Daily Synopsis of the New York market close

Date Issued – 19th September 2024

Market Outlook Hinges on Fed’s Bold Rate Cut: Soft Landing in Sight?

In what many are calling a pivotal moment for monetary policy, the Federal Reserve’s recent decision to lower interest rates by 50 basis points has captured the attention of the financial world. This substantial cut, the first in more than four years, signals the central bank’s efforts to shield a resilient economy from a rapid slowdown. But as investors digest the news, one key question emerges: will this timely intervention allow the U.S. economy to land softly, or is a more turbulent descent ahead? The Fed’s dramatic rate cut comes as a preemptive move, not a panicked response. Chair Jerome Powell emphasized that the reduction was meant to “recalibrate” the policy in light of falling inflation, rather than to address acute weaknesses in the labor market. While many expected a rate cut, the sheer scale surprised the market, sparking debates about the central bank’s foresight and the future trajectory of growth.

Market Reaction: A Momentary Pause?

Despite the sizable rate cut, markets reacted with cautious optimism. Initially, stocks and bonds rallied before retreating to more modest levels. The S&P 500, after a volatile session, closed down 0.3%, although the index remains up nearly 18% for the year. Investors are now grappling with mixed signals: some are skeptical about whether the Fed’s move was too late to mitigate labor market weakness, while others see it as a bullish signal for risk assets. Eric Beyrich, co-CIO of Sound Income Strategies, highlighted market ambivalence: “For many, this was a surprise. The Fed’s bold move makes some wonder, what risks do they see that we might be missing?”

Is a Soft Landing Still Possible?

Amid mounting concerns over labor market softening, the prospect of a “soft landing” remains central to market hopes. Investors are betting that the Fed can cool inflation without triggering a recession. Historically, rate cuts in non-recessionary periods have propelled equity markets, with the S&P 500 posting a 14% average gain six months after the first cut. This pattern offers hope for a continued bull market in 2024, but the risks remain. Jeff Schulze, head of market strategy at ClearBridge Investments, remains optimistic: “This rate cut boosts the chances of the Fed achieving a soft landing, which would be hugely bullish for risk assets.”

Long-Term Impact: Adjusting to a New Normal

The Fed’s forward-looking guidance also provides insight into its evolving stance. Although deeper rate cuts are now expected, the Fed’s longer-term rate forecasts remain above market expectations, reflecting a cautious approach. Some market participants, like Vanguard’s John Madziyire, expect bond yields to adjust accordingly: “The market’s pricing of rate cuts was aggressive. A correction in long-term yields is a logical response.” However, geopolitical uncertainty, especially with the upcoming U.S. presidential election, adds complexity to the path forward. Andrzej Skiba of RBC Global Asset Management warns that trade tensions under a Trump presidency could reignite inflationary pressures, limiting the Fed’s ability to continue cutting rates. As the Fed navigates this delicate balancing act, markets remain on edge, hoping that the bold rate cut was the right move at the right time to guide the U.S. economy towards a stable and prosperous future.

Global Economy ‘Stronger than Expected,’ in 2024 Citi Says

Citi analysts have raised their expectations for the global economy in 2024, predicting it will perform better than initially expected, driven by easing interest rates and strong momentum in some emerging markets. While the global economy is forecast to grow by 2.5%, this figure is slightly below last year’s growth. However, the overall outlook is more positive due to favorable monetary conditions, despite challenges in key developed markets and China.

Key Highlights from Citi’s Global Economic Outlook:

- Developed Economies Slowing Down: Growth in major developed economies like the U.S., UK, and Canada is expected to soften significantly in the second half of 2024. Citi forecasts stagnation in the Eurozone, with particular weakness in Germany. Meanwhile, Japan may experience a mild contraction in its gross domestic product (GDP), despite some expected uptick in consumer spending, which could drive inflation higher. The Bank of Japan is expected to raise interest rates further by the end of the year.

- China’s Weak Consumer Sentiment: China is cited as a key concern due to weaker-than-expected consumer spending and declining economic momentum, especially in manufacturing and services. The country’s property sector has shown no sign of recovery, which has compounded the economic slowdown. Citi expects Chinese GDP growth to hit 4.7% in 2024, falling short of the government’s 5% target. Despite these challenges, the Chinese government has been slow to roll out robust stimulus measures, raising doubts about the effectiveness of its fiscal policies.

- U.S. Resilience with Uncertainty: While the U.S. economy remains somewhat uncertain, resilience in consumer spending and a deeper easing cycle from the Federal Reserve are likely to support some growth. However, a cooling labor market presents risks, as recent indicators suggest steady deterioration in job conditions. This could undermine economic momentum if the trend continues.

- Emerging Markets Strengthening: One of the more optimistic parts of Citi’s report is the outlook for emerging markets. The easing interest rates in developed economies are expected to spur broader monetary easing cycles in these regions, which will help boost their economic growth. Emerging markets are expected to gain more traction as global conditions become more favorable.

Conclusion

While developed economies face stagnation and contraction in certain areas, easing monetary policies and a more positive outlook for emerging markets offer some optimism for the global economy in 2024. However, China’s sluggish growth and slow policy response remain major concerns that could temper overall global growth momentum.

Tupperware’s Bankruptcy: How a Household Name Struggled to Adapt in the Digital Era

Tupperware Brands Corporation, once a dominant force in the world of food storage, has filed for Chapter 11 bankruptcy protection. Despite enjoying a temporary surge in sales during the pandemic, the company has struggled to remain relevant in today’s fast-evolving retail landscape. Here’s a breakdown of the reasons behind Tupperware’s financial decline and what the future might hold for this iconic brand.

The Downfall: What Went Wrong for Tupperware?

In its bankruptcy filing, Tupperware cited a “challenging macroeconomic environment” as a key driver of its financial troubles. This reference to inflation, rising interest rates, and reduced consumer spending highlights the pressures many businesses face today. However, a closer look at the company’s history reveals deeper, structural problems that stretch far beyond external economic conditions. For decades, Tupperware’s business model relied heavily on its direct-selling strategy using independent consultants to market its products through personal networks. While this approach was highly effective in the 20th century, it began to falter in the digital age. According to the bankruptcy petition, Tupperware’s commitment to direct sales came at the cost of developing a robust omnichannel or e-commerce infrastructure. This critical misstep left the company ill-equipped to compete in a world where online shopping has become the norm.

Lagging in the E-Commerce Revolution

By 2023, nearly 90% of Tupperware’s sales still came through its traditional direct-sales channel a staggering statistic in an era dominated by digital commerce. The company only ventured into online sales in the 2020s, decades after e-commerce became an essential component of retail success. Tupperware didn’t open its Amazon storefront until June 2022, and began selling on Target.com just months later in October. This delay proved costly, as competitors quickly captured market share. In its court filings, Tupperware acknowledged the severe impact of this delayed digital transformation, stating that its online presence remains weak and that search results on platforms like Amazon frequently promote rival brands like Rubbermaid.

What’s Next for Tupperware?

Despite its financial woes, Tupperware plans to continue operating while restructuring under Chapter 11. The company’s strategy focuses on preserving its iconic brand while transitioning into a “digital-first, technology-led” business model. The specifics of this turnaround plan remain unclear, but it will likely include expanding its e-commerce presence and strengthening online marketing efforts to capture a larger share of the digital marketplace. Tupperware has also indicated that it will seek approval from the bankruptcy court to facilitate a potential sale of the business. The goal is to find a buyer who can protect the brand’s legacy while accelerating its digital transformation.

Fierce Competition Ahead

Even with a fresh strategy, Tupperware faces stiff competition in the online marketplace. As its court filing reveals, even after launching on Amazon, the company’s products are often overshadowed by competitor offerings. The challenge now will be to leverage effective marketing and branding strategies to stand out in a crowded digital space.

Tupperware’s Legacy: From Market Leader to Penny Stock

Founded in 1938, Tupperware once revolutionized household storage and enjoyed decades of dominance in its field. However, its stock has plummeted from an all-time high of over $74 per share in April 2017 to less than 51 cents as of today. Year-to-date, Tupperware shares have fallen over 74%, underscoring the severity of its financial distress. As the company attempts to navigate bankruptcy, it faces the daunting task of modernizing its business while maintaining the iconic status of its brand. Whether Tupperware can evolve and recapture its former glory remains to be seen, but its story serves as a cautionary tale for legacy brands that fail to adapt to the digital age.

China’s Quest to Rival Nvidia in AI Chips Faces Significant Challenges

China is ramping up efforts to create a domestic rival to Nvidia, the American semiconductor giant whose chips power many of today’s advanced AI applications. Despite its ambitions, China is struggling to keep pace, hindered by U.S. sanctions and technological gaps. Here’s a closer look at the challenges China faces in trying to compete with Nvidia and the companies vying for leadership in this critical space.

The Rise of AI and Nvidia’s Dominance

Nvidia’s surge in demand stems from its cutting-edge Graphics Processing Units (GPUs) that power artificial intelligence (AI) models, such as those behind OpenAI’s ChatGPT. These GPUs are critical for training large datasets, enabling applications like chatbots and other advanced AI technologies. However, U.S. sanctions imposed since 2022 have restricted China’s access to Nvidia’s most advanced chips, a major obstacle in Beijing’s goal to become a leader in AI.

China’s Emerging Contenders

Chinese companies such as Huawei, Alibaba, Baidu, and startups like Biren Technology and Enflame have made notable progress in developing AI chips. However, analysts agree they are still lagging behind Nvidia. According to Wei Sun, a senior analyst at Counterpoint Research, these companies are focusing on application-specific integrated circuits (ASICs) but struggle to close the gap in general-purpose GPUs, making it unlikely that they will match Nvidia in the short term.

U.S. Sanctions and Technological Bottlenecks

The biggest roadblock to China’s semiconductor aspirations remains U.S. sanctions, which have blacklisted some of the country’s leading companies and restricted access to critical AI-related technology. Many of China’s chip designers previously relied on Taiwan Semiconductor Manufacturing Co. (TSMC) for production. However, due to U.S. restrictions, they now turn to China’s largest chipmaker, Semiconductor Manufacturing International Corporation (SMIC). SMIC, however, lags behind TSMC, in part because it lacks access to crucial equipment from Dutch company ASML needed to produce the most advanced chips. Adding to the complexity, Huawei has been using much of SMIC’s production capacity for its own chips, leaving less room for other Chinese GPU startups to scale their manufacturing.

Nvidia’s Competitive Edge: More than Just Hardware

Nvidia’s dominance isn’t limited to hardware. Its success is deeply tied to its CUDA software platform, which enables developers to build applications for Nvidia’s hardware, creating a robust ecosystem around its products. According to Paul Triolo, a partner at consulting firm Albright Stonebridge, this integrated ecosystem of hardware, software, and developer tools gives Nvidia a significant advantage that is difficult for others to replicate.

Huawei Leads the Pack, but Challenges Remain

Among China’s competitors, Huawei appears to be leading with its Ascend series of processors for data centers. The company’s upcoming Ascend 910C could be comparable to Nvidia’s H100 chip, according to reports. While Huawei is a key player, it faces similar hurdles to the rest of the industry, such as U.S. export controls and production limitations at SMIC, which restrict its ability to manufacture advanced GPUs.

IPOs and the Future of China’s AI Chip Ambitions

China’s chip startups, like Biren Technology and Enflame, are pushing forward despite these setbacks. Both companies are reportedly looking to go public in Hong Kong to raise capital for expansion and talent acquisition. While these firms have skilled personnel, many with experience from Nvidia and AMD, they lack the financial resources of a tech giant like Huawei, which further complicates their road to success.

Conclusion

China’s efforts to develop a domestic Nvidia competitor are stymied by both internal challenges and external pressures from U.S. sanctions. While companies like Huawei, Biren, and Enflame are making progress, the road to rivaling Nvidia is steep and fraught with obstacles. With technological bottlenecks, limited manufacturing capabilities, and a lack of comprehensive software ecosystems, it’s clear that China’s ambition to lead in AI chip production is still far from being realized.

UN Advisory Body Proposes Seven Key Recommendations for AI Governance

An artificial intelligence (AI) advisory body established by the United Nations has released its final report, offering seven crucial recommendations aimed at addressing AI-related risks and governance challenges. As AI technology continues to evolve rapidly, particularly following the release of OpenAI’s ChatGPT in 2022, concerns about misinformation, copyright infringement, and social control have intensified globally. The 39-member advisory group, formed last year, has urged the international community to tackle the gaps in AI governance, with the recommendations set to be discussed at an upcoming U.N. summit in September.

Key Recommendations:

- Global AI Panel for Scientific Knowledge: The advisory body recommends the creation of a global panel that would offer impartial and reliable scientific expertise on AI developments. This panel would address the information asymmetry that exists between AI labs and other sectors, ensuring that AI technologies are understood and regulated effectively.

- Policy Dialogue on AI Governance: The U.N. advocates for a new global policy dialogue dedicated to AI governance, with the goal of fostering international cooperation and collaboration on AI regulation and responsible development.

- AI Standards Exchange: Establishing an AI standards exchange is seen as critical for ensuring that AI technologies meet consistent global benchmarks, enhancing transparency and accountability in the development and use of AI systems.

- Global AI Capacity Development Network: The report calls for the creation of a capacity development network that would support governance capabilities around the world, helping nations, particularly those with fewer resources, to keep pace with AI advancements and ensure responsible AI deployment.

- Global AI Fund: The advisory group recommends establishing a global AI fund to address the gaps in capacity and collaboration, particularly in under-resourced regions. This fund would support the equitable distribution of AI benefits while addressing potential risks.

- Global AI Data Framework: A global AI data framework is proposed to ensure transparency, accountability, and ethical data use in AI applications. This framework would also address privacy concerns and the need for responsible handling of data in AI systems.

- Small AI Office for Coordination: Finally, the U.N. advisory body recommends the creation of a small, dedicated AI office to coordinate the implementation of these proposals and ensure that progress is made toward responsible AI governance at a global scale.

The Global Context

The recommendations come at a time when AI regulation is still largely fragmented. The European Union has led the way with its comprehensive AI Act, while the U.S. has taken a voluntary compliance approach, and China has focused on maintaining state control. Additionally, on September 10, the U.S., along with 60 other countries, endorsed a “blueprint for action” aimed at governing the responsible use of AI in military applications, though China opted out of the non-binding agreement.

As AI development remains concentrated in a few large multinational corporations, the U.N. advisory body emphasized the danger of AI technologies being imposed on the global population without adequate representation or control. The recommendations are seen as a significant step toward ensuring that AI is governed in a way that is transparent, accountable, and beneficial for all. These proposals, if adopted, could form the foundation for an international framework that balances innovation with ethical considerations, creating a global approach to AI governance that addresses both risks and opportunities.

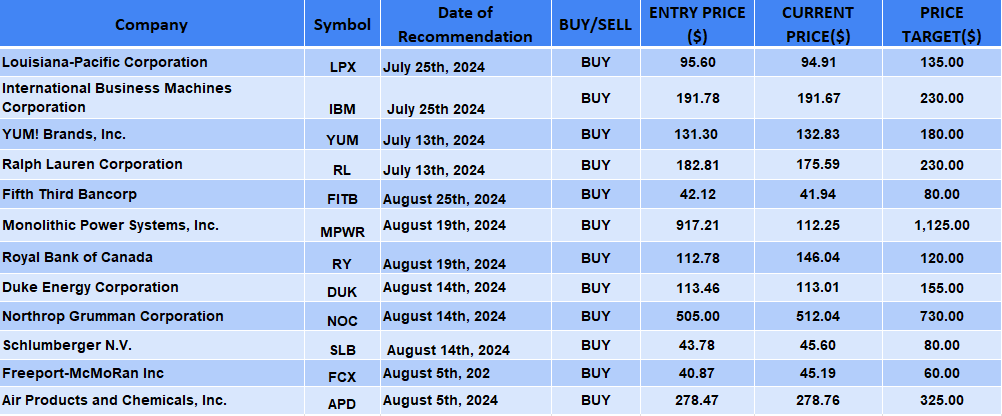

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close

Date Issued – 18th September 2024

Market Focus Shifts to Landmark Fed Decision, Futures Edge Higher

1. Focus on the Fed

The Federal Reserve is at the center of market attention as investors eagerly await its crucial interest rate decision. As speculation mounts, the debate centers around whether the Fed will opt for a 25-basis point cut or a more aggressive 50-basis point reduction. This would mark the first rate cut since March 2020, a significant shift as the Fed seeks to balance economic momentum and inflationary pressures. The FedWatch Tool by CME Group currently reflects a 61% probability of a larger 50-basis point cut, fueled by reports from the Financial Times and Wall Street Journal, which indicate the possibility of a jumbo cut. Former New York Fed President Bill Dudley adds weight to the argument, stating a “strong case” exists for the larger cut, as current rates may be above neutral territory. However, mixed economic data, including stronger-than-expected retail sales in August and tepid inflation trends, makes this a closely contested decision. Analysts at ING describe it as a “close call,” underscoring the uncertainty in the macro outlook. Investors are also eyeing potential signals from the Fed on future rate cuts, with markets anticipating at least 100 basis points in reductions by the end of 2024.

2. Futures Edge Higher

Ahead of the Fed’s pivotal meeting, U.S. stock futures inched upward. As of 03:30 ET (07:30 GMT), Dow futures added 45 points (0.1%), S&P 500 futures edged higher by 7 points (0.1%), and Nasdaq 100 futures gained 39 points (0.2%). These modest gains follow a turbulent Tuesday session, where positive retail sales data propelled the S&P 500 and Dow Jones Industrial Average to record highs, only for markets to fade on Fed uncertainty. The tech-heavy Nasdaq Composite closed the day with a slight 0.2% increase.

3. 23andMe Directors Resign Over Take-Private Offer

Genetic testing firm 23andMe faced board upheaval as all seven independent directors resigned following failed negotiations with CEO Anne Wojcicki regarding her proposal to take the company private. The board expressed disappointment over the lack of a “fully financed, actionable proposal” that would benefit non-affiliated shareholders. Wojcicki controls 49% of the company and had offered to buy remaining shares at $0.40 each, a move rejected by a special committee. In a memo to employees, Wojcicki stated she was “surprised and disappointed” by the resignations, reiterating her belief that going private would free 23andMe from the short-term pressures of public markets. Shares plummeted in extended trading following the announcement.

4. Nippon Steel Wins Extension on U.S. Steel Deal Review

Nippon Steel’s $14.1 billion bid for U.S. Steel is receiving a prolonged security review, potentially extending the timeline past the U.S. presidential election in November. Bloomberg reports that Nippon Steel was granted the ability to revoke and refile its submission to a U.S. security committee, a strategic move amid political sensitivities surrounding the deal. President Joe Biden has publicly opposed the transaction, further complicating the outlook, particularly as U.S. Steel is a major player in Pennsylvania, a key battleground state in the 2024 election. Shares of U.S. Steel rose 3% in aftermarket trading on the news.

5. Oil Prices Decline as Inventories Rise

Oil prices dipped in early European trading, trimming recent gains following an unexpected increase in U.S. crude inventories. Brent futures fell by 0.5% to $73.33 per barrel, while West Texas Intermediate (WTI) dropped to $69.63. Despite the short-term pullback, prices remain elevated on the back of supply disruptions from Hurricane Francine and anticipation of Fed rate cuts, which have pushed traders to take advantage of discounted oil prices. Additionally, rising Middle East tensions are contributing to price volatility, with Hezbollah threatening retaliation against Israel. Both Brent and WTI contracts have rebounded sharply over the past week, recovering from three-year lows.

Why Big Banks Are Obsessed with 1995

The echoes of 1995 are growing louder on Wall Street, and for good reason. That year, a series of Federal Reserve interest rate cuts sparked one of the best multiyear periods in banking history. With inflation cooling and U.S. consumer spending slowing, the Fed reduced rates by 25 basis points in July, December, and again in January 1996. The result? An extraordinary rally for banks. An index tracking the banking sector surged by more than 40%, outperforming the broader market for two consecutive years. Today, with speculation rising over potential Fed rate cuts in 2025, many financial institutions are drawing parallels to that remarkable period, hoping for a repeat performance. While the path to another 1995-like boom may seem distant, Wall Street analysts and bank executives are contemplating what it would take to recreate such a winning streak.

A Strong Start for 2023

The banking sector has already posted respectable gains this year. The KBW Nasdaq Bank Index (^BKX), which tracks large U.S. banks, is up over 14%, and the Financial Select Sector SPDR Fund (XLF), which includes a wide range of financial institutions, has gained 19%. However, these gains still lag behind major market indices. As Mike Mayo, an analyst at Wells Fargo, puts it: “History isn’t likely to repeat, but it may rhyme.” While Mayo is cautious about expecting a full repeat of 1995, he notes that key similarities are emerging. In particular, Mayo points out that in three instances—1995, 1998, and 2019—where the Fed cut rates without triggering a recession, bank stocks initially sold off before rebounding and outperforming the S&P 500. However, history also shows that only in 1995 did this outperformance last longer than three months after the initial rate cut.

1995: A Turning Point for Banks

The conditions leading up to the 1995 boom were far from ideal for banks. Major institutions were reeling from the bankruptcy of Orange County in December 1994 and the collapse of British merchant bank Barings in early 1995. The bond market had suffered a significant wipeout, leading to substantial trading losses. Meanwhile, commercial real estate lenders were still grappling with loan losses from a crisis dating back to the late ’80s.

Despite this, a key factor worked in favor of the banking sector: a steep yield curve. Long-term Treasury yields remained higher than short-term rates, allowing banks to profit from the spread between borrowing at short-term rates and lending at long-term ones. Moreover, deregulation provided a tailwind, with new laws allowing banks to open branches across state lines, setting the stage for the emergence of mega-banks like Wells Fargo and Bank of America.

Could Regulation Swing Back to Favor Banks?

Today’s regulatory environment is different from 1995, but some believe the pendulum may be swinging back in favor of big banks. While regulation has tightened since the Trump administration, recent developments suggest a potential easing. For instance, new bank capital rules introduced last week were less stringent than initially expected. Additionally, the Supreme Court’s rejection of the Chevron doctrine, which granted regulatory agencies broad authority in interpreting laws, may limit regulatory power moving forward.

However, there are significant differences between now and 1995. The current shift in monetary policy follows one of the longest periods of low interest rates in U.S. history. During the pandemic, banks experienced a surge in deposits, which left many institutions ill-prepared for the recent sharp rate hikes. As Allen Puwalski, CIO at Cybiont Capital, noted, “There’s no argument that falling rates are good for banks. I’m just not sure it’s for the same reasons that it was in ’95.”

The Path to 2025: Can Banks Repeat 1995’s Success?

For 2025 to be as strong for banks as 1995, the Fed would need to engineer a “soft landing”—reducing inflation without triggering a recession. This is a challenging task, but not impossible. As former Boston Fed President Eric Rosengren told Yahoo Finance, “There are plenty of things that could go wrong, but I think it’s a high enough probability that it’s still reasonable to talk about a soft landing.” Looking ahead, banks that have benefited from high interest rates may see shrinking profits, while those that struggled could be poised for a rebound. At a recent Barclays conference, several bank executives, including Bank of America CEO Brian Moynihan and PNC CEO Bill Demchak, expressed optimism about earnings in 2025. Others, like JPMorgan Chase COO Daniel Pinto, were more cautious, warning that analysts might be too optimistic about future earnings.

Conclusion: A Dream Worth Pursuing?

While a repeat of 1995 may seem like a long shot, the banking sector is once again in the midst of significant change. Loan growth, a revival in investment banking, and a favorable regulatory environment could provide the necessary ingredients for another rally. But as RBC Capital Markets analyst Gerard Cassidy cautions, “We do expect to see incrementally higher loan loss provisions in the next 12 months.” In the end, while betting on a repeat of 1995 may be risky, the industry’s trajectory is pointing in the right direction—making it a dream worth keeping an eye on.

BlackRock and Microsoft Aim to Raise $30 Billion for AI Investments

BlackRock Inc. and Microsoft Corp. have joined forces in a major initiative to fund the expansion of data centers and energy infrastructure essential to supporting the explosive growth of artificial intelligence (AI). Alongside the United Arab Emirates’ MGX investment vehicle, the two firms are targeting $30 billion in private equity capital for the project, with the potential to leverage this sum into as much as $100 billion in investments over time. According to BlackRock CEO Larry Fink, the Global AI Infrastructure Investment Partnership has been in development for months. The aim is to fund the global buildout of data centers, a project estimated to require trillions of dollars in financing. “This is a prime example of capital markets driving infrastructure development and enabling new technologies,” Fink said.

The infrastructure projects, which will focus on both data and energy investments, are expected to be concentrated in the U.S., with some funds allocated to partner countries. The companies are seeking additional investors for the effort, and Fink expressed confidence that raising the capital would not be a challenge, citing strong interest from pension funds and insurers eager for long-term infrastructure investments. Key players in this initiative include Global Infrastructure Partners, led by Bayo Ogunlesi, which BlackRock is acquiring for $12.5 billion, and Abu Dhabi’s MGX, a newly established investment entity focused on AI. Nvidia Corp., a leading chipmaker, is also part of the collaboration, providing its expertise in building AI data centers and systems, as well as critical software and networking technologies.

Microsoft Vice Chairman Brad Smith emphasized the immense investment opportunity AI presents, describing it as “the next general-purpose technology” poised to drive growth across industries globally. Microsoft, which has already invested $13 billion in OpenAI, is heavily investing in AI-focused data centers and infrastructure to support the burgeoning demand. The company is also grappling with the challenge of limited data center capacity and chip shortages, which constrain its ability to serve AI customers.

Energy and Infrastructure Challenges

One of the most significant hurdles facing the AI boom is the immense energy demand from data centers. According to Bloomberg Intelligence, electricity usage by these facilities is expected to surge up to tenfold by 2030. This has prompted energy companies across the U.S. to delay the retirement of coal and gas plants, plan new gas plants, and ramp up investment in renewable energy sources such as solar and wind farms. However, competition for electricity has already extended the time needed to connect new data centers to the grid up to seven years in Virginia’s Data Center Alley.

Ogunlesi underscored the critical need for increased power generation, stating, “Power availability is now a key constraint on not just data center expansion but broader electrification efforts. We must accelerate the development of renewable energy plants in the U.S.” In parallel, Microsoft has been in discussions with OpenAI co-founder and CEO Sam Altman, who is working on his own plans to bring together investors and tech firms to massively expand the infrastructure needed for AI products. As AI continues to evolve as a transformative technology, the collaboration between BlackRock, Microsoft, and their partners highlights the scale of investment and infrastructure required to meet the industry’s rapid growth.

JPMorgan CEO Jamie Dimon to Visit Africa in Strategic Expansion Push

Jamie Dimon, CEO of JPMorgan Chase, is set to visit Africa in mid-October as part of the bank’s strategy to expand its presence on the continent. This will be Dimon’s first trip to Africa in seven years, with planned visits to key markets including Kenya, Nigeria, South Africa, and Ivory Coast, according to sources familiar with the matter. JPMorgan already operates in South Africa and Nigeria, offering asset and wealth management, as well as commercial and investment banking services. The bank, which holds over $4.1 trillion in assets and operates in more than 100 countries, is actively targeting international markets as a growth strategy.

In 2018, Dimon had expressed interest in expanding into Ghana and Kenya, although local regulatory hurdles initially slowed these efforts. However, recent developments suggest renewed momentum: Kenyan President William Ruto announced in early 2023 that JPMorgan had committed to opening an office in Nairobi. The timeline for entering Ghana and Kenya remains unclear. The move is part of a broader trend where major global banks are increasingly eyeing Africa’s sovereign debt and corporate transactions. Analysts note that international lenders, like JPMorgan, are also looking to provide wealth management services for multinational companies with African operations. Eric Musau, head of research at Standard Investment Bank in Nairobi, explained that such offerings typically focus on access to offshore equity, debt, and mutual funds, which international banks view as key growth areas.

In addition to wealth management, private banking services are gaining traction in Africa, particularly as global banks seek to differentiate themselves from local and regional competitors. Francis Mwangi, CEO of Kestrel Capital in Nairobi, sees private banking as “the next evolution” for financial services on the continent, where most consumers currently rely on local commercial banks. JPMorgan has emphasized its commitment to international expansion, prioritizing growth in overseas markets. As of May 2023, the bank ranked among the top five international private banks by assets under supervision. In recent years, JPMorgan has significantly bolstered its global footprint, adding 700 bankers across 27 new locations, generating $2 billion in additional revenue.

Dimon’s Africa visit underscores JPMorgan’s ambition to capture a larger share of the continent’s banking landscape. The bank is supported by an advisory board that includes influential figures with African ties, such as Nigerian billionaire Aliko Dangote and former UK Prime Minister Tony Blair.

As competition intensifies, global banks are adopting diverse strategies in sub-Saharan Africa, targeting the most promising markets. Standard Chartered, for example, has focused its efforts on Kenya, where assets under management surged by 25% to $1.4 billion in 2022. Meanwhile, the bank has scaled back in other parts of the region, exiting markets such as Angola, Cameroon, and Sierra Leone. JPMorgan’s expansion push signals its belief in Africa’s growing importance in global financial markets, with the continent’s rapid development offering fertile ground for investment banking and wealth management growth.

Factbox: Airlines Suspend Flights as Middle East Tensions Rise

International airlines are adjusting their flight operations amid escalating tensions in the Middle East, with several carriers suspending services to affected regions or avoiding particular airspaces. Here’s a summary of the changes made by some airlines:

Airlines Suspending or Adjusting Flights:

- Air Algérie: Suspended flights to and from Lebanon until further notice.

- AirBaltic: Plans to resume flights between Riga and Tel Aviv on Sept. 17.

- Air France-KLM:

- KLM canceled all flights to and from Tel Aviv until Oct. 26.

- Transavia (a low-cost subsidiary) canceled flights to Tel Aviv until March 31, 2025, and to Amman and Beirut until Nov. 3.

- Air India: Suspended scheduled flights to Tel Aviv indefinitely.

- Cathay Pacific: Canceled all flights to Tel Aviv until March 27, 2025.

- Delta Air Lines: Paused flights between New York and Tel Aviv until Oct. 31.

- EasyJet: Stopped flights to Tel Aviv in April, with plans to resume on March 30, 2025.

- IAG (Vueling): Canceled flights to Tel Aviv until Jan. 12, 2025, and suspended flights to Amman indefinitely.

- LOT Polish Airlines: Suspended flights to Lebanon but is operating flights to Tel Aviv regularly.

- Lufthansa Group:

- Suspended all flights to and from Tel Aviv and Tehran until at least Sept. 19.

- Swiss International Air Lines suspended flights to Beirut until the end of October.

- Ryanair: Canceled flights to Tel Aviv until Oct. 26 due to operational restrictions.

- Sundair: Canceled flights between Bremen and Beirut until Oct. 23.

- SunExpress: Suspended flights to Beirut until Dec. 17.

- United Airlines: Suspended flights to Tel Aviv indefinitely due to security concerns.

Alerts for Lebanese Airspace:

- The UK government advised airlines to avoid Lebanese airspace from Aug. 8 to Nov. 4, citing potential military risks.

These suspensions reflect heightened concerns over safety and security in the region as airlines take precautionary measures.

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close

Date Issued – 17th September 2024

European Stocks Edge Higher as Markets Brace for Fed’s Key Policy Meeting

European stocks posted modest gains on Tuesday, with investors cautiously optimistic ahead of the Federal Reserve’s highly anticipated policy-setting meeting, which begins later today. By 07:05 GMT (03:05 ET), Germany’s DAX rose by 0.4%, France’s CAC 40 gained 0.5%, and the U.K.’s FTSE 100 climbed 0.8%. Market sentiment suggests a shift towards a more dovish stance from the Fed, raising expectations of a potential rate cut.

All Eyes on the Federal Reserve Meeting

The Federal Reserve kicks off its two-day meeting today, with markets widely anticipating the first rate cut in four years to support economic growth. While uncertainty lingers over the scale of the rate reduction, many traders are betting on a more aggressive 50 basis point (bps) cut rather than the more traditional 25 bps. According to CME FedWatch, there is a 68% likelihood of a 50 bps cut, while a 25 bps cut has a 32% chance. Additionally, policymakers at the Bank of England and the Bank of Japan are set to meet later this week, making it a pivotal moment for global monetary policy.

German ZEW Survey and U.S. Retail Data Under Scrutiny

Before the Fed’s decision, market participants are watching the release of Germany’s ZEW economic sentiment index, which is expected to show a slight decline as Europe’s largest economy continues to face headwinds. Meanwhile, U.S. retail sales data for August is projected to show a month-on-month contraction, but investors may discount the report in light of a possible rate cut by the Fed.

EssilorLuxottica Extends Partnership with Meta

In corporate news, shares of EssilorLuxottica (EPA) rose 0.5% after the eyewear giant announced an extension of its partnership with Meta Platforms (NASDAQ). The companies signed a new long-term agreement to continue developing smart eyewear into the next decade. Their collaboration, which began in 2019, has produced two generations of Ray-Ban-branded smart glasses, combining fashion and technology.

Kingfisher’s Shares Surge Following Profit Outlook Upgrade

Kingfisher (LON) saw its stock rise over 5% after the European home improvement retailer reported flat first-half profits, which were impacted by weak demand for large discretionary purchases. However, the company raised its full-year profit outlook, providing a boost to investor confidence.

Crude Prices Strengthen as Hurricane Disruptions Continue

Oil prices moved higher on Tuesday, driven by ongoing disruptions to U.S. crude production following Hurricane Francine. At 03:05 ET, Brent crude rose by 0.5% to $73.12 per barrel, while U.S. West Texas Intermediate (WTI) gained 0.7%, reaching $68.48 per barrel. The aftermath of the hurricane has kept over 12% of crude production and 16% of natural gas output in the Gulf of Mexico offline, according to the U.S. Bureau of Safety and Environmental Enforcement. With the Federal Reserve’s expected rate cut adding to market optimism, traders are also awaiting the American Petroleum Institute’s weekly inventory data, which is expected to show another decline in U.S. crude stockpiles. Markets are closely monitoring these developments as they signal broader trends in both economic and energy sectors.

Von der Leyen Prepares to Unveil New European Commission Leadership

European Commission President Ursula von der Leyen is set to announce the key appointments in the EU’s executive branch on Tuesday, determining which national representatives will take charge of major portfolios such as trade, competition, and climate policy. As the most influential institution within the 27-nation European Union, the Commission holds the authority to propose new laws, oversee corporate mergers, and negotiate international trade agreements. Each EU member state will secure a position within the Commission, akin to a ministerial role. However, the significance of these positions varies depending on the assigned portfolio, with sectors like trade, competition, energy, and the internal market carrying substantial influence over businesses and consumers across the bloc.

The next European Commission is expected to assume office by year-end, aligning with a critical juncture: the outcome of the U.S. presidential election in November. A second Trump presidency could challenge the EU’s unified stance on supporting Ukraine against Russian aggression and disrupt trade relations with the U.S., the world’s largest economy. Beyond the political landscape, the new Commission will face the urgent task of addressing the diminishing competitiveness of European industries, particularly as rivalry with China intensifies over green technologies such as electric vehicles.

Tensions Ahead of New Commission Line-Up

A notable shake-up occurred on Monday when France replaced its candidate, Thierry Breton, with Foreign Minister Stephane Sejourne after Breton abruptly resigned, issuing sharp criticism of von der Leyen. Spain’s nominee, Teresa Ribera, currently serving as the ecological transition minister, is reportedly a contender for a senior role. Meanwhile, Poland’s Piotr Serafin is expected to oversee the EU budget, and Lithuania’s Andrius Kubilius is tipped to become the EU’s inaugural defense commissioner, a new role aimed at bolstering Europe’s defense industry in response to Russian aggression on its eastern borders. However, final appointments are subject to last-minute negotiations, with the gender balance within the Commission proving a complicating factor. Von der Leyen had urged EU governments to nominate both male and female candidates to ensure gender parity, but the current tally stands at 17 men and 10 women—an improvement, yet still falling short of the desired balance.

Once the nominations are finalized, each candidate must undergo a hearing in the European Parliament, where lawmakers will scrutinize their qualifications and extract commitments for their future role. While the Parliament has the power to reject nominees, Hungary’s Oliver Varhelyi is expected to face particularly tough questions during his hearing, potentially complicating his approval. The final make-up of von der Leyen’s new team will set the tone for the EU’s policy direction over the next five years, particularly in the critical areas of trade, defense, and green technology.

Microsoft Boosts Dividend by 10% and Unveils $60 Billion Stock Buyback Plan

Microsoft (MSFT) announced on Monday that its board of directors has approved a substantial $60 billion stock buyback program, alongside a 10% increase in its quarterly dividend. The tech giant will raise its dividend from 75 cents to 83 cents per share, with the dividend payable on December 12 to shareholders of record as of November 21. Additionally, the company’s annual shareholders meeting is set for December 10. These financial maneuvers come at a time when Microsoft is under pressure to demonstrate the return on its significant investments in artificial intelligence (AI). In July, the company informed investors of its plans to accelerate AI infrastructure spending in response to surging demand that exceeds its current capacity.

On the same day, Microsoft introduced several new AI-driven features at its “Wave 2” event, enhancing its Copilot AI assistant. Key updates include the general availability of Copilot in Excel and OneDrive, as well as a new feature in Outlook that summarizes emails. These enhancements aim to improve user experience and boost productivity across Microsoft’s suite of applications. Jefferies analysts responded positively to the announcements, identifying Microsoft as a “top AI beneficiary” due to the early signs of strong Copilot adoption and user engagement improvements. Following the news, Microsoft shares gained 0.7% in extended trading. The stock has risen nearly 15% year-to-date, reflecting growing investor confidence in the company’s strategic focus on AI and its potential to drive long-term growth.

Amazon Announces “Prime Big Deals Day” on October 8-9

Amazon revealed today that it will host its “Prime Big Deals Day” on October 8-9, a sales event similar to its popular Prime Day. This marks the third consecutive year that the e-commerce giant has scheduled a major fall event in October. In addition to the U.S., Prime Big Deals Day will take place across various countries, including Australia, Austria, Belgium, Brazil, Canada, France, Germany, Italy, Luxembourg, the Netherlands, Poland, Portugal, Singapore, Spain, Sweden, the U.K., and Turkey. Japan will also host its version of the event later in the month. Prime Members can expect new deals every five minutes throughout the event. Amazon has also curated a holiday gift guide to enhance the shopping experience. Earlier this year, Amazon introduced its AI shopping assistant, Rufus, to all U.S.-based users, and the company hopes the event will encourage even more adoption of the feature.

“Exclusive savings events like Prime Big Deal Days, combined with unlimited fast, free delivery of over 300 million products across more than 35 categories, make Prime membership more valuable than ever,” said Jamil Ghani, vice president of Prime Worldwide. Analysts consider Amazon’s Prime Day in July a success, generating a record $14.2 billion in sales. Notably, 49.3% of purchases were made via mobile devices, and Adobe predicts that mobile shopping will account for 53% of online sales during this year’s holiday season. Amazon remains the dominant player in U.S. e-commerce, with projected sales expected to reach $491.65 billion in 2024—an increase of 10.5% year-over-year. According to Emarketer, Amazon continues to hold the largest share of the U.S. e-commerce market at 40.4%.

Key Intel Price Levels to Watch as Stock Surges Following CEO Business Update

Intel (INTC) saw its shares surge in after-hours trading on Monday, rising 7.9% to $22.56, following an encouraging business update from CEO Pat Gelsinger. The embattled chipmaker revealed plans to cut costs, reduce its real estate holdings, and sell part of its stake in the Altera programmable chip unit. Gelsinger also announced plans to turn Intel’s chip manufacturing arm into a separate subsidiary, producing chips for Amazon (AMZN) and the U.S. military, further boosting investor confidence. Intel shares had already gained over 6% during regular trading on Monday, driven by a Bloomberg report on the company’s contract to manufacture custom chips for the military. Despite the recent gains, Intel’s stock has lost more than half of its value since the beginning of the year.

Technical Analysis: Key Levels to Watch

Intel’s stock has been trending downward since December, encountering significant selling pressure near the 50-day moving average (MA). The stock is now down 64% from that point, with increased trading volumes during the sell-off, signaling strong bearish momentum. However, the stock has made a partial recovery this month, raising the possibility of a bullish reversal.

Potential Bullish Reversal with Hammer Candlestick

The current price action suggests Intel may be forming a hammer candlestick, a pattern that often indicates a potential bullish reversal after a sharp decline. The key price level to watch here is $20, which the stock reclaimed on Monday. This level aligns with historical support points from 1997 to 2012, making it a critical area for investors looking for signs of a sustained rebound. A confirmed hammer pattern in September would mark a notable victory for bulls.

Key Support Levels to Monitor

- $20 Support: A psychological and historical support level. Holding above this would suggest a potential bottom in Intel’s decline.

- $17 Support: If Intel continues its downtrend, the stock could find support around $17, where it consolidated between 1997 and 1998. This level also aligns with lows from 2006 and 2010.

- $14 Support: A more significant level in the event of prolonged weakness, with buy-and-hold investors potentially entering near lows from the dotcom bubble and the 2009 financial crisis.

Key Resistance Levels to Watch

- $25 Resistance: If Intel sees a reversal, the stock will likely face resistance at $25, a level connected to multiple peaks and troughs from 1997 to early 2022.

- $35 Resistance: Further upward momentum could bring Intel to $35, where a trendline from 1999 to 2023 meets the 200-day moving average, a key point for potential selling pressure.

As Intel continues its efforts to turn the business around, these price levels will be critical for investors assessing both the stock’s recovery potential and risk.

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close

Date Issued – 12th September 2024

Bill Gates-backed startup says a global gold rush for buried hydrogen is picking up momentum

A Bill Gates-backed startup claims a global surge in interest for geologic hydrogen is rapidly gaining traction. Koloma, a U.S.-based clean energy startup, funded by Bill Gates and Jeff Bezos, is leveraging expertise traditionally used in the hydrocarbon industry to fuel what’s being called a “gold rush” for buried hydrogen. The rise in attention surrounding this underutilized resource, known as geologic hydrogen or “white hydrogen,” has sparked excitement for its potential in driving the shift away from fossil fuels. Koloma’s CEO Pete Johnson explains that geologic hydrogen represents a unique exploration and production opportunity, allowing the company to capitalize on the skills and infrastructure of the oil and gas sectors to quickly scale this carbon-free energy source. By adapting existing technologies and service providers, the startup aims to accelerate industry development.

Having raised over $305 million since its inception, Koloma has attracted a broad range of investors, including Khosla Ventures, Amazon’s Climate Pledge Fund, United Airlines, and Bill Gates’ Breakthrough Energy Ventures. Prominent backers like Ray Dalio, Richard Branson, and Jack Ma further underscore the market’s belief in this resource’s transformative potential. Dubbed a potential “gamechanger” by analysts at Rystad Energy, geologic hydrogen could revolutionize the energy transition by offering a low-carbon solution with minimal environmental footprint. Exploration is already underway in the U.S., Canada, Australia, and Europe, with hopes that untapped reserves can play a pivotal role in reducing reliance on fossil fuels. Johnson highlights the benefits of geologic hydrogen as a primary energy source, with a smaller carbon footprint, reduced land use, and lower water demands. Additionally, he points out that this resource could enable the U.S. to scale domestic ammonia production, positioning the country as a major exporter while reducing the carbon impact of fertilizers.

Despite the enthusiasm, challenges remain. While geologic hydrogen’s long-term potential is vast, some industry experts caution against overhyping its current capabilities, citing environmental concerns and logistical hurdles around extraction and distribution. However, Koloma is confident, with substantial financial backing and a strategic approach to navigating the sector’s complexities. According to Johnson, the company is well-positioned to tackle these roadblocks, with support from a diverse group of investors who are either focused on the technology, potential resource discovery, or low-carbon derivative products that could leverage geologic hydrogen’s advantages. Though hurdles remain, Koloma’s ambitious efforts and growing industry momentum could help unlock geologic hydrogen’s promise as a future cornerstone of clean energy.

Asset Managers Are Now Investing in Once-Shunned Nuclear Stocks

Asset managers are now turning their attention to nuclear energy stocks, a sector long avoided by investors with environmental mandates, betting that the once-shunned industry is poised for a comeback. Major firms such as Robeco Institutional Asset Management, J O Hambro Capital Management, and Janus Henderson Investors are reconsidering their stance on nuclear energy, recognizing its role in achieving global net-zero emissions targets. Chris Berkouwer, lead manager for Robeco’s Net Zero 2050 Climate Equities fund, remarked that while the firm had previously taken an exclusionary approach, it’s now clear that nuclear energy is “an indispensable part” of the transition away from fossil fuels. The inclusion of nuclear energy in environmentally-friendly portfolios is sparking debate. Critics highlight concerns about nuclear waste, uranium supply, and the risks posed by geopolitical events, such as Russia’s seizure of Ukraine’s Zaporizhzhia nuclear power plant. Proponents, however, argue that nuclear power is emissions-free and highly efficient, producing vast amounts of electricity with minimal fuel. In fact, nuclear power is the largest source of clean energy in countries like the U.S., France, and South Korea.

In the European Union, heavy lobbying by France helped include nuclear energy in the bloc’s green taxonomy in 2022. The growing demand for energy, especially to power the expanding AI-driven data centers, has also elevated nuclear’s importance. BlackRock Investment Institute sees nuclear energy as essential for supporting the AI revolution, with portfolio manager Alastair Bishop noting the profound implications for the power market as AI adoption skyrockets. Fund managers are also eyeing opportunities in uranium mining and nuclear technology companies. For example, J O Hambro has been investing in uranium miner Cameco Corp., whose stock has surged 80% since early 2022. Other companies in the nuclear space, such as Constellation Energy Corp., BWX Technologies Inc., and NuScale Power Corp., have seen significant stock gains as well, reflecting growing investor interest.

The International Energy Agency projects that global nuclear capacity must double by mid-century to meet net-zero targets, underscoring the sector’s critical role in the energy transition. However, the industry still faces cost challenges, as nuclear plants require massive capital investment and often take longer to build than renewable energy facilities. Nonetheless, small modular reactors (SMRs) are being touted as a cost-effective solution, with the potential to change public perception of nuclear energy. Despite the hurdles, asset managers are optimistic about nuclear’s potential. As Berkouwer notes, there are stringent checks in place for selecting nuclear investments, especially regarding safety and geopolitical risks. With increasing interest in uranium mining, SMRs, and advanced nuclear technologies, the sector is positioning itself as a key player in the future of clean energy.

Nokia and OTE Group set dual world-record optical transmission rates over ultra long distances

Nokia, in collaboration with OTE Group, part of Deutsche Telekom, has achieved two new world records in optical transmission rates using its sixth-generation Photonic Service Engine (PSE-6s) technology. The field trial, conducted over OTE Group’s national dense wavelength division multiplexing (DWDM) network, successfully transmitted 800Gbps on a single channel over 2,580 km and 900Gbps over 1,290 km marking a breakthrough for long-distance, high-capacity data transmission. These records were achieved using Nokia’s 1830 PSI-M optical transport solution and represent a significant leap in the performance of optical networks. Additionally, the trial demonstrated 1.2 Tbps transmission over a 255 km single channel, contributing to a total network capacity of 25.6 Tbps per fiber.

This advancement not only enhances network capacity and spectrum utilization but also reduces energy consumption by 40%, making it more sustainable by minimizing the network’s carbon footprint. Michalis Papamichail, OTE Group’s Core Network Devops and Technology Strategy Director, highlighted the company’s global leadership in long-haul DWDM networks and its commitment to achieving top-tier performance in a cost-effective manner. Nokia and OTE’s achievement aligns with growing demand for bandwidth driven by social media, cloud computing, and video streaming, further positioning Greece as a hub of advanced network infrastructure. James Watt, Senior VP of Nokia’s optical business, emphasized that these dual world records underscore Nokia’s leadership in high-capacity, long-haul transmission solutions, contributing to a global data infrastructure that is essential for future digital applications. This partnership between Nokia and OTE demonstrates their shared commitment to developing cutting-edge optical networks that can meet the increasing demands for data transmission in an ever-evolving digital landscape.

Nippon Steel, U.S. Steel make last-ditch effort to win US nod, source says

Nippon Steel and U.S. Steel are making a last-ditch effort to secure U.S. government approval for Nippon’s $14.9 billion bid to acquire U.S. Steel. According to sources, Takahiro Mori, a senior Nippon Steel executive, and U.S. Steel CEO David Burritt are meeting with key U.S. officials, including Treasury Deputy Secretary Wally Adeyemo and Commerce Deputy Secretary Don Graves, to address concerns raised by the Committee on Foreign Investment in the United States (CFIUS). The Treasury Department leads CFIUS, which is currently reviewing the deal on national security grounds. The meeting takes place in the context of political opposition from both Republican nominee Donald Trump and Democratic nominee Kamala Harris, as the companies seek to navigate scrutiny over the potential impact of the merger on the U.S. steel supply chain, especially with Pennsylvania, U.S. Steel’s headquarters, being a key swing state in the 2024 presidential election.

CFIUS has expressed concerns that the merger could weaken U.S. steel production, potentially threatening national security. However, business groups such as Japan’s Keidanren and U.S. counterparts argue that the review process may be influenced by political considerations, rather than objective security concerns. In a letter to Treasury Secretary Janet Yellen, they voiced fears that CFIUS might be misused for political gain, undermining the economic and strategic benefits of the deal. Nippon and U.S. Steel responded to CFIUS with a detailed counter-argument, asserting that the merger would boost U.S. steel production by injecting essential capital from an allied nation into a struggling domestic industry. Japanese government spokesperson Hideki Murai emphasized the importance of strengthening U.S.-Japan economic ties but refrained from commenting directly on the acquisition. Despite these efforts, the deal faces an uphill battle, as both political pressure and national security concerns continue to influence the outcome of the CFIUS review.

Durex makes India condom push for women, rural consumers

Durex, the globally recognized condom brand owned by Reckitt Benckiser, is shifting its strategy in India to target women and rural consumers as part of a growth initiative. Despite India’s status as the world’s most populous country, contraceptive use, particularly condoms, remains low, with only about 10% of men using them, and sterilization being the preferred method for women. However, attitudes are changing, and the use of condoms among women has nearly doubled in recent years, providing an opportunity for Durex. Reckitt is launching new marketing campaigns and reformulating products, such as lubricants, to appeal to women, especially addressing concerns that 30% of Indian women experience discomfort during sex. The company aims to increase condom use among women, which is currently underrepresented.

However, Reckitt faces challenges in distribution and pricing, particularly in rural areas, which are more price-sensitive. Durex’s main competitor, Manforce, has also adjusted its marketing to appeal to women, increasing competition. While the overall Indian condom market is currently valued at $210 million, it is projected to grow at a compound annual rate of 7.4% through 2030. In rural India, where stigma around purchasing condoms remains, pricing is a significant factor. Free government-provided condoms are often preferred over premium brands like Durex, which are priced higher. Reckitt plans to introduce smaller, more affordable packs to rural consumers to overcome this barrier. The company acknowledges the scale of the challenge but is optimistic about long-term growth, as it works to break down societal taboos and increase condom use across India.

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close

Date Issued – 11th September 2024

Risk Assets and Dollar Drop Following Key US Presidential Debate

The U.S. dollar weakened significantly on Wednesday, reaching its lowest point of the year against the Japanese yen in the aftermath of the crucial U.S. presidential debate. As of 02:36 ET (06:36 GMT), the USD/JPY pair fell by 0.72%, while the EUR/USD strengthened by 0.25% against the dollar. The yen’s appreciation was further supported by Bank of Japan board member Junko Nakagawa’s remarks, indicating that the central bank is ready to raise interest rates if the economy and inflation develop as forecasted. In parallel, Bitcoin saw a downturn, shedding 0.7% of its value, with the cryptocurrency trading at $56,537.00 on the Bitfinex exchange. U.S. stock futures also took a hit, with the S&P 500 Futures down by 15 points, or 0.27%.

The presidential debate, the only one scheduled for this race, showcased Democratic nominee Kamala Harris as the perceived victor over Republican candidate Donald Trump, according to market reactions. The intense debate covered a broad range of issues, from policy distinctions to personal attacks, and appeared to shift investor sentiment. As the U.S. election nears, the debate has added to the mounting anticipation of a tightly contested race. Following the debate on September 10, betting odds reflected a dramatic shift, with Donald Trump’s chances of winning in 2024 leveling with Harris on the Polymarket betting platform. Citi strategists commented on the market’s reaction, noting, “We are awaiting new poll results in the coming days to determine if undecided voters are shifting toward Harris.” They added, “The race remains close for now, and Tuesday’s market moves may signal that investors are beginning to refocus on election-related risks, though Fed policy and the U.S. economic outlook continue to dominate.”

Strategists also highlighted that as the election approaches, especially if the race remains competitive, markets could see increased risk premiums favoring a Trump win, potentially driving a stronger USD in the lead-up to November. In a separate development, pop music superstar Taylor Swift announced via Instagram that she would be voting for Kamala Harris in the 2024 presidential election. Calling Harris a “warrior,” Swift expressed confidence in Harris’s leadership, stating, “I believe we can achieve much more if our country is led by calm rather than chaos.”

IMF and Ukraine Secure Preliminary Deal for $1.1 Billion Aid Package

The International Monetary Fund (IMF) announced on Tuesday that it has reached a preliminary agreement with Ukraine, paving the way for the embattled nation to access approximately $1.1 billion in financial assistance. This agreement, following what Kyiv described as “difficult” negotiations, still requires approval from the IMF’s executive board, expected in the coming weeks. As a key international lender to Ukraine, the IMF plays a crucial role in the country’s economic stability. Its four-year, $15.6 billion program is a cornerstone of a broader global financial support package aimed at helping Ukraine navigate the ongoing challenges posed by Russia’s full-scale invasion, now approaching its third winter.

“Russia’s war in Ukraine continues to have a devastating impact on the country and its people,” remarked Gavin Gray, head of the IMF’s monitoring mission to Kyiv, during the program’s fifth review. Gray emphasized the importance of “skilful policymaking, the adaptability of households and firms, and robust external financing” in maintaining Ukraine’s macroeconomic and financial stability. Despite these efforts, the IMF cautioned that Ukraine faces “exceptionally high” risks, with the country’s economic outlook clouded by the ongoing war. A slowdown is anticipated, driven by the labor market’s strain and continued Russian attacks on critical energy infrastructure. Ukraine’s Central Bank Governor, Andriy Pyshnyi, highlighted the urgency of securing funding for the 2025 budget, stressing that international financial support remains a top priority. Pyshnyi also underscored the importance of Ukraine’s efforts to generate domestic resources, noting, “Timely and predictable assistance from international partners is essential, but Ukraine must also take steps to build internal reserves.”

Kyiv currently allocates approximately 60% of its budget to military expenditures, relying heavily on Western financial aid to cover essential public spending, such as pensions, wages for public sector employees, and humanitarian support. Since the onset of the war, Ukraine has received nearly $98 billion in financial aid from Western partners, according to data from the finance ministry. Looking ahead, the IMF has urged Ukraine’s government recently reshuffled by President Volodymyr Zelenskiy to adhere to “financing constraints and debt sustainability objectives” in planning the 2025 budget. The IMF also recommended exploring avenues for increasing domestic revenues. Kyiv has already implemented several fiscal measures, including raising import and excise duties, and has expressed plans to increase taxes further. Additionally, Ukraine secured an agreement from bondholders to restructure and reduce its debt load, providing some relief to its financial burden.

Visa Aims for Tenfold Expansion in Digital Payments Adoption in Pakistan

Visa has announced ambitious plans to increase the number of businesses in Pakistan accepting digital payments by tenfold within the next three years, according to Leila Serhan, Visa’s General Manager for Pakistan, North Africa, and the Levant. This move comes as part of a broader strategy to modernize Pakistan’s payments infrastructure, in partnership with 1Link, the country’s largest payment service provider. The collaboration seeks to streamline remittances and promote digital transactions across the nation.

With a population of 240 million, Pakistan is home to one of the largest unbanked populations in the world. According to central bank estimates, only 60% of the country’s 137 million adults or 83 million individuals have a bank account. Visa is actively investing in the development of digital payment systems to make these services more affordable and accessible for both consumers and businesses.

At present, Pakistan has approximately 120,541 point-of-sale (POS) machines, a number Visa aims to dramatically increase. “Some businesses have more than one POS machine, but our goal is to increase businesses’ acceptance of digital transactions by tenfold,” Serhan said. Visa’s strategy includes deploying technologies that can turn smartphones into payment devices, as well as facilitating various payment methods such as QR codes and contactless card payments. Visa is also looking to extend its reach beyond major cities, targeting small and medium-sized enterprises (SMEs) to broaden the use of digital payments. The partnership with 1Link is expected to enhance the remittance process by improving security and encouraging the use of official channels for overseas transactions. Pakistan is one of the top global recipients of remittances, with funds from overseas Pakistanis playing a crucial role in maintaining foreign exchange reserves and contributing to the national GDP. Serhan expressed confidence in the potential of this partnership, stating, “We’re excited to complete the technical integration in the coming months, and we believe this will be a game-changer for many consumers in Pakistan.”

Ireland Faces Decision on €13 Billion in Back Taxes from Apple Following EU Court Ruling

Following a landmark decision by the European Court of Justice (ECJ), Ireland is set to receive €13 billion ($14.4 billion) in back taxes from Apple, despite Dublin’s long-standing resistance to the windfall. The ruling finalizes a prolonged legal battle that has left Ireland in an unusual position: grappling with how to allocate a significant cash injection it had previously fought to avoid. The decision arrives at a critical political juncture, with a general election looming no later than March next year. Irish lawmakers must now decide how best to utilize these funds, a topic likely to dominate the national conversation in the coming months, especially as the country faces pressing infrastructural and housing challenges.

The ECJ ruling confirmed that Ireland granted Apple unlawful state aid, as first determined by the European Commission in 2016, and mandated the recovery of the funds. While welcomed by tax justice advocates, the decision creates a dilemma for the Irish government, which has consistently maintained that it does not offer preferential tax treatment to any companies, including Apple. The €13 billion sum, which has been held in escrow, will now be transferred to Ireland, a process expected to take several months. This development comes amid a rare budget surplus for Ireland, buoyed by strong corporate tax receipts. While some international observers warn of reputational risks for Ireland’s low-tax business model, domestic pressures are mounting to use the funds to address urgent societal needs. With elections approaching, the government is likely to face increased scrutiny on how it plans to spend this unexpected windfall, particularly in areas like housing and public services.

Tax justice advocates, including Oxfam and the Tax Justice Network, hailed the ruling as a call for broader reforms in international tax cooperation and the closing of loopholes that allow multinational corporations to avoid paying fair taxes. As one of the lowest corporate tax jurisdictions in the EU, Ireland’s handling of this decision will be closely watched both domestically and internationally.

Oil Prices Recover Amid Hurricane Francine Supply Disruption Fears

Oil prices rebounded over 1% on Wednesday, recovering some of the sharp losses from the previous day, as concerns about potential supply disruptions caused by Hurricane Francine in the U.S. Gulf of Mexico outweighed fears of weakening global demand. Brent crude futures rose by 84 cents, or 1.2%, reaching $70.03 per barrel by 0704 GMT, while U.S. West Texas Intermediate (WTI) crude futures climbed by 81 cents, or 1.2%, to $66.56 per barrel. This recovery follows a significant drop on Tuesday, when Brent crude fell to its lowest since December 2021 and WTI hit a new low for May 2023. The losses were driven by the Organization of the Petroleum Exporting Countries (OPEC) revising down its demand forecasts for both 2024 and 2025, fueling concerns over global consumption trends.

“The market rebounded autonomously after Tuesday’s substantial drop,” said Yuki Takashima, economist at Nomura Securities. He also pointed to fears of supply disruptions due to Hurricane Francine as a factor supporting prices. Despite the recovery, Takashima cautioned that oil prices would likely face continued downward pressure in the near term, as investors remain concerned about a potential demand slowdown due to economic challenges in China and the U.S. Takashima has revised his forecast for WTI to range between $60 and $80 for the rest of the year, down from a previous estimate of $65 to $85. Hurricane Francine, which has strengthened in the Gulf of Mexico, has prompted evacuations in Louisiana and caused significant production shutdowns. The U.S. Bureau of Safety and Environmental Enforcement (BSEE) reported that 24% of crude oil production and 26% of natural gas output in the Gulf were offline as of Tuesday.

In addition to OPEC’s revised demand forecasts, the U.S. Energy Information Administration (EIA) projected that global oil demand is on track to reach a new record in 2024, even though growth in output may fall short of earlier forecasts. Meanwhile, U.S. crude oil inventories provided additional support for prices, with stocks falling by 2.793 million barrels during the week ending September 6, according to the American Petroleum Institute. Gasoline inventories also declined by 513,000 barrels. China’s daily crude oil imports reached a one-year high in August, although year-to-date imports remain 3% lower than the same period last year, suggesting softer demand. This has contributed to a cautious market outlook, with Hiroyuki Kikukawa, president of NS Trading at Nissan Securities, predicting a continued bearish market due to global demand concerns, particularly in China.

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close

Date Issued – 10th September 2024

China’s Exports Beat Forecasts, But Domestic Demand Drags on Imports

Surge in Exports Reflects Pre-Tariff Rush

China’s exports surged in August, marking the fastest growth in nearly 18 months, as manufacturers accelerated orders ahead of anticipated tariffs from a growing list of trade partners. However, this strong export performance was offset by weaker-than-expected imports, underscoring a sluggish domestic demand that continues to challenge Beijing’s efforts to stimulate broader economic growth. According to customs data released Tuesday, China’s outbound shipments grew by 8.7% year-on-year, the quickest pace since March 2023, surpassing the 6.5% forecast in a Reuters poll. This followed a 7% rise in July. In contrast, imports saw a mere 0.5% increase, falling short of the expected 2% growth and down significantly from the 7.2% surge the previous month.

Balancing Export Reliance and Economic Stimulus

China’s export-driven growth raises concerns for policymakers who are wary of over-reliance on trade amid global uncertainties. The country’s economy has faced persistent challenges, with a protracted real estate slump and weak consumer spending weighing heavily on growth. Economists have warned that without stronger domestic demand, China could miss its growth targets, putting pressure on authorities to introduce further stimulus measures. “The robust export performance is positive for third-quarter economic growth,” noted Zhou Maohua, a macroeconomic researcher at China Everbright Bank. “However, the complex global economic and geopolitical environment presents significant headwinds for China’s exports,” he added.

Trade Barriers Complicate Outlook

As China’s exports show resilience, mounting trade barriers are threatening its competitive edge. The country’s trade surplus with the U.S. widened to $33.81 billion in August, up from $30.84 billion in July, drawing further scrutiny from Washington, which has long criticized the imbalance.

The European Union is also adopting a more protectionist stance, with little progress in Beijing’s negotiations to reduce tariffs on Chinese electric vehicles (EVs). Meanwhile, Canada has imposed a 100% tariff on Chinese EVs, alongside a 25% tariff on Chinese steel and aluminum. In Southeast Asia and South Asia, China is encountering resistance as well. India is preparing to raise tariffs on Chinese steel, Indonesia is considering hefty duties on textiles, and Malaysia has launched anti-dumping investigations into Chinese plastic imports.

Outlook for Exports Amid Global Challenges

Despite these rising barriers, some analysts remain optimistic about China’s export resilience, citing the weaker yuan and the ability of exporters to reroute goods to avoid tariffs. “Outbound shipments are likely to remain strong in the coming months,” said Zichun Huang, China Economist at Capital Economics. “While tariffs are increasing, we believe they won’t be sufficient to derail China’s growing global export market share.”

Weak Imports Signal Domestic Struggles