Daily Synopsis of the New York market close – June 26, 2025

Date Issued – 26th June 2025

Preview

BP shares jumped after a report of early-stage takeover talks with Shell, though Shell firmly denied any negotiations. Nvidia surged to a new record, reclaiming its spot as the world’s most valuable company despite China-related export headwinds. The dollar weakened after Trump hinted at replacing Fed Chair Powell by October, increasing expectations for earlier rate cuts. Coinbase hit a 52-week high as analysts dubbed it the “Amazon of crypto.” Finally, J.P. Morgan launched its largest-ever active ETF, anchored by a $2B client investment – signaling a shift in strategy as active management returns to the spotlight.

BP Shares Jump on Takeover Speculation by Shell

BP shares surged over 10% intraday following a Wall Street Journal report that Shell was in early talks to acquire BP – a move that, if confirmed, would mark the largest energy sector deal since Exxon-Mobil’s 1990s merger. However, Shell swiftly denied any ongoing discussions, calling the story “market speculation.” BP shares settled up 1.64% by market close. Analysts say BP’s recent underperformance and shift back toward oil and gas have made it a plausible target, especially after activist investor Elliott Management disclosed a 5% stake. There’s also talk of a possible breakup and sale in parts rather than a full acquisition.

Investment Insight:

The sharp price movement on speculation highlights the fragility of market sentiment around legacy energy giants undergoing strategic shifts. Even though Shell denied the deal, the very plausibility of such M&A suggests continued consolidation pressure in the oil sector. Investors should monitor activist influence on BP’s strategy and potential divestitures, which could unlock value even without a formal takeover. The speculative premium on BP stock may persist short-term, but long-term positioning depends on execution of its reset strategy.

Nvidia Hits Record High, Reclaims Market Cap Crown

Nvidia shares surged over 4% on Wednesday, closing at an all-time high of $154.31 and reclaiming the title of the world’s most valuable company with a market cap of $3.77 trillion, edging out Microsoft. Despite the company being effectively shut out of the $50 billion Chinese market due to U.S. export controls, investor confidence remains strong. The company’s AI leadership, driven by dominant GPU performance in data centers, continues to power revenue. Nvidia reported 69% YoY revenue growth in May, with expectations of a 53% rise to $200 billion for the full year. CEO Jensen Huang reiterated AI and robotics as Nvidia’s twin growth pillars.

Investment Insight:

Nvidia’s resilience, despite losing access to China and absorbing a $4.5 billion write-off, underscores how deeply entrenched it is in the global AI supply chain. Investors appear willing to overlook geopolitical risk in favor of long-term AI dominance. With AI infrastructure demand still growing and minimal viable competition on the horizon, Nvidia’s valuation reflects more than just earnings – it reflects monopoly-like influence in a megatrend. Near-term volatility may come from regulatory or geopolitical news, but the long-term thesis remains strong if execution in data center and robotics verticals continues.

Dollar Drops as Trump Eyes Fed Chair Replacement Before Election

The U.S. dollar fell to a 3-year low following a report from The Wall Street Journal that President Trump may replace Federal Reserve Chair Jerome Powell by September or October, well ahead of Powell’s term ending in May 2026. Bloomberg’s dollar index fell 0.4% Thursday and is now down over 8% in 2025. Markets are interpreting Trump’s move as a signal for earlier and more aggressive rate cuts, with traders now pricing in 66 basis points of easing by year-end, up from 51bps just last week. The greenback weakened broadly, with Asian and emerging market currencies gaining. Trump’s criticisms of the Fed’s hawkish stance and rising U.S. debt are adding pressure. Candidates floated as Powell’s successors include Kevin Warsh and Kevin Hassett.

Investment Insight:

This development introduces a rare blend of political and monetary risk. A potential leadership change at the Fed – especially under pressure from a president seeking looser policy – could undermine the central bank’s credibility and accelerate dollar depreciation. Traders now see increased odds for a July or September rate cut. For investors, this suggests near-term tailwinds for gold, non-dollar assets and EM currencies. However, markets should also brace for volatility if Trump escalates rhetoric or names a controversial successor. Long-term implications could include steeper yield curve shifts and inflation risk repricing if Fed independence is perceived to be under threat.

Coinbase Hits 52-Week High on “Amazon of Crypto” Label

Coinbase (COIN) surged to a 52-week high on Wednesday after Bernstein analysts raised their price target from $310 to $510, calling the exchange the “Amazon of crypto services.” The stock closed over 3% higher and is nearing its 2021 all-time high of $357.39. Analysts highlighted Coinbase’s dominance in U.S. crypto trading, stablecoin operations, institutional custody, Base blockchain infrastructure and Prime lending desk. The platform also acts as custodian for most U.S. spot Bitcoin ETFs and now powers crypto integrations for over 200 banks and fintechs. COIN stock is up more than 40% since the Senate passed the GENIUS Act, a bill that would establish federal regulations for stablecoins. CEO Brian Armstrong emphasized the company’s broad reach, while Fundstrat’s Sean Farrell said there’s still room to enter the trade.

Investment Insight:

Coinbase’s continued momentum underscores its transformation from a pure-play crypto exchange to a full-spectrum financial infrastructure provider. Regulatory progress in Washington – especially the GENIUS Act – offers further legitimacy and upside for Coinbase and the broader crypto ecosystem. The Bernstein upgrade reflects a shift in institutional sentiment, viewing Coinbase not just as a trading platform, but as a strategic backbone for regulated crypto finance. Investors bullish on digital asset adoption, institutional custody and ETF flows may find Coinbase an attractive long-term position – especially if the regulatory narrative remains favorable and spot ETF volumes accelerate.

J.P. Morgan Launches $2B Active High-Yield ETF

J.P. Morgan Asset Management unveiled its largest active ETF to date – the JPMorgan Active High Yield ETF – launched with a $2 billion anchor investment from an unnamed external client. The fund, trading on the Cboe BZX Exchange, targets sub-investment grade bonds (below Baa3/BBB-), offering higher yields at greater risk. Priced at 45 basis points and benchmarked against the ICE BofA US High Yield Constrained Index, the ETF marks a major push by JPMorgan into actively managed fixed-income strategies. CEO George Gatch forecasts a fourfold increase in active fixed-income ETF assets under management (AUM) over the next five years, as investors rotate away from passive strategies that dominated the era of near-zero interest rates.

Investment Insight:

J.P. Morgan’s bold $2B entry into active high-yield ETFs reflects a structural shift in investor preferences amid rising rates and economic uncertainty. In an environment where passive beta no longer guarantees returns, active credit selection becomes crucial – especially in the high-yield space where default risk and dispersion are elevated. This move not only cements JPM’s dominance in active fixed-income ETFs but signals increasing institutional demand for tactical, income-generating vehicles. For investors, it’s a reminder: the era of “buy the index and chill” is giving way to precision-driven positioning, especially in debt markets.

Conclusion

Narratives are shifting, but positioning remains aggressive. Investors are rewarding bold strategies – whether it’s Nvidia’s AI dominance or Coinbase’s infrastructure moat. At the same time, the weakening dollar, energy sector consolidation rumors and a resurgence in active bond fund inflows point to a more tactical, selective capital rotation. Momentum remains the driver, but policy fragility is creeping into the background.

Upcoming Dates to Watch

- June 27th: U.S. Core PCE Price Index

- July 4th: Senate vote on Republican + debt ceiling bill

- July 8th: China Non-Manufacturing PMI

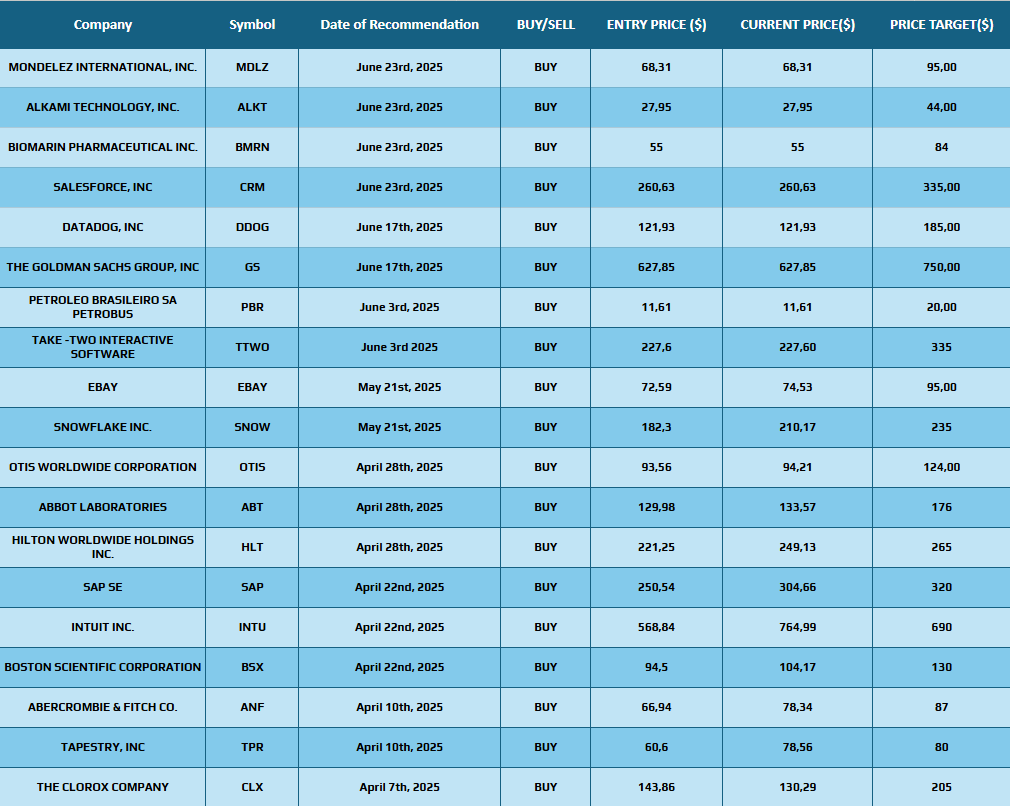

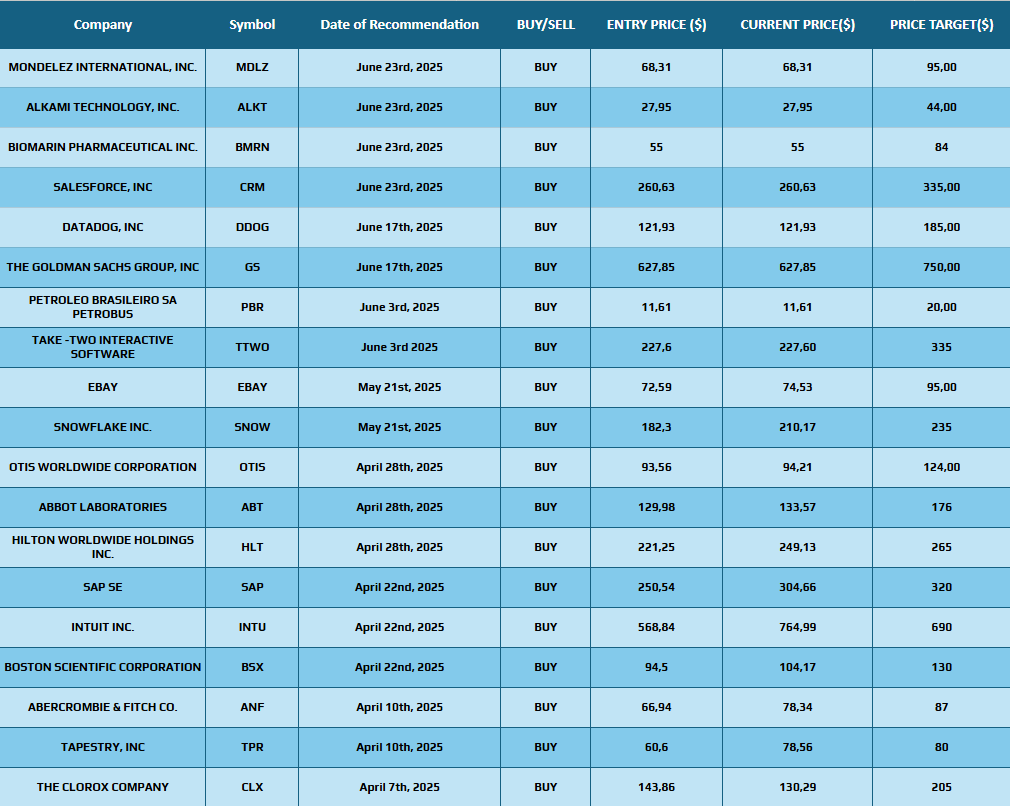

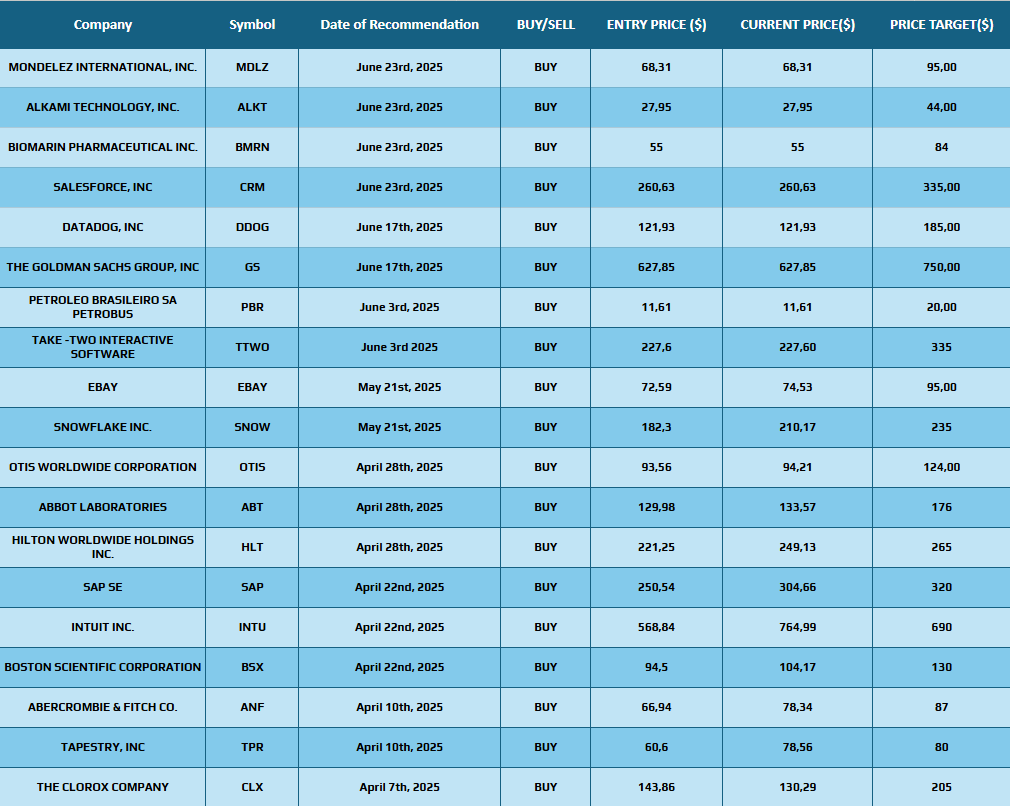

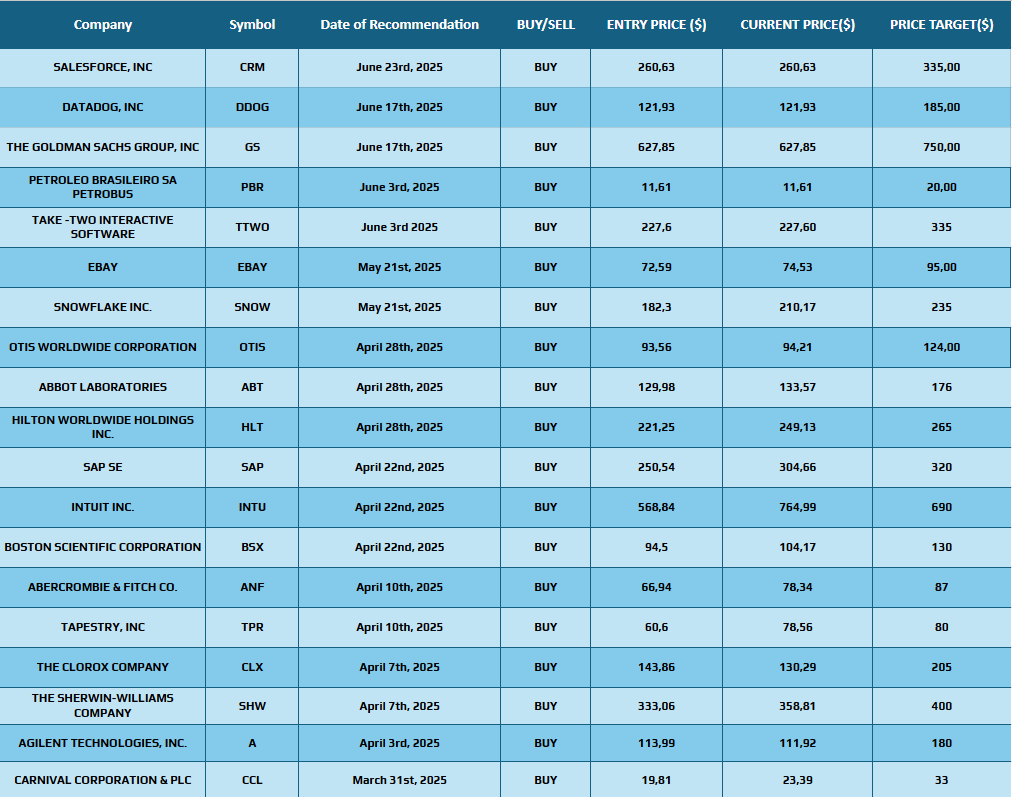

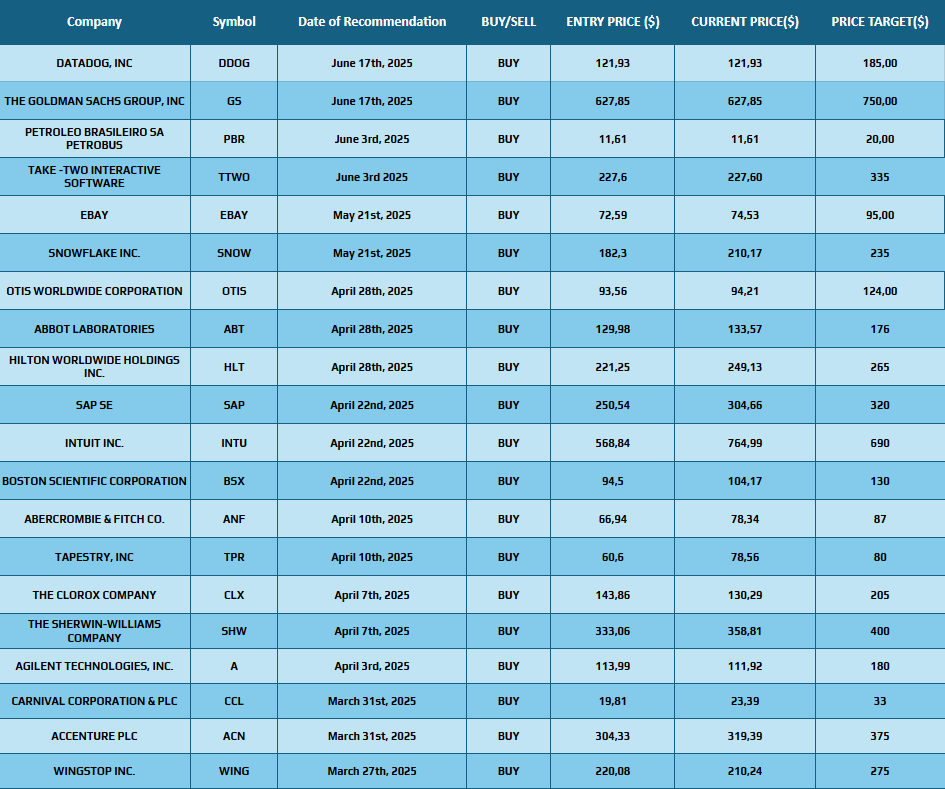

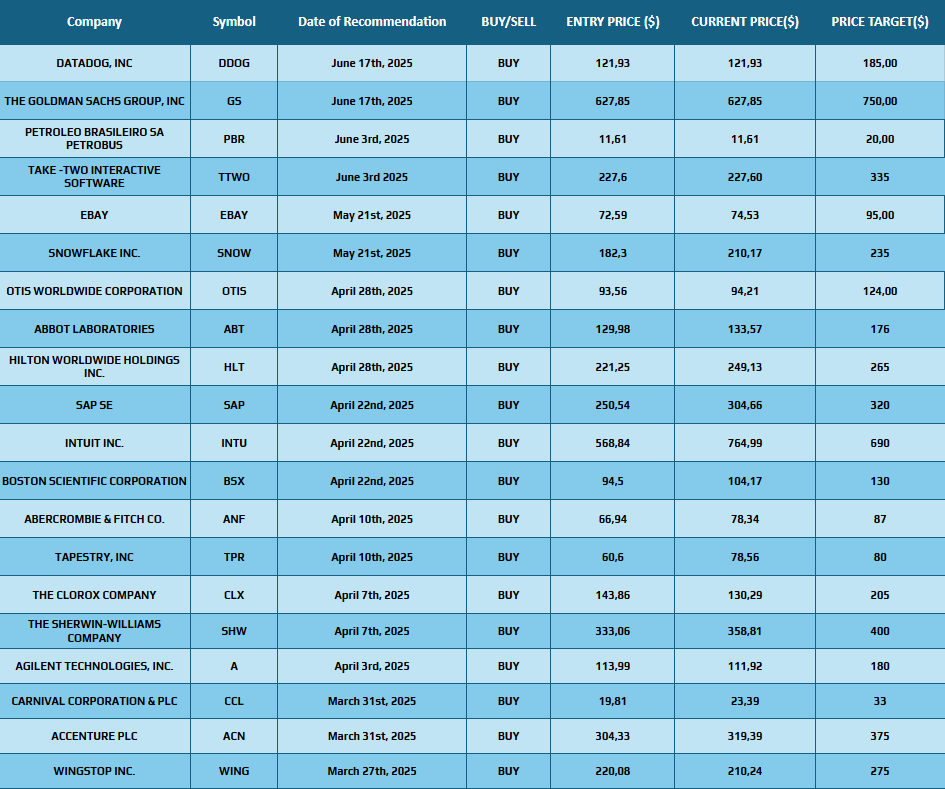

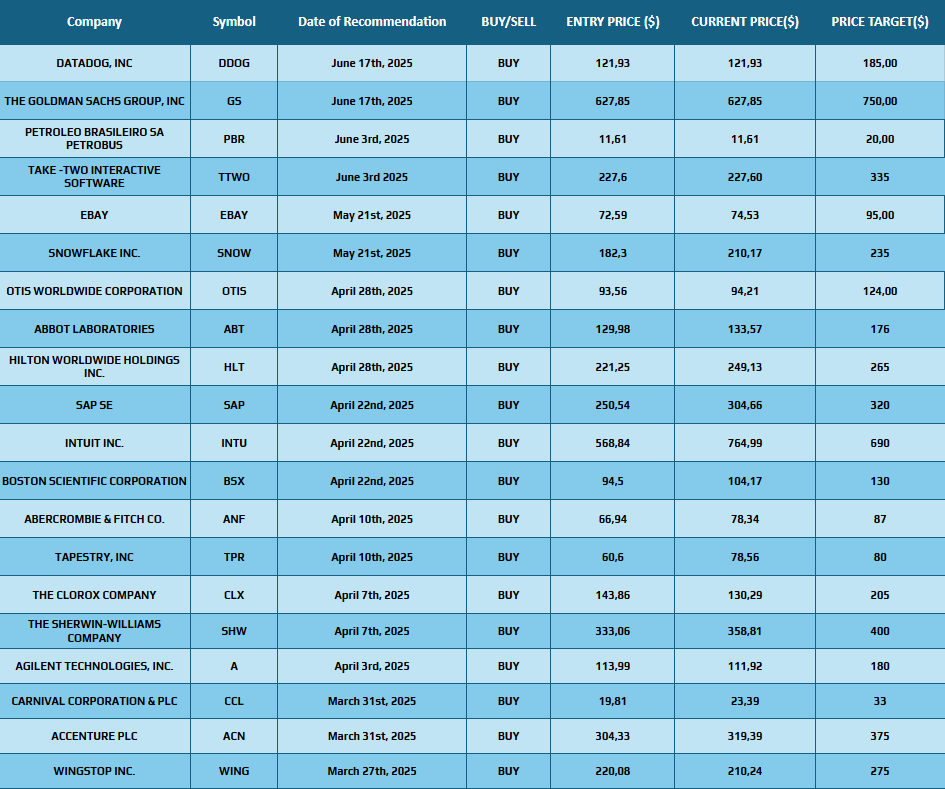

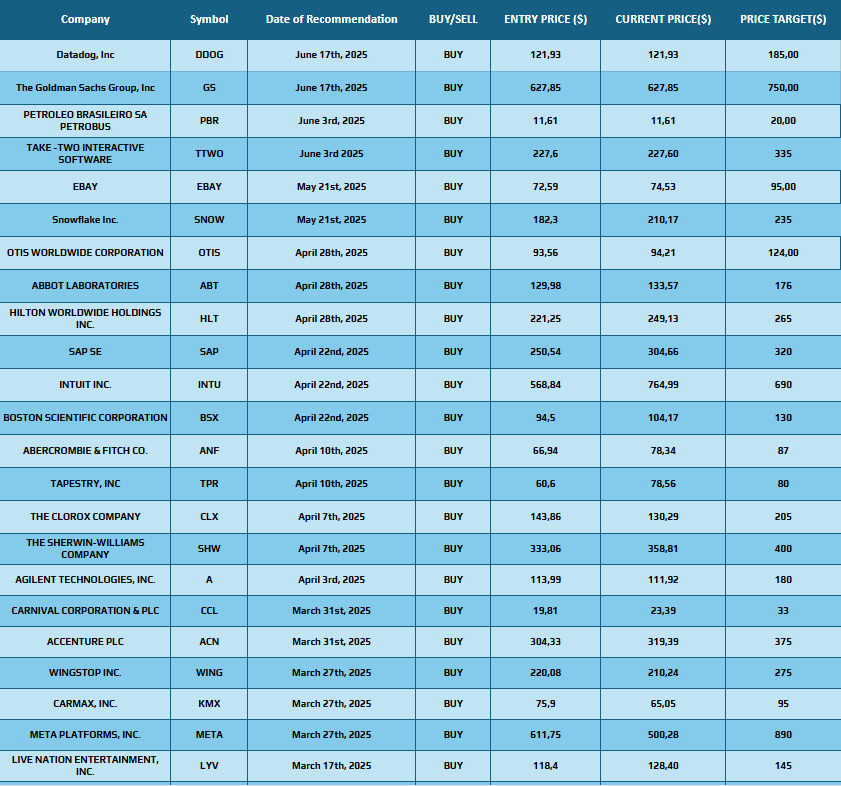

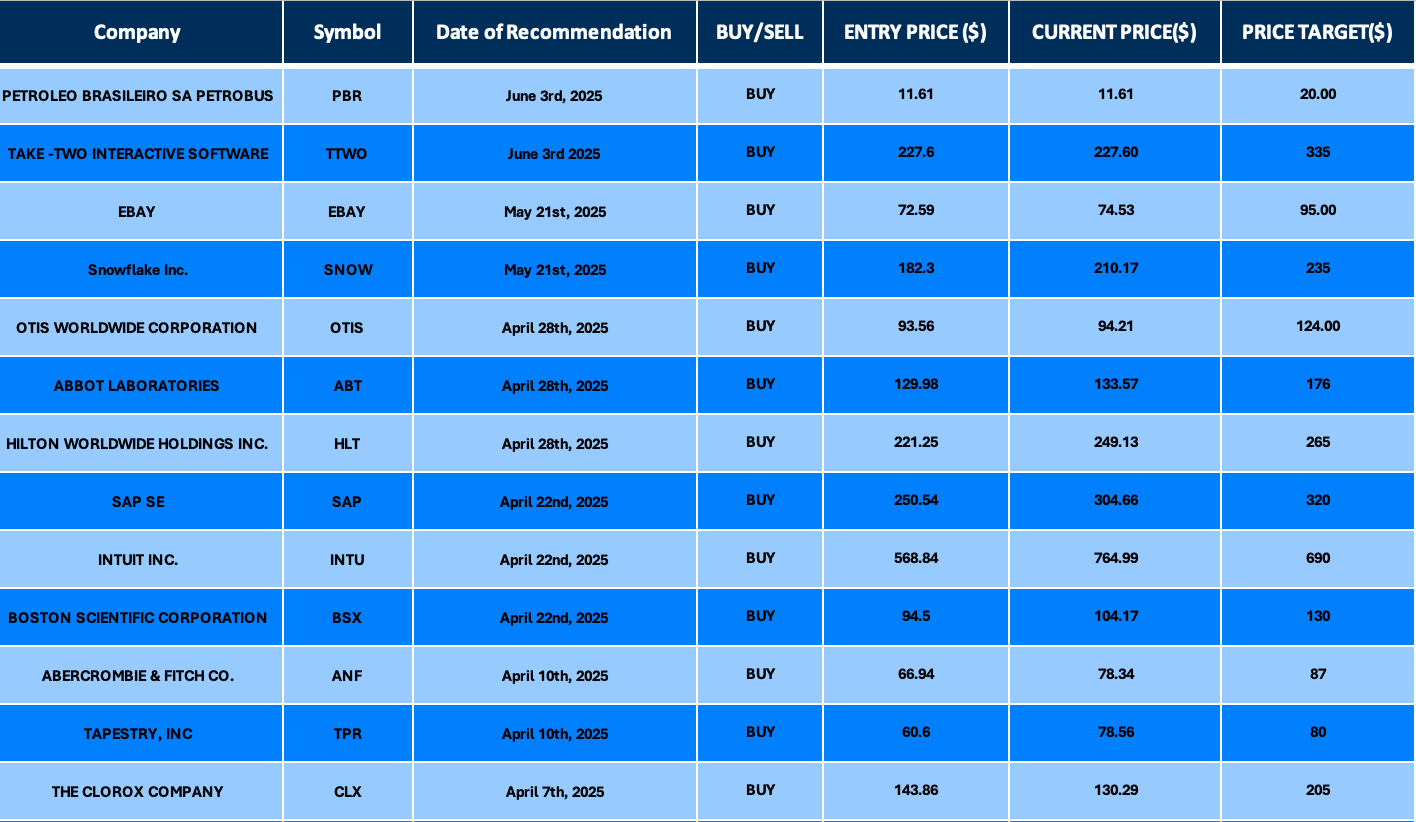

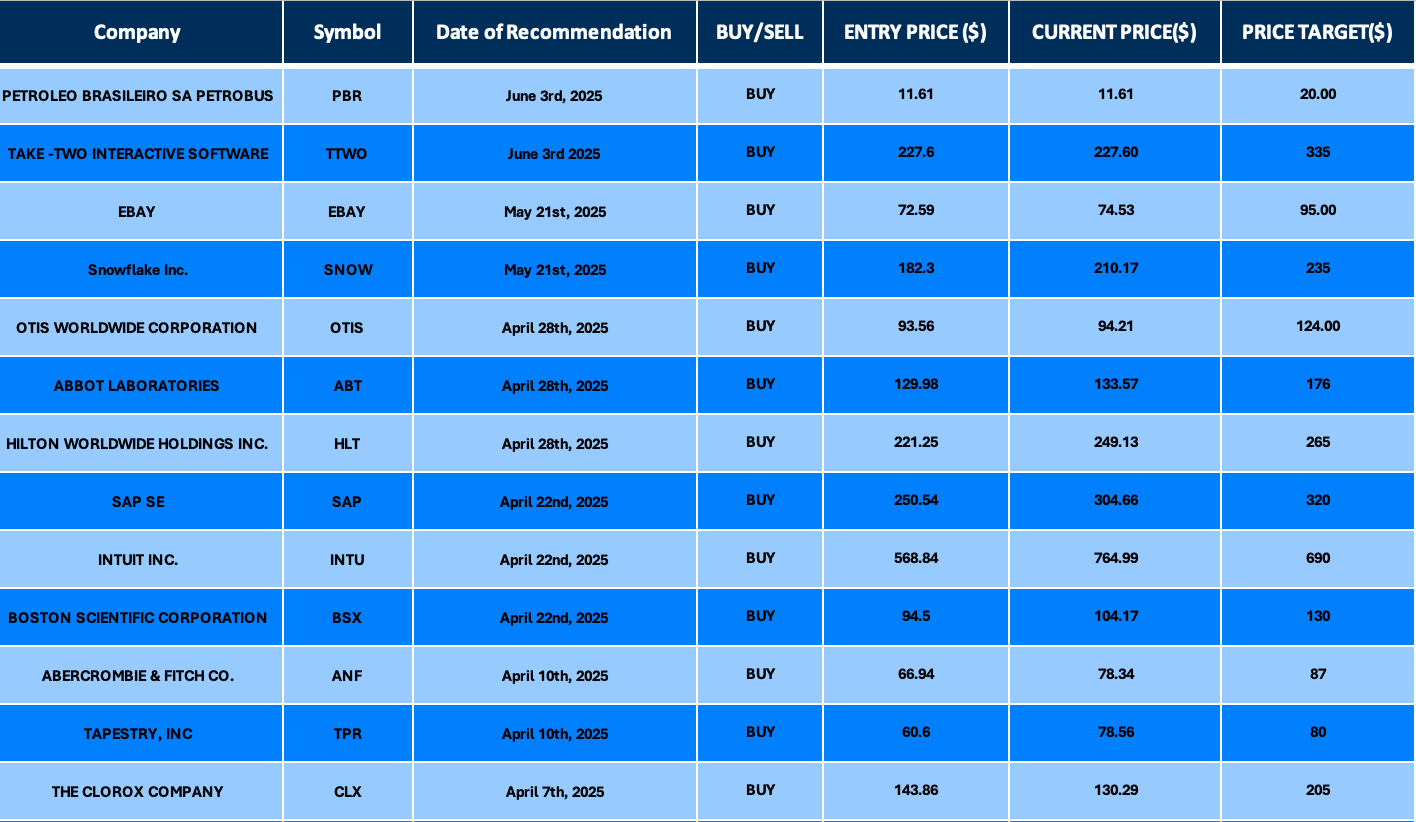

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – June 25, 2025

Date Issued – 25th June 2025

Preview

Markets grappled with a flurry of geopolitical and corporate developments. Oil dropped over 6% as ceasefire hopes between Iran and Israel lowered supply disruption risks. Meanwhile, China accelerated its de-dollarization agenda, expanding yuan-based financial tools as dollar sentiment weakens. In earnings, FedEx and Carnival beat expectations, with the latter raising its outlook. Chipmaker Ambarella surged 20% on sale rumors. However, risk remains high at sea – maritime insurers have begun denying coverage for U.S., Israeli and U.K.-linked ships in the Middle East. Investors now weigh solid corporate performance against fragile geopolitical stability and structural shifts in global finance.

Oil Slides 6% as Ceasefire Eases Supply Fears

Oil prices dropped for a second straight day, with WTI settling at $64.37 and Brent at $67.14, as investors bet on the durability of a ceasefire between Israel and Iran. The sharp decline follows Iran’s limited retaliation after U.S. airstrikes on its nuclear sites, with no damage to energy infrastructure. President Trump stated that China could continue purchasing Iranian oil – later clarified by the White House as not lifting sanctions, but referencing the Strait of Hormuz stability. The ceasefire appears to have reduced fears of a major supply disruption, pulling prices back to levels seen before the June 13 conflict escalation.

Investment Insight:

The market is signaling confidence that the geopolitical risk premium tied to the Iran/Israel conflict is dissipating. With oil now trading below $65, investors may shift focus back to fundamentals such as global demand recovery, U.S. inventory data and OPEC+ policy. However, the ceasefire remains fragile and any sign of renewed hostilities – especially near the Strait of Hormuz – could trigger rapid volatility. Energy investors should watch for potential short-covering rallies or policy shifts, especially involving China’s oil imports and any White House backpedaling on sanctions enforcement. For now, energy stocks may face short-term pressure as risk unwinds.

China Pushes Yuan Forward as Dollar Weakens

China is intensifying its efforts to internationalize the yuan as the U.S. dollar faces weakening global confidence. Beijing has expanded foreign investor access to domestic futures and options, launched digital yuan initiatives and encouraged yuan-based trade settlements and lending. While the yuan only accounted for 2.89% of global payments in May, recent policy moves aim to position it as a credible alternative to the dollar, particularly in Asia. However, concerns over transparency and rule of law remain barriers. The U.S. dollar still dominates global payments, but Beijing’s strategy signals a structural push toward de-dollarization and financial autonomy.

Investment Insight:

Investors should monitor the yuan’s evolving role in global finance, especially as geopolitical instability and U.S. policy uncertainty fuel dollar volatility. While China’s capital controls and regulatory opacity still limit its appeal, incremental reforms – including expanded market access and cross-border lending in yuan – suggest long-term ambitions for currency diversification. Rising institutional flows into CNY assets, as noted by State Street, could foreshadow a gradual shift in asset allocation strategies. For portfolio hedging, this trend merits closer attention – particularly for those exposed to U.S. assets, emerging markets or dollar-dependent commodities. Stay alert for FX policy signals from both Washington and Beijing.

FedEx Beats Q4, Plans $1B in New Cuts

FedEx reported stronger-than-expected Q4 2025 earnings, with adjusted EPS of $6.07 (vs. $5.84 expected) and revenue of $22.22B (vs $21.79B forecast). The company also announced it had completed its $4B cost-cutting initiative under the DRIVE program and now targets an additional $1B in savings in fiscal 2026. Despite the beat, shares fell 5% in after-hours trading due to slightly underwhelming guidance for Q1 2026 EPS. Revenue for the full fiscal year reached $87.9B. Volume growth in U.S. home delivery and lower capital expenditure point to improved efficiency, though international trade pressures—especially China/U.S. routes—remain a headwind.

Investment Insight:

FedEx’s aggressive cost optimization and positive volume trends reflect operational resilience, even amid sluggish global trade. While short-term guidance slightly missed EPS expectations, the company’s long-term focus on structural efficiencies and capex discipline offers a bullish setup for value investors. However, geopolitical friction and U.S./China trade policies remain risks to international revenue. As FedEx proceeds with its freight division spin-off and solidifies DRIVE savings, it could unlock additional shareholder value. Long-term holders may see upside once macro headwinds stabilize—especially with global logistics rebounding. Keep an eye on Q1 margins and progress on spin-off execution.

Carnival Rises on Earnings Beat, Raised Outlook

Carnival Corporation reported a strong Q2 2025, posting adjusted earnings of $0.35 per share—beating analyst estimates of $0.24 and record adjusted revenue of $6.3 billion. Net income surged to $565 million, up sharply from $92 million in Q2 2024. On the back of strong demand and brand momentum, the company raised its full-year outlook, now projecting a 40% increase in adjusted net income over 2024 and boosting EBITDA expectations to $6.9 billion. Carnival’s upcoming launch of Celebration Key in the Bahamas on July 19 is expected to further drive excitement and bookings.

Investment Insight:

Carnival’s impressive earnings beat and raised guidance reflect the cruise sector’s robust post-pandemic rebound, with pricing power and occupancy rates driving profitability. The 7% stock rally underscores investor confidence in long-term demand. The upcoming Celebration Key launch could unlock new revenue streams and brand value. Still, fuel prices and macroeconomic volatility remain risks. For investors seeking consumer discretionary plays with momentum and clear recovery trajectories, Carnival presents a compelling case—particularly as it moves closer to pre-pandemic margins and sustained net profitability.

Ambarella Jumps 20% on Sale Speculation

Ambarella shares surged 20.6%, marking their best day since 2021 – after Bloomberg reported the AI chip designer is exploring a potential sale. The company, known for its system-on-chip semiconductors and edge AI software, has reportedly held talks with bankers and attracted interest from private equity firms and major semiconductor companies, especially those seeking to enhance their automotive technology offerings. While no deal is imminent, the market reacted strongly to the news, driving a sharp rebound in a stock that had previously lost 18% year to date.

Investment Insight:

Ambarella’s strategic relevance in edge AI and automotive chips makes it a prime acquisition target, especially as legacy semiconductor firms look to expand in next-gen vehicle systems. The sudden 20% rally suggests strong speculative interest and potential deal value. However, the lack of a confirmed buyer or timeline adds volatility. For investors, the upside remains tied to M&A outcomes, with downside risks if a deal fails to materialize. Those with a risk appetite may see this as a short-term momentum opportunity, while long-term holders could benefit from a potential premium acquisition, should talks progress.

Insurers Refuse Coverage for U.S. – U.K. and Israeli Ships

Maritime insurance underwriters are refusing to cover vessels linked to the U.S., Israel or the U.K. in Middle Eastern waters, regardless of price, due to escalating geopolitical risks. Premiums have surged to as high as 0.5% of ship value, especially after recent U.S. strikes on Iranian nuclear sites. While a tentative ceasefire has been announced, market uncertainty remains high. Some owners are avoiding regional bookings altogether. Insurers are shortening required notification periods, reflecting heightened volatility. The Strait of Hormuz remains a key flashpoint, with risk appetite influenced by political tensions and China’s continued oil trade with Iran.

Investment Insight:

The shipping insurance turmoil underscores how geopolitical instability can sharply raise operational risks and costs in global trade routes. Investors should closely monitor shipping companies with exposure to these regions, as well as marine insurers adjusting premiums. Persistent uncertainty may lead to booking declines, margin pressures, or shifts in global freight flows – all of which could impact earnings for logistics and transport firms with high Middle Eastern activity.

Conclusion:

Investor sentiment is navigating a complex mix of corporate strength and geopolitical risk. Strong earnings from FedEx and Carnival indicate robust consumer and logistics activity, but escalating marine insurance constraints and rising Middle East tensions underscore fragility in global trade routes. China’s strategic push for yuan internationalization further signals a recalibration in currency power dynamics, while Ambarella’s potential sale highlights sectoral interest in AI and automotive chips. With macro headwinds and regional volatility in flux, markets remain in a state of cautious rotation – selectively favoring growth, hedging geopolitical exposure and watching monetary and energy signals with heightened scrutiny.

Upcoming Dates to Watch:

- June 27th: U.S. Core PCE Price Index

- July 4th: Senate vote on Republican + debt ceiling bill

- July 8th: China Non-Manufacturing PMI

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – June 24, 2025

Date Issued – 24th June 2025

Preview

Oil prices dropped nearly 3% after Iran’s missile strike on Al‑Udeid airbase caused no casualties, easing immediate supply concerns. Super Micro’s stock dipped ~10% following its announcement of a $2 billion convertible debt issue, despite strong YTD AI-driven growth. U.S. existing home sales edged up 0.8% to 4.03 M annualized in May, with inventory rising 20% and median prices reaching a record $422,800. In Sydney, Virgin Australia shares jumped 11% post–A$685 million IPO, though valuation risks linger. Global equities rallied across Asia and Europe after a tentative Israel‑Iran ceasefire was announced, while oil and Treasury yields pulled back.

Oil Drops After Iran Strike Causes No Casualties

Oil prices tumbled after Iran’s retaliatory strike on a U.S. airbase in Qatar caused no casualties, signaling possible de-escalation in the Middle East conflict. Brent fell below $70, reversing gains made after the U.S. struck Iranian nuclear sites. Markets interpreted Tehran’s limited response as a sign of restraint, with President Trump acknowledging Iran’s “early notice” and expressing hope for peace. So far, fears of a Strait of Hormuz shutdown – through which 20% of global crude flows – remain unrealized, though geopolitical risks remain elevated.

Investment Insight:

The sharp drop in crude suggests traders are pricing out an imminent escalation. While energy stocks may lose short-term momentum on easing risk premiums, this could present buying opportunities if the broader conflict remains contained. Keep an eye on tanker rates and Gulf shipping routes – any disruption there would reignite bullish pressure on oil. For now, oil-importing sectors like airlines and transportation may see relief as jet fuel and freight costs stabilize. But sentiment remains fragile: one misstep could flip markets back into risk-off mode.

Super Micro Falls on $2 Billion Debt Offering

Super Micro Computer shares dropped 10% after announcing a $2 billion convertible debt offering, raising investor concerns about dilution. While the company plans to use proceeds for growth and stock buybacks, the market reacted negatively to the potential equity conversion. Despite the dip, shares remain up ~40% YTD, driven by strong AI server demand and partnerships with Nvidia and AMD. Super Micro recently secured a key Middle East contract and is seen as a top AI infrastructure play, though past concerns over tariffs and governance still weigh on sentiment.

Investment Insight:

The pullback may offer a tactical entry for long-term investors bullish on AI infrastructure. Dilution risk from the convertible notes is real, but strategic reinvestment and continued demand for AI servers could offset near-term weakness. Monitor Super Micro’s ability to deliver guidance stability, especially after 2024’s governance shakeup and the May guidance cut. The stock’s AI exposure still positions it favorably if data center capex accelerates – but expect volatility around earnings, geopolitical chip tensions and balance sheet clarity.

U.S. Home Prices Hit Record Despite Rate Headwinds

U.S. existing home sales edged up 0.8% in May, surprising analysts who expected a decline. Inventory rose sharply year-over-year (+20%), but housing supply remains tight overall. Median home prices hit a record $422,800, driven by demand outpacing supply, especially in the mid-tier segment. Homes are taking slightly longer to sell and high mortgage rates continue to weigh on first-time buyers. Cash buyers and stronger activity in the $750K–$1M range are cushioning the broader slowdown.

Investment Insight:

The housing market remains bifurcated: softening activity on the low and ultra-high ends, but stable demand in the mid-tier where inventory is improving. Watch mortgage rate trends – any Fed pivot or yield curve shift could spark a release of pent-up demand. For investors, homebuilder stocks and REITs exposed to mid-market suburban housing may benefit if rates drop and activity rebounds. However, luxury exposure looks more vulnerable as rate sensitivity rises and equity market volatility trickles into buyer behavior.

Virgin Australia Jumps 11% in Sydney After Relisting

Virgin Australia surged 11% on its trading debut in Sydney after Bain Capital raised A$ 685 million in a major IPO – the biggest airline listing in Asia Pacific in a decade. Despite the strong opening, Morningstar flagged valuation concerns, citing the airline industry’s thin margins and structural limitations. Bain retains a 40% stake, while Qatar Airways remains a key investor. Geopolitical risks, especially in the Middle East, could challenge airline profitability if oil prices spike, though Tuesday’s relief in crude helped boost airline stocks across the region.

Investment Insight:

Virgin Australia’s IPO success reflects revived investor appetite for aviation in a bullish Australian equity market. However, long-term returns may be hampered by persistent cost pressure and limited pricing power across the sector. Investors should approach post-IPO enthusiasm cautiously, watching oil prices, geopolitical developments and regional travel trends. While the listing offers liquidity and potential upside in a benign macro environment, valuations already appear rich relative to industry fundamentals.

Markets Rally on Tentative Israel–Iran Ceasefire News

Global markets rallied after President Trump announced a tentative ceasefire between Israel and Iran, easing immediate fears of a broader Middle East escalation. Major indices in Asia and Europe posted gains and oil prices fell as concerns about a Strait of Hormuz blockade diminished. However, Israel’s vow to retaliate after further missile activity clouds the outlook. Meanwhile, U.S. Treasury yields declined following dovish comments from Fed officials and investors await Jerome Powell’s testimony for rate-cut clues. Tesla led U.S. gains with an 8.2% surge on news of its autonomous taxi trial.

Investment Insight:

The markets’ relief rally underscores how investor sentiment remains tethered to geopolitical signals. While the ceasefire de-escalation boosted risk appetite, the situation remains fluid and one misstep could reignite volatility, especially in oil. Keep a close eye on Powell’s congressional remarks – any dovish shift could fuel further equity upside. However, if inflation expectations rise due to renewed energy price pressures, rate cut bets may cool quickly. Traders should stay nimble and focus on sectors most sensitive to Fed policy and Middle East risk, including energy, defense and transport.

Conclusion

This morning’s news paints a nuanced market landscape: geopolitical de-escalation in the Middle East brought relief to oil and equities, but regional tensions remain a wild card. Super Micro’s convertible debt signals both confidence in growth and dilution risk – making it a tactical entry point for AI-focused investors. The housing market shows resilience with rising sales and record prices, buoyed by elevated mortgage rates. Virgin Australia’s IPO highlights renewed appetite in travel, though its elevated valuation demands caution. Moving forward, keep an eye on Middle East developments, Federal Reserve communications and rate-sensitive sectors – energy, housing, airlines – as catalysts for market direction.

Upcoming Dates to Watch

- June 27th: U.S. Core PCE Price Index

- July 4th: Senate vote on Republican + debt ceiling bill

- July 8th: China Non-Manufacturing PMI

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the Asia market close – June 23, 2025

Date Issued – 23rd June 2025

Preview

Global markets remain surprisingly calm despite escalating geopolitical tensions in the Middle East. Following U.S. strikes on Iranian nuclear sites, oil prices surged over 2%, raising fears of supply disruption through the Strait of Hormuz. Shipping threats are rising, with new warnings of potential attacks on commercial vessels and sharp increases in freight rates. Airlines are canceling flights and rerouting around Iran, Israel and neighboring airspaces. Despite the volatility, markets appear to view the crisis as contained – for now. Analysts caution that future developments, particularly Iran’s response, could change the outlook quickly.

Markets Stay Calm as U.S. Strikes Iran’s Nuclear Sites; Focus Shifts to Retaliation Risk

Global markets remained largely unmoved after the U.S. launched strikes on Iranian nuclear sites, with the MSCI World Index dipping just 0.12% and safe haven assets trading mixed. Analysts suggest the strikes are being viewed as a containment move that neutralizes nuclear threats rather than sparking broader conflict. The dollar strengthened while gold and the yen weakened slightly. Markets remain alert to Iran’s response, particularly the threat of closing the Strait of Hormuz. However, experts view this as unlikely, citing Tehran’s limited retaliatory options and fear of U.S. escalation.

Investment Insight:

The muted market reaction signals investor confidence that escalation risk is contained. However, energy markets remain vulnerable to supply disruption scenarios. Traders should monitor Iran’s stance on Hormuz and oil price volatility. A sudden closure could trigger a risk-off shift, but for now, equity and FX markets appear to be pricing in strategic restraint and geopolitical deterrence.

Oil Prices Spike as U.S. Strikes Iran, Raising Fears of Strait of Hormuz Disruption

Oil futures jumped over 2% after the U.S. launched strikes on Iranian nuclear sites, intensifying fears of supply disruption in the Middle East. Brent briefly breached $81 before settling at $78.81 per barrel. The escalation revived concerns over the strategic Strait of Hormuz, through which 20% of global oil supply transits. Iran’s parliament signaled support for a closure, but final approval rests with the national security council. The U.S. warned such action would prompt a severe response. Markets are also monitoring Iran’s allies in Iraq and regional responses from Saudi Arabia and China.

Investment Insight:

Crude markets are pricing in geopolitical risk premiums amid elevated tensions. While a full closure of the Strait remains unlikely, any perceived increase in Iranian retaliation could trigger a sharp oil rally. Energy investors should brace for volatility and monitor military developments, while broader market participants assess the inflationary implications of higher oil prices on central bank policy trajectories.

Shipping Risks Surge in Strait of Hormuz and Red Sea Amid Escalation

Global maritime group Bimco warns of rising threats to commercial shipping around the Arabian Peninsula following U.S. strikes on Iranian nuclear sites. Iran may retaliate with anti-ship missiles, drones or even sea mines, potentially disrupting the critical Strait of Hormuz, which handles 20% of global oil flows. Freight rates have already surged – spot rates from Shanghai to Jebel Ali are up 55% month-over-month, while crude and gas tanker rates have soared over 100%. U.S. or Israel-affiliated vessels are primary targets, though broader disruptions remain possible as tensions escalate.

Investment Insight:

Logistics disruptions in one of the world’s key energy corridors add upward pressure on oil prices and inflation expectations. Investors in energy, shipping and insurance sectors should monitor risk premiums and consider geopolitical hedges. Supply chain-sensitive industries face renewed vulnerability amid volatile freight costs and route uncertainties.

Airlines Divert Routes and Cancel Flights Amid Middle East Tensions

Following U.S. airstrikes on Iranian nuclear sites, global airlines are rerouting flights around the Middle East due to increased geopolitical risk. Carriers like Singapore Airlines and British Airways canceled flights to Dubai and Doha, while U.S. operators suspended service to Qatar and the UAE. Flight paths now avoid Iranian, Iraqi, Syrian and Israeli airspace, adding fuel and labor costs. Risk monitoring group Safe Airspace warns U.S. carriers could face heightened danger amid escalating regional threats, with ripple effects on global air traffic and aviation fuel costs due to rising oil prices.

Investment Insight:

Airline stocks may face near-term pressure due to higher operational costs, regional instability and potential jet fuel price hikes. Watch travel demand, insurance risk premiums and oil market volatility. Investors with exposure to airlines, logistics, or travel ETFs should monitor route disruptions and policy updates from aviation regulators.

Conclusion

While the U.S. strikes on Iran have intensified tensions across the Middle East, financial markets are currently pricing in a limited and contained conflict. Risk assets have remained resilient, supported by the perception that a broader escalation is unlikely and that global oil supply remains intact – at least for now. However, with shipping threats, rerouted airlines and diplomatic uncertainty rising, the situation remains highly fluid. Investors should remain vigilant, particularly as any disruption to the Strait of Hormuz or retaliatory strikes could significantly alter market dynamics and commodity flows in the weeks ahead.

Upcoming Dates to Watch

- June 24th: U.S. Consumer Confidence Index

- June 27th: U.S. Core PCE Price Index

- July 4th: Senate vote on Republican + debt ceiling bill

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – June 20, 2025

Date Issued – 20th June 2025

Preview

Global markets remain on edge as inflation, geopolitical tensions and industrial disruptions shape investor sentiment. Japan’s core inflation hit a 17-month high, driven by a historic surge in rice prices, while the Bank of England held rates steady but signaled a possible August cut. Oil climbed 3% as Israel vowed deeper strikes on Iran, raising fears of supply shocks. Meanwhile, Airbus dominated the Paris Air Show amid Boeing’s muted presence and another SpaceX Starship explosion raised fresh doubts about launch reliability. Together, these developments signal an environment of elevated risk and selective sector resilience.

Japan Inflation Surges on Soaring Rice Prices, Pressuring BOJ Policy Outlook

Japan’s core inflation surged to 3.7% in May – its highest level since January 2023 – driven by a historic 101.7% year-over-year spike in rice prices. The core-core rate, which excludes food and energy, also climbed to 3.3%, signaling persistent pricing pressure. Despite this, the Bank of Japan held its policy rate at 0.5%, citing expected inflation moderation ahead. With inflation running above the 2% target for 38 consecutive months and economic growth contracting by 0.2% in Q1, policymakers face a balancing act between supporting the economy and addressing rising costs.

Investment Insight:

Food-driven inflation, particularly rice prices, is now a central variable in Japan’s monetary outlook. While the BOJ remains cautious, investors should anticipate greater hawkish signaling if core-core inflation remains elevated. Bond markets may see upward pressure on yields, while equity sectors sensitive to consumer spending and input costs could experience volatility. Defensive positioning and attention to BOJ language shifts are warranted.

Oil Prices Climb 3% as Israel Escalates Strikes on Iran, Raising Global Supply Fears

Crude prices surged Thursday, with Brent settling at $78.85 (+2.8%) and U.S. crude topping $77.50 (+3.2%), as Israel vowed to intensify military strikes on Iranian strategic and government targets. The escalation follows reports of an Iranian missile hitting a hospital in Beersheba. Israeli officials openly threatened Iran’s leadership, while President Trump weighs a potential U.S. strike on Iran’s nuclear facilities. JPMorgan warned that any regime change in Iran – an OPEC heavyweight – could trigger prolonged supply disruptions and sustained oil price spikes.

Investment Insight:

Heightened geopolitical tensions in the Middle East are reintroducing risk premia into oil markets. Investors should prepare for potential volatility in energy prices and monitor diplomatic developments closely. Exposure to oil and gas equities may benefit in the short term, while transportation and industrial sectors could face margin pressure. Hedging strategies may be prudent as uncertainty around U.S. involvement intensifies.

Airbus Dominates Paris Air Show as Boeing Retreats Amid Ongoing Crisis

Airbus led the Paris Air Show with over $21 billion in orders, including major deals with VietJet, EgyptAir and LOT, while Boeing maintained a subdued presence amid fallout from the Air India Dreamliner crash. Airbus showcased growing demand for its A321XLR and widebody A350s, reflecting airlines’ push for fuel efficiency and longer range. Boeing’s quieter stance follows years of reputational setbacks and delivery delays, despite still-strong global demand. Defense contracts also featured prominently amid heightened geopolitical tensions, with orders rising as governments boost military spending ahead of the upcoming NATO summit.

Investment Insight:

Airbus’ strong order pipeline reaffirms investor confidence in commercial aviation’s long-term recovery, particularly in fuel-efficient and long-range segments. Boeing’s strategic silence highlights reputational risk and regulatory exposure, though its fundamentals remain supported by robust backlog and state-backed deals. Defense exposure appears increasingly valuable in this climate, positioning diversified aerospace suppliers and contractors for continued momentum.

SpaceX Starship Explodes During Routine Test, Raising Concerns Over Lunar and Mars Timelines

SpaceX’s Starship rocket suffered a catastrophic explosion during a routine test at its Texas Starbase facility, marking the fourth such failure this year. No injuries were reported and an investigation is underway. Starship is critical to NASA’s Artemis III and IV missions as well as Elon Musk’s long-term plans for Mars colonization. The rocket’s sheer scale and complex systems continue to raise technical hurdles, with reliability concerns mounting ahead of key launch milestones, including the deployment of private space stations and future manned missions.

Investment Insight:

While SpaceX remains a privately held leader in aerospace innovation, recurring Starship failures may delay critical NASA and commercial contracts, impacting timelines for broader space infrastructure initiatives. Investors in aerospace and defense should monitor implications for suppliers and partners involved in deep space systems and orbital platforms. Long-term bets on space commercialization remain intact but carry increased execution risk in the near term.

Bank of England Holds at 4.25%, Signals August Rate Cut Possible Amid Global Uncertainty

The Bank of England held interest rates steady at 4.25% in June, with six of nine MPC members voting to maintain the current level. A more dovish tone emerged, however, as three members pushed for a 25 bps cut, citing soft domestic growth and easing wage pressures. Inflation remains elevated at 3.4%, with geopolitical tensions and rising oil prices threatening to reignite upward pressure. Policymakers emphasized they are “not on a pre-set path,” signaling flexibility ahead of a potential cut in August, depending on energy markets, trade policy and macroeconomic data.

Investment Insight:

With disinflation underway but geopolitical risks clouding the horizon, the BOE’s cautious tone suggests investors should expect rate adjustments only with clear justification. A summer rate cut remains likely, favoring gilts and rate-sensitive equities. Yet, any spike in oil or tariff fallout could reverse easing expectations. Stay alert to global developments and UK labor and CPI trends to refine positioning.

Conclusion:

This week underscores a market caught between persistent inflationary pressures and rising geopolitical instability. Central banks are exercising caution, balancing the need for policy flexibility with the reality of slowing growth and energy-driven inflation risks. Meanwhile, the aerospace and energy sectors reflect divergent fortunes: Airbus surges on robust demand, while SpaceX grapples with recurring technical setbacks. Escalating conflict in the Middle East adds to volatility, with oil markets and global risk sentiment at stake. For investors, active risk management and sector-specific positioning remain essential as monetary, geopolitical and technological variables converge in unpredictable ways.

Upcoming Dates to Watch:

- June 21st: Flash PMIs (US, EU, UK, Japan)

- June 23rd: Earnings from FactSet and Naspers ADR

- June 24th: U.S. Consumer Confidence Index

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – June 19, 2025

Date Issued – 19th June 2025

Preview

Markets digest a cautious Fed stance as interest rates remain unchanged, with two cuts still projected for 2025 despite persistent inflation and slowing growth. Nippon Steel finalizes its $11B acquisition of U.S. Steel, ending its NYSE listing under strict U.S. oversight. Gilead secures FDA approval for Yeztugo, a twice-yearly HIV prevention injection, though federal funding threats loom. A politically charged cyberattack wipes out $90M from Iran’s Nobitex exchange, signaling new geopolitical risks in crypto. Together, these developments highlight rising policy uncertainty, strategic sector shifts and the growing intersection of digital infrastructure and international conflict.

Fed Holds Rates Steady, Signals Two Cuts for 2025 Despite Stagflation Concerns

The Federal Reserve left its benchmark rate unchanged at 4.25% – 4.5% but maintained projections for two rate cuts in 2025, according to its latest dot plot. The updated economic outlook points to slower GDP growth at 1.4%, core inflation rising to 3.1% and unemployment edging to 4.5%. While uncertainty is said to be easing, Chair Powell emphasized the Fed will “wait to learn more” before adjusting policy. Rising inflationary risks from tariffs and geopolitical instability remain key considerations, as the Fed balances political pressure from the White House with signs of softening consumer demand and labor market fragility.

Investment Insight:

The Fed’s neutral hold, paired with a modestly dovish dot plot, suggests a policy pivot remains on the table – but not imminent. Investors should watch for incoming inflation data and labor market trends to confirm timing on the anticipated rate cuts. Short-duration Treasuries and rate-sensitive equities may benefit from increased clarity, while volatility could resurface if inflation accelerates or geopolitical shocks persist.

Nippon Steel Finalizes $11B U.S. Steel Takeover; Trading Ceases on NYSE

U.S. Steel shares ceased trading Wednesday as Nippon Steel completed its acquisition, making the American icon a wholly owned subsidiary of Nippon Steel North America. Despite earlier opposition, President Trump approved the deal, securing a “golden share” that grants veto power over key governance and strategic decisions, including jobs, production and relocation. U.S. Steel will retain its name, Pittsburgh HQ and U.S. incorporation, while Nippon has committed to a $11 billion investment through 2028. The NYSE delisting takes effect June 30.

Investment Insight:

The takeover underscores a broader shift in industrial consolidation with geopolitical strings attached. While U.S. Steel will technically remain domestically governed, the structure highlights growing political oversight in foreign ownership of strategic assets. Investors in the industrial sector should expect further scrutiny on cross-border deals and align exposure with firms backed by stable policy frameworks and long-term capital commitments.

FDA Approves Gilead’s HIV Prevention Injection Amid Policy Uncertainty

The FDA has approved Gilead’s twice-yearly HIV prevention injection, Yeztugo (lenacapavir), a milestone in combating the global epidemic. Clinical trials showed near-total efficacy, with one study recording 100% prevention among cisgender women. Yeztugo offers a major advantage in convenience over daily pills and bi-monthly shots, especially in underserved communities. However, proposed cuts to Medicaid and CDC prevention programs under the Trump administration threaten access for vulnerable populations. Gilead has pledged to support uninsured patients and expand global access, but broad insurance adoption remains critical to impact.

Investment Insight:

Gilead’s Yeztugo positions the company at the forefront of next-gen HIV prevention, with potential peak global sales estimated at $4 billion. Yet, policy headwinds and reimbursement risks could temper early adoption in the U.S. Market watchers should evaluate the regulatory and political landscape closely. Long-term upside depends on global licensing strategy and successful penetration into populations not currently reached by existing PrEP solutions.

$90M Crypto Hack on Iran’s Nobitex Marks New Geopolitical Flashpoint in Cyber Warfare

Pro-Israel hacker group “Predatory Sparrow” claimed responsibility for a politically motivated cyberattack on Iran’s largest crypto exchange, Nobitex, draining over $90 million across multiple cryptocurrencies. The funds were funneled into inaccessible “burner wallets,” suggesting symbolic destruction over financial theft. The attack coincided with escalating hostilities between Israel and Iran and follows a similar breach of Bank Sepah earlier in the week. Blockchain firms linked Nobitex to IRGC-associated wallets, Hamas and other sanctioned entities, highlighting the growing weaponization of crypto platforms in geopolitical conflict.

Investment Insight:

The Nobitex breach underlines the rising cybersecurity risks tied to crypto infrastructure, especially in geopolitically sensitive regions. For institutional investors and compliance teams, the incident reinforces the importance of blockchain analytics and real-time risk monitoring tools. As crypto becomes a theater for political retaliation, expect regulatory scrutiny on digital asset exchanges with ties to sanctioned actors to intensify globally.

Conclusion

This week’s developments underscore a complex macro environment shaped by cautious central bank policy, geopolitical risk and sectoral transformation. The Fed’s decision to hold rates steady while projecting limited easing reflects persistent inflationary pressures and softening growth. Meanwhile, cross-border corporate activity – exemplified by Nippon’s U.S. Steel acquisition – continues under heightened regulatory scrutiny. In healthcare, Gilead’s breakthrough HIV prevention therapy offers medical progress, though access risks remain amid proposed funding cuts. Finally, the Nobitex hack marks a new era of politically motivated attacks on digital assets, reinforcing the strategic importance of cyber and crypto infrastructure in modern conflict. Strategic positioning remains key.

Upcoming Dates to Watch

- June 20th: Philly Fed Manufacturing Index, Canadian Retail Sales

- June 21st: Flash PMIs (US, EU, UK, Japan)

- June 23rd: Earnings from FactSet and Naspers ADR

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – June 18, 2025

Date Issued – 18th June 2025

Preview

This week brings a delicate market equilibrium. The Fed is expected to hold rates steady, but revised projections and the dot plot could shift sentiment quickly. Markets still price in a September cut, though the Fed’s cautious tone suggests a slower path. Meanwhile, oil spiked after Trump called for a Tehran evacuation, highlighting renewed geopolitical risk. Japan’s exports saw their sharpest drop in 8 months, driven by falling U.S. auto shipments and rising trade tensions. JPMorgan made headlines by launching JPMD, a blockchain-based deposit token for institutional use – another sign that traditional finance is adapting. JetBlue, under pressure from weak domestic demand, announced more cost cuts and flight reductions, pointing to continued softness in consumer spending.

UK Inflation Holds at 3.4% – Rate Cut Postponed

In May, the U.K.’s annual inflation held steady at 3.4%, matching expectations and casting doubts over any imminent rate cuts by the Bank of England. Although core inflation eased slightly to 3.5% from 3.8%, services inflation remains elevated at 4.7% – keeping pressure on the central bank. The BoE is expected to hold rates at 4.25% in its upcoming meeting, with the next move likely coming in August. Analysts also warn of potential upside risks if the conflict in the Middle East sustains high oil prices.

Investment Insight:

Sticky inflation and rising geopolitical tensions (including a 4% surge in crude oil prices) are keeping central banks cautious. For investors, this reinforces the case for energy sector exposure and a hedge against UK Gilts volatility. Also, watch for renewed strength in the British Pound (GBP) if rates remain elevated longer than expected. A higher-for-longer stance by the BoE may keep UK equities under pressure in the short term – particularly rate-sensitive sectors like housing and retail.

Fed in Focus: No Rate Change, But Dot Plot Could Shake Markets

The Federal Reserve is widely expected to hold interest rates steady at its June meeting, but markets will be watching closely for updated forecasts and forward guidance. Key attention will be on the revised “dot plot” – the Fed’s internal projections for rate cuts this year. In March, the median forecast pointed to two cuts in 2025, but even minor shifts in voting members’ expectations could bring that down to one. While inflation remains relatively tame and labor market data shows signs of softening, geopolitical risks, including Middle East tensions and Trump’s proposed tariffs, complicate the outlook.

Investment Insight:

Markets are currently pricing in a potential first rate cut in September, but recent Fed commentary suggests a more cautious, “wait-and-see” approach. In this context, investors should closely monitor rate-sensitive assets. Treasury yields may remain stable or even rise if the updated dot plot signals a shift toward a single rate cut this year. Equities, particularly in the tech and growth segments, could face short-term volatility. Meanwhile, commodities – especially oil and energy-related stocks – remain highly responsive to geopolitical tensions and could outperform if high rates persist. With the Fed expected to revise its GDP and inflation projections, market attention will likely intensify around macroeconomic indicators throughout the summer. In such an environment, strategic positioning in value stocks, short-duration bonds and inflation-hedged commodities may offer greater resilience.

Japan’s Export Slump Deepens Amid Trade Pressure and Tariff Risk

Japan’s exports fell by 1.7% in May year over year, marking the sharpest decline since September 2024. The drop, though less severe than the 3.8% forecast by economists, reverses the 2% gain recorded in April. Exports to the U.S. were down 11.1%, with automobile shipments plunging 24.7%. Japan’s car industry, which represented over 28% of all exports to the U.S. in 2024, faces rising pressure ahead of a new 24% reciprocal tariff scheduled to take effect on July 9. Exports to China also declined by 8.8%. Meanwhile, imports fell by 7.7%, contributing to a smaller-than-expected trade deficit of 637.6 billion yen. The Bank of Japan noted in its latest statement that growth is likely to moderate due to trade-related uncertainties, while Moody’s Analytics emphasized that tariffs remain the main threat to Japan’s economic outlook.

Investment Insight:

The data confirms a deteriorating trade environment for Japan, particularly in key sectors such as automobiles and industrial exports. Ongoing trade disputes with the United States, combined with weak demand from China, are undermining Japan’s ability to drive growth through external demand. With export momentum weakening and domestic demand also cooling, Japan may face increasing pressure to revise monetary policy in the coming months. Investors should monitor developments in the Japan/U.S. trade talks, as well as the yen’s trajectory, which could further impact export competitiveness. Near-term volatility in Japanese equities remains likely, especially for companies heavily exposed to the U.S. market.

JPMorgan Launches JPMD: A Permissioned Stablecoin Alternative

JPMorgan is stepping deeper into crypto by introducing JPMD, a digital deposit token designed to offer a stablecoin-like experience with the reliability of traditional banking infrastructure. Built on Coinbase’s Base blockchain, JPMD allows 24/7 settlement, interest accrual and seamless B2B transactions – but only for institutional clients.

Unlike public stablecoins such as USDT and USDC, JPMD is a “permissioned” token, meaning it cannot be freely traded on public markets. Instead, it mirrors commercial bank deposits and offers tighter integration with the existing financial system. This structure aligns with upcoming regulatory frameworks, especially as the U.S. Senate prepares to vote on the GENIUS Act, aimed at regulating stablecoins.

Investment Insight:

JPMorgan’s move marks a pivotal step toward on-chain institutional finance. By offering an interest-bearing digital token backed by a major bank, JPM is blurring the lines between traditional banking and decentralized infrastructure – without compromising regulatory alignment. The use of Base (Coinbase’s Layer 2 network) signals a clear intention to build trust and scalability within crypto-native rails. Expect rising demand for regulated digital cash equivalents, particularly among large institutions seeking speed, transparency and interoperability. This development could place pressure on existing stablecoin players – and further validate blockchain infrastructure providers like Coinbase, Ethereum Layer 2s and regulated DeFi custodians.

JetBlue Slashes Costs as Break-Even in 2025 Becomes ‘Unlikely’

JetBlue Airways is enacting deeper cost-cutting measures amid soft travel demand and declining airfares, with CEO Joanna Geraghty warning staff that break-even operating margins in 2025 are now improbable. The airline will reduce off-peak flights, pause retrofits of some older aircraft and evaluate leadership structure and hiring plans. While financial forecasts have been withdrawn, key initiatives remain active, including new aircraft deliveries and its partnership with United Airlines, aimed at driving long-term growth.

Investment Insight:

JetBlue’s post-merger strategy reset underlines the pressures mid-tier airlines face in an uncertain travel market. With domestic airfare down 7.3% YoY and a cloudy economic outlook, cost control has become critical. However, strategic partnerships (like the one with United) and continued investment in premium offerings show a dual focus on survival and selective growth. Investors should view JetBlue’s moves as a defensive posture, but not a retreat – signaling a transition phase that may favor leaner, more connected carriers in the medium term.

Conclusion:

In a week shaped by geopolitical risks, uncertain rate forecasts and corporate realignment, investors are navigating markets defined by caution and recalibration. The Fed’s upcoming dot plot will likely dictate summer positioning. September remains the base case for a potential rate cut – but any signal of reduced cuts could drive yield spikes and short-term equity pullbacks, particularly in tech. Value stocks and inflation-hedged commodities may offer near-term resilience. Meanwhile, oil prices remain reactive to Middle East tension and defense of domestic industry is becoming a theme – from Trump’s “golden share” over U.S. Steel to Japan’s trade vulnerability and JetBlue’s retreat from growth. JPMorgan’s launch of JPMD signals traditional finance leaning deeper into blockchain – but in a tightly controlled, institutional-only format. Overall, capital remains cautious but opportunistic.

Upcoming Dates to Watch:

- June 19th: BoE Interest Rate Decision

- June 20th: Philly Fed Manufacturing Index, Canadian Retail Sales

- June 21st: Flash PMIs (US, EU, UK, Japan)

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – June 17, 2025

Date Issued – 17th June 2025

Preview

Gold Outshines Treasurys, Yen and Swiss Franc

Gold continues to outperform traditional safe havens in 2025, with prices surging 30% year-to-date, outpacing the yen, Swiss franc and U.S. Treasurys. Currently trading around $3,403 per ounce after peaking above $3,500 in April, gold’s rise is fueled by growing global uncertainty, fiscal concerns and diminished confidence in sovereign debt markets. Recent U.S. policy volatility, including Trump’s tariffs and a Moody’s downgrade, has pressured Treasurys, while Japan’s structural weaknesses and Switzerland’s near-zero rates reduce their currencies’ appeal. Experts emphasize that gold’s independence from government liabilities, intrinsic value and absence of counterparty risk strengthen its role as the ultimate safe haven. Central banks remain strong buyers, with 2024 marking a third consecutive year of net purchases above 1,000 tons and the ECB recently reported gold has overtaken the euro as the world’s second-largest reserve asset.

Investment Insight:

Gold’s decisive outperformance highlights a strategic global shift toward non-sovereign stores of value amid persistent geopolitical instability and mounting sovereign debt pressures. The growing central bank accumulation signals a structural rebalancing of reserves away from fiat currencies. Investors should closely monitor continued policy uncertainty in the U.S. and Asia, as further erosion of sovereign credit confidence could extend gold’s secular bull run. Elevated institutional demand, combined with limited supply growth, offers strong technical and fundamental tailwinds for long-term gold positioning.

Bank of Japan Slows Bond Purchase Cuts

The Bank of Japan (BOJ) held its benchmark rate steady at 0.5% while announcing a more gradual reduction in Japanese government bond (JGB) purchases amid rising growth risks. Until March 2026, monthly JGB purchases will be reduced by ¥400 billion ($2.76 billion) per quarter, reaching ¥3 trillion. From April 2026 to March 2027, cuts will slow to ¥200 billion per quarter, targeting ¥2 trillion monthly purchases – roughly the level prior to BOJ’s ultra-loose monetary policy started in 2013. The decision aims to stabilize JGB markets following recent long-end yield spikes, with 30-year yields reaching multi-decade highs near 3.2% in May before easing to 2.93%. Japan faces mounting headwinds as Q1 GDP contracted 0.2% and headline inflation hit 3.6% in April, marking over three years above the BOJ’s 2% target. Governor Ueda reaffirmed that rate hikes will proceed cautiously, contingent on sustained inflation progress.

Investment Insight:

The BOJ’s cautious approach underscores the delicate balance between inflation control and growth stability in Japan’s post-ultra-loose era. While gradual JGB tapering signals confidence in market resilience, persistent inflation and contracting growth may complicate normalization efforts. The yen remains sensitive to global rate differentials and any further delay in BOJ tightening could sustain currency weakness. For fixed income investors, Japan’s evolving yield curve offers selective opportunities, while equities may face increased volatility as policy uncertainty collides with fragile domestic demand.

U.S. Steel & Nippon Steel Merger Approved

U.S. Steel shares rose 5% after President Trump approved its acquisition by Japan’s Nippon Steel through an executive order. The approval was contingent on the signing of a national security agreement granting the U.S. government a “golden share” – a mechanism that gives the president significant oversight authority. Commerce Secretary Howard Lutnick detailed that the golden share grants veto power over key decisions such as headquarters relocation, offshoring production or jobs, plant closures and renaming the company. The deal, structured as U.S. Steel becoming a wholly owned subsidiary of Nippon Steel North America, has cleared all regulatory approvals and is expected to close shortly. Trump emphasized the transaction as a “partnership” rather than a foreign takeover, reflecting political sensitivities surrounding domestic manufacturing and national security.

Investment Insight:

The unique golden share arrangement sets a precedent for foreign acquisitions of U.S. strategic assets under heightened national security scrutiny. While the deal secures capital infusion and operational scale for U.S. Steel, the embedded government oversight limits full foreign control, signaling a more protectionist framework for future cross-border M&A in critical sectors. Investors should monitor how similar structures may impact valuations and deal premiums in sectors like defense, infrastructure and energy. Near term, U.S. Steel gains from operational certainty and political resolution, but longer term, government intervention could influence strategic flexibility and capital allocation.

Meta Launches Ads on WhatsApp

After over a decade since its $19 billion acquisition, Meta is officially introducing ads to WhatsApp, marking a pivotal monetization shift for the previously ad-free messaging platform. The new status ads will appear in the app’s Updates tab, alongside WhatsApp’s Status and Channels features, keeping personal conversations untouched. In addition to ads, Meta will monetize Channels through search ads and future subscription fees. Channel admins can boost visibility and eventually charge monthly subscriptions, with Meta taking a 10% cut. WhatsApp currently boasts over 3 billion monthly users globally, including more than 100 million users in the U.S. – positioning the platform as a major pillar in CEO Mark Zuckerberg’s long-term growth strategy. Meta emphasized that ad targeting will rely on basic user data like location, language and interaction patterns, avoiding intrusive personal data collection.

Investment Insight:

Meta’s move to monetize WhatsApp directly taps into its largest untapped user base and diversifies revenue beyond its core ad platforms. The introduction of native ads, search monetization and subscription models aligns with industry-wide shifts toward messaging-based commerce. While the cautious rollout seeks to minimize user disruption, scaling monetization on WhatsApp could drive meaningful revenue acceleration over time, especially in emerging markets where the app dominates daily communication. However, regulatory scrutiny – particularly as Meta faces ongoing antitrust litigation – remains a structural risk. Investors should monitor adoption metrics, subscription uptake and user engagement as early signals of monetization success.

Oil Jumps After Trump Calls for Tehran Evacuation

Oil prices initially surged after U.S. President Donald Trump publicly called for the evacuation of Tehran amid rising Middle East tensions. The sharp reaction reflects mounting fears that the conflict between Israel and Iran could escalate further and impact global oil supply. While prices later pared some of their gains, the market remains highly sensitive to geopolitical developments in the region. Investors are closely watching for any disruptions that could affect critical energy infrastructure or shipping routes such as the Strait of Hormuz, through which roughly 20% of the world’s oil flows.

Investment Insight:

The oil market’s reaction underscores the fragile balance between geopolitical risks and supply stability. Any direct conflict escalation between Israel and Iran would elevate the probability of significant supply disruptions, potentially pushing crude prices sharply higher. While short-term price spikes remain driven by headlines, sustained price elevation would depend on the extent of physical supply impact. Investors should maintain heightened sensitivity to political developments, potential sanctions, retaliatory actions and logistical threats to global crude flows. Volatility premiums may stay elevated in oil markets as long as the risk of regional escalation persists.

Conclusion:

This week’s developments reflect the underlying shifts in market psychology: safety flows increasingly favor physical assets like gold over sovereign paper, while central banks continue managing fragile growth trajectories. U.S. policy moves show a tightening grip on foreign investments in strategic sectors, while Meta’s WhatsApp ad rollout signals the relentless drive for new monetization vectors. Simultaneously, the Middle East remains the core wildcard for commodity and energy markets, with each escalation carrying amplified systemic risks for oil supply stability. Expect volatility to remain elevated as investors recalibrate exposures across risk and safety assets.

Upcoming Dates to Watch:

- June 18th: U.K. CPI, Eurozone CPI

- June 19th: BoE Interest Rate Decision

- June 21st: Flash PMIs (US, EU, UK, Japan)

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the Asia market close – June 16, 2025

Date Issued – 16th June 2025

Preview

This week’s headlines span across industries, but one common theme dominates: strategic repositioning in response to deep structural shifts. Kering’s surprise move to appoint auto-industry veteran Luca de Meo as CEO reflects the urgency to revitalize its flagship luxury brands. In Australia, Santos shares surge after a $18.7B takeover bid led by ADNOC signals growing Middle East appetite for LNG expansion. Meanwhile, Middle East tensions escalate as Israel strikes Iranian energy infrastructure, pushing oil markets higher once again. Starbucks intensifies its internal reset, focusing on employee engagement as part of its ambitious “Back to Starbucks” turnaround plan. And finally, the advertising world faces a disruptive AI revolution: industry leaders from WPP and Publicis explain how generative AI is rapidly reshaping creativity, personalization and agency economics.

Kering Surges on CEO Shift, Renault’s de Meo Poised to Lead Luxury Turnaround

Shares of Kering jumped over 10% after reports surfaced that Luca de Meo, Renault’s outgoing CEO, is set to take the helm at the luxury conglomerate. De Meo, a 30 year auto industry veteran with prior leadership at Toyota, Fiat and Volkswagen, is widely credited for orchestrating Renault’s significant turnaround, where shares climbed over 90% under his tenure. His entry marks a pivotal moment for Kering, which has struggled in recent years – particularly with Gucci’s sales slump and a 60% drop in share value over two years. Kering’s long-time CEO François-Henri Pinault is reportedly preparing to split the chairman and CEO roles, signaling a broader management restructuring. Despite the optimism, analysts caution that reviving Gucci and Saint Laurent will require substantial investment, patience, and deft brand repositioning in an increasingly crowded luxury market.

Investment Insight:

De Meo’s appointment injects fresh leadership and strategic credibility into Kering’s stalled turnaround narrative. His operational discipline and brand-building experience may reignite growth at Gucci and Saint Laurent – two core revenue drivers under pressure. While execution risks remain elevated due to the cost and complexity of repositioning luxury brands, today’s rally reflects investor enthusiasm for proactive succession planning and the possibility of significant multiple expansion if brand momentum is successfully restored.

Santos Shares Jump 15% on $18.7B Takeover Bid from ADNOC-Led Consortium

Santos shares surged over 15% after receiving an $18.7 billion non-binding takeover bid led by Abu Dhabi’s National Oil Company (ADNOC) investment arm XRG, alongside Abu Dhabi Development Holding Co and private equity giant Carlyle Group. The offer values Santos at AU$ 8.89 per share – a 27.7% premium to its previous close – marking its largest intraday rally since 2020. This is ADNOC’s latest move to secure global energy assets, following multiple prior unsuccessful takeover attempts by other suitors for Santos. If completed, the acquisition would give the consortium control over Santos’ extensive LNG operations in Australia and Papua New Guinea, strengthening its position in global gas markets amid rising demand for LNG and energy transition assets.

Investment Insight:

The ADNOC-led bid reflects continued Middle Eastern appetite for strategic LNG assets as part of their long-term diversification and energy transition strategies. Control of Santos’ LNG infrastructure provides immediate production scale, geographic diversification, and access to Asia-Pacific growth markets. The premium signals strong buyer conviction despite prior failed M&A attempts. Investors should monitor regulatory review, competing bids, and shareholder approval process. If successful, the deal may spark additional consolidation across the global LNG sector.

Oil Prices Surge on Israeli Strikes Against Iranian Energy Facilities

Oil markets remain volatile after Israel escalated its strikes on Iranian energy infrastructure, targeting the massive South Pars gas field and oil depots near Tehran over the weekend. While U.S. crude briefly touched $77.48 per barrel, both WTI and Brent eased slightly in early Monday trading, though prices still sit well above last week’s levels after a 13% weekly surge. The conflict enters its third day with no signs of de-escalation, raising fears of broader disruptions to Middle Eastern oil supplies. Iranian officials have floated the possibility of shutting down the Strait of Hormuz – a critical global oil chokepoint – though analysts question Iran’s ability to fully close the passage under the watch of the U.S. Fifth Fleet. Goldman Sachs warned that a full shutdown could push crude prices beyond $100 per barrel.

Investment Insight:

The escalating Israel-Iran conflict has reintroduced significant geopolitical risk premium into oil markets. While no major supply outages have yet materialized, sustained attacks on energy infrastructure raise the probability of production losses or regional retaliations that could tighten global supply. The Strait of Hormuz remains the key flashpoint. Energy investors should expect continued volatility, with upside risk for crude prices if military action spreads or strategic shipping routes are threatened. Defensive positioning in energy equities and oil-linked assets may offer short-term hedging benefits amid the conflict.

Starbucks Moves to the Next Phase in Its Turnaround: Winning Over Employees

Starbucks CEO Brian Niccol unveiled the next phase of the company’s turnaround plan during its Leadership Experience event in Las Vegas, focusing heavily on regaining employee trust and restoring Starbucks’ original culture. The strategy – branded as “back to Starbucks” – includes reintroducing more seating in cafes, adding fulltime assistant managers to most North American stores, and prioritizing internal promotions as the company expands. Roughly 14,000 store managers attended the event, where Niccol emphasized returning Starbucks to its identity as a “third place” while improving operational efficiency and customer experience. After years of labor cuts that fueled widespread unionization, Starbucks is now accelerating staffing improvements through its Green Apron labor model. The company’s shares have risen nearly 20% since April, supported by recent cost-cutting measures and stronger investor sentiment.

Investment Insight:

Starbucks is attempting to stabilize its long-term growth by addressing one of its most persistent operational risks: labor relations. Management’s shift toward employee-first policies may reduce union pressures and improve store-level performance, while simultaneously strengthening brand identity. If successful, these cultural and operational adjustments could drive higher customer retention and sales per location, particularly as Starbucks plans to add 10,000 new U.S. locations. However, execution risks remain, and investors will be watching labor costs, unionization outcomes, and same-store sales metrics closely through 2025.

AI Is Disrupting the Advertising Business in a Big Way – Industry Leaders Explain How

The global advertising industry is undergoing a massive transformation as artificial intelligence reshapes how creative content is produced, distributed, and optimized. WPP’s outgoing CEO Mark Read called the AI disruption “unnerving” for both investors and industry leaders, stating that AI will “totally revolutionize our business.” Tools like OpenAI’s DALL-E, Google’s Veo, and Midjourney allow agencies to generate high-quality images and videos rapidly, while AI-driven platforms automate campaign creation and personalization. WPP has already integrated AI across its workforce, with 50,000 employees using its proprietary WPP Open platform. Publicis Groupe CEO Maurice Levy echoed similar views, emphasizing AI’s ability to scale personalized messaging and accelerate content production. However, both executives acknowledged that while AI will displace some jobs, it will ultimately create new roles, transforming rather than eliminating much of the workforce.

Investment Insight:

AI is driving both opportunity and risk for the $600+ billion global ad industry. On one side, generative AI enables agencies to lower costs, increase personalization, and improve campaign efficiency—providing margin expansion potential. On the other, it intensifies industry consolidation as smaller agencies struggle to keep pace with AI integration and clients demand higher output for less spend. Publicis and WPP are emerging as early adopters with first-mover advantage, while platform providers like Google, Meta, and OpenAI increasingly control critical AI infrastructure. For investors, leading ad holding companies with deep AI integration may outperform, but client brands face long-term strategic shifts as creative differentiation becomes harder to sustain in a world of mass AI-generated content.

Conclusion:

The market narrative remains centered on leadership shifts, aggressive M&A, and AI-fueled transformation across sectors. Luxury retail, energy, and advertising are all recalibrating their business models to adapt to both cyclical pressures and long-term structural changes. As tensions rise geopolitically, investors are recalibrating risk premiums in energy markets while also betting on companies that successfully leverage technological disruption to secure competitive advantage. Strategic adaptability will remain a key driver of both short-term market moves and long-term equity re-ratings in the coming quarters.

Upcoming Dates to Watch:

- June 17th: U.S. Retail Sales

- June 18th: U.K. CPI, Eurozone CPI

- June 19th: BoE Interest Rate Decision

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – June 13, 2025

Date Issued – 13th June 2025

Preview

Markets remain on edge as geopolitical tensions and sector-specific shocks drive sharp moves across multiple industries

Oil prices surged over 13% at one point after Israel launched airstrikes against Iran’s nuclear facilities, raising fresh concerns over global energy supply chains. Meanwhile, tragedy struck in India as a Boeing Dreamliner suffered its first-ever fatal crash, further complicating Boeing’s ongoing safety and reputational challenges. In the tech sector, Meta finalized its $14.3B deal to acquire Scale AI talent and leadership as it races to catch OpenAI in the generative AI race, while AMD unveiled its latest MI400 AI chips in partnership with OpenAI’s Sam Altman. Finally, Oracle delivered strong cloud-driven earnings, sending shares to new all-time highs and signaling continued momentum in enterprise AI infrastructure.

Oil prices surge on heels of Israeli strikes, set for largest single-day gains in about five years

Oil prices spiked as much as 13% after Israel launched airstrikes against Iran’s nuclear and ballistic missile sites without U.S. backing. Brent rose 6.3% to $73.73 per barrel, while WTI climbed 6.5% to $72.48. The attack heightened fears of broader Middle East instability potentially impacting global oil supplies, particularly if Iran retaliates or attempts to disrupt shipments through the Strait of Hormuz, which handles about 20% of global oil flow. While Iran’s oil production sites were not directly targeted, markets remain wary of escalation. The U.S. emphasized non-involvement, while Israel declared the operation would continue as necessary. Analysts stress that any further retaliation or military miscalculation could rapidly spiral into significant supply disruptions, though for now, physical oil flows remain unaffected.

Investment Insight: