Daily Synopsis of the New York market close – May 1, 2025

Date Issued – 1st May 2025

Preview

AI-powered growth drove Microsoft and Meta to exceed earnings expectations, with shares jumping 7% and 5.4%, respectively, despite macroeconomic pressures. The IMF warned of slowing growth in the MENA region due to falling oil prices and tariffs, though Gulf economies benefit from rising investment. Apple faces heightened antitrust risks after a court ruled it violated a 2021 order, threatening its App Store revenues. Meanwhile, surging gold exports pushed Australia to a rare trade surplus with the US, as geopolitical uncertainty bolsters demand for safe-haven assets. Finally, the US secured a resources deal with Ukraine, granting access to critical materials while supporting reconstruction efforts.

AI-Driven Growth Propels Microsoft and Meta Amid Economic Uncertainty

Microsoft and Meta Platforms exceeded earnings expectations for the March quarter, underscoring the transformative role of artificial intelligence in driving revenue growth. Microsoft’s Azure cloud business surged 33% year-over-year, with AI services contributing 16% of the growth. Meanwhile, Meta’s advertising revenue, powered by AI innovations, rose 16%, pushing the company’s total revenue to $42.31 billion. Shares of Microsoft and Meta climbed 7% and 5.4%, respectively, in after-hours trading, reflecting investor confidence despite headwinds from Trump-era tariffs and regulatory challenges in Europe.

Investment Insight: The robust performance of Microsoft and Meta highlights the strategic importance of AI investments in navigating macroeconomic pressures and evolving market dynamics. Investors should watch for long-term value generation from AI-driven product ecosystems, while remaining cautious of geopolitical risks and regulatory hurdles that may temper growth in international markets.

Market price: Microsoft Corp (MSFT): USD 395.26

MENA Economies Face Pressure from Tariffs, Oil Prices, and Aid Reductions

The Middle East and North Africa (MENA) region faces mounting economic challenges as falling oil prices, new tariffs, and declining foreign aid weigh on growth prospects, according to the IMF’s latest regional report. Brent crude prices, forecasted at $65-$69 per barrel for 2025-2026, leave energy exporters vulnerable, while broader geopolitical and economic uncertainties could reduce regional GDP growth by up to 4.5%. Despite these headwinds, Gulf economies continue to attract foreign direct investment, while fragile states like Syria and Lebanon face uphill battles, requiring international support and structural reforms. Growth in the region is expected to rise modestly to 2.6% this year, up from 1.8% in 2024.

Investment Insight: Investors should remain cautious of the MENA region’s exposure to oil price volatility and geopolitical risks, but opportunities exist in Gulf economies benefiting from sustained foreign direct investment. Long-term returns may hinge on diversification efforts and structural reforms across the broader region.

Apple Faces Major Setback in App Store Antitrust Case

A federal court ruled that Apple violated a 2021 injunction by continuing to block third-party payment options on its App Store, potentially costing the company billions in revenue. US District Judge Yvonne Gonzalez Rogers referred Apple to prosecutors for a possible criminal contempt investigation, accusing the company of willfully maintaining anticompetitive barriers. The decision is a major win for Epic Games, as it forces Apple to allow developers to bypass its in-app payment system. Apple shares fell 1.6% in after-hours trading, as the tech giant also faces separate antitrust risks over its search engine deal with Google.

Investment Insight: This ruling underscores escalating antitrust scrutiny on tech giants and raises risks for Apple’s high-margin App Store revenues. Investors should monitor the outcome of the criminal referral and broader regulatory actions, as these could impact Apple’s profitability and set precedents for other industry players. Diversified exposure to the tech sector may help mitigate concentration risks in the face of mounting legal and regulatory challenges.

Market price: Apple Inc (AAPL): USD 212.50

Gold Demand Fuels Rare Australian Trade Surplus with US

Australia reported an unprecedented trade surplus of A$4.1 billion with the United States for the March quarter, reversing a deficit of A$6.2 billion a year earlier. Driven by a surge in gold exports, Australian shipments to the US tripled to A$16.7 billion, as American buyers sought physical gold amid tariff uncertainties and futures market coverage. The gold frenzy, combined with recovering iron ore exports, pushed Australia’s overall goods surplus to A$6.9 billion in March, exceeding expectations. Gold prices, up 19% in Australian dollar terms this year, continue to boost miners’ revenues.

Investment Insight: Australia’s resource-driven trade windfall underscores the enduring appeal of gold as a hedge against geopolitical and economic instability. Investors should watch for sustained demand in safe-haven assets while considering opportunities in Australian mining equities, which benefit from rising commodity prices and export strength.

US Secures Resource Access in Landmark Deal with Ukraine

The US and Ukraine signed a critical resources agreement granting Washington priority in developing Ukraine’s aluminum, graphite, oil, and natural gas projects. The deal, finalized after weeks of contentious negotiations, establishes a joint reconstruction fund to attract global investment and reimburse future US military aid. While the agreement reaffirms US commitment to Ukraine’s recovery, it avoids direct security guarantees and leaves questions about long-term military support. The accord arrives as President Trump faces pressure to deliver peace in Ukraine and signals strengthened US-Ukraine ties despite challenges in ongoing ceasefire talks with Russia.

Investment Insight: This deal positions US companies to capitalize on Ukraine’s vast resource potential, particularly in critical materials essential for technology and energy sectors. Investors should monitor progress on reconstruction efforts and geopolitical stability, as these factors will shape the viability of long-term resource extraction and infrastructure projects in Ukraine.

Conclusion

This week underscores the delicate balance markets face between optimism in select sectors and mounting macroeconomic challenges. While strong earnings from Royal Caribbean and promising developments in European defense signal resilience, headwinds from trade tensions, slowing growth, and volatile oil prices weigh heavily on investor sentiment. Key data on GDP and inflation will provide critical insights into the broader economic trajectory, while tech earnings could shape market direction amid tariff uncertainties. As geopolitical and economic pressures persist, a cautious and diversified investment approach remains essential to navigate the evolving landscape.

Upcoming Dates to Watch

- May 1st, 2025: US S&P Global Manufacturing PMI, Swiss Retail Sales, BoJ Press Conference

- May 2nd, 2025: Hong Kong GDP, EU Core CPI, EU Unemployment rate

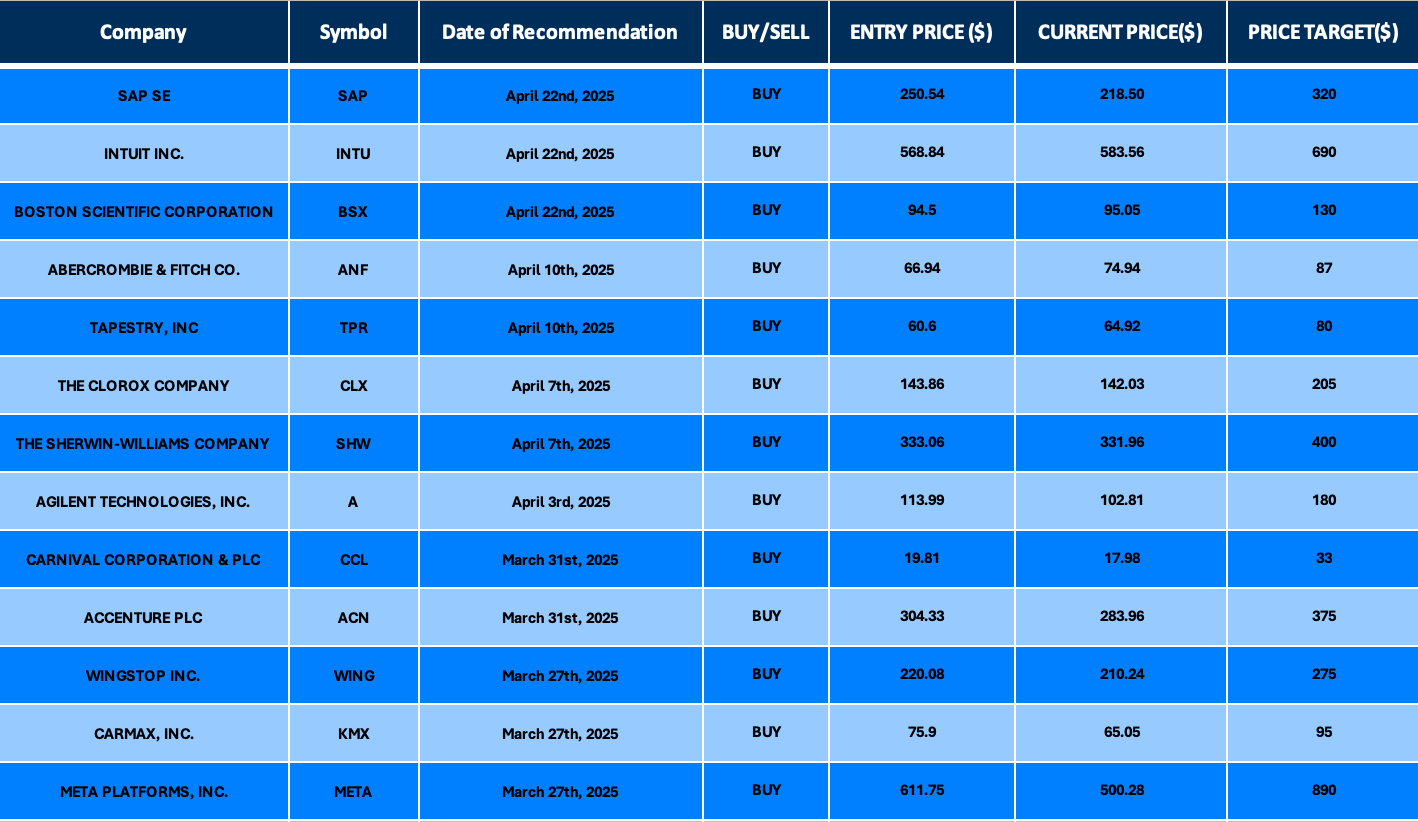

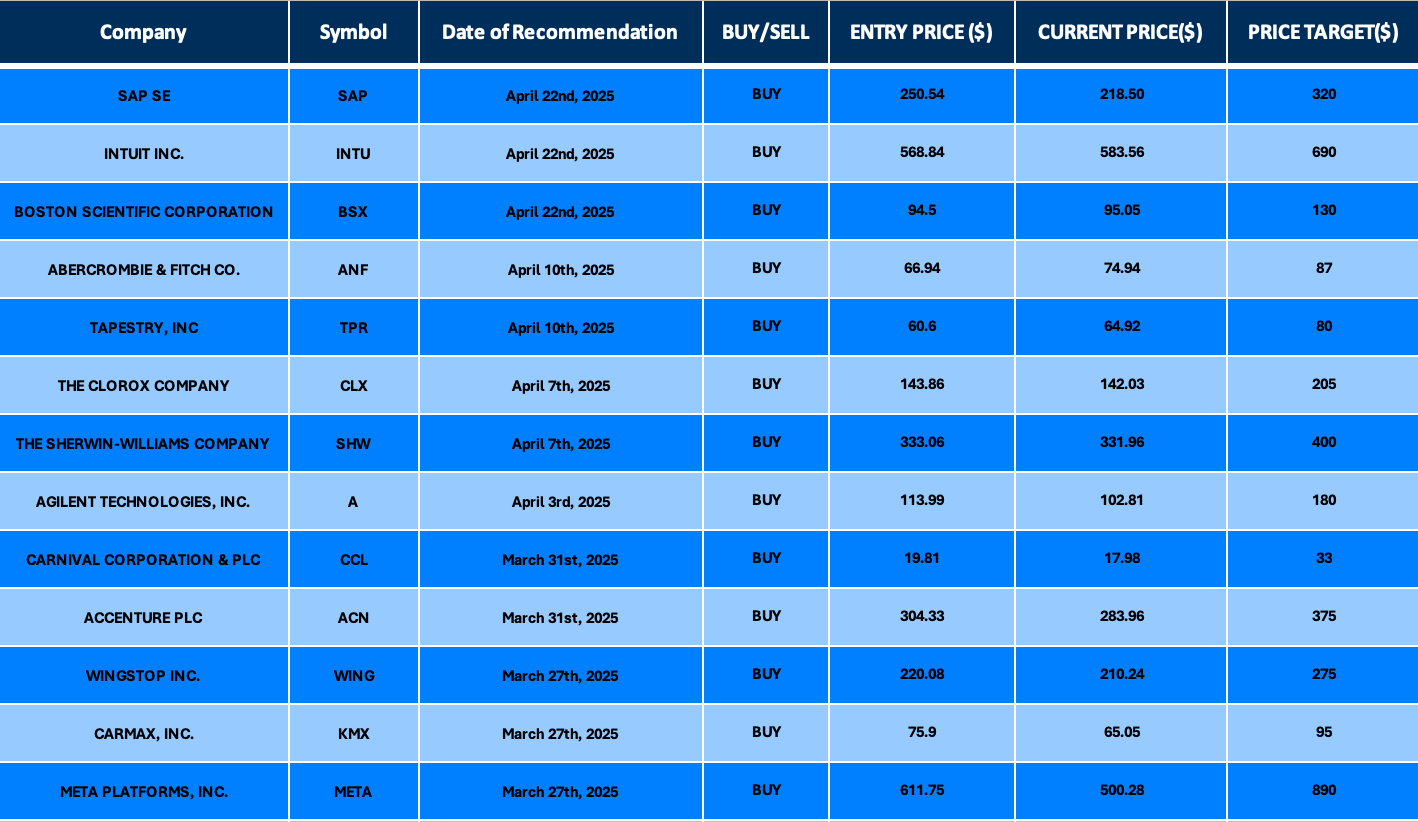

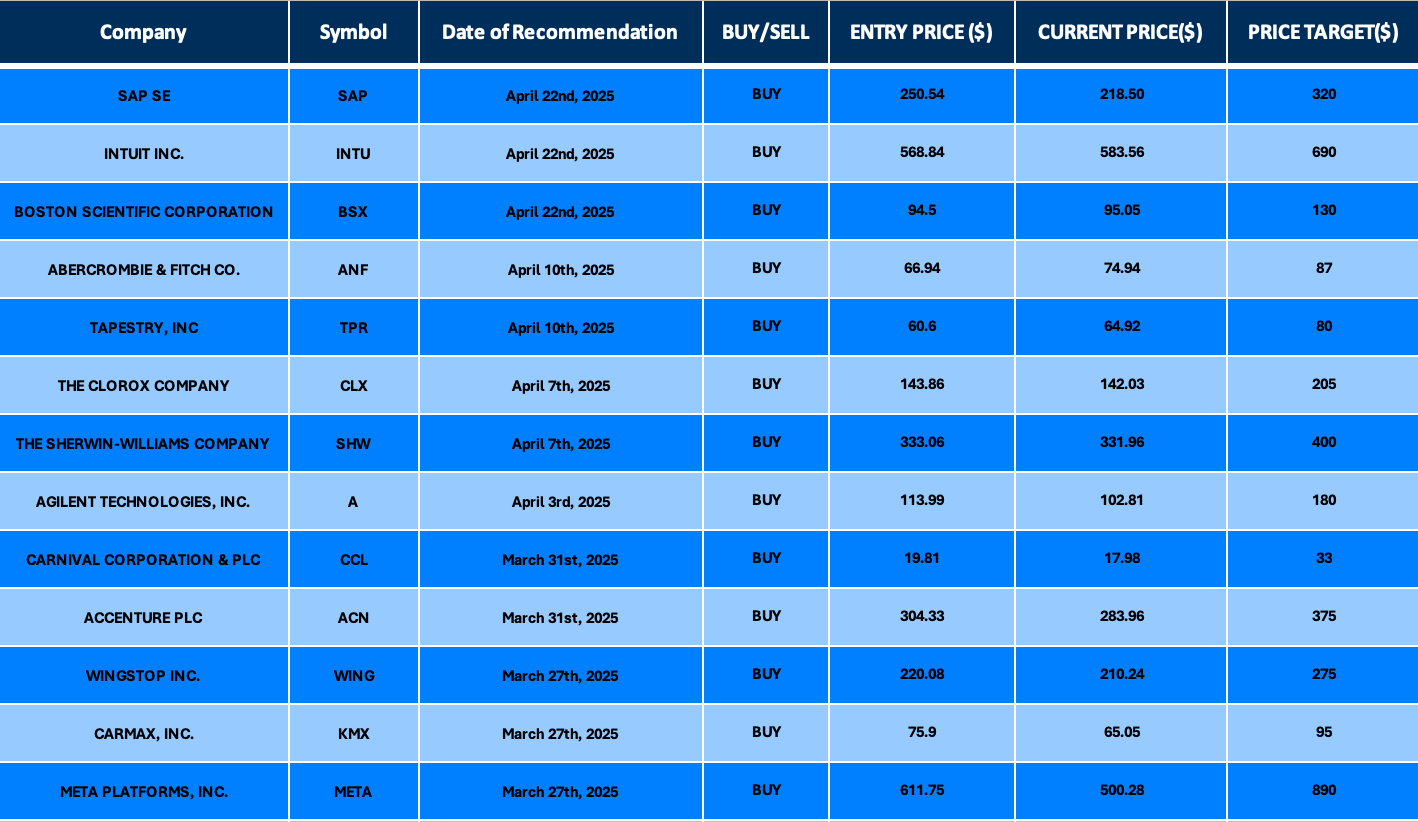

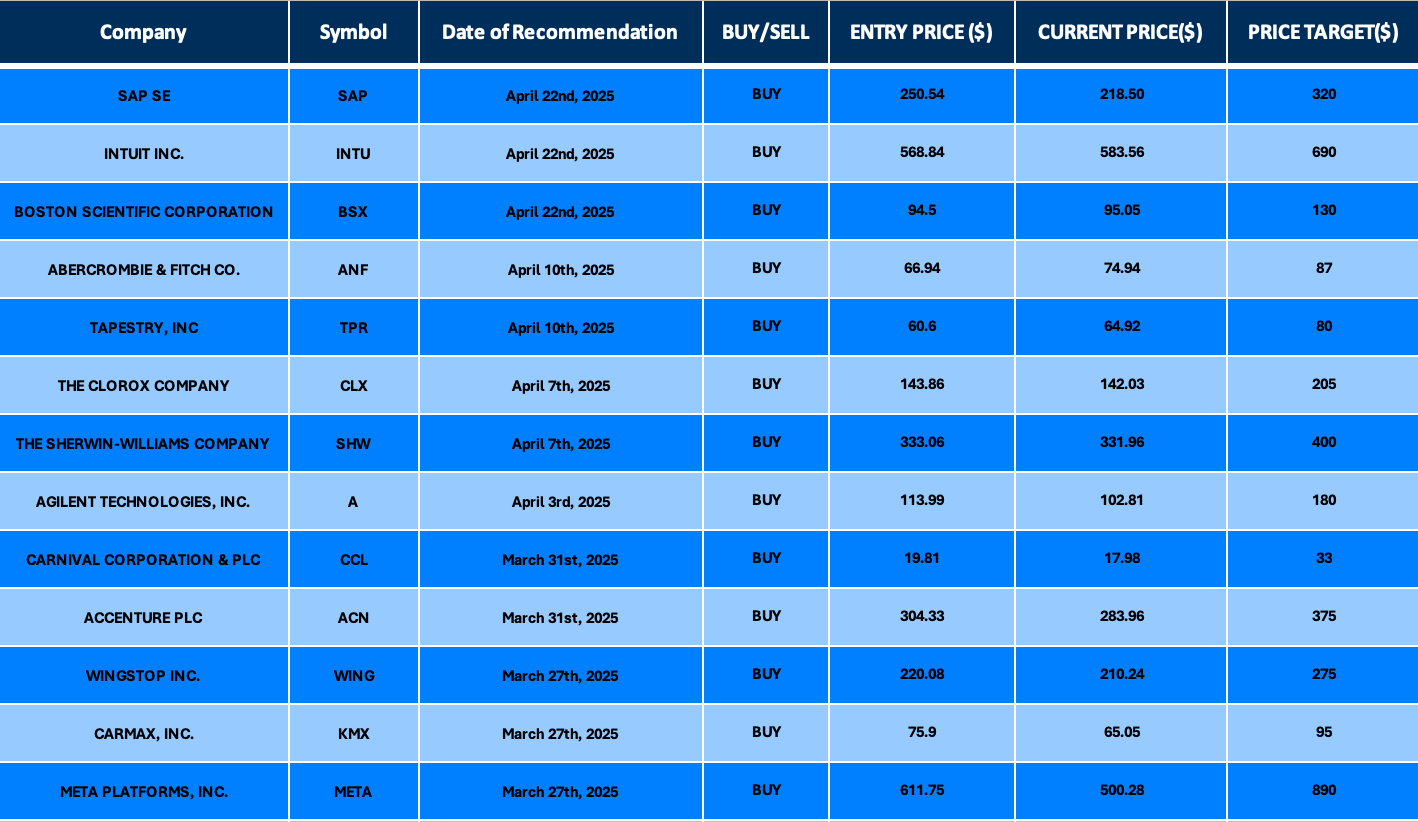

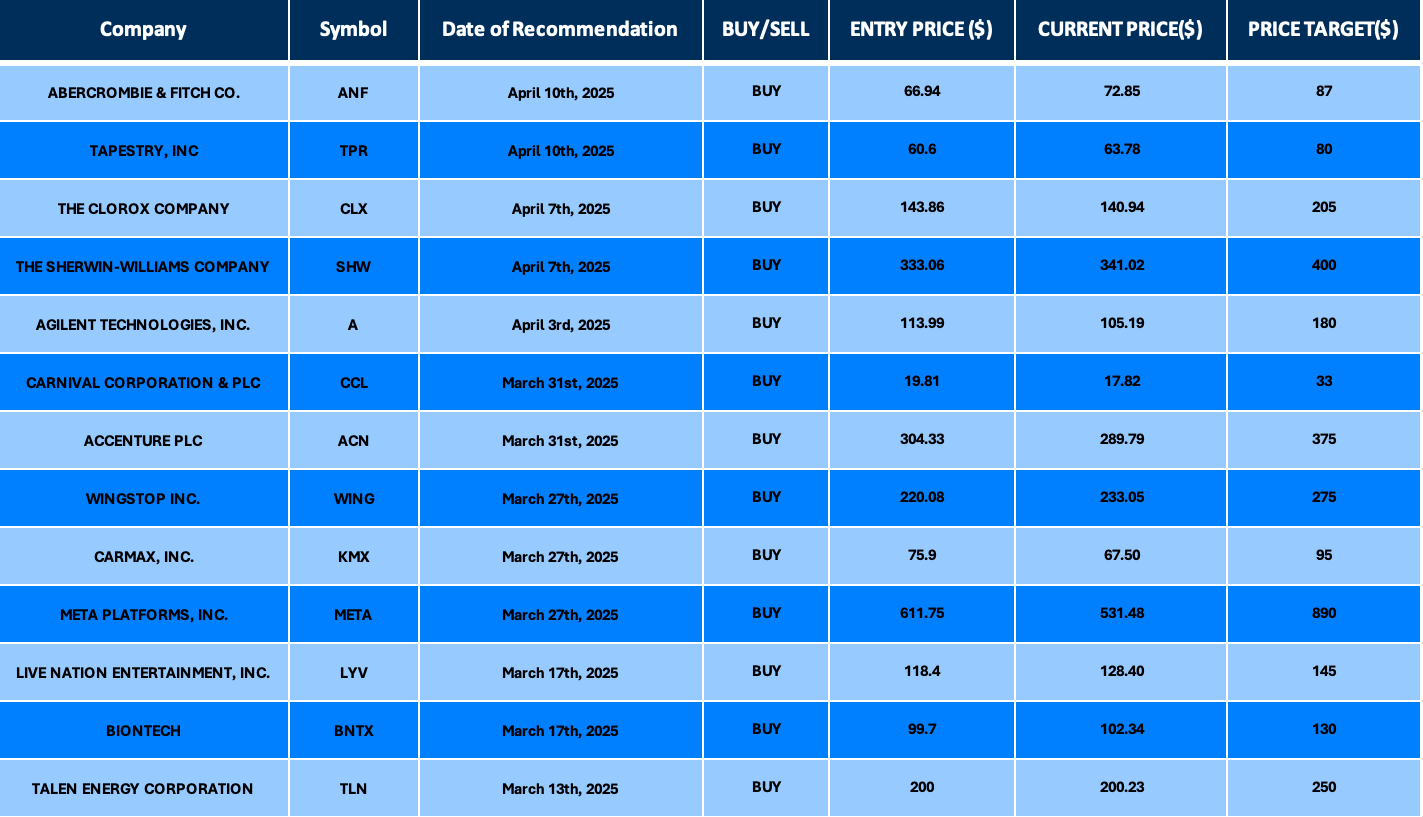

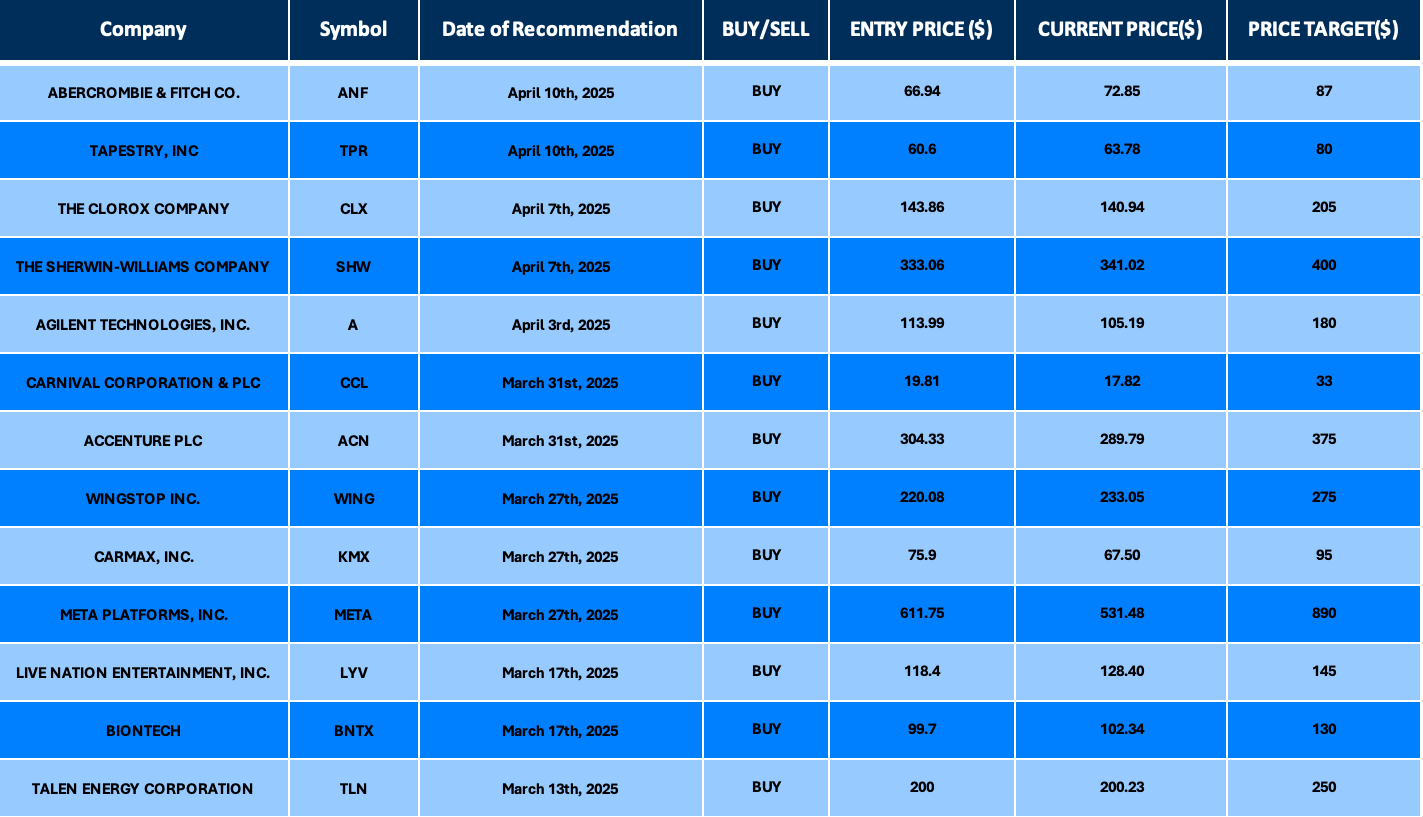

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – April 30, 2025

Date Issued – 30th April 2025

Preview

Markets face a pivotal week as mega-cap tech earnings, including Microsoft and Meta, take center stage amid ongoing tariff-driven uncertainty. President Trump’s easing of auto tariffs offers temporary relief, but broader trade policies continue to weigh on economic growth, with Q1 GDP and inflation data expected to guide Federal Reserve decisions. Oil is set for a historic 15% monthly decline as trade tensions and OPEC+ supply increases pressure prices. In corporate updates, Royal Caribbean raised its profit outlook, signaling resilience in the cruise sector, while U.S. construction job openings hit record lows due to rising material costs from tariffs. Meanwhile, Rheinmetall and Lockheed Martin plan a missile facility in Germany, highlighting Europe’s push for defense self-reliance as geopolitical tensions persist.

Markets Brace for Tech Earnings Amid Trade Policy Shifts

U.S. stock futures edged lower Wednesday as investors prepared for a critical week of mega-cap tech earnings and key economic data releases. Microsoft and Meta Platforms headline the earnings roster, with markets keen on updates regarding AI investments and tariff impacts. Meanwhile, President Trump eased auto tariffs, offering temporary relief to carmakers amid escalating trade policies. Economic data, including Q1 GDP and inflation metrics, may provide clarity on the broader impact of tariffs and guide Federal Reserve policy. Oil prices extended losses, with Brent crude down 1.5%, reflecting trade tensions and weak Chinese manufacturing data.

Investment Insight: Investors should monitor tech earnings for insights into AI spending and sector resilience amid tariff uncertainties. Slowing GDP and falling oil prices signal potential headwinds for growth-oriented assets, emphasizing the need for balanced exposure to defensive sectors and cash-flow-generating equities.

Construction Job Openings Fall Amid Tariff Pressures

The U.S. construction sector is showing signs of a slowdown, with job openings declining by 38,000 in March and down 90,000 year-over-year, according to Bureau of Labor Statistics data. Hiring in the sector also hit a record low, with only 3.6% of industrywide jobs filled. Analysts point to President Trump’s tariffs on steel, aluminum, and lumber, which have raised costs and caused developers to delay new projects. Broader economic uncertainty and rising material expenses are expected to further dampen labor demand in the sector.

Investment Insight: Rising input costs and slowing hiring signal potential challenges for construction-related equities and materials suppliers. Investors should consider reducing exposure to cyclical construction stocks and prioritizing companies with diversified revenue streams or limited reliance on tariff-sensitive materials.

Royal Caribbean Raises Profit Forecast Despite Sector Challenges

Royal Caribbean Cruises (RCL) defied market expectations by raising its full-year profit forecast to $14.55–$15.55 per share, surpassing analyst estimates of $14.78. This optimism stems from a record-breaking “WAVE season,” putting the company in a robust booking position for the remainder of 2025 and 2026. Despite the upbeat outlook, RCL shares reversed an initial 3% gain to close down 2.6%, dragging peers Carnival Corp (CCL) and Norwegian Cruise Line (NCLH) lower ahead of their earnings. Travel stocks remain pressured by macroeconomic uncertainty, with other industry players like American Airlines pulling guidance due to weakening domestic demand.

Investment Insight: Royal Caribbean’s strong forecast highlights resilience in the cruise industry amid broader travel sector headwinds. Investors may find value in cruise line stocks, particularly those with strong forward bookings and pricing power, as they outperform air carriers facing demand softness. Diversifying within travel-related holdings could balance risks tied to broader economic uncertainty.

Oil Faces Historic Monthly Decline Amid Trade War and Supply Glut

Brent crude is on track for a historic 15% drop in April, marking its worst monthly performance since trading began in 1988, while West Texas Intermediate hovers in the upper $50s. Weakened by U.S.-China trade tensions, slowing economic growth, and OPEC+ supply increases, the market outlook remains bearish. U.S. crude stockpiles rose by 3.8 million barrels last week, and Chinese factory activity slumped to its lowest level since 2023, signaling reduced energy demand. OPEC+ is expected to further loosen production curbs in May, with analysts warning of a potential supply glut as non-cartel nations ramp up output.

Investment Insight: Oil’s steep selloff highlights vulnerabilities tied to geopolitical risks and supply-demand imbalances. Investors should approach energy stocks cautiously, favoring companies with low breakeven costs and diversified revenue streams. Hedging against further downside in crude prices may also be prudent as uncertainties around OPEC+ policies and global trade persist.

Rheinmetall and Lockheed Martin Partner to Boost European Missile Production

Rheinmetall (ETR:RHMG) and Lockheed Martin (NYSE:LMT) announced plans to establish a missile and rocket manufacturing center in Germany, expanding their strategic partnership. Led by Rheinmetall, the facility will produce and distribute advanced munitions across Europe, aiming to enhance the continent’s defense self-reliance amid ongoing support for Ukraine and NATO commitments. This initiative underscores Europe’s push to reduce reliance on U.S. weaponry and replenish military stockpiles. The agreement is pending U.S. and German government approvals but highlights significant anticipated demand in Europe’s defense sector.

Investment Insight: The collaboration positions Rheinmetall and Lockheed Martin to capitalize on rising European defense spending. Investors may find opportunities in defense stocks as geopolitical tensions sustain demand for advanced weaponry. Rheinmetall, with its regional expertise, could see substantial growth as Europe prioritizes local production capabilities.

Conclusion

This week underscores the delicate balance markets face between optimism in select sectors and mounting macroeconomic challenges. While strong earnings from Royal Caribbean and promising developments in European defense signal resilience, headwinds from trade tensions, slowing growth, and volatile oil prices weigh heavily on investor sentiment. Key data on GDP and inflation will provide critical insights into the broader economic trajectory, while tech earnings could shape market direction amid tariff uncertainties. As geopolitical and economic pressures persist, a cautious and diversified investment approach remains essential to navigate the evolving landscape.

Upcoming Dates to Watch

- April 30th, 2025: EU GDP, US GDP

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – April 29, 2025

Date Issued – 29th April 2025

Preview

Asian equities rose on tariff easing optimism, while gold fell on a stronger dollar. Boeing climbed out of CreditWatch negative as S&P cited improving production and cash flow, despite lingering risks tied to trade tensions. Microsoft highlighted Asia’s leadership in AI adoption, driven by innovation and cost-efficient models like China’s DeepSeek, while LG announced an additional $1.7 billion investment in Indonesia’s EV battery sector, signaling the region’s growing role in supply chains. Meanwhile, HSBC reported a $1.6 billion potential loss from its reduced stake in China’s BOCOM but reassured investors with a $3 billion buyback. Elevated trade and economic risks persist across markets.

Stocks Rise on Tariff Easing, Gold Falls Amid Stronger Dollar

Asian equities reached a one-month high as optimism grew following news of a potential reprieve on US auto tariffs, signaling a possible de-escalation in trade tensions. A regional index climbed 0.3%, led by gains in South Korean automakers like Hyundai, while US equity futures edged up 0.1%. The dollar strengthened 0.2%, pressuring gold prices, which fell as much as 1.1%. Market participants remain cautious, with the week ahead featuring key US economic data and high-profile earnings, as investors navigate mixed signals on global trade and inflation.

Investment Insight: While easing tariff concerns offer a temporary boost for equities, heightened volatility underscores the need for a balanced portfolio. Investors should monitor US economic data and earnings for clarity on growth trends, while considering exposure to domestically-driven markets like India, which may be better insulated from global trade disruptions.

S&P Lifts Boeing From CreditWatch Negative on Recovery Prospects

S&P Global Ratings has removed Boeing from CreditWatch negative, citing improvements in aircraft production and reduced cash burn following last year’s strike-related disruptions. The planemaker’s first-quarter free cash flow usage improved to negative $2.3 billion, beating expectations of negative $3.6 billion. Boeing aims to double monthly 737 MAX production to 38 units by year-end, bolstering confidence in its recovery. However, S&P maintained a negative outlook, reflecting risks tied to production delays and global trade tensions, which could hinder cash flow and credit metrics improvement.

Investment Insight: Boeing’s improving production and cash flow signal early recovery progress, but the retained negative outlook highlights lingering uncertainties. Investors should weigh near-term opportunities against potential disruptions in global trade and supply chains, while monitoring the company’s progress toward sustainable production targets.

Market price: Boeing Co (BA): USD 182.30

Microsoft Says Asia Is Becoming a Leader in AI Adoption

Asia’s transition from “Made in” to “Created in” is driving its leadership in AI adoption, according to Microsoft Asia President Rodrigo Kede Lima. The region accounts for 70% of global patents, hosts two-thirds of the world’s developers, and leads GPU consumption, underscoring its role as a hub for design and technological innovation. Microsoft’s latest Work Trend Index reveals that over 60% of Asia-Pacific leaders aim to boost productivity through AI, though 85% cite time constraints as a barrier. Lima sees smaller, cost-efficient AI models like those pioneered by China’s DeepSeek reshaping the competitive landscape, fostering broader adoption and domain-specific applications.

Investment Insight: Asia’s growing dominance in AI signals long-term opportunities in sectors tied to innovation and productivity enhancement. Investors should focus on companies enabling AI infrastructure and adoption in the region, while monitoring emerging players like DeepSeek, whose disruptive models could challenge Big Tech’s traditional advantage.

LG Commits Additional $1.7 Billion to Indonesian Battery Factory

South Korea’s LG Group will expand its investment in an Indonesian battery cell factory by $1.7 billion, bringing the total project value to $2.8 billion, according to Indonesia’s investment minister Rosan Roeslani. The factory, a joint venture between LG Energy Solution (LGES) and Hyundai Motor Group known as HLI Green Power, recently launched Indonesia’s first battery cell production plant with a 10 GWh annual capacity and is now entering its second investment phase. This commitment follows LGES’s withdrawal from a separate $8.46 billion EV battery supply chain project, citing market and investment challenges. China’s Zhejiang Huayou Cobalt will step in to replace LGES in the latter initiative.

Investment Insight: LG’s expanded investment underscores Indonesia’s growing role in the global EV battery supply chain, driven by its abundant nickel resources. Investors should monitor Indonesia’s partnerships with key global players like LG and Huayou Cobalt, as well as the broader push for battery production scalability and regional EV market growth.

Market price: LG Corp (KRX: 003550): KRW 65,500

HSBC Faces China Stake Loss, Launches $3 Billion Buyback Amid Trade War Concerns

HSBC announced a potential pre-tax loss of up to $1.6 billion as its stake in China’s Bank of Communications (BOCOM) will drop from 19.03% to 16% following BOCOM’s $16.9 billion private placement to recapitalize state banks. Despite the loss, HSBC emphasized the move will not impact its capital ratios or dividend capacity. Meanwhile, the bank reported a 25% drop in Q1 profit to $9.5 billion, citing one-time charges from divestitures in Canada and Argentina.

Economic uncertainty stemming from U.S. President Donald Trump’s sweeping trade tariffs has raised credit risk and dampened loan demand. To reassure investors, HSBC launched a $3 billion share buyback, which analysts described as a “positive surprise.” The bank’s Asia-focused wealth operations posted strong growth, with Hong Kong wealth management gaining 29% in new customers quarter-on-quarter. However, the macroeconomic environment remains volatile, with HSBC warning it could face an additional $500 million in credit losses if tariffs further slow global growth.

Investment Insight: HSBC’s strategic pivot highlights the balancing act between mitigating short-term challenges—such as trade tensions and rising credit risks—and pursuing long-term growth in Asia’s wealth and institutional banking sectors. Investors should monitor the bank’s cost-cutting measures, its focus on high-growth Asian markets, and the broader implications of China’s state bank recapitalization on HSBC’s regional footprint.

Market price: HSBC Holdings plc (HKG: 0005): HKD 88.50

Conclusion

Global markets are navigating a mix of optimism and caution as easing tariffs lift equities, while trade tensions and economic uncertainty weigh on sectors like banking and manufacturing. Asia’s rise as a leader in innovation and AI adoption is reshaping industries, with significant investments like LG’s battery expansion in Indonesia highlighting regional growth opportunities. Meanwhile, corporate responses to challenges, such as Boeing’s production recovery and HSBC’s strategic buyback, signal resilience amid volatility. Investors face a complex landscape, balancing short-term risks with long-term opportunities in innovation, supply chains, and emerging markets poised for transformation.

Upcoming Dates to Watch

- April 29th, 2025: EU Consumer Confidence, South Korea industrial production

- April 30th, 2025: EU GDP, US GDP

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – April 28, 2025

Date Issued – 28th April 2025

Preview

Markets are navigating cautiously this week as investors eye US-China trade negotiations, Chinese stimulus measures, and major tech earnings from Apple, Microsoft, Meta, and Amazon

Asian equities edged higher, but S&P 500 futures signal a pause in the US rally, and gold slid 6.5% from record highs amid improving risk sentiment. Beijing remains committed to a 5% GDP growth target despite US tariffs, unveiling measures to boost domestic demand and stabilize employment. Apple’s earnings will test its resilience against tariff pressures, while Toyota Industries surged 23% on buyout speculation by Toyota Motor, signaling potential shifts in Japan’s corporate landscape. Investors remain defensive, focusing on domestic equities and sectors poised to benefit from stimulus and easing trade tensions.

Cautious Markets Amid Earnings and Trade Tensions

Asian markets began the week with restrained gains as investors awaited clarity on US-China trade negotiations and potential Chinese stimulus measures. The MSCI Asia Pacific Index edged up 0.6%, while S&P 500 futures fell 0.6%, signaling a potential pause in the recent US equity rally. European stock futures remained flat. Gold prices slid 1.6% as traders reassessed its recent rally, and 10-year US Treasury yields inched higher by 1 basis point. Key economic events, including the Bank of Japan’s rate decision and US GDP and jobs data, loom large, while earnings from major US tech players—Microsoft, Apple, Meta, and Amazon—are set to drive sentiment. Despite hopes of an earlier Federal Reserve rate cut, fund managers remain cautious, emphasizing defensive, domestic-focused strategies amid ongoing tariff and geopolitical uncertainties.

Investment Insight

With market volatility persisting, investors should prioritize defensive sectors and quality domestic equities over high-risk international plays. Earnings from tech giants this week may shape near-term sentiment, but trade tensions and economic uncertainties warrant a measured approach. Diversification across stable dividend-paying stocks and cash-rich companies can provide resilience against potential downside risks.

Gold’s Rally Pauses Amid Trade War Optimism

Gold prices have dropped 6.5% from their record highs last week as easing US-China trade tensions spurred a global stock market rally, reducing haven demand. Hedge funds have sharply cut net long positions, signaling diminished bullish sentiment. The euro’s strength against the dollar, a key factor in gold’s earlier surge, has also softened as risk appetite improves. Analysts warn of downside risks, citing technical overbought signals, slowing central bank purchases, and tightened liquidity conditions. However, lingering uncertainties and inflation risks may still provide support for gold as a haven asset in the medium term.

Investment Insight

Gold’s correction reflects a recalibration of overextended positions as risk appetite returns. Investors should remain cautious, avoiding aggressive exposure to gold until technical levels stabilize. Diversifying into equities poised to benefit from easing trade tensions or hedging with broader commodity exposure may offer better near-term opportunities. For long-term holders, gold remains a viable hedge against geopolitical risks and inflation, but a measured allocation is prudent amidst current volatility.

China Asserts Resilience Amid Escalating US Tariffs

China’s leadership has sought to reassure markets and citizens of its ability to counter the economic impact of the US trade war, emphasizing robust policy tools to protect jobs and stabilize growth. Amid combined US tariffs of up to 145% on Chinese imports, Beijing announced measures including easier lending conditions, corporate support, and incentives for domestic demand, such as rebates on consumer and industrial upgrades. Officials dismissed US tariff policies as “bullying” while downplaying reliance on US imports, particularly in energy and agriculture. Despite these challenges, China remains committed to its 5% GDP growth target, leveraging urbanization and increased domestic consumption as key growth drivers. Uncertainty persists, however, as trade negotiations remain stalled.

Investment Insight

China’s proactive stance to bolster domestic demand and stabilize employment underscores its resilience, but prolonged uncertainty around US-China trade tensions adds risks to global supply chains and market sentiment. Investors should consider exposure to sectors benefiting from China’s domestic stimulus, such as infrastructure, renewables, and consumer goods. However, caution is advised regarding industries directly tied to global trade, as tariff escalation could weigh further on exports and corporate earnings.

Apple Earnings Loom Amid Tariff Concerns and Technical Signals

Apple shares are under scrutiny ahead of its fiscal Q2 earnings report on Thursday, as Wall Street assesses the impact of tariffs and price adjustments on consumer demand. The tech giant’s broader strategy, including plans to shift significant iPhone production to India by 2026, will also be closely watched. Year-to-date, Apple’s stock is down 16% but has rebounded 25% from this month’s lows. Technical indicators suggest muted momentum, with the RSI hovering below 50. Key support levels to watch include $169 and $157, while resistance zones near $220 and $237 could attract selling pressure in the event of a rally.

Investment Insight

Apple’s earnings and guidance will be pivotal for short-term stock performance, particularly in the context of tariffs and production realignment. For investors, $169 represents a critical support level for potential entry, while profit-taking opportunities might arise near $220 or $237. Long-term buyers should focus on Apple’s ability to diversify its supply chain and sustain demand amid economic pressures, positioning the stock as a strategic hold despite near-term volatility.

Market price: Apple Inc (AAPL): USD 161.47

Toyota Industries Soars on Buyout Speculation

Shares of Toyota Industries surged by their daily limit of 23% on Monday, poised for their largest one-day gain in over four decades, following Toyota Motor’s announcement of a potential buyout. The automaker is reportedly considering a deal worth as much as 6 trillion yen ($41 billion), according to Bloomberg. Toyota Industries, a key supplier and parts manufacturer, confirmed receiving proposals to go private but denied any formal offer from Toyota or its chairman, Akio Toyoda.

Analysts see the potential sale of Toyota Industries’ stake in Toyota Motor as a strong catalyst, with the buyout potentially enabling Toyota to acquire its supplier’s high-growth materials handling business at minimal cost. Cross-shareholding pressures and Japan’s corporate reform agenda are further driving the speculation.

Investment Insight

Toyota Industries’ possible privatisation signals a strategic shift in Japan’s corporate landscape, with increased focus on streamlining cross-shareholdings and unlocking shareholder value. Investors should monitor developments closely, as a buyout could significantly enhance Toyota’s vertical integration, particularly in materials handling and EV components. For shareholders of Toyota Industries, the potential premium offers a profitable exit, while Toyota Motor investors should weigh the long-term synergies against near-term financial outlay.

Market price: Toyota Industries Corp (TYO: 6201): JPY 16,225.0

Conclusion

This week’s market dynamics highlight the delicate balance between cautious optimism and persistent economic uncertainties. Key earnings from tech giants, developments in US-China trade negotiations, and central bank decisions will shape sentiment in the days ahead. While Apple and Toyota Industries dominate headlines with pivotal corporate moves, gold’s retreat signals shifting risk appetites. China’s proactive policy measures underscore resilience, but global investors remain defensive, prioritizing stability amid volatility.

As markets navigate these crosscurrents, strategic focus on quality assets, domestic plays, and diversification will be essential to weather potential disruptions and capitalize on emerging opportunities.

Upcoming Dates to Watch

April 29th, 2025: EU Consumer Confidence, South Korea industrial production

April 30th, 2025: EU GDP, US GDP

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – April 25, 2025

Date Issued – 25th April 2025

Preview

Wall Street rallied on optimism over easing US-China trade tensions and possible Federal Reserve rate cuts, with the Nasdaq jumping 2.7%. Alphabet surged nearly 5% after strong Q1 earnings driven by search advertising and cloud profitability, while Apple announced plans to shift most US iPhone production to India by 2026 to reduce reliance on China. Meanwhile, Intel slid 4% in Frankfurt trading on weak forecasts, and JD.com and Meituan lost $70 billion in combined market value amid an escalating price war. Investors remain focused on inflation data and corporate strategies to navigate geopolitical and competitive pressures.

Wall Street Rallies on Easing Trade Tensions and Rate-Cut Hints

US equities surged on Friday, with the Dow Jones climbing 1.2% (nearly 500 points), the S&P 500 gaining 2%, and the Nasdaq soaring 2.7%. Markets were buoyed by signs of easing US-China trade tensions as China hinted at pausing its 125% tariff on select goods. Federal Reserve officials also signaled a potential rate cut, further fueling optimism. Alphabet led the Nasdaq higher after beating earnings expectations, hiking its dividend, and announcing a $70 billion stock buyback. Meanwhile, investors are eyeing the University of Michigan consumer sentiment report for further clues on inflation and economic resilience.

Investment Insight:

The rally underscores how sensitive markets remain to trade and monetary policy developments. With easing trade tensions and potential rate cuts on the horizon, growth-oriented sectors like technology are poised for further upside. Investors should monitor consumer sentiment closely, as persistent inflationary pressures could temper the current bullish momentum. Diversifying into high-quality growth stocks with strong fundamentals may offer a strategic edge amid these developments.

Intel Shares Slide Amid Weak Outlook and Trade Concerns

Intel shares tumbled nearly 4% in Frankfurt trading on Friday, extending a 6% drop in after-hours trading Thursday. The selloff followed a downbeat revenue and profit forecast that rattled investor confidence. While Intel’s stock had gained 4.37% during Thursday’s regular session to close at $21.49, concerns about the chip sector’s resilience amid ongoing US-China trade tensions overshadowed the earlier optimism.

Investment Insight:

Intel’s weak guidance highlights the challenges facing the semiconductor industry as geopolitical tensions and shifting demand weigh on growth prospects. Investors should remain cautious about chipmakers with significant exposure to China while focusing on companies with diversified revenue streams and strong cash flow to weather sector volatility.

JD.com and Meituan’s Price War Erases $70 Billion in Market Value

JD.com’s aggressive push into food delivery through its JD Takeaway platform has sparked a costly battle with Meituan, eroding investor confidence in both companies. Shares of JD.com and Meituan have each dropped about 30% from March highs, wiping out approximately $70 billion in combined market value. Analysts warn that JD’s cash-burning strategy, which includes $1.4 billion in subsidies and waived merchant fees, risks slashing operating profits by 36% this year. Meanwhile, Meituan has countered by expanding into JD’s quick-commerce stronghold. This intensifying rivalry has weighed heavily on the Hang Seng Tech Index, where both companies now rank among the worst performers in 2025.

Investment Insight:

The escalating competition between JD.com and Meituan underscores the risks of aggressive market-share battles in a maturing domestic landscape. Investors should remain cautious, as prolonged price wars threaten profitability for both firms. Defensive positioning in options markets reflects broader skepticism about near-term recovery. For exposure to Chinese tech, consider diversifying into companies with less exposure to domestic rivalries and stronger international growth prospects.

Market price: JD.COM (BA): USD 172.37

Alphabet Shares Soar on Strong Q1 Earnings and AI-Driven Growth

Alphabet’s stock surged nearly 5% in after-hours trading after the tech giant reported first-quarter earnings that beat expectations. Revenue rose 12% year-on-year to $90.2 billion, led by a 9.8% jump in Google Search advertising revenue to $50.7 billion. Google Cloud also saw a remarkable 28% revenue growth, with its profitability surging over 200% to $2.18 billion. Alphabet’s AI investments bolstered growth across all divisions, while a $70 billion share buyback and a 5% dividend hike further lifted investor sentiment. Despite these strong results, the stock remains down 16% year-to-date, weighed by broader tech-sector challenges and US tariff headwinds.

Investment Insight:

Alphabet’s robust Q1 results underscore the resilience of its core advertising business and the growing profitability of its cloud segment, driven by strategic AI investments. While geopolitical and tariff-related risks linger, Alphabet’s solid fundamentals and shareholder-friendly initiatives, including its $70 billion buyback, make it an attractive long-term play. Investors seeking exposure to transformative AI technologies and scalable growth may find Alphabet well-positioned in a competitive tech landscape.

Market price: Alphabet Inc (GOOG): USD 161.47

Apple Accelerates iPhone Production Shift to India Amid Geopolitical Risks

Apple plans to manufacture most iPhones sold in the US in India by the end of 2026, doubling its output in the country to reduce reliance on China and mitigate tariff and geopolitical risks. Currently, Apple produces 20% of its iPhones in India, including premium Pro models, with exports reaching $17.5 billion in the fiscal year through March 2025. The shift, supported by India’s state subsidies and manufacturing incentives, gained momentum after US tariffs on Chinese imports tightened. While China remains Apple’s largest production base, India’s role in its supply chain is rapidly expanding, reflecting its growing importance as a manufacturing hub.

Investment Insight:

Apple’s pivot to India strengthens its supply chain resilience while capitalizing on local subsidies and export opportunities. This strategic shift reduces exposure to geopolitical tensions and tariffs, supporting long-term margin stability. Investors should view this as a positive development, reinforcing Apple’s ability to navigate external challenges while expanding its manufacturing footprint in a high-growth market. With India emerging as a key player in Apple’s global strategy, further upside potential exists for the company’s operational efficiency and regional sales.

Market price: Apple Inc (AAPL): USD 208.37

Conclusion

This week’s market movements highlighted the delicate balance between optimism and caution. While easing trade tensions and strong earnings from tech giants like Alphabet lifted investor sentiment, challenges persist as Intel’s weak outlook and JD.com’s costly rivalry with Meituan underscore sector-specific pressures. Apple’s strategic pivot to India signals a growing emphasis on supply chain resilience amid geopolitical risks. As markets navigate inflation concerns and shifting economic conditions, the focus remains on companies with robust fundamentals and adaptive strategies. Investors should stay vigilant, balancing growth opportunities with defensive positioning to weather potential volatility in the months ahead.

Upcoming Dates to Watch

- April 29th, 2025: EU Consumer Confidence, South Korea industrial production

- April 30th, 2025: EU GDP, US GDP

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – April 24, 2025

Date Issued – 24th April 2025

Preview

Global markets waver as trade tensions and tariff uncertainties weigh on sentiment

Stocks retreated after mixed signals from the US-China trade dispute, while China’s tightened export controls on critical minerals disrupted supply chains and pushed prices higher. Boeing faces a $1 billion revenue gap as Chinese tariffs block aircraft deliveries, but strong Q1 results highlight its resilience. Japanese investors returned to overseas bonds after a six-week selloff, while foreign demand for Japanese assets surged amid expectations of delayed BOJ rate hikes. Unilever exceeded sales forecasts with premium demand and price hikes, reaffirming its outlook despite macroeconomic pressures.

Stocks Stall Amid Trade Tariff Uncertainty

Global equities pared recent gains on Thursday as mixed signals from the US administration on China tariffs dampened risk appetite. European stocks fell, with US futures and Asian markets retreating after a five-day rally. Treasury Secretary Scott Bessent warned of a protracted resolution to the US-China trade dispute, sending the dollar lower while boosting demand for safe havens like the yen, Swiss franc, and gold.

Corporate earnings added to the volatility, with Unilever rising on solid sales but BNP Paribas slipping on weaker profits. Investors remained cautious amid headline-driven market swings, as President Trump hinted at potential tariff adjustments in the coming weeks but offered no clarity on broader trade policy.

Investment Insight

With US equities facing valuation pressures and geopolitical risks, investors should consider diversifying globally. Opportunities in Chinese, Indian, and European markets may offer a hedge against potential corrections in US stocks and the dollar. Strategic portfolio rebalancing is critical as the era of US market dominance shows signs of waning.

China Tightens Grip on Mineral Exports, Disrupting Global Supply

China’s control over critical minerals has intensified with its expanded export control list, now covering 16 minerals vital for clean energy, defense, and semiconductors. Recent additions, including seven rare earths, aim to counter U.S. tariffs, creating supply disruptions and driving up prices.

Under China’s export licensing system, exporters must provide detailed documentation, including sensitive end-user data, while importers face strict non-transfer commitments. License approvals, involving multiple agencies, can take months, particularly for U.S. clients amid ongoing trade tensions. These measures highlight Beijing’s leverage over global supply chains and its strategic use of export controls to safeguard national interests.

Investment Insight

China’s export restrictions underscore the strategic importance of diversifying supply chains for critical minerals. Investors should monitor companies outside China that mine or refine rare earths and other essential materials, as they could benefit from increased demand and rising prices. Enhanced geopolitical risks also favor investment in technologies and industries focused on resource independence and recycling.

Boeing Faces $1 Billion China Challenge Amid Trade Tensions

Boeing is grappling with a $1 billion revenue gap as 50 aircraft originally destined for Chinese airlines remain undelivered due to escalating trade tensions. Chinese tariffs have forced the American aerospace giant to redirect these planes to other markets, with Malaysia Airlines among potential buyers. Despite the setback, Boeing reported strong first-quarter revenues of $19.5 billion, an 18% increase, and narrowed losses to $31 million. However, executives warn that global adoption of protectionist policies could cost the company $500 million annually and threaten its competitive edge against rivals like Airbus.

Investment Insight

Boeing’s resilience, showcased by rising revenues and proactive market redirection, highlights its ability to weather geopolitical disruptions. Investors should monitor its success in securing new buyers for the redirected planes and mitigating tariff-related costs. Meanwhile, heightened trade risks may benefit Boeing’s competitors in untapped markets, presenting both challenges and opportunities for global aerospace supply chains.

Market price: Boeing Co (BA): USD 172.37

Japanese Investors Return to Overseas Bonds Amid U.S. Recovery

Japanese investors became net buyers of overseas bonds for the first time since February, purchasing ¥223.7 billion ($1.57 billion) in the week ending April 19. This shift follows a six-week selling streak driven by concerns over U.S. tariffs and economic uncertainty. The rebound aligns with a partial recovery in U.S. bond markets, despite rising Treasury yields and ongoing doubts about the dollar’s safe-haven status.

Meanwhile, foreign investors have increasingly favored Japanese assets, injecting ¥11.95 trillion into Japanese bonds and ¥3.7 trillion into equities over the past three weeks, bolstered by expectations of delayed rate hikes by the Bank of Japan.

Investment Insight

The renewed appetite for overseas bonds by Japanese investors signals cautious optimism about global debt markets, particularly U.S. Treasuries. However, rising yields and geopolitical risks warrant vigilance. Investors should also monitor the Bank of Japan’s dovish stance, which continues to attract foreign capital to Japanese markets, potentially enhancing opportunities in yen-denominated assets.

Unilever Tops Sales Forecasts Amid Price Hikes and Premium Demand

Unilever reported a 3% rise in first-quarter underlying sales, surpassing analysts’ expectations of 2.8%, driven by price increases and resilient demand for premium products like Dove and Ben & Jerry’s. The consumer goods giant reaffirmed its 2025 outlook, despite ongoing macroeconomic uncertainty and evolving consumer habits shaped by tariff concerns and inflationary pressures.

Under new CEO Fernando Fernandez, Unilever continues to execute cost-cutting measures and plans to save £550 million by 2025, including separating its ice cream division, which will be listed in Amsterdam with secondary listings in London and New York.

Investment Insight

Unilever’s ability to pass on higher costs while maintaining demand highlights its pricing power and brand strength, making it a stable pick in uncertain markets. Investors should watch its cost-saving initiatives and ice cream business spin-off, as these could unlock further shareholder value. However, macroeconomic risks and shifting consumer trends warrant close monitoring.

Market price: Unilever plc (ULVR): GBX 4,830.00

Conclusion

Global markets are navigating a complex web of trade tensions, geopolitical risks, and shifting consumer behaviors. From Boeing’s efforts to mitigate a $1 billion revenue gap to China’s strategic grip on critical minerals, the ripple effects of protectionist policies are reshaping industries. Meanwhile, Japanese investors’ renewed interest in overseas bonds signals cautious optimism, while Unilever’s strong sales reaffirm its pricing power and resilience.

As macroeconomic uncertainties persist, diversification and strategic positioning remain critical for navigating these volatile conditions. Investors should stay alert to evolving opportunities and risks across global supply chains, asset classes, and emerging market trends.

Upcoming Dates to Watch

April 24th, 2025: Tokyo CPI

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – April 23, 2025

Date Issued – 23rd April 2025

Preview

Markets rebounded sharply Tuesday as easing trade tensions and a softer tone from President Trump toward Fed Chair Jerome Powell calmed investor nerves, driving the Dow up over 1,000 points and lifting the S&P 500 and Nasdaq more than 2.5%.

Gold retreated from record highs, reflecting reduced haven demand, while Tesla rallied over 5% in after-hours trading despite a Q1 miss, as Elon Musk pledged to refocus on the company. Meanwhile, short interest in SK Hynix hit a record, with investors increasingly wary of AI-linked chipmakers amid trade uncertainty and tightening U.S. tech policy. Despite improved sentiment, investors remain cautious, with political risk and macro headwinds continuing to shape market direction.

Market Rebounds Sharply on Trade Hopes Amid Political Volatility

U.S. equities staged a powerful rally Tuesday, with the Dow Jones Industrial Average surging over 1,000 points and the S&P 500 and Nasdaq gaining 2.5% and 2.7%, respectively. The rebound followed comments from Treasury Secretary Scott Bessent suggesting potential deescalation in trade tensions with China, despite cautioning that negotiations remain complex. Investor sentiment also improved on signs of progress in U.S.-India trade talks. The gains reversed sharp losses from the prior session, which were driven by renewed tensions between President Trump and Fed Chair Jerome Powell. After the bell, Tesla reported weaker-than-expected earnings and withheld forward guidance, citing trade uncertainty and brand challenges tied to Musk’s political role.

Investment Insight

The market’s swift rebound highlights investors’ sensitivity to trade rhetoric and the potential for volatility tied to political developments. While improved diplomatic signals offer short-term relief, the absence of concrete policy resolution suggests continued risk. Investors should remain defensively positioned, favoring quality assets with low trade exposure as the geopolitical landscape continues to shape market direction.

Tesla Shares Climb Despite Q1 Miss as Musk Vows Refocus on Company

Tesla stock rose more than 5% in after-hours trading Tuesday after CEO Elon Musk pledged to reduce his time spent at the Department of Government Efficiency (DOGE) and reallocate efforts toward the company. This came despite Tesla reporting Q1 results that missed both revenue and earnings expectations, citing $19.34 billion in revenue versus the $21.43 billion consensus and adjusted EPS of $0.27 against estimates of $0.44. Musk reiterated plans to launch affordable EVs in early 2025 and begin robotaxi testing in Austin by June. Investors appeared to welcome Musk’s renewed focus, even as Tesla warned that ongoing trade uncertainty and political factors are weighing on global demand and its brand image.

Investment Insight

Tesla’s post-earnings rally underscores investor appetite for leadership stability amid operational headwinds. While Q1 results reveal softening demand and mounting competition, particularly from BYD, Musk’s commitment to refocus on Tesla may ease concerns over strategic drift. However, with guidance withdrawn and trade policy in flux, investors should treat the stock’s rebound cautiously and monitor delivery trends and pricing power closely heading into midyear.

Market Price

Tesla Inc. (TSLA): USD 237.97

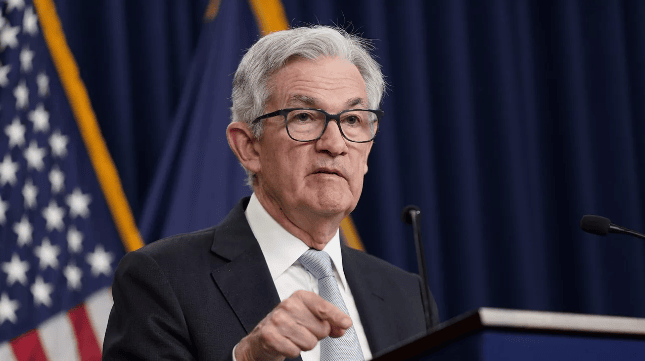

Trump Walks Back Powell Threats, Easing Market Anxiety

President Trump signaled a softer stance toward Federal Reserve Chair Jerome Powell on Tuesday, stating he has “no intention of firing” the central bank head, despite recent public criticisms over interest rate policy. The clarification comes after days of escalating tension, including Trump’s social media remarks calling Powell a “major loser” and suggestions from White House officials that the administration was exploring legal avenues for potential removal. The president’s walk-back follows market unease and bipartisan defense of Fed independence. Powell, whose term runs through May 2026, has maintained that he will complete his term and that the Fed remains focused on inflation and economic stability amid rising tariffs and political volatility.

Investment Insight

Trump’s deescalation may calm near-term market jitters, but the episode underscores the political risks facing monetary policy independence. Investors should remain vigilant as the Fed balances inflation pressures from rising tariffs with political demands for rate cuts. Policy clarity may be limited until legal questions around Fed independence are resolved, suggesting continued volatility in rate-sensitive assets. Holding a diversified position across fixed income durations and inflation-hedged equities may help mitigate policy-driven swings.

Gold Retreats as Geopolitical Tensions Ease on Trump Comments

Gold prices slid for a second consecutive session on Tuesday, falling 2.7% to $3,326.90 per ounce, as investor anxiety eased following more conciliatory remarks from President Trump on both Federal Reserve policy and U.S.-China trade relations. The precious metal, which recently touched a record high above $3,500, has been buoyed this year by haven demand amid global economic uncertainty and aggressive ETF and central bank buying. However, Trump’s pivot away from threats to remove Fed Chair Jerome Powell and signals that China tariffs may be lowered triggered profit-taking in an overbought market, leading to the sharp pullback.

Investment Insight

Gold’s decline reflects a partial unwind of risk hedges as geopolitical rhetoric softens, but its broader uptrend remains underpinned by macro uncertainty. With inflation risks still elevated and central banks continuing to accumulate reserves, dips may present strategic entry points for long-term positioning. Investors should monitor real yields and Fed policy signals closely, as any renewed volatility could quickly restore demand for safe-haven assets.

Short Sellers Target SK Hynix Amid AI and Trade Policy Uncertainty

Bearish bets against SK Hynix surged to a record this month, with short positions totaling 1.5 trillion won ($1 billion) as of mid-April, following South Korea’s removal of its short-selling ban. The memory chipmaker, once buoyed by AI-driven demand, now faces heightened scrutiny amid fears of a slowdown in U.S. AI capital expenditure and intensifying global trade tensions. Foreign institutional investors have offloaded a net 2.9 trillion won in shares, signaling broad skepticism ahead of earnings. Despite expectations that SK Hynix will surpass Samsung as the top DRAM vendor, concerns over macro risks and valuation have prompted many to view strong earnings as a trigger for profit-taking rather than a bullish catalyst.

Investment Insight

The surge in short interest reflects deepening investor caution toward tech names highly sensitive to geopolitical developments and AI spending trends. While SK Hynix’s fundamentals remain solid, positioning suggests markets are bracing for downside amid policy-driven volatility. Investors should be wary of momentum reversals in AI-linked semiconductors and consider risk-managed exposure, particularly in firms with high trade exposure and elevated valuations.

Market Price

SK Hynix Inc (KRX: 000660): KRW 181,000

Conclusion

Markets may have found temporary relief in softer rhetoric from Washington and signs of diplomatic progress, but underlying risks remain firmly in play. Trade uncertainty, political volatility, and shifting central bank dynamics continue to challenge investor confidence. While rebounds in equities and Tesla suggest resilience, rising short interest in key tech names like SK Hynix and a pullback in gold signal caution beneath the surface. As earnings season unfolds and policy signals evolve, investors should stay nimble, prioritize quality, and brace for renewed volatility in a landscape still defined by geopolitical tension and economic recalibration.

Upcoming Dates to Watch

April 23rd, 2025: Singapore CPI, US S&P Global Manufacturing PMI, US Crude Oil imports, South Korea GDP

April 24th, 2025: Tokyo CPI

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – April 22, 2025

Date Issued – 22nd April 2025

Preview

US stock futures rebounded Tuesday after Monday’s selloff, driven by Federal Reserve criticism and economic concerns. Gold hit a record $3,500 as haven demand surged, while trade tensions and upcoming earnings from Tesla and Alphabet kept markets cautious. Ericsson will localize antenna production in India to meet soaring 5G demand, offsetting slowing US orders. Japan is resisting US pressure to strengthen the yen, with limited room for intervention, as trade negotiations loom. China’s trade flows remained strong in April despite tariffs, though early signs of strain are emerging in rail cargo and e-commerce pricing. Meanwhile, Roche announced a $50 billion US investment, creating 12,000 jobs, as drugmakers brace for potential pharmaceutical tariffs.

Futures Rebound as Market Eyes Fed and Trade Tensions

US stock futures showed resilience on Tuesday, with S&P 500 and Nasdaq 100 contracts gaining 1% following Monday’s sharp selloff. The decline was fueled by President Trump’s criticism of the Federal Reserve and concerns over rate policy and economic growth. While risk appetite saw a tentative recovery, haven assets like gold surged to a record $3,500 an ounce, and the yen strengthened to its highest level since September. Global markets remain jittery as trade tensions escalate, with investors scrutinizing US-China tariff talks and upcoming earnings from Tesla and Alphabet. Meanwhile, the dollar’s haven appeal faltered, weighed down by uncertainty over Fed leadership and rate cuts.

Investment Insight: Persistent trade tensions and uncertainty over Fed independence are reshaping market dynamics, with haven assets like gold and the yen gaining ground. Investors should remain cautious, as volatility may persist amid mixed signals from global markets. Diversifying into non-correlated assets and monitoring geopolitical developments will be key to navigating this turbulent environment.

Ericsson Expands Indian Manufacturing Amid Surging 5G Demand

Ericsson announced plans to localize all telecom antenna production for the Indian market by June, capitalizing on soaring demand from Bharti Airtel and Jio as they scale up 5G services. This expansion, which builds on Ericsson’s decades-long presence in India since 1994, offsets a slowdown in US orders, its largest market. The Swedish telecom giant also aims to export antennas globally after fulfilling domestic needs, leveraging India’s growing role as a manufacturing hub alongside its facilities in Mexico, Romania, and China.

Investment Insight: Ericsson’s strategic shift to localize production in India underscores the region’s critical role in the global 5G supply chain. As 5G adoption accelerates, investors should monitor telecom infrastructure providers with strong exposure to high-growth markets like India, where increasing demand could drive revenue diversification and long-term upside.

Japan Unlikely to Yield on Yen Strengthening Amid U.S. Talks

As Japanese Finance Minister Katsunobu Kato prepares to meet U.S. Treasury Secretary Scott Bessent in Washington, expectations for a significant agreement on yen policy remain low. Despite U.S. pressure to address exchange rates and Japan’s slow monetary tightening, Tokyo is unlikely to take immediate measures to strengthen the yen, citing limited tools and concerns over exporters’ margins. With the yen already at seven-month highs against the dollar, Japan aims to resist currency intervention or interest rate hikes, focusing instead on gauging U.S. intentions regarding trade and tariffs. Analysts predict the discussions may result in vague commitments to stable exchange rates rather than coordinated action.

Investment Insight: Rising yen strength and geopolitical currency tensions highlight risks for exporters and sectors reliant on dollar-based pricing. Investors should monitor Japanese equities, particularly manufacturers, for potential margin compression. Currency-sensitive hedging strategies may be prudent given the uncertain outcomes of U.S.-Japan negotiations and the yen’s recent appreciation.

China’s Trade Resilient Despite Tariff Pressures

China’s trade flows surged in April, with ports processing 6.3 million containers, a 10% year-over-year increase, defying expectations amid ongoing US-China tariff tensions. The resilience reflects exemptions on high-value goods like smartphones and computers, as well as a delay in broader reciprocal duties by the US. While US exports to China have declined sharply, Chinese exports to the US remain robust, with major shipping hubs like the Port of Los Angeles maintaining steady activity. However, early signs of strain are emerging, as China-Europe rail cargo volumes dropped and platforms like Shein and Temu face price pressures due to shifting trade rules.

Investment Insight: China’s ability to sustain trade growth underscores its adaptability in redirecting exports and leveraging exemptions during tariff wars. Investors should watch for potential disruptions in the second half of 2025 as tariffs tighten, particularly in consumer electronics and e-commerce. Supply chain shifts could create opportunities in logistics and trade hubs, while rising costs may pressure margins for exporters reliant on US demand. Diversifying into non-US markets remains critical for long-term stability.

Roche to Invest $50 Billion in U.S. Amid Tariff Pressures

Swiss pharmaceutical giant Roche announced a $50 billion investment in the United States over the next five years, creating more than 12,000 jobs and expanding its manufacturing and R&D footprint. The move comes as the Trump administration targets pharmaceutical imports with potential tariffs of up to 31%. Roche plans to expand facilities in Kentucky, Indiana, New Jersey, and California, build a gene therapy factory in Pennsylvania, and establish a weight-loss medicine plant at an undisclosed location. The investment will make the U.S. a net exporter of Roche medicines, underscoring the company’s commitment to its largest market and its strategy to mitigate tariff risks.

Investment Insight: Roche’s significant U.S. expansion highlights a growing trend of reshoring in response to protectionist trade policies. Investors should monitor pharmaceutical firms with heavy reliance on U.S. markets, as domestic manufacturing investments could shield them from tariffs while boosting long-term production capacity. Those with less diversified operations may face margin pressures, making this a key inflection point for the sector.

Conclusion

Global markets remain in flux as geopolitical tensions, trade dynamics, and monetary policy shifts drive uncertainty. US stock futures show signs of recovery, but persistent volatility underscores the need for cautious positioning. Ericsson’s India focus highlights growth opportunities in emerging markets, while Roche’s $50 billion US investment reflects the reshoring trend amid tariff pressures. China’s resilience in trade offers a silver lining, though risks are mounting. With Japan resisting US demands on the yen and gold hitting record highs, investors are navigating a complex landscape. Diversification and close monitoring of global developments will be key to weathering near-term challenges.

Upcoming Dates to Watch

- April 22nd, 2025: Japan (BoJ) CPI

- April 23rd, 2025: Singapore CPI, US S&P Global Manufacturing PMI, US Crude Oil imports, South Korea GDP

- April 24th, 2025: Tokyo CPI

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the Asia market close – April 21, 2025

Date Issued – 21st April 2025

Preview

Global markets opened the week under pressure as political risk in the US rattled investor confidence—President Trump’s attacks on the Fed sent the dollar sliding and lifted gold to record highs. Meanwhile, emerging market local bonds surged ahead of their dollar peers, buoyed by expectations of rate cuts and a weaker greenback. Oil extended losses, with Brent dipping below $67, as demand fears and easing geopolitical tensions—especially US-Iran nuclear talks—undermined sentiment. In Asia, LG Energy Solution exited an $8.45 billion Indonesian EV battery project, raising concerns about the region’s investment climate. Separately, South Korea is edging closer to MSCI developed market status after lifting its short-selling ban, a move that could attract index-driven inflows if reclassification proceeds.

Dollar Slides, Futures Fall as Trump Targets Fed Independence

US stock futures and the dollar fell sharply after President Donald Trump publicly criticized the Federal Reserve and hinted at the potential removal of Chair Jerome Powell, fueling investor anxiety over the central bank’s independence. The Bloomberg Dollar Spot Index dropped 0.9%, extending last week’s losses, as all major currencies gained against the greenback—led by the euro and Swiss franc. Gold surged to an all-time high, underscoring demand for safe havens amid rising political risk. Treasuries sold off across longer maturities, steepening the yield curve, while Japanese and European bonds attracted fresh inflows. Equity markets in Asia declined, with Japan’s Nikkei falling over 1%, as concerns mounted over the politicization of US monetary policy and its knock-on effects on global asset allocation.

Investment Insight: Investor confidence in US assets is wavering as political interference in Fed policy stokes fears of long-term instability. With the dollar under pressure and global diversification accelerating, investors should reassess exposure to US sovereign debt and consider reallocating toward non-dollar safe havens such as gold, high-grade European bonds, and Japanese government securities. Elevated volatility around US policy decisions may continue to drive defensive positioning in the near term.

Emerging Markets Gain Favor as Dollar Weakens, Rate Cuts Loom

Emerging market local-currency bonds are outperforming their dollar-denominated counterparts in a rare shift, as investors respond to a weakening US dollar, rising recession risks, and increasing expectations for rate cuts in developing economies. The Bloomberg index for EM local debt has returned 3.2% year-to-date, compared with just 0.9% for EM dollar bonds, despite offering lower yields—averaging 4.03% versus 7.1%. A steep drop in oil prices and US trade tensions have cooled inflationary pressures, giving EM central banks room to ease policy. Meanwhile, volatility in US Treasuries and declining demand for dollar assets are driving capital flows toward local-currency instruments. Dollar bond issuance in EMs (ex-China) has fallen 36% year-over-year in April, underscoring the shift in investor appetite.

Investment Insight: With the dollar under sustained pressure and EM central banks pivoting toward easing, local-currency bonds offer a compelling risk-reward profile. Investors should consider increasing exposure to EM local-rate markets, particularly in economies with stable inflation dynamics and credible monetary frameworks. As US policy volatility elevates term premiums and threatens dollar assets’ haven status, diversified fixed-income strategies anchored in select EM currencies could provide both yield pickup and portfolio resilience.

Oil Slumps as Demand Fears and Geopolitical Easing Weigh on Prices

Crude prices opened the week lower, with Brent falling below $67 and WTI nearing $64, as bearish signals swept through the energy market. Weaker global demand expectations—driven by escalating US-led trade tensions and a potential global economic slowdown—continue to pressure prices. Talks between the US and Iran over Tehran’s nuclear program added to the downside, raising prospects of increased Iranian crude supply. Meanwhile, OPEC+’s faster-than-expected return of output has revived oversupply concerns. A return to contango in portions of the futures curve and a broadly risk-off market tone further compounded the retreat. Analysts warn that sentiment remains fragile, with macro, fundamental, and geopolitical indicators all pointing lower.

Investment Insight: Energy investors should brace for continued volatility as bearish fundamentals, trade-driven demand uncertainty, and shifting geopolitical dynamics converge. Hedging exposure to oil-sensitive assets and reevaluating overweight positions in energy may be prudent until demand signals stabilize. The evolving US-Iran negotiations and OPEC+ supply trajectory will remain key catalysts. In the near term, defensive commodity strategies and exposure to sectors less reliant on global trade may offer relative resilience.

LG Energy Withdraws from $8.45 Billion Indonesia EV Battery Project

LG Energy Solution has formally exited a major $8.45 billion electric vehicle battery investment in Indonesia, citing market conditions and an unfavorable investment environment. The South Korean battery maker had been a key player in the Indonesia Grand Package deal signed in 2020, aimed at building out the EV battery supply chain in Southeast Asia’s largest economy. Despite the withdrawal, LGES reaffirmed its commitment to the region through its existing joint venture, HLI Green Power, with Hyundai Motor Group—a partnership that launched Indonesia’s first EV battery cell plant last year. The move raises questions about Indonesia’s attractiveness as a long-term hub for global battery manufacturing amid growing competition and policy uncertainty.

Investment Insight: LGES’s retreat underscores the rising sensitivity of large-scale industrial investments to geopolitical, regulatory, and market dynamics. For investors, the decision highlights the importance of evaluating execution risks in emerging-market infrastructure plays, particularly in sectors like EVs where supply chains are complex and capital-intensive. While Indonesia retains strategic appeal due to its nickel reserves, the setback suggests a more cautious outlook on near-term investment flows. Watch for how other global battery and EV players recalibrate their Southeast Asia strategies in response.

Market price: LG Energy Solutions Ltd. (KRX: 373220): KRW 332,500

South Korea Edges Closer to Developed Market Status in MSCI Index

South Korea is nearing a long-anticipated upgrade to developed market status by MSCI, according to the country’s Financial Services Commission. Vice Chairman Kim So-young stated Monday that over 90% of MSCI’s concerns have been addressed, and a reclassification could come “soon, if not this time.” The recent lifting of a five-year ban on short selling marks a key reform aimed at improving market accessibility for global investors. Currently classified as an emerging market, South Korea’s inclusion in the MSCI Developed Markets Index would represent a structural shift in global capital flows and elevate the nation’s standing in passive investment strategies. MSCI’s next market classification review is set for June.

Investment Insight: South Korea’s potential upgrade to developed market status may trigger significant inflows from global index-tracking funds and institutional investors. While near-term market impact depends on MSCI’s timeline, positioning ahead of a formal watch-listing could be advantageous. Investors should monitor Korean equities with high foreign ownership and liquidity—likely candidates to benefit most from reweighting—and consider the broader implications for EM portfolios facing potential outflows.

Conclusion

Markets are navigating a volatile landscape shaped by political interference, shifting global capital flows, and geopolitical recalibrations. As the Fed’s independence comes under fire and US trade tensions ripple across asset classes, investors are repositioning toward safe havens and emerging-market local debt. Commodities remain vulnerable to demand shocks, while structural reform in Asia—highlighted by South Korea’s MSCI ambitions—offers longer-term opportunities. The retreat of LG Energy in Indonesia underscores rising execution risks in frontier markets. In the weeks ahead, investors will need to stay nimble, balancing macro uncertainty with selective, risk-adjusted exposure across fixed income, equities, and commodities.

Upcoming Dates to Watch

- April 21st, 2025: IMF Meetings, South Korea PPI

- April 22nd, 2025: Japan (BoJ) CPI

- April 23rd, 2025: Singapore CPI, US S&P Global Manufacturing PMI, US Crude Oil imports, South Korea GDP

- April 24th, 2025: Tokyo CPI

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – April 17, 2025

Date Issued – 17th April 2025

Preview

Asian Stocks Rise Amid Trade Optimism; Yen Weakens

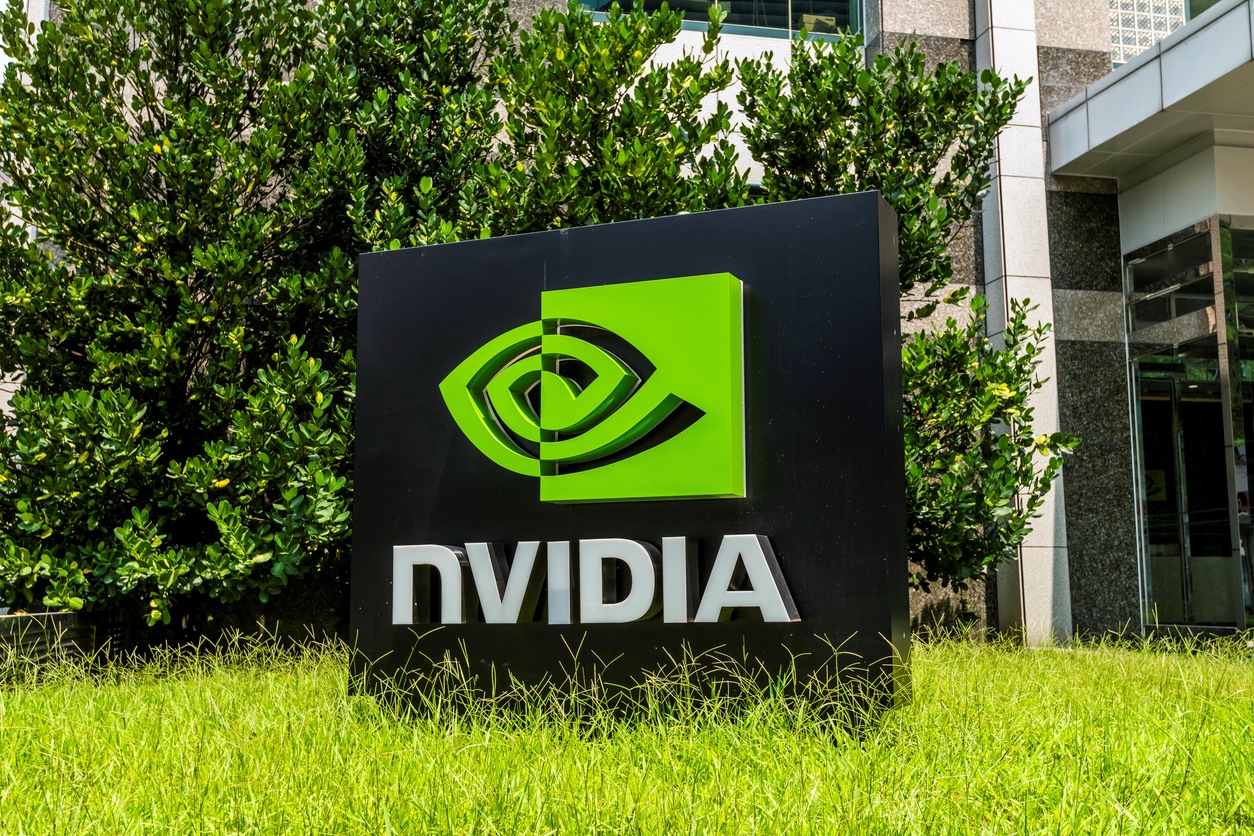

Asian stocks rose on optimism around US-Japan trade talks, while the yen weakened as currency issues were left off the table. Gold hit a record $3,357.78 per ounce, fueled by safe-haven demand amid Federal Reserve Chair Powell’s cautious comments and ongoing trade tensions. TSMC reported a 60% profit surge on strong AI chip demand, though shares fell 3.6% on profit-taking. Nvidia, grappling with a $5.5 billion charge from US export curbs on AI chips to China, dropped 6.9%, with investors eyeing key technical levels. Meanwhile, OpenAI’s $500 billion Stargate project is weighing UK investment as global competition for AI infrastructure heats up.

Asian Stocks Rise Amid Trade Optimism; Yen Weakens

Asian equities advanced on optimism surrounding US-Japan trade negotiations, with Japanese shares gaining after President Trump cited “big progress” in talks aimed at averting higher tariffs. The yen weakened as Japan’s negotiator confirmed that currency issues were not discussed, easing investor concerns. Gold hit a record high on safe-haven demand, while US Treasury yields climbed, reflecting a cautious risk-off sentiment. US equity futures edged higher, while European contracts declined, as global markets assess the broader implications of ongoing trade tensions, particularly with China. Meanwhile, the Bank of Korea held rates steady, emphasizing stability amidst monetary policy uncertainty in the region.

Investment Insight: The preliminary progress in US-Japan trade talks offers a modest tailwind for Japanese equities and signals a potential roadmap for US trade negotiations with other allies. Investors should monitor developments in US-China discussions, as any further escalation could drive shifts into safe-haven assets like gold and Treasuries. A balanced portfolio strategy, incorporating defensive assets alongside equity exposure, may help navigate the unpredictability of trade policy outcomes.

TSMC Q1 Profit Jumps 60% on AI Chip Demand

Taiwan Semiconductor Manufacturing Co. (TSMC) reported a 60% surge in Q1 net profit to T$361.6 billion ($11.12 billion), surpassing market expectations of T$354.6 billion. The world’s largest contract chipmaker benefited from robust demand for semiconductors powering artificial intelligence applications, with key customers such as Apple and Nvidia driving growth. Despite the strong results, TSMC shares fell 3.6%, reflecting broader market concerns and potential profit-taking following recent gains.

Investment Insight: TSMC’s results highlight the accelerating adoption of AI technologies and the critical role semiconductor manufacturers play in this ecosystem. While the stock’s pullback may signal near-term caution, long-term investors should consider TSMC’s strong market position and its exposure to high-growth industries like AI and advanced computing. Allocating to semiconductor leaders could provide a strategic edge in portfolios seeking growth from technological innovation.

Market price: Taiwan Semiconductor Manufacturing Co Ltd (TPE: 2330) TWD: 847.00

OpenAI’s $500 Billion Stargate Eyes UK Expansion

Stargate, a $500 billion AI infrastructure project funded by SoftBank, OpenAI, and Oracle, is considering the UK as a potential site for future investment, according to the Financial Times. The project aims to expand overseas as it builds critical data-center infrastructure to support AI development. British Prime Minister Keir Starmer’s pro-innovation regulatory stance and promises to improve access to electricity for data centers have bolstered the UK’s appeal, alongside Germany and France. Stargate previously committed to investing up to $500 billion in US AI infrastructure over four years, with discussions of a European expansion also gaining momentum.

Investment Insight: The Stargate project underscores the escalating global competition in AI infrastructure. The UK’s regulatory push to become an AI hub may attract significant capital inflows, providing opportunities for investors in tech infrastructure, utilities, and AI-related sectors. As AI adoption accelerates, companies involved in data-center development, energy provisioning, and advanced computing technologies are poised to benefit from this transformative trend.

Nvidia Falls on Chip Export Curbs; Key Levels in Focus

Nvidia shares dropped 6.9% Wednesday to $104.49 after announcing a $5.5 billion charge tied to new U.S. export restrictions on its H20 AI chips to China. The curbs, aimed at limiting Beijing’s access to advanced computing technologies, caught investors off guard, adding to broader concerns over U.S.-China trade tensions. Nvidia has lost about 20% of its value year-to-date as regulatory uncertainty and constrained AI-related spending weigh on sentiment. While the stock formed a doji candlestick pattern—a signal of market indecision—investors are closely watching key technical levels for potential moves.