Daily Synopsis of the New York market close – May 29, 2025

Date Issued – 29th May 2025

Global markets rallied after a U.S. court ruled against Trump-era tariffs

Global markets rallied after a U.S. court ruled against Trump-era tariffs, lifting trade-sensitive stocks and sending the S&P 500 futures up 1.6%. Nvidia surged nearly 5% in after-hours trading as earnings beat expectations despite an $8 billion hit from China export curbs, pushing it past Microsoft and Apple in market cap. Elon Musk exited his White House advisory role, refocusing on Tesla and SpaceX, a shift welcomed by investors. Meanwhile, Bitcoin ETFs pulled in $9 billion in recent weeks as investors rotated out of gold, signaling growing institutional confidence in digital assets amid U.S. fiscal concerns. Salesforce also impressed, raising its full-year outlook after AI-fueled revenue topped $9.8 billion in Q1 and announcing an $8 billion acquisition of Informatica to expand its data cloud capabilities.

Court Ruling on Tariffs Sparks Global Market Rally

Stocks across global markets advanced after a U.S. federal court ruled that former President Donald Trump exceeded his authority in imposing widespread tariffs under the 1977 International Emergency Economic Powers Act. The decision casts doubt on the legality of key trade policies that have weighed on global sentiment and inflation expectations. Futures on the S&P 500 rose 1.6%, while the Dow gained 1.2%.

In Asia, Japan’s Nikkei 225 led with a 1.5% jump, aided by relief over potential tariff rollbacks. South Korea’s Kospi climbed 1.4% after a surprise interest rate cut by the Bank of Korea, while Australia’s ASX 200 edged 0.3% higher. The dollar strengthened sharply against the yen, hitting 146.06. Meanwhile, U.S. Treasury yields ticked up, with the 10-year rising to 4.47%, and oil prices made modest gains. Investor focus now shifts to Nvidia’s earnings, which lifted the stock 4.9% in after-hours trading.

Investment Insight

The court’s tariff ruling injects near-term optimism into equity markets, particularly for export-reliant economies and multinational firms. While policy uncertainty remains pending appeal, investors may find opportunity in sectors poised to benefit from reduced trade friction, such as industrials and autos. However, the limited bond market reaction and Fed’s cautious stance suggest inflation and policy risk still loom large—underscoring the need for selective positioning.

Nvidia Surges After Earnings, Shrugging Off China Export Blow

Nvidia shares rallied nearly 5% in after-hours trading after the chipmaker delivered better-than-expected first-quarter earnings and a bullish outlook, despite an $8 billion revenue hit from U.S. export restrictions to China. The company’s data center revenue soared 73% year-on-year to $39.1 billion, fueling total revenue growth of 69% to $44.1 billion. Earnings per share reached $0.96, topping estimates, as global AI demand remained firmly intact.

Nvidia’s outlook for the current quarter—$45 billion in revenue and a 72% non-GAAP gross margin—reassured investors, even as China-related write-downs dragged Q1 gross margin down to 61%. Nvidia now holds the top spot in global market capitalization, surpassing Microsoft and Apple, as its AI dominance deepens through new ventures, including U.S. factory expansions and a strategic partnership in Saudi Arabia.

Investment Insight

Nvidia’s earnings reaffirm its central role in the AI infrastructure boom, with resilience in the face of geopolitical headwinds. While China’s market is effectively off-limits, diversification into the Middle East and continued strength from global hyperscalers mitigate regional risk. For investors, Nvidia’s margin guidance and forward momentum suggest AI tailwinds are far from peaking—supporting a long-term overweight stance despite near-term policy volatility.

Market price: NVIDIA Corp (NVDA): USD 134.81

Elon Musk Exits White House Role, Refocuses on Business Amid Political Shift

Elon Musk announced his departure from the Trump administration’s DOGE office, signaling the end of his tenure as a special government employee tasked with reducing federal spending. The Tesla and SpaceX CEO thanked President Trump for the opportunity but criticized a recent budget bill for undermining cost-cutting efforts.

Musk’s decision to step back from Washington and reduce political spending follows months of backlash over his government role—an involvement that had weighed on Tesla’s public image. With Musk now refocusing on his companies, Tesla shares have rebounded, supported by investor relief as the billionaire returns to full-time leadership. A White House official confirmed Musk’s offboarding has begun.

Investment Insight

Musk’s return to hands-on operational leadership at Tesla and SpaceX may ease investor concerns over executive distraction and reputational risk. His withdrawal from the political spotlight could reduce headline volatility for Tesla, potentially restoring focus on fundamentals amid a competitive EV landscape. Investors may view this as a stabilizing pivot that supports medium-term performance, particularly if it coincides with renewed innovation and production milestones.

Bitcoin ETFs Attract $9 Billion as Investors Rotate Out of Gold

U.S. Bitcoin ETFs have raked in over $9 billion in inflows over the past five weeks, led by BlackRock’s iShares Bitcoin Trust (IBIT), as investors pivot away from traditional safe havens. Gold-backed ETFs, by contrast, saw more than $2.8 billion in outflows during the same period, reflecting a notable shift in risk hedging preferences.

Bitcoin recently hit an all-time high of $111,980, buoyed by favorable regulatory signals and growing macroeconomic unease, even as gold pulled back from recent peaks. Analysts highlight Bitcoin’s appeal as a hedge against both private and sovereign risks, especially amid rising fiscal concerns and a downgraded U.S. credit rating. While gold remains the stronger performer year-to-date—with a 25% gain versus Bitcoin’s 15%—Bitcoin’s low recent correlation with traditional assets offers new diversification potential.

Investment Insight

The rotation from gold to Bitcoin ETFs underscores a growing institutional embrace of digital assets as credible hedges in an era of fiscal uncertainty. While volatility remains a concern, Bitcoin’s evolving correlation profile and decentralized nature may offer diversification benefits beyond traditional safe havens. Investors should monitor the regulatory landscape and macro signals closely, as Bitcoin’s role in multi-asset portfolios continues to transition from speculative bet to strategic allocation.

Salesforce Lifts Outlook on Strong AI-Driven Growth, Beats Q1 Estimates

Salesforce raised its full-year revenue guidance after posting better-than-expected fiscal Q1 results, buoyed by accelerating demand for its AI offerings. Adjusted earnings per share came in at $2.58, topping the $2.55 consensus, while revenue rose 8% year-over-year to $9.83 billion, outpacing both company and Wall Street forecasts.

The enterprise software firm now expects FY26 revenue of $41.0–$41.3 billion, up from prior guidance of $40.5–$40.9 billion, and guided Q2 earnings and sales above estimates. AI remains the primary growth engine, with annual recurring revenue from its data cloud and Agentforce platform more than doubling to $1 billion. Shares rose 1.8% in after-hours trading following the upbeat report. Salesforce also announced an $8 billion acquisition of Informatica to strengthen its AI capabilities, though the deal won’t impact current-year results.

Investment Insight

Salesforce’s results highlight accelerating enterprise demand for AI-integrated solutions, validating its pivot around Agentforce. The raised outlook and strong subscription momentum signal durable topline growth, even as broader IT budgets remain mixed. The Informatica acquisition reinforces the company’s multi-year AI strategy and could further entrench Salesforce in data-driven enterprise workflows. Investors may view the stock favorably as it combines margin discipline with AI-led growth, positioning it as a core holding in the evolving software landscape.

Market price: Salesforce Inc (CRM): 276.03

Conclusion

This week’s developments underscore a shifting investment landscape defined by AI-driven performance, evolving macro risks, and deepening market recalibrations. From Nvidia’s dominance to Salesforce’s strategic expansion, tech remains the engine of growth. Meanwhile, Bitcoin’s ascent as an institutional hedge and the rollback of tariff pressures point to a broader rebalancing of risk and opportunity. Elon Musk’s retreat from politics adds clarity to Tesla’s leadership narrative, while central banks and fiscal policy remain key watchpoints. As volatility persists, investors appear increasingly selective—favoring innovation, clarity, and resilience in a market still navigating structural change and geopolitical complexity.

Upcoming Dates to Watch

- May 29th, 2025: US GDP, US Jobless claims, South Korea Industrial Production, Japan Unemployment rate

- May 30th, 2025: German CPI, Chinese Composite PMI, Chinese Manufacturing PMI, PCE Index

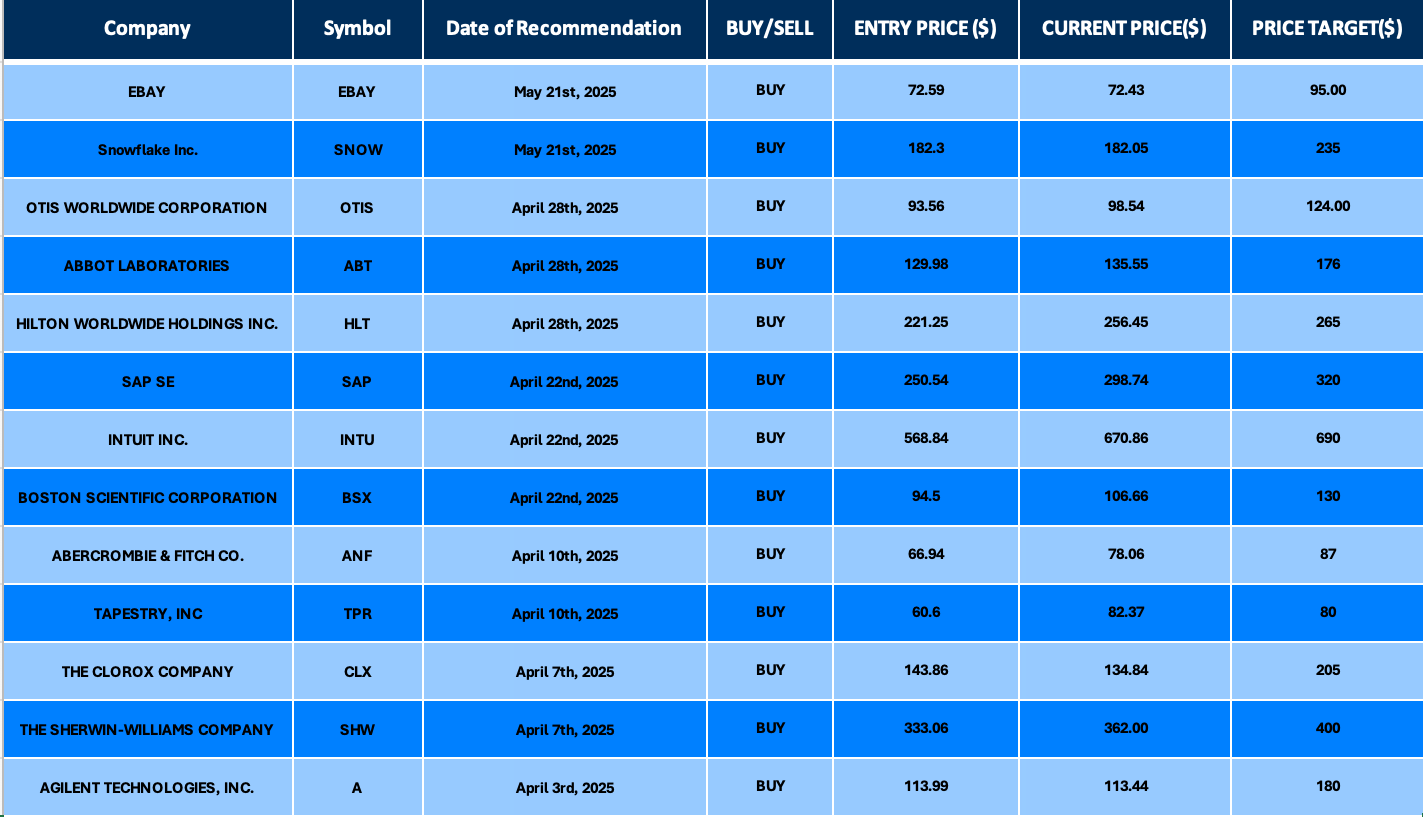

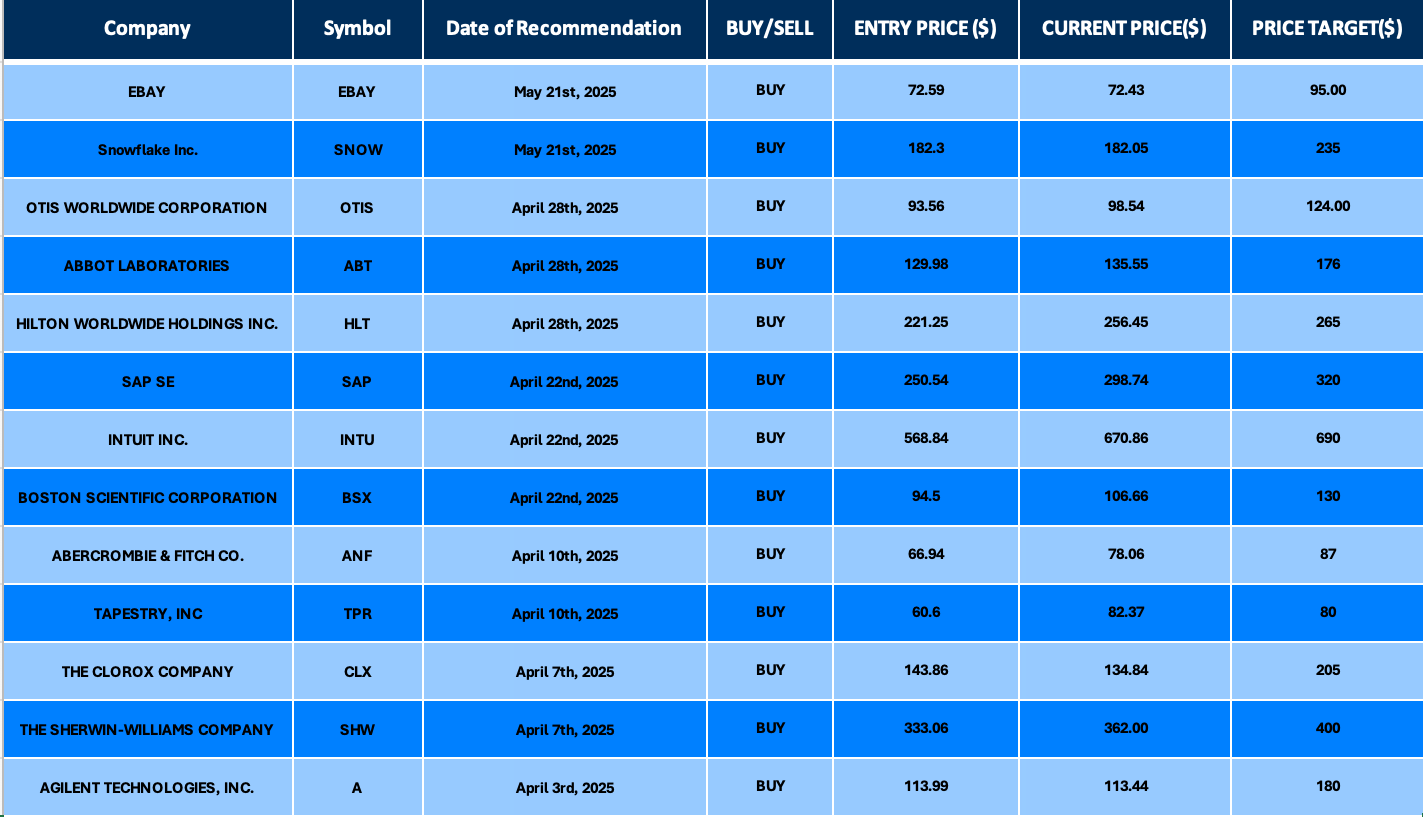

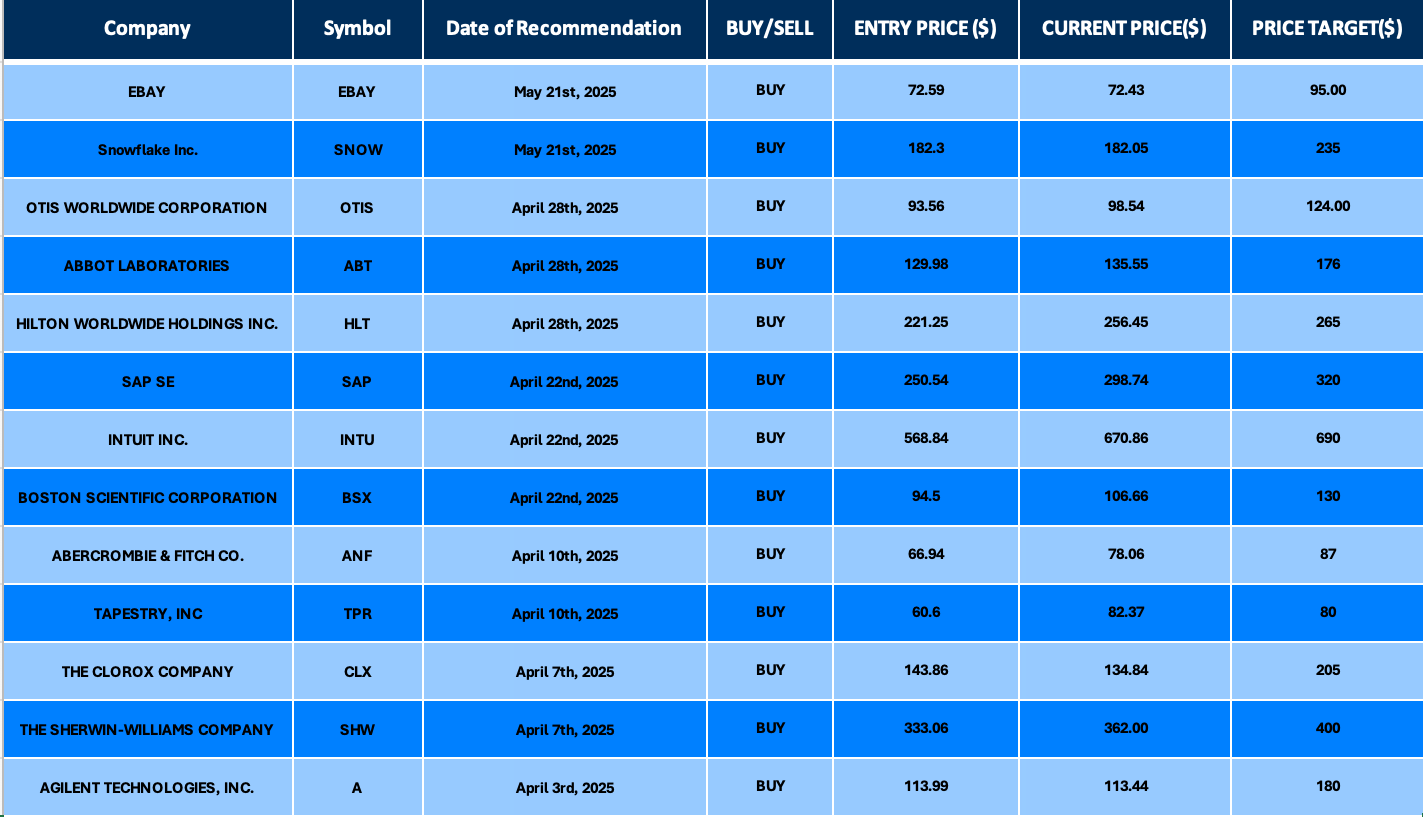

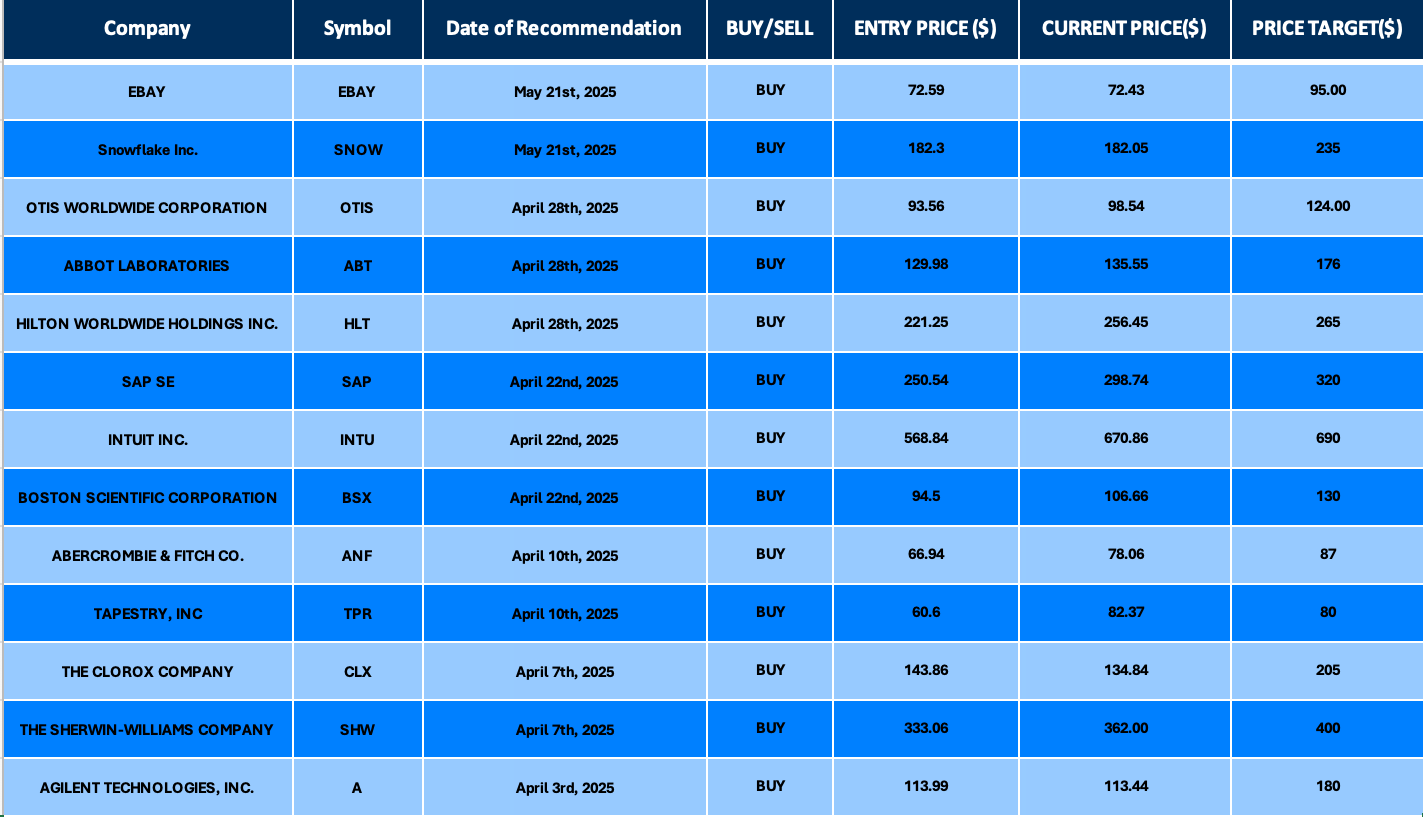

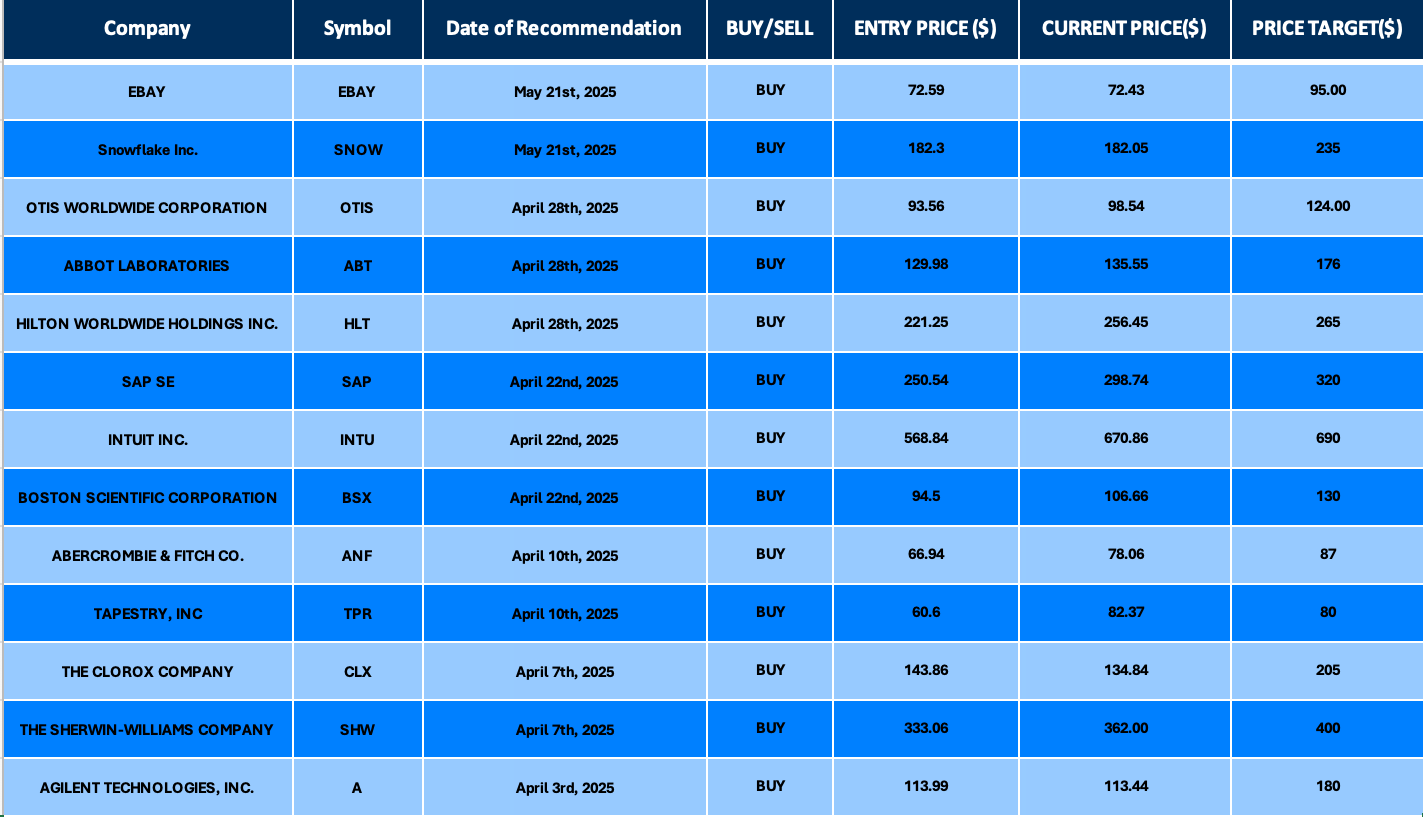

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – May 28, 2025

Date Issued – 28th May 2025

Preview

Markets rebounded sharply as easing US-EU trade tensions lifted global equities, with the Dow soaring over 700 points and Germany’s DAX hitting a record high. President Trump’s tariff pause and optimistic tone on negotiations boosted sentiment, while Nvidia and Tesla led tech gains, the latter jumping nearly 7% after Elon Musk reaffirmed his focus on the EV maker. In Asia, Groq warned that AI adoption is outpacing infrastructure capacity, spotlighting risks in data center and power constraints despite heavy investment. Meanwhile, Xiaomi shares rose on record Q1 results, underscoring the firm’s successful pivot to premium products and diversified growth beyond smartphones.

Market Rebounds Sharply as Trump Pauses EU Tariff Hike

U.S. stocks rallied Tuesday, snapping back from last week’s losses as investors cheered a temporary pause on new EU tariffs and a rebound in consumer confidence. The Dow Jones Industrial Average jumped 1.78%, or more than 700 points, while the S&P 500 gained 2.05%, and the Nasdaq Composite surged 2.47%, led by strength in tech shares. Optimism grew after President Trump delayed a planned 50% tariff hike on EU imports to allow time for accelerated trade negotiations. Bond markets also steadied as Treasury yields fell, with the 30-year yield retreating to 4.94% amid indications that Japan will scale back bond sales following recent volatility. Nvidia climbed 3.21% ahead of its earnings, as it unveiled a lower-cost chip for China, further fueling the market’s bullish tone.

Investment Insight: Markets are pricing in relief from escalating trade tensions and a more stable bond environment, suggesting a near-term tactical opportunity in cyclical and tech sectors. However, with key economic data and Fed commentary on deck, investors should maintain a balanced posture, watching for confirmation of sustained consumer strength and policy clarity before extending risk exposure.

Asia Faces Infrastructure Strain Amid AI Acceleration, Groq Warns

AI adoption in Asia is outpacing the region’s data center and power infrastructure, according to Groq Chief Revenue Officer Ian Andrews. Speaking at Singapore’s ATxSummit, Andrews highlighted severe compute bottlenecks as demand for inference—AI decision-making—surges. Despite governments and tech giants ramping up investment, including Taiwan’s $3 billion initiative and OpenAI’s expansion in South Korea, infrastructure remains the limiting factor. As more advanced models debut at a record pace, the gap between AI capability and physical capacity is widening. Groq, which designs chips optimized for inference speed, sees this infrastructure lag as a critical challenge for the region’s AI ambitions.

Investment Insight: Investors should monitor infrastructure buildouts in Asia as a key enabler of AI scalability. While model innovation garners headlines, the long-term value lies in firms positioned to solve compute and energy constraints—data center operators, power providers, and edge hardware firms are set to benefit as AI demand collides with physical limitations.

DAX Hits Record High as US-EU Trade Tensions Ease

Germany’s DAX climbed 0.18% to a record 24,269.47 on Wednesday, extending its rally for a third straight session amid easing transatlantic trade tensions. Optimism surged after President Trump signaled progress in US-EU negotiations, delaying punitive tariffs and suggesting imminent meeting dates. The Euro Stoxx 600 edged up 0.07%, while Wall Street gains from Tuesday echoed across European markets. Defence and banking sectors led the DAX higher, buoyed by Germany’s fiscal stimulus and increased defence spending. Meanwhile, the euro slipped below 1.14 against the dollar, reflecting renewed confidence in the US economic trajectory and risk-on sentiment.

Investment Insight: With trade tensions receding and fiscal tailwinds in play, European equities—particularly German industrials and financials—are positioned for continued outperformance. Investors should watch for follow-through in policy implementation and trade talks, as well as ECB policy stability, to sustain momentum. The rally in defence stocks highlights a structural shift in European spending priorities, offering a longer-term thematic opportunity.

Tesla Surges as Musk Reaffirms Focus, Breaks Out of Key Chart Pattern

Tesla shares soared nearly 7% on Tuesday, closing at their highest level since early February, after CEO Elon Musk reaffirmed his full-time commitment to the EV maker. Musk’s social media post over the weekend signaled a renewed operational focus, helping to ease investor concerns around his prior distractions. The stock, which had fallen sharply earlier this year, has now rallied over 60% from its April lows. Technical traders noted a breakout from a bullish pennant formation, suggesting further upside potential. Key resistance levels lie at $430 and $489, while support sits at $325 and $289, with bullish momentum confirmed by a strong RSI reading.

Investment Insight: Tesla’s technical breakout and leadership clarity offer near-term momentum for bullish investors, but overbought indicators signal heightened risk of pullback. Strategic entries on dips near $325 or $289 may offer more attractive risk-reward, while profit-taking at resistance levels could temper gains. Long-term positioning should balance Musk’s renewed operational focus with execution risks tied to upcoming product launches like the Robotaxi.

Market wrap: Tesla Inc (TSLA): USD 362.89

Xiaomi Shares Rise on Record Q1 Earnings and Diversification Strategy

Xiaomi shares jumped as much as 3.4% in Hong Kong trading Wednesday after the company posted record first-quarter revenue and profit, reflecting strong execution of its pivot toward premium products across smartphones, home appliances, and electric vehicles. The stock pared gains to trade 0.6% higher later in the session. With a market cap now surpassing $171 billion—eclipsing EV giant BYD—Xiaomi is gaining investor favor as a diversified consumer tech and lifestyle brand. Analysts credit the company’s multi-sector strategy for helping it weather China’s intensifying EV price war, though macroeconomic risks and trade tensions remain potential headwinds.

Investment Insight: Xiaomi’s ability to scale across verticals positions it as a defensible growth play in China’s competitive tech landscape. Its premiumization strategy and consumer ecosystem model provide resilience amid sector-specific volatility. Investors may look to Xiaomi as a long-term compounder, though global trade risks and profit margin pressures in its automotive segment warrant close monitoring.

Market price: Xiaomi Corp (HKG: 1810): HKD 51.75

Conclusion

Investor sentiment is turning cautiously optimistic as trade tensions ease, tech leadership stabilizes, and corporate results bolster confidence across regions. Momentum in Tesla and Xiaomi underscores the market’s appetite for innovation-driven growth, while structural shifts in European defense spending and Asia’s AI infrastructure needs signal longer-term themes. However, with key economic data, Fed commentary, and geopolitical developments still ahead, markets remain sensitive to macro signals. For now, risk appetite is returning—but investors would do well to stay selective, balancing opportunity with vigilance as global markets navigate a complex but increasingly constructive landscape.

Upcoming Dates to Watch

- May 28th, 2025: Japan Foreign Bonds Buying, Nvidia earnings

- May 29th, 2025: US GDP, US Jobless claims, South Korea Industrial Production, Japan Unemployment rate

- May 30th, 2025: German CPI, Chinese Composite PMI, Chinese Manufacturing PMI, PCE Index

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – May 27, 2025

Date Issued – 27th May 2025

Preview

Markets are reacting to President Trump’s tariff delay, with European stocks and U.S. futures rebounding while the dollar hovers near a two-year low. Nvidia’s earnings report on Wednesday could shape sentiment, as investors watch for AI spending trends and China sales updates. Meanwhile, Australian wheat faces pressure from weak Chinese demand and Russian competition, risking a fire sale that could further depress prices. In energy, U.S. offshore oil production is set for long-term growth, with Gulf output projected to rise by 33% by 2027, even as shale activity slows. Tesla continues to struggle in Europe, with April sales halving amid growing competition and a Musk-linked boycott.

Stocks Rebound on Tariff Delay; Dollar Nears Two-Year Low

European stocks and US equity futures advanced after President Trump postponed a potential 50% tariff on EU goods to July 9, reversing a prior aggressive stance. The Stoxx Europe 600 erased Friday’s losses, while S&P 500 and Nasdaq 100 futures climbed 1.3% and 1.5%, respectively. Trump’s policy volatility, dubbed the “Trump Pattern,” continues to drive market oscillations, though signs of investor fatigue are emerging. Meanwhile, the dollar weakened, with Bloomberg’s dollar spot index nearing its lowest since July 2023, as traders remain bearish on the currency. Nvidia’s earnings and key US inflation data later this week could further shape sentiment amid ongoing macro and trade uncertainties.

Investment Insight: The “Trump Pattern” of trade threats followed by concessions creates tactical opportunities for short-term gains, but declining rebound strength signals potential erosion of risk appetite. Investors should remain cautious, focusing on defensive sectors and companies with limited exposure to unresolved trade tensions. Monitoring Nvidia’s outlook and inflation data this week will be critical for gauging market resilience.

Australian Wheat Faces Price Pressure Amid Weak Chinese Demand and Russian Competition

Australian wheat stockpiles are set to climb significantly by the end of the season due to a collapse in Chinese imports and stiff competition from Russian exports. Shipments to China from October to March fell 81% year-over-year, as Russian grain continues to flow at competitive prices. Analysts warn that mounting inventories, projected at 5-6 million tons of carryover, could force a fire sale to clear storage ahead of the next harvest, driving prices lower. Benchmark wheat futures are already near five-year lows amid abundant global supply, with Australian wheat prices potentially dropping to A$300 per ton from current levels of A$325-A$350.

Investment Insight: Oversupply dynamics and diminishing demand from key markets signal continued downward pressure on wheat prices, making near-term recovery unlikely. Investors should anticipate headwinds for Australian agricultural exporters while monitoring potential opportunities in alternative grains or geographic markets. Diversification into sectors less exposed to commodity price swings may offer defensive positioning as the global grain surplus persists.

U.S. Offshore Oil Production Poised for Major Growth

Offshore oil production in the U.S. is set to surge, with Gulf of Mexico output projected to rise from 1.8 million bpd to 2.4 million bpd by 2027, driven by streamlined permitting, technological advancements, and increased investment. The sector offers a reliable, high-volume production profile as shale growth plateaus and onshore rig activity declines. In 2024, offshore areas accounted for 14% of U.S. crude production, with federal leases generating $7 billion in revenue. However, global dynamics, including OPEC+ production hikes and soft oil prices, may weigh on the broader U.S. energy outlook.

Investment Insight: Offshore drilling’s long-term, steady output profile is becoming a key growth driver as the shale boom matures. Investors should focus on companies leveraging deepwater technologies and AI-driven efficiencies, which enhance productivity and reduce costs. While regulatory and geopolitical risks remain, the Gulf of Mexico’s expanding role in U.S. energy production positions it as a cornerstone for future oil market stability and investment opportunities.

Nvidia Earnings in Focus: Key Price Levels to Watch

Nvidia shares are consolidating ahead of its earnings report on Wednesday, with technical indicators signaling potential bullish momentum. Recent price action has formed a flag pattern, suggesting a continuation of the stock’s uptrend. Key resistance levels to monitor are $143, near February’s swing high, and $150, a zone tied to prior peaks from late 2024. On the downside, support levels at $121 and $115 align with critical trendlines and moving averages. Nvidia’s performance will hinge on AI infrastructure demand and updates on its China sales, under pressure from U.S. export restrictions.

Investment Insight: Nvidia’s technical setup offers traders actionable entry and exit points, with resistance at $143 and $150 presenting profit-taking opportunities. Long-term investors should monitor fundamental drivers, including AI spending trends and geopolitical risks tied to export controls. While volatility may spike around earnings, the stock’s resilience and growth prospects in AI make it a compelling play for tech-focused portfolios.

Market wrap: NVIDIA Corp (NVDA): USD 131.29

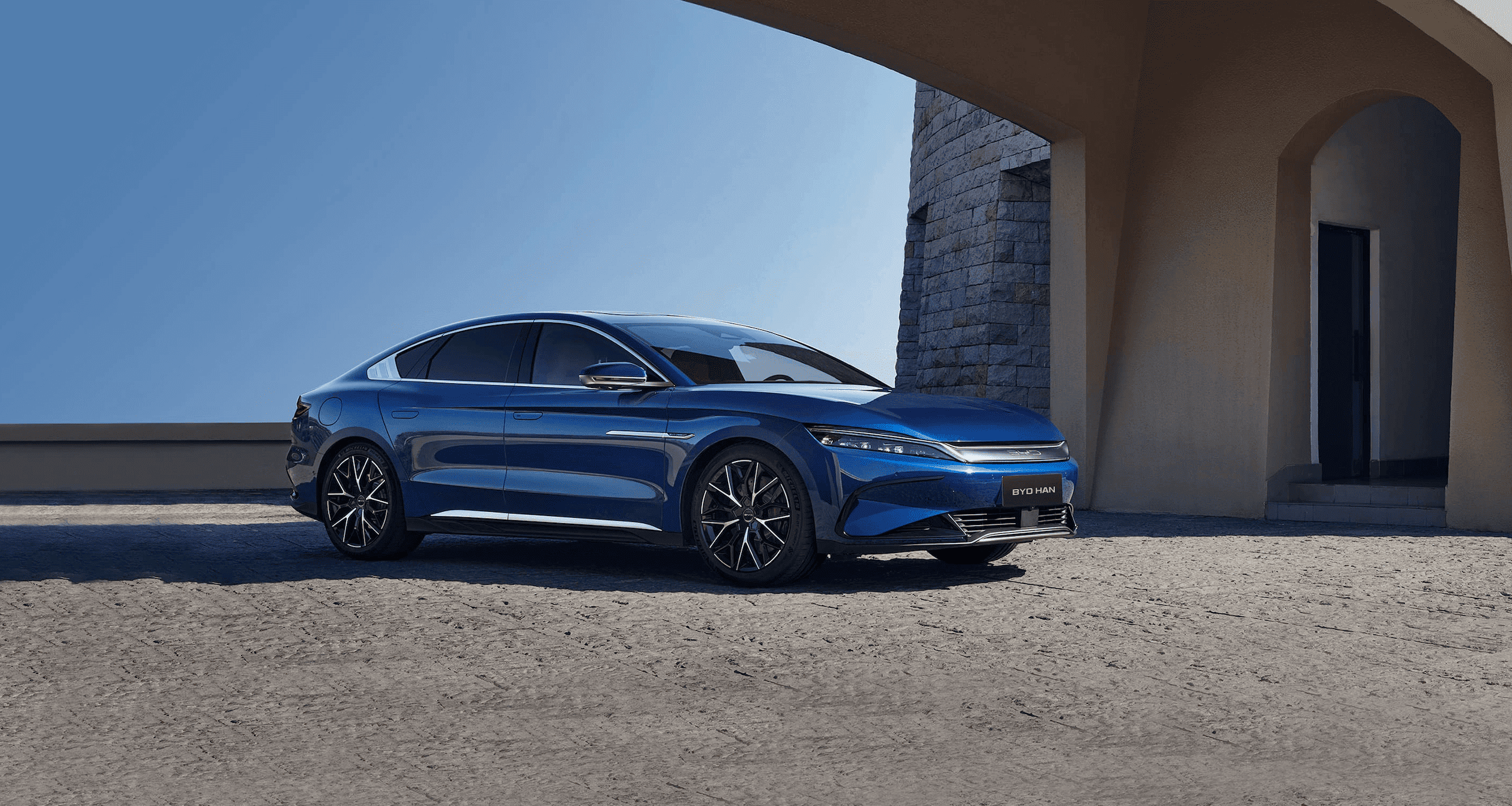

Tesla Europe Sales Plunge Amid Competition and Musk Boycott

Tesla’s European sales fell 49% year-over-year in April to 7,261 units, with market share dropping to 0.7% from 1.3%, according to ACEA data. This decline contrasts with a 34.1% growth in overall EV sales in the region, as competition from European automakers and Chinese EVs, including BYD, intensifies. Tesla’s aging lineup and a regional boycott linked to CEO Elon Musk’s political affiliations have compounded challenges, despite plans to update key models like the Model Y. While Tesla reports recovery in other markets, it faces mounting pressure in Europe and China amid rising competition and price wars.

Investment Insight: Tesla’s waning dominance in Europe highlights the risks of relying on an aging product lineup amid intensifying competition. Investors should monitor Tesla’s ability to execute model updates and maintain pricing power in key markets. Diversifying EV exposure into competitors with growing European market shares, such as BYD or hybrid-focused automakers, may offer a hedge against Tesla’s regional struggles.

Conclusion

Markets are navigating a mix of opportunities and challenges, from geopolitical uncertainty driving tariff-induced volatility to sector-specific pressures in energy, agriculture, and tech. Nvidia’s earnings and U.S. inflation data this week will be closely watched for signals on AI demand and broader economic trends. Meanwhile, Tesla’s struggles in Europe and Australia’s wheat oversupply highlight the competitive and dynamic nature of global markets. As offshore oil production gains momentum and key price levels emerge across industries, investors should adopt a strategic approach, balancing short-term opportunities with the need to manage risks in an evolving macroeconomic landscape.

Upcoming Dates to Watch

- May 27th, 2025: Japan BoJ Core CPI

- May 28th, 2025: Japan Foreign Bonds Buying, Nvidia earnings

- May 29th, 2025: US GDP, US Jobless claims, South Korea Industrial Production, Japan Unemployment rate

- May 30th, 2025: German CPI, Chinese Composite PMI, Chinese Manufacturing PMI, PCE Index

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the Asia market close – May 26, 2025

Date Issued – 26th May 2025

Preview

Global markets face a critical week as investors digest US President Trump’s delayed EU tariffs, Nvidia’s earnings, and key inflation data. European equities are rebounding after the tariff extension to July 9, while US indices remain pressured by rising Treasury yields, which hit multi-year highs. Nvidia’s results on Wednesday could steer tech sentiment as demand for AI chips faces scrutiny. In Asia, Chinese EV stocks slumped as BYD’s aggressive price cuts raised fears of a prolonged margin squeeze, despite robust sales momentum. Meanwhile, VietJet’s $20 billion Airbus order highlights Vietnam’s aviation growth amid geopolitical trade talks. Oil prices steadied near $65 as traders eye OPEC+ decisions on production and potential supply risks from US-Iran negotiations. Investors remain cautious amid ongoing volatility tied to trade policies, fiscal concerns, and supply dynamics.

Tariffs, Treasury Yields, and Nvidia Earnings Take Center Stage

Markets stumbled last week as concerns over President Trump’s escalating tariff threats and a surging fiscal deficit kept investors on edge. The Nasdaq and S&P 500 each fell over 2%, while the Russell 2000 slumped nearly 4%, reflecting heightened sensitivity to rising Treasury yields. The 10-year yield briefly crossed 4.6%, its highest since February, before retreating slightly. Nvidia’s upcoming earnings report on Wednesday is set to dominate investor focus, with expectations of robust AI-chip demand amid growing tech sector volatility. Meanwhile, the Federal Reserve’s preferred inflation gauge, the PCE index, due Friday, will offer critical insights into price stability following renewed tariff concerns.

Investment Insight: With trade tensions reigniting and bond yields testing multi-year highs, investors should brace for continued volatility. Defensive positioning in sectors less sensitive to interest rate swings, such as healthcare or consumer staples, may provide a buffer. Nvidia’s results could sway broader tech sentiment—watch for guidance on AI demand to assess the sector’s resilience. Additionally, inflation data on Friday will be pivotal in shaping expectations for the Fed’s future policy trajectory.

Chinese EV Stocks Slide as BYD Sparks Price War

Shares of Chinese electric vehicle makers fell sharply on Monday, with BYD tumbling up to 8.3% in Hong Kong following aggressive price cuts of up to 35% across 22 models. Rivals Li Auto, Great Wall Motor, and Geely also dropped over 5% as the announcement intensified concerns of a prolonged price war pressuring margins. While BYD’s cuts aim to revive sluggish consumer demand amid China’s economic slowdown, dealership inventories remain high, hitting their steepest levels since late 2023. Analysts warn that the move could trigger further discounts among peers, straining profitability and accelerating industry consolidation. Despite the challenges, BYD’s May sales volumes may continue to climb, supported by strong overseas growth, including its recent lead over Tesla in Europe.

Investment Insight: BYD’s aggressive pricing underscores the competitive challenges in China’s EV market, where price wars could erode earnings across the sector. Investors should remain cautious of automakers with high inventory levels and limited pricing flexibility. However, BYD’s overseas expansion and record-breaking sales momentum position it better to weather margin pressures. Long-term investors may find opportunities in globally diversified EV leaders with strong brand loyalty and innovation pipelines.

Market price: BYD Ord Shares H (HKG: 1211) HKD 423.20

VietJet Expands Airbus Fleet with New A330neo Order

Vietnamese budget carrier VietJet has bolstered its fleet expansion strategy by ordering 20 additional Airbus A330neo wide-body jets, coinciding with French President Emmanuel Macron’s visit to Hanoi. This latest agreement, signed by VietJet’s chairwoman Nguyen Thi Phuong Thao and Airbus senior executive Wouter van Wersch, brings the total A330neo orders from VietJet to 40. The airline aims to leverage the aircraft for ambitious growth across the Asia-Pacific region and potential long-haul routes to Europe. While the deal underscores VietJet’s alignment with Airbus, the carrier also maintains a longstanding but delayed commitment to Boeing, having agreed to purchase 200 Boeing 737 MAX planes since 2016. The announcement highlights Vietnam’s strategic aviation growth amid ongoing trade negotiations with the U.S. to address tariff concerns.

Investment Insight: VietJet’s strategic fleet expansion signals confidence in long-term growth in Asia-Pacific aviation demand, driven by rising middle-class travel. The focus on A330neo wide-body jets positions the airline to tap into lucrative international routes, potentially enhancing profitability. Investors in Airbus benefit from the strengthening of its foothold in emerging markets like Vietnam, while Boeing faces challenges with delayed deliveries. For aviation investors, monitoring VietJet’s ability to execute its expansion plans and navigate geopolitical trade dynamics will be key.

Market price: Airbus SE (AIR): EUR 157.30

European Markets Rebound as Trump Delays EU Tariffs

European stock markets are poised to recover on Monday after US President Trump announced a delay in implementing 50% tariffs on EU imports until July 9. The move, following discussions with European Commission President Ursula von der Leyen, eased fears of escalating trade tensions that had pressured global equities last week. Futures on the Euro Stoxx 600 and Germany’s DAX rose 1.54% and 1.35%, respectively, alongside US futures gains. Meanwhile, the euro hit a one-month high against the dollar, which weakened amid mounting concerns over US fiscal challenges and Moody’s recent credit rating downgrade. Analysts suggest optimism around a potential trade resolution is driving the rally, though market sentiment remains fragile given unresolved trade disputes.

Investment Insight: The temporary reprieve in US-EU trade tensions offers a window for investors to capitalize on a rebound in European equities, particularly in export-heavy sectors like autos and industrials. However, with tariff risks merely postponed, caution is warranted. Diversifying into defensive European plays or sectors less exposed to US trade policy could hedge against future volatility. Currency investors should also monitor the weakening dollar, which may signal further pressure on US assets amid fiscal uncertainty.

Oil Prices Hold Steady Amid Tariff Extension and OPEC+ Focus

Oil markets stabilized on Monday as traders assessed President Trump’s decision to delay the implementation of 50% tariffs on EU goods until July 9, offering a temporary reprieve from trade-related demand concerns. Brent crude hovered near $65 per barrel, while West Texas Intermediate remained below $62. The market’s near-term focus now shifts to the upcoming OPEC+ meeting, where the group is expected to announce a substantial production increase, potentially adding to bearish pressures. Additionally, optimism surrounding US-Iran nuclear talks has introduced a potential wildcard for global supply dynamics, with discussions hinting at progress toward an agreement.

Investment Insight: Oil markets face a precarious balance as trade tensions ease but oversupply risks mount. Investors should monitor OPEC+ production decisions closely, as further output increases could weigh on prices in the second half of the year. For those in energy equities, focusing on companies with low break-even costs and robust cash flows may mitigate downside risks from prolonged price weakness. Additionally, any breakthrough in US-Iran talks could alter supply expectations, warranting a cautious approach to oil-linked investments.

Conclusion

This week’s market narrative centers on the intersection of trade tensions, monetary policy, and corporate performance. Trump’s tariff maneuvers provide temporary relief in Europe but prolong uncertainty globally, keeping investors on edge. Nvidia’s earnings and the Fed’s inflation gauge will serve as pivotal indicators for tech and macroeconomic sentiment, while OPEC+ decisions could shape the energy market’s direction. In Asia, BYD’s price war underscores competitive pressures in China’s EV sector, even as VietJet’s Airbus order signals optimism in aviation growth. With volatility expected to persist, strategic positioning in resilient sectors and close monitoring of geopolitical developments remain essential for investors.

Upcoming Dates to Watch

- May 27th, 2025: Japan BoJ Core CPI

- May 28th, 2025: Japan Foreign Bonds Buying, Nvidia earnings

- May 29th, 2025: US GDP, US Jobless claims, South Korea Industrial Production, Japan Unemployment rate

- May 30th, 2025: German CPI, Chinese Composite PMI, Chinese Manufacturing PMI, PCE Index

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – May 23, 2025

Date Issued – 23rd May 2025

Preview

Markets entered Friday with a cautious tone as U.S. equity futures dipped on concerns over President Trump’s fiscal agenda and a Moody’s credit downgrade, while rising Treasury yields signaled growing debt anxiety. Despite this, mega-cap tech stocks have staged a powerful rebound, inflicting $257 billion in losses on short sellers since April, driven by outsized gains in Tesla, Nvidia, and Microsoft. In Europe, Germany’s economy surprised with 0.4% Q1 growth on pre-tariff export strength, though economists warn the momentum may not last. Meanwhile, BYD overtook Tesla in European EV sales for the first time, sending its shares to record highs despite EU tariffs. On the digital front, major U.S. banks are exploring a joint stablecoin initiative to counter crypto disruption, pending regulatory clarity from the GENIUS Act. Investors are balancing optimism in tech and industrial resilience with persistent macro risks and policy uncertainty.

Wall Street Slips as Trade Policy, Debt Concerns Pressure Sentiment

U.S. equity futures edged lower Friday as markets digested renewed concerns over economic stability tied to President Trump’s evolving trade and tax proposals. Dow futures slipped 0.1%, S&P 500 futures lost 0.2%, and Nasdaq 100 contracts dropped 0.3% as Wall Street looked to close a volatile week. Early optimism following U.S.-China trade truce talks faded midweek after Moody’s downgraded the U.S. credit rating, citing fiscal risks from Trump’s proposed tax legislation. The bond market reacted sharply, with 30-year Treasury yields surging past 5%, signaling growing investor unease over long-term debt sustainability. Asian markets, by contrast, posted modest gains, reflecting regional hopes for sustained trade stability.

Investment Insight: The market’s cautious tone reflects a shift in investor focus from geopolitical relief to fiscal reality. Elevated Treasury yields underscore rising skepticism over the macroeconomic impact of deficit-funded tax cuts. In this environment, investors should prioritize balance sheet strength and cash flow resilience, particularly ahead of Nvidia’s earnings, which may test sentiment in tech amid policy headwinds and AI spending scrutiny.

Short Sellers Crushed by Tech Surge as Tariff Relief Fuels Rally

A powerful rebound in U.S. equities has left short sellers deep in the red, with losses totaling $257 billion from April 8 to May 20, according to S3 Partners. The brunt of the damage came from the “Magnificent Seven” tech stocks, which accounted for $35.8 billion in mark-to-market losses. Tesla led the rout for bears, soaring 54% and inflicting $9.7 billion in losses on shorts. Nvidia and Microsoft followed closely, with respective rallies of 38% and 29%. The surge followed a steep sell-off triggered by President Trump’s tariff announcements, but markets have since rallied sharply, with the S&P 500 up 17% and the Roundhill Magnificent Seven ETF gaining 28% since early April.

Investment Insight: The sharp rebound in mega-cap tech underscores the risk of concentrated short positioning in highly liquid, sentiment-driven names. With volatility tied to trade policy still in play, investors should be cautious about timing contrarian bets. Instead, consider focusing on long exposure to secular growth leaders with pricing power and strong earnings momentum—particularly in AI and cloud computing—where fundamental support meets favorable market dynamics.

German Economy Surprises With Stronger Q1 Growth on Export Surge

Germany’s economy expanded 0.4% in the first quarter of 2025, twice the initial estimate, driven by a late-quarter surge in exports and industrial activity, according to revised data from the Federal Statistical Office. The rebound marks the strongest quarterly growth since Q3 2022 and offers a rare bright spot for Europe’s largest economy, which has grappled with back-to-back annual contractions. Analysts attribute the uptick to firms accelerating shipments ahead of anticipated U.S. trade barriers tied to President Trump’s tariff agenda. However, economists warn the strength may prove temporary, with the government’s advisory panel forecasting flat growth for 2025 and just 1% expansion in 2026.

Investment Insight: Germany’s better-than-expected Q1 growth reflects front-loaded industrial activity amid trade uncertainty rather than a structural turnaround. Investors should remain cautious on eurozone cyclicals and export-heavy sectors, particularly as geopolitical trade risks persist. Focus may shift to infrastructure-linked opportunities tied to Chancellor Merz’s investment push, which could support select German industrials and construction plays over the medium term.

BYD Surges to Record High After Overtaking Tesla in European EV Sales

Shares of BYD hit an all-time high in Hong Kong trading Friday after data showed the Chinese automaker outsold Tesla in Europe for the first time. According to JATO Dynamics, BYD registered 7,231 battery-electric vehicles in April, narrowly surpassing Tesla’s 7,165 units—a symbolic milestone in the increasingly competitive EV space. BYD’s rally was fueled further by a bullish outlook from Citi, which cited strong export momentum despite EU tariffs. The company’s stock rose as much as 1.97% before paring gains slightly, helping lift the Hang Seng index by 0.6%. Tesla, meanwhile, continues to navigate a global sales slowdown amid delayed model refreshes and reputational headwinds linked to CEO Elon Musk.

Investment Insight: BYD’s breakthrough in Europe signals its growing global clout and resilience amid trade barriers, reinforcing its position as a formidable rival to Tesla. Investors may consider increasing exposure to Chinese EV exporters with diversified powertrain portfolios and expanding international footprints. However, continued geopolitical friction and regulatory scrutiny in Western markets warrant a selective, risk-aware approach within the sector.

Market price: BYD Ord Shares H (HKG: 1211) HKD 465.20

Wall Street Banks Explore Joint Stablecoin to Fend Off Crypto Disruption

America’s largest banks are in early-stage discussions to create a joint stablecoin, aiming to safeguard their dominance in payments amid mounting pressure from crypto and big tech, The Wall Street Journal reported. JPMorgan, Bank of America, Citigroup, and Wells Fargo are among the institutions involved, alongside payment infrastructure players like Zelle operator Early Warning Services and the Clearing House. The initiative remains conceptual and hinges on progress of the GENIUS Act, which would establish a regulatory framework for stablecoins. If enacted, the move could enable banks to offer faster, cheaper cross-border payments while defending against disintermediation from decentralized finance and nonbank issuers.

Investment Insight: A banking-backed stablecoin could mark a pivotal shift in the digital payments landscape, signaling traditional finance’s bid to reclaim ground from crypto-native platforms. Investors should monitor regulatory developments around the GENIUS Act, which may unlock new fintech-bank collaborations. Long-term, incumbents with robust digital infrastructure and strategic partnerships stand to benefit from integrating blockchain-based settlement layers into their core operations.

Conclusion

As markets navigate a landscape shaped by policy shocks, fiscal strain, and evolving global competition, investor attention is shifting from short-term rallies to structural positioning. The rebound in tech and industrial resilience reflects selective optimism, but elevated bond yields, regulatory overhangs, and geopolitical risks remain key hurdles. From Germany’s export-driven surprise to Wall Street’s stablecoin ambitions, the week underscores a broader recalibration underway across sectors and asset classes. With Nvidia earnings ahead and legislation like the GENIUS Act poised to reshape digital finance, staying agile and focused on fundamentals will be critical in the weeks to come.

Upcoming Dates to Watch:

May 23rd, 2025: Singapore CPI

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – May 22, 2025

Date Issued – 22nd May 2025

Preview

Asian markets slipped Thursday, led by tech declines amid U.S. economic concerns and rising bond yields, while OpenAI acquired Jony Ive’s design startup for $6.5 billion to drive AI hardware innovation. Bitcoin surged past $111,000 on institutional demand and regulatory optimism, reinforcing its dominance in crypto markets. Health insurers tumbled as Medicare Advantage audits expanded, raising regulatory risks. Meanwhile, Lenovo shares dipped after a 64% profit drop, despite strong revenue from infrastructure and cloud services. Investors remain cautious as regulatory and macroeconomic challenges weigh on key sectors.

Tech Weakness and U.S. Concerns Drag Asian Markets Lower

Asian stocks extended losses on Thursday, echoing Wall Street’s deep declines as heightened U.S. economic uncertainty and rising bond yields weighed on sentiment. The tech sector led the retreat, with South Korea’s KOSPI falling 1.2% and Hong Kong’s Hang Seng slipping 0.5%, mirroring weakness in U.S. peers like Nvidia (-1.92%) amid concerns over U.S.-China chip tensions. Japan’s Nikkei 225 shed 0.9% after soft PMI data highlighted ongoing pressure from U.S. trade tariffs. Meanwhile, China’s indexes edged higher, supported by hopes of further domestic stimulus, despite broader regional caution fueled by escalating U.S. debt worries and geopolitical uncertainties.

Investment Insight: Tech’s underperformance signals heightened sensitivity to rising yields and U.S.-China trade friction, underscoring the importance of portfolio diversification. With Asia’s growth outlook clouded by weak PMI data and geopolitical risks, investors may consider defensive sectors or dollar-hedged assets to navigate near-term volatility.

OpenAI Acquires Jony Ive’s Startup to Redefine AI Hardware

OpenAI has purchased io, the design startup founded by former Apple design chief Jony Ive, in a $6.5 billion deal aimed at creating a new generation of AI-powered products. Ive, renowned for crafting iconic Apple devices like the iPhone and iMac, will lead design and creative efforts for OpenAI. CEO Sam Altman emphasized the importance of blending technology and human-centered design in developing revolutionary tools. This acquisition fuels speculation that OpenAI is developing an AI device to challenge traditional smartphones, as tech giants like Meta and Google continue to bet on augmented reality and wearable AI technologies.

Investment Insight: OpenAI’s bold move into hardware signals a potential disruption in the stagnating smartphone market. Investors should monitor developments in AI-driven consumer devices, which could reshape the competitive landscape. Companies with strong design and AI integration capabilities, like OpenAI, may unlock new revenue streams, while incumbents like Apple and Samsung could face heightened competition in the long term.

Bitcoin Hits $111,000 as Institutional Demand and Regulatory Optimism Drive Rally

Bitcoin surged to a record high of $111,878, gaining 3.3% amid rising institutional interest and growing optimism over U.S. regulatory clarity following Senate advancements on a stablecoin bill. Institutional players like Michael Saylor’s Strategy, which now holds over $50 billion in Bitcoin, continue to fuel demand, while small-cap firms and SPACs are employing innovative financing to acquire the cryptocurrency. Analysts view the rally as structurally supported by supply-demand imbalances, with options traders eyeing further upside toward $125,000. Bitcoin’s dominance over altcoins has also widened, with BTC up 17% in 2025 compared to a 40% decline in altcoin indexes.

Investment Insight: Bitcoin’s record-breaking ascent underscores its growing appeal as a strategic asset in institutional portfolios, driven by regulatory progress and market maturity. Investors may consider allocating to Bitcoin for its resilience and leadership in the crypto market, but should remain mindful of volatility and monitor regulatory developments that could influence long-term adoption.

Health Insurers Slide as Medicare Advantage Audits Intensify

Shares of UnitedHealth (-5.78%), Humana (-3.74%), and CVS (-2.56%) fell sharply following the Centers for Medicare & Medicaid Services (CMS) announcement of expanded audits targeting Medicare Advantage (MA) plans. The initiative will audit all eligible MA contracts for payment years 2018–2024, addressing concerns over potentially billions in annual overpayments. With federal estimates suggesting MA plans may overbill the government by up to $43 billion annually, CMS plans to scale its workforce and technology, significantly increasing audit volume. Investors are reacting to the potential financial risks these audits pose for insurers reliant on MA revenue.

Investment Insight: The expanded CMS audits highlight rising regulatory risks for health insurers heavily invested in Medicare Advantage. While these audits aim to ensure accurate billing, the potential for significant financial recoveries could pressure insurers’ earnings. Investors may consider reducing exposure to affected names or diversifying into less-regulated healthcare sectors to mitigate regulatory-driven volatility.

Lenovo Shares Dip as Q4 Profit Falls 64% Amid One-Time Charges

Lenovo reported a sharp 64% decline in fourth-quarter profit to $90 million, falling well below analyst estimates of $225.8 million, primarily due to a non-cash warrant valuation loss. Despite the profit miss, revenue of $16.98 billion exceeded expectations of $15.6 billion, supported by a 64% surge in its infrastructure solutions group and a 22% rise in its enterprise-focused cloud services. Lenovo’s AI-driven PCs, launched globally last year, signal long-term growth potential, with CEO Yang Yuanqing projecting AI PCs to account for 25% of shipments by 2025. Shares fell 2.08% post-earnings, reflecting investor concerns over near-term profitability.

Investment Insight: Lenovo’s mixed results highlight the transitional challenges of scaling AI-powered PCs while navigating volatile profit drivers. Investors should focus on the company’s strong infrastructure and services growth as potential offsetting factors to weakness in core PC margins. Long-term exposure to Lenovo may hinge on its ability to capitalize on AI adoption trends and stabilize earnings performance.

Market price: Lenovo Group Ltd (HKG: 0992): HKD 9.71

Conclusion

Markets remain on edge as regulatory pressures, geopolitical uncertainties, and evolving economic conditions shape investor sentiment. Tech weakness in Asia highlights the impact of rising bond yields and U.S.-China tensions, while Bitcoin’s record-breaking rally signals growing institutional confidence in crypto assets. OpenAI’s move into AI hardware underscores the race for innovation, even as traditional sectors like healthcare face heightened scrutiny from regulators. Lenovo’s mixed earnings reflect transitional challenges amid broader shifts toward AI adoption. As volatility persists across sectors, staying diversified and attuned to regulatory and macroeconomic developments will be crucial for navigating the current investment landscape.

Upcoming Dates to Watch

- May 22nd, 2025: HK CPI, South Korea PPI, Japan CPI

- May 23rd, 2025: Singapore CPI

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – May 21, 2025

Date Issued – 21th May 2025

Preview

US stock futures slipped as lingering tariffs weighed on sentiment, while Japan’s super-long bond yields hit a 25-year high following a poor auction. Oil prices surged above $66 a barrel on reports of a potential Israeli strike on Iran, stoking Middle East supply fears. Meanwhile, Google unveiled Gemma 3n, an AI model capable of running on low-powered devices, alongside health-focused and accessibility tools, cementing its edge in edge computing. Lastly, bearish bets against the dollar hit record levels amid fiscal concerns and Moody’s downgrade, signaling investor caution on US economic stability.

US Futures Slide as Tariffs Weigh on Sentiment

US stock futures dipped Wednesday, with the Dow, S&P 500, and Nasdaq all down 0.3% as lingering tariffs dampened optimism over recent trade developments. While markets rallied last week on news of a temporary rollback in US-China duties, concerns are growing that current tariff levels—the highest since 1939—are curbing economic growth. Retail earnings, including Walmart’s warning of higher prices and Home Depot’s pledge to hold steady, have spotlighted the strain on consumer sentiment. Investors now await Target and Lowe’s results for further clues on retail resilience amid muted economic forecasts.

Investment Insight: The market’s response underscores the fragility of recent gains, as trade and pricing pressures remain key risks. Investors should temper enthusiasm for short-term rallies and focus on defensive sectors like consumer staples and utilities, which may offer stability amid heightened tariff uncertainty and cautious consumer spending trends.

Japan’s Super-Long Bond Yields Stay Elevated Amid Auction Woes

Japanese government bonds (JGBs) saw little recovery Wednesday after a lackluster auction sent 20-year yields to 2.57%, their highest since 2000. The selloff, fueled by rising U.S. Treasury yields and concerns over potential fiscal stimulus ahead of July elections, underscores challenges for the Bank of Japan’s efforts to taper debt purchases. Analysts warn sentiment will remain pressured with 30- and 40-year bond auctions looming. Meanwhile, above-target inflation and calls for consumption tax cuts are compounding upward pressure on yields, raising alarm over Japan’s fiscal sustainability.

Investment Insight: The JGB market faces heightened volatility, reflecting global trends of rising term premiums and shifting monetary policy. Investors should exercise caution with exposure to ultra-long bonds, favoring shorter durations or inflation-protected assets as Japan navigates fiscal and monetary uncertainties.

Oil Surges Amid Geopolitical Tensions Over Potential Israeli Strike on Iran

Oil prices climbed sharply after reports suggested Israel is preparing a potential strike on Iranian nuclear facilities, heightening geopolitical risks in the Middle East. Brent crude rose above $66 a barrel, and WTI jumped as much as 3.5% before paring gains. The uncertainty surrounding US-Iran nuclear talks, coupled with fears of escalating unrest in a region supplying a third of the world’s crude, has injected a risk premium into oil markets. Analysts warn that any disruption to Iranian supply—recently boosted by one million barrels per day—could significantly lift prices, even as concerns over oversupply linger into the year’s second half.

Investment Insight: The geopolitical backdrop underscores the importance of hedging against oil price volatility. Investors should monitor developments in the Middle East closely while considering energy equities and commodities with upside exposure to sustained geopolitical risk. Diversifying into alternative energy or defensive sectors may also safeguard against prolonged market uncertainty.

Google Unveils Gemma AI Model for Phones and Multimodal Applications

At Google I/O 2025, the tech giant introduced Gemma 3n, an AI model designed to function seamlessly on devices with less than 2GB of RAM, including phones, laptops, and tablets. This marks a significant step toward efficient, offline AI that enhances privacy by eliminating reliance on cloud computing. Alongside Gemma 3n, Google announced MedGemma for health-related AI applications and SignGemma for translating sign language into spoken-language text, aiming to empower developers and expand accessibility. Despite criticism over non-standard licensing, Gemma’s models have seen tens of millions of downloads, highlighting its growing adoption.

Investment Insight: Google’s focus on edge AI positions it as a leader in privacy-focused and cost-efficient solutions, with potential for widespread adoption in mobile and health-tech markets. Investors should monitor Google’s AI ecosystem as it drives innovation in multimodal technology, strengthening its competitive edge against rivals in the rapidly evolving AI landscape.

Market price: Alphabet Inc (GOOG): USD 165.32

Options Traders Turn Sharply Bearish on the Dollar Amid Fiscal Concerns

Currency options traders have pushed bearish dollar sentiment to record levels, with one-year risk reversals hitting a historic low of -27 basis points, reflecting heightened demand for downside protection. The Bloomberg Dollar Spot Index has fallen over 6% in 2025, its worst start in two decades, as US fiscal challenges—including Moody’s recent credit downgrade—exacerbate concerns. Despite a temporary reprieve from US-China trade tensions, structural risks such as rising deficits and a shift toward protectionist policies weigh on the greenback’s long-term prospects. Analysts caution that elevated US debt and political inaction could sustain downward pressure on the dollar.

Investment Insight: The dollar’s structural weakness highlights opportunities for diversification into non-dollar assets, including gold, emerging-market currencies, and euro-denominated bonds. While near-term inflation may temper the Federal Reserve’s policy shifts, long-term investors should prepare for continued dollar depreciation tied to fiscal imbalances and geopolitical uncertainties.

Conclusion

Markets are navigating a complex landscape of geopolitical tensions, fiscal challenges, and shifting economic policies. From sliding US stock futures under tariff strain to Japan’s bond market volatility and surging oil prices on Middle East unrest, uncertainty remains a dominant theme. Meanwhile, innovation like Google’s Gemma AI underscores opportunities in tech, even as dollar bearishness highlights broader concerns about US fiscal sustainability. Investors should stay vigilant, focusing on diversification and defensive strategies to weather volatility while positioning for long-term growth in sectors poised to benefit from these evolving dynamics.

Upcoming Dates to Watch

- May 21st, 2025: UK CPI, Singapore GDP

- May 22nd, 2025: HK CPI, South Korea PPI, Japan CPI

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – May 20, 2025

Date Issued – 20th May 2025

Preview

US futures waver as trade optimism fades, with the Dow up 0.1% while the S&P and Nasdaq remain flat. Tesla fell 2.25% after a 45% rally, as competition from Xiaomi’s EV launch looms, with key support at $289. Xiaomi began mass production of its Xring O1 chip, signaling a $1.87 billion push toward semiconductor independence. CATL surged 14% in its Hong Kong debut, buoyed by its dominant EV battery share and plans for $7.6 billion in overseas expansion. Meanwhile, Australia’s RBA cut rates to 3.85% citing global trade risks, as the Australian dollar slid 0.4%.

Futures Waver Amid Lingering Trade and Tariff Concerns

US stock futures showed mixed performance as optimism over last week’s temporary trade agreement between the US and China faced renewed scrutiny. Dow futures edged up 0.1%, while S&P 500 and Nasdaq futures traded flat, reflecting investor hesitation. Despite last week’s rally following the rollback of some tariffs, concerns are mounting that relief could be short-lived. Elevated tariff levels and cautious Federal Reserve commentary on rate cuts are tempering sentiment. Retail earnings remain in focus, with Walmart flagging higher prices and Home Depot set to provide further insight into consumer resilience.

Investment Insight: While recent trade optimism has buoyed markets, investors should remain cautious as elevated tariffs and restrained monetary policy loom. Focus on sectors resilient to price pressures, such as consumer staples, and watch upcoming earnings for signals of broader economic strain. Diversification remains critical amid heightened global uncertainties.

Tesla Retreats After Four-Week Rally: Key Levels to Watch

Tesla shares fell 2.25% on Monday, ending a four-week, 45% rally that was driven by easing trade tensions and CEO Elon Musk’s hands-on management approach. The pullback coincided with Xiaomi’s announcement of its YU7 electric SUV launch, potentially intensifying competition in the mid-size EV market. Technical indicators suggest the stock remains in an uptrend, though consolidation near $342 signals investor caution. Key support levels to monitor include $289 and $271, while resistance at $430 and $489 could test the stock’s ability to resume its upward momentum.

Investment Insight: Tesla’s recent rally underscores strong investor sentiment, but the pullback highlights the importance of monitoring competitive pressures and technical signals. For investors, $289 and $271 may present attractive entry points, while resistance levels near $430 and $489 could serve as profit-taking zones. Consider balancing exposure to Tesla with broader EV and technology plays to hedge against sector-specific risks.

Market price: Tesla Inc (TSLA): USD 342.09

Australia’s RBA Cuts Rates to 3.85% Amid Global Uncertainty

The Reserve Bank of Australia (RBA) lowered its cash rate by 25 basis points to 3.85%, marking a two-year low, as the board cited a dimming global economic outlook and easing inflationary pressures. The Australian dollar slipped 0.4% to $0.6429 following the announcement, while bond futures rose. Inflation has returned to the RBA’s target band of 2-3%, with core inflation at 2.9%, while the unemployment rate remains steady at 4.1%. However, global trade tensions, including U.S. tariffs and their impact on China, Australia’s top export market, weigh heavily on the domestic economy. Despite the cut, the RBA signaled caution regarding further easing.

Investment Insight: The RBA’s rate cut reflects growing pressures on Australia’s economy from global trade disruptions and softer domestic spending. Investors should anticipate continued volatility in the Australian dollar and commodity markets, particularly iron ore. Fixed-income assets may benefit from further rate cuts, while equity investors may focus on sectors resilient to global headwinds, such as healthcare and domestic consumer staples.

Xiaomi Begins Mass Production of Xring O1 Chip

Xiaomi has officially started mass production of its self-developed Xring O1 chip, marking a significant milestone in its push toward semiconductor independence. Founder Lei Jun announced that the chip will debut in the Xiaomi 15S Pro smartphone and Xiaomi Pad 7 Ultra, with a product launch scheduled for Thursday. The company has already invested 13.5 billion yuan ($1.87 billion) in the chip’s development and plans to allocate at least 50 billion yuan over the next decade to bolster its chip design capabilities, signaling a long-term commitment to innovation in hardware technology.

Investment Insight: Xiaomi’s foray into chip production positions it as a stronger competitor in the high-margin semiconductor space while reducing reliance on third-party suppliers. Investors should monitor the performance of Xring O1-powered devices and the company’s ability to scale chip production efficiently. With the potential for margin expansion and greater control over its supply chain, Xiaomi’s strategy could unlock significant shareholder value in the long term.

Market price: Xiaomi Corp (HKG: 1810): HKD 54.40

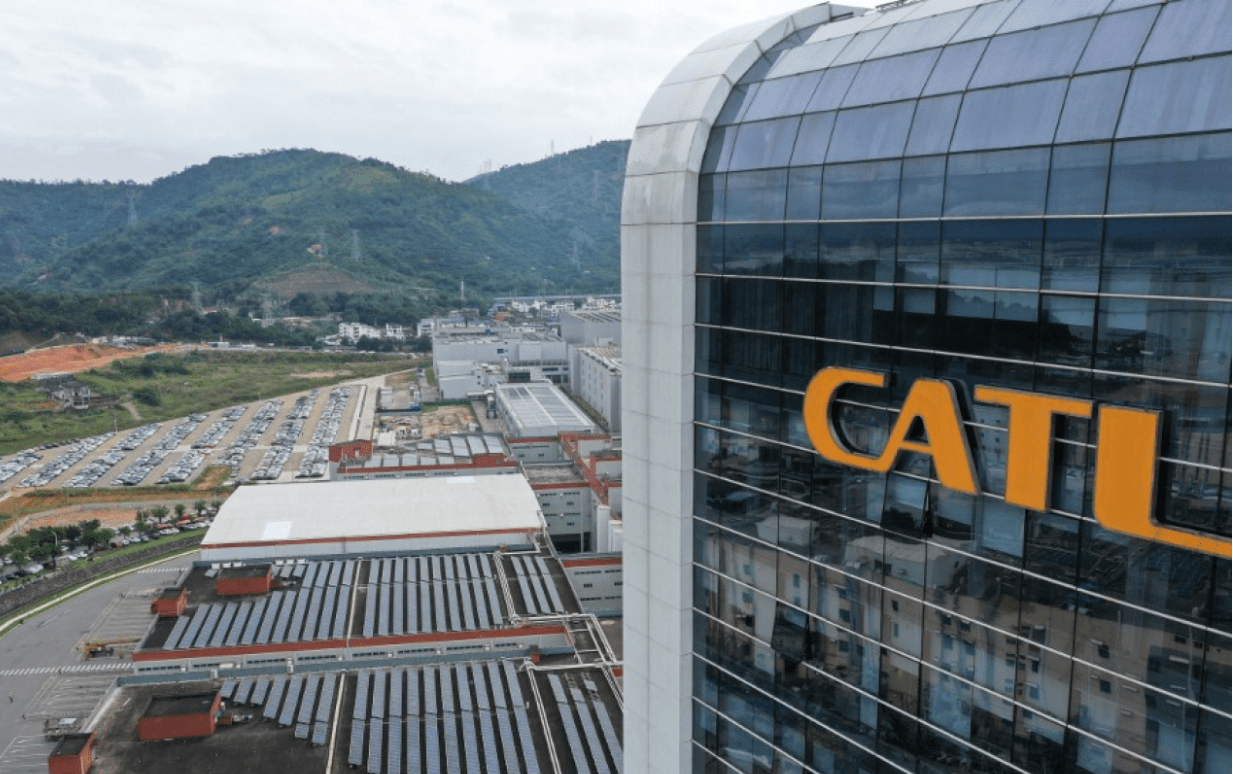

CATL Soars in Hong Kong Debut After Landmark Listing

Shares of Contemporary Amperex Technology Co. Ltd. (CATL), the world’s largest EV battery maker, surged as much as 14% in its Hong Kong trading debut following this year’s largest global listing, which raised $4.6 billion. The debut highlights strong investor confidence in CATL’s dominant 38% global market share and cutting-edge battery technology, despite geopolitical headwinds including a Pentagon blacklist. Priced at 17 times earnings, CATL’s Hong Kong shares reflect a smaller discount than typical mainland listings, with analysts projecting up to 50% upside. Proceeds are earmarked for a $7.6 billion overseas expansion, further solidifying CATL’s position as a global leader in the energy transition.

Investment Insight: CATL’s successful listing underscores strong demand for green technology leaders amid the global shift toward zero-carbon solutions. The company’s dominance in EV battery supply and ambitious growth plans present robust long-term potential. Investors should monitor geopolitical risks but consider CATL as a cornerstone for portfolio exposure to the booming EV and renewable energy sectors.

Market price: Contemporary Amperex Technology Co Ltd (3750.HK): HKD 311.00

Conclusion

Markets remain on edge as global trade uncertainties and competition across key sectors shape investor sentiment. US futures are flat, with attention shifting to retail earnings for clues on consumer resilience. Tesla’s pullback highlights the importance of monitoring competitive pressures, while Xiaomi’s chip production and CATL’s strong Hong Kong debut signal innovation and growth in Asia’s tech sector. The RBA’s rate cut underscores the challenges of navigating a cooling global economy. As volatility persists, investors should stay diversified, focus on sectors resilient to external shocks, and remain vigilant for opportunities amid shifting macroeconomic and geopolitical landscapes.

Upcoming Dates to Watch

- May 20th, 2025: German PPI

- May 21st, 2025: UK CPI, Singapore GDP

- May 22nd, 2025: HK CPI, South Korea PPI, Japan CPI

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the Asia market close – May 19, 2025

Date Issued – 19th May 2025

Preview

Markets Open Lower Amid US Credit Downgrade and Weak Chinese Data

US stock futures slid Sunday evening following Moody’s downgrade of the US credit rating to Aa1, citing growing deficits and refinancing challenges in a high-rate environment. Dow futures dropped 0.8%, while the S&P 500 and Nasdaq fell 1.1% and 1.3%, respectively. This bearish sentiment follows a strong rally last week, fueled by optimism over a temporary US-China tariff truce. Meanwhile, Asian markets mirrored the downturn, weighed down by softer-than-expected Chinese retail sales growth (5.1% vs. 5.5% forecast) and slowing industrial output. Investors are now closely watching manufacturing and jobs data, alongside developments in the Republican tax-and-spend negotiations.

Investment Insight: The downgrade underscores rising fiscal risks, pressuring US Treasuries and reinforcing a cautious tone for equities. Investors should brace for near-term volatility, especially in tech-heavy indices like the Nasdaq, while seeking opportunities in defensive sectors and dividend-paying stocks that can weather credit-related uncertainty.

Diageo Unveils $500M Cost-Saving Plan Amid Reduced Tariff Concerns

Diageo, the global spirits leader behind Johnnie Walker and Guinness, announced a $500 million savings initiative by 2028 to counter prolonged sales pressure and bolster cash flow. The move aims to generate $3 billion in annual free cash flow by 2026 and reduce debt, according to CEO Debra Crew. Meanwhile, the company lowered its projected tariff impact on U.S. sales to $150 million annually, down from $200 million, as proposed levies on Mexican tequila and Canadian whisky were delayed. Diageo’s third-quarter organic sales rose 5.9%, driven by accelerated North American shipments ahead of potential tariff implementation—an effect expected to fade by Q4.

Investment Insight: Diageo’s strategic focus on cost efficiency and cash flow generation positions it well for shareholder returns, even in a challenging macro environment. Investors should monitor the company’s ability to navigate tariff risks and sustain U.S. sales, while its premiumization strategy and strong North American presence remain key growth drivers.

Market price: Diageo plc (DGE): GBX 2,152.00

Goldman Revises Oil Demand Upward, Maintains Bearish Price Forecast

Goldman Sachs raised its global oil demand growth forecast to 600,000 barrels per day (bpd) in 2025 and 400,000 bpd in 2026, citing stronger global GDP prospects from easing tariff tensions. Despite this revision, the bank held its price forecasts steady at $60 for Brent and $56 for WTI this year, expecting both benchmarks to decline further in 2026 due to the potential U.S.-Iran nuclear deal. While the deal could increase supply pressure, persistent disagreements on uranium enrichment conditions leave its outcome uncertain. Goldman warned that prolonged tariff disputes and OPEC+ supply normalization could push Brent as low as $40 by late 2026 if global growth falters.

Investment Insight: Goldman’s outlook highlights a delicate balance between demand recovery and supply risks. Investors should remain cautious of geopolitical developments, particularly U.S.-Iran negotiations, while considering short-term opportunities in oil-related equities. Hedging against prolonged price declines may be prudent as structural oversupply risks loom into 2026.

Xiaomi to Launch YU7 EV and New Mobile Chip, Expanding Tech Ecosystem

Xiaomi will unveil its YU7 electric SUV on Thursday, positioning it as a direct competitor to Tesla’s Model Y in the world’s largest EV market. The launch follows the success of Xiaomi’s SU7 sedan, which has outsold Tesla’s Model 3 monthly since December, despite a recent dip in orders due to a fatal March accident. Alongside the YU7, Xiaomi will debut its self-developed Xring O1 mobile chip, a milestone in its $1.87 billion investment in chip design, with plans to inject an additional $7 billion over the next decade. CEO Lei Jun emphasized Xiaomi’s ambition to dominate both EVs and smartphones through tighter ecosystem integration, leveraging its success in hardware innovation.

Investment Insight: Xiaomi’s aggressive push into EVs and semiconductors underscores its diversification strategy to reduce reliance on smartphones amid intensifying competition. Investors should monitor its ability to scale EV production profitably and capture market share from established players like Tesla, while its chip investments signal long-term growth potential in high-margin technology.

Market price: Xiaomi Corp (HKG: 1810): HKD 52.35

Qualcomm Returns to Data Center CPUs, Partners with Nvidia on AI Integration

Qualcomm announced plans to reenter the data center CPU market, developing custom processors designed to connect seamlessly with Nvidia’s dominant AI GPUs. Leveraging technology from Nvidia, Qualcomm aims to enhance communication between its CPUs and Nvidia’s GPUs, advancing high-performance, energy-efficient AI computing for data centers. This marks Qualcomm’s renewed push into the sector after a prior attempt in the 2010s, revived with expertise gained from acquiring ex-Apple chip designers. The company has already garnered interest from key players, including Meta Platforms and Saudi AI startup Humain, signaling its ambition to challenge Intel and AMD in the CPU space.

Investment Insight: Qualcomm’s strategic alignment with Nvidia positions it to capitalize on surging AI workloads, as seamless CPU-GPU integration becomes critical for next-gen data centers. Investors should watch for Qualcomm’s ability to secure market share in a sector long dominated by incumbents, while its collaboration with Nvidia could drive incremental revenue from AI infrastructure adoption.

Market price: Qualcomm Inc (QCOM): USD 152.50

Conclusion

Global markets face heightened uncertainty as credit downgrades, geopolitical risks, and mixed economic data weigh on sentiment. Companies like Diageo and Xiaomi are doubling down on cost efficiencies and innovation to drive growth, while Qualcomm’s partnership with Nvidia underscores the accelerating shift to AI-driven computing. Meanwhile, Goldman Sachs’ revised oil demand outlook highlights the delicate balance between demand recovery and supply-side risks. Investors should brace for near-term volatility while staying focused on opportunities in resilient sectors and emerging technologies. As macroeconomic and geopolitical developments unfold, strategic positioning will remain key to navigating an increasingly complex investment landscape.

Upcoming Dates to Watch

- May 19th, 2025: Europe CPI

- May 20th, 2025: German PPI

- May 21st, 2025: UK CPI, Singapore GDP

- May 22nd, 2025: HK CPI, South Korea PPI, Japan CPI

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – May 16, 2025

Date Issued – 16th May 2025

Preview

Markets opened Friday on a cautious note as optimism over a U.S.-China tariff truce faded under the weight of lingering economic uncertainty. U.S. futures were little changed, while Japanese GDP data disappointed and Walmart flagged inflationary pressures tied to tariffs. A Bloomberg survey revealed Trump-era tariffs on Chinese goods are likely to persist at 30% through late 2025, threatening export flows and dampening China’s growth outlook. Still, Barclays scrapped its U.S. recession forecast, lifting 2025 growth expectations to 0.5% amid improved trade sentiment. In equities, Richemont beat sales forecasts thanks to robust U.S. jewellery demand, offsetting weakness in Asia. Meanwhile, Coinbase shares tumbled after a $400 million data breach linked to bribed offshore agents, just days after the company joined the S&P 500. With macro signals mixed and geopolitical risks mounting, investors are rotating cautiously, favoring resilient sectors and monitoring sentiment and security developments closely.

Market Caution Returns as Trade Optimism Fades

U.S. equity futures hovered near flat early Friday, reflecting a cautious tone across global markets as investors digest conflicting economic signals. Futures on the Dow Jones Industrial Average rose 0.09%, while the S&P 500 was unchanged and Nasdaq 100 futures dipped 0.02%. Thursday’s trading was marked by muted gains eroded by concerns over the economic drag from President Trump’s tariffs, despite initial optimism from a partial rollback agreement with China. Walmart’s earnings underscored inflationary pressures, warning of “unavoidable” price hikes. Meanwhile, in Asia, markets traded mixed following a sharper-than-expected 0.7% annualized contraction in Japan’s Q1 GDP, casting doubt on regional growth momentum ahead of key economic releases. Investors are now eyeing the University of Michigan’s consumer sentiment data for further insight into domestic resilience.

Investment Insight: Despite temporary relief on the trade front, markets remain vulnerable to lingering tariff effects and softening economic data. Investors should maintain a defensive posture, prioritizing sectors resilient to inflation and geopolitical noise, while closely monitoring consumer sentiment as a leading indicator for broader spending trends.

Tariff Uncertainty Weighs on China Outlook as U.S. Maintains Pressure

Markets are bracing for prolonged trade tensions after a Bloomberg survey showed U.S. tariffs on Chinese goods are likely to remain at 30% through late 2025, despite the recent 90-day truce between Washington and Beijing. Analysts warn the elevated levies—significantly lower than peak levels but still punitive—could erase up to 70% of Chinese exports to the U.S. in the medium term. The survey underscores low expectations for substantial progress in negotiations before the 2026 U.S. midterm elections. Chinese industrial output is forecast to slow to 5.9% in April, down from 7.7% in March, with export softness and weakening factory activity already reflecting the tariff impact. While the yuan is expected to stabilize near 7.2 per dollar, Chinese equities and bond yields are seen trading in tight ranges as policy uncertainty tempers investor enthusiasm.

Investment Insight: Persistent tariff headwinds reinforce a cautious stance on Chinese assets, particularly in export-sensitive sectors. With limited scope for near-term policy easing and trade negotiations expected to yield only incremental progress, investors should favor companies with domestic demand exposure and structural growth drivers. Currency stability may offer some relief, but headline risk from U.S. trade policy remains a key volatility trigger through year-end.

Barclays Scraps U.S. Recession Call on Trade Truce Optimism

Barclays has reversed its U.S. recession forecast, citing easing U.S.-China trade tensions as a key driver of improved economic prospects. In a note released Thursday, the bank now anticipates U.S. GDP growth of 0.5% in 2025, compared to a prior projection of a 0.3% contraction. Growth for 2026 was also adjusted modestly higher to 1.6%. The more stable trade environment has also prompted upward revisions for the euro area, with Barclays now expecting flat growth in 2025 instead of a 0.2% decline. However, the bank maintains a cautious stance on Europe, forecasting a shallow technical recession in the second half of the year amid persistent uncertainty around U.S.-EU tariff negotiations.

Investment Insight: The shift in Barclays’ U.S. outlook underscores how pivotal trade sentiment remains for macro forecasts. While risks linger, especially in Europe, reduced recession probability in the U.S. supports a constructive stance on risk assets. Investors may consider selectively adding cyclical exposure while remaining hedged against geopolitical volatility and trade-related setbacks.

Richemont Sales Beat Forecasts as U.S. Jewellery Demand Offsets Asia Weakness