiously than expected. Key economic data on inflation, retail sales, and manufacturing will further shape market sentiment. In Asia, Chinese equities dragged regional markets after weak retail sales growth, while Japan bucked the trend with strong machinery orders. Globally, Bitcoin hit a record $106,000 amid speculation of a U.S. strategic reserve, and Palantir gained attention following its Nasdaq 100 inclusion. Meanwhile, the “Magnificent Seven” tech stocks sustain U.S. markets, though declining breadth is a concern. Investors should remain cautious, monitoring Powell’s remarks, China’s policy shifts, and Bitcoin’s regulatory outlook.

The Final Fed Meeting of 2024: Key Highlights for the Week Ahead

Investors are bracing for the Federal Reserve’s last meeting of the year on Dec. 18, where a widely expected 25-basis-point rate cut will be announced. Markets are closely watching Fed Chair Jerome Powell’s comments on the 2025 outlook, as the path for rate reductions appears less aggressive than previously anticipated. Economic updates on retail sales, the Fed’s preferred inflation gauge (PCE), and activity in manufacturing and services will also shape the week. Meanwhile, the “Magnificent Seven” tech stocks continue to buoy markets despite signs of declining breadth, with the Dow suffering its worst streak since 2020.

Investment Insight: Stay cautious as markets digest Fed signals. A slower pace of rate cuts could mean prolonged pressure on sectors sensitive to higher rates, favoring resilient growth stocks. Monitor inflation trends and Powell’s remarks for clarity on 2025.

Chinese Shares Drag Asian Markets Amid Weak Retail Data

Asian equities slumped as Chinese stocks weighed on the region following disappointing retail sales data. China’s retail sales grew just 3% year-on-year, missing forecasts of 5%, highlighting continued struggles in the world’s second-largest economy. The CSI 300 Index fell for a second day, dragging Hong Kong and Australian markets lower, while Japan posted gains. Investors remain cautious as Beijing’s recent consumption-boosting pledges lack concrete fiscal measures.

Meanwhile, Korea’s Kospi erased gains after President Yoon Suk Yeol’s impeachment, with the central bank pledging support to stabilize markets. Globally, traders are preparing for a week of central bank meetings, including the Fed, Bank of Japan, and Bank of England. In commodities, oil retreated on supply glut concerns, and gold remained stable.

Investment Insight: China’s economic weakness and lack of decisive stimulus could continue to pressure Asian markets. Investors should remain cautious on regional equities while monitoring potential policy shifts.

Bitcoin Hits Record High on Strategic Reserve Speculation

Bitcoin surged past $106,000 to a new record on Monday after President-elect Donald Trump hinted at plans to create a U.S. bitcoin strategic reserve akin to the oil reserve, fueling optimism among crypto investors. Trump’s pro-crypto stance, coupled with MicroStrategy’s inclusion in the Nasdaq-100 index, has bolstered sentiment, with Bitcoin now up 192% year-to-date. Smaller cryptocurrencies such as Ether also rallied, climbing 1.5% to $3,965.

While some analysts remain cautious about the feasibility of a bitcoin reserve, the market is responding to Trump’s crypto-friendly rhetoric and the broader embrace of digital assets by governments worldwide. Bitcoin’s total market value has nearly doubled this year, reaching over $3.8 trillion.

Investment Insight: Bitcoin’s record-breaking rally highlights its growing role as a speculative and institutional asset. Investors should monitor regulatory developments, as Trump’s pro-crypto policies could drive further gains but introduce volatility tied to policy implementation risks.

Japan’s Machinery Orders Beat Expectations in October

Japan’s core machinery orders rose 2.1% month-on-month in October, exceeding the 1.2% growth forecast by economists, and jumped 5.6% year-on-year, far outpacing the 0.7% prediction. Orders from manufacturers surged 12.5%, signaling strength in the manufacturing sector, while non-manufacturing orders dipped 1.2%. Despite the better-than-expected data, the Cabinet Office maintained its view that the recovery in machinery orders is pausing.

Investment Insight: Japan’s manufacturing sector shows resilience, but the subdued non-manufacturing activity and cautious outlook suggest uneven recovery. Investors should focus on capital spending trends, as they could signal broader economic momentum in the months ahead.

Palantir Gains Spotlight After Nasdaq 100 Inclusion

Palantir Technologies (PLTR) shares are set to attract attention after being added to the Nasdaq 100 Index, announced late Friday. The stock has more than quadrupled this year, fueled by growing demand for its AI-driven software solutions. This shift follows Palantir’s strategic move from the NYSE to Nasdaq, making it eligible for index inclusion alongside other high-growth tech companies.

The inclusion is expected to drive passive inflows and further institutional interest. However, analysts caution that overbought conditions, as indicated by a high relative strength index (RSI), could lead to near-term price fluctuations. Investors are also watching key support levels around $45 and between $33 and $29 as potential entry points during pullbacks.

Investment Insight: Palantir’s Nasdaq 100 inclusion underscores its growing prominence in AI-driven tech. While short-term volatility may arise, the firm’s AI adoption story and index visibility make it a key stock to monitor for long-term growth.

Market Price: Palantir Technologies Inc. (PLTR): USD 76.07

Conclusion

This week offers a critical mix of central bank decisions, economic data, and market-moving developments. The Federal Reserve’s final meeting of 2024 will set the tone for 2025, as investors assess the pace of rate cuts and inflation trends. Globally, China’s economic struggles and Bitcoin’s record rally highlight diverging opportunities and risks, while Japan’s strong machinery data signals resilience. Palantir’s Nasdaq 100 inclusion and the ongoing dominance of tech giants underline the tech sector’s influence. As markets navigate cautious optimism and potential volatility, staying focused on policy signals, economic trends, and sector-specific strength will be key for informed decision-making.

Upcoming Dates to Watch

- December 18, 2024: US Federal Reserve Economic Projections

- December 18, 2024: US interest rate decision

- December 18, 2024: UK/Eurozone CPI

- December 19, 2024: Japan rate decision

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close

Date Issued – 13th December 2024

Preview

Xiaomi’s stock has soared 103% this year, driven by strong momentum in its electric vehicle (EV) business, which now accounts for 10% of revenue. Demand for its SU7 sedan and upcoming YU7 SUV positions Xiaomi to rival smartphone revenues with EV sales by 2025. Meanwhile, Rio Tinto’s $2.5 billion investment in Argentina’s Rincon lithium mine underscores confidence in EV growth, despite falling prices. In Europe, central banks are cutting rates to brace for potential global disruptions tied to Donald Trump’s return, while Asian bond markets face $1.92 billion in outflows amid U.S. trade fears and a surging dollar. South Korean bonds, however, remain resilient due to global index inclusion. Costco capped the week with robust Q1 results, beating earnings estimates as membership income surged and same-store sales grew 7.2%. Despite tariff uncertainties, Costco’s pricing power and growth make it a standout in retail. Across sectors, EVs, geopolitical shifts, and resilient consumer plays dominate investor focus.

Xiaomi’s EV Push Powers 103% Stock Surge, Nears Record High

Xiaomi Corp.’s stock has more than doubled this year, surging 103% as the company rapidly establishes itself in China’s competitive electric vehicle (EV) market. Leveraging its expertise in marketing and manufacturing, Xiaomi’s EV business now contributes 10% of its total revenue, with strong demand for its SU7 sedan and an upcoming YU7 SUV poised to drive further growth. Analysts project EV sales could surpass smartphone revenues by 2025, with overall sales expected to double. Despite valuation concerns, bullish sentiment prevails as Xiaomi capitalizes on China’s booming EV market, outperforming rivals like Nio and Li Auto.

Investment Insight: Xiaomi’s successful entry into EVs reflects its operational efficiency and market agility. While the stock’s valuation at 27x forward earnings may seem stretched, its growth trajectory and dominance in China’s EV space could sustain investor enthusiasm.

Market price: Xiaomi Corp (HKG 1810): HKD 31.25

Rio Tinto’s $2.5 Billion Lithium Bet Aligns With Argentina’s Deregulation Push

Rio Tinto will invest $2.5 billion in Argentina’s Rincon lithium mine, marking a major win for President Javier Milei’s pro-business reforms. The project, supported by Milei’s RIGI incentives program, includes a processing plant with a capacity of 60,000 metric tons annually and is set to begin construction next year. Despite falling lithium prices, Rio is doubling down on Argentina’s lithium triangle, leveraging direct extraction technology to reduce environmental impact. This move aligns with Rio’s broader strategy to expand its battery metals portfolio amid growing global demand.

Investment Insight: Rio Tinto’s aggressive push into lithium signals confidence in long-term EV growth despite current market challenges. Investors should monitor risks tied to the novel extraction technology and fluctuating prices but may find opportunity in Rio’s strategic positioning in the lithium triangle.

Market price: Rio Tinto Ltd. (RIO): AUD 120.72

Europe Cuts Rates as Central Banks Brace for Trump’s Return

European central banks are easing rates to prepare for economic disruptions tied to Donald Trump’s second presidency. The Swiss National Bank made a surprise 0.5% rate cut, while the European Central Bank lowered its rate to a 1.5-year low, signaling further reductions in early 2025. Concerns about trade tensions, currency volatility, and slowing growth are prompting this dovish shift, with the ECB slashing its growth projections for 2025 to 1.1%. Analysts warn that additional cuts may be needed as inflation risks ease and geopolitical uncertainty looms.

Investment Insight: Eurozone rate cuts reflect mounting economic caution ahead of global trade shifts under Trump. Investors should anticipate prolonged accommodative monetary policy but remain vigilant about risks tied to sluggish growth and geopolitical turbulence.

Asian Bonds See $1.92 Billion Outflows Amid Trump Policy Fears, Strong Dollar

Asian bond markets faced $1.92 billion in foreign outflows in November, marking the first net sales in seven months. Concerns over U.S. trade restrictions under the incoming Trump administration and a surging dollar weighed on investor sentiment. Indonesian bonds saw $1.8 billion in foreign outflows, while Thailand and Malaysia posted their second consecutive month of declines. The Malaysian ringgit, Thai baht, and South Korean won each fell 1.5% against the dollar. However, South Korean bonds bucked the trend with $1.07 billion in inflows, buoyed by their future inclusion in the FTSE Russell’s WGBI.

Investment Insight: Rising U.S. trade tensions and a strong dollar are pressuring Asian bond markets, signaling potential volatility ahead. Investors should monitor currency risks and focus on markets like South Korea, which may benefit from structural tailwinds like global index inclusion.

Costco Beats Expectations With Strong Sales Growth Amid Mixed Consumer Trends

Costco delivered solid fiscal Q1 results, with adjusted earnings per share of $4.04 beating estimates of $3.81 and revenue of $62.15 billion exceeding expectations of $61.98 billion. Same-store sales grew 7.2%, driven by U.S. performance, while foot traffic rose 5.1%. Membership income increased 7.8% following a September fee hike, with renewal rates hitting 90.4%. E-commerce sales grew 13.2%, slightly missing estimates. Management acknowledged uncertainty around potential Trump-era tariffs, citing strategies like alternative sourcing to mitigate risks. Year-to-date, Costco shares are up over 50%, significantly outpacing the S&P 500.

Investment Insight: Costco’s resilience in a challenging retail environment highlights its pricing power and membership model’s strength. While tariff risks loom, its capacity to manage costs and sustain growth positions it as a defensive play for long-term investors.

Market price: Costco Wholesale Corporation (COST): USD 988.39

Conclusion

This week’s market movements highlight a landscape shaped by innovation, geopolitical shifts, and investor adaptability. Xiaomi’s EV success underscores the transformative potential of new ventures, while Rio Tinto’s lithium bet reflects confidence in the EV boom despite price pressures. Central banks in Europe signal caution amid Trump-era uncertainties, as Asian bonds face volatility from trade fears and a strong dollar. Meanwhile, Costco’s strong performance showcases resilience in a challenging retail environment. From EV growth to shifting monetary policies, the week reaffirms the need for investors to balance optimism with vigilance in navigating an evolving global economy.

Upcoming Dates to Watch

- December 18, 2024: US Federal Reserve Economic Projections

- December 18, 2024: US interest rate decision

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close

Date Issued – 12th December 2024

Preview

Asian stocks rallied Thursday as softer US inflation data strengthened expectations of a Federal Reserve rate cut, with the MSCI Asia Pacific Index hitting a one-month high. Japanese and Hong Kong markets led gains, while Australia’s jobless rate fell unexpectedly, tempering RBA rate-cut bets and boosting the Australian dollar. Meanwhile, Alphabet surged to a record high on AI and quantum breakthroughs, while Nvidia expanded in China despite U.S. trade restrictions. The Biden administration escalated trade tensions with higher tariffs on Chinese solar and tungsten imports, signaling supply chain shifts. Investors eye opportunities in Asian tech stocks, resilient Australian assets, and U.S. innovation leaders like Alphabet, but geopolitical risks remain a concern.

Asian Markets Rally as US Inflation Data Supports Fed Rate Cut

Asian stocks climbed on Thursday, buoyed by expectations of a Federal Reserve rate cut following benign US inflation data. The MSCI Asia Pacific Index hit a one-month high, led by gains in Japanese and Hong Kong markets. US consumer price index data aligned with forecasts, cementing a 25-basis-point rate cut later this month, as swaps traders now price in near-certainty of the move. Meanwhile, Australian bond yields and the dollar rose on stronger-than-expected employment data, while China’s yuan gained after authorities set a firmer currency fixing. The Nasdaq 100’s record rally on Wednesday further propped up sentiment in technology stocks.

Elsewhere, South Korea’s political turbulence weighed on the won, oil steadied after a three-day rally, and traders awaited ECB and Swiss National Bank rate decisions. Bitcoin slipped slightly, while Ethereum saw gains.

Investment Insight: Lower US inflation strengthens the case for a Fed rate cut, bolstering risk-on sentiment in equities. Investors may find opportunities in Asian tech stocks, but geopolitical and currency risks, particularly in South Korea and China, warrant close monitoring.

Australia’s Jobless Rate Hits 8-Month Low, Easing Rate-Cut Bets

Australia’s unemployment rate unexpectedly fell to 3.9% in November, its lowest level since March, defying forecasts of a rise to 4.2%. Employment rose by 35,600, outpacing expectations, and full-time job gains led the increase. The robust labor market prompted markets to scale back chances of a Reserve Bank of Australia (RBA) rate cut in February, with swap-implied probabilities dropping to 55% from 68%. The Australian dollar gained 0.6% to $0.6409, while bond futures fell. Analysts noted that while soft economic growth and muted wage gains previously raised the odds of a rate cut, the resilient labor market tempers this expectation.

Investment Insight: Australia’s strong labor market reduces the likelihood of near-term rate cuts, boosting the Australian dollar. Investors should monitor upcoming Q4 CPI and employment data for further clarity on RBA policy, as steady rates may support equities and local currency bonds.

Alphabet Hits All-Time High on AI and Quantum Breakthroughs

Alphabet’s stock surged over 5% to a record high on Wednesday, fueled by the unveiling of its advanced AI model, Gemini 2.0, and optimism around President-elect Trump’s nomination of Andrew Ferguson to lead the FTC. Investors anticipate a friendlier regulatory climate under Ferguson. The rally also followed Alphabet’s introduction of its new quantum computing chip, Willow, which Bank of America analysts say underscores the company’s innovation leadership, though commercial applications remain distant. Alphabet’s shares have climbed nearly 40% year-to-date, with analysts maintaining a “buy” rating and a $210 price target.

Investment Insight: Alphabet’s advancements in AI and quantum computing strengthen its competitive edge, while a potentially softer regulatory stance could ease investor concerns. Long-term investors may find value in Alphabet’s innovation-driven growth, despite regulatory and technological uncertainties.

Market price: Alphabet Inc (GOOG): USD 196.75

US Raises Tariffs on Chinese Solar and Tungsten Imports

The Biden administration announced sharp tariff increases on Chinese imports of solar wafers, polysilicon, and tungsten products. Starting January 1, tariffs on solar materials will rise to 50%, while tungsten duties will increase to 25%. The move, aimed at protecting U.S. clean energy industries and supply chain resilience, follows a broader review of Chinese trade practices. This escalation comes amid heightened trade tensions, with Beijing recently restricting exports of critical minerals like gallium and graphite to the U.S. Analysts warn tungsten could become a flashpoint, given its strategic importance and China’s dominance in its production.

Investment Insight: Tariff hikes signal continued trade frictions and could drive up costs for U.S. clean energy and manufacturing sectors. Investors may look to domestic suppliers and alternative markets in Africa or Southeast Asia as potential beneficiaries of supply chain shifts.

Nvidia Expands in China to Boost AI and Autonomous Driving R&D

Nvidia has significantly expanded its workforce in China, growing its headcount from 3,000 to 4,000 this year, including the addition of 200 researchers in Beijing focused on autonomous driving technologies. Despite U.S. trade restrictions limiting sales of its most advanced AI chips, China remains a key research hub and market for Nvidia, contributing $5.4 billion in sales during the September quarter. The company is also strengthening after-sales service and networking software teams in the region. Meanwhile, a fresh antitrust probe into Nvidia’s 2020 Mellanox acquisition signals rising tensions amid the U.S.-China trade dispute.

Investment Insight: Nvidia’s strategic investment in China underscores the region’s centrality to AI and EV innovation. However, escalating U.S.-China trade tensions and regulatory risks could weigh on long-term prospects. Investors should balance Nvidia’s growth potential against geopolitical uncertainties.

Market Price: NVIDIA Corp (NVDA): USD 139.31

Conclusion

Global markets are navigating a mix of optimism and caution. Softer US inflation data has bolstered hopes for a Fed rate cut, lifting Asian equities, while Australia’s strong labor market challenges expectations of RBA easing. Alphabet’s AI and quantum strides highlight innovation-driven growth, while Nvidia’s expansion in China underscores the region’s importance despite trade tensions. However, escalating U.S.-China tariffs and geopolitical risks, particularly in South Korea, could temper sentiment. Investors should balance opportunities in resilient labor markets, tech innovation, and shifting supply chains with the uncertainties posed by regulatory and geopolitical challenges across key markets.

Upcoming Dates to Watch

December 12, 2024: US PPI

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.