Makena Capital

Makena Capital

Reporting Period: March 31st, 2025

Filing Date: May 15th, 2025

Makena Capital has established himself as a prominent figure in the investment world through a career marked by strategic acumen and a deep understanding of global markets. With a background rooted in finance and economics, Makena Capital has led his firm to remarkable success, leveraging a disciplined investment philosophy that emphasizes long-term value creation, diversification, and a keen eye for emerging opportunities. His approach integrates rigorous research, risk management, and a commitment to aligning investments with broader economic trends. Under his leadership, Makena Capital has consistently outperformed benchmarks, earning a reputation for reliability and foresight in the competitive landscape of asset management.

Beyond his professional achievements, Makena Capital is also known for his philanthropic efforts, particularly in education, environmental sustainability, and community development. He has made significant contributions to various charitable organizations, focusing on initiatives that support underprivileged communities and promote sustainable economic growth. His philanthropic philosophy mirrors his investment strategies, emphasizing long-term impact and measurable outcomes. Through his work, both in finance and philanthropy, Makena Capital has made a lasting impact, demonstrating that success in business can be effectively coupled with a strong commitment to social responsibility.

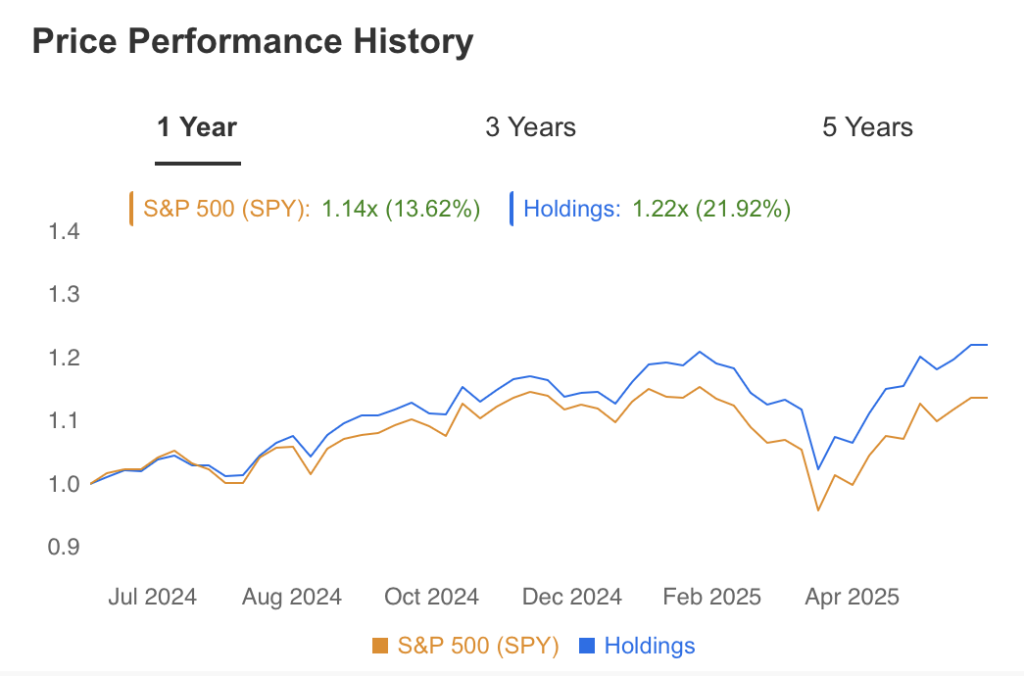

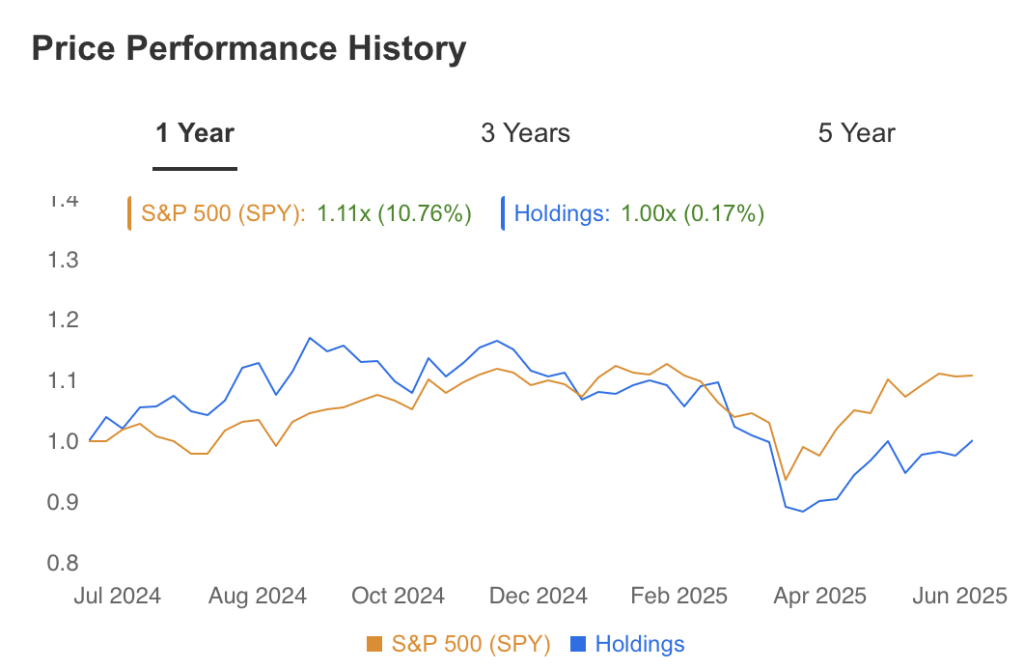

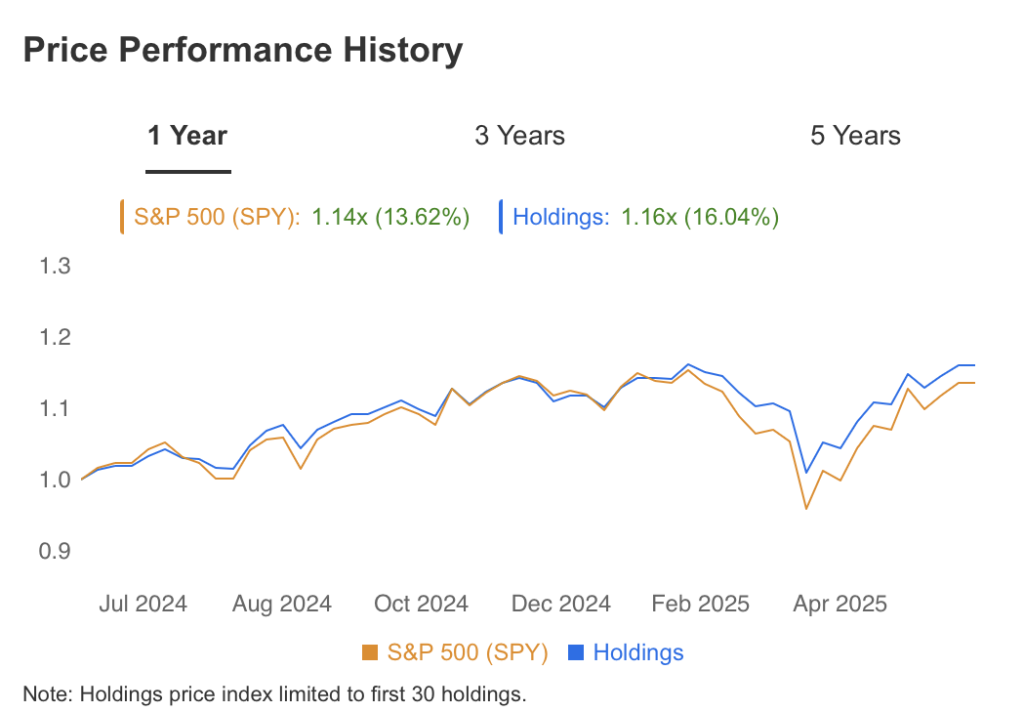

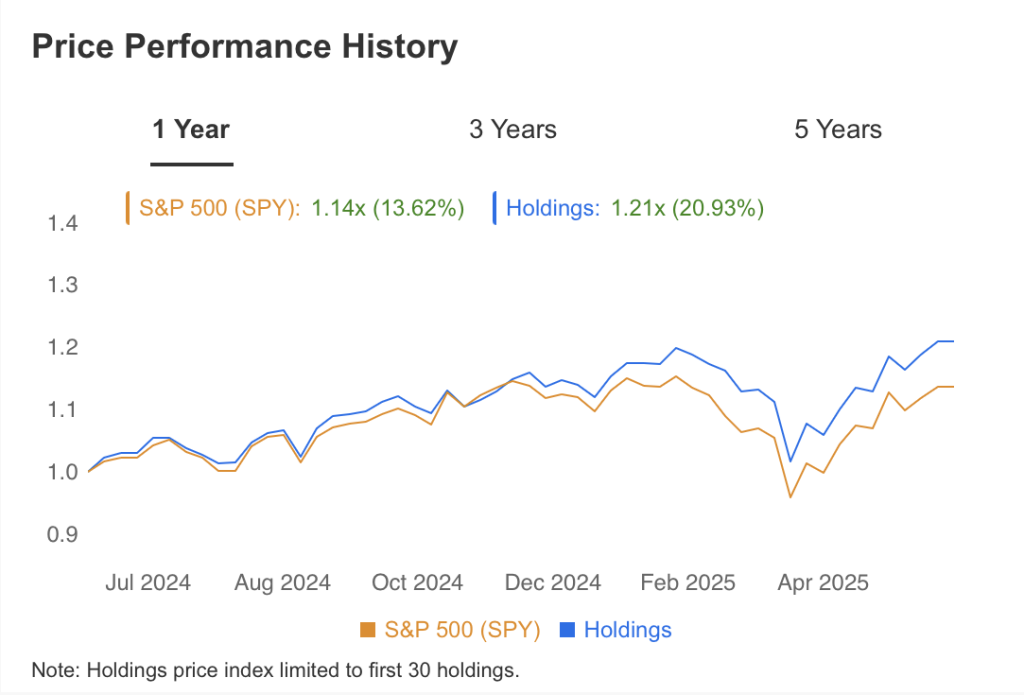

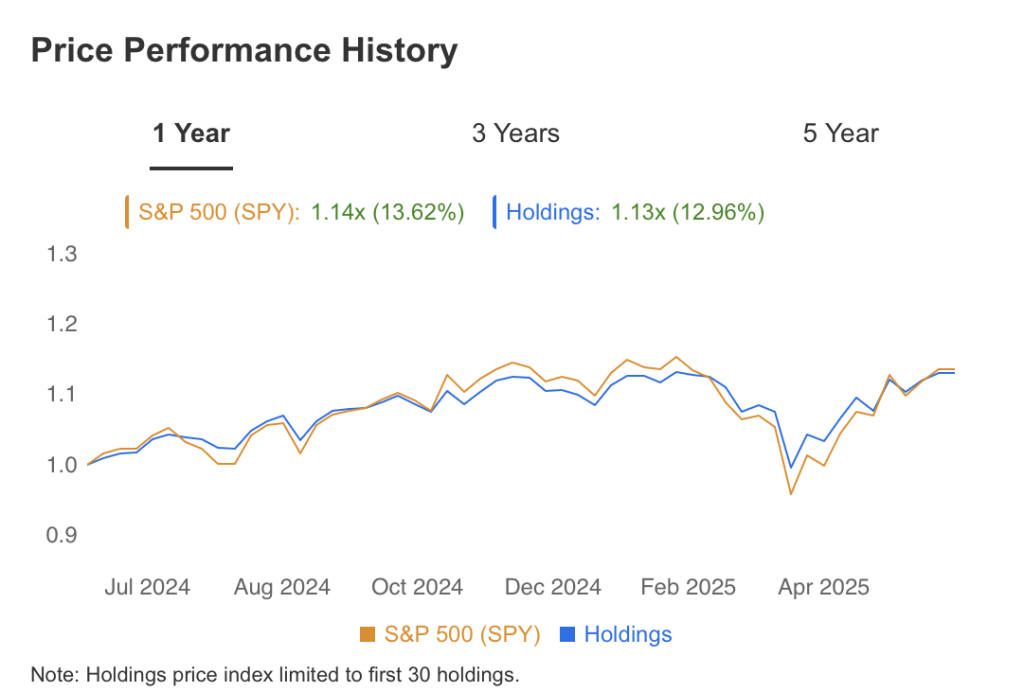

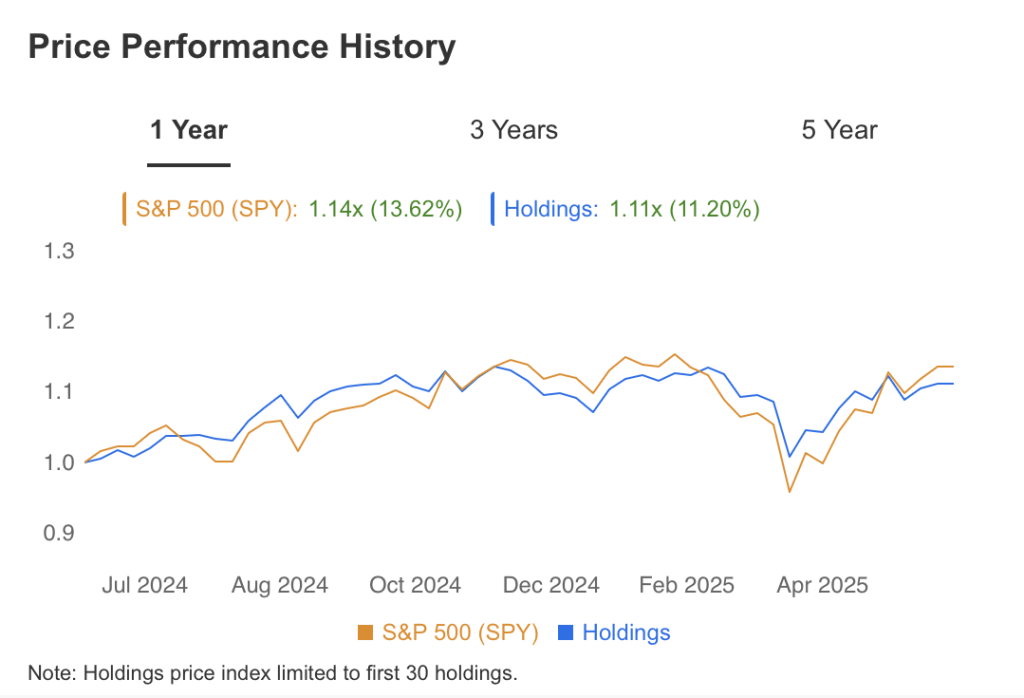

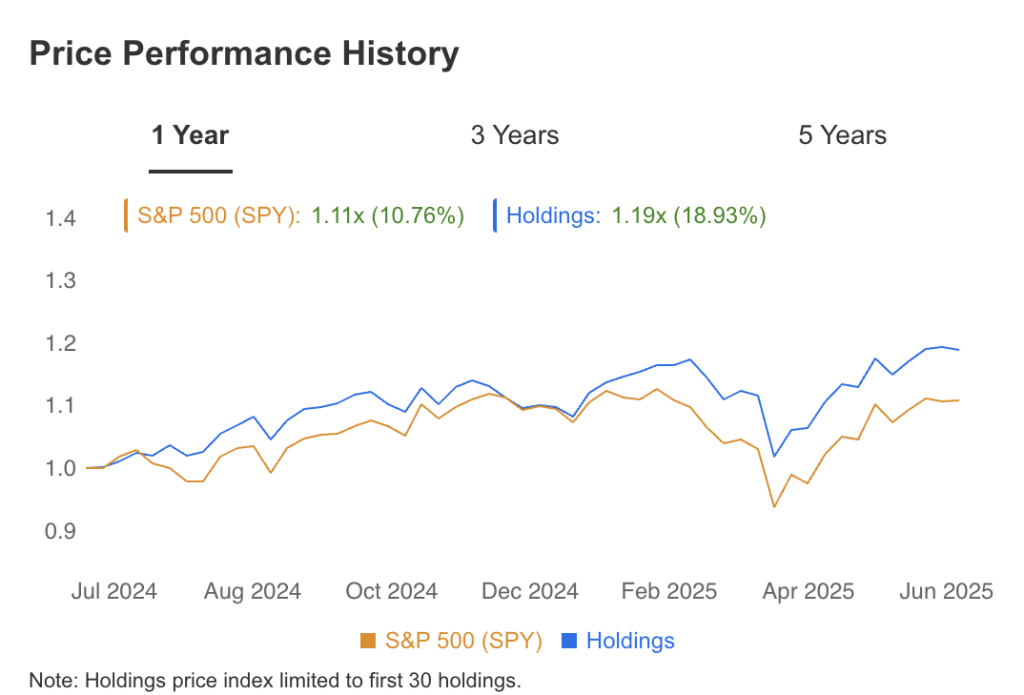

Three Year Return & Holdings Summary

View Holdings

Makena Capital

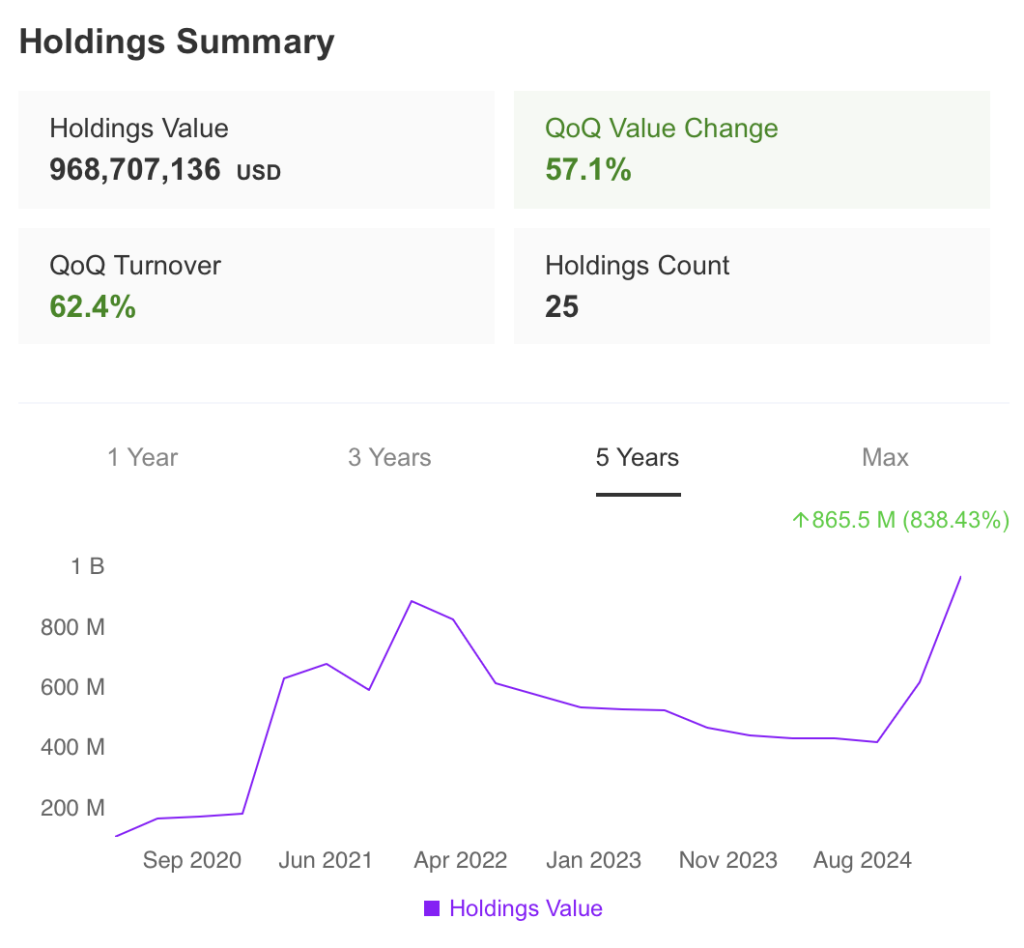

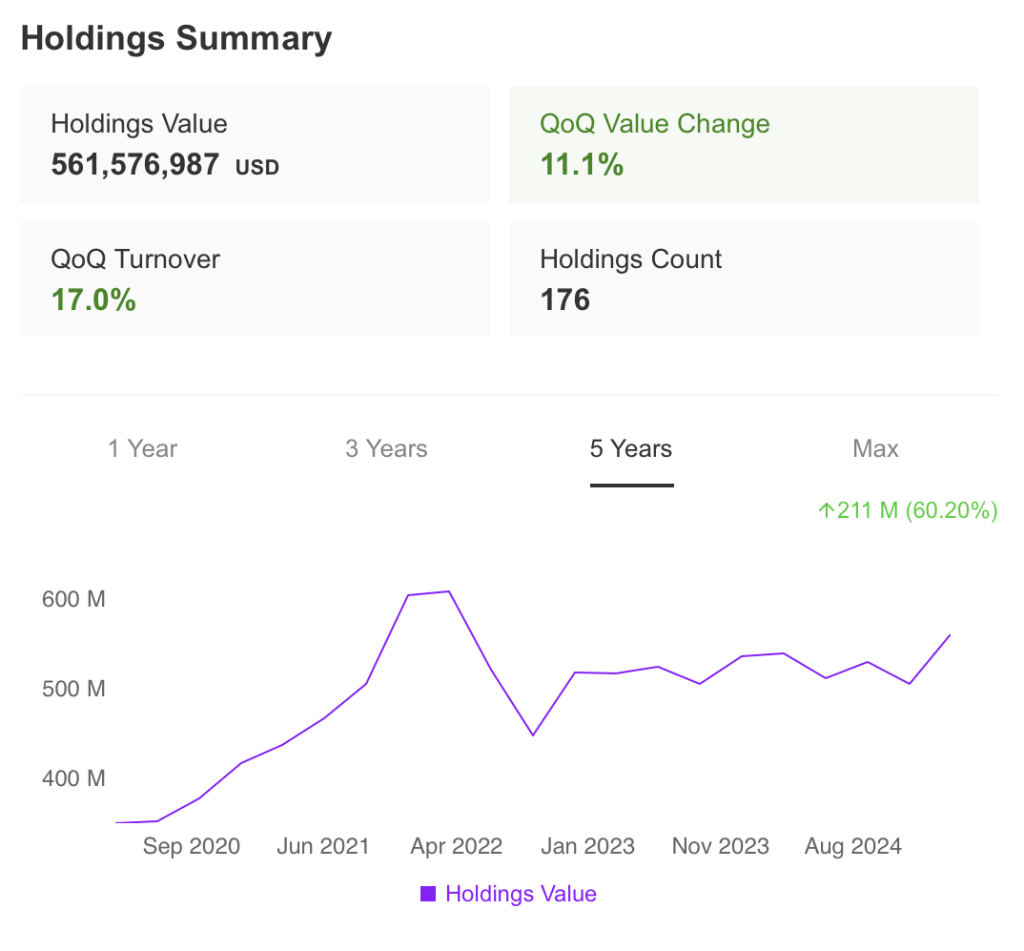

Holdings Summary

View Market

Makena Capital

Market View

View Projections

Makena Capital

Projections

View Health

Makena Capital

Health

Colony Capital

Colony Capital

Reporting Period: Mar 31st, 2025

Filing Date: May 15th, 2025

Colony Capital, founded by Thomas J. Barrack Jr. in 1991, quickly grew into a leading global investment management firm with a focus on real estate and real assets. Barrack, with a background in law and real estate investment, leveraged his deep industry knowledge and extensive network to build a firm that specialized in opportunistic investments in distressed assets. His investment philosophy centered on identifying undervalued properties and assets, particularly during economic downturns, and generating value through strategic management and restructuring. This approach allowed Colony Capital to thrive during periods of financial instability, making significant acquisitions and earning substantial returns for its investors.

Throughout his career, Barrack not only demonstrated a keen eye for investment opportunities but also exhibited a commitment to philanthropy. He supported various charitable causes, particularly those related to education, the arts, and healthcare. Barrack’s leadership and strategic vision led Colony Capital to manage billions in assets and establish a global presence. His success in real estate investment, combined with his philanthropic efforts, solidified his reputation as a prominent figure in the financial industry.

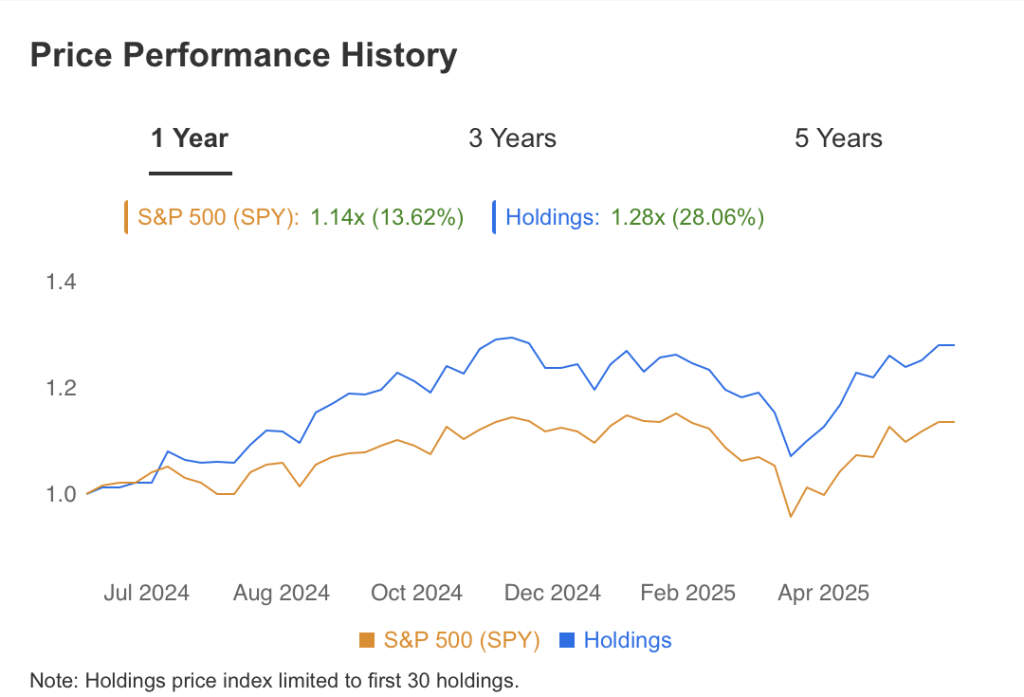

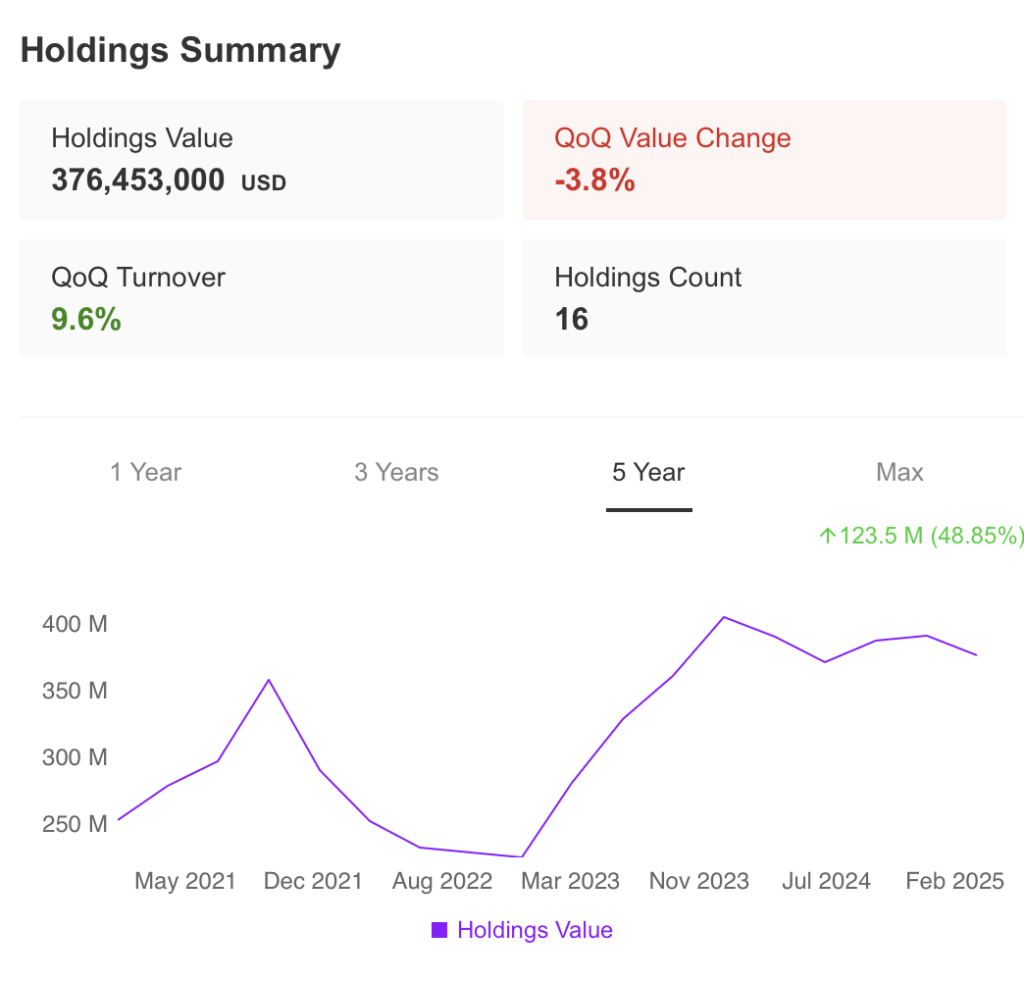

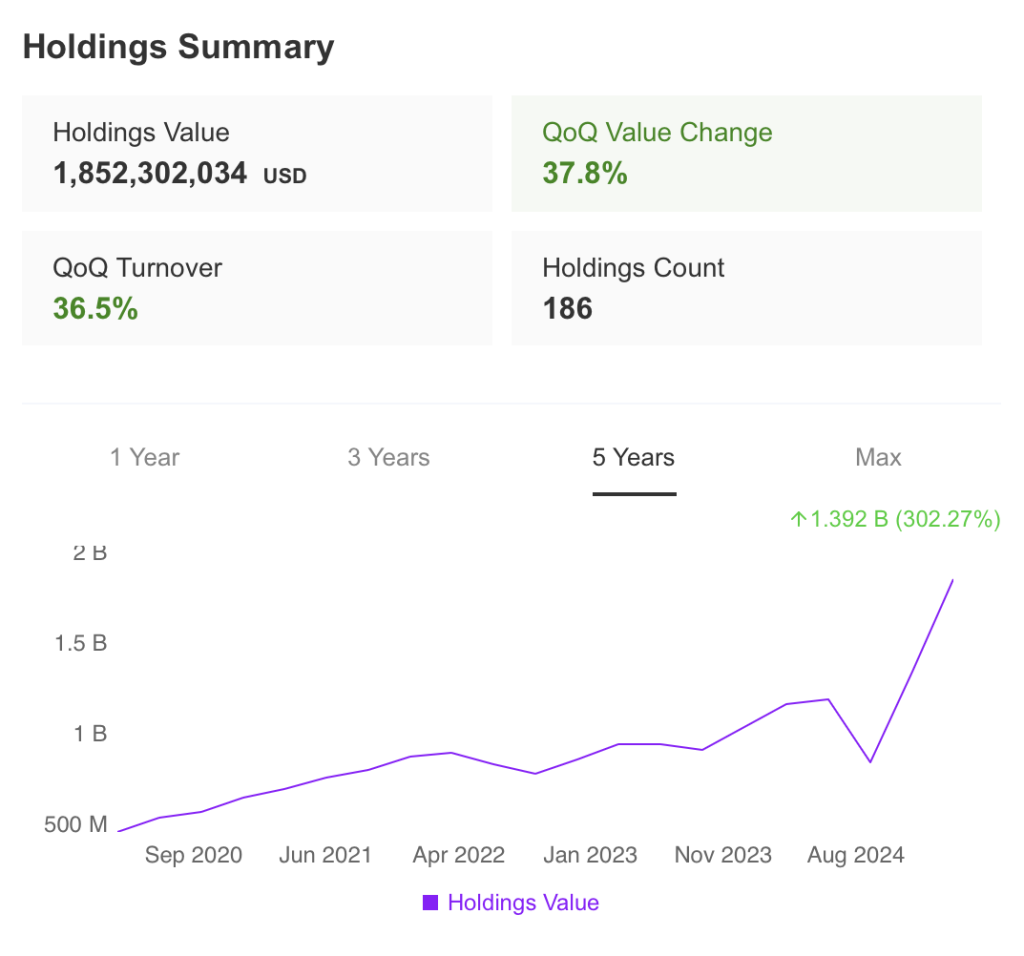

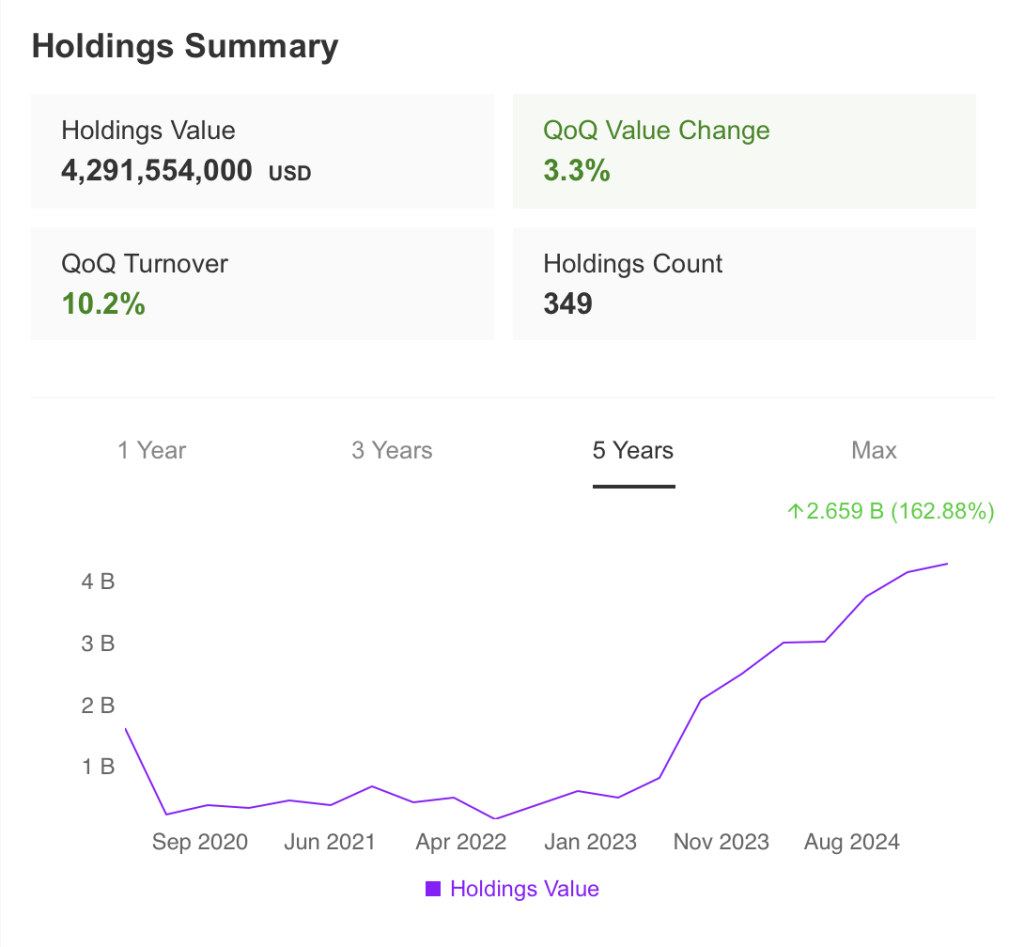

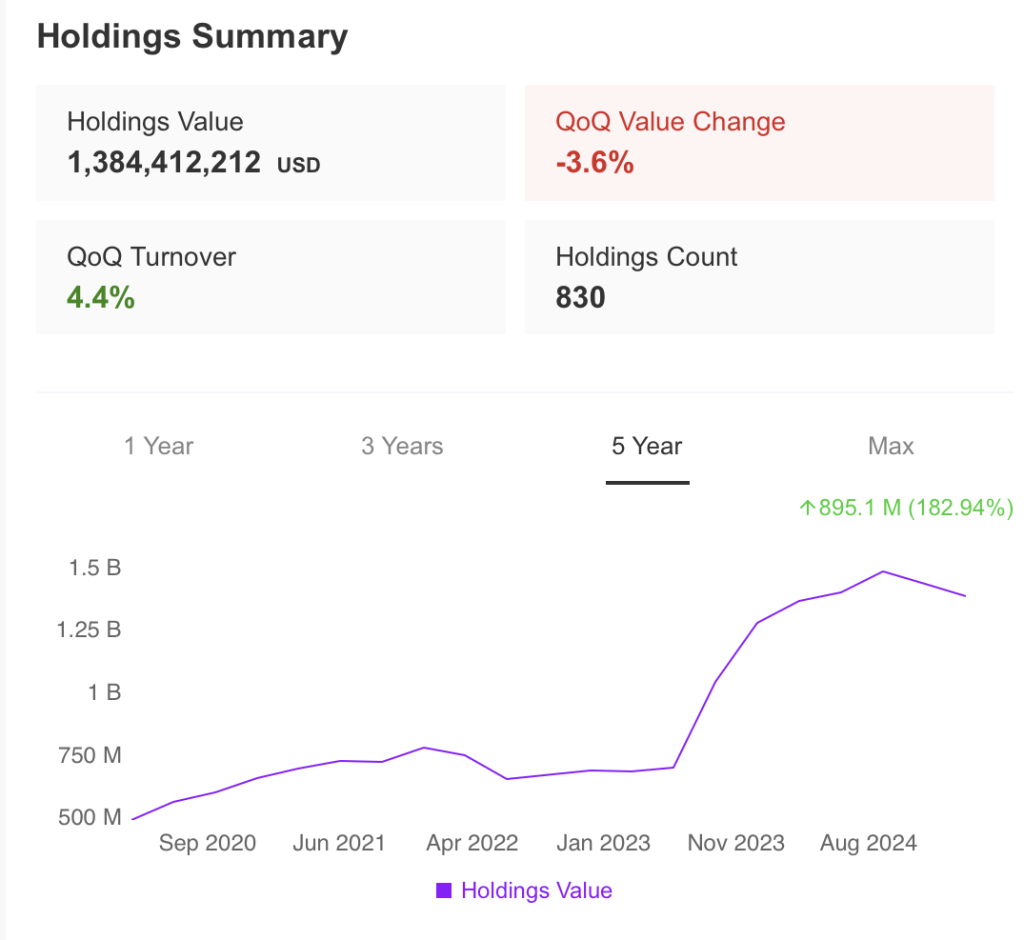

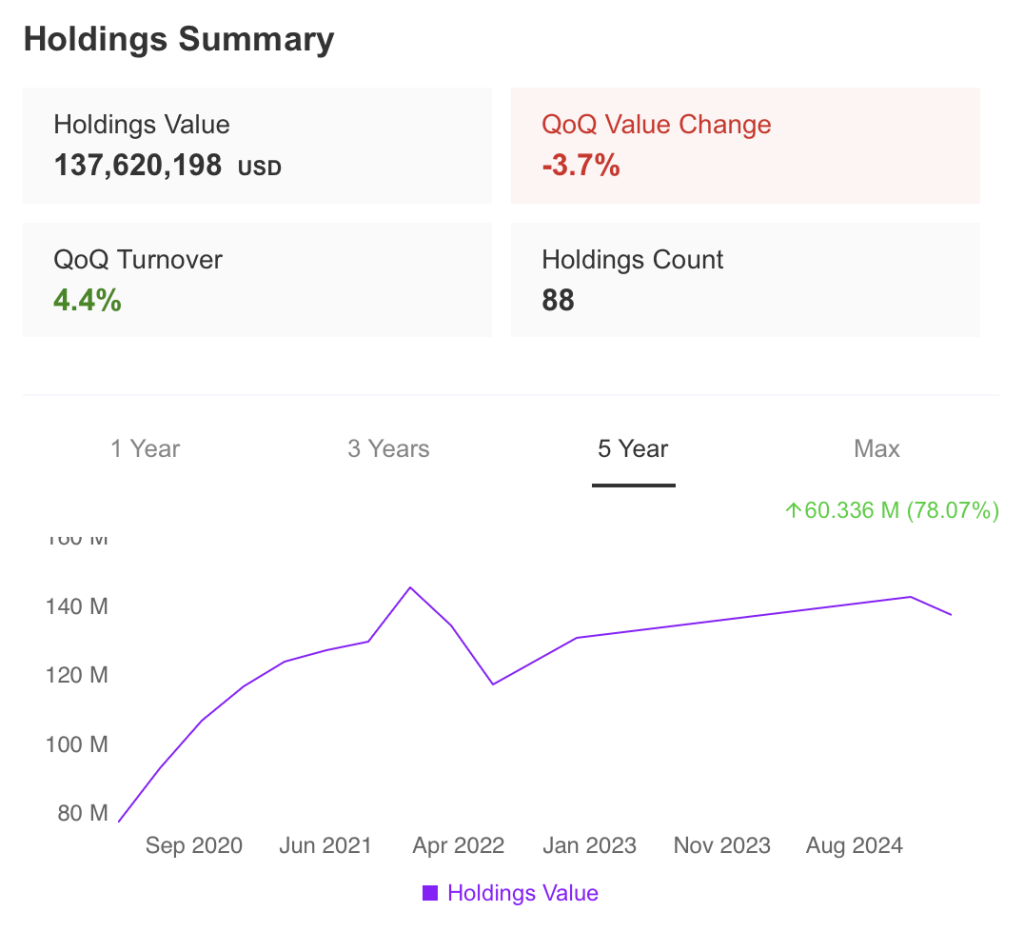

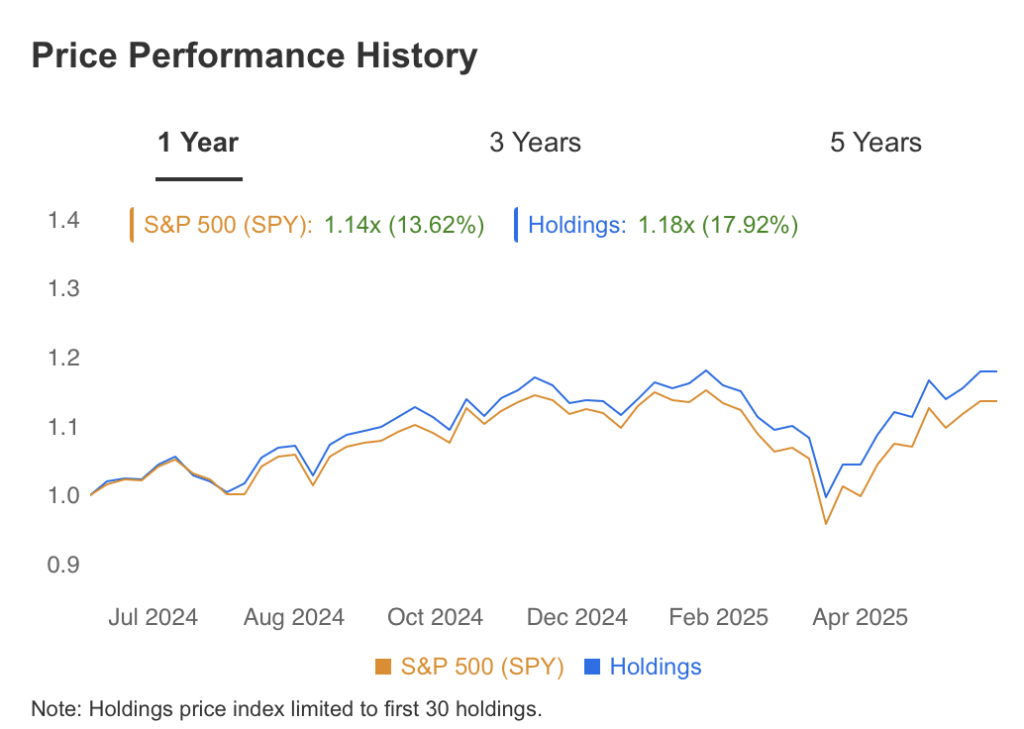

Three Year Return & Holdings Summary

View Holdings

Colony Capital

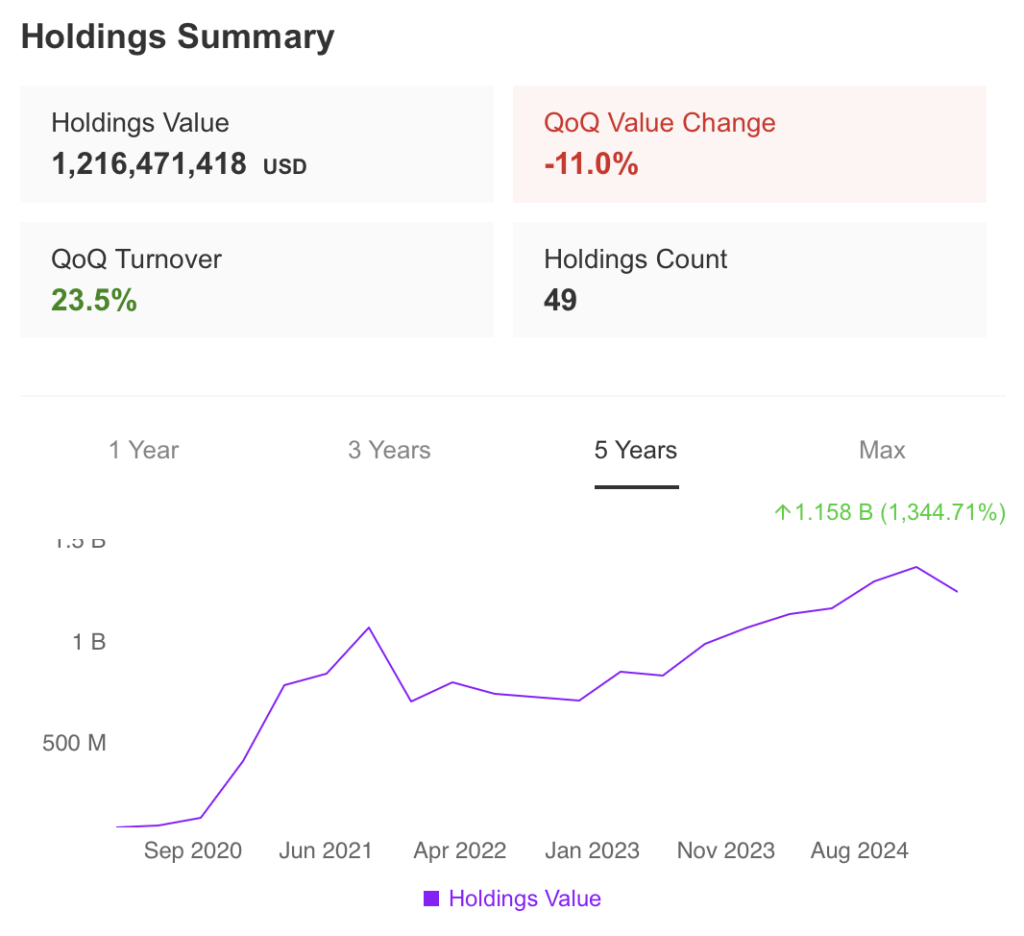

Holdings Summary

View Market

Colony Capital

Market View

View Projections

Colony Capital

Projections

View Health

Colony Capital

Health

H/2 Credit Manager

H/2 Credit Manager

Reporting period: Mar 31st, 2025

Filling Date: May 15th, 2025

The H/2 Credit Manager, a prominent figure in the finance industry, has built a distinguished career through his deep expertise in credit markets and investment management. With a background in finance and economics, he has cultivated a keen understanding of market dynamics and risk assessment, which has been the cornerstone of his investment philosophy. At H/2, he has played a pivotal role in managing credit investments, focusing on a disciplined, research-driven approach to identify undervalued opportunities in the market. His strategies are marked by a meticulous analysis of creditworthiness and a strong emphasis on capital preservation, which has consistently delivered impressive returns for his clients.

Beyond his professional achievements, the H/2 Credit Manager is also known for his philanthropic efforts, particularly in supporting education and financial literacy initiatives. He believes in the power of financial knowledge to transform lives and has dedicated resources to programs that aim to equip underprivileged communities with the skills needed to succeed in today’s economy. His commitment to both excellence in investment management and giving back to society has earned him a reputation as not only a successful investor but also a compassionate leader who leverages his success to make a positive impact on the world.

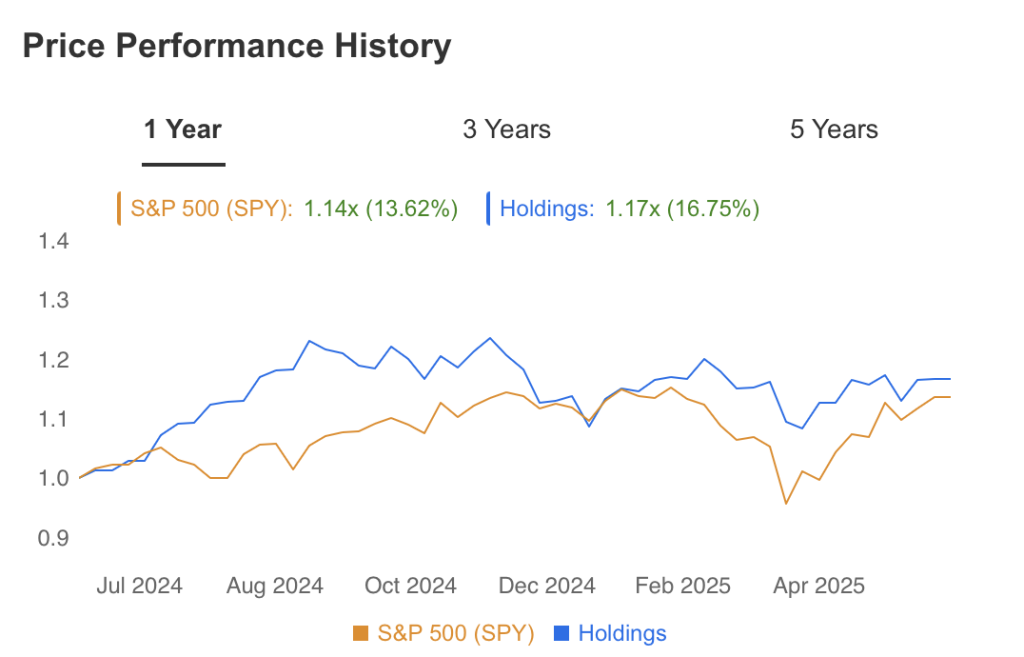

Three Year Return & Holdings Summary

View Holdings

H/2 Credit Manager

Holdings Summary

View Market

H/2 Credit Manager

Market View

View Projections

H/2 Credit Manager

Projections

View Health

H/2 Credit Manager

Health

B&i Capital Ag

B&i Capital Ag

Reporting Period: Mar 31st, 2025

Filing Date: May 15th, 2025

B&i Capital AG, a prominent figure in the investment world, has built a reputation for his strategic and disciplined approach to investing. With a background in finance and economics, he founded B&i Capital AG, which quickly became known for its focus on long-term, value-driven investments. His investment philosophy centers on identifying undervalued companies with strong fundamentals, a clear growth trajectory, and the potential for sustainable returns. This approach has led to significant success, with B&i Capital AG consistently outperforming market benchmarks and earning recognition as a top investment firm.

Beyond his professional achievements, B&i Capital AG is also known for his philanthropic efforts. He has used his success to give back to the community, supporting various charitable initiatives focused on education, healthcare, and economic development. His commitment to these causes reflects his belief in the importance of social responsibility in business. Through both his investment strategies and his philanthropy, B&i Capital AG has made a lasting impact on the financial world and beyond.

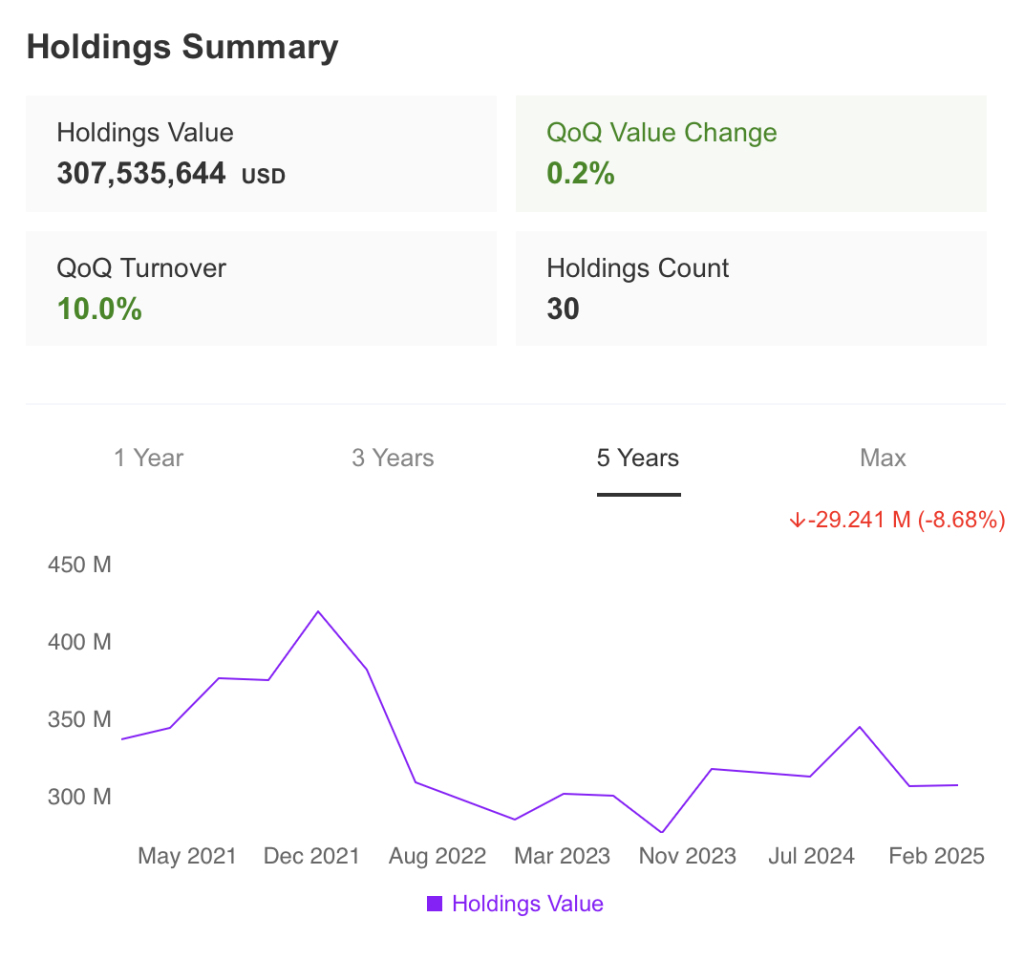

Three Year Return & Holdings Summary

View Holdings

B&i Capital Ag

Holdings Summary

View Market

B&i Capital Ag

Market View

View Projections

B&i Capital Ag

Projections

View Health

B&i Capital Ag

Health

Bell Bank

Bell Bank

Reporting period: Mar 31st, 2025

Filling Date: April 18th, 2025

Bell Bank is one of the largest privately owned banks in the United States, headquartered in Fargo, North Dakota. Founded in 1966, Bell Bank offers a wide range of financial services, including personal and business banking, mortgages, wealth management, and insurance. Known for its exceptional customer service and strong community involvement, Bell Bank has grown significantly over the years, expanding its presence with branches in Minnesota, Arizona, and other states.

The bank is particularly recognized for its unique “Pay It Forward” program, where employees are given funds each year to donate to individuals or causes in need, fostering a culture of generosity and community support. Bell Bank’s commitment to customer satisfaction, innovative services, and community outreach has established it as a respected and trusted financial institution in the regions it serves.

Three Year Return & Holdings Summary

View Holdings

Bell Bank

Holdings Summary

View Market

Bell Bank

Market View

View Projections

Bell Bank

Projections

View Health

Bell Bank

Health

Commerzbank

Commerzbank

Reporting period: Mar 31st, 2025

Filling Date: May 15th, 2025

Commerzbank is one of Germany’s largest and most prominent banks, headquartered in Frankfurt. Founded in 1870, Commerzbank has a long history of providing a comprehensive range of financial services to individuals, small and medium-sized enterprises (SMEs), and large corporations. The bank offers services including retail banking, corporate banking, investment banking, and asset management, with a strong focus on digitalization and innovation in recent years.

Commerzbank operates internationally, with a significant presence in Europe and extensive operations in countries across the globe. It is particularly known for its strength in supporting German SMEs, often referred to as the “Mittelstand,” which are a critical component of the German economy. Despite facing challenges, including restructuring efforts and adapting to the changing financial landscape, Commerzbank remains a key player in the European banking sector. Its commitment to providing tailored financial solutions and fostering economic growth has established it as a reliable partner for businesses and individuals alike.

Three Year Return & Holdings Summary

View Holdings

Commerzbank

Holdings Summary

View Market

Commerzbank

Market View

View Projections

Commerzbank

Projections

View Health

Commerzbank

Health

NBT Bank N.A

NBT Bank N.A

Reporting period: Mar 31st, 2025

Filling Date: Apr 17th, 2025

NBT Bank N.A. is a regional bank headquartered in Norwich, New York. Established in 1856, the bank has a long history of serving communities across the Northeast, with a focus on New York, Pennsylvania, Vermont, Massachusetts, New Hampshire, and Maine. NBT Bank offers a broad range of financial services, including personal and business banking, commercial lending, wealth management, and insurance.

Known for its community-oriented approach, NBT Bank emphasizes personalized customer service and a commitment to supporting local economic development. The bank has a reputation for building strong relationships with its customers, providing tailored financial solutions that meet the needs of individuals, families, and businesses. With its long-standing history and focus on regional growth, NBT Bank has established itself as a trusted and reliable financial institution in the communities it serves.

Three Year Return & Holdings Summary

View Holdings

NBT Bank N.A

Holdings Summary

View Market

NBT Bank N.A

Market View

View Projections

NBT Bank N.A

Projections

View Health

NBT Bank N.A

Health

Security National Bank

Security National Bank

Reporting period: Apr 30th, 2025

Filling Date: May 20th, 2025

Security National Bank is a well-established financial institution headquartered in Sioux City, Iowa. Founded in 1884, the bank has a long history of serving individuals, businesses, and communities with a comprehensive range of banking services, including personal and business banking, loans, mortgages, and wealth management.

Security National Bank is known for its commitment to customer service, community involvement, and financial stability. With multiple branches across the region, the bank focuses on providing personalized financial solutions tailored to the needs of its customers, while also supporting local economic development and charitable initiatives. Its reputation for reliability and community focus has made Security National Bank a trusted partner for generations of clients.

Three Year Return & Holdings Summary

View Holdings

Security National Bank

Holdings Summary

View Market

Security National Bank

Market View

View Projections

Security National Bank

Projections

View Health

Security National Bank

Health

TrustCo Bank Corp NY

TrustCo Bank Corp NY

Reporting period: Mar 31st, 2025

Filling Date: May 14th, 2025

TrustCo Bank Corp N is a publicly traded bank holding company headquartered in Glenville, New York. Its primary subsidiary, Trustco Bank , has been serving customers since 1902, offering a wide range of financial services including personal and business banking, mortgages, and investment services. Known for its conservative approach to banking, Trustco Bank emphasizes financial stability, customer service, and community involvement.

The bank operates a network of branches primarily in New York, Florida, Massachusetts, New Jersey, and Vermont. Trustco Bank is recognized for its competitive mortgage products and low fees, appealing to both individual and business clients. Its longstanding commitment to sound banking practices and customer care has made Trustco a trusted name in the regional banking sector.

Three Year Return & Holdings Summary

View Holdings

TrustCo Bank Corp NY

Holdings Summary

View Market

TrustCo Bank Corp NY

Market View

View Projections

TrustCo Bank Corp NY

Projections

View Health

TrustCo Bank Corp NY

Health

Bremer Bank National

Bremer Bank National

Reporting period: Feb 28th, 2025

Filling Date: Apr 10th, 2025

Bremer Bank National Association is a regional financial institution based in Minnesota, providing a range of banking services to individuals, businesses, and communities.

Founded in 1943, Bremer Bank offers traditional banking services including personal and business accounts, loans, mortgages, and wealth management. The bank is known for its strong focus on community involvement and customer service, emphasizing personalized banking solutions tailored to the needs of its clients. With a commitment to local economic development and a broad network of branches throughout the region, Bremer Bank plays a significant role in supporting the financial well-being of its communities and fostering regional growth.

Three Year Return & Holdings Summary

View Holdings

Bremer Bank National

Holdings Summary

View Market

Bremer Bank National

Market View

View Projections

Bremer Bank National

Projections

View Health

Bremer Bank National

Health