Daily Synopsis of the New York market close

Date Issued – 3rd September 2024

Jefferies Downgrades Novartis Amid Near-Term Caution, Despite Long-Term Optimism

Jefferies analysts have downgraded their rating for Novartis (SIX: NOVN) (NYSE: NVS) from “buy” to “hold,” reflecting a more cautious stance on the pharmaceutical giant’s short-term prospects, despite maintaining a positive long-term outlook. The downgrade, dated Tuesday, stems from concerns over upcoming product releases, evolving market dynamics, and revised financial projections. Novartis has experienced a strong year, with its stock appreciating over 20%. Jefferies believes this surge has already captured much of the potential upside from recent favorable developments, leaving limited room for further immediate gains. As a result, the brokerage has adjusted its price target to CHF 105 from CHF 110 per share, indicating only a modest 3% potential upside from current levels. This suggests that recent positive factors may be fully reflected in the stock’s price, with little immediate catalyst for additional gains.

A key factor behind Jefferies’ downgrade is the anticipated delay in market enthusiasm surrounding Novartis’ upcoming product launches, including Scemblix, Pluvicto, and Fabhalta. The analysts noted that “it will take time into 2025 for approvals and ramp-ups to drive wider optimism in trajectory to 2030+,” tempering near-term expectations despite the long-term growth potential of these products. Jefferies also highlighted that while they are more optimistic than the consensus on Novartis’ long-term sales and profit trajectories, their near-term growth projections for 2024 to 2026 remain modest. The analysts expect only a 1% to 3% upside in consensus estimates for this period, indicating that it may take time for approvals and product launches to build broader market confidence beyond 2026.

In a survey conducted among U.S. physicians, Jefferies sought to assess the potential of Scemblix in treating chronic myeloid leukemia. The survey results indicated strong market penetration by 2029, supporting a bullish long-term outlook. However, the analysts cautioned that more concrete evidence of Scemblix’s effectiveness compared to existing treatments is needed, which could delay its wider adoption and make near-term prospects less certain. Pluvicto, another critical drug in Novartis’ pipeline, also faces challenges in achieving its full commercial potential. While Jefferies remains optimistic about Pluvicto’s peak sales, the analysts highlighted several obstacles, including the need to improve patient access to radioligand therapies and secure earlier-line treatment approvals. These uncertainties contribute to the tempered short-term expectations, even as the drug’s long-term outlook remains promising.

Despite the downgrade, Jefferies maintains a bullish long-term view on Novartis. The analysts predict that the company’s sales and profits will exceed current market expectations by 2030, driven by the success of key products such as Scemblix, Pluvicto, Fabhalta, Kisqali, and Cosentyx. These drugs are expected to contribute significantly to Novartis’ growth, solidifying its position in the pharmaceutical industry in the years ahead.

Intel Eyes Strategic Shift Amid Potential Asset Sales and Cost-Cutting Measures

Intel (NASDAQ: INTC) is under the spotlight this week following reports from Reuters that CEO Pat Gelsinger and other senior executives are poised to unveil strategic plans later this month aimed at revitalizing the company. These plans reportedly include asset divestitures and capital expenditure reductions as Intel seeks to reverse its downward trajectory. Last Friday, Intel’s stock surged by more than 9% after Bloomberg revealed that the tech giant is contemplating the spin-off or sale of its foundry business—a division currently operating at a loss by producing chips for external clients. However, sources close to the situation indicate that Intel is not yet committed to selling its contract manufacturing unit but is exploring the possibility of offloading its Altera programmable chip business.

Despite Friday’s rally, Intel’s stock has plummeted over 56% year-to-date, with the decline accelerating last month after a disappointing second-quarter earnings report. In response, the company announced a suspension of its dividend and a 15% reduction in its workforce, targeting $10 billion in cost savings.

Technical Analysis: Key Levels to Watch

Intel’s stock has shown signs of potential recovery, with technical indicators suggesting the formation of a double bottom—a pattern that often signals a reversal to the upside. After gapping down over 26% in early August following its earnings release, the stock has formed two significant troughs, hinting at a possible trend reversal. Although Intel closed above the pattern’s neckline on Friday with above-average trading volume, investors should await a more decisive breakout this week for confirmation.

Key Overhead Resistance Levels

- $25: This level corresponds to a region where early buyers might seek to secure profits, particularly those who entered near the lows of October 2022 and February 2023.

- $30: A move to this level could encounter resistance from a horizontal line that connects multiple peaks and troughs formed between November 2022 and July 2023.

- $32.25: If the stock successfully closes above $30, it may advance to $32.25, where selling pressure could emerge from a trendline that links the August and October 2023 lows with recent trading levels from May to July 2024.

- $37: Continued buying momentum could push the stock towards $37, a confluence point of resistance marked by the downward-sloping 200-day moving average and several price peaks recorded between June 2023 and July 2024.

Conclusion: As Intel prepares for a possible strategic overhaul, these technical levels will be critical in determining whether the stock can sustain its recent upward momentum or face renewed selling pressure.

Tesla Sees Record China Sales in August, but Competition Remains Fierce

Tesla (NASDAQ: TSLA) recorded its best sales month of the year in China this August, driven by strong demand in smaller cities across the world’s largest auto market. The U.S. electric vehicle (EV) giant reported over 63,000 units sold, marking a substantial 37% increase from July. However, this figure is likely slightly below the 64,694 units sold in August 2023. While this uptick in sales is a positive sign, Tesla’s performance continues to trail significantly behind its major Chinese competitors. BYD (SZ: 002594), the world’s leading EV manufacturer, saw its China passenger vehicle sales skyrocket by 35% year-on-year in August, hitting a record monthly high of 370,854 units. Other local EV makers, including Leapmotor (HK: 9863) and Li Auto (NASDAQ: LI), also posted impressive sales growth during the same period.

Tesla, like many automakers, has been hit hard by an ongoing price war in China, exacerbated by sluggish economic growth and fragile consumer confidence. The company’s China sales declined by 5% in the first half of 2024. Despite these challenges, several factors have contributed to Tesla’s recent sales momentum. Since April, Tesla has been offering zero-interest loans of up to five years for Chinese buyers. Additionally, several local governments have recently included Tesla vehicles in their official car purchase programs. Tesla also gained a significant regulatory win earlier this year when China’s top auto industry association confirmed that the company’s data collection practices were in compliance with local regulations. This approval allowed Tesla vehicles to access certain government facilities from which they were previously barred.

An analysis by China Merchants Bank International revealed a 78% year-on-year increase in Tesla deliveries in China’s so-called tier-three cities in July, with sales in second-tier cities such as Hangzhou and Nanjing rising by 47%. Further supporting its growth, Tesla’s China-made vehicle sales, which include exports, rose 3% year-on-year in August, totaling 86,697 units, according to data from the China Passenger Car Association. Deliveries of the China-made Model 3 and Model Y vehicles were up 17% from July. Looking ahead, Tesla plans to produce a six-seat variant of its Model Y in China by late 2025, a move aimed at revitalizing interest in its best-selling, yet aging, EV model.

European Stocks Edge Higher as Investors Monitor Economic Data

European stock markets inched higher on Tuesday, continuing the subdued momentum seen at the start of the week as investors kept a close eye on global interest rate outlooks. As of 03:05 ET (07:05 GMT), Germany’s DAX index rose by 0.3%, the CAC 40 in France gained 0.3%, and the U.K.’s FTSE 100 increased by 0.2%.

Focus on U.S. Data

The European markets traded within narrow ranges on Monday due to the U.S. Labor Day holiday, which kept Wall Street closed. A similar cautious trading pattern is expected throughout the week as investors anticipate the release of Friday’s crucial U.S. nonfarm payrolls report. Investors, along with the Federal Reserve, are seeking confirmation that the economic conditions are conducive to an interest rate cut later this month. The previous month’s labor report missed expectations, triggering a significant sell-off in equity markets over growing recession fears. Given this backdrop, market participants are likely to adopt a conservative approach ahead of this week’s data.

Later in the session, the U.S. ISM manufacturing survey will be a key economic indicator to watch. It is expected to show that the U.S. manufacturing sector remains in contraction, adding further weight to the argument for potential rate cuts.

Eurozone Manufacturing Remains Weak

In Europe, inflation recently dropped to its lowest level in three years, with August’s Eurozone CPI registering a 2.2% year-on-year increase. Additionally, Monday’s data revealed that Eurozone manufacturing activity continued to contract in August, signaling that a recovery may still be distant and could warrant further monetary easing. The European Central Bank (ECB) had already cut interest rates in June, ahead of the U.S. Federal Reserve, and is widely expected to reduce rates again later this month, alongside updated inflation and growth projections.

Volvo Announces Long-Range Electric Truck

In corporate news, Volvo (ST: VOLVb) saw its stock rise by 0.2% after the Swedish automaker announced plans to launch a long-range version of its FH Electric truck. The new model, expected to be available in the second half of 2025, will have a range of up to 600 km (373 miles) on a single charge, targeting customers who require longer-distance capabilities. The truck will maximize battery space while enhancing software to improve performance.

Crude Prices Near Two-Month Highs

Crude oil prices traded mixed on Tuesday as traders balanced concerns over sluggish economic growth in China, the world’s largest crude importer, against supply disruptions in Libya. By 03:05 ET, Brent crude futures were down 0.1% at $77.41 per barrel, while U.S. crude futures (WTI) edged up 0.1% to $74.11 per barrel. The WTI contract did not settle on Monday due to the U.S. Labor Day holiday. China’s purchasing managers’ index hit a six-month low in August, indicating potential weakening demand from the world’s largest crude importer. However, supply constraints provided some support to prices, as oil exports at key Libyan ports were halted on Monday due to political unrest, curtailing production across the OPEC member nation.

Navigating Conflict and Crisis: How Ukraine Secured a Wartime Debt Restructuring

In the wake of Russia’s invasion, Ukraine faced an economic crisis that required a swift and significant restructuring of its sovereign debt. Just months after the conflict began, Yuriy Butsa, Ukraine’s debt chief, was handed a crucial document from Rothschild & Co., the country’s financial advisor, detailing major debt restructurings over the past three decades. This would soon become vital as Ukraine embarked on one of the fastest and largest debt restructurings in history. By August 2022, with Ukraine’s economy devastated by war, the country reached an agreement with creditors to pause bond payments. Last week, in a landmark achievement, Ukraine finalized the restructuring of over $20 billion in debt, a move that will save the country $11.4 billion over the next three years. This restructuring is not only crucial for Ukraine’s war effort but also aligns with its commitments under the International Monetary Fund (IMF) program.

Reviving Stalled Negotiations

Initial negotiations between Ukraine and its creditors were rocky. By June, talks had broken down, with creditors balking at Ukraine’s demands, which exceeded the 20% writedown most had anticipated. The core committee of bondholders warned that Ukraine’s demands could harm long-term relations. With time running out before the August 2022 payment moratorium expired, Rothschild organized face-to-face meetings in Paris. These discussions took place in Rothschild’s prestigious offices on Avenue de Messine, a setting that underscored the gravity of the negotiations. Both government and creditor representatives approached the talks pragmatically, despite significant differences in their positions.

Overcoming Exceptional Uncertainty

Several factors prompted a return to negotiations. The looming deadline was one, but equally important was the IMF’s updated economic projections for Ukraine, which, despite reflecting a worsening situation, provided a new basis for talks. Ukraine’s proposal, presented in July, was met with counter-demands from creditors. The creditors, including major asset managers like BlackRock and Amundi, insisted on the immediate resumption of ‘coupon’ payments and a clear path to higher principal recovery. They also emphasized the need for simplicity in the restructuring process. IMF experts played a critical role, providing real-time support from Kyiv and Washington. Their involvement was crucial for the labor-intensive modeling required to evaluate the impact of various proposals on Ukraine’s long-term debt sustainability. By July 18, after nearly 48 hours of intense discussions, the teams were still fine-tuning the numbers, working under extreme pressure to reach a deal.

Closing the Deal

A significant challenge in the negotiations was the need to avoid the costly GDP warrants that had complicated Ukraine’s 2015 restructuring. Instead, Ukraine proposed a simpler GDP-linked bond, which, along with the immediate coupon payments that creditors wanted, helped bridge the gap between the two sides. The restructuring deal was finally within reach, but the process wasn’t without its last-minute dramas. As Butsa was driving back from a Polish airport, a safer route since the invasion had grounded flights from Kyiv a car crash delayed his return. Despite this, Butsa managed to finalize the agreement, securing more than 97% support from bondholders. This historic restructuring, executed amidst unprecedented challenges, not only provides Ukraine with the financial relief needed to continue its war effort but also sets a precedent for how sovereign debt can be restructured under extreme conditions.

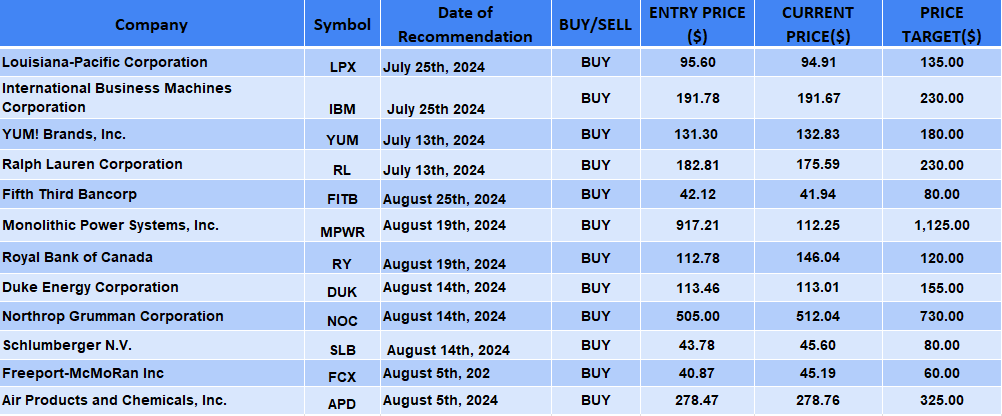

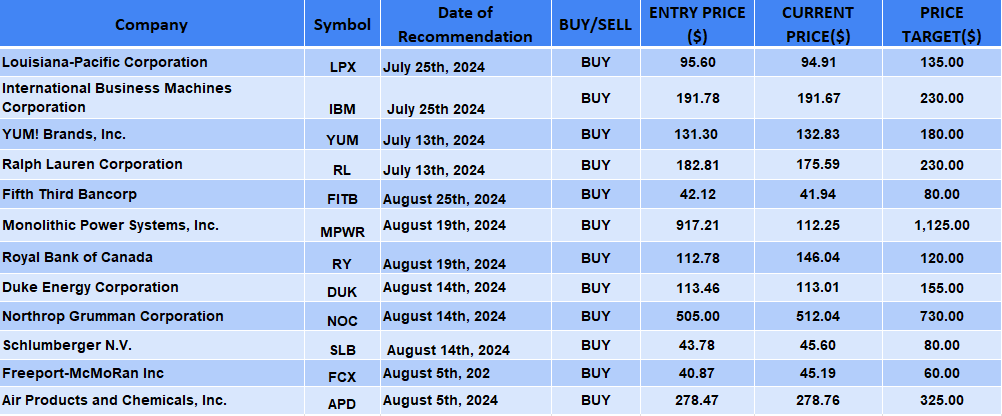

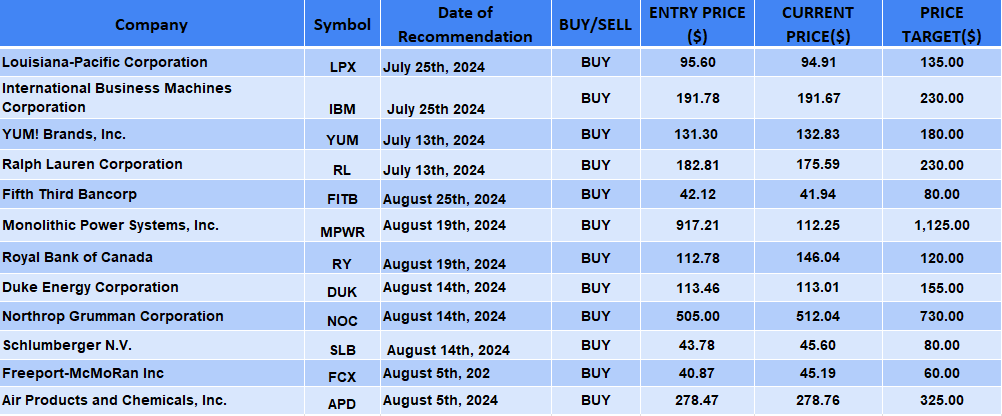

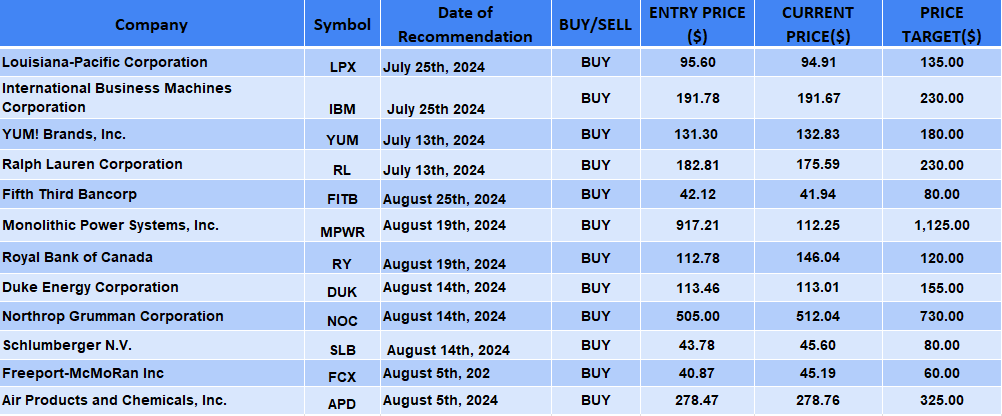

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close

Date Issued – 27th August 2024

Asian Stocks Slip as Geopolitical Fears Sap Confidence

Asian Markets Slide as Geopolitical Tensions and Rate Cut Speculation Weigh on Investor Confidence. Asian stock markets took a hit on Tuesday, with investor sentiment dampened by rising geopolitical tensions in the Middle East and concerns over U.S. interest rate cuts. The anticipation of upcoming earnings from AI giant Nvidia (NASDAQ: NVDA) added to the cautious mood, as any disappointment could unsettle the recent AI-driven rally.

Gold prices hovered near record highs as investors sought safe havens, while the U.S. dollar remained stable and the yen held close to a three-week peak, reflecting heightened risk aversion amid the ongoing conflict between Israel and Lebanon’s Hezbollah. Meanwhile, crude oil prices were bolstered by supply concerns following Libya’s shutdown of all oil fields, disrupting production and exports. The MSCI’s broadest index of Asia-Pacific shares outside Japan dropped 0.48%, retreating from a one-month high reached in the previous session. China’s CSI300 index declined 0.61%, and Hong Kong’s Hang Seng index fell 0.27%, pressured by weaker-than-expected earnings from PDD Holdings, the parent company of Temu, amid reduced consumer spending.

Adding to the market’s woes, Canada joined the U.S. and the EU in imposing a 100% tariff on Chinese electric vehicle imports and a 25% tariff on Chinese steel and aluminum, further straining trade relations. Investors are now turning their attention to a pivotal speech by Federal Reserve Chair Jerome Powell, who on Friday signaled the possibility of imminent interest rate cuts, shifting focus to the Fed’s upcoming September meeting. The market is fully pricing in a 25-basis-point cut, with expectations of 100 bps of easing by year-end. However, Powell’s cautious tone left the door open for adjustments based on economic data.

Looking ahead, all eyes are on the U.S. personal consumption expenditure (PCE) price index, the Fed’s preferred inflation measure, due on Friday, followed by the August payrolls report next week. These data points will be critical in shaping expectations for the Fed’s next move. In currency markets, the yen softened to 144.645 per dollar after hitting a three-week high of 143.45 in the previous session. The U.S. dollar index remained steady at 100.84, near a 13-month low.

Oil prices paused after a strong 3% rise on Monday, driven by supply disruptions and Middle East tensions. Brent crude futures edged down 0.21% to $81.26 per barrel, while U.S. crude futures dipped 0.32% to $77.17 per barrel, both close to recent highs. Gold prices eased 0.39% to $2,507.12 per ounce, slightly below the record high of $2,531.60 reached earlier this month.

These stocks ‘are all expected to prosper’ if Trump wins election: Navellier

In his latest market commentary, Louis Navellier highlighted several stocks poised to benefit significantly if Donald Trump wins the upcoming U.S. Presidential election. According to Navellier, Trump’s expected focus on doubling U.S. electricity generation particularly through the use of inexpensive natural gas would boost industries tied to cloud computing and AI infrastructure.

Here are the key stocks Navellier identified:

- Crowdstrike Holdings: As AI technology expands, so does the need for secure cloud environments, making Crowdstrike a potential winner in the cybersecurity space.

- Eaton (NYSE): With the expansion of data centers to support AI, Eaton’s expertise in power management technologies could see increased demand.

- Emcor (NYSE): The growth in cloud computing infrastructure will drive the need for extensive electrical and mechanical construction services, positioning Emcor for growth.

- Nutanix (NASDAQ): Nutanix’s enterprise cloud software could thrive as businesses seek scalable cloud solutions, making it a standout in the expanding cloud computing market.

- Parsons (NYSE): Specializing in critical infrastructure, Parsons could benefit from increased AI and cloud infrastructure projects, particularly in the government sector.

- Quanta Services (NYSE): With a focus on electric power infrastructure, Quanta is well-positioned to gain from the expected rise in electricity generation and distribution needs.

- Super Micro Computer (NASDAQ): As AI and cloud computing demand advanced server technology, Super Micro Computer is set to become a key player in this sector.

- Vertiv Holdings (NYSE): Vertiv’s critical digital infrastructure solutions will be essential to supporting the growing data center industry driven by AI.

Navellier also noted the broader implications for the energy sector, particularly with natural gas and crude oil, suggesting that Trump’s policies could create a unique investment landscape favoring companies at the intersection of energy and technology.

Canada to impose 100% tariff on Chinese EVs, including Teslas

In a bold move aligned with recent actions by the United States and the European Union, Canada has announced a 100% tariff on imports of Chinese electric vehicles (EVs), including those produced by Tesla in Shanghai. This tariff, set to take effect on October 1st, comes alongside a 25% tariff on imported Chinese steel and aluminum, marking a significant escalation in trade tensions between Canada and China.

Canadian Prime Minister Justin Trudeau justified the tariffs as a response to what he described as China’s “intentional, state-directed policy of over-capacity,” accusing China of not playing by global trade rules. Trudeau emphasized that Canada’s actions are coordinated with other global economies, underscoring a united front against China’s trade practices. The Chinese government has sharply criticized Canada’s decision, labeling it as “protectionist” and a violation of World Trade Organization (WTO) rules. The Chinese embassy in Canada warned that the tariffs would harm economic and trade relations between the two nations and urged Canada to reconsider its stance.

The tariffs are expected to have immediate implications for Tesla, whose shares dropped by 3.2% following the announcement. Tesla, which has been exporting its Model 3 and Model Y vehicles from its Shanghai Gigafactory to Canada, may now face higher costs if it continues to source vehicles from China. Analysts suggest Tesla might shift production and logistics to its U.S. facilities to mitigate the impact of the tariffs, although this would involve higher production costs.

Canada’s decision is part of a broader strategy to strengthen its position in the global EV supply chain, particularly as it seeks to attract European automakers. The tariffs also reflect growing domestic pressure to protect Canadian industries from what are seen as unfair trade practices by China.

Further punitive measures from Ottawa, potentially targeting Chinese semiconductors and solar cells, could be on the horizon, as Trudeau hinted at ongoing efforts to counter non-market practices by China. This move by Canada, while likely to strain bilateral relations, underscores its commitment to protecting domestic industries and aligning with international allies in the face of global trade challenges.

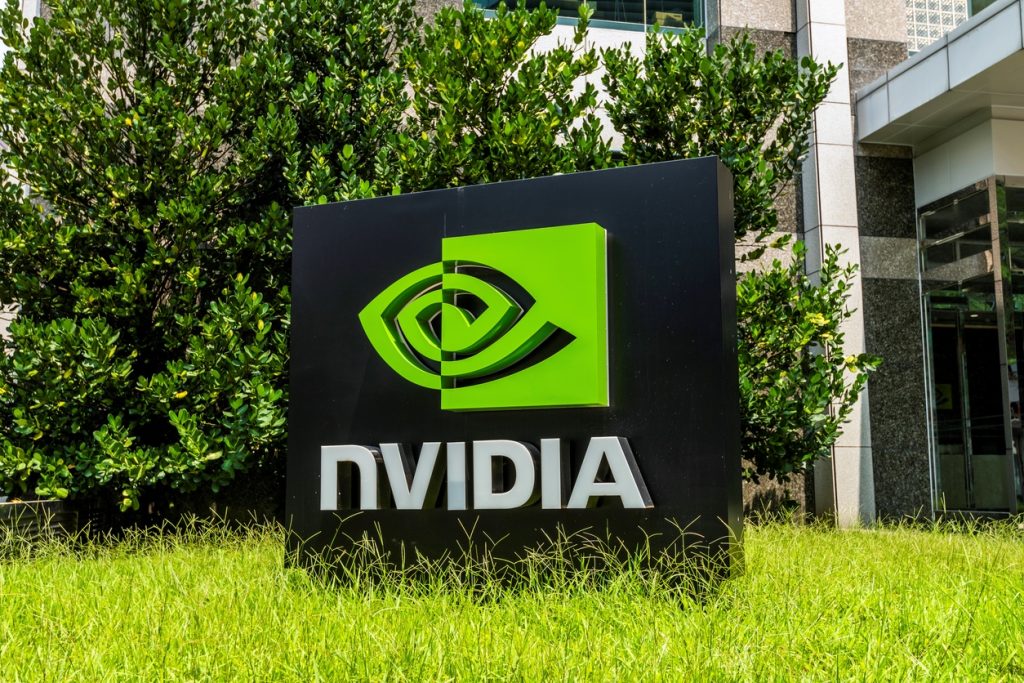

Where Will Nvidia Stock Open on Thursday After Earnings?

Nvidia’s stock is likely to experience significant volatility following its earnings report on August 28, with options activity suggesting a potential 10% fluctuation in its price on August 29. The stock’s recent trading range has been between $90 and $140 since May 23, with a majority of investors predicting it will settle between $120 and $140 post-earnings, according to a survey by Evercore ISI. Key factors influencing Nvidia’s stock include the strong demand for its H200 and H20 products, which are expected to mitigate any potential revenue shifts due to delays with its Blackwell product. Despite these delays, market sentiment remains bullish, as investors view the situation as a buying opportunity.

Morgan Stanley analysts have expressed confidence in Nvidia’s ability to manage the production and ramp-up of new products, expecting initial volumes in the October quarter and a more significant increase in production by January. The company’s momentum, driven by robust demand signals, is anticipated to continue, even in the face of minor headwinds. Given these dynamics, if Nvidia’s earnings report aligns with or exceeds expectations, the stock could open on Thursday, August 29, within the higher end of the predicted range, possibly around $120 to $140 or even above $140 if the market reacts positively. Conversely, any unexpected negative news could push the stock lower, though a drop below $90 seems unlikely based on current investor sentiment.

Gold (XAU) Daily Forecast: Will Fed Signals and Geopolitical Risks Drive Prices Above $2,516?

Market Overview

Gold prices (XAU/USD) are experiencing a downward trend, currently hovering around $2,509. The recent decline, marked by an intra-day low of $2,505.93, can be attributed to a modest recovery in the US Dollar (USD) on Tuesday. However, this trend could shift as potential changes in US monetary policy and escalating geopolitical tensions come into play.

Fed Signals: Could Interest Rate Cuts Propel Gold?

A key factor currently influencing gold prices is the prospect of interest rate cuts by the US Federal Reserve. Fed Chair Jerome Powell hinted at Jackson Hole that rate cuts might be on the horizon, which could be a boon for gold. Lower interest rates generally make non-yielding assets like gold more attractive, as they reduce the opportunity cost of holding them. Additionally, other Fed officials, such as San Francisco Fed President Mary Daly, have suggested that rate cuts could soon be appropriate, potentially providing further support for gold prices.

Geopolitical Uncertainty: A Safe Haven for Gold?

Rising geopolitical tensions, particularly in the Middle East, continue to keep gold in focus as a safe-haven asset. Recent military skirmishes between Israel and Hezbollah, coupled with ongoing concerns about Iran, have added a layer of uncertainty to the global landscape. While fears of a broader conflict have somewhat eased, the situation remains fluid. Any escalation could drive investors towards gold, pushing prices higher as they seek refuge in safe assets.

China’s Economic Slowdown: A Drag on Gold?

China’s sluggish economy is another factor exerting downward pressure on gold prices. The People’s Bank of China (PBOC) has paused gold purchases for the third consecutive month, weakening overall market support for the precious metal. As the world’s largest producer and consumer of gold, China’s economic health significantly influences gold market trends. Traders are closely monitoring any new data that might indicate shifts in China’s demand for precious metals.

Looking Ahead: What’s Next for Gold?

Traders and analysts will be closely watching upcoming US economic indicators, including the Consumer Confidence report and the Housing Price Index, for further insights into the direction of gold prices. Additionally, preliminary US GDP data and the PCE Price Index later this week will be critical in assessing the likelihood of further monetary policy adjustments.

Short-Term Forecast

Gold remains under pressure below the $2,516 mark, with immediate support at $2,500. A move above $2,516 could signal a bullish trend, but broader market uncertainties continue to pose risks. Currently, gold (XAU/USD) is priced at $2,509.32, down 0.35%. The key level to watch is the pivot point at $2,516.55. If prices remain below this threshold, the outlook is bearish, with immediate support at $2,500.15, followed by $2,486.23 and $2,470.51.

On the upside, breaking above $2,516.55 could lead to a bullish trend, with resistance levels at $2,529.03, $2,541.48, and $2,555.85. The 50-day EMA at $2,495.79 and the upward trendline offer some support for a potential bullish move, but caution is warranted given the 200-day EMA at $2,442.47.

Conclusion

Gold remains bearish below $2,516, but if it climbs above $2,516, it could shift towards a more bullish outlook. Key drivers will include Fed signals on interest rates, geopolitical developments, and economic data from the US and China.

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Oil & Energy

Date Issued – 26th August 2024

Oil Prices Climb Amid Middle East Tensions and Fed Rate Cut Signals

Crude oil prices have started the week on a strong note, reversing last week’s losses as escalating conflict in the Middle East raises concerns over potential supply disruptions. Meanwhile, in the U.S., the Federal Reserve hinted at a possible interest rate cut in the near future, adding further momentum to the market. By late morning in Asia, Brent crude had risen above $79 per barrel, while West Texas Intermediate (WTI) was trading above $75 per barrel.

The recent uptick in prices is also supported by a tightening global oil supply. Inventories have dropped to a two-year low, with OECD stocks particularly strained, falling 4% below the ten-year seasonal average equivalent to 120 million barrels. U.S. oil inventories have similarly been on a steady decline for several consecutive weeks. Tony Sycamore, an analyst at IG, highlighted the impact of geopolitical events, stating,

“Israel’s pre-emptive strike on Lebanon over the weekend, aimed at thwarting an imminent Hezbollah attack, should provide a strong opening for WTI crude, potentially pushing prices toward $77.50, and then $80.00.”

However, Warren Patterson, head of commodities strategy at ING, offered a more cautious perspective, noting that the market may be growing desensitized to Middle East tensions.

“These risks have been escalating for nearly a year without significantly affecting oil supply,”

Patterson remarked in a note to Bloomberg. He suggested that any price rally driven by these developments could be short-lived unless Iran becomes directly involved, which would significantly heighten supply risks.

Adding to the bullish sentiment, U.S. Federal Reserve Chairman Jerome Powell signaled last week that a rate cut could be on the horizon at the Fed’s next meeting in September. Speaking at the Kansas City Fed’s annual economic conference in Jackson Hole, Wyoming, Powell stated,

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

These developments are setting the stage for what could be a volatile week in the oil markets, with traders closely watching both geopolitical events and economic indicators.

Russia’s Coal Reserves Secure Long-Term Supply Amid Global Market Shifts

Russia has reaffirmed its status as a key player in the global energy market, announcing that its coal reserves are sufficient to last over a century. Despite the increasing pressures from Western sanctions and a competitive global market, the country remains steadfast in its coal production and export strategies. According to Alexander Kozlov, Russia’s Minister of Natural Resources and Environment, the nation’s coal reserves stand at an impressive 273 billion metric tons, with 46.4 billion tons currently being extracted. Even with Russia’s 2023 production reaching 392 million tons, these reserves are expected to sustain the country’s coal industry for more than 100 years at current extraction rates.

This declaration comes amidst significant challenges for Russia’s coal sector. The Western sanctions imposed following the 2022 invasion of Ukraine have forced Russian coal producers to pivot their focus toward Asian markets, often selling at substantial discounts to stay competitive. However, this shift has not been without hurdles. In 2023, Russia faced stiff competition from major coal exporters such as Indonesia and Australia, whose lower prices and established market presence have put pressure on Russian coal exports.

In March, Russia’s coal exports to Asia experienced a noticeable decline, as countries in the region opted for cheaper alternatives from Indonesia, South Africa, and Australia. This trend underscores the intense price competition and the complexities of maintaining a foothold in the Asian market. Russia’s vast coal reserves present a paradox for the global energy market. On one hand, they offer a stable and potentially long-term energy supply for Asian countries seeking to diversify their energy sources. On the other hand, the global coal market dynamics shaped by fierce competition and a growing shift towards renewable energy raise questions about the future of coal as a cornerstone of Russia’s energy exports.

While coal continues to be a significant component of Russia’s energy strategy, the evolving global energy landscape and the competitive pressures from other coal-producing nations pose challenges to Russia’s dominance in the sector. As the world increasingly gravitates toward cleaner energy solutions, the long-term viability of coal as a key export commodity for Russia remains uncertain.

Halliburton Hit by Cyberattack: Operations Disrupted and Response Underway

Halliburton, one of the world’s largest oilfield services companies, has been targeted by a cyberattack, according to a report from Reuters citing an unnamed source. The cyberattack reportedly affected operations at Halliburton’s north Houston campus as well as some of its global connectivity networks. In a statement to the media, a company spokesperson confirmed that they were aware of an issue impacting certain systems and were actively working to assess and mitigate the situation. “We have activated our pre-planned response plan and are working internally and with leading experts to remediate the issue,” the spokesperson said.

While Halliburton has not officially confirmed that the issue is the result of a cyberattack, reports from Cybernews suggest that the attack may have been cloud-based. The company has remained tight-lipped about the specific nature and extent of the disruption. Energy companies like Halliburton are increasingly attractive targets for cybercriminals due to the strategic importance of the infrastructure they operate. This incident brings back memories of the 2021 cyberattack on the Colonial Pipeline, the largest fuel pipeline in the United States, which resulted in widespread panic, fuel shortages along the East Coast, and a significant ransom payment of $5 million to the attackers.

The Halliburton incident highlights ongoing vulnerabilities in the energy sector. “Critical infrastructure operators in the United States get to decide how well they do or do not employ cybersecurity controls,” said Eric Noonan, CEO of cybersecurity firm CyberSheath, in comments to CNN. He warned that the current state of cybersecurity in critical infrastructure cannot continue without posing significant risks to the American public. As the energy landscape diversifies with the integration of renewable sources and electric vehicles, the cybersecurity threats extend beyond traditional oil and gas infrastructure. Wind and solar farms, as well as electric vehicles and charging stations, are also vulnerable to cyberattacks, underscoring the need for robust cybersecurity measures across the entire energy spectrum. Halliburton’s response to this cyberattack will be closely watched, as it may set a precedent for how other energy companies address similar threats in the future.

KazMunayGas Remains Unaffected by New OPEC+ Output Reduction Plans

Kazakhstan recently announced a significant update to its oil production compensation plan in response to overproduction in July, signaling its commitment to the OPEC+ agreement. However, Kazakhstan’s National Oil Company, KazMunayGas, has yet to receive any directives to reduce its output in line with this new compensation strategy, according to a report by Interfax on Friday. This development highlights a persistent disconnect between Kazakhstan’s public commitment to the OPEC+ framework and its actual production practices. Despite Kazakhstan’s frequent declarations of its dedication to the OPEC+ agreement, the country has consistently struggled to meet its assigned production quotas. The updated compensation plan, which Kazakhstan submitted to OPEC on Thursday, is an attempt to align its oil production with the agreed-upon targets and to make amends for exceeding its production limits earlier this year.

Kazakhstan has been under scrutiny from the OPEC Secretariat, alongside other nations like Iran and Russia, for consistently exceeding production limits during the first half of 2024. The new compensation plan is part of a broader strategy by Kazakhstan to maintain its credibility within the OPEC+ alliance. This plan includes significant reductions in production through September 2025, aiming to offset the excess volumes produced earlier in the year. In addition to the compensation plan, Kazakhstan’s Agency for the Protection and Development of Competition has proposed adjustments to market controls and an increase in the maximum prices for petroleum products. These measures are intended to stabilize the market and ensure fair pricing as the country navigates its obligations under the OPEC+ framework. Kazakhstan’s production ceiling is set at 1.468 million barrels per day (bpd), but the country exceeded this limit by approximately 70,000 bpd in June and continued to overproduce in July. The revised compensation plan calls for a cumulative reduction of nearly 700,000 bpd, a significant step to bring production back in line with OPEC+ targets.

This announcement comes at a crucial time as the global oil market grapples with fluctuating demand and supply challenges. While Kazakhstan’s intentions to comply with OPEC+ agreements are clear, the absence of immediate action from KazMunayGas raises questions about the effectiveness of these commitments. The coming months will be critical in determining whether Kazakhstan can successfully align its production practices with its stated goals and maintain its standing within the global oil market.

UK Electricity Bills to Jump 10% Amid Rising Wholesale Costs

Household electricity bills in the UK are set to rise by 10% this October as the energy regulator Ofgem increases the energy price cap, responding to higher wholesale electricity costs faced by suppliers. The adjustment will see the average annual electricity bill for British households increase to approximately £1,840 (around $2,250) from £1,675 (around $2,055), marking the first cap hike since January. Jonathan Brearley, CEO of Ofgem, acknowledged the difficulties this increase will pose for many families. “We know that this rise in the price cap is going to be extremely difficult for many households,” Brearley said, urging those struggling to pay their bills to explore all available benefits, including pension credits, and to reach out to their energy providers for additional support.

The price cap revision has sparked widespread concern, particularly as the colder months approach. Earlier in the month, a consumer advocacy organization, Citizens Advice, warned that as many as a quarter of British households might be forced to turn off their heating and hot water this winter due to the revised price cap. The anticipated hike was initially estimated at 9%, but the actual increase has surpassed those expectations.

The impact of rising electricity costs is expected to hit households with children and low-income families the hardest. According to a Citizens Advice survey, 31% of households with children and 39% of low-income households expressed significant concern about affording electricity this winter. The survey also revealed that 48% of respondents plan to reduce or entirely turn off their heating to manage financially, while 34% foresee difficulties in affording essentials such as food, mortgage payments, or childcare due to the increased energy costs.

In a related development, the Labour government has announced the cancellation of approximately £1.6 billion ($2 billion) in fuel subsidy payments for more affluent pensioners. This decision is part of an effort to address a £23-billion ($29-billion) shortfall in the national budget. The upcoming price cap increase and the broader economic pressures it reflects highlight the ongoing challenges facing UK households as energy prices continue to rise, placing a growing strain on family finances across the country.

Disclaimer: This article provides financial insights and developments for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Invest in HSHG Digital Notes for Unparalleled Upside Potential

Date Issued – 23th August 2024

Own HSHG’s Digital Notes in Your Portfolios

HSHG’s Digital Notes in Your Portfolios Harley Street Healthcare Group, a leader in healthcare innovation, is offering digital tradeable redeemable notes under theticker symbol HSHG on BX Digital Swiss (regulated by FINMA) andAsseteraFinancial Markets, a fully regulated financial market in the EU. These notes are part of Swiss and Eu’s fintech innovation drive, backed bythorough KYC and due diligence processes.

These notes signify a breakthrough in the integration of healthcare and financial innovation, offering investors the potential to double their investment with virtually no risk.

As a holder of these digital notes, investors gain not only

lucrative returns but also access to exclusive benefits, including premium memberships and digital healthcare products-adding significant value to your financial opportunities.

Balfour Capital Group & Market Liquidity

Balfour Capital Group, a prestigious global boutique investment management firm, plays a crucial role in providing liquidity across global markets. Led by Chief Investment Officer Steve Alain Lawrence, who manages over $400 million in assets, Balfour Capital offers unparalleled diversification across more than 5,000 assets globally. This ensures strong liquidity for Harley Street Healthcare’s digital notes, supported by Balfour’s advanced algorithmic and

discretionarytrading strategies.

World-Class Technology & 24/7 Portfolio Access

Balfour Capital Group leverages world-class technology to enhance its trading strategies and portfolio management. Clients benefit from 24/7 portfolio access, providing real-time insights and control over their investments. This level of access exceeds industry standards, ensuring that clients are always informed and capable ofmaking timely decisions.

The blend of cutting-edge technology with human expertise guarantees that each portfolio is managed with precision and care.

Symbiotic Relationship: Risk Management & Expertise

The partnership between Harley Street Healthcare Group and Balfour Capital Group is built on a shared commitment to excellence in risk management and service. Their collaboration expertly manages risk, ensuring that investors’ assets are protected. This symbiotic relationship combines Balfour’s financial acumen with Harley Street’s innovative healthcare solutions, offering clients unparalleled peaceo fmind and growth opportunities.

Digital Notes Structure & Benefits

The HSHG digital notes are a regulated, secured, publiclytraded, ESG compliant hybrid financial product with upfront yield and exponential upside. They offer strong downside protection and are issued by HSHG.

- Denomination: CHF 1,000

- Bundle Purchase: Typically CHF 11,200

(equivalent to CHF 10,000 in (GBP/EUR)

Investor Options:

1) 12% Yield Option: Purchase CHF 1,000 worth of notes and receive an additional 12% yield, resulting in an immediate 12% return on the principal, redeemable after nine months.

2) 2.12% Discount Option: Purchase CHF 1,000 notes at a 12% discount, paying CHF 880

while still receiving CHF 1,000 in digital notes.

These notes, with a four-year maturity linked to the company’s IPO, offer flexibility in redemption (cash or equity) and are backed by true collateral. Whether you choose cash or equity redemption, the upside potential could see

your investment double.

Balfour Capital Group, along with B Digital and Assetera, will provide ongoing liquidity by quoting bid/ask prices, ensuring an active and reliable market for these assets.

Harley Street Healthcare Group (HSHG)

“Making 90 the new 50”

Harley Street Healthcare Group, including its brands and subsidiaries such as Harley Club, HARLEY of LONDON, and Harley Street Clinics of LONDON, offers integrated health &wellness services globally. Combining modern medicine with state-of-the-art technological innovations and ancient healing systems, HSHG partners withc u s t o m e r s on their health &wellness journey, moving away from the traditional sick care system.

With a focus on the direct correlation between wellness and corporate profitability, especially post-pandemic, HSHG emphasizes that “health is wealth.

Healthcare Industry Growth

The healthcare industry is poised for exponential growth, with data generation expected to increase at a compound annual growth rate of 36% by 2025. This growth is driven by an aging population in developed markets,4 booming populations in emerging markets, and rising drug development costs. The global healthcare budget is projected to reach $15 trillion by 2030, with digital health innovations-such as genomics, wearables, A,l and electronic health records–leading the way

Commitment to Market Support & Investor Confidence

Harley Street Healthcare Group is dedicated to supporting its digital notes through continuous market updates and strategic announcements aimed at enhancing liquidity and valuation in linewith investor sentiment. Balfour Capital Group’s active involvement in providing liquidity and market-making ensures that investors can confidently engage with this innovative financial product.

About Balfour Capital Group

Since its establishment in 1989, Balfour Capital Group has distinguished itself as a leader in financial stewardship, catering to a diverse clientele, including pension funds, insurance companies, foundations, and esteemed family offices.The firm is committed topersonalized client service, aligning strategies with each client’s unique financial goals.

Balfour Capital currently manages three flagship funds with over $400 million, including the Discretionary Trading Program, which manages $56 million in assets and has a proven track record of consistent and robust financial performance.

Discretionary Trading Program: Complete Diversification

Balfour Capital Group’s Discretionary Trading Program, initiated on March 18th, 2018, combines advanced algorithmic strategies with discretionary decision-

making, analyzing over 3,500 assets globally. This program offers clients

complete diversification across various asset classes and markets, reducing risk while enhancing potential returns. With an average annual5 return of

50.79% over the last three years, the program’s effectiveness ni navigating global markets is clear. This level of diversification, coupled with Balfour’s sophisticated risk management, ensures that investors can confidently pursue their financial goals while mitigating market-specific risks.

Balfour Capital Group

Contact Information:

UK: +44 20 3833 1752 | US: +1 312 857 6941 | AUS: +61 2 5127 5306 Email: support@balfourcapitalgroup.com

Steve Alain Lawrence, CIO: steve.lawrence@balfourcapitalgroup.com

Johan Boos (EU): johan.boos@balfourcapitalgroup.com

Vikram Srivastava (Asia): v.srivastava@balfourcapitalgroup.com Website: www.balfourcapitalgroup.com

Harley of London

Contact Information:

UK: +44 7903 311682 | US: +1 (289) 690-4359

Email:Hari Singh: hari@harleyoflondon.co.uk,

Vidhi Buddhdev: Vidhi@g1magazine.digital

Link to the Digital Note: www.harleyoflondon.co.uk/digital-note Website: www.harleyoflondon.co.uk | www.theharleyclub.com

Daily Synopsis of New York Market Close

Date Issued – 23th August 2024

Courtesy of the Research Department at Balfour Capital Group

HSBC Targets Doubling UK Wealth Business Amid Mass Affluent Market Push

HSBC (HSBA.L) is setting its sights on doubling the assets under management (AUM) in its UK wealth division to £100 billion ($131 billion) over the next five years. This strategic move aligns with a broader industry trend of banks tapping into the ‘mass affluent’ segment for increased fee income. José Carvalho, Head of Wealth and Personal Banking UK, emphasized HSBC’s goal of becoming a top-five player in the British market, leveraging its global reach to attract clients who bank across multiple markets or hail from overseas.

“International connectivity is our competitive edge and a key growth driver,” Carvalho told Reuters. HSBC, which manages $712 billion in assets globally, plans to expand its advisory team to support this growth initiative, though specific hiring numbers were not disclosed. The UK’s wealth management market is currently dominated by St James’s Place, which reported AUM of £168 billion at the end of last year. According to research firm Coalition Greenwich, the largest UK banks collectively generated $12 billion from wealth management in 2023, marking an 11% year-on-year increase. St James’s Place forecasts a 7% growth in the overall wealth market.

Rivals Barclays (BARC.L) and Lloyds (LLOY.L) have also recently announced plans to target the ‘mass affluent’ segment, defined by Lloyds as customers with deposit balances ranging from £75,000 to £250,000. This demographic holds approximately £4 trillion, accounting for half of the UK’s wealth market, according to data from Lloyds and the Investment Association. This strategic pivot reflects banks’ desire to diversify into sectors less impacted by falling interest rates, where technological advancements are enabling competition with independent providers. However, experts caution that the market is becoming increasingly crowded.

“The appetite for wealth management services is growing, but competition is fierce, with nearly every major bank now aiming for a larger share,” said Nigel Moden, EMEIA Banking & Capital Markets Leader at EY, in an interview with Reuters.

Historically, big banks have focused on ultra-high-net-worth individuals, leaving the mass affluent to independent financial advisors like St James’s Place. However, Carvalho noted a shift in strategy, highlighting an opportunity in the mass affluent segment, which remains largely dominated by independent financial advisors (IFAs), controlling around 55% of the market. HSBC’s approach includes cross-selling more products to its wealth clients via enhanced mobile and digital platforms, while also encouraging wealthier clients with substantial savings to consider long-term investments.

“For the mass affluent market, banks are adopting a hybrid model that combines digital technology with human advisors, offering enhanced services that particularly appeal to younger clients,” said Grace Miu, Head of Wealth at Coalition Greenwich.

Lloyds is pursuing a similar strategy with its new Lloyds 360 digital tool, while Barclays is focusing on its recently merged Private Bank and Wealth Management unit. However, Christian Edelmann, Managing Partner for Europe at Oliver Wyman, warned that the collective ambitions across all banks may exceed what the market can realistically deliver, suggesting potential disappointments ahead.

Nestle Shares Under Pressure After CEO’s Sudden Departure

Nestle shares are expected to drop on Friday following the unexpected resignation of CEO Mark Schneider and the appointment of long-time company executive Laurent Freixe. Schneider’s abrupt departure, announced late Thursday after a board meeting, ends his nearly eight-year tenure as the first outsider to lead the Swiss food giant in almost a century.

Investor confidence in Schneider had already been waning over the past 15 months, and his sudden exit has rattled the market, with shares in Nestle maker of KitKat and Nescafe indicated to fall nearly 3% in premarket trading in Zurich.

Freixe, a 62-year-old Frenchman with deep industry knowledge and extensive networks, is expected to steer Nestle back to its core strengths in sales and marketing. His appointment comes as the company has lagged behind competitors like Danone and Unilever in recent quarters. Critics have pointed out that Nestle’s heavy reliance on price hikes has hurt sales volumes, driving cash-strapped consumers towards cheaper alternatives. Freixe, who has already begun his new role, faces the challenge of restoring market share and boosting sales in a challenging environment.

“There will always be challenges, but we have unparalleled strengths,” he remarked. “We can strategically position Nestle to lead and win in every market we operate in.”

Freixe’s experience includes leading Nestle’s European business during the global financial crisis and most recently heading the company’s Latin America zone, which has experienced robust growth. Analysts believe Freixe’s focus on fundamentals and passion for products will be crucial for Nestle’s recovery.

“With Laurent Freixe in charge, Nestle will return to its roots,” said Jean-Philippe Bertschy, an analyst at Bank Vontobel. “Successful food companies like Lindt and Danone have marketing and sales experts as CEOs, and Nestle is likely to benefit from this approach as well.”

Restoring sales growth will be key to regaining investor trust, particularly after Nestle shares hit an all-time high in January 2022 but have been declining since May 2023 due to earnings misses and guidance downgrades. While Schneider was praised for some strategic moves, including selling Nestle’s U.S. confectionery business and North American water brands, his efforts to revitalize the company did not materialize quickly enough for investors. Missteps, such as the costly acquisition and subsequent sale of a peanut allergy treatment company, further eroded confidence. As Freixe takes the helm, his ability to reignite growth and stabilize the company will be closely watched by the market.

Apple to Allow iPhone Users in Europe to Delete the App Store

Apple will soon permit iPhone and iPad users in the European Union to delete the App Store and Safari browser from their devices, a significant shift in its long-standing policy. This move comes as Apple adjusts to the EU’s new digital regulations aimed at increasing competition and reducing Big Tech’s dominance. Previously, Apple had tightly controlled the App Store as the exclusive gateway for apps and digital content on its devices. However, under the EU’s Digital Markets Act (DMA), the tech giant is required to offer more flexibility to users. According to an update on Apple’s support page, users in the EU will soon be able to delete the App Store, Messages, Camera, Photos, and Safari apps, with only Settings and Phone remaining undeletable.

Apple is also introducing a new section in iOS where users can manage default settings for key functions like browsers, messaging, and phone calls. The company emphasized that developers will need to meet strict privacy and security criteria before offering alternative browser engines on iPhones, given the high risk of exposure to malicious content. Historically, app developers were required to use Apple’s payment system within the App Store, allowing Apple to take a share of transactions. The EU has criticized this practice, arguing that it restricts developers from directing users to alternative payment methods. Apple was recently accused of violating the DMA, marking the first time a tech firm faced such charges under the new law.

In response, Apple announced that, starting this autumn, developers in the EU will be allowed to promote and sell their products outside of the App Store. This includes introducing a new fee structure for transactions made through alternative platforms. The European Commission, which oversees compliance with the DMA, has stated it will review Apple’s upcoming changes to ensure they meet regulatory requirements and consider feedback from developers and the market.

The DMA is part of the EU’s broader effort to regulate Big Tech, with other companies like Google, Amazon, Meta, Microsoft, and TikTok’s owner ByteDance also required to comply. The law empowers the EU to impose substantial fines on companies that fail to adhere to the rules.

As the digital landscape continues to evolve under these new regulations, Apple’s decision marks a significant shift in how it operates within the EU, potentially setting a precedent for other regions.

Japan’s Core Inflation Accelerates, but Demand-Driven Growth Slows Below 2%

Japan’s core inflation continued to rise for the third consecutive month in July, with the core consumer price index (CPI) which excludes fresh food climbing 2.7% year-on-year, slightly up from June’s 2.6%. This keeps inflation above the Bank of Japan’s (BOJ) 2% target for the 28th straight month. However, a closer look reveals that demand-driven inflation is weakening, which could complicate the BOJ’s decision-making on future interest rate hikes.

The “core core” index, which strips out both fresh food and energy costs and is a key indicator for broader inflation trends, rose just 1.9% in July, down from 2.2% in June. This marks the first time since September 2022 that it has fallen below the critical 2% threshold. The rise in core CPI largely reflected the phasing out of government subsidies for household utility bills. Without this factor, overall inflation appears to be decelerating, especially with recent government measures to reinstate utility bill relief and a stronger yen lowering import costs. As a result, core CPI growth is expected to slow further.

This inflation data is crucial as the BOJ considers its next steps on monetary policy. In July, the BOJ surprised markets by raising interest rates to a 15-year high and indicated it might continue to tighten monetary policy if inflation remains on track to consistently hit its 2% target. This move caused significant market reactions, with the yen surging and Tokyo stocks suffering their steepest single-day decline since 1987’s Black Monday.

BOJ Governor Kazuo Ueda, speaking on Friday, reiterated the bank’s readiness to hike rates again if inflation sustains above 2%. However, he also emphasized the need for caution given the ongoing volatility in financial markets.

Japan’s economy showed strong recovery in the second quarter, driven by robust consumer spending, which supports the case for continued monetary tightening. However, in a recent Reuters poll, 57% of economists predicted that the BOJ would raise borrowing costs again before the year’s end, reflecting uncertainty about the future direction of Japan’s inflation and economic growth.

DAX Index News: Market Eyes Powell’s Jackson Hole Speech Amid Rate Cut Speculation

Market Overview

On Thursday, August 22, the DAX gained 0.24%, adding to the previous day’s 0.50% rise, closing at 18,493. This modest uptick came as investors eagerly await Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium, a key event that could shape expectations for future interest rate cuts.

Key DAX Market Movers on Thursday

Bank stocks led the DAX, with Deutsche Bank and Commerzbank posting gains of 4.00% and 2.12%, respectively. Positive sentiment was driven by Deutsche Bank’s settlement of lawsuits related to its acquisition of Postbank, which removed a significant overhang on the stock.

German Private Sector PMIs Support ECB Rate Cut Expectations

Germany’s economic outlook showed signs of weakening, as the HCOB Services PMI fell to 51.4 in August from 52.5 in July, and the HCOB Manufacturing PMI dropped to 48.5 from 49.1. The downturn in both services and manufacturing underscores the challenges facing the Eurozone’s largest economy and bolsters expectations of a potential rate cut by the European Central Bank (ECB) in September. According to Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, “The struggles in manufacturing are starting to spill over into the otherwise steady services sector,” highlighting the growing economic pressures.

Wage Growth and ECB Minutes Signal September Rate Cut Debate

Adding to the rate cut speculation, wage growth in the Eurozone decelerated, with Q2 2024 growth slowing to 3.55% from 4.74% in Q1. The ECB’s recent meeting minutes also suggested that policymakers are seriously considering a 25-basis point rate cut in September to stimulate the economy. Lower borrowing costs could enhance corporate earnings and lift stock prices, provided the broader economic environment remains stable.

US Jobless Claims and Services PMI Ease Recession Fears

Across the Atlantic, the US labor market showed resilience, with initial jobless claims rising slightly to 232,000 in the week ending August 17. The S&P Global Services PMI edged up to 55.2 in August from 55.0 in July, signaling continued strength in the US economy. This helped ease recession fears, although investors are still betting on a potential 25-basis point rate cut by the Fed in September, which could boost demand for DAX-listed stocks. Parker Ross, Chief Economist at Arch Capital Global, noted,

“We are still seeing a very gradual deterioration in jobless claims data, suggesting that while layoffs remain low, finding new employment is becoming more challenging.”

US Market Trends

On Thursday, August 22, US equity markets struggled as 10-year Treasury yields rose, driven by diminishing expectations for a 50-basis point Fed rate cut. The Nasdaq Composite dropped by 1.67%, while the Dow and S&P 500 declined by 0.43% and 0.89%, respectively.

US Economic Calendar

All eyes are now on Fed Chair Powell’s speech at the Jackson Hole Symposium on Friday, August 23. A hawkish tone could dampen hopes for a September rate cut, potentially triggering a sell-off in the DAX. Conversely, dovish comments supporting multiple 2024 rate cuts could propel the DAX towards 19,000. Nick Timiraos, Chief Economics Correspondent at the Wall Street Journal, suggested that

“Officials could cut rates by a quarter-point at each of their next few meetings, depending on economic conditions.”

Near-Term Outlook

The DAX’s near-term direction hinges on Powell’s upcoming speech. A dovish stance could push the index towards 19,000, while a hawkish message might see it dip below 18,000.

DAX Technical Indicators

The DAX remains above its 50-day and 200-day EMAs, indicating bullish momentum. A move towards 18,750 is possible if the index can reclaim 18,500, potentially challenging the all-time high of 18,893. However, a drop below the 50-day EMA could see the index test the 18,000 level, with further support at 17,615. The 14-day RSI at 60.13 suggests the DAX could approach its all-time high before reaching overbought conditions, making Powell’s speech a crucial factor to watch.

Conclusion

Investors should remain vigilant, closely monitoring Powell’s speech, economic indicators, and expert analyses to navigate market risks effectively.

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This Buy/Sell Recommendations provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close

Date Issued – 5th September 2024

Tesla’s Stock Poised for Breakout: Key Price Levels to Watch

Tesla (TSLA) shares surged over 4% on Wednesday, defying a broader downturn in large-cap tech stocks. Despite a 25% gain over the past three months, Tesla’s stock has remained relatively flat since late July. Investors are awaiting critical updates on vehicle deliveries, the highly anticipated robotaxi event, and Q3 earnings, all expected next month.

Symmetrical Triangle Formation: Potential for Volatility Ahead

Tesla’s chart reveals a symmetrical triangle pattern, signaling a pause in price movement. This formation suggests that a significant move could be on the horizon, either upwards or downwards. Investors should pay close attention to the following key levels that could shape Tesla’s next trend.

Upside Breakout Levels to Watch

If Tesla’s stock breaks above the symmetrical triangle with strong trading volume, it could rally to the $265 mark, where previous highs from December and July may create resistance. Should momentum continue, the stock could target $300, where it would likely face substantial resistance from levels last seen between December 2021 and July 2022.

Key Support Levels on a Breakdown

Conversely, a breakdown below the triangle pattern could push Tesla’s stock down to the $185 level. This zone could offer support, aligning with the neckline of an inverse head-and-shoulders pattern formed between February and June. Should weakness persist, the next critical support area lies near $152, where bargain hunters may step in around the swing low from April 2023, coinciding closely with another low from April 2024.

Tesla’s stock is at a crucial juncture, and the next move could set the tone for its performance in the coming months. Investors should monitor these key price levels closely as the company gears up for a potentially game-changing quarter.

Qualcomm, Samsung, and Google Collaborate on Mixed-Reality Glasses: A New Approach to AR/VR Technology

Qualcomm’s CEO Cristiano Amon has revealed that the company is partnering with Samsung and Google to develop a new set of mixed-reality glasses, offering a distinct alternative to Apple’s larger headset approach. This collaboration, first announced last year, aims to create glasses that seamlessly integrate augmented reality (AR) and virtual reality (VR) experiences, connected directly to a smartphone. Amon highlighted that the primary goal is to deliver “new experiences” through these smart glasses, with the ultimate vision of encouraging smartphone users to purchase them as complementary devices. Unlike Apple’s Vision Pro, the Samsung-Google-Qualcomm collaboration focuses on smaller, wearable glasses that may offer a more practical and stylish solution for daily use.

Qualcomm’s Role and AR1 Gen 1 Chip

Qualcomm, which has made mixed-reality technology a strategic focus as it diversifies from its smartphone-centered business, is contributing its Snapdragon AR1 Gen 1 chip specifically designed for smart glasses. This chip is crucial in Qualcomm’s broader strategy of enabling AI applications to run directly on devices, enhancing the processing power of both the glasses and the smartphone they connect to. Amon emphasized the importance of localized AI processing: “AI will run on the device, on the cloud, and across both the glasses and the phone,” delivering enhanced, real-time experiences without relying solely on cloud infrastructure.

Market Potential and Challenges

While mixed-reality headsets remain a smaller segment compared to the vast smartphone market with the International Data Corporation predicting only 9.7 million VR/AR headsets shipped this year compared to 1.23 billion smartphones, smaller and more wearable devices like smart glasses could unlock broader consumer adoption. Amon believes the industry needs to achieve a level of comfort and style, where these glasses resemble regular eyewear, to drive mass adoption. In comparison to Meta’s Ray-Ban smart glasses, which are integrated with a camera and AI-powered voice assistant, Qualcomm’s vision is centered around creating a product that feels as natural as wearing everyday glasses, yet fully capable of delivering mixed-reality experiences.

Strategic Implications for Tech Giants

This project represents a significant step in the competition among tech giants for leadership in the mixed-reality space. Apple’s Vision Pro headset has already made waves, but Google, Samsung, and Qualcomm are betting on a different form factor and strategy. With further details expected to emerge soon, this collaboration could be pivotal in shaping the future of AR and VR, potentially transforming how consumers interact with technology in their daily lives. As the development progresses, industry watchers are keen to see how this trio’s product will stand up against other emerging AR/VR technologies, including Apple’s high-profile offerings.

Dollar Struggles Amid Growing Bets on Aggressive Fed Rate Cut

The U.S. dollar found itself under pressure on Thursday, weighed down by rising expectations of an outsized rate cut from the Federal Reserve as concerns about the U.S. economy’s growth outlook intensify. Renewed fears over the slowing U.S. labor market and softer-than-expected economic data have driven investor sentiment toward a more aggressive easing cycle by the Fed. Amid this, the Japanese yen emerged as a standout performer, gaining on the back of its safe-haven status and speculation that upcoming rate hikes from the Bank of Japan (BoJ) could strengthen the yen by narrowing interest rate differentials. The yen rose 0.26% to 143.36 per dollar, reaching a one-month high earlier in the session. For the week, the yen is up 1.8%, reflecting increased demand for safer assets.

U.S. Economic Outlook and Fed Expectations

Global financial markets remain on edge, with stocks taking a hit following weak U.S. economic data. Earlier this week, U.S. job openings for July fell to a 3.5-year low, indicating a cooling labor market. This came on the heels of Tuesday’s ISM manufacturing report, which showed continued contraction in the sector. Investors are now factoring in the possibility of a larger-than-expected rate cut by the Fed, as economic growth prospects appear less robust than previously forecast. Hemant Mishr, Chief Investment Officer at S CUBE Capital, remarked, “The markets are becoming more anxious. There’s been a shift from focusing on positive news to rationalizing a sell-off based on negative data.” Economists at Wells Fargo noted that the latest labor market data reaffirm the notion that the job market is no longer a primary source of inflationary pressure for the U.S. economy. With the Fed focused on labor market stability, any signs of further weakening are likely to influence the central bank’s decision-making.

Dollar’s Performance and Market Sentiment

The U.S. dollar made a modest recovery on Thursday, inching up 0.02% against a basket of major currencies to 101.28, but remained subdued overall. The euro dipped slightly by 0.05% to $1.1077, while the British pound held steady at $1.3146. Meanwhile, the Australian dollar slipped 0.02% to $0.6724, although it remained supported by a still-hawkish stance from the Reserve Bank of Australia. Investors are now betting on a 45% chance of the Federal Reserve lowering interest rates by 50 basis points at its upcoming meeting, with more than 100 basis points worth of cuts priced in by the year’s end. The market’s focus remains squarely on Friday’s nonfarm payrolls report, where economists expect the U.S. economy to have added 160,000 jobs in August, compared with 114,000 in July. The unemployment rate is anticipated to tick down to 4.2%. Mishr from S CUBE Capital commented, “If the unemployment rate rises beyond 4.5%, markets will likely start pricing in a more aggressive 50-basis-point cut.”

Global Currency Movements

Elsewhere, the New Zealand dollar edged up 0.05% to $0.6202, while the Chinese yuan strengthened, with the onshore rate gaining around 0.2% to 7.1003 per dollar, approaching its strongest level in over a year.

As the U.S. economy shows signs of slowing, the prospect of a significant rate cut by the Federal Reserve continues to weigh on the dollar, while currencies like the yen and yuan benefit from their safe-haven status. All eyes are now on Friday’s labor market report, which could set the tone for the Fed’s next move.

Hang Seng Index Falls as Tech Stocks Struggle, Mainland China Markets Rebound on Stimulus Hopes

U.S. Markets End Mixed on Wednesday

U.S. equity markets closed mixed on Wednesday, September 4, following a market sell-off the previous day. The Nasdaq Composite and S&P 500 dipped 0.30% and 0.16%, respectively, while the Dow Jones Industrial Average gained a modest 0.09%. Notably, Nvidia (NVDA) extended its Tuesday 9.53% decline with an additional 1.66% loss.

Fed Rate Cut Speculation Grows Amid Labor Market Weakness

Weak U.S. labor market data intensified bets on a more aggressive 50-basis-point rate cut from the Federal Reserve in September. The latest JOLTs report showed job openings declined from 7.910 million in June to 7.673 million in July, prompting an increase in the likelihood of a larger cut from 38% to 45%. FOMC member Raphael Bostic highlighted the growing vulnerabilities in the labor market, signaling that further Fed action may be required. Weaker labor conditions raise concerns about slower wage growth and lower consumer spending, which could hamper U.S. economic performance as consumption accounts for more than 60% of GDP.

Analyst Insights on U.S. Labor Market

Arch Capital Global Chief Economist Parker Ross commented on the latest figures: “Today’s JOLTs report largely reaffirms the weakening we’ve already observed in July’s jobs data and other indicators. It doesn’t offer any major surprises but reinforces the trend of labor market deterioration.”

Australia’s Trade Surplus Widens as Imports Drop

Australia’s trade surplus widened unexpectedly from A$5.425 billion in June to A$6.009 billion in July, as imports dropped by 0.8%, while exports increased by 0.7%. Despite rising exports, falling imports signal a potential weakening in domestic demand.

RBA Signals No Rate Cuts in 2024

Reserve Bank of Australia Governor Michele Bullock indicated that interest rate cuts are unlikely in 2024, maintaining a vigilant stance on inflationary risks. Although inflation concerns persist, the tone was slightly less hawkish than previous statements.

Hang Seng Declines, Mainland China Markets Buoyed by Stimulus Hopes

The Hang Seng Index fell 0.27% on Thursday, following a sell-off in U.S. tech stocks, particularly the Nasdaq’s overnight losses. The Hang Seng Tech Index (HSTECH) dropped 0.17%, with notable names like Baidu (-1.18%), Alibaba (-0.37%), and Tencent (-0.13%) contributing to the decline. However, mainland China markets saw a modest recovery, with the CSI 300 and Shenzhen Composite Index rising 0.16% and 0.73%, respectively, as speculation grew around a potential fiscal stimulus package from Beijing. The mixed private sector PMI data from China underscored the need for stimulus to meet the government’s 5% growth target.

Nikkei Edges Higher Despite Strong Yen

The Nikkei 225 Index inched up 0.03% on Thursday morning, despite the yen strengthening against the dollar, following a 1.20% slide in USD/JPY to 143.728 on Wednesday. A stronger yen can reduce the profits of export-oriented companies, but selective stocks saw gains. Nissan Corp rose by 1.64%, and Softbank Group added 1.12%, while Tokyo Electron Ltd extended losses, dropping 2.54%.

ASX 200 Tracks Dow Higher

The ASX 200 Index gained 0.16%, buoyed by strength in banking and tech stocks, despite weakness in gold, mining, and oil sectors. The S&P/ASX All Tech Index climbed 1.25%, led by ANZ Group Holdings Ltd., which advanced 1.74%. However, Northern Star Resources Ltd fell 0.21%, following a dip in gold prices, and Woodside Energy Group declined by 6.90% amid a crude oil pullback and a Citi downgrade.

Investor Outlook: Monitoring Central Bank Commentary

As central bank rhetoric intensifies and with the U.S. Jobs Report on the horizon, investors should remain vigilant. Real-time data and expert commentary will be crucial for managing trading strategies, especially across Asian equity markets. Stay updated with the latest analysis to navigate the volatile landscape.

BOJ Policymaker Urges Caution on Rate Hikes Amid Market Volatility

Bank of Japan (BOJ) board member Hajime Takata emphasized the need for a cautious approach to interest rate hikes, highlighting the potential impact of market volatility on businesses. Speaking on Thursday, Takata reiterated that while the central bank remains committed to gradually raising rates, any adjustments would depend on ensuring that volatile markets do not undermine corporate investment and wage growth. Takata’s remarks align with BOJ Governor Kazuo Ueda’s previous comments, signaling that future rate increases will proceed in stages if economic conditions and inflation targets evolve as forecasted. However, Takata stressed that these hikes are conditional and would only occur if financial market conditions allow businesses to continue their spending and wage-increase plans without disruption.

“We are prepared to adjust monetary policy if our economic and inflation forecasts are achieved, but we must be mindful of potential risks posed by market turbulence,” Takata said during a news conference. “We cannot proceed with a preset timeline for rate hikes, as we need to closely monitor the impact of market developments on the economy.”

Inflation Risks and Market Volatility in Focus

Takata’s caution is driven by global market volatility, exacerbated by concerns over the U.S. economic outlook. Japan’s Topix stock index plunged 3.7% on Wednesday, its sharpest daily drop since early August, when global market sell-offs intensified. BOJ Deputy Governor Shinichi Uchida had previously assured that the central bank would not raise rates in an unstable market environment, echoing the current sentiment. In a significant policy shift earlier this year, the BOJ abandoned its negative interest rate policy and raised short-term rates to 0.25% in July, as it saw progress toward achieving its 2% inflation target. Governor Ueda has expressed the bank’s readiness to raise rates further, provided inflation remains around 2% and wage growth continues to support consumption. However, Takata pointed out that the global divergence in monetary policies could contribute to market instability. While many central banks, including the Federal Reserve, are beginning to ease after aggressive tightening cycles, the BOJ plans to continue its gradual hikes to avoid overheating the economy or stoking inflationary pressures.

Balancing Inflation with Wage Growth