Daily Synopsis of the New York market close – April 16, 2025

Date Issued – 16th April 2025

Preview

Global markets are under pressure as escalating US-China trade tensions weigh on investor sentiment. Nvidia shares fell 6.3% after warning that new US export restrictions on AI chips to China would cost the company $5.5 billion, dragging tech stocks lower. Oil prices extended losses, with Brent crude near $64 per barrel, as oversupply concerns and slowing demand forecasts from the International Energy Agency fuel bearish sentiment. Meanwhile, ASML flagged tariff-driven uncertainty for its 2025–2026 outlook, despite AI demand supporting growth projections. In China, Q1 GDP grew 5.4%, beating expectations, but economists warn that mounting tariffs could slow momentum in the coming quarters. Gold surged to a record $3,275 per ounce, as trade war fears push investors toward safe havens. Markets await further clarity on US tariff policies, with US retail sales data and corporate earnings reports in focus.

US Futures Slide Amid Nvidia Export Restrictions

US stock futures dropped on Wednesday as Nvidia disclosed a $5.5 billion hit tied to new US export restrictions on its H20 AI chips to China, intensifying trade tensions. Nasdaq futures fell 2.2%, leading declines, while S&P 500 and Dow futures slid 1.4% and 0.8%, respectively. Nvidia shares dropped over 6% in after-hours trading. Meanwhile, gold hit a record $3,275 per ounce, surging as investors sought safety amid escalating US-China trade uncertainty. The broader market remains on edge as shifting tariff policies and slowing retail sales data add to recession fears.

Investment Insight

Heightened geopolitical risks and regulatory headwinds are pressuring growth-heavy sectors like technology, while safe-haven assets such as gold are outperforming. Investors should consider diversifying portfolios with defensive plays, including gold and consumer staples, while approaching high-growth equities with caution as trade tensions and policy unpredictability weigh on sentiment.

China’s Economy Beats Expectations Ahead of Tariff Impact

China’s GDP grew by 5.4% in Q1 2025, outperforming forecasts of 5.1%, as export-driven growth provided resilience in the face of escalating trade tensions with the US. Retail sales rose 5.9% in March, and factory output surged 7.7%, underscoring consumer and industrial strength. However, US tariffs—now exceeding 145% on Chinese imports—are expected to weigh heavily on the economy in coming quarters. Economists have downgraded China’s 2025 growth forecast, with UBS projecting a sharp slowdown to 3.4%. Beijing has signaled readiness to counteract pressures with fiscal stimulus and monetary easing, while continuing to diversify trade relationships beyond the US.

Investment Insight

China’s stronger-than-expected Q1 growth reflects short-term resilience but masks longer-term risks from trade restrictions. As tariffs bite, investors should anticipate increased volatility in export-reliant sectors and closely watch for further policy stimulus. Diversifying exposure to Southeast Asian markets, where China is strengthening trade ties, could offer a hedge against the fallout from the US-China trade war.

UK Inflation Slows, Rate Cuts Expected

UK inflation eased to 2.6% in March, down from 2.8% in February, beating expectations of 2.7%, according to the ONS. The drop was driven by lower petrol and diesel prices, with fuel costs declining by 1.6p per litre compared to March 2024. Food prices remained stable, while clothing saw notable price increases. The cooling inflation strengthens expectations for a Bank of England interest rate cut next month, aimed at supporting households amid growing concerns over Donald Trump’s trade war and its potential to dampen global growth. Chancellor Rachel Reeves welcomed the progress but stressed the need for continued economic vigilance.

Investment Insight

The easing inflation and likely rate cuts signal a more accommodative monetary stance, which could boost consumer spending and equity markets in the near term. Investors should focus on rate-sensitive sectors like real estate and financials, while also considering defensive positions as global trade tensions persist. With risks of a broader economic slowdown, diversification remains essential.

ASML Warns of Tariff-Driven Uncertainty Despite AI Growth

ASML, the global leader in chipmaking equipment, cautioned that recent tariffs are clouding its 2025–2026 outlook, despite expectations of continued growth driven by demand for AI-related technologies. CEO Christophe Fouquet highlighted the macroeconomic risks, while CFO Roger Dassen detailed four areas of impact, including tariffs on shipments, imported tools, and materials for manufacturing. The indirect effects on global growth remain uncertain. ASML reported Q1 net bookings of €3.9 billion, missing analyst estimates of €4.89 billion, and issued a Q2 revenue forecast of €7.2–€7.7 billion, slightly below market expectations. AI remains a key growth driver, though market shifts pose mixed risks and opportunities.

Investment Insight

ASML’s reliance on high-value AI chip demand positions it as a pivotal player in the semiconductor sector, but tariff uncertainties could pressure its supply chain and margins. Investors should monitor geopolitical developments and consider the potential for delayed capital spending by its customers. A long-term focus on AI-driven growth remains valid, though diversification into less tariff-sensitive parts of the supply chain could help mitigate risks.

Market price: ASML Holding NV (ASML): EUR 605.40

Oil Falls as Glut Concerns and Trade War Cloud Demand Outlook

Oil prices extended their decline on Wednesday as fears of oversupply and weakening global demand intensified amid escalating US-China trade tensions. Brent crude traded near $64 per barrel, while West Texas Intermediate slipped below $61, both hovering near four-year lows. China’s warning that domestic consumption alone cannot sustain growth, coupled with the International Energy Agency’s downgraded oil demand forecast, added to bearish sentiment. Rising US crude inventories and uncertainty over retaliatory trade measures further weighed on risk appetite, leaving investors wary of near-term demand recovery.

Investment Insight

Oil markets face dual pressures from oversupply concerns and trade-driven demand uncertainty. Investors should brace for continued volatility, particularly in energy-related equities and commodities. Defensive positioning with exposure to midstream oil infrastructure or diversified energy ETFs could provide stability while awaiting clarity on geopolitical and economic developments.

Conclusion

Markets remain caught in a web of uncertainty as trade tensions, tariff impacts, and slowing global demand dominate headlines. Tech and energy sectors face mounting pressures, while safe-haven assets like gold continue to attract investors seeking stability. China’s stronger-than-expected GDP growth offers a brief reprieve, but the long-term effects of US tariffs loom large. As earnings season unfolds and economic data trickles in, investors are bracing for heightened volatility. The path forward hinges on geopolitical clarity and policy decisions, leaving markets in a precarious balance between opportunity and risk. Caution and diversification remain key strategies in this turbulent environment.

Upcoming Dates to Watch

- April 16th, 2025: Industrial Production

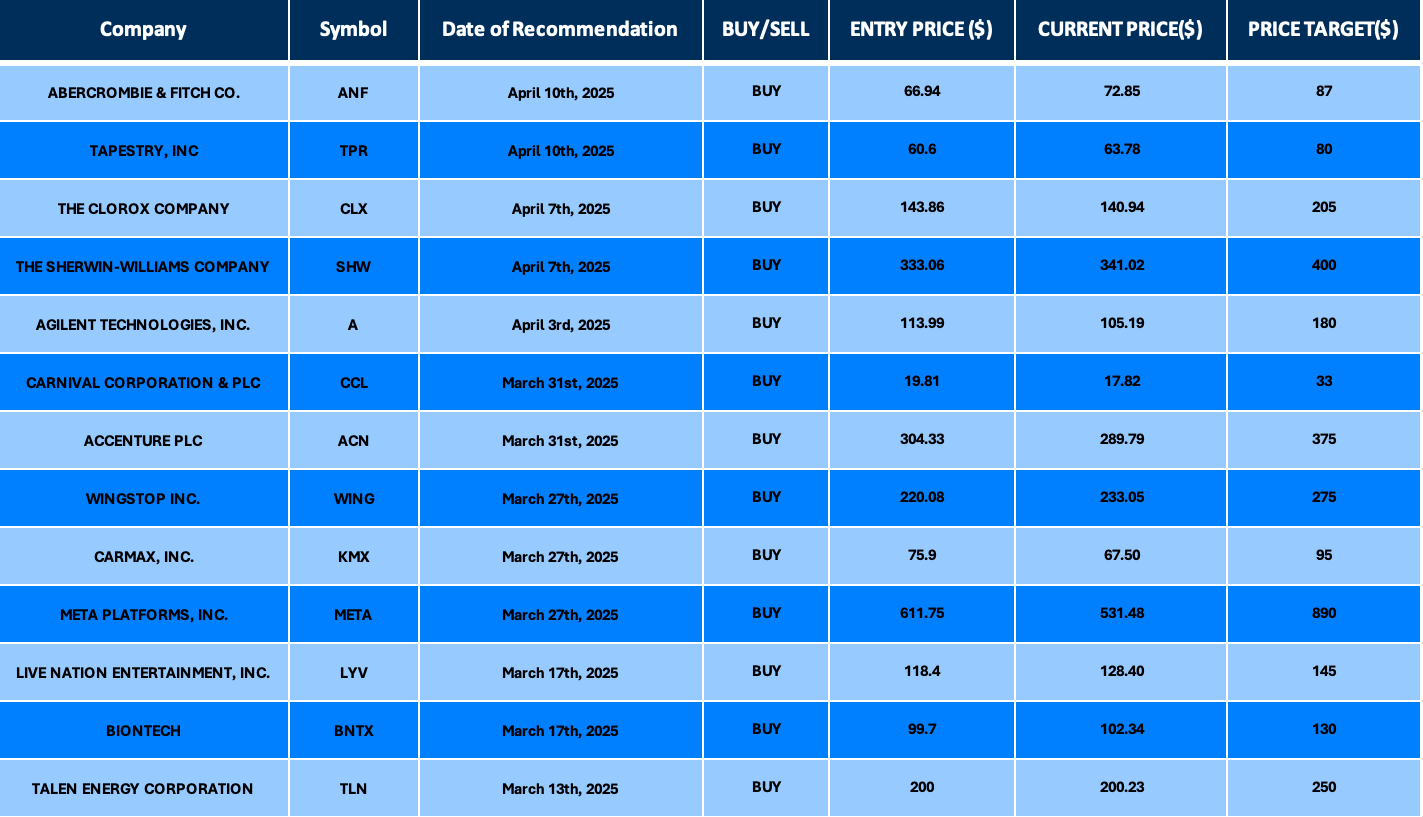

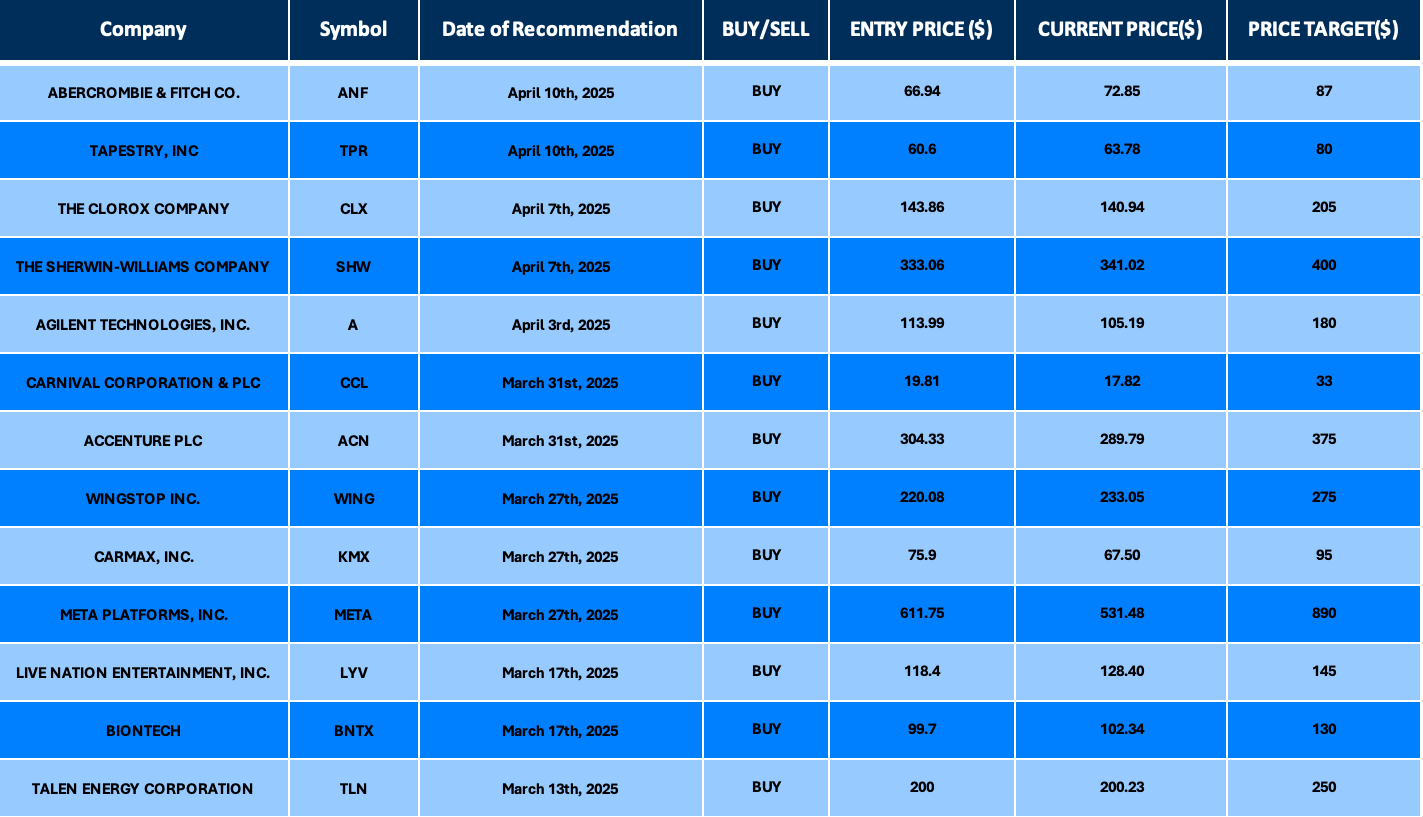

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – April 15, 2025

Date Issued – 15th April 2025

Preview

Global markets rallied as President Trump eased tariff tensions, lifting equities in Europe and Asia, though luxury giant LVMH plunged 7.9% on weak Q1 sales. Palantir shares rose 4.6% after a NATO deal boosted sentiment, while US Treasury yields dropped to 4.35%, offering relief after last week’s historic selloff. In the UK, job vacancies hit pre-Covid lows, with hiring dampened by higher taxes and wages. Amid ongoing volatility, investors are eyeing opportunities in cyclical sectors like autos, defensive assets such as Treasuries and gold, and potential rate cuts from central banks to counter growing economic risks.

Tariff Reprieve Lifts Global Markets

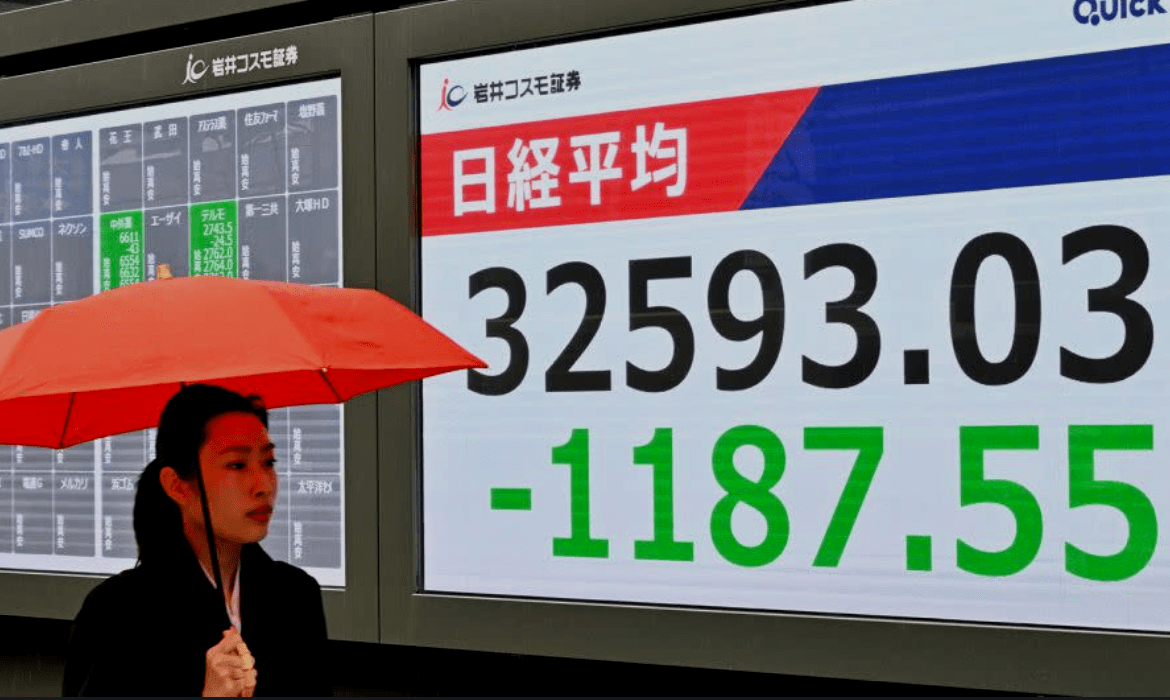

Global stocks rallied as US President Trump hinted at a pause in auto tariffs, easing market fears after earlier trade tensions erased $10 trillion from global equities. Europe’s Stoxx 600 gained 0.6%, led by automakers such as Stellantis, while Japan’s Nikkei surged on strength in Toyota and Honda. Luxury giant LVMH dropped over 7% in Paris following underwhelming sales, dragging down other high-end retailers. US equity futures edged higher, while 10-year Treasury yields stabilized after last week’s record 50-basis-point jump. Oil and gold both climbed, reflecting cautious optimism in markets amid ongoing trade uncertainties.

Investment Insight: The market’s positive reaction to potential tariff relief underscores the importance of policy clarity in a volatile environment. Investors should remain cautious, as shifting US trade stances and slowing global growth continue to pose risks. Opportunities may emerge in cyclical sectors like autos, while defensive assets such as gold and Treasuries remain critical hedges. As volatility persists, disciplined asset allocation will be key.

LVMH Shares Plunge as Q1 Sales Disappoint

LVMH shares tumbled 7.9% after first-quarter revenue fell 3%, missing analysts’ forecasts of 2% growth. Weak U.S. demand for beauty products and cognac, paired with sluggish Chinese sales, signaled deeper troubles for the luxury sector. The disappointing results dragged down shares of peers Kering and Hermès, with analysts warning of a challenging year ahead. RBC cut its forecast for LVMH’s 2025 sales to flat, citing a weaker macroeconomic backdrop and ongoing trade concerns.

Investment Insight: LVMH’s miss reflects mounting headwinds for the luxury sector, including softer consumer spending and geopolitical uncertainties. Investors should monitor demand trends in key markets like the U.S. and China, as well as the impact of trade policies. While luxury stocks may face near-term volatility, long-term opportunities could arise if valuations adjust to reflect slower growth expectations. Diversification across sectors remains prudent amidst heightened macro risks.

Market price: LVMH Moet Hennesy Louis Vuitton SE (MC): EUR 497.3

Palantir Extends Gains on NATO Deal

Palantir Technologies shares climbed 4.6% Monday, continuing a recovery fueled by NATO’s acquisition of the company’s AI-enabled military system. The deal alleviated fears of reduced European reliance on U.S. defense contractors amid trade uncertainty. Palantir is up 22% year-to-date, despite losing nearly 25% of its value since February’s record high. A bullish engulfing pattern on the weekly chart, coupled with a rally in the relative strength index, signals improving investor sentiment. Key resistance levels lie at $121 and $300, while critical support areas to monitor are $66 and $45.

Investment Insight: Palantir’s NATO deal reinforces its strategic importance in the defense sector, but volatility remains amid geopolitical and fiscal uncertainties. The bullish technical signals suggest potential for further upside, yet investors should remain cautious at key resistance levels, particularly near $121. Long-term growth prospects in AI-driven defense solutions remain promising, but maintaining a disciplined approach to entry and exit points around technical levels is crucial.

Market price: Palantir Technologies Inc. (PLTR): USD 92.62

Bond Market Rebound Eases Trade-Induced Turmoil

US Treasury yields retreated Monday, with 10-year yields falling 12 basis points to 4.35%, offering relief after last week’s historic selloff triggered by escalating trade tensions. Wall Street also saw modest gains as President Trump extended tariff exemptions on electronics and refrained from further trade escalations. The S&P 500 rose 0.8%, while volatility gauges like the VIX remained elevated, underscoring lingering market unease. Fixed-income leaders, including JPMorgan and Barclays, signaled that current yield levels may offer buying opportunities as recession risks loom, but uncertainty around trade and economic growth persists.

Investment Insight: The bond market’s rebound highlights its enduring appeal as a defensive asset amid trade-induced volatility and slowing growth concerns. While yields may stabilize in the near term, investors should consider diversifying into high-quality fixed-income assets to manage risk. Equity markets may remain choppy, with trade policy uncertainty likely to spur further volatility—positioning for resilience through balanced portfolios will be critical as the macroeconomic landscape evolves.

UK Job Vacancies Fall to Pre-Covid Levels Amid Tax and Wage Pressures

Job vacancies in the UK have dropped to 781,000, their lowest level since the pandemic, as businesses respond to Chancellor Rachel Reeves’ £25bn National Insurance hike and a 6.7% minimum wage increase. The Office for National Statistics (ONS) also reported a decline in payrolled employees by 78,000 in March, reflecting mounting caution among employers. Economists warn that Donald Trump’s trade war and rising costs could further dampen hiring, with unemployment expected to rise to 4.6% this year. Meanwhile, rapid wage growth of 5.9% is complicating the Bank of England’s decision on whether to prioritize inflation control or support a weakening labor market.

Investment Insight: The UK labor market’s slowdown underscores broader economic risks from rising costs and geopolitical uncertainty. Investors should anticipate potential downward revisions to growth forecasts and maintain caution toward consumer-facing sectors reliant on discretionary spending. Fixed-income instruments may gain appeal if the Bank of England cuts interest rates to support growth, while defensive stocks with steady cash flows could offer resilience in a softening economic environment.

Conclusion

Markets are showing tentative signs of stabilization, but volatility remains a key theme as trade tensions, economic uncertainty, and corporate challenges weigh on sentiment. While tariff relief has provided some optimism, weak data from the UK labor market and disappointing earnings from LVMH highlight broader risks to global growth. Investors are balancing caution with opportunity, focusing on defensive assets like gold and Treasuries, while selectively eyeing growth areas such as AI-driven technologies and cyclical sectors. As central banks weigh rate decisions, the path ahead will require disciplined portfolio management and a focus on resilience in an uncertain economic environment.

Upcoming Dates to Watch

April 16th, 2025: Industrial Production

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – April 14, 2025

Date Issued – 14th April 2025

Preview

Markets enter the week on edge as escalating U.S.-China trade tensions threaten global growth momentum

While a surprise jump in Chinese exports and selective U.S. tariff exemptions buoyed Asian equities, Citigroup’s downgrade of U.S. stocks to neutral highlights growing concern over earnings headwinds. Apple led a tech rally after smartphones and laptops were spared from tariffs, but President Trump’s threat to target semiconductors keeps uncertainty elevated.

Meanwhile, China’s credit surged in March on record government bond issuance, signaling aggressive stimulus to offset external shocks. Yet, the labor market remains fragile, with up to 20 million jobs tied to U.S. exports at risk. Goldman Sachs now sees China’s 2025 GDP growth at just 4%, down from 4.5%.

Investors are watching for fresh policy responses as Beijing seeks to hit its 5% growth target amid fading private-sector hiring and soft consumer sentiment. With volatility rising, equity positioning is shifting toward Japan and away from emerging markets, as global investors seek relative shelter from trade-driven turbulence.

Asian Stocks Climb as Trade Tensions Ease Slightly and Wall Street Rallies

Asian markets kicked off the week with broad gains, buoyed by a modest easing in U.S.-China trade tensions and a strong rebound on Wall Street. Japan’s Nikkei 225 rose 1.8%, South Korea’s Kospi added 0.8%, and Hong Kong’s Hang Seng surged 2.4%, led by tech stocks and upbeat Chinese export data.

Investors responded positively after President Trump signaled that key electronics like smartphones and laptops would be spared from the latest round of tariffs, even as broader trade risks persist. China’s 12.4% export growth in March added to optimism, though tensions remain elevated following Beijing’s latest retaliatory measures.

U.S. bond yields pulled back from multi-year highs, with the 10-year Treasury at 4.466%, while gold extended its climb to a record $3,249 an ounce. Oil prices edged lower and the dollar weakened, reflecting cautious sentiment amid ongoing geopolitical and inflation concerns.

Investment Insight

Markets are navigating a fragile reprieve in trade tensions. The tech-led rally underscores selective investor optimism, but sustained volatility in rates and safe-haven flows into gold highlight persistent macro uncertainty. In this environment, investors should prioritize defensiveness and earnings quality, particularly in sectors with global supply chain exposure and pricing resilience.

China’s Credit Growth Surges as Beijing Front-Loads Stimulus Amid Tariff Pressures

China’s credit expansion sharply overshot expectations in March, reflecting a policy-driven push to cushion the economy from intensifying U.S. trade tariffs. Aggregate financing rose 5.89 trillion yuan ($808 billion), up nearly 22% year-on-year and well above the 4.96 trillion yuan consensus estimate.

The surge was led by a record wave of sovereign and local government bond issuance—nearly 1.5 trillion yuan—as Beijing accelerated fiscal spending to buffer against export headwinds. New bank loans also beat forecasts, reaching 3.64 trillion yuan. However, the uptick was concentrated in short-term corporate loans, while long-term business credit remained sluggish, signaling muted private sector confidence.

Meanwhile, money supply indicators showed mixed trends, and housing loan data suggested continued softness in the property market. Though the U.S. exempted some electronics from tariffs, broader uncertainty continues to weigh on investment sentiment.

Investment Insight

The scale and structure of China’s credit expansion point to a top-down stimulus effort rather than organic economic momentum. With long-term corporate borrowing still subdued, investors should be cautious of near-term growth sustainability. Policy-sensitive sectors—particularly infrastructure, banks, and select state-linked SOEs—stand to benefit, but broader equity and credit markets may remain volatile amid unresolved trade risks and fragile consumer demand.

Tariffs Threaten Millions of Chinese Jobs as Economic Pressures Mount

China’s labor market is showing signs of strain as U.S. tariffs—now as high as 145%—threaten to undermine export-driven employment. Goldman Sachs estimates up to 20 million Chinese workers are exposed to U.S.-bound trade, raising the risk of widespread job losses amid weakening corporate hiring.

Despite early 2025 growth holding above 5%, policy stimulus has yet to meaningfully lift employment indicators. Job postings have fallen sharply, and business surveys show declining hiring intentions. While sectors like heavy equipment and AI-linked firms are showing momentum, broader confidence remains fragile.

With exports to the U.S. at risk and consumption still tepid, economists warn that up to 3% of GDP could be jeopardized. The central bank has held off on rate cuts so far, but calls for stronger stimulus are growing louder as Beijing aims to meet its 5% growth target.

Investment Insight

High U.S. tariffs are accelerating structural shifts in China’s economy, exposing vulnerabilities in labor-intensive export sectors. Investors should watch for increased policy intervention aimed at domestic demand and consumption. Sectors tied to infrastructure, automation, and AI innovation may outperform, while export-reliant industries face sustained headwinds.

Citigroup Cuts U.S. Equities to Neutral on Tariff-Driven Earnings Risk

Citigroup downgraded its outlook on U.S. equities to neutral from overweight, citing growing risks to corporate earnings from President Trump’s sweeping tariffs. The bank warned that the exceptional performance of U.S. stocks is losing its edge, with trade policy creating headwinds for both GDP and earnings per share. The S&P 500 last closed at 5,363.36, having rebounded on Friday, but Citigroup sees downside risk as tariffs weigh on profit margins.

The firm simultaneously upgraded Japanese equities to overweight, pointing to relative resilience, while cutting emerging markets to underweight amid rising global uncertainty.

Investment Insight

Citigroup’s shift underscores the rising pressure tariffs pose to U.S. corporate profitability. Investors should brace for downward revisions in earnings estimates and consider diversifying exposure toward developed markets with stronger policy visibility and lower geopolitical risk—particularly Japan. Defensive positioning within U.S. equities, favoring sectors less exposed to global trade flows, may offer relative stability in a volatile macro backdrop.

Tech Stocks Rally as U.S. Tariff Exemptions Lift Sentiment

Apple led a broad tech rally in Frankfurt trading, jumping over 6% after the U.S. granted tariff exemptions on smartphones, computers, and other electronics predominantly imported from China. Nvidia rose more than 3%, Dell surged 6.3%, and ASML gained 2.8%, as investors welcomed the targeted relief.

Nasdaq futures advanced 1.6% in early European hours, reflecting optimism for the sector. However, uncertainty lingers after President Trump signaled plans to impose new levies on imported semiconductors in the coming week, threatening to reintroduce volatility just as markets began to recover.

Investment Insight

The tariff reprieve offers temporary relief for hardware-focused tech names, particularly those with deep China exposure. While the bounce reflects easing near-term pressure, the threat of semiconductor tariffs underscores ongoing policy unpredictability. Investors should remain selective within tech—favoring firms with diversified supply chains and pricing power—while preparing for renewed volatility as geopolitical risks evolve.

Conclusion

As trade tensions intensify and policy responses ramp up, markets are recalibrating to a more uncertain global outlook. China’s stimulus efforts may support near-term growth, but persistent labor market weakness and external shocks cloud the path ahead.

In the U.S., tariff-driven earnings risks are prompting a shift in equity positioning, with investors rotating toward more stable developed markets like Japan. While selective relief in tech offers pockets of optimism, the broader environment remains fragile.

With volatility set to remain elevated, investors will need to navigate policy signals carefully and prioritize resilience, diversification, and earnings quality in the quarters ahead.

Upcoming Dates to Watch

- April 16th, 2025: Industrial Production

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – April 11, 2025

Date Issued – 11th April 2025

Preview

Markets remain volatile as key global developments shape investor sentiment. Chinese stocks extended their rally, with stimulus hopes outweighing intensifying U.S.-China trade tensions. Meanwhile, Zillow’s ban on off-market listings has reignited debates over transparency versus seller flexibility in real estate. Gold surged past $3,200/oz, hitting a record high on safe-haven flows amid dollar weakness, while oil prices are poised for a second weekly decline on trade war concerns and slowing demand forecasts. The euro climbed to a three-year high as investors fled U.S. assets, driven by tariff uncertainties and expectations of Federal Reserve rate cuts.

Chinese Stocks Rally on Stimulus Hopes Despite Trade Tensions

Chinese equities extended gains for a fourth consecutive session, driven by optimism around potential stimulus measures and signs of flexibility in U.S.-China trade negotiations. Hong Kong’s Hang Seng China Enterprises Index rose as much as 2.7%, while the onshore CSI 300 Index added 0.4%, outperforming broader Asian markets. Investors are betting on Beijing introducing growth-support measures following key leadership meetings, bolstered by U.S. President Donald Trump’s indications of possible tariff exemptions. However, escalating trade tensions remain a headwind, with Chinese authorities imposing an 84% tariff on U.S. imports in response to Trump’s 145% levy, underscoring the fragility of bilateral relations.

Investment Insight: While short-term gains in Chinese markets reflect optimism over stimulus and trade flexibility, the broader outlook remains precarious amid intensifying U.S.-China tensions. Investors should approach Chinese equities with caution, focusing on sectors likely to benefit from domestic policy support rather than relying on external trade resolutions. Diversification across Asian markets may mitigate risks tied to prolonged volatility in Sino-American relations.

Zillow Bans Off-Market Listings, Fueling Industry Tensions

Zillow announced it will prohibit homes marketed privately to select buyers from appearing on its platform, escalating a long-standing industry debate over “pocket listings.” The move aligns with the National Association of Realtors’ (NAR) updated Clear Cooperation Policy, which requires properties to be listed on multiple listing services (MLS) within a day of public marketing. Zillow’s ban, effective next month, will target properties promoted exclusively on platforms like Instagram or single brokerage websites. While Zillow and fair housing advocates argue the policy enhances transparency and maximizes seller returns, some luxury market brokers criticize the restriction, citing reduced seller flexibility. The decision underscores a growing divide between promoting transparency and preserving niche marketing strategies.

Investment Insight: Zillow’s policy shift reflects the increasing push for transparency in real estate transactions, potentially reshaping buyer access and seller strategies. For investors, this could level the playing field by broadening visibility into property markets, especially in competitive urban and luxury sectors. However, the ban may also limit opportunities to access exclusive deals, particularly for institutional investors leveraging off-market listings. Staying informed about evolving listing policies will be crucial for navigating real estate investments going forward.

Gold Breaks $3,200 Barrier Amid Dollar Weakness and Safe-Haven Demand

Gold surged past the $3,200/oz milestone for the first time, climbing 1% to a record $3,219.84 earlier in Friday’s session before retreating slightly. A weakening U.S. dollar, down 0.5% against major currencies, and escalating U.S.-China trade tensions spurred the rally, as investors sought refuge in safe-haven assets. Gold has gained 5% this week, supported by central bank demand, expectations of Federal Reserve rate cuts, and geopolitical uncertainty. Analysts see $3,500 as the next target but caution that the path may be volatile. Other precious metals saw mixed movements, with silver up 0.1% and platinum down 0.3%.

Investment Insight: Gold’s record-breaking rally underscores its resilience as a hedge against currency risk and global instability. For investors, the metal remains a key portfolio diversifier amid heightened trade tensions, a falling dollar, and dovish monetary policies. While further upside is likely, tactical allocations to gold-backed ETFs or mining stocks can help mitigate potential volatility. Monitor central bank moves and inflation data closely, as they will play a pivotal role in shaping gold’s trajectory.

Oil Prices Face Second Weekly Decline Amid Trade War Fears

Oil prices rebounded slightly on Friday, with Brent crude rising 1.4% to $64.23 per barrel and WTI gaining 1.5% to $60.95. However, both benchmarks are set to post their second consecutive weekly loss, with Brent down 2.1% and WTI off 1.8% for the week. Escalating U.S.-China trade tensions, highlighted by new tariffs and retaliatory measures, are fueling concerns about a global economic slowdown that could dent oil demand. The U.S. Energy Information Administration (EIA) lowered its global growth and oil demand forecasts, while analysts from BMI and ANZ predict further price pressure as trade disputes threaten economic stability. Attention now shifts to the OPEC+ meeting in May, as any signal of additional supply growth could prompt further selloffs.

Investment Insight: Investor caution is warranted as oil markets navigate rising geopolitical risks and trade-driven demand uncertainty. While OPEC+ intervention could stabilize prices, the risk of prolonged economic weakness suggests a cautious approach to energy investments. Consider diversifying exposure to oil with hedges in other commodities or sectors less sensitive to trade disruptions, and closely monitor policy announcements from the upcoming OPEC+ meeting.

Euro Hits 3-Year High as Investors Shift Away from US Assets

The euro surged to a three-year high against the US dollar, reaching 1.1387 during Friday’s Asian session, as investors dumped US assets amid tariff-driven economic uncertainty. The US Dollar Index dropped below 100 for the first time since July 2023, with haven currencies such as the Swiss franc and Japanese yen also strengthening. Cooler-than-expected US inflation data and expectations of further Federal Reserve rate cuts added pressure to the dollar. Meanwhile, US Treasuries saw significant sell-offs, pushing yields on 10- and 30-year government bonds higher, reflecting rising risk premiums. While Wall Street extended its selloff, European markets are poised to open higher, buoyed by the euro’s strength.

Investment Insight: The euro’s rally signals a broader shift toward non-dollar assets as trade tensions and economic risks weigh on the US outlook. For investors, this presents opportunities in European equities and bonds, which may benefit from capital inflows amid dollar weakness. However, with higher safe-haven demand driving currencies like the yen and Swiss franc, currency risk management will be essential. Monitor Fed policy signals and geopolitical developments closely, as these will shape future currency and capital flow dynamics.

Conclusion

Global markets are navigating a turbulent landscape shaped by trade tensions, policy shifts, and economic uncertainty. Chinese equities continue to rally on stimulus optimism, but geopolitical risks loom large. Gold’s record-breaking surge highlights investor moves toward safe havens, while oil markets face pressure from slowing demand and prolonged trade disputes. Zillow’s real estate policy changes reflect broader shifts toward transparency, and the euro’s rise underscores weakening confidence in U.S. assets. As volatility persists, investors should remain strategic, balancing risk exposure with diversification across asset classes and geographies, while closely monitoring central bank actions and geopolitical developments.

Upcoming Dates to Watch

- April 11th, 2025: US PPI

- April 16th, 2025: Industrial Production

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – April 10, 2025

Date Issued – 10th April 2025

Preview

Markets staged a dramatic rebound this week as President Trump paused broad-based tariffs, fueling a 10% surge in the S&P 500—its biggest one-day gain since 2008—though fragility in bonds and policy uncertainty linger. Fast Retailing raised its profit outlook after a 33% jump in Q2 earnings, but tariff risks cloud the outlook. March CPI data is expected to show inflation easing to 2.5%, possibly the last such print before new trade measures reverse the trend. TSMC’s Q1 revenue soared 42%, driven by AI demand, outpacing forecasts despite geopolitical risks. Meanwhile, Chinese and Hong Kong equities climbed on stimulus hopes, even as Sino-U.S. tensions escalated with tit-for-tat tariffs.

Markets Surge After Tariff Reversal, But Fragility Remains

After a week of historic volatility, U.S. equities staged a dramatic comeback as President Trump’s partial rollback of sweeping new tariffs ignited a relief rally. The S&P 500 surged nearly 10% on Wednesday—its biggest one-day gain since 2008—following a sharp downturn that had pushed it to the brink of a bear market. The Cboe Volatility Index spiked to pandemic-era highs earlier in the week, reflecting deep investor unease. The turnaround came as Trump paused duties on most trading partners while maintaining pressure on China, signaling a potential revival of the so-called “Trump put.” However, the bond market remains jittery, with Treasury yields spiking amid forced liquidations, underscoring systemic fragility and the economic uncertainty stemming from erratic trade policy.

Investment Insight

The week’s extreme market swings reaffirm the heightened sensitivity of risk assets to policy volatility. While the rally suggests renewed investor faith in policy support, the lack of clarity on trade direction and the fragility in bond markets warn against complacency. Investors should remain defensively positioned, favoring liquidity and sectoral resilience, while monitoring policy cues as potential catalysts for both risk and recovery.

Fast Retailing Lifts Outlook as Uniqlo Profit Surges, Eyes Tariff Risks

Fast Retailing, the parent of Uniqlo, posted a 33% year-on-year jump in second-quarter operating profit to ¥146.7 billion ($999.9 million), well above analyst expectations, buoyed by strong global sales ahead of fresh U.S. tariff threats. The Japanese retailer raised its full-year profit forecast to ¥545 billion, citing robust overseas demand, particularly in North America and Europe, even as China—its largest overseas market—continues to slow. The upbeat earnings come amid rising macro uncertainty after President Trump’s sweeping tariff plan, which includes a 24% duty on Japanese goods, was temporarily paused. With over 2,500 stores globally and a supply chain rooted in Asia, Fast Retailing’s outlook remains vulnerable to geopolitics despite short-term momentum.

Investment Insight

Fast Retailing’s strong quarter and upgraded forecast highlight the strength of its global brand and operational scale. Yet the company’s exposure to U.S. trade policy and Asian manufacturing underscores rising execution risk. Investors should watch for profit margin pressures if tariffs materialize and assess the company’s ability to diversify sourcing and sustain growth in Western markets amid geopolitical headwinds.

March CPI May Mark Inflation Lull as Tariffs Threaten Fresh Pressures

The March Consumer Price Index (CPI), expected to show continued moderation in inflation, could be the final report reflecting easing price pressures before new tariffs reignite upward momentum. Forecasts point to headline inflation cooling to 2.5% year-over-year, down from 2.8% in February, with core CPI slipping slightly to 3.0%. However, economists warn that the data may already be outdated amid President Trump’s escalating trade measures, including a 125% tariff on Chinese goods and baseline duties on most countries. While the Fed remains cautious, the evolving tariff landscape is poised to complicate its inflation fight, potentially stalling the disinflationary trend seen in early 2025.

Investment Insight

March CPI may offer a short-lived reprieve for inflation watchers. With fresh tariffs likely to magnify cost pressures in the months ahead, especially in core components like goods and services, investors should prepare for renewed inflation volatility. Market expectations for near-term Fed rate cuts may need recalibration, reinforcing the case for inflation-resilient assets and a cautious approach to duration risk in fixed income portfolios.

TSMC Posts 42% Revenue Surge on AI Demand, Beats Forecasts

Taiwan Semiconductor Manufacturing Co. (TSMC) reported a 42% year-on-year jump in first-quarter revenue to T$839.3 billion ($25.6 billion), slightly ahead of analyst estimates and its own guidance. The world’s top contract chipmaker continues to capitalize on surging demand for AI-related chips, offsetting the post-pandemic slowdown in consumer electronics. Despite a one-time impact from a January earthquake, revenue remained resilient. TSMC shares rebounded 9.9% following President Trump’s temporary suspension of new tariffs, though year-to-date losses remain steep at nearly 20%. Investors now await full Q1 earnings and forward guidance on April 17 amid growing geopolitical and trade uncertainties.

Investment Insight

TSMC’s robust top-line growth underscores its pivotal role in the AI supply chain and its resilience to cyclical headwinds in broader tech. However, with tariff risks still looming and Taiwan’s strategic position in global trade under scrutiny, investors should monitor geopolitical developments closely. The stock’s recent rebound may offer selective entry points, but long-term positioning should account for both AI-driven upside and policy-driven volatility.

Market price: Taiwan Semiconductor Manufacturing Co Ltd (TPE: 2330): TWD 863.00

Markets Eye Stimulus as U.S.-China Trade Tensions Escalate

Investor sentiment in Asia turned cautiously optimistic despite U.S. President Trump’s escalation of tariffs on Chinese imports to 125%, with Beijing swiftly retaliating by lifting its own duties to 84%. While the tariff standoff between the world’s two largest economies intensified, equity markets in China and Hong Kong posted gains, buoyed by hopes of domestic stimulus and signs of state-backed buying. Analysts noted that China’s reduced export dependence on the U.S. and policy preparedness have limited downside risks for Chinese equities. However, the broader investment landscape remains volatile as trade negotiations remain strained and the long-term economic impact of tariffs grows more pronounced.

Investment Insight

The resilience of Chinese and Hong Kong equities amid rising tariffs reflects investor confidence in Beijing’s ability to cushion economic shocks through targeted stimulus and policy levers. Yet, the durability of this rebound hinges on the trajectory of U.S.-China negotiations. Investors should brace for headline-driven volatility and focus on structurally sound sectors—such as high-growth internet and undervalued SOEs—while maintaining a balanced exposure given the heightened geopolitical risk.

Conclusion

This week’s whirlwind of market moves underscores the delicate balance between policy shifts and investor sentiment. While equities rallied on tariff pauses and strong corporate earnings, underlying risks remain—from inflation re-acceleration to geopolitical flashpoints. As trade tensions between the U.S. and China deepen and macro uncertainties mount, markets may stay headline-driven and volatile. Investors are repositioning around resilience: AI beneficiaries like TSMC, defensive plays amid sticky inflation, and sectors poised to weather policy shocks. With central banks in wait-and-see mode and stimulus expected in Asia, the path forward hinges on diplomacy, data, and the durability of global economic momentum.

Upcoming Dates to Watch

- April 10th, 2025: US CPI

- April 11th, 2025: US PPI

- April 16th, 2025: Industrial Production

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – April 9, 2025

Date Issued – 9th April 2025

Preview

Global markets slid as U.S. tariffs on Chinese goods took effect, dragging European indices down more than 2% and pushing Japan’s Nikkei 225 4% lower. U.S. Treasuries faced a sharp selloff, with the 10-year yield jumping to 4.41%, while haven assets like gold and the yen saw mixed responses amid liquidity concerns. Japan ruled out using its $1.27 trillion in U.S. Treasury holdings as a retaliatory tool, emphasizing their role in currency intervention preparedness. Meanwhile, gold erased earlier gains to finish flat at $2,982.92 an ounce, reflecting volatility-driven selling despite its year-to-date rally. Investors are advised to focus on diversification, shorter-duration bonds, and defensive assets as uncertainty around trade policy and economic growth persists.

Markets Slide as Tariffs Deepen Global Uncertainty

European markets opened sharply lower, with the Euro STOXX 50 falling 2.4% and major indices across Germany, France, and the UK following suit, as President Trump’s sweeping tariffs on Chinese goods came into effect. Asian markets mirrored the downturn, with Japan’s Nikkei 225 slumping 4% and South Korea’s Kospi dropping 1.7%, while China allowed further weakening of the Yuan to offset trade pressures. US stock futures pointed to declines, with the S&P 500 down 2.56%, as investor sentiment soured. Risk-off flows buoyed haven assets like gold, which climbed above $3,018 per ounce, while oil prices extended losses, with Brent crude down nearly 4% to $60.41 per barrel.

Investment Insight: Ongoing tariff escalations have heightened global market volatility, with cyclical sectors like autos and industrials hit particularly hard. Investors may consider pivoting toward defensive plays, including precious metals and currencies like the yen and Swiss franc, while maintaining caution around equities until greater clarity emerges on US trade policy. The prolonged uncertainty underscores the importance of diversification and a focus on quality assets with robust balance sheets.

Bond Market Rout Raises Liquidity Concerns Amid Global Turmoil

U.S. Treasuries faced a sharp selloff as yields on the 10-year note surged to 4.41%, marking a 16-basis-point rise during Asian trading and a 50-basis-point leap since Monday. The 30-year yield spiked above 5%, the largest three-day increase since 1981, driven by forced liquidations from hedge funds unwinding leveraged “basis trades.” The volatility extended to global bond markets, with Japan’s 30-year bond yield hitting a 21-year high. Analysts warn that growing liquidity concerns, coupled with fears of foreign selling.

Investment Insight: The speed and scale of the Treasury selloff highlight rising liquidity risks in global markets, signaling potential stress in leveraged positions. Investors should monitor central bank responses closely, as intervention could stabilize volatility. Near-term strategies may include reducing exposure to long-duration bonds and pivoting toward cash or shorter-term instruments to mitigate risk. Additionally, diversification across currencies and geographies remains critical as uncertainty around trade flows and safe-haven dynamics grows.

Japan Dismisses Using U.S. Treasury Holdings as Tariff Countermeasure

Japanese Finance Minister Katsunobu Kato ruled out leveraging Japan’s $1.27 trillion in foreign reserves, largely composed of U.S. Treasuries, to counter President Trump’s tariffs on Japanese imports. Speaking in parliament, Kato emphasized that Japan’s Treasury holdings are managed to prepare for potential exchange-rate interventions, not as a diplomatic tool. While some lawmakers suggested selling U.S. Treasuries as retaliation, Kato warned such actions would effectively amount to yen.

Investment Insight: Japan’s commitment to maintaining its U.S. Treasury holdings underscores the global reliance on Treasuries as a reserve asset despite escalating trade tensions. For investors, this highlights the resilience of U.S. debt markets against geopolitical shocks. However, sustained trade disputes and potential retaliatory measures elsewhere could introduce volatility, warranting a focus on diversifying fixed-income portfolios and monitoring shifts in global reserve strategies.

Gold Flatlines as Tariff Anxiety Tempers Haven Demand

Gold erased earlier gains of 1.3% to finish flat at $2,982.92 per ounce as markets digested news that the US is moving forward with 104% tariffs on Chinese goods. Despite its haven status, gold has faced headwinds from liquidity-driven selling amid heightened volatility in equities and bonds. Still, bullion remains up more than 13% year-to-date, benefiting from fears of stagflation as inflation risks persist alongside slowing growth. Other metals saw mixed movements, with silver slipping and platinum edging higher.

Investment Insight: Gold’s muted performance amid tariff-driven volatility highlights its vulnerability to liquidity crunches, even as it remains a favored hedge against stagflationary pressures. Investors should maintain exposure to gold as a long-term portfolio diversifier, particularly with economic disruption and inflation risks on the horizon. However, near-term price movements could remain choppy as markets react to evolving trade dynamics and macroeconomic signals.

Volkswagen’s EV Sales Surge in Europe Amid Growing Demand

Volkswagen more than doubled its European battery-electric vehicle (BEV) deliveries in Q1 2025, reaching over 150,000 units compared to 74,400 in the same period last year. Total orders for Volkswagen vehicles, including both electric and combustion models, rose 29% in Western Europe, reflecting surging demand driven by stricter EU emissions regulations and new EV model launches. The growth comes as BEVs outperform the broader European auto market, where total car sales have declined.

Investment Insight: Volkswagen’s strong EV sales growth highlights a pivotal shift in the European automotive market toward electrification. For investors, this underscores the competitive advantage of automakers with robust EV pipelines amid tightening emissions standards. The trend also signals opportunities in supporting sectors like battery production and EV infrastructure, as demand for sustainable mobility continues to accelerate.

Conclusion

Global markets are navigating heightened uncertainty as trade tensions, recession fears, and policy responses dominate investor sentiment. While rebounds in Japanese equities and oil prices offer brief relief, downside risks persist across equities, commodities, and currency markets. Defensive positioning remains critical, with opportunities emerging in less trade-sensitive sectors and regions. As central banks and governments intervene to stabilize markets, monitoring liquidity conditions and diplomatic developments will be key to anticipating shifts. Investors should remain cautious, prioritizing diversification and quality assets to weather continued volatility and capitalize on potential recovery scenarios in the coming weeks.

Upcoming Dates to Watch

- April 10th, 2025: US CPI

- April 11th, 2025: US PPI

- April 16th, 2025: Industrial Production

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – April 8, 2025

Date Issued – 8th April 2025

Preview

Global markets remain volatile as escalating U.S.-China trade tensions weigh on sentiment. China pledged to retaliate against U.S. tariff hikes, propping up markets with stimulus and yuan devaluation, while Hong Kong’s Hang Seng Index rebounded 2.87%. The S&P 500 narrowly avoided a bear market after dropping 21% intraday, while hedge funds reduced net leverage to historical lows amid mounting losses. Japanese equities surged 6% on hopes of a U.S.-Japan trade deal and a weaker yen, though risks linger. Oil prices rose 1% following last week’s sharp selloff, but analysts warn of persistent demand concerns tied to recession fears. Investors are advised to adopt defensive strategies, focusing on resilient sectors and monitoring geopolitical developments.

China Escalates Trade War Amid Market Support Measures

China has vowed to retaliate against the latest U.S. tariff threats, intensifying the trade standoff between the world’s two largest economies. Beijing signaled its determination to shield markets, with central bank actions weakening the yuan to boost exports and state-linked funds injecting record inflows into equities. Despite a rebound in the Hang Seng China Enterprises Index (+2.87%), the yuan hit a two-month low offshore as fears of decoupling grow. President Trump’s escalating tariffs, now reaching a cumulative rate of 104%, have dimmed hopes for a near-term resolution, with both sides adopting increasingly entrenched positions. Beijing is pivoting towards domestic consumption and stimulus to offset external pressures, while Hong Kong looks to diversify trade relations amid its own tariff challenges.

Investment Insight

Investors should brace for prolonged volatility in China-related assets as trade tensions intensify. While Beijing’s market interventions may stabilize equities in the short term, the weaker yuan and heavy reliance on stimulus suggest longer-term risks. Diversification into emerging markets with lower trade exposure to the U.S. or sectors tied to domestic Chinese consumption could mitigate downside risks.

S&P 500 Teeters on Bear Market Amid Tariff Uncertainty

The S&P 500 briefly fell into bear market territory on Monday, dropping 21% from its February high of 6,144 before recovering to close at 5,062, narrowly avoiding an official bear market designation. The tech-heavy Nasdaq-100, however, officially entered a bear market on Friday. Investor sentiment remains fragile as markets react to mixed signals from the White House regarding the longevity of tariffs. Monday’s 4.7% intraday decline highlights the mounting pressure on equities, with analysts noting this could become the second-fastest bear market in history after the 2020 pandemic crash.

Investment Insight

The risk of continued market volatility underscores the importance of a defensive approach. Investors should consider rotating into sectors that are less sensitive to trade headwinds, such as healthcare and utilities, while maintaining liquidity to capitalize on potential buying opportunities during market dislocations.

Hedge Funds Cut Risk as Markets Plunge on Trade War Fears

Global hedge funds tracked by Morgan Stanley reported mounting losses last week, with year-to-date performance turning negative (-3%) as markets reeled from escalating U.S.-China trade tensions. The S&P 500 and FTSE fell over 10% and 6%, respectively, while oil hit a four-year low, reflecting fears of a global recession. Hedge funds sharply reduced net leverage, with U.S. long-short funds dropping to 37%, near historical lows. Export-driven Asian markets bore the brunt of the selloff, with Hong Kong’s Hang Seng Index suffering its steepest decline since 1997. Analysts warn of heightened volatility amid tariff uncertainty, suggesting further downside risk for equities.

Investment Insight

Amid significant deleveraging by hedge funds and ongoing market volatility, a risk-off strategy remains prudent. Investors should prioritize defensive sectors like consumer staples and fixed income while maintaining a cautious stance on export-reliant markets. Monitoring liquidity conditions and hedge fund positioning could offer early signals of market stabilization.

Japanese Stocks Surge on Tariff Deal Hopes and Yen Weakness

Japanese equities rallied sharply on Tuesday, with the Topix jumping 6.3% and the Nikkei 225 gaining 6%, marking their largest single-day increases since August. Optimism surrounding a potential U.S.-Japan tariff deal, sparked by a call between Prime Minister Shigeru Ishiba and President Trump, fueled the rebound. Exporters led the rally, buoyed by a weaker yen, as Hitachi surged 14% and Toyota rose 7.2%. Banking stocks also outperformed, with Mitsubishi UFJ Financial Group climbing 13% intraday. Despite the gains, both indices remain down over 7% since the tariff announcement on April 2, underscoring lingering trade-related risks.

Investment Insight

The rebound in Japanese equities highlights the market’s sensitivity to trade developments and currency movements. Investors should stay attuned to further U.S.-Japan negotiations while considering sectors like exporters and financials that benefit from yen weakness and improving trade sentiment. However, caution is warranted as the broader trade environment remains uncertain, suggesting the importance of diversification within Asia-Pacific portfolios.

Oil Prices Rebound 1% Amid Volatile Markets and Tariff Concerns

Oil prices rose about 1% on Tuesday, with Brent crude at $64.87 per barrel and WTI at $61.37, recovering slightly from a near four-year low following last week’s 14%-15% slump driven by U.S.-China tariff tensions. The relief rally was supported by steadier equity markets, though analysts warn of persistent downside risks as escalating trade conflicts threaten global growth and energy demand. ING and other market watchers caution that further tariff escalation, including President Trump’s proposed 50% levy on Chinese goods, could deepen recession fears and weigh on crude prices. Inventory data later this week will provide additional clues on demand trends.

Investment Insight

With oil prices remaining vulnerable to trade-driven demand shocks, investors should carefully monitor geopolitical developments and economic indicators for clarity on global energy trends. A defensive approach in energy markets, focusing on high-quality producers with strong balance sheets, can help mitigate downside risks during periods of heightened volatility.

Conclusion

Global markets are navigating heightened uncertainty as trade tensions, recession fears, and policy responses dominate investor sentiment. While rebounds in Japanese equities and oil prices offer brief relief, downside risks persist across equities, commodities, and currency markets. Defensive positioning remains critical, with opportunities emerging in less trade-sensitive sectors and regions. As central banks and governments intervene to stabilize markets, monitoring liquidity conditions and diplomatic developments will be key to anticipating shifts. Investors should remain cautious, prioritizing diversification and quality assets to weather continued volatility and capitalize on potential recovery scenarios in the coming weeks.

Upcoming Dates to Watch

- April 10th, 2025: US CPI

- April 11th, 2025: US PPI

- April 16th, 2025: Industrial Production

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – April 7, 2025

Date Issued – 7th April 2025

Preview

Global markets face intensifying turmoil as U.S. tariffs and China’s retaliation disrupt equities, cryptocurrencies, and economic forecasts. The Federal Reserve remains cautious, citing uncertainty from trade tensions and inflation risks, while JPMorgan projects a 0.3% GDP contraction for 2025. Asian markets plunged, with Japan’s Nikkei dropping 8% and Taiwan’s Taiex falling 9.7%, as the impact of tariffs ripples across export-driven economies. Bitcoin slipped below $80,000, mirroring sharp selloffs in equities, as global market capitalization shed $8.2 trillion. Meanwhile, LG Energy Solution’s Q1 profit surged 138% on U.S. subsidies, though underlying losses reflect cooling EV demand. Investors are advised to brace for volatility, explore defensive sectors, and monitor opportunities in domestic-focused markets and alternative assets.

Fed Stays on Sidelines Amid Economic Uncertainty

Federal Reserve Chair Jerome Powell signaled a cautious approach to monetary policy, citing elevated uncertainty due to conflicting economic signals, including President Trump’s unexpected tariff hikes and their potential inflationary impact. Despite strong March job growth, Powell indicated the Fed is unlikely to cut interest rates soon, emphasizing the risks of premature action. Markets remain jittery as tariffs are expected to drive inflation higher while curbing growth; JPMorgan now forecasts a 0.3% GDP contraction for 2025. Powell underscored the Fed’s commitment to deliberate action, contrasting the current situation with past crises that demanded immediate responses.

Investment Insight

Investors should brace for heightened volatility as the Fed adopts a wait-and-see stance amid tariff-driven economic disruptions. With inflation risks rising and growth forecasts dimming, portfolio hedges against stagflation—such as commodities or inflation-protected securities—may offer strategic value. Avoid heavy bets on rate cuts in the near term, as the Fed appears focused on maintaining optionality.

China Rallies Domestic Resilience Amid Escalating Trade War

China responded to President Trump’s sweeping tariff hikes with a call for calm and a detailed plan to counter economic fallout. The Communist Party’s People’s Daily emphasized resilience, pledging domestic stimulus measures such as rate cuts, increased liquidity, and fiscal expansion to bolster growth. While the Hang Seng China Enterprises Index plunged 10.8% and the yuan weakened, Beijing signaled readiness for further retaliation if needed. Analysts warn of escalating risks to global growth, with China’s strategy shifting toward fostering domestic demand and diversifying trade partnerships. Negotiations remain possible, but the trade war continues to weigh heavily on markets.

Investment Insight

Investors should prepare for prolonged volatility as China prioritizes domestic stimulus over immediate trade resolutions. Consider exposure to sectors tied to Chinese domestic consumption, which Beijing aims to strengthen, while exercising caution around export-reliant industries vulnerable to US tariffs. The yuan’s potential devaluation and increased fiscal measures may also create opportunities in Chinese government bonds and consumer-driven equities.

LG Energy Solution Posts 138% Profit Surge Amid Industry Headwinds

LG Energy Solution (LGES) reported a 138% rise in Q1 operating profit to 374.7 billion won, surpassing expectations of 29 billion won. The surge was driven by tax credits from the U.S. Inflation Reduction Act (IRA). However, excluding these credits, the company faced an operating loss of 83 billion won ($56.52 million), reflecting the impact of declining EV demand. LGES, a key supplier to General Motors and Tesla, highlighted ongoing challenges in the electric vehicle market despite supportive policy tailwinds.

Investment Insight

The sharp contrast between LGES’s headline profit and its underlying loss underscores the market’s dependency on government incentives. Investors should monitor policy developments like the IRA for near-term support but remain cautious about the structural challenges posed by softening EV demand. Diversified exposure to battery materials or renewable energy infrastructure may provide more balanced opportunities in the sector.

Bitcoin Slips Below $80,000 Amid Market Turmoil

Bitcoin fell under $80,000 on Sunday, losing over 3% in two hours, as U.S. tariffs triggered widespread selloffs across global markets. Ethereum dropped nearly 8%, and the GMCI 30 Index of top cryptocurrencies declined over 6% in one day, extending its year-to-date losses to 32%. The crypto slump mirrored sharp pullbacks in equities, with the S&P 500 and Nasdaq shedding nearly 6% last week, as global market capitalization plunged by $8.2 trillion. Analysts warn of heightened volatility ahead, with Bitcoin potentially poised for a major move depending on broader market sentiment.

Investment Insight

Amid escalating market uncertainty, Bitcoin’s safe-haven narrative faces pressure as both crypto and equities decline. Investors should monitor Bitcoin’s price action alongside Wall Street’s volatility index (VIX), as compressed crypto volatility could signal an upcoming breakout. Diversifying into lesser-correlated assets or stablecoins may offer protection, while long-term holders could see buying opportunities if Bitcoin stabilizes near key technical levels.

Asian Markets Plunge Amid Escalating Trade War

Asian markets tumbled Monday as President Trump’s sweeping tariffs and China’s forceful retaliation deepened global market turmoil. Japan’s Nikkei fell over 8% shortly after opening, while the Shanghai Composite and Hong Kong’s Hang Seng dropped 6.7% and 9%, respectively. Taiwan’s Taiex plummeted 9.7%, with major exporters like TSMC and Foxconn hitting circuit breakers. The sell-off follows a $5.4 trillion wipeout in global equities, with U.S. futures signaling further losses. Economists warn of worsening economic damage, as trade tensions between the U.S. and key Asian economies escalate, stoking fears of a global slowdown.

Investment Insight

With Asian markets under pressure, investors should focus on defensive sectors and consider reducing exposure to export-reliant stocks in regions heavily impacted by U.S. tariffs. Diversifying into non-correlated assets, such as gold or cash equivalents, may help navigate volatility. In the medium term, watch for potential buying opportunities in undervalued equities once the trade landscape stabilizes.

Conclusion

Markets remain fragile as escalating U.S.-China trade tensions, volatile crypto movements, and mixed corporate earnings weigh on investor sentiment. The Federal Reserve’s cautious stance highlights the uncertainty surrounding inflation and growth, while Asian markets and Bitcoin’s slump underscore the global ripple effects of tariffs. Despite LG Energy Solution’s profit surge, underlying challenges in the EV market reflect broader headwinds. Investors face a landscape marked by heightened volatility and shifting dynamics. Staying defensive, diversifying portfolios, and monitoring policy developments will be critical as markets navigate the fallout from trade disruptions and search for stability in the weeks ahead.

Upcoming Dates to Watch

- April 10th, 2025: US CPI

- April 11th, 2025: US PPI

- April 16th, 2025: Industrial Production

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – April 4, 2025

Date Issued – 3rd April 2025

Preview

Markets are reeling as escalating U.S. tariffs ripple through global financial systems. European shares suffered their steepest weekly loss since 2022, while J.P. Morgan raised global recession odds to 60%, citing trade disruptions and weakened business sentiment. Oil plunged below $70 per barrel, driven by surprise OPEC+ output hikes and recession fears, while the euro neared a six-month high as investors bet on central bank rate cuts. Australian pension funds faced a cyberattack compromising 20,000+ accounts, highlighting security vulnerabilities in financial infrastructure. Amid growing uncertainty, safe-haven assets like gold and U.S. Treasuries are gaining favor, while defensive equities and resilient sectors present opportunities in an increasingly volatile environment.

Cyberattacks Target Australia’s Pension Funds, Impacting Thousands of Accounts

Australia’s largest pension funds, managing a combined A$4.2 trillion in retirement savings, have been hit by a series of coordinated cyberattacks, compromising over 20,000 accounts. Major funds, including AustralianSuper, Rest, and Hostplus, confirmed breaches, with some members losing up to A$500,000. AustralianSuper, the biggest fund managing A$365 billion, reported 600 compromised accounts, while Rest’s attack affected 1% of its members. Government agencies and regulators are coordinating a response as cybersecurity concerns mount. Prime Minister Anthony Albanese called the attacks part of a growing trend, with breaches occurring every six minutes. The incidents highlight vulnerabilities in Australia’s financial infrastructure, despite an A$587 million cybersecurity strategy launched in 2023.

Investment Insight: Cybersecurity risks are a growing threat to financial institutions, underscoring the importance of robust risk management in portfolio strategies. Investors should monitor companies with exposure to cybersecurity solutions, as demand for defensive technologies is likely to accelerate. Funds holding significant positions in vulnerable sectors, such as financial services, may face reputational and operational risks, making diversification essential.

European Shares Slide as Tariffs Stoke Recession Fears

European markets ended the week sharply lower, with the STOXX 600 index dropping 0.9% on Friday and posting a 4.4% weekly loss—the steepest since June 2022. Investor sentiment soured after U.S. President Donald Trump imposed sweeping 20% tariffs on European imports, heightening global recession concerns. European banks, particularly vulnerable to economic downturns, led sector losses with a 3.8% decline. Meanwhile, Germany’s industrial orders stagnated in February, signaling a sluggish recovery for Europe’s largest economy. Market participants now await the U.S. March jobs report for further clues on global economic health.

Investment Insight: Heightened trade tensions and recession fears underscore the need for defensive positioning in portfolios. Investors should consider increasing exposure to less cyclical sectors, such as healthcare and utilities, while monitoring opportunities in undervalued European equities if central banks respond with rate cuts. Additionally, companies with resilient supply chains or limited exposure to U.S.-EU trade may offer relative stability in this volatile environment.

J.P. Morgan Raises Global Recession Risk to 60% Amid U.S. Tariff Escalation

J.P. Morgan has increased its global recession odds to 60%, up from 40%, citing fallout from President Donald Trump’s sweeping tariff measures. The U.S. imposed a 10% baseline tariff on all imports, with higher duties targeting specific nations, raising concerns about retaliatory trade actions, weakened business sentiment, and supply chain disruptions. J.P. Morgan strategists, led by Bruce Kasman, noted that U.S. trade policy has become less business-friendly than anticipated, exacerbating global economic risks. Wall Street firms, including Barclays and Deutsche Bank, echoed these warnings. While J.P. Morgan expects the Federal Reserve to implement two 25-basis-point rate cuts this year, investor expectations point to four, signaling a growing demand for monetary easing to offset economic pressures.

Investment Insight: Rising recession risks and trade policy uncertainty call for a cautious investment approach. Investors should prioritize high-quality assets, including government bonds and defensive equities, to navigate market volatility. Additionally, sectors with limited exposure to global trade, such as technology and consumer staples, may offer relative resilience. With central banks poised for rate cuts, income-focused strategies in dividend-yielding stocks and corporate bonds could also provide opportunities in this challenging environment.

Oil Prices Plunge on Tariff Escalation and Surprise OPEC+ Supply Hike

Oil markets faced their steepest selloff since 2022, with Brent crude dropping below $70 per barrel and West Texas Intermediate falling to $66. President Donald Trump’s sweeping tariffs, coupled with OPEC+’s unexpected decision to triple its planned May output hike, sent shockwaves across markets. Analysts view the OPEC+ decision as a deliberate move to discipline members exceeding quotas. While falling oil prices may ease inflationary pressures, they also reflect mounting concerns about global economic growth amid recession fears. Goldman Sachs cut its Brent forecast by $5 to $66 for December, warning of sustained volatility as recession risks rise.

Investment Insight: The oil market’s sharp downturn highlights the need for caution in energy sector investments. Investors should focus on integrated oil majors with diversified revenue streams and strong balance sheets, which are better positioned to weather price declines. Additionally, the broader economic uncertainty makes defensive sectors like utilities and healthcare attractive alternatives. For those seeking opportunities in commodities, a focus on gold or other safe-haven assets may provide stability in a volatile macroeconomic environment.

Euro Nears Six-Month High as U.S. Tariffs Shake Global Currency Markets

The euro edged closer to a six-month high on Friday, buoyed by its largest daily gain in nearly three years as investors assessed the fallout from U.S. tariffs. The dollar index rebounded slightly after plunging 1.9% on Thursday, its worst day since November 2022, while the safe-haven yen strengthened and risk-sensitive currencies like the Australian and New Zealand dollars tumbled. The Australian dollar fell 1.36% to $0.6241, reflecting concerns over the impact of tariffs on China, Australia’s largest trading partner. Meanwhile, market participants priced in multiple central bank rate cuts, with the European Central Bank expected to deliver three cuts by year-end and the Federal Reserve four.

Investment Insight: Currency markets are signaling heightened volatility amid escalating trade tensions and recession fears. For investors, this presents opportunities in safe-haven assets such as gold and U.S. Treasuries, which remain supported by risk aversion. Diversification into currencies less exposed to trade disputes, such as the Swiss franc or Japanese yen, may also provide stability. For equity investors, companies with limited exposure to global trade or those positioned in resilient sectors like technology or consumer staples may offer relative protection in uncertain economic conditions.

Conclusion

Global markets face mounting pressure as trade tensions, recession fears, and market volatility dominate headlines. U.S. tariffs are reshaping economic forecasts, with central banks expected to respond with aggressive rate cuts. Oil’s sharp decline and the euro’s rally underscore the fragile balance between inflation concerns and growth risks. Cybersecurity vulnerabilities and rising geopolitical uncertainty further compound challenges for investors. In this environment, strategic asset allocation is critical, with a focus on safe-haven assets, defensive equities, and sectors resilient to trade disruptions. As markets adjust to these shifting dynamics, maintaining a diversified portfolio remains key to navigating the uncertainty ahead.

Upcoming Dates to Watch

- April 4th, 2025: US Employment Report, Fed Chair Jerome Powell to Speak

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.

Daily Synopsis of the New York market close – April 3, 2025

Date Issued – 3rd April 2025

Preview

Asian markets tumbled as President Trump’s sweeping tariffs sparked fears of a global trade war, with Japan’s Nikkei 225 falling 2.8% to an eight-month low. Bitcoin slid 0.8% to $83,421, reflecting risk-off sentiment, while gold surged to record highs. Ray Dalio warned that tariffs could prepare economies for geopolitical conflicts but risk inflation and stagflation. BlackRock’s $22.8 billion ports deal faces scrutiny in Panama, potentially delaying its completion amid legal and geopolitical tensions. Meanwhile, Mitsubishi announced a $27 billion investment plan over three years, targeting long-term growth and shareholder returns, supported by majority stakeholder Berkshire Hathaway.

Asian Markets Sink as U.S. Tariffs Trigger Global Trade Concerns

Asian equities plunged on Thursday following President Donald Trump’s announcement of sweeping tariffs on imports, including a 10% universal levy and higher reciprocal duties on countries with significant trade barriers. Japan’s Nikkei 225 led the selloff, dropping 2.8% to an eight-month low, while the broader TOPIX index fell 3.1%.

Export-driven economies like China, Japan, and Vietnam face significant pressure, with new tariffs as high as 54% on Chinese imports and 25% on foreign-made autos. Broader Asian markets followed suit, with the Hang Seng down 1.8%, South Korea’s KOSPI losing 1.2%, and Australia’s ASX 200 slipping 1.1%.

Meanwhile, China’s services PMI data offered a slight silver lining, exceeding expectations at 51.9, though it did little to stem market declines.

Investment Insight

Heightened trade tensions are likely to exacerbate volatility in global markets, with export-heavy sectors in Asia facing earnings risks. Investors should consider rotating into defensive plays, such as domestic-focused sectors and dividend-yielding assets, while exercising caution with companies directly exposed to U.S.-bound exports, particularly in the auto and technology industries.

Bitcoin Slides to $83.4K Amid Risk-Off Mood Following Trump Tariffs

Bitcoin dropped 0.8% to $83,421.50 on Thursday as global markets reacted to the announcement of sweeping U.S. tariffs. President Trump’s policy includes a 10% universal import tariff and steep reciprocal duties on key trading partners, with China facing a combined 54% tariff. The risk-off sentiment drove investors away from volatile assets like cryptocurrencies, favoring safe-haven assets such as gold, which hit record highs.

Crypto-related stocks also tumbled, with Coinbase falling 7.5% and Bitcoin miners Marathon Digital and Riot Platforms sliding over 7%. Among altcoins, Ethereum fell 1.2% to $1,832.57, while Solana and Polygon lost 3.2% and 3.5%, respectively.

Investment Insight

Bitcoin’s decline highlights its correlation with broader market risk, challenging its reputation as a hedge during uncertainty. Investors should approach cryptocurrencies cautiously in the current risk-averse environment, considering diversification into traditional safe-haven assets or defensive equities to mitigate volatility.

Ray Dalio: Tariffs Signal Strategic Preparation Amid Rising Global Conflict Risk

Ray Dalio, founder of Bridgewater Associates, emphasized that tariffs serve a dual purpose beyond generating tax revenue—they can reduce foreign reliance and prepare economies for potential global conflicts. In a LinkedIn post coinciding with the Trump administration’s new reciprocal tariffs, Dalio argued that import taxes help mitigate supply chain dependencies, making domestic industries more resilient, albeit less efficient.

He warned, however, that tariffs often lead to domestic inflation and global stagflation. Consistent with his longstanding concerns, Dalio reiterated that the world is heading toward heightened geopolitical strife and that the U.S. must urgently address its unsustainable debt-to-GDP ratio, now at 120%. Without action, Dalio cautioned, the U.S. risks a financial “heart attack.”

Investment Insight

Dalio’s commentary underscores the importance of diversification and risk management as geopolitical tensions escalate. Investors should monitor sectors poised to benefit from domestic supply chain strengthening, while remaining cautious of inflationary pressures. Defensive plays in energy, agriculture, and critical manufacturing may offer opportunities in an increasingly protectionist global economy.

Could Panama Derail BlackRock’s $22.8 Billion Ports Deal?

BlackRock’s $22.8 billion acquisition of CK Hutchison’s global port assets, including two major Panama Canal ports, faces potential delays as Panama audits the 25-year port concession granted to CK Hutchison. The Panama Ports Company operates the Balboa and Cristobal ports, critical trade hubs. Panama’s Comptroller General is investigating alleged irregularities in the concession renewal, raising questions about its constitutionality.